TIDMHUW

RNS Number : 0680B

Helios Underwriting Plc

29 September 2022

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Helios Underwriting plc

("Helios" or the "Company")

Interim Results for the Six Months Ended 30 June 2022

Helios Underwriting plc, the unique investment vehicle which

provides investors with exposure to the Lloyds insurance market

through an actively managed portfolio of syndicate capacity ,

announces its unaudited results for the six months ended 30 June

2022, during which it continued its strategy of driving portfolio

growth and future shareholder value, building on its recent rapid

growth in retained capacity.

-- Gross written premiums increased by 133% to GBP124m (30 June

2021 - GBP53m) reflecting the increase in the capacity

portfolio

-- Further rate increase achieved by Lloyds' of 7.7% over the

six month period which together with greater discipline encouraged

by the Franchise Board at Lloyd's market, has bolstered the

prospects for profitable underwriting

-- 76% improvement in the underwriting result to GBP3.3m with a 94.5% combined ratio

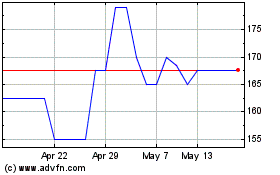

-- The increase in the underwriting exposure in 2022 to GBP172m

of retained capacity will contribute to the underwriting result in

the future.

-- Investment losses of GBP3.5m have been booked in the first

six months driven by mark to market investment losses as interest

rates have increased, which has masked the improvement in the

underwriting margins, although higher yields on both syndicate and

Group funds will benefit future returns

-- Operating costs of GBP3.6m include non-recurring costs of

GBP0.7m relating to a contemplated significant acquisition and

increased reinsurance costs given the increase in the underwriting

exposure

-- Operating loss is GBP3.4m (30 June 202 1 - a loss of GBP0.4m)

-- The net tangible asset value per share is GBP1.49 per share

(31(st) December 2021 - GBP1.57 per share)

Chairman's statement

Six months ended 30 June 2022

Nigel Hanbury, Chief Executive, provides the following

overview:

"The steady improvement in current market conditions continues

to open up exciting windows of opportunity for Helios. The progress

in underwriting conditions over five years is being reflected in

the improved underwriting margins.

"The results are skewed as a consequence of the recent 133%

growth in our retained capacity and a cautious approach to

reserving, as we would expect, by our portfolio. With the passage

of time, we are confident that our portfolio will demonstrate

outperformance against a prudent reserving strategy. The impact of

the increased yields on the Group investments will make a

contribution in the future.

"Mark to market losses within syndicates' investment bond

portfolios have also impacted results. Rising interest rates will

help negate that with improved returns from fixed income in future

periods.

" We have increased our retained capacity to GBP172m for the

2022 underwriting year to take advantage of the current market

conditions. We are confident that we can continue to demonstrate

our ability to achieve attractive shareholder returns over the next

few years."

SUMMARY FINANCIAL INFORMATION

6 months to 30(th) June Year to

31(st) December

2022 2021 2021

GBP000's GBP000's GBP000's

Gross written premium 124,097 53,351 106,058

------------ ------------ -----------------

Underwriting result 3,291 1,873 5,681

Investment Income

- syndicates (3,560) 179 37

Net quota share (383) (951) (2,319)

Net profits (652) 1,102 3,399

Other income 833 526 2,700

Costs (3,612) (2,107) (6,744)

Operating loss for

the period before impairment (3,431) (480) (645)

------------ ------------ -----------------

(Loss)/profit after

tax (3,902) (2,659) 4,932

------------ ------------ -----------------

Earnings per share (5.38)p (3.88)p (0.75)p

Net Tangible Asset GBP1.49p GBP1.46 GBP1.57

Value per Share

Helios Underwriting plc

Nigel Hanbury - Chief Executive +44 (0)7787 530 404 / nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer +44 (0)7754 965 917

Shore Capital

Robert Finlay +44 (0)20 7601 6100

David Coaten

Gallagher (Financial Adviser)

Alastair Rodger +44 (0)20 3124 6033

Buchanan

Helen Tarbet / Henry Wilson / George Beale +44 (0)7872 604 453

+44 (0)20 7466 5111

The combined underwriting result continues to recover as the

underlying profitability starts to be recognised. The potential

losses from Ukraine have been recognised to the extent that they

are known. The events in Ukraine continue to unfold and the full

extent of the insured losses have yet to be fully recognised.

2022 2021

GBP000's GBP000's % Increase

Gross premium written 124,067 53,351 133%

Net earned premium 59,990 28,626 110%

Net insurance claims & operating expenses (56,699) (26,752) 112%

Underwriting result 3,291 1,874 76%

Investment Income (3,560) 179

Operating loss / profit (269) 2,053

Combined ratio 94.5% 93.5%

The increase in the gross written premiums reflect the growth of

the capacity portfolio to GBP233m for the 2022 underwriting year.

The combined portfolio ratio of 94.5% has been impacted by the

early stage contribution of the 2022 underwriting year.

2020 and prior 2021 2022 Total

GBP000's GBP000's GBP000's GBP000's

Net Earned

Premium 3,306 35,444 21,240 59,990

-------------------------- ------------------------ ---------------------- --------------------

Underwriting

result 3,041 5,229 (4,979) 3,291

Investment Income (2,315) (941) (304) (3,560)

-------------------------- ------------------------ ---------------------- --------------------

Operating (loss)

/ profit 726 4,288 (5,283) (269)

Quota Share

Reinsurers (150) (1,621) 1,388 (383)

-------------------------- ------------------------ ---------------------- --------------------

Total Group

Underwriting

Profit/(loss) 576 2,667 (3,895) (652)

-------------------------- ------------------------ ---------------------- --------------------

The underwriting contribution from the 2020 and 2021

underwriting years reflects the expected development of those years

after recognising underwriting losses at an early stage. 2022 to

date represents an initial loss due to the higher proportion of

expenses and reinsurance costs allocated to the first six months of

the underwriting year. The future recognition of the Net Earned

Premiums from 2022 year, given the increased underwriting exposure,

will benefit the underwriting result for the full year.

6 months to 30th June

2022 2021

GBP000's GBP000's

Stop loss costs (1,224) (968)

Operating costs (2,389) (1,139)

Total Costs (3,612) (2,107)

=========== ===========

Operating costs have increased to GBP2.4m as a potential

significant acquisition was contemplated in the period where costs

of due diligence were incurred of GBP0.7m and as GBP20m

(2021-GBP7.6m) of additional underwriting capital has been sourced

through a bank facility adding a further GBP0.2m to the costs. The

stop loss for Helios retained capacity continues to be bought which

has a 10% indemnity to protect the Group from a loss excess of 7.5%

loss for the 2022 underwriting year. The increase in the retained

capacity of 84% to GBP172m contributed to the increase in the stop

loss costs incurred.

Investment

Return

Financial Investments GBP000's - GBP000's Yield

Syndicate investment assets 127,615 (3,560) (2.8%)

Group investment assets 58,838 85 0.1%

186,453 (3,475) (1.9%)

----------------------- ------------ -------

Helios's share of the syndicate investments incurred a loss in

the first six months of 2.8% as interest rates increased and this

has masked the improvement in underwriting margins. Group

investment funds remained in cash and targeted investments have

since been made. The Group funds will continue to earn interest for

the balance of the year. The Group's share of the syndicate

investments is expected to continue to increase to reflect the

growth of the capacity portfolio.

