Adamas Finance Asia Limited Share Buyback Programme (9385Q)

February 25 2019 - 2:03AM

UK Regulatory

TIDMADAM

RNS Number : 9385Q

Adamas Finance Asia Limited

25 February 2019

ADAMAS FINANCE ASIA LIMITED

("ADAM" or the "Company")

Share Buyback Programme

The Board of Adamas Finance Asia Limited ("ADAM"), the London

quoted pan-Asian diversified investment vehicle, has approved a

share buyback programme ("Programme") to repurchase ordinary shares

of no par value ("Ordinary Shares") up to an aggregate value of

US$500,000.

The Programme will commence on 25 February 2019 and is due to be

completed by the end of 2019. ADAM plans to hold any Ordinary

Shares purchased under the Programme in treasury.

Ordinary Share purchases will take place in open market

transactions and may be made from time to time depending on market

conditions, share price, trading volume and other factors. The

Company has appointed VSA Capital Limited ("VSA") to manage an

irrevocable, non-discretionary share buyback programme to

repurchase Ordinary Shares on its behalf, subject to pre-agreed

parameters including a maximum price of US$0.79 per Ordinary Share

(being a 25% discount to the proforma net asset value per share of

US$1.06, calculated by dividing the estimated net assets of the

Company as at 30 September 2018 by the current number of Ordinary

Shares in issue of 88,733,069).

Any purchases of Ordinary Shares by the Company in relation to

this announcement will be carried out on the London Stock Exchange

and will be effected in accordance with (and subject to the limits

prescribed by) (i) the general authority granted by shareholders to

the Board at the Company's 2018 annual general meeting that the

Company may purchase or repurchase up to 14.99% of the number of

shares of the Company in issue as at 17 August 2018; and (ii) the

Market Abuse Regulation 596/2014 ("MAR") and the AIM Rules.

This announcement includes inside information for the purposes

of Article 7 of MAR.

Enquiries

Adamas Finance Asia Limited

John Croft +44 (0) 1825 830587

WH Ireland Limited - Nominated

Adviser +44 (0) 113 394 6600

James Joyce

James Sinclair-Ford

VSA Capital Limited - Corporate

Broker +44 (0) 20 3005 5000

Andrew Monk

Andrew Raca

Buchanan - Financial PR +44 (0) 20 7466 5000

Charles Ryland

Victoria Hayns

Henry Wilson

About Adamas Finance Asia

ADAM is a London quoted investment company focusing on

delivering long-term income and capital growth to shareholders

through a diverse portfolio of pan-Asian investments. It aims to

provide uncorrelated returns through a combination of capital

growth and dividend income from a broad spectrum of national

geographies and asset classes from the Asian Small and Medium

Enterprise (SME) sector.

The company's investment manager, Harmony Capital, which has a

dedicated team with real Asian expertise, is focussed on the

strategy of creating income and capital growth. Harmony is sourcing

predominately private opportunities and has created a strong

pipeline of income generating assets from potential investments in

industries such as healthcare, fintech, hospitality, IT and

property across Asia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSCKPDQKBKKQBB

(END) Dow Jones Newswires

February 25, 2019 02:03 ET (07:03 GMT)

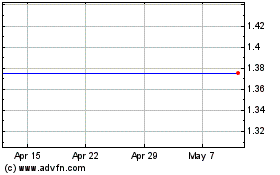

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From Apr 2024 to May 2024

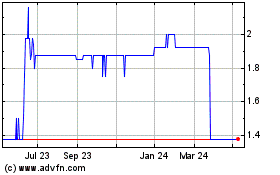

Jade Road Investments (LSE:JADE)

Historical Stock Chart

From May 2023 to May 2024