RNS Number:4181Q

H&T Group PLC

19 March 2008

Preliminary results

For the year ended 31 December 2007

H&T Group ("H&T" or the "Group"), the UK's largest pawnbroker by size of pledge

book, is pleased to announce its preliminary results for the year ended 31

December 2007

Financial highlights

2007 �m 2006 �m Change %

Gross profit 27.7 23.3 +18.6

Earnings before Interest, Tax, Depreciation, Amortisation ("EBITDA") 11.4 9.4 +20.8

before exceptional items

Operating profit before exceptional items 10.0 8.0 +24.1

PBT before exceptional items 7.2 4.7 +52.5

PBT 7.4 2.0 +261.5

Basic EPS excluding exceptional items 14.72p 11.91p +23.6

Basic EPS 15.17p 3.65p +315.6

Proposed final dividend 3.4p 3.0p +13.3

Pledge book 27.9 25.2 +10.4

Operational highlights

* Excellent growth in all revenue lines

* Total number of stores reached 89 at 31 December 2007 (2006: 77)

with 12 new stores opened during the year: seven acquisitions and five

greenfields

* Full roll-out of gold purchasing in store, providing customers

with a quicker, fairly valued cash solution

* Successful placing of 3.6 million shares in May 2007 raising over

�7 million for store expansion

* Recent acquisitions will serve as a springboard for some regional

development of strong pawnbroking markets in Yorkshire and the South coast

John Nichols, Chief Executive of H&T Group commented

"My fellow directors and I are extremely pleased with this set of results where

operating profit before exceptional items reached the �10 million milestone.

Against wider perception, the more difficult economic climate is not

automatically a driver for our pawnbroking business. We have seen strong growth

in turnover and gross profit across all business segments.

The demand for gold asset-backed lending remains strong and the business is

continuing to benefit from the rise in the price of gold through higher margin

on disposition. Our core stores continue to deliver growth while our investment

in new stores and acquisitions offer good profit prospects for the future years.

I have every reason to look to the future with confidence."

Enquiries:

H&T Group plc Tel: 0870 9022 600

John Nichols, Chief Executive

Laurent Genthialon, Finance Director

Hawkpoint (Nominated adviser) Tel: 020 7665 4500

Lawrence Guthrie/Sunil Duggal

Numis Securities (Broker) Tel: 020 7260 1000

Lee Aston/Charles Farquhar

College Hill Tel: 020 7457 2020

Gareth David/Paddy Blewer

Chairman's Statement

I am delighted to report that 2007 has seen excellent growth in all areas of the

business with H&T's 2007 profit before tax and exceptional items reaching �7.2

million.

Financial Performance

The Group has delivered a year of double digit growth in gross profit, EBITDA

(before exceptional items), profit before tax and exceptional items and number

of stores. Gross profit increased by 18.6 per cent. to �27.7 million (2006:

�23.3 million). EBITDA before exceptional items increased by 20.8 per cent. to

�11.4 million (2006: �9.4 million). Operating profit before exceptional items

increased by 24.1 per cent. to �10.0 million (2006: �8.0 million). We also

opened 12 additional stores during 2007, taking the total number of stores at 31

December 2007 to 89.

Secondary placing

On 16 May 2007, H&T completed the placing of 3.6 million new ordinary shares to

existing shareholders, all UK institutions. This provided the Group with �7

million of additional finance for its store expansion programme in which it

invested �3.6 million during the year.

Final Dividend

In accordance with the dividend policy declared at the time of the flotation,

the directors are pleased to recommend a final dividend of 3.4 pence per

ordinary share (2006: 3.0 pence). This dividend will be paid to all shareholders

on the register at the close of business on 16 May 2008.

Outlook

Since the beginning of 2008 our expansion programme has continued and as of

today we have already opened four new stores - two by acquisition and two

greenfields. This takes the total current number of stores to 93. We are

confident in the Group's prospects for 2008. H&T will prosper through a mix of

continued growth in the established estate, development of the 18 greenfield

stores opened over the last three years and profit enhancement from the recent

acquisitions. The current high price of gold should also provide some profit

opportunities in the short term.

The hard work and commitment of staff has been central to achieving 2007's

result and I would like to thank all of them for that.

Peter J Middleton

Chairman

Chief Executive's Review

Introduction

2007 was a record year for H&T on a number of metrics. Our business model has

proved scaleable, with new stores and continued improvements to our existing

businesses driving strong growth.