The positive momentum in both insurance and reinsurance pricing

has continued into 2022. The improvement in underwriting conditions

over the last five years will provide a platform for better

prospects for underwriting margins over the next few years.

Helios has increased its retained capacity to GBP172m for the

2022 underwriting year to take advantage of the current market

conditions. The proportion of the capacity reinsured has been

reduced while the capital provided by the reinsurers has remained

steady. The quota share reinsurers fund their share of the capital

requirements and pay Helios a fee and a profit commission. The

strategy of building a portfolio of underwriting capacity that can

be accessed by alternative sources of capital is expected to be

developed in the future as we regard this as an attractive

opportunity to increase the fee income generated from the

portfolio.

Helios has received preliminary indications of pre-emptions for

the 2022 year of account from the syndicates supported of GBP21m

which are subject to approval by Lloyd's and could increase the

capacity portfolio for the 2023 year of account to GBP254m - an

increase of 9%.

The value of the capacity portfolio, using the 2021 weighted

average prices, including the value of the expected pre-emptions

for 2023 (using the 2021 weighted average capacity prices) could

increase to GBP72m - an increase of 20%. Should the average

auctions prices in 2022 decrease by 10%, the net tangible asset

value per share should still increase by 5.37p.

Impact of pre-emptions on capacity portfolio

GBPm 2022 Capacity Capacity

Value

GBPm

2022 YOA as at 1st January 2022 232.7 59.9

Expected Pre-emptions 21.7 12.1

254.4 72.0

Decrease of 10% 64.8

Increase in NTAV per share - 25%

Corporation Tax 5.37p

It is expected that there will continue to be demand for the top

syndicates that make up a significant proportion of the Helios

Capacity Fund at the Lloyds Capacity Auctions that take place later

this year. Our strategy of building a portfolio of syndicate

capacity continues to rely on the flow of LLVs for sale at

reasonable prices. The discounts achieved to the Humphrey

Valuations have decreased as both Vendor expectations of future

value have increased and as other purchasers have realised the

value of the potential future profitability of these capacity

portfolios. There are over 17 LLV's for sale at present and it is

expected that we will be able to conclude further acquisitions this

year.

The net tangible asset value per share is GBP1.49p per share

(Dec 2021 - GBP1.57p per share). The net assets include a deferred

tax provision of GBP13m on the value of the capacity portfolio. The

reduction of corporation tax rate to 19%, will reduce the deferred

tax provision by GBP3.5m and increase the net tangible asset per

share by 4.7p.

IFRS 17

The Company's consolidated accounts are presently prepared in

accordance with current IFRS applicable to the insurance industry.

In May 2017, the IASB published its standard on insurance

accounting (IFRS 17, 'Insurance Contracts') which replaces the

current IFRS 4 standard. Some targeted amendments to this standard,

including to the effective date, were issued in June 2020 and

December 2021. IFRS 17, 'Insurance Contracts', as amended, will

have the effect of introducing fundamental changes to the statutory

reporting of insurance entities that prepare accounts under IFRS

from 2023. Given compliance with IFRS will not be feasible due to

the UK GAAP based Lloyd's information provision and syndicate

disclosures, the Board is considering alternative arrangements

including the use of an alternative standard, including UK GAAP.

The Board is confident that an appropriate alternative will be

available and a further announcement will be made in due

course.

Financial results summary

Six months ended 30 June 2022

6 months to 30 June 2022 6 months to 30 June 2021 Year to 31 December 2021

GBP'000 GBP'000 GBP'000

Underwriting profits (652) 1,102 3,399

Other Income

Fees from reinsurers 442 474 616

Corporate reinsurance recoveries 307 14 (372)

Goodwill on bargain purchase - - 1,219

Investment income 84 38 1,237

------------------------- ------------------------- -------------------------

Total Other Income 833 526 2,700

Costs

Pre-acquisition - - (1,269)

Stop loss costs (1,224) (968) (1,871)

Operating costs (2,388) (1,140) (3,604)

------------------------- ------------------------- -------------------------

Total Costs (3,612) (2,108) (6,744)

Operating profit before impairments

of goodwill

and capacity (3,431) (480) (645)

Tax (214) (1,839) 211

Revaluation of syndicate capacity (257) (340) 8,132

Income tax relating to the

components of other

Comprehensive income - - (2,766)

------------------------- ------------------------- -------------------------

(Loss)/profit for the period/year (3,902) (2,659) 4,932

------------------------- ------------------------- -------------------------

Period to 30(th) June 2022

Helios retained

capacity at Helios

30 June 2022 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

2020 65.9 1.84% 576

2021 92.8 2.4% 2,667

2022 171.9 N/A (3,895)

------------------ --------------- ---------------- --------

(653)

------------------ --------------- ---------------- --------

Period to 30(th) June 2021

Helios retained

capacity at Helios

30 June 2021 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

------------------ --------------- ---------------- --------

2019 31.3 0.01% 1,062

2020 30.8 0.98% 984

2021 58.7 - (944)

------------------ --------------- ---------------- --------

1,102

------------------ --------------- ---------------- --------

Year to 31 December 2021

Helios retained

capacity at

31 December Helios

2021 Portfolio mid Profits

Underwriting Year GBPm point forecasts GBP'000

------------------ --------------- ---------------- --------

2019 67.4 2.7% 4,092

2020 66.6 0.97% 2,915

2021 93.6 - (3,606)

------------------ --------------- ---------------- --------

3,401

------------------ --------------- ---------------- --------

Summary Balance Sheet

The summary Group balance sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 Months to June 2022 6 Months to June 2021 Year to 31 December 2021

GBP'000 GBP'000 GBP'000

------------------ --------------------- ----------------------- ------------------------

Intangible assets 60,889 31,601 60,889

Funds at Lloyd's 58,838 18,543 43,589

Other cash 13,039 52,272 16,178

Other assets 6,108 12,385 5,517

------------------ --------------------- ----------------------- ------------------------

Total assets 138,874 114,801 126,173

------------------ --------------------- ----------------------- ------------------------

Deferred tax 11,568 8,546 11,887

Borrowings 15,000 - -

Other liabilities 3,587 3,409 3,052

------------------ --------------------- ----------------------- ------------------------

Total liabilities 30,155 11,955 14,939

------------------ --------------------- ----------------------- ------------------------

Syndicate equity (6,910) (3,573) (3,488)

------------------ --------------------- ----------------------- ------------------------

Total equity 101,809 99,273 107,746

------------------ --------------------- ----------------------- ------------------------

Summary Group Cash Flow

The summary group cash flow sheet excludes items relating to

syndicate participations. See Note 15 for further information.

