TIDMICGC

Preliminary Statement of Results for the year ended 31 December 2014

FINANCIAL HIGHLIGHTS 2014 2013 Change %

Revenue EUR290.1m EUR264.7m +9.6%

EBITDA EUR50.5m EUR49.2m +2.6%

Operating profit (before non-trading items) EUR32.7m EUR30.0m +9.0%

Non-trading item: Curtailment gain less

related costs EUR28.7m -

Non-trading item: Gain on disposal of

subsidiary - EUR3.5m

EPS

EPS Basic 30.4c 14.6c +108.2%

EPS Adjusted 15.5c 13.8c +12.3%

Final dividend 7.035c 6.7c +5.0%

Net Debt EUR61.3m EUR93.4m -34.4%

CARRYINGS 2014 2013

'000 '000 Change %

Passengers 1,643.3 1,568.3 +4.8%

Cars 381.8 350.9 +8.8%

RORO Freight 247.9 205.3 +20.8%

Container Freight (teu*) 277.2 279.2 -0.7%

Port Lifts 187.0 177.3 +5.5%

*teu = twenty foot equivalent units

Key financial and performance highlights:

-- Revenue up 9.6%, adjusted EPS up 12.3%

-- Dividend increased by 5%, Net Debt down 34.4%

-- RORO freight volumes +20.8%, car carryings +8.8%

Commenting on the results Chairman John B McGuckian said,

"2014 was another successful year for the group with growth in revenue

of almost 10% to EUR290.1 million and earnings before non-trading items,

interest, tax, depreciation and amortisation (EBITDA) of EUR50.5 million,

up 2.6%, having absorbed the costs of the newly introduced vessel,

'Epsilon'. The strong momentum, evident in Q4 of 2014 has continued into

early 2015 giving us confidence that we can look forward in 2015, in the

absence of unforeseen developments and assuming continued lower oil

prices, to strong growth in revenue and earnings."

5 March 2015

Irish Continental Group (ICG) is a leading Irish based maritime

transport group. ICG carries passengers and cars, Roll on Roll off

(RORO) freight and container Lift on Lift off (LOLO) freight, on routes

between Ireland, the United Kingdom and Continental Europe.

PRELIMINARY STATEMENT OF RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014

2014 proved to be another successful year for the Group, with a positive

financial and operational performance, and a strengthening of the

Group's strategic positioning as the leading maritime transport provider

in the Republic of Ireland.

Revenue for the year grew 9.6% to EUR290.1 million with growth of 14.0%

in the Ferries Division and 2.6% in the Container & Terminal Division.

Operating costs (excluding depreciation) were 11.2% higher at EUR239.6

million as we absorbed the full year incremental cost of the additional

vessel, 'Epsilon', introduced in late 2013. EBITDA increased by 2.6%, to

EUR50.5 million. Operating profit (before non-trading items) was up 9.0%

at EUR32.7 million. The net finance charge was EUR4.7 million (2013:

EUR6.3 million). The taxation charge was EUR0.7 million compared with

EUR0.4 million in 2013. There was a non-trading item of EUR28.7 million

resulting from the curtailment gain recognised as a result of the

pension deficit funding agreement concluded during the year. Basic EPS

(including non-trading items) was 30.4 cent (2013: 14.6 cent), while

adjusted EPS (excluding non-trading items and the net interest cost on

defined benefit pension schemes) was 12.3% higher at 15.5 cent.

BUSINESS REVIEWS

FERRIES DIVISION

The chartered Ropax vessel, 'Epsilon', introduced to the fleet in late

2013 and, which is an enhancement of Irish Ferries service offering, has

provided 18 additional weekly sailings between Dublin and Holyhead as

well as a weekly round trip between Dublin and France. As a result,

Irish Ferries increased its sailings across its route network, from

4,381 in 2013 to 5,210 in 2014 (up 19%).

Revenue in the division was 14.0% higher than the previous year at

EUR184.3 million while operating profit (before non-trading items) was

EUR28.0 million compared with EUR24.9 million in 2013. The increase in

profit was due primarily to increased freight and passenger revenue

partially offset by additional operating costs of the newly introduced

'Epsilon'. While underlying fuel prices were lower in the year compared

with 2013, particularly in the last quarter, the operation of the

'Epsilon' meant that the division's total fuel cost was 13.7% higher

than the previous year at EUR40.7 million (2013: EUR35.8 million).