During 2007, H&T has set a number of new records. Turnover and gross profit of

all business segments increased by double digit figures. Pawnbroking activities,

comprising Pawn Service Charge and Disposition, represented 87 per cent. (2006:

88 per cent.) of total 2007 gross profit and grew 17 per cent. year on year.

Gold asset-backed lending continues to see strong demand both in existing and

new markets. At the same time financial services activities, comprising Cheque

Cashing and Other Financial Services, represented 13 per cent. (2006: 12 per

cent.) of total 2007 gross profit and grew 29 per cent. year on year. The

transition in 2006 of the back office functions of Cheque Cashing and Pay Day

Advance in-house gave us the opportunity to market these products more

effectively during 2007.

H&T remains the UK's leading pawnbroker by size of pledge book and had 89

outlets across the UK at the end of 2007. The estate increased by the record

number of 12 stores (2006: nine) during 2007. Of these, five were greenfield

stores and seven were acquired branches. The acquisitions located in Yorkshire,

Nottinghamshire and the South Coast will give us access to new markets where

pawnbroking has historically been strong. We will be looking at expanding in

those regions through a regional hub system and take full advantage of market

potential.

The continuing growth we derive from our established and greenfield stores

combined with profit-enhancing acquisitions has led to record profits.

Operating profit before exceptional items reached �10.0 million in 2007 (2006:

�8.0 million), a 24.1 per cent. increase on 2006.

Review of Operations

Pawn Service Charge

H&T has been the largest pawnbroker in the UK based on the size of the pledge

book for many years and as at 31 December 2007 had a pledge book of �27.8

million (2006: �25.2 million). As indicated in the "develop and establish new

products and services" section of this review, the growth in the pledge book was

impacted by the full roll out of gold purchasing. The increase in pledge book

combined with an improved yield translated to an 11.9 per cent. increase in Pawn

Service Charge. Maintaining this market leading position remains a priority for

the Group.

Disposition

The sale of forfeited items to the general public ("Retail") is the most

important element of Disposition, generating higher margins when compared with

items that are sold in auction or scrap. Although the general trading

environment on the high street deteriorated during the last quarter of 2007, I

am delighted to report that trading remained good for H&T and we achieved

turnover growth of 18.8 per cent. year on year (11.7 per cent. LFL) while

increasing Retail gross profit margin to 49.4 per cent. (2006: 44.2 per cent.).

This has resulted in gross profit increasing by 32.6 per cent. between 2006 and

2007. This very strong performance is a result of the continued investment in

training, marketing and a wider product range.

In 2007, Scrap gross profit reached �1.5 million (2006: �1.1 million). This �0.4

million increase is as a result of the increase in the price of gold (�0.2

million) and higher Scrap volumes (�0.2 million).

Other Financial Services

Cheque Cashing and Pay Day Advance

In January 2006, H&T brought in-house the back office for underwriting the

in-store Cheque Cashing and Pay Day Advance businesses, enabling the Group to

manage both products internally saving the fees previously paid to a third

party. It has also allowed us to apply our own expertise in managing this

product without the restrictions imposed by a third party.

Our experience in 2007 on Cheque Cashing appears to go against the market trend.

Whilst our competitors reported difficult times and reducing turnover, H&T

turnover grew by 7 per cent. on a like-for-like basis. Although this is

encouraging we acknowledge that this is in the face of a changing market. Pay

Day Advance continues to provide excellent growth. We did however experience a

small increase in the percentage of bad debt which was expected in the context

of a rapidly expanding loan book.

In 2007, gross revenues from Cheque Cashing increased to �2.2 million (2006:

�1.9 million) and Pay Day Advance increased to �2.9 million (2006: �1.8

million).

The revenues net of bad debt from Cheque Cashing and Pay Day Advance increased

to �3.4 million (2006: �2.6 million).

KwikLoan

The KwikLoan product has continued to develop as a medium term alternative for

our Pay Day Advance customers. As in 2006 our focus has been on the development

of Pay Day Advance, with KwikLoan growing alongside it. We believe there is

further opportunity to grow the KwikLoan product through the development of the

loan term, loan value and the customer base.

The KwikLoan loan book increased from �0.4 million to �0.5 million in the 12

months to 31 December 2007. KwikLoan gross profit increased by 45.5 per cent.

during the same period.

Point of sale development

In 2006 we commenced the development of our new point of sale system which will

unify the current store and head office systems which have developed over a

number of years with one, purpose built, application to support all current

business activities.

The use of new technology will result in some improvement in operational

efficiency, but more importantly, will simplify store operations to enable us to

achieve the full potential of the existing product range and implement new

products more easily.