6 months to 30 June 2022 6 months to 30 June 2021 Year to 31 December 2021

GBP'000 GBP'000 GBP'000

Opening Balance (free cash) 16,178 4,961 4,961

Income

Acquired on acquisition - - 1,939

Distribution of profits (net of tax

retentions) 2,422 365 475

Transfers from Funds at Lloyds' 5,277 224 336

Investment income 55 5 95

Issue of new ordinary shares - 53,231 53,231

Borrowings 15,000 - -

Cancelled Reinsurance policy refunds - - 6,964

Expenditure

Operating costs (inc Hampden /

Nomina fees) (1,409) (933) (3,702)

Purchase of capacity - - (2,663)

Reinsurance Cost (857) (1,025) -

Acquisition of LLV's - - (26,529)

Transfers to Funds at Lloyds' (21,886) - (12,270)

Tax 293 (8) (641)

Dividends paid (2,034) (548) (2,018)

Revolving credit facility repayment - (4,000) (4,000)

Closing balance 13,039 52,272 16,178

------------------------- ------------------------- -------------------------

Net tangible asset per share

6 months 6 months Year to

to 30 June to 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Net tangible assets 40,919 67,642 46,856

Value of capacity

(WAV) 59,796 30,826 59,796

------------ ------------ -------------

100,715 98,468 106,652

------------ ------------ -------------

Shares in issue

- on the market 67,786 67,254 67,786

Shares in issue

- total of on the

market and JSOP

shares 68,886 67,754 68,886

Net tangible asset

value per share

GBP - on the market 1.49 1.46 1.57

Net tangible asset

value per share

GBP - on the market

and JSOP shares 1.46 1.45 1.55

Interim condensed consolidated statement of comprehensive

income

Six months ended 30 June 2022

6 months

ended 6 months 12 months

30 June ended 30 ended

2022 June 2021 31 December

Unaudited Unaudited 2021 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------ ---------- ---------- -------------

Gross premium written 4 124,067 53,351 106,058

Reinsurance premium ceded (35,291) (17,107) (26,935)

------------------------------------------------------- ------ ---------- ---------- -------------

Net premium written 4 88,776 36,244 79,123

------------------------------------------------------- ------ ---------- ---------- -------------

Change in unearned gross premium provision 5 (46,338) (15,678) (11,201)

Change in unearned reinsurance premium provision 5 15,945 6,141 1,484

------------------------------------------------------- ------ ---------- ---------- -------------

(30,393) (9,537) (9,717)

------------------------------------------------------- ------ ---------- ---------- -------------

Net earned premium 3,4 58,383 26,707 69,406

Net investment income 6 (3,476) 185 568

Other underwriting income 442 476 723

Gain on bargain purchase - - 1,219

Other income - 30 (82)

------------------------------------------------------- ------ ---------- ---------- -------------

Revenue 55,349 27,398 71,834

------------------------------------------------------- ------ ---------- ---------- -------------

Gross claims paid (28,627) (19,108) (46,478)

Reinsurers' share of gross claims paid 7,153 4,946 11,328

------------------------------------------------------- ------ ---------- ---------- -------------

Claims paid, net of reinsurance 21,474 (14,162) (35,150)

------------------------------------------------------- ------ ---------- ---------- -------------

Change in provision for gross claims 5 (17,146) (2,118) (15,796)

Reinsurers' share of change in provision for gross

claims 5 3,879 (156) 6,204

------------------------------------------------------- ------ ---------- ---------- -------------

Net change in provision for claims 5 (13,267) (2,274) (9,592)

------------------------------------------------------- ------ ---------- ---------- -------------

Net insurance claims and loss adjustment expenses 4 (34,741) (16,436) (44,472)

------------------------------------------------------- ------ ---------- ---------- -------------

Expenses incurred in insurance activities (22,310) (10,665) (25,407)

Other operating expenses (1,729) (777) (2,330)

------------------------------------------------------- ------ ---------- ---------- -------------

Operating expenses (24,039) (11,442) (27,737)

------------------------------------------------------- ------ ---------- ---------- -------------

Operating (loss)/profit before impairments of goodwill

and capacity 4 (3,431) (480) (645)

Impairment of goodwill - - -

Impairment of syndicate capacity - - -

------------------------------------------------------- ------ ---------- ---------- -------------

(Loss)/profit before tax (3,431) (480) (645)

Income tax charge 7 (214) (112) 211

Income and deferred tax charge as a result of change

in tax rates 7 - (1,727) -

(Loss)/Profit for the period (3,645) (2,319) (434)

------------------------------------------------------- ------ ---------- ---------- -------------

Other comprehensive income

Foreign currency translation differences - - -

Revaluation of syndicate capacity - - 8,132

Deferred tax relating to change in tax rates on

revaluation of capacity (257) (340) (2,766)

------------------------------------------------------- ------ ---------- ---------- -------------

Other comprehensive (loss)/income for the period,

net of tax (257) (340) 5,366

------------------------------------------------------- ------ ---------- ---------- -------------

Total other comprehensive (loss)/income for the

period (3,902) (2,659) 4,932

------------------------------------------------------- ------ ---------- ---------- -------------

(Loss)/profit for the period attributable to owners

of the Parent (3,645) (2,319) (434)

------------------------------------------------------- ------ ---------- ---------- -------------

Total comprehensive (loss)/income for the period

attributable to owners of the Parent (3,902) (2,659) 4,932

------------------------------------------------------- ------ ---------- ---------- -------------

(Loss)earnings per share attributable to owners

of the Parent

Basic 8 (5.38)p (3.88)p (0.75)p

Diluted 8 (5.38)p (3.88)p (0.75)p

------------------------------------------------------- ------ ---------- ---------- -------------

The profit attributable to owners of the Parent and earnings per

share set out above are in respect of continuing operations.

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of financial

position

Six months ended 30 June 2022

6 months

ended 6 months 12 months

30 June ended 30 ended

2022 June 2021 31 December

Unaudited Unaudited 2021 Audited

Note GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------ ---------- ---------- -------------

Assets

Intangible assets 60,889 31,601 60,889

Financial assets at fair value through profit or

loss 186,453 83,047 153,844

Reinsurance assets:

- reinsurers' share of claims outstanding 5 73,074 32,800 53,433

- reinsurers' share of unearned premium 5 23,992 10,694 10,538

Other receivables, including insurance and reinsurance

receivables 127,483 66,227 87,859

Deferred acquisition costs 19,424 8,119 13,615

Prepayments and accrued income 2,922 1,633 799

Cash and cash equivalents 36,064 62,143 24,624

------------------------------------------------------- ------ ---------- ---------- -------------

Total assets 530,301 296,264 405,601

------------------------------------------------------- ------ ---------- ---------- -------------

Liabilities

Insurance liabilities:

- claims outstanding 5 241,783 115,559 186,653

- unearned premium 5 97,509 42,974 59,611

Deferred income tax liabilities 11,568 8,546 11,965

Borrowings 15,000 - -

Other payables, including insurance and reinsurance

payables 58,147 25,640 34,927

Accruals and deferred income 4,485 4,272 4,700

------------------------------------------------------- ------ ---------- ---------- -------------

Total liabilities 428,492 196,991 297,856

------------------------------------------------------- ------ ---------- ---------- -------------

Equity

Equity attributable to owners of the Parent:

Share capital 11 6,931 6,817 6,931

Share premium 11 86,330 85,502 86,330

Other reserves - treasury shares 11 (110) (50) (110)