Revenue in the first half of the year increased 12.0% to EUR77.7 million

(2013: EUR69.4 million), while in the second half revenue increased

15.5%, to EUR106.6 million (2013: EUR92.3 million).

Car and Passenger markets

It is estimated that the overall car market, to and from the Republic of

Ireland, grew by approximately 3.6% in 2014 to 780,000 cars, while the

all-island market, i.e. including routes into Northern Ireland, is

estimated to have grown by 2.4%. Irish Ferries' car carryings performed

strongly during the year, at 381,800 cars, (2013: 350,900), up 8.8% on

the previous year. In the first half Irish Ferries grew its car volumes

by 5.9% while in the second half, which includes the busy summer holiday

season, the increase was higher, at 10.8%. The strong market and Irish

Ferries performances reflect the positive performance of the Irish

tourist industry. Initiatives by the tourist industry such as the Wild

Atlantic Way, have been instrumental in promoting 'own car' tourism

around the west and southern Irish coasts, and have helped broaden the

distribution of tourists around the island.

The total sea passenger market (i.e. comprising car, coach and foot

passengers) to and from the Republic of Ireland also grew by 2.6% in

2014, to a total of 3.2 million passengers, while the all-Island market

grew by 1.6%. Irish Ferries' passenger numbers carried were up 4.8% at

1.643 million (2013: 1.568 million). In the first half of the year,

Irish Ferries passenger volumes were up by 0.8% and in the second half

of the year, which is seasonally more significant, the growth in

passenger numbers was 7.8%.

Freight

The RORO freight market between the Republic of Ireland, and the U.K.

and France, which had resumed growth in 2013, continued to develop in

2014 with the total number of trucks and trailers up by around 6.7% to

approximately 838,000 units. On an all-island basis, the market was up

around 3.3% to approximately 1.6 million units.

Irish Ferries' carryings, at 247,900 freight units (2013: 205,300), were

up 20.8% in the year reflecting a strong performance by Irish Ferries

relative to the market (volumes were up 18.5% in the first half and

22.9% in the second half). The increased capacity provided by the

'Epsilon' was a major contributor to the growth as was the increased

frequency the vessel offers Irish Ferries' freight clients with a

freight departure on the key Dublin-Holyhead route every six hours

rather than the previous twelve hour frequency.

Chartering

The 'Kaitaki' remained on its 4 year charter to KiwiRail during the year,

operating in New Zealand.

In April 2014, the Group received EUR17.0 million in full settlement of

all amounts then due under the terms of the Bareboat Hire Purchase

Agreement relating to the sale of the vessel 'Bilbao' concluded in 2010.

Under this Agreement, the finance lease receivable was originally to

have been received in instalments from the Russian charterer, St. Peter

Line, over the period to September 2016. The funds were utilised towards

the reduction of net debt.

CONTAINER AND TERMINAL DIVISION

Revenue in the division increased to EUR107.0 million (2013: EUR104.3

million). The revenue is derived from container handling and related

ancillary revenues at our terminals and in Eucon from a mix of domestic

door-to-door, quay-to-quay and feeder services. With a flexible

chartered fleet and slot charter arrangements Eucon was able to adjust

capacity and thereby continue to meet the requirements of customers in a

cost effective and efficient manner. Operating profit in the division

was down 7.8% at EUR4.7 million (2013: EUR5.1 million) due mainly to

reduced feeder carryings. Fuel costs were down 5.4% to EUR12.3 million

(2013: EUR13.0 million), offset by reduced freight surcharges to

customers. Overall container volumes shipped were down 0.7% compared

with the previous year at 277,200 teu (2013: 279,200 teu). Feeder

volumes were down approximately 4% while domestic volumes were up

approximately 2%.

We ceased calling to Le Havre (Radicatel) in January 2015 in order to

concentrate our capacity on our Rotterdam and Antwerp services.

Containers handled at the Group's terminals in Dublin Ferryport

Terminals (DFT) and Belfast Container Terminal (BCT) were up 5.5% at

187,000 lifts (2013: 177,300 lifts). DFT's volumes were up 6.1%, while

BCT's lifts were up 2.4%.

