RNS No 3647b

KENWOOD APPLIANCES PLC

1st December 1998

KENWOOD APPLIANCES PLC

INTERIM RESULTS: HALF YEAR ENDING 2 OCTOBER 1998

Sales hit by slowdown in consumer spending in key markets.

Restructuring programme accelerated

6 months to 6 months to

2/10/98 3/10/97

Restated*

Sales #73.4m #81.5m

Operating Profit #3.2m #4.6m

Profit before tax and exceptionals #0.9m #2.2m

Profits before tax #0.8m #0.4m

Borrowings #39.7m #47.4m

EPS 1.1p 0.1p

Dividend - -

Gross Margins 36.7% 35.1%

*Restated for FRS 12

David Nash, Chairman, said today:

"Sales and profits in the first half were hit by a serious

slowdown in consumer spending in the UK and a number of our

other key markets, coupled with the turbulence in markets

outside Europe. Despite these difficult trading conditions,

the progress made in improving gross margins was maintained.

"As a result of tight control of capital expenditure and

working capital, borrowings were reduced substantially. The

Directors are not recommending an interim dividend."

Colin Gordon, Chief Executive, said today:

"The current difficult trading environment has accelerated the

need to implement Kenwood's strategy of moving away from

vertically integrated manufacturing and focusing upon brand

marketing. As part of this strategy there will be a number of

important product launches in the second half. A series of

measures to cut costs and increase competitiveness, such as

moving the manufacture of more product lines to China,

centralising European warehousing operations and streamlining

our international businesses, are being implemented.

"As ever, the full year results will be dependent upon the

Christmas season. However, at this stage the Board anticipates

the disappointing market conditions will continue and that

profits for the second half will be no higher than those made

in the first half."

For further enquiries:

Kenwood Appliances Plc T: 0171 282 8000 (today only)

Colin Gordon, Chief Executive 01705 476 000 (thereafter)

Graham Wickenden, Group Finance Director

Citigate Dewe Rogerson T: 0171 282 8000

Simon Rigby

Alex Brown

01 December 1998

UNAUDITED

KENWOOD APPLIANCES PLC

INTERIM RESULTS: HALF YEAR ENDING 2 OCTOBER 1998

FINANCIAL RESULTS

Sales of continuing operations for the half-year were #73.4m

compared to #80.4m last year. This represents a fall of 8.7%.

Profits before tax and exceptionals were #0.9m compared to

#2.2m for 1996/7. The margin improvements of last year were

maintained and gross margins increased to 36.7% from 35.1%.

Tight controls on capital expenditure and reduced working

capital resulted in borrowings reducing by #7.7m to #39.7m in

the past twelve months.

TRADING REVIEW

UK

After a promising start there was a significant sales

slow down in the second quarter. Turnover fell 8.3% to

#19.7m. Core market categories for Kenwood, such as food

processors and fryers were weak, however, percentage

gross margins showed an encouraging improvement.

Italy

Ariete

Ariete performed well; domestic turnover increased by

2.0% to 26.6 billion Lira (#9.3m) and exports grew by

37.0% to 22.1 billion Lira (#7.7m). A new range of

kitchen appliances was launched at the end of the period

and sales of the steam broom, Vapori, to the U.S., have

been encouraging.

Mizushi

Better weather in Italy resulted in a sales increase of

50% in the rate of sell out in the domestic market, which

contributed to a reduction in debtors. Working capital

was reduced to #6.1m compared to #10.2m at 3rd October

1997.

Overseas Subsidiaries

In France, new product launches and better sales mix

resulted in a significant improvement in contribution.

Germany also showed an improved contribution over last

year, but remains a difficult market and a new sales

strategy has been implemented. The subsidiaries outside

Europe were affected by the economic turmoil with

significant sales declines recorded in Malaysia (-52%),

Singapore (-13%), South Africa (-11%) and New Zealand (-

19%).

Export Markets - Kenwood Distributors

The impact of the increase of the strength of sterling

last year continued to hit sales, which were 20% down at

#12.4m. Margins were maintained. Trading in Russia was

severely disrupted by the economic downturn, however

Kenwood's conservative trading policies have ensured

minimal exposure to bad debt. A change of distributor in

the largest export market, Australia, has resulted in a

temporary sales decline.

Manufacturing & Product Sourcing

UK

Manufacturing employment was reduced by 129 to 674 in the

six months. The move out of primary engineering

activities has been successfully completed. Further

models are currently being transferred to China.

China

Third party manufacture in China rose to 29% from 26% as

the Group's policy of outsourcing more product took

effect. Over capacity exists within the region and as a

result cost prices are expected to continue to fall.

RESTRUCTURING

The restructuring programme, instigated in 1997, is being

accelerated:

* A further reduction in the UK workforce was implemented in

May at a cost of #940k, involving 89 redundancies.