Retained earnings 8,658 7,004 14,595

------------------------------------------------------- ------ ---------- ---------- -------------

Total equity 101,809 99,273 107,746

------------------------------------------------------- ------ ---------- ---------- -------------

Total liabilities and equity 530,301 296,264 405,602

------------------------------------------------------- ------ ---------- ---------- -------------

The Financial Statements were approved and authorised for issue

by the Board of Directors on 28 September 2022, and were signed on

its behalf by

Nigel Hanbury

Chief Executive

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of changes in

equity

Six months ended 30 June 2022

Attributable to owners

of the Parent

-------------------------------------------------------

Share Share Revaluation Other Retained

capital premium reserve reserves earnings Total

Consolidated Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

At 1 January 2022 6,931 86,330 9,348 (110) 5,247 107,746

Total comprehensive income for

the year:

Loss for the year - - - - (3,645) (3,645)

Other comprehensive income, net

of tax - - (257) - - (257)

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - (257) - (3,645) (3,902)

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Transactions with owners: - - - - - -

Dividends paid 9 - - - - (2,034) (2,034)

Company buy back of shares 11 - - - - - -

Share issue - - - - - -

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total transactions with owners - - - - (2,034) (2,034)

At 30 June 2022 6,931 86,330 9,091 (110) (432) 101,810

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

At 1 January 2021 3,393 35,525 3,982 (50) 7,699 50,549

Total comprehensive income for

the year:

Loss for the year - - - - (2,319) (2,319)

Other comprehensive income, net

of tax - - (340) - - (340)

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - (340) - (2,319) (2,659)

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Transactions with owners: - - - - - -

Dividends paid 9 - - - - (2,018) (2,018)

Company buy back of shares 11 - - - - - -

Share issue 3,424 49,977 - - - 53,401

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total transactions with owners 3,424 49,977 - - (2,018) 51,383

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

At 30 June 2021 6,817 85,502 3,642 (50) 3,362 99,273

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

At 1 January 2021 3,393 35,525 3,982 (50) 7,699 50,549

Total comprehensive income for

the year:

Profit for the year - - - - (434) (434)

Other comprehensive income, net

of tax - - 5,366 - - 5,366

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total comprehensive income for

the year - - 5,366 - (434) 4,932

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Transactions with owners:

Dividends paid - - - - (2,018) (2,018)

Company buy back of shares 11 - - - - - -

Share issue 11 3,538 50,805 - (60) - 54,283

Other comprehensive income, net - -

of tax - - - -

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

Total transactions with owners 3,538 50,805 - (60) (2,018) 52,265

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

At 31 December 2021 6,931 86,330 9,348 (110) 5,247 107,746

-------------------------------- ------ -------- --------- ----------- ---------- --------- --------

The notes are an integral part of these Financial

Statements.

Interim condensed consolidated statement of cash flows

Six months ended 30 June 2022

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2022 2021 Unaudited 2021

Unaudited GBP'000 Audited

GBP'000 GBP'000

-------------------------------------------------------------- ------- ---------- --------------- ------------

Cash flows from operating activities

Loss before tax (3,431) (480) (645)

Adjustments for:

- Other comprehensive income, gross of tax - - -

- Interest received (78) (2) (17)

- Investment income 3,503 (183) (1,549)

- Recognition of negative goodwill - - -

- Goodwill on bargain purchase - - (1,219)

- Loss on sale of intangible assets - - (12)

Changes in working capital:

* change in fair value of financial assets held at fair

value through profit or loss (617) (140) 1,316

* decrease/(increase) in financial assets at fair value

through profit or loss (32,609) 2,230 (31,436)

- (increase)/decrease in other receivables (47,556) (8,729) 1,162

- decrease/(increase) in other payables 23,005 5,245 (3,799)

- net decrease/(increase) in technical provisions 59,933 6,121 18,285

----------------------------------------------------------------------- ---------- --------------- ------------

Cash generated/(utilised) from operations 2,150 4,062 (17,914)

----------------------------------------------------------------------- ---------- --------------- ------------

Income tax paid (252) - (675)

----------------------------------------------------------------------- ---------- --------------- ------------

Net cash inflow from operating activities 1,898 4,062 (18,589)

----------------------------------------------------------------------- ---------- --------------- ------------

Cash flows from investing activities

Interest received 78 2 17

Investment income (3,503) 183 1,549

Purchase of intangible assets - - (2,984)

Proceeds from disposal of intangible assets - - 1,809

Acquisition of subsidiaries, net of cash acquired - - (13,255)

----------------------------------------------------------------------- ---------- --------------- ------------

Net cash inflow/(outflow) from investing activities (3,425) 185 (12,864)

----------------------------------------------------------------------- ---------- --------------- ------------

Cash flows from financing activities

-------------------------------------------------------------- ------- ---------- --------------- ------------

Net proceeds from issue of ordinary share capital - 53,401 53,601

Buy back of ordinary share capital - - -

Payment for company buy back of shares - - -

Proceeds from borrowings 15,000 - -

Repayment of borrowings - (4,000) (4,000)

Dividends paid to owners of the Parent (2,034) - (2,018)

----------------------------------------------------------------------- ---------- --------------- ------------

Net cash inflow from financing activities 12,966 49,401 47,583

----------------------------------------------------------------------- ---------- --------------- ------------

Net increase in cash and cash equivalents 11,439 53,648 16,130

Cash and cash equivalents at beginning of period 24,625 8,495 8,495

----------------------------------------------------------------------- ---------- --------------- ------------

Cash and cash equivalents at end of period 36,064 62,143 24,625

----------------------------------------------------------------------- ---------- --------------- ------------

Cash held within the syndicates' accounts is GBP23,085,000

(2021: GBP9,871,000) of the total cash and cash equivalents held at

the end of the period GBP36,064,000 (2021: GBP62,143,000). The cash

held within the syndicates' accounts is not available to the Group

to meet its day-to-day working capital requirements.

Cash and cash equivalents comprise cash at bank and in hand.

The notes are an integral part of these Financial

Statements.

Notes to the financial statements

Six months ended 30 June 2022

1. General information

The Company is a public limited company quoted on AIM. The

Company was incorporated in England, is domiciled in the UK and its

registered office is 40 Gracechurch Street, London EC3V 0BT. The

Company participates in insurance business as an underwriting

member at Lloyd's through its subsidiary undertakings.

These condensed interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. Statutory accounts for the year ended 31

December 2021 were approved by the board of directors on 26 May

2022 and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 of the Companies Act 2006. The financial

statements have been reviewed, not audited

2. Accounting policies

Basis of preparation

The Condensed Consolidated Interim Financial Statements have

been prepared using accounting policies consistent with

International Financial Reporting Standards (IFRSs) and in

accordance with UK adopted International Accounting Standard (IAS)

34 Interim Financial Reporting, in accordance with the requirements

of the Companies Act 2006.

The Condensed Consolidated Interim Financial Statements are

prepared for the six months ended 30 June 2022.

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 June 2022 and 2021 are unaudited, but have been

subject to review by the Group's auditors. The Condensed

Consolidated Interim Financial Statements have been prepared in

accordance with the accounting policies adopted for the year ended

31 December 2021, and the adoption of new and amended standards as

set out further below.

