RNS Number:6050C

H&T Group PLC

22 August 2007

H&T Group plc

"H&T" or "the Group"

Interim Results for the six months ended 30 June 2007

H&T Group plc, which trades under the H&T Pawnbrokers and Get>Go brands, is the

UK's leading pawnbroking business by size of pledge book. The Group today

announces its Interim Results, for the period ended 30 June 2007.

Financial highlights (under IFRS)

6 months to 6 months to Change

30 June 2007 30 June 2006

#m #m %

Gross profit 12.8 10.6 +20.9

Earnings before Interest, Tax, Depreciation, Amortisation

(EBITDA) before exceptional items 4.6 3.7 +26.3

Operating profit before exceptional items 4.0 3.1 +30.1

Operating profit 4.0 1.2 +242.0

Pledge book 25.6 24.3 +5.4

Operational highlights

* Interim dividend declared of 1.6p per share payable on 15 October 2007

* Successful placing in May 2007 at 204p raising #7m for store

acquisition and expansion programme

* 6 new stores have opened since the beginning of the year giving a

current total of 83 stores

John Nichols, Chief Executive, comments:

"This is an excellent result for the first half of 2007 with all product lines

showing double digit growth and gold asset backed lending continuing to prove a

success. We are capitalising on the opportunities we described at last year's

IPO, both in terms of revenue growth and development of our store base through

new builds and acquisitions. We have also declared an interim dividend of 1.6p

per share. Christmas remains a key season for our retail segment so provided

current retail conditions continue, we can look forward to the outturn of the

full year with confidence."

21 August 2007

Enquiries:

H&T Group plc Tel: 0870 9022 600

John Nichols, Chief Executive

Laurent Genthialon, Finance Director

Hawkpoint (Nominated adviser) Tel: 020 7665 4500

Lawrence Guthrie/Sunil Duggal

Numis Securities (Broker) Tel: 020 7260 1000

Oliver Hemsley/Charles Farquhar

College Hill Tel: 020 7457 2020

Gareth David/Paddy Blewer

Report of the Chief Executive Officer and Finance Director

H&T Group plc is pleased to report a very positive trading performance for the

first six months of 2007 ("H1 2007"). Gross profit for H1 2007 was #12.8 million

compared with #10.6 million for the first six months of 2006 ("H1 2006"), an

increase of 20.9%. Earnings before interest, tax, depreciation and amortisation

("EBITDA") before exceptional items rose by 26.3% from #3.7 million in H1 2006

to #4.6 million in H1 2007.

The directors have approved a 1.6p interim dividend (nil pence last year). This

will be payable on 15 October 2007 to all shareholders on the register at the

close of business on 14 September 2007.

In May 2007, H&T completed the placing of 3.6 million new ordinary shares to

existing shareholders, all leading UK institutions, and provides the Group with

#7 million of additional finance for its store expansion programme.

In accordance with the AIM Rules for Companies, this is the first period when H&

T will use International Financial Reporting Standards ("IFRS") accounting

standards rather than UK Generally Accepted Accounting Practices ("UK GAAP") as

the basis to report its financial results. This transition may lead to some

differences between reported numbers under IFRS and UK GAAP that are simply a

result of the accounting framework change and are not a reflection of a change

in business performance.

Pawnbroking activities, comprising Pawn Service Charge and Disposition,

performed well in the first six months of 2007 with gross profit increasing by

16.2% on the equivalent period last year, driven by an increase in pledge book

yield. The jewellery retail element has experienced growth in both revenue

(21.6%) and gross margin (39.1%) between H1 2006 and H1 2007.

The financial services segment's gross profit increased by 63.0% between H1 2006

and H1 2007; this strong performance was driven by growth across the financial

services product range including cheque cashing, pay day advance and KwikLoan.

In line with the Group's growth strategy, H&T has continued to grow its store

estate with two new stores opening in the first half of 2007. Since 30 June

2007, the Group has acquired an additional four stores. Taking into

consideration these six new stores H&T currently operates through 83 stores

across the United Kingdom.

Operational review

Pawnbroking:

- Pawnbroking activities contributed #11.1 million (H1 2006: #9.5

million) or 87% of the Group gross profit in H1 2007 (H1 2006: 90%).