* Total worldwide employment has fallen by 646 to 2346 (-22%).

* Outsourcing European logistics is progressing.

* Excess property on the Havant site is for sale.

* We anticipate closing or streamlining a number of our

overseas sales subsidiaries.

PROSPECTS

Prospects have materially worsened in the UK since mid-summer

with declining consumer confidence resulting in reduced sales

and destocking by certain customers. Much will depend on the

Christmas season although the Group is not anticipating any

recovery.

After a strong first half in Italy, the outlook for the second

half is less buoyant. France continues to improve. There is,

however, no prospect of an early recovery in the Asia Pacific

or Eastern European markets.

In the light of these more difficult trading circumstances the

Board anticipates the disappointing market conditions will

continue and that profits for the second half will be no

higher than those made in the first half. Consequently the

Board is accelerating its strategy to move away from

vertically integrated manufacturing and to focus upon brand

marketing. As part of this strategy there will be a number of

important product launches in the second half. Additionally,

the manufacture of further products will be transferred to

China, European warehousing is being outsourced and the

distribution structure streamlined.

Group Profit & Loss Account

As restated As restated

Unaudited Unaudited Audited

6 months to 6 months to year to

2/10/98 3/10/97 3/4/98

#000 #000 #000

Turnover:

Continuing operations 73,362 80,380 168,371

Discontinued operations - 1,085 1,966

_________ _________ _________

73,362 81,465 170,337

Cost of sales (46,458) (52,841) (110,465)

_________ _________ _________

Gross profit 26,904 28,624 59,872

Distribution costs (14,465) (14,837) (34,518)

Administrative expenses (7,686) (7,350) (13,314)

_________ _________ _________

(22,151) (22,187) (47,832)

_________ _________ _________

4,753 6,437 12,040

Other operating

expenditure (1,564) (1,812) (1,745)

_________ _________ _________

Operating profit:

Continuing operations 3,189 4,412 9,935

Discontinued operations - 213 360

3,189 4,625 10,295

Exceptional items:

Continuing

- fundamental reorganisation (105) (1,791) (3,713)

Discontinued

- profit on sale of operation - - 569

Bank interest receivable 37 126 603

Interest payable (2,308) (2,556) (5,297)

_________ _________ _________

(2,271) (2,430) (4,694)

_________ _________ _________

Profit on ordinary

activities before taxation 813 404 2,457

Tax on ordinary activities (317) (360) (2,191)

_________ _________ _________

Profit attributable

to members of the

parent company 496 44 266

Earnings per share 1.1 p 0.1 p 0.6 p

Fully diluted

earnings per share 1.1 p 0.1 p 0.6 p

Group Balance Sheet

As restated As restated

Unaudited Unaudited Audited

2/10/98 3/10/97 3/4/98

#000 #000 #000

Fixed assets

Tangible fixed assets 36,261 39,778 37,058

Investments 1,927 1,927 1,927

_________ _________ _________

38,188 41,705 38,985

_________ _________ _________

Current assets

Stocks 31,860 31,149 32,203

Debtors 48,416 52,781 45,776

Cash at bank and in hand 12,898 12,937 20,470

_________ _________ _________

93,174 96,867 98,449

_________ _________ _________

Creditors: amounts

falling due

within one year

Borrowings (51,991) (58,881) (54,598)

Trade and other creditors (43,760) (41,281) (45,770)

_________ _________ _________

Net current liabilties (2,577) (3,295) (1,919)

_________ _________ _________

Total assets less

current liabilities 35,611 38,410 37,066

_________ _________ _________

Creditors: amounts falling due

after more than one year

Borrowings (645) (1,437) (1,328)

Provisions for

liabilities and charges (119) (455) (1,153)

_________ _________ _________

34,847 36,518 34,585

======== ======== ========

Capital and reserves

Called up share capital 4,586 4,586 4,586

Share premium 25,101 31,101 25,101

Special reserve 2,180 - 2,180

Profit and loss account 2,980 831 2,718

_________ _________ _________

34,847 36,518 34,585

======== ======== ========

Group Statement of Cash Flows

Unaudited Unaudited Audited

6 months to 6 months to year to

2/10/98 3/10/97 3/4/98

#000 #000 #000

Operating profit 3,189 4,625 10,295

Depreciation 3,565 3,845 7,090

Loss/(profit) on

disposal of fixed assets 133 - (74)

Decrease/(increase)

in stock 1,126 (1,949) (4,529)

(Increase)/decrease

in debtors (1,675) (2,644) 4,828

(Decrease)/increase

in creditors (1,890) (2,022) 2,232

________ ________ ________

4,448 1,855 19,842

Cash outflow from

exceptional items (1,203) (2,828) (3,589)

________ ________ ________

Net cash inflow/(outflow)

from operating activities 3,245 (973) 16,253

Returns on investment and

servicing of finance (2,315) (2,199) (4,686)