The Condensed Consolidated Interim incorporate the Financial

Statements of Helios Underwriting plc, the Parent Company, and its

directly and indirectly held subsidiaries (see note 10).

The underwriting data on which these Condensed Consolidated

Interim Financial Statements are based upon has been supplied by

the managing agents of those syndicates which the Group supports.

The data supplied is the 100% figures for each syndicate. The Group

has applied its share of the syndicate participations to the gross

figures to derive its share of the syndicates transactions, assets

and liabilities.

Significant accounting policies

The Condensed Consolidated Interim Financial Statements have

been prepared under the historical cost convention as modified by

the revaluation of the financial assets at fair value through the

profit and loss. The same accounting policies, presentation and

methods of computation are followed in these Condensed Consolidated

Interim Financial Statements as were applied in the preparation of

the Group Financial Statements for the year ended 31 December

2021.

International Financial Reporting Standards

Adoption of new and revised standards

In the current year, the Group has applied new IFRSs and

amendments to IFRSs issued by the IASB that are mandatory for an

accounting period that begins on or after 1 January 2022.

Amendments to IFRS 3: Business combinations - Reference to the

Conceptual Framework. IFRS 3 is updated so that it refers to the

2018 Conceptual Framework instead of the 1989 Framework. They also

add to IFRS 3 a requirement that, for transactions and other events

within the scope of IAS 37 or IFRIC 21, an acquirer applies IAS 37

or IFRIC 21 to identify the liabilities it has assumed in a

business combination. Lastly, they add to IFRS 3 an explicit

statement that an acquirer does not recognise contingent assets

acquired in a business combination.

Amendments to IAS 16: Property, Plant and Equipment. The changes

introduced amend the standard to prohibit deducting from the cost

of an item of property, plant and equipment any proceeds from

selling items produced while bringing that asset to the location

and condition necessary for it to be capable of operating in the

manner intended by management. Instead, an entity recognises the

proceeds from selling such items, and the cost of producing those

items, in profit or loss.

Amendments to IAS 37: Provisions, Contingent Liabilities and

Contingent Assets. The changes specify that the 'cost of

fulfilling' a contract comprises the 'costs that relate directly to

the contract'. Costs that relate directly to a contract can either

be incremental costs of fulfilling that contract or an allocation

of other costs that relate directly to fulfilling contracts.

Annual Improvements to IFRS Standards 2018-2020 Cycle. The

pronouncement contains amendments to four International Financial

Reporting Standards (IFRS 1, IFRS 9, IFRS 16 and IAS 41) as result

of the IASB's annual improvements project

New standards, amendments and interpretations not yet

adopted

A number of new standards and amendments adopted by the UK, as

well as standards and interpretations issued by the IASB but not

yet adopted by the UK, have not been applied in preparing the

Consolidated Financial Statements.

The Group does not plan to adopt these standards early; instead

it will apply them from their effective dates as determined by

their dates of UK endorsement. The Group continues to review the

upcoming standards to determine their impact.

Notes to the financial statements

Six months ended 30 June 2022

IFRS 9, Financial Instruments (IASB effective date 1 January

2018) has not been applied under IFRS 4 Amendment option to defer

until IFRS 17 comes into effect on 1 January 2023.

IFRS 17 "Insurance Contracts" (IASB effective date 1 January

2023).

IAS 1 Presentation of Financial Statements Amendments,

Classification of Liabilities as Current or Non-current (IASB

effective date 1 January 2023).

IAS 8 Accounting Policies Amendments, Changes in Accounting

Estimates and Errors (IASB effective date 1 January 2023).

IAS 12 Income Taxes - Deferred Tax related to Assets and

Liabilities arising from a Single Transaction (IASB effective date

1 January 2023)

IFRS 9 "Financial Instruments" (IASB effective date 1 January

2018) has not been applied under the IFRS 4 amendment option.

IFRS 9 provides a reform of financial instruments accounting to

supersede IAS 39 "Financial Instruments: Recognition and

Measurement". Applying IFRS 9 "Financial Instruments" with IFRS 4

"Insurance Contracts" contained an optional temporary exemption

from applying IFRS 9 for entities whose predominant activity is

issuing contracts within the scope of IFRS 4. The Group meets the

eligibility criteria and has taken advantage of this temporary

exemption not to apply this standard until the effective date of

IFRS 17.

IFRS 17 "Insurance Contracts" (IASB effective date 1 January

2023) - This replaces IFRS 4 and requires an IFRS reporter to

measure insurance contracts using updated estimates and assumptions

that reflect the timing of cash flows and any uncertainty relating

to insurance contracts. It also requires that profits are

recognised as insurance services are delivered (rather than when

premiums are received) and for the IFRS reporter to provide

information about insurance contract profits the company expects to

recognise in the future.

3. Segmental information

Nigel Hanbury is the Group's chief operating decision-maker. He

has determined its operating segments based on the way the Group is

managed, for the purpose of allocating resources and assessing

performance.

The Group has three segments that represent the primary way in

which the Group is managed, as follows:

-- syndicate participation;

-- investment management; and

-- other corporate activities.

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 June 2022 Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 58,767 - (383) 58,384

Net investment income (3,561) 85 - (3,476)

Other income - - 442 442

Net insurance claims and loss adjustment

expenses (34,740) - (1) (34,741)

Expenses incurred in insurance activities (21,650) - (660) (22,310)

Other operating expenses - - (1,729) (1,729)

Loss before tax (1,184) 85 (2,331) (3,430)

------------------------------------------ -------------- ----------- ----------- --------

Other

Syndicate Investment corporate

participation management activities Total

6 months ended 30 June 2021 Unaudited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 27,658 - (951) 26,707

Net investment income 157 28 - 185

Other income - - 506 506

Net insurance claims and loss adjustment

expenses (16,436) - - (16,436)

Expenses incurred in insurance activities (9,068) - (1,597) (10,665)

Other operating expenses - - (777) (777)

Profit before tax 2,311 28 (2,819) (480)

------------------------------------------ -------------- ----------- ----------- --------

Other

Syndicate Investment corporate

participation management activities Total

12 months ended 31 December 2021 Audited GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- ----------- ----------- --------

Net earned premium 69,407 - - 69,407

Net investment income 185 383 - 568

Other income 119 - 523 642

Net insurance claims and loss adjustment

expenses (42,423) - (2,319) (44,742)

Expenses incurred in insurance activities (24,491) - (916) (25,407)

Other operating expenses (267) - (2,063) (2,330)

Gain on bargain purchase - - 1,219 1,219

Impairment of syndicate capacity - - - -

------------------------------------------ -------------- ----------- ----------- --------

Profit before tax 2,531 383 (3,558) (644)

------------------------------------------ -------------- ----------- ----------- --------

The Group does not have any geographical segments as it

considers all of its activities to arise from trading within the

UK.

No major customers exceed 10% of revenue.