- The Group's pledge book was #25.6 million at 30 June 2007

(#24.3 million at 30 June 2006).

- Pawn Service Charge rose to #8.4 million in H1 2007, an

increase of 10.8% on H1 2006 (#7.6 million).

- Disposition combines contributions from both the retail and

scrap operations. The retail segment recovery experienced in H2 2006 continued

in the first half of 2007 with retail gross revenues up by 21.6% on

H1 2006 (12.9% on a like for like basis). The improvement in the retail gross

profit margin in 2006 continued in H1 2007 with the retail gross profit margin

rising from 39.8% in H1 2006 to 49.6% in H1 2007. This translated in an increase

in retail gross profit of 39.1%, from #1.4 million in H1 2006 to #2.0 million in

H1 2007. Scrap gross profit increased by #0.2 million between H1 2006 and H1

2007, driven by higher volume of scrap sales.

Financial services:

- In H1 2007, the Group financial services activities contributed

#1.7 million (H1 2006: #1.1 million) or 13% of the Group's gross profit (H1

2006: 10%).

- The transition to in-house facilities for the underwriting of

cheque cashing and pay day advances implemented in early 2006 has enabled H&T to

drive both volumes and margins. The cheque cashing and pay day advance gross

profit increased from #1.0 million in H1 2006 to #1.6 million in H1 2007, an

increase of 60%.

- KwikLoan, the Group's unsecured loan product, doubled its loan

book from #0.3 million at

30 June 2006 to #0.6 million at 30 June 2007 (#0.4 million at 31 December 2006).

The pre-paid debit card product continues to attract new customers to the stores

although the general market awareness of the product has taken longer to develop

than anticipated. As a result, the pre-paid debit card operation has made only a

small contribution to the Group's H1 2007 results. However, the H&T Group Board

believes there is further potential in this product driven by the increased

convenience it grants to the consumer.

Strategy review

Update on business acquisitions

On 16 May 2007, the Group announced the placing of 3.6 million new ordinary

shares to finance the expansion of its store estate, in particular to fund the

cash element of acquisitions and the working capital required to grow these

businesses. At the time of the placing, H&T had already acquired a store in

Willesden, which was subsequently relocated to a nearby H&T store, and a store

in Wolverhampton. The contribution of these two new stores to the H1 2007

results was limited due to the timing of their acquisitions (mid May 2007).

Four stores for which key terms and exclusivity had been agreed in May 2007 were

acquired on 20 August 2007.

Exclusivity terms have been signed for a further 6 stores and completions are

expected to take place between September and November 2007 and terms are being

progressed on further opportunities.

Update on Greenfield sites

The Group opened one Greenfield store in H1 2007 (one in H1 2006) in Watford.

Leases have been signed in respect of four further sites and subject to planning

consents these stores will be opened during the second half of 2007.

Update on new point of sale development

The development of the replacement point of sale system for the business remains

within budget and the full roll out is expected in the second half of 2007 as

planned.

Trading outlook

The Board is pleased with the overall trading performance of the Group which

remains in line with expectations.

Seasonality within the business means that the second half of the year tends to

make a larger contribution to the full year result than the first half. The

extent of the impact of seasonality is affected by retail sentiment,

particularly during the Christmas period. The business has good prospects for

growth driven by a combination of further branch openings in the second half of

the year together with recent and scheduled store acquisitions.

Financial review

The financial results provided in the main body of this report have been

prepared using IFRS. For information only, we have included in the appendix the

Group's financial results under pro-forma UK GAAP and a reconciliation between

the pro-forma UK GAAP and IFRS. We should also point readers to the Group's

report on the impact of IFRS (relative to UK GAAP) on H&T's results released on

1 August 2007 and accessible on the Group's website (www.handtgroup.co.uk).

Turnover and gross profit

Turnover for the first six months of 2007 amounted to #17.3 million compared

with #14.5 million for the corresponding period in 2006; a 19.5% increase driven

by strong growth across all of the Group's activities. The improvement in retail

gross margin together with the growth in Pawn Service Charge and financial

services resulted in H1 2007 total gross profit of #12.8 million, an increase of

20.9% on H1 2006 (#10.6 million).