On 1 January 2015, the EU Sulphur Directive came into force in many

parts of Northern Europe, including the North Sea and the English

Channel termed as Sulphur Emission Control Area's (SECA's). This reduced

the permissible level of sulphur in bunker fuel from 1.0% to 0.1% for

vessels in these SECA's requiring the vessels in the Eucon fleet to

consume, higher cost, low sulphur fuel. The increased costs from

consuming this low sulphur fuel are being passed onto the end user via

increased surcharges in order to maintain a viable freight network for

the benefit of Ireland's exporters and importers.

PENSIONS

During the year we completed negotiations on a recovery plan with the

trustee of the Group's largest defined benefit pension scheme. Under the

terms of the recovery plan, liabilities in the scheme have been reduced

by the removal of guaranteed inflation-linked pension increases for some

scheme members while the funding of the plan has been enhanced through a

payment plan which will see the Group contribute annual payments of

EUR1.5 million per annum (supplemented by EUR0.5 million per annum into

an escrow account) until 2023 or until the deficit is eliminated, if

earlier.

The changes agreed give rise to a net gain of EUR28.7 million which

includes a curtailment gain of EUR31.0 million less directly related

costs and has been accounted for as a non-trading credit.

FINANCE

EBITDA for the year was EUR50.5 million (2013: EUR49.2 million). There

was a net outflow of working capital of EUR2.2 million, due to an

increase in receivables of EUR4.8 million, due to higher freight revenue,

partially offset by a decrease in inventories of EUR0.7 million and an

increase in payables of EUR1.9 million. The Group made payments, in

excess of service costs, to the Group's pension funds of EUR3.9 million.

Cash generated from operations amounted to EUR44.4 million (2013:

EUR40.3 million).

Net interest paid was EUR3.5 million (2013: EUR4.3 million) while

taxation paid was EUR1.1 million (2013: EUR0.2 million).

Capital expenditure was EUR8.0 million (2013: EUR8.7 million) which

primarily included the annual refits of the vessels and new containers

to enhance the Eucon fleet of equipment.

Net debt at year end was EUR61.3 million (2013: EUR93.4 million) which

represents 1.2 times EBITDA (2013: 1.9 times EBITDA).

DIVIDEND

During the year the Group paid the final dividend for 2013 of 6.7 cent

per ICG Unit. The Group also paid an interim dividend for 2014 of 3.465

cent per ICG Unit, and the Board is proposing a final dividend of 7.035

cent per ICG Unit, payable in June 2015, making a total dividend for

2015 of 10.5 cent per ICG Unit, an increase of 5% on the prior year.

Subject to shareholder approval at the Annual General Meeting, the final

dividend will be paid on 19 June 2015 to shareholders on the register at

close of business on 5 June 2015. Irish dividend withholding tax will be

deducted where appropriate.

SUB-DIVISION OF ICG UNITS

During the year the Board received shareholder approval to implement a

10-for-1 sub-division of its ordinary shares and to redeem all of the

redeemable shares in issue. The purpose of these actions was to improve

the marketability and liquidity of ICG's Units. As a result the

comparative EPS, dividend per share and number of ordinary shares have

been restated.

CURRENT TRADING & OUTLOOK

Since our last update to the market, in the Interim Management Statement

of November 2014, trading conditions have continued to improve. Revenue

for the year was up 9.6% for the full year, versus 9.0% for the 9 months

to the end of September 2014 resulting in EBITDA for the final quarter

of 2014 up EUR1.9 million at EUR8.4 million. The improved momentum has

continued into the first two months of 2015. In the period to 28

February cars are up 16% on last year and passenger carryings are 3%

ahead of 2014. RORO freight volumes are up 14% on the same period in

2014 as we continue to benefit from the additional capacity of the

'Epsilon'. In the Container and Terminal Division containers carried are

down 1% while port lifts are up 6% year to date.

Lower world fuel prices have softened the impact of the introduction of

the low sulphur directive in the English Channel and are also providing

a stimulus to the transportation sector generally. As a result of these

factors, and bearing in mind the general improvement in the economic

outlook in our sphere of operations, we look forward, in the absence of

unforeseen circumstances and assuming continued low oil prices, to

strong growth in revenue and earnings for the financial year 2015.