Net earned premium within 2022 other corporate activities

totalling GBP383,000 (2021: GBP951,000 Net insurance claims and

loss adjustment expenses - 2019, 2020 and 2021 years of account)

represents the 2020, 2021 and 2022 years of account net Group quota

share reinsurance premium payable to Hampden Insurance Guernsey PCC

Limited - Cell 6. This net quota share reinsurance premium payable

is included within "reinsurance premium ceded" in the Consolidated

Statement of Comprehensive Income of the period.

4. Operating profit before impairments of goodwill and

capacity

Underwriting year of account*

-------------------------------------------

2020 and Pre- Corporate Other

6 months ended 30 prior 2021 2022 Sub-total acquisition reinsurance corporate Total

June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 930 11,407 111,730 124,067 - - - 124,067

Reinsurance ceded (96) (2,410) (31,178) (33,684) - (383) (1,224) (35,291)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written 834 8,997 80,552 90,383 - (383) (1,224) 88,776

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 3,306 35,444 21,240 59,990 - (383) (1,224) 58,383

Other income (2,315) (941) (304) (3,560) - 442 84 (3,034)

Net insurance claims

and loss adjustment

expenses 578 (20,389) (15,237) (35,048) - - 307 (34,741)

Operating expenses (843) (9,826) (10,982) (21,651) - - (2,388) (24,039)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 726 4,288 (5,283) (269) - 59 (3,221) (3,431)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share adjustment (150) (1,621) 1,388 (383) - 383 - -

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 576 2,667 (3,895) (652) - 442 (3,221) (3,431)

----------------------- -------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2019 and Pre- Corporate Other

6 months ended 30 prior 2020 2021 Sub-total acquisition reinsurance corporate Total

June 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 285 5,823 47,243 53,351 - - - 53,351

Reinsurance ceded (430) (1,168) (13,590) (15,188) - (951) (968) (17,107)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written (145) 4,655 33,653 38,163 - (951) (968) 36,244

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 1,218 18,769 8,639 28,626 - (951) (968) 26,707

Other income 84 41 54 179 - 474 38 691

Net insurance claims

and loss adjustment

expenses 901 (11,323) (6,028) (16,450) - - 14 (16,436)

Operating expenses (725) (5,225) (4,353) (10,302) - - (1,139) (11,442)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 1,478 2,262 (1,687) 2,053 - (477) (2,056) (480)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (416) (1,278) 743 (951) - (951) - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 1,062 984 (944) 1,102 - 474 (2,056) (480)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Underwriting year of account*

---------------------------------------------

2019 Pre- Corporate Other

12 months ended 31 and prior 2020 2021 Sub-total acquisition reinsurance corporate Total

December 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Gross premium written 721 11,712 122,179 134,612 (28,554) - - 106,058

Reinsurance ceded (713) (2,569) (28,909) (32,191) 7,126 - (1,871) (26,936)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net premium written 8 9,143 93,270 102,421 (21,428) - (1,871) 79,122

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Net earned premium 3,426 40,573 48,693 92,692 (21,415) - (1,871) 69,404

Other income 206 (166) (3) 37 (681) 616 2,456 2,428

Net insurance claims

and loss adjustment

expenses 5,113 (22,945) (36,256) (54,088) 12,037 (2,319) (372) (44,742)

Operating expenses (2,261) (12,406) (18,254) (32,921) 8,788 - (3,604) (27,737)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity 6,484 5,056 (5,820) 5,720 (1,271) (1,703) (3,391) (645)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Quota share

adjustment (2,392) (2,141) 2,214 (2,319) - 2,319 - -

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Operating profit

before impairments

of goodwill and

capacity

after quota share

adjustment 4,092 2,915 (3,606) 3,401 (1,271) 616 (3,391) (645)

--------------------- ---------- --------- --------- ----------- ------------ ------------ ---------- --------

Pre-acquisition relates to the element of results from the new

acquisitions before they were acquired by the Group.

* The underwriting year of account results represent the Group's

share of the syndicates' results by underwriting year of account

before corporate member level reinsurance and members' agents

charges.

5. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2022 186,653 53,433 133,220

Increase in reserves arising from acquisition of

subsidiary undertakings - - -

Movement of reserves 17,146 3,879 13,267

Other movements 37,984 15,762 22,222

------------------------------------------------- -------- ----------- --------

At 30 June 2022 241,783 73,074 168,709

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2022 59,611 10,538 49,073

Increase in reserves arising from acquisition of

subsidiary undertakings - - -

Movement of reserves 46,338 15,945 30,393

Other movements (8,440) (2,491) (5,949)

------------------------------------------------- -------- ----------- --------

At 30 June 2022 97,509 23,992 73,517

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2019 and prior years'

claims reserves reinsured into the 2020 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 113,371 30,781 82,590

Increase in reserves arising from acquisition of

subsidiary undertakings - - -

Movement of reserves 2,118 (156) 2,274

Other movements 70 2,175 (2,105)

------------------------------------------------- -------- ----------- --------

At 30 June 2021 115,559 32,800 82,759

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 32,356 6,028 26,328

Increase in reserves arising from acquisition of

subsidiary undertakings - - (1)

Movement of reserves 15,678 6,141 9,537

Other movements (5,060) (1,475) (3,584)

------------------------------------------------- -------- ----------- --------

At 30 June 2021 42,974 10,694 32,280

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2018 and prior years'

claims reserves reinsured into the 2019 year of account on which

the Group does not participate and currency exchange

differences.

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 113,371 30,781 82,590

Increase in reserves arising from acquisition of

subsidiary undertakings 57,941 15,405 42,537

Movement of reserves 15,796 6,204 9,592

Other movements (455) 1,043 (1,499)

------------------------------------------------- -------- ----------- --------

At 31 December 2021 186,653 53,433 133,220

------------------------------------------------- -------- ----------- --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------- ----------- --------

At 1 January 2021 32,356 6,028 26,328

Increase in reserves arising from acquisition of

subsidiary undertakings 15,649 3,095 12,553

Movement of reserves 11,201 1,484 9,717

Other movements 405 (69) 475

------------------------------------------------- -------- ----------- --------

At 31 December 2021 59,611 10,538 49,073

------------------------------------------------- -------- ----------- --------

Included within other movements are the 2018 and prior years'

claims reserves reinsured into the 2019 year of account on which

the Group does not participate and currency exchange

differences.

6. Net investment income

6 months

ended 6 months 12 months

30 June ended ended 31

2022 Unaudited 30 June December

GBP'0 2021 Unaudited 2021 Audited

00 GBP'000 GBP'000

------------------------------------------------------ --------------- ---------------- -------------

Investment income (3,503) 183 1,549

Realised (losses)/gains on financial assets at fair

value through profit or loss 12 - 392

Unrealised (losses)/gains on financial assets at fair

value through profit or loss (61) - (1,316)

Investment management expenses (2) - (74)

Bank interest 78 2 17

------------------------------------------------------ --------------- ---------------- -------------

Net investment income (3,476) 185 568

------------------------------------------------------ --------------- ---------------- -------------

Included within Investment income are investment losses of

GBP3,560,000 from Syndicate participations.