Administrative expenses

The Group's administrative expenses before exceptional items increased from #7.5

million in H1 2006 to #8.8 million in H1 2007. The increase was mainly due to

the higher number of stores owned by the Group (additional ten stores), the

development of the authorisations and collections back office and cost

inflation. There were no exceptional expenses in H1 2007 while #1.9 million were

incurred as part of the Initial Public Offer ("IPO") in H1 2006.

Operating profit

The Group recorded an operating profit before exceptional items of #4.0 million

for H1 2007 compared with #3.1 million in H1 2006. Earnings before interest,

taxation, depreciation, amortisation and exceptional items increased by 26.3%

between H1 2006 (#3.7 million) and H1 2007 (#4.6 million). After taking account

of the exceptional items, operating profit in H1 2007 was #4.0 million compared

with #1.2 million in H1 2006.

Other gains

The Group disposed of a freehold property in H1 2007 resulting in an exceptional

gain of #0.2 million (#nil in H1 2006).

Finance costs and similar charges

Finance costs before exceptional items decreased by #1.1 million from #2.5

million in H1 2006 to #1.4 million in H1 2007. This reduction resulted from the

repayment of the Rutland loan notes and the restructuring of bank facilities at

the time of the Group's admission to AIM in May 2006. The financial

restructuring in 2006 incurred an exceptional charge of #0.8 million. Had this

restructuring and IPO been effective from the beginning of 2006, the Board

estimates that the interest payable before exceptional items would have been

#1.6 million for H1 2006.

Under IFRS, movements in the fair value of the Group's interest rate swap are

recognised in the income statement. As a result, the Group recorded changes in

the fair value of the instrument amounting to income of #0.5 million in H1 2007

compared with income of #0.2 million in H1 2006.

Financial review (continued)

Profit/(loss) before taxation

The Group recorded a profit before taxation of #3.3 million in H1 2007 compared

with a loss before taxation of #1.9 million in H1 2006. In H1 2006, the Group

incurred #2.7 million exceptional costs compared with

#0.2 million of exceptional profit in H1 2007. Profit before taxation, fair

value hedge accounting and exceptional items in H1 2007 was #2.6 million

compared with #0.6 million in H1 2006. Profit before taxation and exceptional

items in H1 2007 was #3.1 million compared with #0.8 million in H1 2006.

Earnings/(loss) per share

Basic earnings per share for H1 2007 was 7.15 pence compared with basic loss per

share of 7.99 pence in H1 2006. After adjusting for exceptional items, adjusted

basic earnings per share for H1 2007 was 6.64 pence compared with 1.81 pence in

H1 2006.

Dividends

The directors have approved a 1.6p interim dividend (nil pence last year)

payable on the 15 October 2007. In June 2007, the Group paid a 3p final dividend

for the 2006 financial year results.

Interim Financial Statements

Unaudited consolidated income statement

For the 6 months ended 30 June 2007

6 months ended 30 June 2007 6 months ended 30 June 2006

Note Before Exceptional Before Exceptional

Exceptional Items Exceptional Items

Items (Note 4) Total Items (Note 4) Total

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

#'000 #'000 #'000 #'000 #'000 #'000

Continuing operations

Revenue 17,269 - 17,269 14,453 - 14,453

Cost of sales (4,459) - (4,459) (3,856) - (3,856)

Gross profit 12,810 - 12,810 10,597 - 10,597

Administrative expenses (8,827) - (8,827) (7,534) (1,896) (9,430)

Operating profit 3,983 - 3,983 3,063 (1,896) 1,167

Depreciation and 3 (664) - (664) (620) - (620)

amortisation

EBITDA* 4,647 - 4,647 3,683 (1,896) 1,787

Investment revenues 8 - 8 11 - 11

Other gains and losses 4 - 196 196 - - -

Finance costs 7 (1,409) - (1,409) (2,479) (800) (3,279)

Movement in fair value of 481 - 481 229 - 229

interest rate swap

Profit/(loss) before 3,063 196 3,259 824 (2,696) (1,872)

taxation

Tax on profit/(loss) 5 (947) (36) (983) (399) 400 1

Profit/(loss) for the period 2,116 160 2,276 425 (2,296) (1,871)

Earnings/(loss) per ordinary 7.15 p (7.99) p

share - basic 6

Earnings/(loss) per ordinary 7.14 p (7.99) p

share - diluted 6

*EBITDA: Earnings before Interest, Tax, Depreciation and Amortisation

The consolidated income statement for the 12 months ended 31 December 2006 is

provided in note 2.