John B. McGuckian

Chairman

Enquiries:

Eamonn Rothwell Chief Executive Officer +353 1 607 5628

Garry O'Dea Finance Director +353 1 607 5628

Consolidated Income Statement for the year ended 31 December 2014

Notes 2014 2013

EURm EURm

Revenue 290.1 264.7

Depreciation and amortisation (17.8) (19.2)

Employee benefits expense (18.9) (17.8)

Other operating expenses (220.7) (197.7)

32.7 30.0

Non-trading items 4 28.7 -

Operating profit 61.4 30.0

Investment revenue 0.1 0.2

Finance costs (4.8) (6.5)

Profit before tax 56.7 23.7

Income tax expense 3 (0.7) (0.4)

Profit from continuing operations 56.0 23.3

Discontinued operations

Non-trading items 4 - 3.5

Total discontinued operations - 3.5

Profit for the year: all attributable

to equity holders of the parent 56.0 26.8

Earnings per share - expressed in EUR cent per share

Basic 5 30.4c 14.6c

Diluted 5 30.1c 14.5c

Consolidated Statement of Comprehensive Income for the year ended 31

December 2014

2014 2013

EURm EURm

Profit for the year 56.0 26.8

Items that may be reclassified subsequently to profit

or loss:

Cash flow hedges:

- Fair value movements arising during the year (1.0) 0.2

-Transfer to Consolidated Income Statement - net settlement

of cash flow hedge 0.3 0.4

Exchange differences on translation of foreign operations 0.3 -

Exchange difference on defined benefit pension schemes 0.1 (0.2)

Items that will not be reclassified subsequently to

profit or loss:

Actuarial (loss) / gain on retirement benefit obligations (21.2) 14.3

Deferred tax movements - (0.1)

Other comprehensive (expense) / income for the year (21.5) 14.6

Total comprehensive income for the year:

all attributable to equity holders of the parent 34.5 41.4

Consolidated Statement of Financial Position as at 31 December 2014

Notes 2014 2013

EURm EURm

Assets

Non-current assets

Property, plant and equipment 154.0 163.5

Intangible assets 0.7 0.8

Finance lease receivable - 14.7

Retirement benefit surplus 8 5.4 4.7

160.1 183.7

Current assets

Inventories 2.0 2.7

Trade and other receivables 34.7 33.0

Cash and bank balances 6 22.7 18.5

59.4 54.2

Total assets 219.5 237.9

Equity and liabilities

Equity

Share capital 12.0 12.0

Share premium 9.7 8.5

Other reserves (8.0) (9.3)

Retained earnings 47.6 31.0

Equity attributable to equity

holders of the parent 61.3 42.2

Non-current liabilities

Borrowings 6 66.7 95.2

Trade and other payables - 0.6

Deferred tax liabilities 3.8 3.9

Provisions 0.5 0.4

Deferred grant 0.5 0.6

Retirement benefit obligation 8 29.5 41.4

101.0 142.1

Current liabilities

Borrowings 6 17.3 16.7

Trade and other payables 38.4 35.9

Derivative financial instruments 0.7 -

Current income tax liabilities 0.2 0.5

Provisions 0.5 0.4

Deferred grant 0.1 0.1

57.2 53.6

Total liabilities 158.2 195.7

Total equity and liabilities 219.5 237.9

Consolidated Statement of Changes in Equity for the year ended 31

December 2014

Share Share Other Retained

Capital Premium Reserves Earnings Total

EURm EURm EURm EURm EURm

Balance at 1 January 2014 12.0 8.5 (9.3) 31.0 42.2

Profit for the year - - - 56.0 56.0

Other comprehensive expense - - (0.4) (21.1) (21.5)

Total comprehensive (expense) / income for the year - - (0.4) 34.9 34.5

Employee share-based payment expense - - 2.2 - 2.2

Share issue - 1.2 - - 1.2

Dividends - - - (18.8) (18.8)

Transferred to retained earnings on exercise of share

options - - (0.5) 0.5 -

- 1.2 1.3 16.6 19.1

Balance at 31 December 2014 12.0 9.7 (8.0) 47.6 61.3

Analysed as follows:

Share capital 12.0

Share premium 9.7

Other reserves (8.0)

Retained earnings 47.6

61.3

Other Reserves comprise the following:

Share

Capital Options Hedging Translation

Reserve Reserve Reserve Reserve Total

EURm EURm EURm EURm EURm

Balance at 1 January 2014 7.3 3.1 - (19.7) (9.3)

Total comprehensive (expense) / income - - (0.7) 0.3 (0.4)

Employee share-based payment expense - 2.2 - - 2.2

Transferred to retained earnings on exercise of share

options - (0.5) - - (0.5)

- 1.7 (0.7) 0.3 1.3

Balance at 31 December 2014 7.3 4.8 (0.7) (19.4) (8.0)

Consolidated Statement of Changes in Equity for the year ended 31

December 2013

Share Share Other Retained

Capital Premium Reserves Earnings Total

EURm EURm EURm EURm EURm

Balance at 1 January 2013 11.9 7.5 (9.6) 8.2 18.0

Profit for the year - - - 26.8 26.8

Other comprehensive income - - 0.6 14.0 14.6

Total comprehensive income for the year - - 0.6 40.8 41.4

Employee share-based payment expense - - 0.1 - 0.1

Share issue 0.1 1.0 - - 1.1

Dividends - - - (18.4) (18.4)

Transferred to retained earnings on exercise of share

options - - (0.4) 0.4 -

0.1 1.0 0.3 22.8 24.2

Balance at 31 December 2013 12.0 8.5 (9.3) 31.0 42.2

Analysed as follows:

Share capital 12.0

Share premium 8.5

Other reserves (9.3)

Retained earnings 31.0

42.2

Other Reserves comprise the following:

Share

Capital Options Hedging Translation

Reserve Reserve Reserve Reserve Total

EURm EURm EURm EURm EURm

Balance at 1 January 2013 7.3 3.4 (0.6) (19.7) (9.6)

Total comprehensive income - - 0.6 - 0.6

Employee share-based payment expense - 0.1 - - 0.1

Transferred to retained earnings on exercise of share

options - (0.4) - - (0.4)

- (0.3) 0.6 - 0.3

Balance at 31 December 2013 7.3 3.1 - (19.7) (9.3)

Consolidated Statement of Cash Flows for the year ended 31 December 2014

2014 2013

Notes EURm EURm

Net cash inflow from operating activities 7 39.7 35.6

Cash flow from investing activities

Interest received 0.1 0.2

Proceeds on disposal of property, plant and equipment 0.1 0.4

Net proceeds received on disposal of subsidiary - 9.4

Payment received on finance lease receivable 17.8 2.9

Purchases of property, plant and equipment (7.7) (8.4)

Purchases of intangible assets (0.3) (0.3)

Net cash inflow from investing activities 10.0 4.2

Cash flow from financing activities

Dividends paid to equity holders of the Company (18.8) (18.4)

Repayments of borrowings (39.6) (31.9)

Repayments of obligations under finance leases (0.8) (0.7)

Proceeds on issue of ordinary share capital 1.2 1.1

New bank loans raised 7.5 5.0

Proceeds from sale and leaseback 1.6 1.2

Net cash used in financing activities (48.9) (43.7)

Net increase / (decrease) in cash and cash

equivalents 0.8 (3.9)

Cash and cash equivalents at the beginning of the

year 18.5 22.3

Effect of foreign exchange rate changes 0.1 0.1

Cash and cash equivalents at the end of the year 6 19.4 18.5

Notes to the Preliminary Statement for the year ended 31 December 2014

1. Accounting policies

The Group did not adopt any new International Financial Reporting

Standards (IFRS) or Interpretations in the year that had a material

impact on the Group's Financial Statements.

Restatement of Earnings per share, dividend per share and number of

ordinary shares

The comparative information for the earnings per share calculation has

been restated to reflect the 10-for-1 sub-division of ICG Units which

occurred on 9 June 2014. The comparative dividend per ICG Unit, numbers

of ordinary shares information and all other share / Unit disclosures

have also been restated.

2. Segmental information

The Board is deemed the chief operating decision maker within the Group.