Taxation (644) (394) (3,477)

Capital expenditure (2,525) (2,907) (4,539)

Acquisitions and disposals (244) (192) 646

Financing - (increase)/

decrease in debt (3,736) (967) 33,446

________ ________ ________

(Decrease)/increase

in cash in the period (6,219) (7,632) 37,643

________ ________ ________

Reconciliation to net debt

(Decrease)/increase

in cash in the period (6,219) (7,632) 37,643

Cash outflow/(inflow)

from decrease/(increase)

in debt and lease financing 3,736 967 (33,446)

________ ________ ________

Change in net debt

resulting from cash flows (2,483) (6,665) 4,197

Translation difference (1,799) 924 1,987

________ ________ ________

Movement in net debt

in the period (4,282) (5,741) 6,184

Opening net debt (35,456) (41,640) (41,640)

________ ________ ________

Closing net debt (39,738) (47,381) (35,456)

________ ________ ________

Turnover & Segmental Analysis

Unaudited Unaudited Audited

6 months to 6 months to year to

2/10/98 3/10/97 3/4/98

#000 #000 #000

Turnover

Turnover by destination:

Sales to third parties

United Kingdom 20,889 22,889 46,337

Continental Europe 36,725 38,271 85,748

Rest of the World 15,748 20,305 38,252

________ ________ ________

73,362 81,465 170,337

======= ======= =======

Turnover by origin:

United Kingdom 35,348 42,563 86,073

Continental Europe 37,806 35,194 82,289

Rest of the World 19,364 27,447 53,297

________ ________ ________

92,518 105,204 221,659

======= ======= =======

Inter-segment sales:

United Kingdom 4,034 5,698 12,109

Continental Europe 10,969 10,749 26,100

Rest of the World 4,153 7,292 13,113

________ ________ ________

19,156 23,739 51,322

======= ======= =======

Sales to Third parties:

United Kingdom 31,314 36,865 73,964

Continental Europe 26,837 24,445 56,189

Rest of the World 15,211 20,155 40,184

________ ________ ________

73,362 81,465 170,337

======= ======= =======

Notes

1 Consolidated profit & loss account (before FRS12 adjustment)

Unaudited Unaudited

6 months to 6 months to Year to

2/10/98 3/10/97 3/4/98

#000 #000 #000

Turnover:

Continuing operations 73,362 80,380 168,371

Discontinued operations - 1,085 1,966

________ ________ ________

73,362 81,465 170,337

Cost of sales (46,458) (52,841) (110,465)

________ ________ ________

Gross profit 26,904 28,624 59,872

Distribution costs (14,465) (14,837) (34,518)

Administrative expenses (7,686) (7,350) (13,314)

________ ________ ________

(22,151) (22,187) (47,832)

________ ________ ________

4,753 6,437 12,040

Other operating expenditure (1,564) (1,812) (1,745)

________ ________ ________

Operating profit:

Continuing operations 3,189 4,412 9,935

Discontinued operations - 213 360

3,189 4,625 10,295

Exceptional items:

Discontinued

- profit on sale of operation - - 569

Bank interest receivable 37 126 603

Interest payable (2,308) (2,556) (5,297)

________ ________ ________

(2,271) (2,430) (4,694)

________ ________ ________

Profit on ordinary

activities before taxation 918 2,195 6,170

Tax on ordinary activities (358) (549) (2,191)

________ ________ ________

Profit attributable

to members

of the parent company 560 1,646 3,979

Earnings per share 1.3 p 3.7 p 9.0 p

Fully diluted

earnings per share 1.3 p 3.7 p 9.0 p

Notes continued

2 Due to the implementation of FRS12, (Provisions and

Contingencies), the financial statements in respect of

the previous year have been restated by way of a prior

year adjustment. The impact on the results for the

current period is immaterial.

3 The interim financial statements are unaudited and do not

constitute full accounts within the meaning of the

Companies Act 1995. Figures for the financial year to 3

April 1998 have been extracted from the financial

statements which have been delivered to the Registrar of

Companies on which the Auditors have given an unqualified

report.

4 Except for the effects of the implementation of FRS 12

explained in Note 1 above the financial statements have

been prepared on the basis of the accounting policies set

out in the Group's 1998 statutory accounts.

5 A copy of the announcement will be sent to shareholders,

additional copies can be obtained from the Company

Secretary, Kenwood Appliances Plc, New Lane, Havant,

Hants PO9 2NH.

END

IR FDIFASUAUFFF

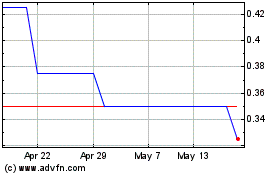

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

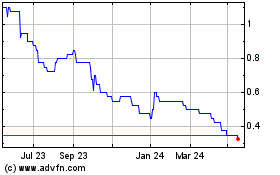

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024