Unaudited consolidated statement of changes in equity

For the 6 months ended 30 June 2007

Note 6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2007 2006 2006

Unaudited Unaudited Audited

#'000 #'000 #'000

Opening total equity 19,606 498 498

Profit/(loss) for the period 2,276 (1,871) 1,002

Dividend paid 10 (945) - -

Deferred tax credit on share based payments - - 400

taken directly to equity

Total of recognised income and expense for the period 20,937 (1,373) 1,900

Issue of new shares 8 7,063 17,687 17,687

Share option charge taken directly to equity 44 - 19

Closing total equity 28,044 16,314 19,606

Unaudited consolidated balance sheet

At 30 June 2007

At 30 June At 30 June At 31 December

2007 2006 2006

Unaudited Unaudited Audited

Note #'000 #'000 #'000

Non-current assets

Goodwill 15,300 14,346 14,899

Other intangible assets 1,216 554 804

Property, plant and equipment 5,594 4,825 5,396

22,110 19,725 21,099

Current assets

Inventories 6,290 4,442 4,237

Trade and other receivables 33,198 30,908 31,869

Assets held for sale - 58 37

Cash and cash equivalents 1,368 1,220 2,108

Derivative financial instruments 614 - 133

41,470 36,628 38,384

Current liabilities

Trade and other payables (3,322) (3,843) (3,510)

Current tax liabilities (857) (50) (88)

Bank overdrafts and loans (2,860) (1,043) (1,255)

Derivative financial instruments - (199) -

(7,039) (5,135) (4,853)

Net current assets 34,431 31,493 33,531

Non-current liabilities

Borrowings (28,034) (34,846) (34,617)

Deferred tax liabilities (463) (58) (407)

(28,497) (34,904) (35,024)

Total liabilities (35,536) (40,039) (39,877)

Net assets 28,044 16,314 19,606

EQUITY

Share capital 8 1,754 1,574 1,574

Share premium 23,995 17,113 17,112

Share option reserve 63 - 19

Retained earnings 2,232 (2,373) 901

Total equity 28,044 16,314 19,606

Unaudited consolidated cash flow statement

For the 6 months ended 30 June 2007

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2007 2006 2006

Unaudited Unaudited Unaudited

#'000 #'000 #'000

Cash flows from operating activities

Profit/(loss) for the period 2,276 (1,871) 1,002

Adjustments for:

Investment revenues (8) (11) (27)

Other gains and losses (196) - (46)

Finance costs 1,409 3,279 4,737

Movement in fair value of interest rate swap (481) (229) (561)

Income tax expense 983 1 1,035

Depreciation of property, plant and equipment 623 526 1,154

Amortisation of intangible assets 41 94 204

Share based payment expense 44 - 19

Profit on disposal of fixed assets (8) (7) (12)

Operating cash flows before movements in working 4,683 1,782 7,505

capital

Increase in inventories (1,772) (939) (734)

(Increase)/decrease in receivables (898) 456 (298)

(Decrease)/increase in payables (195) 1,721 1,152

Cash generated from operations 1,818 3,020 7,625

Income taxes paid (158) (150) (291)

Debt restructuring cost - (800) (801)

Interest paid (1,287) (1,299) (6,787)

Net cash from/(used by) operating activities 373 771 (254)

Investing activities

Interest received 8 11 27

Proceeds on disposal of property, plant and equipment 260 42 118

Purchases of property, plant and equipment (1,021) (1,462) (2,642)

Acquisition of trade and assets of businesses (1,377) - (1,013)

Net cash used in investing activities (2,130) (1,409) (3,510)

Financing activities

Dividends paid (945) - -

Repayments of borrowings (6,450) (23,663) (19,500)