For management purposes, the Group is currently organised into two

operating segments: Ferries and Container & Terminal.

Net Assets (equity

Revenue Profit Before Tax attributable to equity holders)

Analysis of

results 2014 2013 2014 2013 2014 2013

EURm EURm EURm EURm EURm EURm

Ferries 184.3 161.7 28.0 24.9 97.8 110.3

Container and

Terminal 107.0 104.3 4.7 5.1 24.8 25.3

Intersegment

Revenue (1.2) (1.3) - - - -

Total 290.1 264.7 32.7 30.0 122.6 135.6

Non-trading

items - - 28.7 3.5 - -

Net interest

/ debt - - (4.7) (6.3) (61.3) (93.4)

Other

liabilities - - - - - -

290.1 264.7 56.7 27.2 61.3 42.2

Analysis by

origin of

booking 2014 2013

EURm EURm

Ireland 147.5 131.0

United

Kingdom 52.8 46.1

Netherlands 48.3 45.9

Belgium 24.6 25.0

France 7.1 7.4

Other 9.8 9.3

Total 290.1 264.7

3. Income tax expense

2014 2013

EURm EURm

Current tax 0.8 0.6

Deferred tax (0.1) (0.2)

Income tax expense for the year 0.7 0.4

The Company and its Irish tax resident subsidiaries have elected to be

taxed under the Irish tonnage tax method. Under the tonnage tax method,

taxable profit on eligible activities is calculated on a specified

notional profit per day related to the tonnage of the ships utilised.

In accordance with the IFRIC guidance on IAS 12 Income Taxes, the

tonnage tax charge is not considered an income tax expense and has been

included in other operating expenses in the Consolidated Income

Statement.

Domestic income tax is calculated at 12.5% of the estimated assessable

profit for the year for all activities which do not fall to be taxed

under the tonnage tax system. Taxation for other jurisdictions is

calculated at the rates prevailing in the relevant jurisdictions and

range between 21% and 23% (2013: 23% and 24%).

The total expense for the year is reconciled to the accounting profit as

follows:

2014 2013

EURm EURm

Profit before tax 56.7 23.7

Gain on disposal of discontinued operations - 3.5

56.7 27.2

Tax at the domestic income tax rate of 12.5% (2013:

12.5%) 7.1 3.4

Effect of tonnage relief (1.9) (1.8)

Non-taxable curtailment gain (3.9) -

Tax exempted earnings - (0.4)

Net utilisation of tax losses (0.1) (0.2)

Difference in effective tax rates 0.1 0.1

Other items (0.6) (0.7)

Income tax expense recognised in the

Consolidated Income Statement 0.7 0.4

4. Non-trading items

2014 2013

EURm EURm

Continuing operations

Curtailment gain arising from pension deficit funding

agreement

less related costs 28.7 -

Discontinued operations

Gain on the disposal of discontinued operations - 3.5

Total non-trading items 28.7 3.5

During the year the Group concluded a deficit funding agreement with the

trustee of the Group's main defined benefit pension scheme, the Irish

Ferries Limited Pension Scheme. Under the terms of the agreement,

liabilities of the scheme will be reduced by the replacement of

guaranteed pension increases for some members of the scheme with

discretionary pension increases linked to the funding of the scheme. The

reduction in liability arising has been estimated at EUR31.0 million by

the scheme actuary. This curtailment gain of EUR31.0 million less EUR2.0

million in directly related share options expenses and EUR0.3 million of

directly related professional fees has been included as a non-trading

item in the Consolidated Income Statement. The share-based payment

expense directly attributable to the gain arises because the curtailment

gain resulted in the EPS performance criteria for the vesting of the

options being met.

In 2013, a gain of EUR3.5 million on disposal of a former subsidiary was

recognised, following the receipt of all deferred contingent

consideration due under the Sale Agreement, which had been dependent

upon the achievement of certain conditions. In addition there was a

settlement for working capital less costs of disposal incurred.

5. Earnings per share

2014 2013*

Number of shares '000 '000

Weighted average number of ordinary shares for the

purposes of

basic earnings per share 184,357 183,650

Effect of dilutive potential ordinary shares: Share

options 1,438 970

Weighted average number of ordinary shares for the

purposes of

diluted adjusted earnings per share 185,795 184,620

The denominator for the purposes of calculating both basic and diluted

earnings per share has been adjusted to reflect shares issued during the

year and excludes treasury shares.

