TIDMJDW

RNS Number : 7790K

Wetherspoon (JD) PLC

12 July 2017

12 July 2017

J D WETHERSPOON PLC

PRE-CLOSE TRADING STATEMENT

J D Wetherspoon plc presents below its pre-close trading

statement for the financial year to 30 July 2017. The preliminary

results are due to be announced on 15 September 2017.

Current trading

For the 11 weeks to 9 July 2017 like-for-like sales increased by

5.3% and total sales increased by 3.6%. In the year to date (50

weeks to 9 July 2017) like-for-like sales increased by 3.9% and

total sales increased by 1.9%.

The full-year operating margin before exceptional items and

before a GBP1.6m gain on property is expected to be between 7.6%

and 7.8% for the 53-week period, compared to 6.9% last year.

Property

The Company has opened 9 new pubs since the start of the

financial year and has sold or closed 38. We expect to open one

more pub before the financial year end. There are expected to be

around GBP24m of exceptional, non-cash losses in this financial

year, which are mainly associated with pub disposals and

closures.

As previously announced, the company has increased capital

expenditure in older pubs, which will be about GBP65m in the

current year. Areas of expenditure include staff rooms, kitchen and

garden upgrades, and IT improvements. We anticipate expenditure

continuing at this, or a slightly higher, rate for the next few

years.

As previously announced, the company has bought the freeholds of

a number of properties of which it was previously the tenant. We

have spent GBP89.5 million on 44 of these freeholds in the year to

date, and have spent GBP190.9 million on 102 freeholds since

2011.

Financial position

The Company remains in a sound financial position. Net debt at

the end of this financial year is currently expected to be around

GBP715m.

The company has bought back 3.4m shares, at a total cost of

GBP31m, since the start of the financial year.

Outlook

The chairman of Wetherspoon, Tim Martin, said:

"Sales have been good in the last 11 weeks, probably helped by

unusually good weather.

"As previously stated, the Company anticipates that

like-for-like sales of about 3 to 4% will be required to maintain

profits at this year's levels in our next financial year.

"As is the case for most public companies, shareholders and the

media are interested in our views on the Brexit process. I have

outlined my views in a few paragraphs on some of the issues, which

can be found at the end of this statement. In general, it is my

view that requests to the government, like the one last week from

the FCA, for "clarity" and to "hammer out a post-Brexit

transitional arrangement this year" are unrealistic and increase

pressure to agree unfavourable terms. It also makes the FCA and

similar organisations seem rather weak. Everyone knows that these

sorts of deals aren't within the government's gift - and the City

and businesses are supposed to be able to deal with

uncertainty."

Trading statement ends.

Comments by Tim on Brexit negotiations:

DON'T TIE THE GOVERNMENT'S HANDS

"We'll do well with or without a free trade deal, so stop tying

the hands of our negotiators" says Tim Martin

"Don't believe the media furore - an unprecedented political

consensus has emerged on the main aspects of leaving the EU.

However, it is not one most politicians or the media care to

acknowledge. A consensus, especially between Labour and

Conservatives, is just too embarrassing for our adversarial system

- and is also barely newsworthy.

"The last parliament voted overwhelmingly to trigger Article 50,

and the main manifestos, the basis for the election of about 85% of

MPs, backed the referendum decision.

"Since Theresa May and Jeremy Corbyn each won more votes for

their parties than many thought possible, helped by their upholding

of the referendum result, thoughtful MPs and commentators realise

that the UK star is irrevocably hitched to the Brexit caravan.

"This surreal unity of political purpose, disguised by

handbags-at-dawn polemics, is reinforced by almost complete

unanimity in favour of a free trade deal with the EU.

"The government has stated that it wants "a bold and ambitious

free trade agreement" and shadow Brexit Secretary Keir Starmer

agrees, saying in March that it was critical to hold the government

to account on this pledge. The DUP, the SNP, Sinn Fein and Plaid

Cymru all sing from a similar hymn-sheet.

"The media too seems united in this objective. The Times, the

Guardian, the Financial Times, the Mail and Mirror, for example,

are all free-traders now.

