RNS No 6156k

KENWOOD APPLIANCES PLC

30th June 1998

KENWOOD APPLIANCES PLC

Preliminary results for the year ended 3 April 1998

KENWOOD PROFITS UP 37% DESPITE STRENGTH OF STERLING

# million 1997/98 1996/97

Sales

170.3 203.2

Operating profit

10.3 8.8

Profit before exceptionals and tax

5.6* 4.1

Exceptional items -operating

-non-operating 0.0 (0.9)

0.6 (14.6)

Profit before tax

6.2 (11.4)

Net borrowings

35.5 41.6

Gross margins

35.2%** 32.4%

Earnings per share

8.7p (29.3p)

* #9.6m at constant exchange rates

** 36.9% at constant exchange rates

David Nash, Chairman, said today:

"The Kenwood recovery continues, with a 37% increase in pre-

tax profits before exceptionals. This was achieved despite

the continuing strength of sterling which reduced full year's

profits by #4m. On a constant currency basis profits would

have been 134% ahead. Tight cash control resulted in

borrowings reducing by #6.1m to #35.5m, after spending #3.6m

on restructuring charges.

"Whilst these results are encouraging, there is still more to

do to restore the Group to a stronger trading and financial

position, and, at this stage, the Board is not recommending

the payment of a dividend."

Colin Gordon, Chief Executive, said today:

"Following my appointment last year, I announced a profit

improvement programme designed to improve margins, lower the

fixed cost base and reduce borrowings. Since then, margins

have increased from 32.4% to 35.2%, the fixed cost base has

been cut by #4.8m and borrowings have been significantly

reduced.

In addition a number of other issues have been addressed:

* Our workforce has been reduced by 19%;

* The non core UK printing business was sold making an

exceptional profit of #0.6m;

* The Group has exited low added value basic engineering

activities in the UK without disruption;

* Mizushi, the Italian air conditioning business, has achieved

breakeven and significantly reduced its working capital

despite adverse weather conditions in Italy last Summer; and

* A Group marketing function has been established in line with

our strategy of becoming an agile brand led business.

Trading in the first quarter in the two core businesses of the

UK and Ariete is satisfactory and in line with expectations.

However, trading in export markets has been impacted

commercially and financially by the continuing strength of

sterling and the Far East crisis. Action has been taken to

reduce costs further but it will take some time to recover the

export sales which have been lost in the past year as a result

of the strength of sterling. Nevertheless the Board

anticipates, that whilst profits in the first half are

expected to be somewhat lower than last year, the full year

should show further progress in the Kenwood recovery

programme."

For further enquiries:

Kenwood T: 0171 282 8000 (today only)

Colin Gordon,Chief Executive 01705 476 000(thereafter)

Citigate Communications T: 0171 282 8000

Simon Rigby or Alex Brown

KENWOOD APPLIANCES PLC

PRELIMINARY RESULTS FOR YEAR ENDED 3 APRIL 1998

Financial Results

Following a year of product rationalisation and a strong focus

on margins, sales for the year were #170.3m compared to

#203.2m last year. This represents a fall of 16%, of which

currency accounted for a reduction of nearly #16m (8%).

Profit before tax and exceptional charges was #5.6m (and would

have been #4.0m higher at constant exchange rates) compared to

#4.1m for 1996/7, an increase of 37% (134% at constant

currency). Margins improved from 32.4% to 35.2% as a result of

improved sales mix, manufacturing fixed cost reductions and

purchasing savings. Margins would have been 36.9% at constant

exchange rates.

The sale of Print 4, the UK printing business, resulted in an

exceptional profit of #0.6m.

Profit before tax was #6.2m compared to a loss of #11.4m in

1996/7. Earnings per share were 8.7p (1996/7 loss per share of

29.3p).

Whilst these results are encouraging, there is still more to

do to restore the Group to a stronger trading and financial

position. The Board is therefore not recommending a dividend

payment for the year 1997-98.

Borrowings

During the year net borrowings were reduced by #6.1m to #35.5m

after spending #3.6m of the restructuring charges provided in

1996/7. Stocks were #2.0m higher at the year-end, partially as

a result of the longer supply chain with more products being

sourced in China. Debtors were reduced by #7.2m, of which

Mizushi accounted for #4.1m.

Gearing was reduced from 129% to 105%.

Increased interest rates offset the impact of reduced

borrowings and as a result the net interest charge was only

slightly lower at #4.7m. Interest cover improved from 1.8 to

2.2 times.