The earnings used in both the adjusted basic and diluted earnings per

share have been adjusted to take into account the non-trading items

together with the net interest on defined benefit pension schemes.

Profit attributable to ordinary shareholders

The calculation of the basic and diluted earnings per share attributable

to the ordinary equity holders of the parent is based on the following

data:

2014 2013

Earnings EURm EURm

Earnings for the purposes of basic earnings per share

-

Profit for the year attributable to equity holders

of the parent 56.0 26.8

Earnings for the purposes of diluted earnings per

share 56.0 26.8

Earnings for the purposes of basic earnings per share

-

Profit for the year attributable to equity holders

of the parent 56.0 26.8

Effect of non-trading items (28.7) (3.5)

Net interest cost on defined benefit pension schemes 1.2 2.0

Earnings for the purposes of adjusted earnings per

share 28.5 25.3

2014 2013*

Cent Cent

Basic earnings per share 30.4 14.6

Diluted earnings per share 30.1 14.5

Adjusted basic earnings per share 15.5 13.8

Adjusted diluted earnings per share 15.3 13.7

* The comparative information has been adjusted for the 10-for-1

sub-division of ICG Units which became effective on 9 June 2014.

6. Net debt

Bank

Cash Overdraft Loans Leases Total

EURm EURm EURm EURm EURm

At 1 January 2014

Current assets 18.5 - - - 18.5

Creditors due within one year - - (16.0) (0.7) (16.7)

Creditors due after one year - - (92.3) (2.9) (95.2)

18.5 - (108.3) (3.6) (93.4)

Cash flow 4.2 - - - 4.2

Drawdown - (3.3) (7.5) (1.6) (12.4)

Repayment - - 39.6 0.8 40.4

Foreign exchange rate changes - - - (0.1) (0.1)

4.2 (3.3) 32.1 (0.9) 32.1

At 31 December 2014

Current assets 22.7 - - - 22.7

Creditors due within one year - (3.3) (13.0) (1.0) (17.3)

Creditors due after one year - - (63.2) (3.5) (66.7)

22.7 (3.3) (76.2) (4.5) (61.3)

The loan drawdown and repayments have been made under the Group's loan

facilities.

For the purposes of the statement of cash flows, cash and cash

equivalents include cash on hand and in banks net of outstanding bank

overdrafts. Cash and cash equivalents at the end of the reporting period

as shown in the statement of cash flows can be reconciled as follows:

2014 2013

EURm EURm

Cash and bank balances 22.7 18.5

Bank overdraft (3.3) -

Cash and cash equivalents 19.4 18.5

7. Net cash from operating activities

2014 2013

EURm EURm

Operating activities

Profit for the year 56.0 26.8

Adjustments for:

Finance costs (net) 4.7 6.3

Income tax expense 0.7 0.4

Retirement benefit obligations - current service cost 1.9 1.9

Retirement benefit obligations - payments (4.0) (5.6)

Retirement benefit obligations - past service credit (1.8) (2.1)

Depreciation of property, plant and equipment 17.5 19.0

Amortisation of intangible assets 0.4 0.3

Amortisation of deferred income (0.1) (0.1)

Share-based payment expense 0.2 0.1

Non-trading item: Gain on disposal of subsidiary - (3.5)

Non-trading item: Net gain on pension deficit agreement (28.7) -

Non-trading item: Fees related to pension deficit

agreement (0.3) -

Gain on disposal of property, plant and equipment (0.1) (0.4)

Increase in other provisions 0.2 -

Operating cash flows before movements in working capital 46.6 43.1

Decrease in inventories 0.7 -

Increase in receivables (4.8) (1.5)

Increase / (decrease) in payables 1.9 (1.3)

Cash generated from operations 44.4 40.3

Income taxes paid (1.1) (0.2)

Interest paid (3.6) (4.5)

Net cash generated from operating activities 39.7 35.6

8. Retirement benefit schemes

The principal assumptions used for the purpose of the actuarial

valuations were as follows:

STERLING EURO

LIABILITIES LIABILITIES

2014 2013 2014 2013

Discount rate 3.65% 4.35% 2.00% 3.60%

Inflation rate 3.10% 3.55% 1.50% 2.00%

Rate of increase of

pensions in payment 2.90% 3.20% 0.60% - 0.70% 1.80% - 2.00%

Rate of general salary

increases 1.44% 4.05% 1.00% 3.00%

The average life expectancy used in all schemes at age 60 is as follows:

2014 2013

Male Female Male Female

Current retirees 24.3 years 27.2 years 24.3 years 27.2 years

Future retirees 27.5 years 29.8 years 27.3 years 29.6 years

The amount recognised in the balance sheet in respect of the Group's

defined benefit schemes,

is as follows:

SCHEMES WITH SCHEMES WITH

LIABILITIES IN LIABILITIES IN

STERLING EURO

2014 2013 2014 2013

EURm EURm EURm EURm

Equities 8.9 8.4 131.9 121.6

Bonds 15.9 13.9 81.8 73.3

Property 0.3 0.3 14.2 11.4

Other 0.7 1.0 2.8 0.6

Market value of scheme assets 25.8 23.6 230.7 206.9

Present value of scheme liabilities (22.6) (22.0) (258.0) (245.2)

Surplus / (deficit) in schemes 3.2 1.6 (27.3) (38.3)

The movement during the year is reconciled as follows:

2014 2013

EURm EURm

Opening net deficit (36.7) (54.6)

Current service cost (1.9) (1.9)

Employer contributions paid 4.0 5.6

Past service credit 1.8 2.1

Curtailment gain (note 4) 31.0 -

Net interest cost (1.2) (2.0)

Actuarial (loss) / gain (21.2) 14.3

Other 0.1 (0.2)

Closing net deficit (24.1) (36.7)

Schemes in surplus 5.4 4.7

Schemes in deficit (29.5) (41.4)

Net deficit (24.1) (36.7)

9. Related party transactions

Transactions between the company and its subsidiaries, which are related

parties, have been eliminated on consolidation.

During the year ended 31 December 2014 the material transactions between

Irish Continental Group plc and its key management personnel, were; the

remuneration of employees and Directors, the participation in Group

dividends on the same terms available to shareholders generally, and the

provision of professional services at arm's length basis.

10. General information

The financial information in this preliminary announcement does not

constitute full statutory financial statements, a copy of which is

required to be annexed to the annual return to the Companies

Registration Office. A copy of the financial statements in respect of

the financial year ended 31 December 2014 will be annexed to the annual

return for 2015. The auditors have made a report, without any

qualification on their audit, of the consolidated financial statements

in respect of the financial year ended 31 December 2014 and the

Directors approved the consolidated financial statements in respect of

the financial year ended 31 December 2014 on 4 March 2015. A copy of the

consolidated financial statements in respect of the year ended 31

December 2013 has been annexed to the annual return for 2014 filed at

the Companies Registration Office.

The consolidated financial statements have been prepared in accordance

with IFRS as adopted by the European Union and therefore the Group's

financial statements comply with Article 4 of the IAS Regulations. The

consolidated financial statements have also been prepared in accordance

with the Companies Acts, 1963 to 2013, and the Listing Rules of the

Irish Stock Exchange and the UK Listing Authority.

The consolidated financial statements have been prepared on the

historical cost basis except for the revaluation of certain financial

instruments.

11. Subsequent events

The Board is proposing a final dividend of 7.035 cent per ICG unit in

respect of the results for the year ended 31 December 2014.

There have been no other significant events, outside the ordinary course

of business, affecting the Group since 31 December 2014.

12. Board Approval

This preliminary announcement was approved by the Board of Directors of

Irish Continental Group plc. on 4 March 2015.

13. Annual Report and Annual General Meeting

The Group's Annual Report and notice of Annual General Meeting, which

will be held on Wednesday 20 May 2015, will be notified to shareholders

in April 2015.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Irish Continental Group plc via Globenewswire

HUG#1899564

www.icg.ie

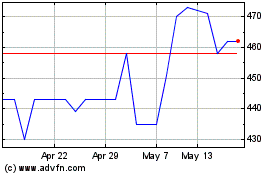

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jul 2023 to Jul 2024