Increase in borrowings - 6,400 6,251

Proceeds on issue of shares 7,063 17,687 17,687

Increase in bank overdrafts 1,349 - -

Net cash from financing activities 1,017 424 4,438

Net (decrease)/increase in cash and cash equivalents (740) (214) 674

Cash and cash equivalents at beginning of period 2,108 1,434 1,434

Cash and cash equivalents at end of period 1,368 1,220 2,108

Notes to the Interim Financial Report

Note 1 Basis of preparation

The AIM rules require that the next annual consolidated financial statements of

the Group for the year ending 31 December 2007, be prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by the EU. The

company published its statement on the impact of the adoption of IFRS on 1

August 2007 which is available on the company website at www.handtgroup.co.uk

and the financial information presented in that document has been used as the

comparative information for the year ended 31 December 2006 and the period ended

30 June 2006.

The directors have applied the same accounting policies, as set out in the

document on the impact of the adoption of IFRS, which they expect to apply when

the first annual IFRS financial statements are prepared for the year ended 31

December 2007. This documented was audited by Deloitte & Touche LLP, the Group

auditors. The document, which includes their audit opinions on the IFRS opening

consolidated balance sheet as at 1 January 2006, and the IFRS consolidated

balance sheet as at 31 December 2006 is available from www.handtgroup.co.uk.

The comparative figures for the year ended 31 December 2006 or for the period

ended 30 June 2006 do not constitute statutory accounts for the purposes of

section 240 of the Companies Act 1985. A copy of the statutory accounts for the

year 31 December 2006, prepared under UK GAAP, has been delivered to the

Registrar of Companies and contained an unqualified auditors' report which made

no statement under sections 237(2) or (3) of the Companies Act 1985.

This interim financial report is unaudited.

Note 2 Consolidated income statement for the year ended 31 December 2006

Note Before Exceptional Total

Exceptional Items (Note 4)

Items

Audited Audited Audited

#'000 #'000 #'000

Continuing operations

Revenue 32,115 - 32,115

Cost of sales (8,787) - (8,787)

Gross profit 23,328 - 23,328

Administrative expenses (15,285) (1,903) (17,188)

Operating profit 8,043 (1,903) 6,140

Depreciation and amortisation 3 (1,358) - (1,358)

EBITDA 9,401 (1,903) 7,498

Investment revenues 27 - 27

Other gains and losses 4 - 46 46

Finance costs 7 (3,936) (801) (4,737)

Movement in fair value of interest rate 561 - 561

swap

Profit before taxation 4,695 (2,658) 2,037

Tax on profit 5 (1,421) 386 (1,035)

Profit for the financial year 3,274 (2,272) 1,002

Earnings per ordinary share - basic 6 3.65

Earnings per ordinary share - diluted 6 3.65

Notes to the Interim Financial Report (continued)

Note 3 Depreciation and amortisation

Operating profit is stated after charging:

6 months ended 6 months ended Year ended

30 June 2007 30 June 2006 31 December 2006

Unaudited Unaudited Audited

#'000 #'000 #'000

Depreciation on property, plant and equipment 623 526 1,154

Amortisation charge on intangible assets 41 94 204

664 620 1,358

Note 4 Exceptional items

During the first 6 months of 2007, the Group disposed of one freehold property

(6 months ended 30 June 2006: nil and year ended 31 December 2006: one which was

leased back as an operating lease) generating a profit of #196,000 (6 months

ended 30 June 2006: #nil and year ended 31 December 2006: #46,000).

During the first 6 months of 2006, the Group incurred a charge of #1,896,000 (6

months ended 30 June 2007: #nil and year ended 31 December 2006: #1,903,000) as

part of administrative expenses relating to the Initial Public Offering (IPO)

and #800,000 (6 months ended 30 June 2007: #nil and year ended 31 December 2006:

#801,000) as part of finance costs relating to the restructuring of the bank

facilities held by the Group following the IPO.

Note 5 Taxation

The taxation charge for the 6 months ended 30 June 2007 has been calculated by

reference to the expected effective corporation tax and deferred tax rates for

the full financial year to end on 31 December 2007. The underlying effective

full year tax charge is estimated to be 30.1% (6 months ended 30 June 2006:

48.4% and year ended 31 December 2006: 30.3%).