Although the development of our new point of sale system is taking longer than

originally anticipated, the project remains within budget and is expected to be

fully rolled out into all stores by late summer. Since the beginning of the

project we have incurred capital expenditure of �1.3 million and the total cost

including implementation is expected to be in the region of �1.8 million.

Business Overview and Strategy

Our growth strategy is based on two main streams. Each of them is progressing in

line or ahead of the Board's expectations.

1. Expand geographical footprint

The significant fragmentation in the UK pawnbroking market will continue to

provide the Group with acquisition opportunities. In addition, there remains

substantial opportunity for organic growth with a significant number of towns

with an appropriate population size and demographic mix to support a greenfield

store.

H&T's strategy at IPO was to develop 30 units between 2006 and 2008, both

through greenfield stores and acquisitions, using current resources whilst

maintaining cash flow and earnings growth at an appropriate level. During 2007,

we added 12 outlets (2006: nine) to the store portfolio - five greenfield and

seven acquisitions. Two of the acquisitions opened up new regions to us, in

Yorkshire and the South coast, and can now be used as a regional hub to further

develop these key markets. We would expect to grow the store footprint by a

similar number during 2008 and exceed the original 30 unit target.

Initially, new pawnbroking units tend to be loss-making. As a consequence,

expanding the store base can suppress short term earnings growth but provides

significant medium term benefit.

The Group is actively pursuing acquisitions to accelerate the consolidation of

the industry. During the year the Group issued 3.6m shares to raise additional

capital of �7m, of which �3.4m remained at the year end. This new capital and

the headroom available on existing borrowing facilities provide the Group with

the resources to complete a number of further transactions. The H&T Board will

make acquisitions selectively, appraising each opportunity fully before

proceeding with a transaction. Consequently, the timing and nature of these

transactions depends on the availability of appropriate opportunities.

Our greenfield stores are performing well and are on average exceeding our

expectations in terms of pledge book growth. Whilst encouraging, we note that

given the maturity of these stores they will not have a significant impact on

revenues in the immediate term. These stores will nevertheless deliver a

greater contribution to group profitability over the next few years.

2. Develop and establish new products and services

During 2007 we introduced the purchase of gold and jewellery into all of our

stores. This minimises the time required to access the asset for disposition

and also enables simpler communication with the customer. Whilst this has the

effect of reducing the pledge book as customers who would previously pledge now

sell, it allows a more efficient use of capital as those goods are held for only

30 days, rather than up to eight months for a pledge.

The strategy in 2008 is to further develop gold purchasing and to expand the

portfolio of unsecured products, using the Pay Day Advance and KwikLoan models

to their best advantage. All of these products provide customers with a simple

and accessible route to cash, a service that is invaluable, especially in the

current credit climate. We believe that through cautious development we can

expand our customer base, whilst maintaining an acceptable risk profile.

The prepaid card continues to attract new customers to the stores although the

general market awareness has taken longer to develop than anticipated.

Review of the Pawnbroking Market

Competition

The competitive environment has not changed substantially in the last year.

The pawnbroking industry remains very fragmented. Although there are no

official statistics, the National Pawnbrokers Association estimates that there

are around one thousand pawnbroking locations in the UK.

In this environment it is critical to maintain the high levels of customer

service in store and by doing so we will continue to be the first choice for our

customers.

Regulation

There have been no changes to regulation that will have an impact on the

products and services we offer.

Current Trading and Outlook

The increasing awareness of the pawnbroking industry will undoubtedly provide

opportunities in the coming year. I believe that the current portfolio of

pawnbroking and other financial services products will enable H&T to capitalise

on those opportunities.

Against wider perception, the general economic climate is not necessarily a

driver for our business - we do not and have not seen the pawnbroking industry

as cyclical. Our success has been based on the fundamentals of a well run

business, with the focus on the customer and an understanding of the

opportunities to grow within a fragmented market. We remain confident that we

can achieve further success.

Finally I would like to recognise the hard work and commitment of our staff year

after year and give them full credit for our 2007 business achievements. Thank

you all.

John G Nichols

Chief Executive

Finance Director's Review

Due to the materiality of the amount of exceptional items in 2006 and in order

to have meaningful comparatives in 2007, some of the metrics used to report

performance are presented excluding these exceptional items.