7. Income tax charge

Analysis of tax charge/(credit) in the period

6 months 6 months 12 months

ended ended ended 31

30 June 30 June December

2022 Unaudited 2021 Unaudited 2021 Audited

GBP'000 GBP'000 GBP'000

------------------ --------------- ---------------- -------------

Income tax credit 214 1,839 (210)

------------------ --------------- ---------------- -------------

The income tax expense is recognised based on management's best

estimate of the weighted average annual income tax rate expected

for the full financial year. The estimated average annual tax rate

used is 19.00% (2021: 19.00%).

On 23 September 2022, the Chancellor announced that next year's

increase in the corporation tax rate from 19% to 25% will be

cancelled. The deferred tax asset provided in the financial

statements has been calculated at 25% being the substantively

enacted corporation tax rate at the Balance Sheet date. The maximum

impact of the reduction in the corporation tax rate is a reduction

in the deferred tax asset of GBP3.5m.

8. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary shareholders after tax by the weighted

average number of ordinary shares outstanding during the

period.

Diluted earnings per share is calculated by dividing the net

profit attributable to ordinary equity holders of the Company by

the weighted average number of ordinary shares outstanding during

the period, plus the weighted average number of ordinary shares

that would be issued on the conversion of all the dilutive

potential ordinary shares into ordinary shares.

Earnings per share has been calculated in accordance with IAS 33

"Earnings per share".

The earnings per share and weighted average number of shares

used in the calculation are set out below:

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2022 June 2021 December

Unaudited Unaudited 2021 Audited

------------------------------------------------------- ----------- ----------- -------------

(Loss)/profit for the year after tax attributable

to ordinary equity holders of the parent (3,645,000) (2,319,000) (434,000)

------------------------------------------------------- ----------- ----------- -------------

Basic - weighted average number of ordinary shares* 67,786,212 59,704,671 58,058,164

------------------------------------------------------- ----------- ----------- -------------

Weighted average number of ordinary shares for diluted

earnings per share* 67,786,212 59,704,671 58,058,164

------------------------------------------------------- ----------- ----------- -------------

Basic (loss)/earnings per share (5.38)p (3.88)p (0.75)p

------------------------------------------------------- ----------- ----------- -------------

Diluted (loss)/earnings per share (5.38)p (3.88)p (0.75)p

------------------------------------------------------- ----------- ----------- -------------

* Diluted loss per share is not permitted to be reduced from the

basic loss per share.

9. Dividends paid or proposed

It was proposed and agreed at the AGM on 29 June 2022 that a

dividend of 3p would be payable.

10. Investments in subsidiaries

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

------ -------- -------- -----------

Total 71,362 45,335 71,362

------ -------- -------- -----------

30 June 31 December

Direct/indirect 2022 2021

interest ownership ownership Principal activity

----------------------------------- ---------------- ---------- ----------- ---------------------------

Lloyd's of London corporate

Nameco (No. 917) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Devon Underwriting Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No. 346) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Pooks Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Charmac Underwriting Limited Direct 100% 100% vehicle

Joint Share Ownership

RBC CEES Trustee Limited(ii) Direct 100% 100% Plan

Lloyd's of London corporate

Nottus (No 51) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Chapman Underwriting Limited Direct 100% 100% vehicle

Llewellyn House Underwriting Lloyd's of London corporate

Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Advantage DCP Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Romsey Underwriting Limited Direct 100% 100% vehicle

Helios UTG Partner Limited(i) Direct 100% 100% Corporate partner

Lloyd's of London corporate

Salviscount LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Inversanda LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Fyshe Underwriting LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Nomina No 505 LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Nomina No 321 LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Nameco (No. 409) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No. 1113) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Catbang 926 Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Whittle Martin Underwriting Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 408) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nomina No 084 LLP Indirect 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 510) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 544) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

N J Hanbury Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1011) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1111) Limited Direct 100% 100% vehicle

Nomina No 533 LLP Indirect 100% 100% Corporate partner

North Breache Underwriting Lloyd's of London corporate

Limited Direct 100% 100% vehicle

Lloyd's of London corporate

G T C Underwriting Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Hillnameco Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 2012) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1095) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

New Filcom Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Kemah Lime Street Capital Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1130) Limited Direct 100% 100% vehicle

Nomina No 070 LLP Indirect 100% 100% Corporate partner

Lloyd's of London corporate

Nameco (No 389) Limited Direct 100% 100% vehicle

Nomina No 469 LLP Indirect 100% 100% Corporate partner

Nomina No 536 LLP Indirect 100% 100% Corporate partner

Lloyd's of London corporate

Nameco (No 301) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1232) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Shaw Lodge Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Queensberry Underwriting Direct 100% 100% vehicle

Nomina No 472 LLP Indirect 100% 100% Corporate partner

Nomina No 110 LLP Indirect 100% 100% Corporate partner

Lloyd's of London corporate

Chanterelle Underwriting Limited Direct 100% 100% vehicle

Kunduz LLP Indirect 100% 100% Corporate partner

Lloyd's of London corporate

Exalt Underwriting Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Nameco (No 1110) Limited Direct 100% 100% vehicle

Lloyd's of London corporate

Clifton 2011 Limited Direct 100% 100% vehicle

Nomina No 378 LLP Indirect 100% 100% Corporate partner

Gould Scottish Limited Partnership Indirect 100% 100% Corporate partner

(i) Helios UTG Partner Limited, a subsidiary of the Company,

owns 100% of Salviscount LLP, Inversanda LLP, Fyshe Underwriting

LLP, Nomina No 505 LLP, Nomina No 321 LLP Nomina No 084 LLP, Nomina

No 533 LLP, Nomina No 070 LLP, Nomina No 469 LLP, Nomina No 536

LLP, Nomina No 472 LLP, Nomina No 110 LLP, Kunduz LLP. Nomina No

348 LLP and Gould Scottish Limited Partnership. The cost of

acquisition of these LLPs is accounted for in Helios UTG Partner

Limited, their immediate parent company.

(ii) RBC CEES Trustee Limited was an incorporated entity in year

2017 to satisfy the requirements of the Joint Share Ownership.

11. Share capital and share premium

Partly

Ordinary share paid ordinary Share

Number of capital share capital premium Total

shares (i) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 31

December 2021 69,305,381 6,821 110 86,330 93,261

----------------------------------------------------- ----------- -------------- -------------- -------- --------

Ordinary shares of 10p each and share premium at 30

June 2022 69,305,381 6,821 110 86,330 93,261

----------------------------------------------------- ----------- -------------- -------------- -------- --------

(i) Number of shares

30 June 2022 31 December 2021

------------------------------------------------------------------- ------------ ----------------

Allotted, called up and fully paid ordinary shares:

On the market 67,786,212 67,786,212

Company buy back of ordinary shares held in treasury 419,169 419,169

------------------------------------------------------------------- ------------ ----------------

68,205,381 68,205,381

------------------------------------------------------------------- ------------ ----------------

Uncalled and partly paid ordinary share under the JSOP scheme (ii) 1,100,000 1,100,000

------------------------------------------------------------------- ------------ ----------------

69,305,381 69,305,381

------------------------------------------------------------------- ------------ ----------------

(ii) The partly paid ordinary shares are not entitled to

dividend distribution rights during the year.

12. Related party transactions

A number of subsidiary companies have entered into quota share

reinsurance contracts for the 2020, 2021 and 2022 years of account

with protected cell companies of Hampden Insurance PCC (Guernsey)

Limited.