Kenwood Recovery Programme

A profit improvement programme was introduced last year with

the objectives of improving margins, lowering the fixed cost

base and reducing borrowings. The results achieved in the past

year have been as follows: -

* Gross margins have increased from 32.4% to 35.2%;

* Fixed costs fell by #4.8m and at the year end the Group

employed 534 fewer people than in March 1997 - a reduction of 19%;

* Borrowings were reduced by #6.1m at the year-end;

* In addition, a Group marketing function has been established

in line with the strategy of becoming an agile brand-led

business.

#9.9m of the exceptional charges taken in 1996/7 were for

fundamental restructuring of the business. In the year #3.6m

was spent primarily on redundancies and on reshaping the UK

manufacturing operation.

Trading Report

UK

Turnover fell by 15% reflecting a soft market in core

Kenwood categories such as food processors, where the

market declined by 11.5%. Overall Kenwood market share

declined from 13.9% to 12.1%, partly as the result of

rationalising the product range. There were share gains

in the stand mixer, toaster and liquidiser categories.

The strategy of focusing on profit rather than turnover

resulted in the prior year's margin decline being

reversed and a significant overall increase in gross

margin being achieved.

Italy - Ariete

A strong performance was achieved with domestic sales

increasing 13% to 73.9 billion lire (#26m) and exports

increasing 26% to 23.3 billion lire (#8m). Market share

in Italy grew 0.2% to 6.3%. Passi, the puree machine,

maintained its sales at over 350,000 units. The most

successful new product introduction in the Group was

Vapori, a steam broom, which was launched in July 1997.

Backed by television advertising in Italy, this product

sold 260,000 pieces.

Italy - Mizushi

A breakeven position was achieved despite another poor

summer for the portable air conditioning business which

resulted in a further sales decline. Extended credit

balances were reduced by one third to 8bn lire (#2.6m).

Overseas Subsidiaries

France, following the appointment of new supervisory

management and the launch of the Passi showed a second

half recovery, but Germany continued to disappoint and

was hard hit by continuing difficult market conditions.

South Africa, one of the more important Kenwood

subsidiaries, performed well.

In Asia Pacific, New Zealand had an excellent year, but

the other subsidiaries still suffered as a result of the

financial crisis. However, the Group's exposure to the

Far East markets was limited to 7% of turnover.

Third Party Distributors

Export sales to third party distributors were hard hit in

the second half of the year by the strength of sterling.

For the full year turnover declined by 9.5% to #27.6m.

Margins, however, were slightly better than in the

previous year. Good growth was achieved in some of the

larger markets, particularly Australia (+52%) and Israel

(+15%).

MANUFACTURING

UK

A major transformation of the Havant plant has been

commenced in the year, with the size of the facility cut

by 50% and direct manufacturing headcount reduced by 28%

to 671 employees.

The lower added value basic engineering activities of die

casting and metal stamping have been out sourced. "Build

to order" capability was introduced on the high value

Chef and new Cuisine mixer lines with the objective of

driving down stock and increasing service levels.

Negotiations are well advanced for the sale of the lease

of a UK warehouse, which will close in September 1998.

Italy

The Ariete operation is now a pilot plant for new

products and the Mizushi plant has been further down

sized to reflect the reduced trading levels.

China

The transfer of the kettle production to China was

successfully completed in May 1997 and the motor winding

capacity was also increased during the year. Tricom

turnover increased by 19% and now represents 28% of the

Group's production. A partnership agreement was signed

with a key supplier and a new food processor and the

latest deep fryer sourced from this Company.

FUTURE PROSPECTS

Trading in the first quarter in the two core businesses of the

UK and Ariete is satisfactory and in line with expectations.

However, trading in export markets has been impacted

commercially and financially by the continuing strength of

sterling and the Far East crisis. Action has been taken to

reduce costs further but it will take some time to recover the

export sales which have been lost in the past year as a result

of the strength of sterling. Nevertheless the Board

anticipates that whilst profits in the first half are expected

to be somewhat lower than last year, the full year should show

further progress in the Kenwood recovery programme.