International Financial Reporting Standards (IFRS)

In accordance with the AIM's reporting regime, the Group has adopted

International Financial Reporting Standards ("IFRS") for the financial year

ended 31 December 2007 rather than UK Generally Accepted Accounting Practice ("

UK GAAP") as the basis to report its financial results. This transition has lead

to some differences between reported numbers under IFRS and UK GAAP that are

simply a result of the accounting framework change and are not a reflection of a

change in business performance. The Group released on 1 August 2007 a report on

the impact of IFRS (relative to UK GAAP) on H&T's results which is accessible on

the Group's website (www.handtgroup.co.uk).

Turnover and gross profit

Turnover in 2007 grew 19.5 per cent. to �38.4 million compared with �32.1

million in 2006. Total gross profit in 2007 increased by 18.6 per cent. to �27.7

million (2006: �23.3 million) driven by the turnover growth across all business

segments.

Other direct expenses and Administrative expenses

The other direct expenses in 2007 were �12.8 million compared with �10.9 million

in 2006. The 18.0 per cent. increase in other direct expenses was primarily

driven by the development of twelve additional stores and the overall increase

in business volumes. At the same time the Group's administrative expenses before

exceptional items increased by �0.4 million from �4.4 million in 2006 to �4.8

million in 2007.

Operating profit

During 2007, EBITDA before exceptional items increased by 20.8 per cent. to

�11.4 million (2006: �9.4 million). The Group recorded a 24.1 per cent. increase

in operating profit before exceptional items reporting �10.0 million in 2007

compared with �8.0 million in the previous year. Exceptional expenses in 2006 of

�1.9 million were incurred as part of the IPO. After taking account of the

exceptional items, H&T's operating profit was �10.0 million in 2007 compared

with �6.1 million in 2006.

Finance costs and similar charges

Finance costs before exceptional items decreased by �1.2 million from �3.9

million in 2006 to �2.7 million in 2007. This reduction was a result of the

restructuring of bank facilities and loan notes at the time of H&T's admission

to AIM in May 2006 combined with the unspent new money raised in May 2007 which

has temporarily been used to reduce the level of borrowings. The restructuring

in May 2006 incurred an exceptional charge of �0.8 million in the 2006 financial

year (2007: �nil).

Profit before taxation

Profit before taxation and exceptional items increased by �2.5 million from �4.7

million in 2006 to �7.2 million in 2007. The 2007 result was impacted by a �0.2

million (2006: �0.05 million) exceptional profit relating to the disposal of a

freehold property while the 2006 result included a �1.9 million exceptional

administrative expense relating to H&T's admission onto AIM and �0.8 million of

debt restructuring costs. As a result, the Group recorded a profit before

taxation of �7.4 million in 2007 compared with a profit before taxation of �2.0

million in 2006.

Taxation

The 2007 effective corporation tax rate excluding exceptional items was 31 per

cent. (30 per cent. in 2006).

Earnings per share

Basic earnings per share for 2007 were 15.17p compared with 3.65p in 2006.

Diluted earnings per share for 2007 was 15.14p compared with 3.65p in 2006.

After adjusting for exceptional items referred to in the profit before taxation

section, adjusted basic earnings per share increased by 23.6 per cent. from

11.91p in 2006 to 14.72p in 2007.

Dividend

The H&T Board has recommended a final dividend of 3.4 p per share (2006: 3.0 p)

giving a total dividend per share of 5.0 p for 2007 (2006: 3.0 p).

Cash flow and capital expenditure

The Group generated cash of �6.3 million in 2007 from operations (2006: �7.6

million). This result was impacted by the increase in receivables (�3.2 million)

driven by the growth in the pledge book and loan portfolio and in inventories

(�2.1 million) between 2006 and 2007. The Group invested �3.6 million (2006:

�1.0 million) in the acquisition of pawnbroking and cheque cashing businesses

and assets.

Capital expenditure during the year was �1.9 million (2006: �1.6 million). Of

this, �1.5 million related to new stores opened or acquired during the period

and store refurbishments. The Group also spent �0.4 million in store and head

office new hardware for both the existing and future EPOS systems. An investment

of �0.2 million in the new EPOS software was reported in intangible assets.

New money/ debt structure

The Group placed 3.6 million new shares in May 2007 raising �7.0 million net of

expenses.

The Group repaid �1.5 million of facility A debt in 2007. Net debt (before

unamortised debt issue costs) was �32.2 million at 31 December 2007 compared

with �34.7million at 31 December 2006. The Group has in place a hedging

agreement fixing the interest rate on �35.0 million of banking debt for a period

ending 30 June 2009.

