IP Group PLC Enterprise Therapeutics raises £29m

April 12 2018 - 4:19AM

RNS Non-Regulatory

TIDMIPO

IP Group PLC

12 April 2018

FOR RELEASE ON 12 April 2018

IP Group plc - Portfolio company Enterprise Therapeutics raises

GBP29m funding

IP Group plc (LSE: IPO) ("IP Group" or "the Group"), the

developer of intellectual property-based businesses, is pleased to

note that its portfolio company Enterprise Therapeutics Limited

("Enterprise" or "the Company"), has announced a GBP29 million

fundraising.

Enterprise Therapeutics, which entered the IP Group portfolio

following the combination with Touchstone Innovations, is

developing muco-regulatory therapies to treat patients with

respiratory diseases of high unmet medical need, where mucus

obstruction reduces lung function, leading to difficulty in

breathing and recurrent lung infections.

The financing, which was oversubscribed, was co-led by Versant

Ventures and Novartis Venture Fund with funding from new investor

Forbion and existing shareholders Epidarex Capital and IP

Group.

IP Group has committed to invest a total of GBP4.7 million of

the round, which is tranched and subject to the achievement of

certain milestones. The Group has invested GBP2.5 million in the

first tranche of the fundraising.

The investment will fund Enterprise Therapeutics' drug discovery

pipeline of muco-regulatory therapies into clinical development,

enabling new treatment options for cystic fibrosis, chronic

obstructive pulmonary disease and severe asthma.

For more information, please contact:

IP Group plc www.ipgroupplc.com

Alan Aubrey, Chief Executive

Officer +44 (0) 20 7444 0050

Greg Smith, Chief Financial

Officer +44 (0) 20 7444 0062/+44

Liz Vaughan-Adams, Communications (0) 7979 853802

Charlotte Street Partners

Andrew Wilson +44 (0) 7810 636995

Martha Walsh +44 (0) 7876 245962

Notes for editors

About IP Group

IP Group is a leading intellectual property commercialisation

company which focuses on evolving great ideas, mainly from its

partner universities, into world-changing businesses. The Group has

pioneered a unique approach to developing these ideas and the

resulting businesses by providing access to business building

expertise, capital (through its 100%-owned FCA-authorised

subsidiaries IP Capital and Parkwalk Advisors), networks,

recruitment and business support. IP Group has a strong track

record of success and its portfolio comprises holdings in

early-stage to mature businesses across life sciences and

technology. IP Group is listed on the Main Market of the London

Stock Exchange under the code IPO.

Group holdings in portfolio companies reflect the undiluted

beneficial equity interest excluding debt, unless otherwise

explicitly stated.

For more information, please visit our website at

www.ipgroupplc.com.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAMMGMDRZVGRZG

(END) Dow Jones Newswires

April 12, 2018 04:19 ET (08:19 GMT)

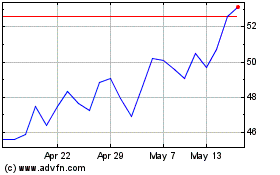

Ip (LSE:IPO)

Historical Stock Chart

From Apr 2024 to May 2024

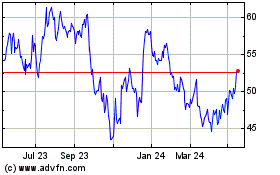

Ip (LSE:IPO)

Historical Stock Chart

From May 2023 to May 2024