Grit Real Estate Income Group Update from QuotedData

September 27 2023 - 8:00AM

RNS Non-Regulatory

TIDMGR1T

Grit Real Estate Income Group

27 September 2023

Grit Real Estate Income Group - Update from QuotedData

27(th) September 2023

Grit 2.0

Having concluded its acquisition of a leading property developer

and asset manager, pan-African property company Grit Real Estate

Income Group (Grit) has been reborn. Grit 2.0 has a greater and

more achievable return target (of between 12% and 15% per annum)

thanks to the controlling stake it now owns in Gateway Real Estate

Africa (GREA) and its attractive pipeline of net asset value (NAV)

accretive, risk-mitigated development projects - most notably

diplomatic residences across the continent that are let to the US

government.

Ongoing asset recycling - away from the retail and hospitality

sectors - has shored up its balance sheet, while creative means of

raising additional capital should secure the substantial

development pipeline and plot a way to ongoing, sustainable returns

and growing, resilient income. A new line of revenue through the

fee income earned from the property asset management business adds

further robustness to its earnings and supports its dividend.

Full Research:

https://quoteddata.com/research/grit-real-estate-income-group-grit-2-0-qd/

This research is also available free on our website

www.quoteddata.com where you will also find news, performance data

and factsheets on every London listed Investment Company.

QuotedData writes and distributes research on a number of quoted

companies, facilitates meetings between those companies and

existing and potential investors and assists in raising additional

capital where required.

NB: Marten & Co was paid to produce this note on Grit Real

Estate Income Group and it is for information purposes only. It is

not intended to encourage the reader to deal in the security or

securities mentioned in this report. Please read the important

information at the back of this note. QuotedData is a trading name

of Marten & Co Limited which is authorised and regulated by the

Financial Conduct Authority. Marten & Co is not permitted to

provide investment advice to individual investors categorised as

Retail Clients under the rules of the Financial Conduct

Authority.

QUOTEDDATA

50 Gresham Street | London EC2V 7AY

Tel: +44 (0) 20 3691 9430

www.quoteddata.com | research@quoteddata.com |

www.martenandco.com

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRANKOBPDBKDOCB

(END) Dow Jones Newswires

September 27, 2023 08:00 ET (12:00 GMT)

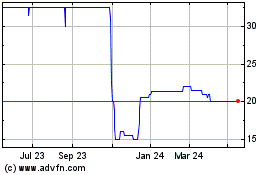

Grit Real Estate Income (LSE:GR1T)

Historical Stock Chart

From Dec 2024 to Jan 2025

Grit Real Estate Income (LSE:GR1T)

Historical Stock Chart

From Jan 2024 to Jan 2025