Return On Capital Employed (ROCE)

ROCE, defined as profit before tax excluding exceptional items, interest

receivable, finance costs and movement in fair value of interest rate swap as a

proportion of net current assets and tangible and intangible fixed assets

(excluding goodwill), increased from 20.2 per cent. in 2006 to 21.7 per cent. in

2007.

Laurent P Genthialon

Finance Director

This announcement includes 'forward-looking statements'. These statements

contain the words "anticipate", "believe", "intend", "estimate", "expect", and

words of similar meaning. All statements other than statements of historical

facts included in this announcement, including, without limitation, those

regarding the Group's financial position, business strategy, plans and

objectives of management for future operations (including development plans and

objectives relating to the Group's products and services) are forward-looking

statements that are based on current expectations. Such forward-looking

statements involve known and unknown risks, uncertainties and other important

factors that could cause the actual results, performance, achievements or

financial position of the Group to be materially different from future results,

performance, achievements or financial position expressed or implied by such

forward-looking statements. Such forward-looking statements are based on

numerous assumptions regarding the Group's operating performance, present and

future business strategies, and the environment in which the Group will operate

in the future. These forward-looking statements speak only as at the date of

this announcement. Past performance cannot be relied upon as a guide to future

performance.

Consolidated income statement

Year ended 31 December 2007

Note Before Before

exceptional Exceptional 2007 exceptional Exceptional 2006

items Items Total items Items Total

�'000 �'000 �'000 �'000 �'000 �'000

Revenue 2 38,363 - 38,363 32,115 - 32,115

Cost of sales (10,699) - (10,699) (8,787) - (8,787)

Gross profit 2 27,664 - 27,664 23,328 - 23,328

Other direct expenses (12,844) - (12,844) (10,886) - (10,886)

Administrative expenses (4,836) - (4,836) (4,399) (1,903) (6,302)

Operating profit 9,984 - 9,984 8,043 (1,903) 6,140

Investment revenues 35 - 35 27 - 27

Other gains - 201 201 - 46 46

Finance costs 3 (2,706) - (2,706) (3,936) (801) (4,737)

Movement in fair value of (151) - (151) 561 - 561

interest rate swap

Profit before taxation 7,162 201 7,363 4,695 (2,658) 2,037

Tax charge on profit 4 (2,232) (52) (2,284) (1,421) 386 (1,035)

Profit for the financial 4,930 149 5,079 3,274 (2,272) 1,002

year

Note 2007 2006

Pence Pence

Earnings per share

From continuing operations

Basic 5 15.17 3.65

Diluted 5 15.14 3.65

All results derive from continuing operations.

Consolidated income statement

Year ended 31 December 2007

2007 2006

�'000 �'000

Non-current assets

Goodwill 16,415 14,899

Other intangible assets 1,480 804

Property, plant and equipment 6,093 5,396

23,988 21,099

Current assets

Inventories 6,720 4,237

Trade and other receivables 36,105 31,869

Cash and cash equivalents 1,966 2,108

Derivative financial instruments - 133

Assets held for sale - 37

44,791 38,384

Total assets 68,779 59,483

Current liabilities

Trade and other payables (3,322) (3,510)

Current tax liabilities (1,193) (88)

Borrowings (1,766) (1,255)

Derivative financial instruments (18) -

(6,299) (4,853)

Net current assets 38,492 33,531

Non-current liabilities

Borrowings (31,651) (34,617)

Deferred tax liabilities (365) (407)

Provisions (119) -

(32,135) (35,024)

Total liabilities (38,434) (39,877)

Net assets 30,345 19,606

2007 2006

�'000 �'000

Equity

Share capital 1,754 1,574

Share premium account 23,994 17,112

Retained earnings 4,597 920

Total equity 30,345 19,606

Consolidated statement of changes in equity

Year ended 31 December 2007

Share Retained

Share premium (deficit)/

capital account earnings Total

�'000 �'000 �'000 �'000

At 1 January 2006 1,000 - (502) 498

Profit for the financial year - - 1,002 1,002

Total income for the financial year - - 1,002 1,002

Issue of share capital 574 17,790 - 18,364

Share issue costs - (678) - (678)

Share option credit taken directly to - - 19 19

equity

Corporation tax on share options - - 401 401

At 1 January 2007 1,574 17,112 920 19,606

Profit for the financial year - - 5,079 5,079

Total income for the financial year - - 5,079 5,079

Issue of share capital 180 7,164 - 7,344

Share issue costs - (282) - (282)

Share option credit taken directly to - - 105 105

equity

Dividends paid - - (1,507) (1,507)