"Yet the cherished goal is at risk from the phoney war being

waged in parliament and the media.

"As any buyer of a house or car knows, if you want something too

badly, you will pay a very high price - especially if your desire

is obvious to the counterparty. The basic principle of obtaining a

good deal is that you need an alternative plan - necessity never

makes a good bargain, as Benjamin Franklin said. So a viable

alternative has be the cornerstone of the government's

position.

"Yet the unelected EU presidents, Jean Claude Juncker and Donald

Tusk, have unfortunately become convinced of our desperation for a

free trade deal, and are determined to extract a high price. Hence

the early suggestions of a contribution to the EU of EUR50bn, or

even EUR100bn, combined with a petulant and antagonistic

negotiating stance.

"The UK's viable alternative, the basis on which we and the EU

trade with America, China, India and most of the world, is World

Trade Organisation rules. EU tariffs, themselves subject to WTO

rules, are relatively small, averaging about 3%, as many

commentators have noted - and the EU, according to the rules,

cannot impose higher tariffs on the UK than are charged to other

non-EU countries.

"Since the majority of the UK's trade is currently conducted on

the basis of these rules, it is absurd to talk of cliff edges and

an apocalypse if EU trade reverts to them in the future.

"The think tank Open Europe, neutral during the referendum

campaign, estimates a likely difference to our 2030 GDP of less

than 1%, plus or minus, from leaving the EU, depending on the deals

that are struck and the policies that are pursued.

"Many dyed-in-the-wool remainers, especially economists, are

currently engaged in a rerun of project fear, forecasting dire

outcomes in the absence of a deal.

"However, the public can see that the recession, combined with

increased unemployment and interest rates, predicted by many of the

same economists for the immediate aftermath of a leave vote, did

not materialise. They are deeply sceptical of apocalyptic warnings

now from the same quarter.

"The majority of the public instinctively understands the

government's bargaining dilemma. Yet the supposedly sophisticated

CBI, the Financial Times, the Times and the other usual suspects

are vociferous in their forecasts of trouble in the absence of a

free trade deal. As a result, they are loading the dice hugely in

favour of EU negotiators.

"The public's message to Carolyn "We're all doomed" Fairbairn,

head of the CBI, and other gloomsters is: put a sock in it. We'll

do well with or without a free trade deal, so stop tying the hands

of our negotiators, who are doing their best to achieve a

respectable outcome."

Ends.

Enquiries:

John Hutson Chief Executive Officer 01923 477777

Ben Whitley Finance Director 01923 477777

Eddie Gershon Company spokesman 07956 392234

Notes to editors

1. J D Wetherspoon owns and operates pubs throughout the UK. The

Company aims to provide customers with good-quality food and drink,

served by well-trained and friendly staff, at reasonable prices.

The pubs are individually designed, and the Company aims to

maintain them in excellent condition.

2. Visit our website: www.jdwetherspoon.com

3. This announcement has been prepared solely to provide

additional information to the shareholders of J D Wetherspoon, to

meet the requirements of the FCA's Disclosure and Transparency

Rules. It should not be relied on by any other party, for any other

purposes. Forward-looking statements have been made by the

directors in good faith, using information available up until the

date on which they approved this statement. Forward-looking

statements should be regarded with caution, because of the inherent

uncertainties in economic trends and business risks.

4. This announcement contains inside information on JD Wetherspoon plc.

5. The current financial year comprises 53 trading weeks to 30 July 2017.

6. The next trading update is expected to be the Company's final

results announcement on 15 September 2017.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTKMGMNNMGGNZM

(END) Dow Jones Newswires

July 12, 2017 02:00 ET (06:00 GMT)

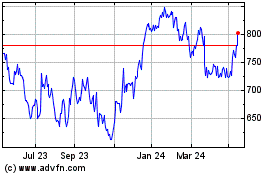

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Dec 2024 to Jan 2025

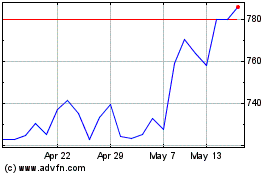

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Jan 2024 to Jan 2025