Note 6 Earnings/(loss) per share

Basic earnings/(loss) per share is calculated by dividing the profit for the

period attributable to equity shareholders by the weighted average number of

ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of ordinary shares

in issue is adjusted to assume conversion of all dilutive potential ordinary

shares. With respect to the Group these represent share options granted to

employees where the exercise price is less than the average market price of the

Company's ordinary shares during the period.

The directors also present an adjusted earnings/(loss) per share as the

directors consider that it reflects the Group results on a comparable basis once

non recurring items are taken into consideration. All the adjustments made to

the non-adjusted earnings/(loss) per share in arriving at adjusted earnings/

(loss) per share are for exceptional items disclosed separately on the face of

the consolidated income statement. Other than for the adjusting items, the

calculation is the same as for the statutory per share amounts.

Notes to the Interim Financial Report (continued)

Note 6 Earnings/(loss) per share (continued)

Reconciliations of the earnings/(loss) per ordinary share and weighted average

number of shares used in the calculations are set out below:

Unaudited Unaudited Audited

6 months ended 30 June 2007 6 months ended 30 June 2006 Year ended 31 December 2006

Earnings Weighted Per-share (Loss)/ Weighted Per-share Earnings Weighted Per-share

average amount earnings average amount average amount

#'000 number of pence number of pence #'000 number of pence

shares #'000 shares shares

Earnings/(loss) per

share basic 2,276 31,863,607 7.15 (1,871) 23,426,675 (7.99) 1,002 27,489,310 3.65

Effect of dilutive

securities

Options - 57,538 (0.01) - - - - 388 -

Earnings/(loss) per

share diluted 2,276 31,921,145 7.14 (1,871) 23,426,675 (7.99) 1,002 27,489,698 3.65

Earnings/(loss) per 2,276 31,863,607 7.15 (1,871) 23,426,675 (7.99) 1,002 27,489,310 3.65

share - basic

IPO costs - - - 1,896 - 8.09 1,903 - 6.92

Fixed assets (196) - (0.62) - - - (46) - (0.17)

disposal

Debt issue costs - - - 800 - 3.41 801 - 2.91

Tax adjustment 36 - 0.11 (400) - (1.70) (386) - (1.40)

Adjusted earnings

per share - basic 2,116 31,863,607 6.64 425 23,426,675 1.81 3,274 27,489,310 11.91

Effect of dilutive

securities

Options - 57,538 (0.01) - - - - 388 -

Adjusted earnings

per share - diluted 2,116 31,921,145 6.63 425 23,426,675 1.81 3,274 27,489,698 11.91

Note 7 Finance costs

6 months 6 months Year

ended ended ended

30 June 2007 30 June 2006 31 December 2006

Unaudited Unaudited Audited

#'000 #'000 #'000

Interest payable on bank loans and 1,265 1,360 2,684

overdraft

On loan notes - 896 896

Other interest 22 15 16

Amortisation of debt issue costs 122 208 340

1,409 2,479 3,936

Exceptional items - note 4 - 800 801

Total finance costs 1,409 3,279 4,737

Notes to the Interim Financial Report (continued)

Note 8 Share capital

At 30 June 2007 At 30 June 2006 At 31 December 2006

Unaudited Unaudited Audited

# # #

Authorised

(Ordinary Shares of #0.05 each)

# Sterling 2,098,500 2,098,500 2,098,500

Number 41,970,000 41,970,000 41,970,000

Allotted, called up and fully paid

(Ordinary Shares of #0.05 each)

# Sterling 1,754,285 1,574,285 1,574,285

35,085,706 31,485,706 31,485,706

Number

The reconciliation of the movement in share capital and share premium account is

set out below:

Share premium

account Total

Share capital share capital

Unaudited Unaudited Unaudited

#'000 #'000 #'000

At 1 January 2006 1,000 - 1,000

Issue of share capital 574 17,790 18,364

Issue expenses - (677) (677)

At 30 June 2006 1,574 17,113 18,687

Issue expenses - (1) (1)

At 31 December 2006 1,574 17,112 18,686

Issue of share capital 180 7,164 7,344

Issue expenses - (281) (281)