At 31 December 2007 1,754 23,994 4,597 30,345

Consolidated cash flow statement

Year ended 31 December 2007

Note 2007 2006

�'000 �'000

Net cash from/(used by) operating activities 6 2,647 (254)

Investing activities

Interest received 35 27

Proceeds on disposal of property, plant and equipment 267 118

Purchases of property, plant and equipment (2,155) (1,936)

Purchases of intangible assets (242) (706)

Acquisition of trade and assets of businesses (3,550) (1,013)

Net cash used in investing activities (5,645) (3,510)

Financing activities

Dividends paid (1,507) -

Repayments of borrowings (2,700) (19,500)

Increase in borrowings - 6,251

Net proceeds on issue of shares 7,063 17,687

Net cash from financing activities 2,856 4,438

Net (decrease)/increase in cash and cash equivalents (142) 674

Cash and cash equivalents at beginning of year 2,108 1,434

Cash and cash equivalents at end of year 1,966 2,108

Notes to the preliminary announcement

Year ended 31 December 2007

1. Financial information and basis of preparation

The financial information has been abridged from the audited financial

statements for the year ended 31 December 2007.

The financial information set out in this document does not constitute the

company's statutory accounts for the year ended 31 December 2007, but is derived

from those accounts. Statutory accounts for 2006 have been delivered to the

Registrar of Companies and those for 2007 will be delivered following the

company's annual general meeting. The auditors have reported on those accounts;

their reports were unqualified and did not contain statements under s.237(2) or

(3) Companies Act 1985.

Whilst the financial information included in this preliminary announcement has

been prepared in accordance with International Financial Reporting Standards ('

IFRS'), this announcement does not itself contain sufficient information to

comply with IFRS. The Group will be publishing full financial statements that

comply with IFRS later this month.

2. Business and geographical statements

Business segments

For reporting purposes, the Group is currently organised into five segments -

Pawnbroking, Retail, Scrap, Cheque cashing and Other financial services. The

principal activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge). In the case of

the group over 98% of the collaterals against which amounts are lent is

jewellery made of gold and/or diamonds. The pawnbroking contract is a six month

credit agreement bearing a monthly average interest rate of 8%. The contract is

governed by the terms of the Consumer Credit Act 2007 (previously the Consumer

Credit Act 2002). If the customer does not redeem the goods by repaying the

secured loan before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge is over �75

(disposal proceeds being reported in this segment) or, if the value of the

pledge is under �75, through public auctions or the Retail or Scrap activities

of the Group.

Retail:

The Group's retail proposition is primarily gold and jewellery and almost all

retail sales are forfeited items from the pawnbroking pledge book or purchased

second-hand jewellery. The retail offering is complemented with a small amount

of new jewellery.

2. Business and geographical segments (continued)

Scrap:

Items that are damaged beyond repair, are slow moving or surplus may be smelted

and sold at the current gold spot price less a small commission.

Cheque cashing:

This segment comprises two products:

O Third Party Cheque Encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission fee based on

the face value of the cheque.

O Pay Day Advance which is a simple form of credit where the

advance is repaid by post dated cheques presented by the customer at the point

of the loan. H&T applies a 13% charge per 30 days on the value of the advance.

At the end of the 30 days, the customer has a choice to either extend the

advance for another 30 days, repay the advance or allow the cheques to be

deposited in the Group's bank account.

Both products are subject to bad debt risk which is reflected in the commissions

and fees applied.

Other financial services:

This segment comprises:

O KwikLoan product which is an unsecured loan repayable over

12 months of up to �750. H&T earns approximately �300 gross interest on a �500

loan over 12 months.

O The Prepaid debit card product where H&T earns a commission

when selling the card or when the customer is topping up their card.

Only the KwikLoan product is subject to bad debt risk which is reflected in the

interest rate offered.

Segment information about these businesses is presented below:

Pawnbroking Retail Scrap Cheque Other Consolidated

cashing financial Year

services ended

2007 2007 2007 2007 2007 2007

2007 �'000 �'000 �'000 �'000 �'000 �'000

Revenue

External sales 17,122 11,024 6,602 3,356 259 38,363

Total revenue 17,122 11,024 6,602 3,356 259 38,363

Segment result 17,122 5,443 1,484 3,356 259 27,664

Gross profit is stated after charging bad debt expenses and the direct costs of

stock items sold or scrapped in the period. Other operating expenses of the

stores are included in other direct expenses. The Group is unable to

meaningfully allocate the other direct expenses of operating the stores between

segments as the activities are conducted from the same stores, utilising the

same assets and staff. The Group is also unable to meaningfully allocate Group

administrative expenses, or financing costs or income between the segments.

