Interim Management Statement

May 17 2011 - 4:14AM

UK Regulatory

TIDMICGC

INTERIM MANAGEMENT STATEMENT

Highlights

* Passenger & Freight revenue up EUR3.3 million

* Recovery in Ro Ro freight volumes

* Fuel cost up EUR2.9 million in 4 months

* Initiative to reduce VAT on hospitality a positive for tourism

Volumes (Year to date, 14 May 2011)

Cars 96,700 -1.4%

Passengers 430,100 -6.5%

RoRo Freight 70,900 +11.7%

Container Freight (teu) 151,600 -2.7%

Terminal Lifts 69,900 +14.5%

Financial (January - April 2011)

2011 2010

Revenue EUR77.5m EUR75.7m +2.4%

EBITDA EUR5.2m EUR8.0m -35.0%

EBIT (EUR1.6m) EUR0.6m

Profit (loss) before tax (EUR1.2m) EUR0.2m

Net Debt EUR4.0m EUR6.3m (31 December)

Current Trading

ICG issues this interim management statement which covers volume data up to 14

May 2011 (i.e. 19 weeks) and financial information for the first four months of

the year. It should be noted that ICG's business is significantly weighted

towards the second half of the year when normally a higher proportion of the

Group's operating profit is generated than in the first six months. Also, the

comparative figures for 2010 include the period during which European airspace

was closed due to volcanic ash, which had a significant positive impact on

passenger volumes in particular, in 2010.

In the first four months of the year Group revenue was up 2.4% at EUR77.5 million,

compared with EUR75.7 million in the same period last year. Passenger and freight

revenue was up 4.5% while charter revenue was down EUR1.4 million due to the

termination of the charter of the Pride of Bilbao. Operating costs (before

depreciation & amortisation) were 6.8% higher at EUR72.3 million versus EUR67.7

million the previous year, principally due to a 24% increase (of EUR2.9 million)

in fuel costs to EUR15.3 million. The remaining cost increases were primarily

volume-related port charges arising from increased Ro Ro freight volumes.

Earnings before interest tax and depreciation (EBITDA) were EUR5.2 million

compared with EUR8.0 million in the same period in 2010. The termination of the

charter of the Pride of Bilbao resulted in a reduction in EBITDA of EUR1.4 million

although this was offset by depreciation savings of EUR0.8 million and interest

receivable of EUR0.6 million. There was net interest receivable of EUR0.4 million

compared with a charge of EUR0.3 million the previous year. The loss before

interest was EUR1.6million (2010 profit EUR0.6 million) while the loss before tax

was EUR1.2 million (2010 profit EUR0.2 million). Net debt at the end of April was

EUR4.0 million compared with EUR6.3 million at 31 December 2010.

In the period up to 14 May 2011, we carried 96,700 cars, a 1.4% reduction on the

same period last year. The lower volumes were compensated for by higher yields.

In the previous year, we had an unprecedented increase in passengers in April

due to the ash cloud disruption to air travel. Consequently while our total

passenger numbers were in line with expectations at 430,100, they were 6.5%

behind the same period in 2010. On a like for like basis, i.e. ignoring

exceptional passenger business carried during the ash cloud, underlying

passenger and car business is in line with 2010.

In the Roll on Roll off freight market, while the overall market is weaker than

expected, Irish Ferries carried 70,900 units, an increase of 11.7% compared with

the same period in 2010.

Container freight volumes shipped decreased by 2.7% to 151,600 teu (twenty foot

equivalent units) in the period to 14 May 2011 compared with the same period

last year with an increase in freight to and from Ireland offset by a reduction

on the North Sea. Units handled at our terminals in Dublin and Belfast increased

by 14.5% year on year, over the same period.

Outlook

The greatest threat to our financial performance this year is the very

significant increase in our fuel cost, following on from the EUR10 million

increase in our fuel bill in 2010. We were successful last year in passing on

that increase in that financial year. However given the scale of the back-to-

back increase in 2011, it will be a significant challenge to pass on all of this

increase in the remainder of the current financial year, if oil remains at

current price levels. Notwithstanding the current difficult economic backdrop we

are confident of passing on fuel cost increases through the cycle, as has been

successfully proven by our business model in the past.

Container volumes, particularly on the North Sea, are seeing some reduction due

to the disruption in the supply chain arising out of the earthquake in Japan.

While it is too early to predict the Summer tourism market, the reductions in

VAT in the hospitality sector recently announced in the Government's jobs

initiative is a positive for inward tourism which is also likely to be boosted

by Tourism Ireland's recently announced 30% increase in its marketing budget in

the UK market. The capacity reductions in the Ro Ro market and the airline

sector are positive backdrops while the strength of the balance sheet is a major

positive in the current market.

Dublin

17 May 2011

Enquiries

Eamonn Rothwell, CEO, +353 1 607 5628

Garry O'Dea, Finance Director, +353 1 607 5628

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Irish Continental Group plc via Thomson Reuters ONE

[HUG#1516357]

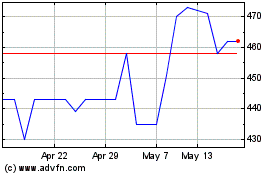

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Jul 2024 to Aug 2024

Irish Continental (LSE:ICGC)

Historical Stock Chart

From Aug 2023 to Aug 2024