Nigel Hanbury, a Director of Helios Underwriting plc and its

subsidiary companies, is also a director and majority shareholder

in Hampden Insurance Guernsey PCC Limited. Hampden Capital plc, a

substantial shareholder in Helios Underwriting plc, is also a

substantial shareholder in Hampden Insurance Guernsey PCC Limited -

Cell 6. Under quota share agreements between Cell 6 and certain

Helios subsidiaries, the Group accrued a net reinsurance premium

recovery of GBP2,596,000 (2021: GBP4,232,000) during the

period.

In addition, HIPCC provide stop loss, portfolio stop loss and

HASP reinforce policies for the company.

HIPCC Limited acts as an intermediary for the reinsurance

products purchased by Helios. An arrangement has been put in place

so that 51% of the profits generated by HIPCC (being Nigel

Hanbury's share) in respect of the business relating to Helios will

be repaid to Helios for the business transacted for the 2021 and

subsequent underwriting years.

13. Ultimate controlling party

The Directors consider that the Group has no ultimate

controlling party.

14. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's are as follows:

Allocated capacity per

year of account

-------------------------------------

Syndicate

or

MAPA 2022 2021 2020

number Managing or members' agent GBP GBP GBP

--------- ------------------------------------ ----------- ----------- -----------

33 Hiscox Syndicates Limited 13,830,779 13,830,793 14,193,201

218 IQUW Syndicate Management Limited 7,070,046 7,070,053 6,558,839

Cincinnati Global Underwriting

318 Agency Limited 992,637 992,635 404,687

386 QBE Underwriting Limited 2,543,190 2,312,008 2,249,975

510 Tokio Marine Kiln Syndicates Limited 32,301,169 22,594,020 19,595,324

557 Tokio Marine Kiln Syndicates Limited 3,458,576 3,458,576 3,236,695

609 Atrium Underwriters Limited 12,071,789 11,612,849 10,545,464

623 Beazley Furlonge Limited 21,576,129 18,913,248 16,129,766

727 S A Meacock & Company Limited 2,059,162 1,999,191 3,053,284

1176 Chaucer Syndicates Limited 2,784,204 2,784,212 2,813,031

1200 Argo Managing Agency Limited 10,050,000 - 160,714

1729 Asta Managing Agency Limited 10,148,838 131,123 295,476

1902 Asta Managing Agency Limited 10,000,002 - -

1969 Apollo Syndicate Management Limited 5,610,170 400,001 -

1971 Apollo Syndicate Management Limited 6,467,147 - -

1991 Coverys Manageming Agency Limited - - 53,345

2010 Lancashire Syndicates Limited 10,137,041 9,547,814 4,188,754

2014 Pembroke Managing Agency Limited - - -

2121 Argenta Syndicate Management Limited 10,019,394 5,472,177 2,473,682

2288 Astra Managing Agency Limited - - 8,139

2525 Asta Managing Agency Limited 1,281,801 1,193,027 1,149,189

2689 Asta Managing Agency Limited 10,025,276 438,655 518,866

2791 Managing Agency Partners Limited 9,217,847 9,217,851 10,303,120

4242 Asta Managing Agency Limited 12,561,664 8,483,065 423,592

4444 Canopius Managing Agents Limited - 162,189 281,110

5623 Beazley Furlonge Limited 6,894,032 4,769,792 2,883,293

5886 Asta Managing Agency Limited 22,520,345 12,054,953 7,277,465

6103 Managing Agency Partners Limited 3,073,952 2,704,446 2,076,669

6104 Hiscox Syndicates Limited 1,702,213 1,695,393 1,738,097

6107 Beazley Furlonge Limited 1,562,047 1,548,102 1,562,779

6117 Argo Managing Agency Limited 2,741,022 1,715,599 1,556,376

6133 Apollo Syndicate Management Limited - - 14,400

--------- ------------------------------------ ----------- ----------- -----------

Total 232,700,472 145,101,772 115,745,332

--------- ------------------------------------ ----------- ----------- -----------

15. Group-owned net assets

The Group statement of financial position includes the following

assets and liabilities held by the syndicates on which the Group

participates. These assets are subject to trust deeds for the

benefit of the relevant syndicates' insurance creditors. The table

below shows the split of the statement of financial position

between Group and syndicate assets and liabilities:

30 June 2022 30 June 2021 31 December 2021

------------------------- ----------------------------- ----------------------------- -----------------------------

Group Syndicate Total Group Syndicate Total Group Syndicate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Assets

Intangible assets 60,889 - 60,889 31,601 - 31,601 60,889 - 60,889

Financial assets at fair

value through profit or

loss 58,838 127,615 186,453 18,543 64,504 83,047 43,589 110,256 153,844

Reinsurance assets:

- reinsurers' share of

claims outstanding 60 73,014 73,074 61 32,739 32,800 60 53,373 53,433

- reinsurers' share of

unearned premium - 23,992 23,992 - 10,694 10,694 - 10,538 10,538

Other receivables,

including

insurance and

reinsurance

receivables 4,885 122,598 127,483 11,496 54,731 66,227 5,456 82,403 87,859

Deferred acquisition

costs - 19,424 19,424 - 8,119 8,119 - 13,615 13,615

Prepayments and accrued

income 1,223 1,699 2,922 828 805 1,633 1 798 799

Cash and cash equivalents 12,979 23,085 36,064 52,272 9,871 62,143 16,178 8,447 24,624

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total assets 138,874 391,427 530,301 114,801 181,463 296,264 126,173 279,430 405,601

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Liabilities

Insurance liabilities:

- claims outstanding - 241,783 241,783 - 115,559 115,559 - 186,653 186,653

- unearned premium - 97,509 97,509 - 42,974 42,974 - 59,611 59,611

Deferred income tax

liabilities 11,568 - 11,568 8,546 - 8,546 11,887 79 11,965

Borrowings 15,000 - 15,000 - - - - - -

Other payables, including

insurance and

reinsurance

payables 844 57,303 58,147 89 25,551 25,640 445 34,482 34,926

Accruals and deferred

income 2,743 1,742 4,485 3,320 952 4,272 2,607 2,093 4,700

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities 30,155 398,337 428,492 11,955 185,036 196,991 14,939 282,918 297,855

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Equity attributable to

owners of the Parent

Share capital 6,931 - 6,931 6,817 - 6,817 6,931 - 6,931

Share premium 86,330 - 86,330 85,502 - 85,502 86,330 - 86,330

Revaluation reserve - - - 3,642 - 3,642 - - -

Other reserves (110) - (110) (50) - (50) (110) - (110)

Retained earnings 15,568 (6,910) 8,658 6,935 (3,573) 3,362 18,083 (3,488) 14,595

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total equity 108,719 (6,910) 101,809 102,846 (3,573) 99,273 111,234 (3,488) 107,746

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

Total liabilities and

equity 138,874 391,427 530,301 114,801 181,463 296,264 126,173 279,430 405,601

------------------------- -------- --------- -------- -------- --------- -------- -------- --------- --------

The Interim Report will be made available in electronic format

on the Company's website, www.huwplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QVLFLLKLEBBE

(END) Dow Jones Newswires