Accordingly, the Group is unable to meaningfully disclose an allocation of items

included in the income statement below Gross profit, which represents the

reported segment results.

The Group does not apply any inter-segment charges when items are transferred

between the pawnbroking activity and the retail or scrap activities.

2. Business and geographical segments (continued)

Other Consolidated

Cheque financial Year

Pawnbroking Retail Scrap cashing services ended

2007 2007 2007 2007 2007 2007

�'000 �'000 �'000 �'000 �'000 �'000

Other information

Capital additions (*) - - - - - 1,154

Depreciation and - - - - - 1,368

amortisation (*)

Impairment losses recognised 80 - - 1,637 799 2,516

in income

Balance sheet

Assets

Segment assets 32,283 6,182 537 2,089 531 41,622

Unallocated corporate 27,157

assets

Consolidated total assets 68,779

Liabilities

Segment liabilities - (149) - (58) (95) (302)

Unallocated corporate (38,132)

liabilities

Consolidated total (38,434)

liabilities

(*) See below

2. Business and geographical segments (continued)

Other Consolidated

Cheque Financial Year

Pawnbroking Retail Scrap cashing Services ended

2006 2006 2006 2006 2006 2006

2006 �'000 �'000 �'000 �'000 �'000 �'000

Revenue

External sales 15,299 9,278 4,731 2,629 178 32,115

Total revenue 15,299 9,278 4,731 2,629 178 32,115

Segment result 15,299 4,250 972 2,629 178 23,328

Other Consolidated

Cheque financial Year

Pawnbroking Retail Scrap cashing services ended

2006 2006 2006 2006 2006 2006

Other information �'000 �'000 �'000 �'000 �'000 �'000

Capital additions (*) - - - - - 1,643

Depreciation and - - - - - 1,358

amortisation (*)

Impairment losses recognised 66 - - 901 4 971

in income

Balance sheet

Assets

Segment assets 28,930 4,180 57 1,273 399 34,839

Unallocated corporate 24,644

assets

Consolidated total assets 59,483

Liabilities

Segment liabilities - (143) - (58) (69) (270)

Unallocated corporate (39,607)

liabilities

Consolidated total (39,877)

liabilities

2. Business and geographical segments (continued)

(*) The Group cannot meaningfully allocate this information by segment due to

the fact that all the segments operate from the same stores, and the assets in

use are common to all segments.

Geographical segments

The Group's operations are located entirely in the United Kingdom and all sales

are within the United Kingdom. Accordingly, no further geographical segments

analysis is presented.

3. Finance costs

2007 2006

�'000 �'000

Interest on bank overdrafts and loans 2,451 2,684

On other loans - 896

Other interest 11 16

Total interest expense 2,462 3,596

Exceptional items - 801

Amortisation of loan issue costs 244 340

2,706 4,737

The �801,000 exceptional charge in 2006 relates to costs expensed associated

with the arrangement fees of the bank loan restructuring.

The �896,000 interest charge on other loans in 2006 relates to interest payable

on loan notes from the previous controlling party, The Rutland Fund.

4. Tax charge

(a) Tax on profit on ordinary activities

Before Before

Exceptional Exceptional 2007 Exceptional Exceptional 2006

Items Items Total Items Items Total

�'000 �'000 �'000 �'000 �'000 �'000

Current tax

United Kingdom corporation tax

charge/(credit) at 30% (2006 -

30%) based on the profit for the

year 2,329 - 2,329 1,362 (402) 960

Adjustments in respect of prior (2) - (2) (14) (250) (264)

periods

Total current tax 2,327 - 2,327 1,348 (652) 696

Deferred tax

Short term timing differences, (136) 52 (84) 71 16 87

origination and reversal

Effect of change in tax rate (26) - (26) - - -

Adjustments in respect of prior 67 - 67 2 250 252

periods

Total deferred tax (95) 52 (43) 73 266 339

Tax charge on profit 2,232 52 2,284 1,421 (386) 1,035

4. Tax charge (continued)

(b) Factors affecting the tax charge for the year

The tax assessed for the year is higher than that resulting from applying the

standard rate of corporation tax in the UK of 30% (2006 - 30%). The differences

are explained below:

