German Smaller Co - Final Results

May 15 1998 - 3:35AM

UK Regulatory

RNS No 5257u

GERMAN SMALLER COMPANIES INVESTMENT TRUST PLC

14th May 1998

German Smaller Companies Investment Trust plc

Preliminary Results for the Year ended 31 March 1998

The directors announce the audited results for the year ended 31 March 1998.

The objective of the company is to achieve capital appreciation through

investment primarily in the equity securities of small and medium-sized German

companies.

The directors have decided to recommend at the annual general meeting to be

held on Tuesday 14th July 1998 a foreign income dividend (FID) of 0.6p per

ordinary share to be paid to shareholders on the register on 1 June 1998. The

payment of a FID of 0.6p would be made on 22nd July 1998. Payment of a FID

enables the Company to recover all of its advance corporation tax, which would

otherwise have been largely irrecoverable.

Statement of Total Return (incorporating the revenue

account) of the Company

Year ended 31 March 1998 Year ended 31 March

1997

Revenue Capital Total Revenue Capital Total

#'000 #'000 #'000 #'000 #'000 #'000

Gains on investments - 5,015 5,015 - 933 933

Exchange (losses)/gains (19) (197) (216) (24) (320) (344)

Overseas dividends 994 - 994 1,319 - 1,319

Bank interest and other 34 - 34 58 - 58

income - (100) (100) - - -

Reduction of share

premium account expenses

------- ------- ------- ------- ------- -------

1,009 4,718 5,727 1,353 613 1,966

Investment management fee (477) - (477) (464) - (464)

Other expenses (111) - (111) (130) - (130)

------- ------- ------- ------- ------- -------

Return on ordinary 421 4,718 5,139 759 613 1,372

activities before

taxation

Tax on ordinary (161) - (161) (234) - (234)

activities

------- ------- ------- ------- ------- -------

Return on ordinary 260 4,718 4,978 525 613 1,138

activities after taxation

Dividends in respect of (254) - (254) (466) - (466)

ordinary shares

------- ------- ------- ------- ------- -------

Transfer to reserves 6 4,718 4,724 59 613 672

------- ------- ------- ------- ------- -------

- - - - - -

Return per ordinary share 0.6p 11.2p 11.8p 1.2p 1.5p 2.7p

===== ===== ===== ===== ===== =====

The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 March 1998 or 1997 but is derived

from those accounts. Statutory accounts for 1997 have been delivered to the

registrar of companies and those for 1998 will be delivered following the

company's annual general meeting. The auditors have reported on those

accounts; their reports did not contain statements under section 237 (2)

(accounting records or returns inadequate or accounts not agreeing with

records and returns) or (3) (failure to obtain necessary information and

explanations) of the Companies Act.

German Smaller Companies Investment Trust plc is registered in England and

Wales No 1879372. During the year ended 31 March 1998 it was an investment

company within the meaning of section 266 of the Companies Act 1985.

Registered office: 10 Fleet Place, London, EC4M 7RH.

For further information contact:

Alison Powell or Michael Oliver

Hill Samuel Asset Management Limited

0171 203 3000

Ten largest investments

% of Trust's

equity holdings

at 31 March 1998

Name and description

1. MLP Financials 5.0

2. Adidas Textiles 4.1

3. Hugo Boss Textiles 4.0

4. Fresenius Chemicals 3.9

5. Depfa Bank Financials 3.8

6. Kolnische Financials 3.4

Ruckversicherung

7. SKW Trostberg Chemicals 3.0

8. Mobilcom Consumer Goods and 2.6

Services

9. GEA Engineering 2.2

10. Rhon-Klinikum Healthcare 2.2

____

34.2

====

Investment portfolio % of Trust equity % sector

at holdings weightings

31 March 1998 C Dax (ex Dax)

Index*

Automobiles 1.8 3.6

Breweries 1.5 1.6

Building & 6.9 7.4

Construction

Chemicals 10.0 14.9

Electricals 5.0 2.4

Financials 20.1 28.2

Engineering 13.0 9.9

Utilities - 10.0

Textiles 12.5 4.5

Consumer goods & 18.4 8.3

services

Steel 7.7 4.0

Miscellaneous 0.9 2.9

Healthcare 2.2 -

Paper - 2.3

*The sectoral index figures shown above are as at 31 January 1998 because the

31 March 1998 data is not readily available. However, it is anticipated that

the Deutsche Borse will be publishing the CDAX(exDAX) capital index from the

end of June 1998, which will be used for comparative purposes in future.

Statement by the Chairman

The Trust's undiluted net asset value per share has increased by 8.6% during

the year ended 31 March 1998 to 139.7p. The share price has increased 6.4% to

112.3p. The German stock market rose strongly during the Trust's financial

year and outperformed most of Europe's other stock markets in local currency

terms. A proportion of this rise was eroded however by the 12% decline of the

deutschmark against sterling over the year.

Corporate profits grew faster than many analysts' expectations as the benefits

of heavy restructuring over the last two years coincided with improved demand

and favourable currency conditions. There were strong inflows of liquidity

into the market, particularly from domestic institutions which are gradually

shifting assets from lower yielding bonds and time deposits into equities.

The Neuer Markt (New Market), launched in March 1997, to promote stock market

listings for smaller growth companies, particularly in electronics and

biotechnology sectors, met with spectacular success and encouraged many

domestic retail investors into equity investment for the first time. The

Trust benefited from this growing interest in smaller stocks and from a more

general change in the pattern of investment away from sector rotation in

favour of individual stocks.

Although the market is highly valued, it is not overvalued relative to the

bond market and the economic background remains highly supportive: domestic

demand is reviving, but not sufficiently to trigger inflation or more than

modest interest rate rises. Corporate activity in the form of takeovers,

restructuring and, following recent legislation, share buybacks will continue

to excite investor interest. The German government has, as of 1 April 1998,

allowed the establishment of private pension plans for both corporate entities

and individuals. Over time this should promote major funds flows into the

stock market.

The smaller sector should thrive in this environment, not least thanks to

increased new issue activity. The Trust remains fully invested in a

diversified portfolio of companies which are well managed and able to take

advantage of the changing opportunities within their industries.

Approval was given by shareholders at an extraordinary general meeting on 11

March 1998 for our company to buy in up to 6.3 million (14.99%) of its issued

share capital. It is intended that such purchases will enhance the net asset

value of the company's shares as well as contributing to the reduction of the

discount to net asset value.

P D Minchin

13 May 1998

END

FR AAMRBLLMBMIP

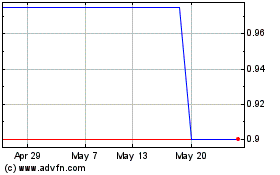

Gs Chain (LSE:GSC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gs Chain (LSE:GSC)

Historical Stock Chart

From Jul 2023 to Jul 2024