At 30 June 2007 1,754 23,995 25,749

Notes to the Interim Financial Report (continued)

Note 9 Business combinations

The Group made the following acquisitions during the period:

Total Total Total

6 months 6 months year

Acquisition Acquisition ended ended ended

1 2

30 June 2007 30 June 2006 31 December 2006

Unaudited Unaudited Audited

#'000 #'000 #'000 #'000 #'000

Assets acquired:

Intangible assets 74 175 249 - 163

Property, plant and equipment - 15 15 - -

Retail inventory - 281 281 - -

Current trade and other 142 289 431 - 297

receivables

Cash and cash equivalent - 18 18 - 7

Total assets acquired 216 778 994 - 467

Consideration:

Cash 236 1,159 1,395 - 1,020

Total consideration 236 1,159 1,395 - 1,020

Goodwill 20 381 401 - 553

The Group will present further disclosures with respect to the acquisition as

required by IFRS 3, "Business Contributions", in the financial statements for

the year ending 31 December 2007.

Note 10 Dividends

On 16 May 2007, the shareholders approved the payment of a 3.0p final dividend

for 2006 which equates to a dividend payment of #945,000. The dividend was paid

on 4 June 2007.

On 21 August 2007, the directors approved a 1.6p interim dividend (30 June 2005:

nil pence) which equates to a dividend payment of #563,000 (30 June 2006: #nil).

The dividend will be paid on 15 October 2007 to shareholders on the share

register at the close of business on 14 September 2007and has therefore not

been provided for in the 2007 interim results.

Appendix 1

Reconciliation of proforma UK GAAP* to IFRS

Six months ended 30 June 2007 (unaudited) Profit before tax Tax Profit after tax

#'000 #'000 #'000

Proforma UK GAAP * 2,688 (961) 1,727

IAS 12 Deferred tax on business combinations - 28 28

IAS 17 Lease incentives (1) - (1)

IAS 19 Holiday pay accrual (229) 69 (160)

IAS 38 Intangible assets amortisation (24) - (24)

IAS 39 Interest receivable recognition (59) 18 (41)

IAS 39 Interest hedging fair value 481 (137) 344

IFRS 3 Business combinations: reversal of 403 - 403

goodwill amortisation

IFRS 3,259 (983) 2,276

Six months ended 30 June 2006 (unaudited) Loss before tax Tax Loss after tax

#'000 #'000 #'000

Proforma UK GAAP * (2,307) (8) (2,315)

IAS 12 Deferred tax on business combinations - 25 25

IAS 17 Lease incentives 11 (3) 8

IAS 19 Holiday pay accrual (199) 60 (139)

IAS 39 Interest receivable recognition (25) 7 (18)

IAS 39 Interest hedging fair value 229 (69) 160

IFRS 3 Business combinations: reversal of 384 - 384

goodwill amortisation

Change in accounting policy for stock 35 (11) 24

IFRS (1,872) 1 (1,871)

Year ended 31 December 2006 (audited) Profit before tax Tax (Loss)/profit

#'000 #'000 after tax #'000

Proforma UK GAAP * 669 (903) (234)

IAS 12 Deferred tax on business combinations - 48 48

IAS 17 Lease incentives 15 (5) 10

IAS 19 Holiday pay accrual - - -

IAS 38 Intangible assets amortisation (9) - (9)

IAS 39 Interest receivable recognition (15) 4 (11)

IAS 39 Interest hedging fair value 561 (168) 393

IFRS 3 Business combinations: reversal of 779 - 779

goodwill amortisation

Change in accounting policy for stock 37 (11) 26

IFRS 2,037 (1,035) 1,002

* The UK GAAP applied in this appendix to prepare the proforma UK GAAP figures

above is defined as that which was applicable to the Group's UK GAAP statutory

financial statements for the year ended 31 December 2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PUURWRUPMGBG

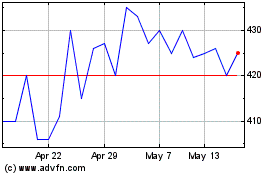

H&t (LSE:HAT)

Historical Stock Chart

From Sep 2024 to Oct 2024

H&t (LSE:HAT)

Historical Stock Chart

From Oct 2023 to Oct 2024