Before Before

Exceptional 2007 Exceptional Exceptional 2006

items items Total items items Total

�'000 �'000 �'000 �'000 �'000 �'000

Profit before taxation 7,162 201 7,363 4,695 -2,658 2,037

Tax charge/(credit) on profit at 2,149 60 2,209 1,409 (797) 612

standard rate

Effects of:

Disallowed expenses and 44 (8) 36 24 395 419

non-taxable income

Change in tax rate (26) - (26) - - -

Adjustments to tax charge in 65 - 65 (12) 16 4

respect of previous periods

Total actual amount of current 2,232 52 2,284 1,421 (386) 1,035

tax charge

From April 2008, the standard rate of corporation tax in the UK will decrease

from 30% to 28%. This new rate has been used to calculate any deferred tax

expected on timing differences that are expected to reverse in a period when the

new rate applies.

In addition to the amount charged to the income statement, �401,000 of tax

relief available to the Group arising on share options exercised in 2006 was

credited directly to accumulated profits in the year ended 31 December 2006.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit for the year

attributable to equity shareholders by the weighted average number of ordinary

shares in issue during the year.

For diluted earnings per share, the weighted average number of ordinary shares

in issue is adjusted to assume conversion of all dilutive potential ordinary

shares. With respect to the Group these represent share options granted to

employees where the exercise price is less than the average market price of the

Company's ordinary shares during the year.

5. Earnings per share (continued)

The directors also present an adjusted earnings per share as the directors

consider that it reflects the Group results on a comparable basis once

non-recurring items are taken into consideration. All the adjustments made to

the non-adjusted earnings per share in arriving at adjusted earnings per share

are for exceptional items disclosed separately on the face of the consolidated

income statement. Other than for the adjusting items, the calculation is the

same as for the statutory per share amounts.

Reconciliations of the earnings per ordinary share and weighted average number

of shares used in the calculations are set out below:

Year ended 31 December 2007 Year ended 31 December 2006

Weighted Weighted

average Per-share average Per-share

Earnings number amount Earnings number amount

�'000 of shares pence �'000 of shares pence

Earnings per share basic 5,079 33,487,898 15.17 1,002 27,489,310 3.65

Effect of dilutive securities

Options - 64,573 (0.03) - 388 -

Earnings per share diluted 5,079 33,552,471 15.14 1,002 27,489,698 3.65

Earnings per share - basic 5,079 33,487,898 15.17 1,002 27,489,310 3.65

IPO costs - - - 1,903 - 6.92

Fixed assets disposal (201) - (0.60) (46) - (0.17)

Debt issue costs - - - 801 - 2.91

Tax adjustment 52 - 0.15 (386) - (1.4)

Adjusted earnings per share

- basic 4,930 33,487,898 14.72 3,274 27,489,310 11.91

Effect of dilutive securities

Options - 64,573 (0.03) - 388 -

Adjusted earnings per share

- diluted 4,930 33,552,471 14.69 3,274 27,489,698 11.91

6. Note to the cash flow statement

2007 2006

�'000 �'000

Profit for the year 5,079 1,002

Adjustments for:

Investment revenues (35) (27)

Other gains and losses (201) (46)

Finance costs 2,706 4,737

Movement in fair value of interest rate swap 151 (561)

Movement in provisions 119 -

Income tax expense 2,284 1,035

Depreciation of property, plant and equipment 1,260 1,154

Amortisation of intangible assets 107 204

Share-based payment expense 105 19

Profit on disposal of fixed assets (8) (12)

Operating cash flows before movements in working capital 11,567 7,505

Increase in inventories (2,073) (734)

Increase in receivables (3,203) (298)

Increase in payables 39 1,152

Cash generated from operations 6,330 7,625

Income taxes paid (1,221) (291)

Debt restructuring cost - (801)

Interest paid (2,462) (6,787)

Net cash from/(used by) operating activities 2,647 (254)

Cash and cash equivalents (which are presented as a single class of assets on

the face of the balance sheet) comprise cash at bank and other short-term highly

liquid investments with a maturity of three months or less.

Interest paid in 2006 includes �3,191,000 of interest that arose in previous

periods, and was added to the principal amount of borrowings at 1 January 2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BIGDXRGBGGII

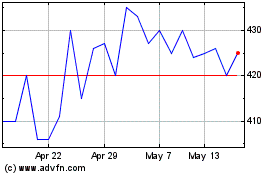

H&t (LSE:HAT)

Historical Stock Chart

From Aug 2024 to Sep 2024

H&t (LSE:HAT)

Historical Stock Chart

From Sep 2023 to Sep 2024