TIDMHMSO

RNS Number : 7874Y

Hammerson PLC

08 March 2017

The following amendments have been made to the 'Dividend

Declaration' announcement released on 7 March 2017 at 09:00 under

RNS No 6721Y. The amendments only concern the conversion to ZAR

cents.

PID UK Shareholders SA Shareholders

(GBP pence) (ZAR cents)

--------------------------- ---------------- ----------------

Gross amount of PID 4.90p 77.96880 cents

--------------------------- ---------------- ----------------

Less 20% UK withholding 0.98p 15.59376 cents

tax/20% SA dividends tax*

--------------------------- ---------------- ----------------

Net PID dividend payable 3.92p 62.37504 cents

--------------------------- ---------------- ----------------

Non-PID* UK Shareholders SA Shareholders

(GBP pence) (ZAR cents)

----------------------------- ---------------- ----------------

Gross amount of Non-PID 9.00p 143.20800 cents

----------------------------- ---------------- ----------------

Less 20% SA dividends tax - 28.64160 cents

----------------------------- ---------------- ----------------

Net Non-PID dividend payable 9.00p 114.56640 cents

----------------------------- ---------------- ----------------

All other details remain unchanged.

The full amended text is shown below.

Hammerson plc ("Hammerson" or "the Company")

7 March 2017

Dividend Currency Conversion Announcement

Dividend No. 132

On 20 February 2017, the board of directors of Hammerson

proposed a final dividend of GBP 13.90 pence per share ("the

Dividend"). The Dividend will be subject to a 20% UK withholding

tax unless exemptions apply. GBP 4.90 pence will be paid as a

Property Income Distribution ("PID"), net of withholding tax where

appropriate, with the balance of GBP 9.00 pence paid as a normal

dividend ("Non-PID").

The Dividend Reinvestment Plan ("DRIP") will be available for

those shareholders who wish to receive the Dividend in the form of

shares. The Dividend is payable on Thursday, 27 April 2017 to those

shareholders registered on the UK principal register ("UK

Shareholders"), and Friday, 28 April 2017 to those shareholders

registered on the South African branch register ("SA

Shareholders"). The Record Date for both UK Shareholders and SA

Shareholders is at the close of business on Friday, 17 March

2017.

The Dividend should be regarded as a "foreign dividend" for SA

income and SA dividend tax purposes.

Shareholders receiving the Dividend in cash

The Company confirms that the South African Rand exchange rate

for the Dividend will be ZAR 15.9120 to GBP 1. The Dividend is

payable in South African Rand to SA Shareholders. Accordingly,

shareholders who do not elect the DRIP will be paid as follows:

PID UK Shareholders SA Shareholders

(GBP pence) (ZAR cents)

--------------------------- ---------------- ----------------

Gross amount of PID 4.90p 77.96880 cents

--------------------------- ---------------- ----------------

Less 20% UK withholding 0.98p 15.59376 cents

tax/20% SA dividends tax*

--------------------------- ---------------- ----------------

Net PID dividend payable 3.92p 62.37504 cents

--------------------------- ---------------- ----------------

*Please note that this is the net position after SA Shareholders

have claimed back 5% from HMRC under the double tax agreement

between the United Kingdom and South Africa.

Non-PID* UK Shareholders SA Shareholders

(GBP pence) (ZAR cents)

----------------------------- ---------------- ----------------

Gross amount of Non-PID 9.00p 143.20800 cents

----------------------------- ---------------- ----------------

Less 20% SA dividends tax - 28.64160 cents

----------------------------- ---------------- ----------------

Net Non-PID dividend payable 9.00p 114.56640 cents

----------------------------- ---------------- ----------------

*Non-PID - taxed as a normal dividend

Cash PIDs

A 20% UK withholding tax will be deducted from cash PIDs. The

Company will account to Her Majesty's Revenue & Customs

("HMRC") in sterling for the total UK withholding tax deducted.

SA dividends tax, at the rate of 20% (previously announced as

15%, however the rate has subsequently been increased from 15% to

20% following an announcement by the South African Minister of

Finance on 22 February 2017), will apply to cash PIDs payable by

the Company unless the beneficial owner of the Dividend is exempt

from SA dividends tax (e.g. if it is a South African resident

company). Under the double tax agreement between the UK and South

Africa ("the DTA"), the maximum tax payable in the UK is 15%. South

African resident shareholders are therefore entitled to claim the

excess of 5% from HMRC. As SA Shareholders are entitled to reclaim

this excess from HMRC, the maximum rebate allowable in respect of

the UK withholding tax against the SA dividends tax is 15%, which

means that the Company will have to withhold a further 5% from the

Dividend in South Africa to bring the total dividends tax to 20%.

In summary, therefore, 20% will be withheld in the UK, a further 5%

will be withheld in South Africa (where appropriate), but South

African resident shareholders will be entitled to claim back 5%

from HMRC, which will bring the overall total to 20%.

Cash Non-PIDs

SA dividends tax at the rate of 20% will apply to cash Non-PIDs

paid by the Company, unless the beneficial owner of the Dividend is

exempt from SA dividends tax (e.g. if the beneficial owner is a

South African company or a non-South African resident). Since no

withholding tax is suffered in the UK on cash Non-PIDs, no rebate

can be claimed. The relevant regulated intermediary (being the SA

transfer secretaries or other CSDP, broker or institution, as

applicable) will therefore be required to deduct 20% tax on all

cash Non-PID's paid to persons who are not exempt from SA dividends

tax, and pay this to the South African Revenue Service.

Shareholders electing the DRIP

SA Shareholders electing the DRIP should note that, in respect

of fractional entitlements that may arise, all allocations of

shares will be rounded down to the nearest whole number, and any

residual amounts that are not used to reinvest in shares (as a

result of rounding down) will be paid out to these SA Shareholders

in cash.

It is the Company's understanding that the residual cash paid to

SA Shareholders who have made DRIP elections would already have

been taxed prior to the calculation of the number of shares and any

residual cash owing to such SA Shareholders. Accordingly, no

further tax should be payable on the cash paid to SA Shareholders

as a result of any fractional entitlements.

The above information and the guidelines on the taxation of

dividends are provided as a general guide based on the Company's

understanding of the law and practice currently in place. Any

shareholder who is in any doubt as to their tax position should

seek independent professional advice.

Registered Office UK Registrars SA Transfer Secretaries

Kings Place Capita Asset Services Computershare Investor

90 York Way The Registry Services Proprietary

London 34 Beckenham Road Limited

N1 9GE Beckenham (Registration number

United Kingdom Kent 2004/003647/07)

BR3 4TU 1st Floor, Rosebank

United Kingdom Towers,

15 Biermann Avenue,

Rosebank, 2196

South Africa

(PO Box 61051, Marshalltown,

2107, South Africa)

Sarah Booth

General Counsel and Company Secretary

The announcement above has been released on the SENS system of

the Johannesburg Stock Exchange.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DIVSSDFMWFWSEED

(END) Dow Jones Newswires

March 08, 2017 04:00 ET (09:00 GMT)

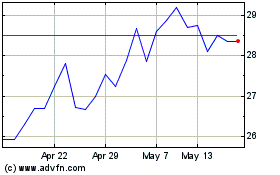

Hammerson (LSE:HMSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

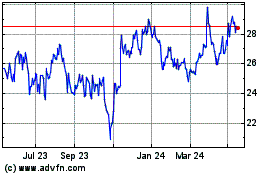

Hammerson (LSE:HMSO)

Historical Stock Chart

From Apr 2023 to Apr 2024