Group Profit and Loss Account

for the year ended 3 April 1998

1998 1997

Total Total

Note #'000 #'000

Turnover 1

Continuing operations 168,371 201,273

Discontinued operations 1,966 1,920

170,337 203,193

Cost of sales (110,465) (137,272)

Gross profit 59,872 65,921

Distribution costs (34,518) (38,653)

Administrative expenses (13,314) (17,290)

(47,832) (55,943)

12,040 9,978

Other operating expenditure (1,745) (2,018)

Operating Profit

Continuing operations 9,935 7,784

Discontinued operatons 360 176

10,295 7,960

Exceptional items:

Continuing operations - (14,575)

Discontinued operations 569 -

Income from listed investments - 57

Bank interest receivable 603 358

Interest payable (5,297) (5,159)

(4,694) (4,744)

Profit/(Loss) before taxation 6,170 (11,359)

Tax on profit on ordinary activities (2,191) (2,064)

Profit/(Loss) attributable to

members of the parent Company 3,979 (13,423)

Dividends - (1,490)

Retained Profit/(Loss) for the year 3,979 (14,913)

Earnings/(Loss) per share 8.7p (29.3p)

Adjusted earnings per share 9.0p 2.9p

Group Balance Sheet

3 April 4 April

1998 1997

#'000 #'000

Fixed Assets

Tangible fixed assets 37,809 41,571

Investments 1,927 1,927

39,736 43,498

Current Assets

Stocks 32,203 30,236

Debtors 45,776 52,960

Cash at bank and in hand 20,470 20,652

98,449 103,848

Creditors: amounts falling

due within one year (103,046) (107,996)

Net current liabilities (4,597) (4,148)

Total Assets less

Current Liabilities 35,139 39,350

Creditors: amounts falling

due after more than one year (1,328) (7,032)

Provision for Liabilities

and Charges (55) (121)

33,756 32,197

Capital and Reserves

Called up share capital 4,586 4,586

Share premium 25,101 31,101

Special reserve 2,180 -

Profit and loss account 1,889 (3,490)

Shareholders' funds-equity interest 33,756 32,197

Group Statement of Cash Flows

Year to Year to

3 April 4 April

1998 1997

#'000 #'000

Cash flow from operating activities 16,253 12,873

Returns on investment and

servicing of finance (4,686) (4,724)

Taxation (3,477) (2,147)

Capital expenditure (4,539) (8,729)

Acquisitions and disposals 646 (763)

Equity dividends paid - (4,585)

Financing 33,446 (7,950)

Increase/(decrease) in cash

in the period 37,643 (16,025)

Reconciliation of net cash flow to movement in net debt (note 17)

Increase/(decrease) in

cash in the period 37,643 (16,025)

Cash (inflow)/outflow from (increase)/

decrease in debt and lease financing (33,446) 7,950

Change in net debt resulting

from cash flows 4,197 (8,075)

Net financing leases - -

Translation difference 1,987 4,273

Movement in net debt in the period 6,184 (3,802)

Net debt at 4 April 1997 (41,640) (37,838)

Net debt at 3 April 1998 (35,456) (41,640)

Notes

1. Turnover and segmental analysis for the year ended 3rd

April 1998

Year ended Year ended

3.4.98 4.4.97

#'000 #'000

Turnover

Turnover by destination:

Sales to third parties

United Kingdom 46,337 54,806

Continental Europe 85,748 105,263

Rest of the World 38,252 43,124

________ ________

170,337 203,193

________ ________

Turnover by origin:

United Kingdom 86,073 96,358

Continental Europe 82,289 98,916

Rest of the World 53,297 57,250

________ ________

221,659 252,524

________ ________

Inter-segment sales:

United Kingdom (12,109) (9,412)

Continental Europe (26,100) (25,569)

Rest of the World (13,113) (14,350)

________ ________

(51,322) (49,331)

________ ________

Sales to third parties:

United Kingdom 73,964 86,946

Continental Europe 56,189 73,347

Rest of the World 40,184 42,900

________ ________

170,337 203,193

________ ________

The above accounts do not constitute full accounts within the

meaning of the Companies Act. Full accounts to the year 3

April 1998, which have not yet been delivered to the Registrar

of Companies, will be circulated to shareholders.

The auditors have issued an unqualified audit report.

Copies of this announcement are available to members of the

public at the Company's registered office, New Lane, Havant,

Hampshire PO9 2NH.

END

FR AKUKKWKKNUAR

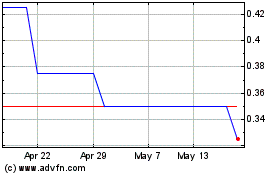

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

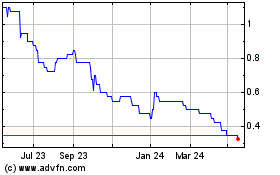

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024