Grit Real Estate Income Group (GR1T)

Acquisition of controlling interest of Gateway Real Estate African Limited ('GREA') and African Property Development

Managers Limited ('APDM')

26-Jul-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

GRIT REAL ESTATE INCOME GROUP LIMITED

(Registered in Guernsey)

(Registration number: 68739)

LSE share code: GR1T

SEM share codes (dual currency trading):

DEL.N0000 (USD) / DEL.C0000 (MUR)

ISIN: GG00BMDHST63

LEI: 21380084LCGHJRS8CN05

("Grit" or the "Company" and, together with its subsidiaries, the "Group")

ACQUISITION OF CONTROLLING INTERESTS IN GATEWAY REAL ESTATE

AFRICA LIMITED ("GREA") AND AFRICAN PROPERTY DEVELOPMENT MANAGERS

LIMITED ("APDM")

The board of Directors (the "Board") of Grit Real Estate Income

Group Limited are pleased to announce the conclusion of the final

phase in the acquisition of controlling interests in GREA and APDM

from Gateway Africa Real Estate Limited ("Gateway Partners") and

Prudential Impact Investments Private Equity LLC ("Prudential").

Grit now owns a direct interest of 51.48% in GREA and a 78.95%

shareholding in APDM. The respective remaining balances are held by

the Public Investment Corporation of South Africa (PIC).

GREA successfully completed several developments during the

three-phase acquisition timeframe which has materially derisked the

transaction for Grit shareholders. Notable project deliveries

include:

-- Adumah Place, Ghana (winner of "API Best Commercial Office

development 2022"),

-- ADC data centre, Nigeria,

-- Rosslyn Grove US embassy accommodation, Kenya (winner of the

"API best high end development award in2022"),

-- The Precinct Office park, Mauritius (the first 5 star green

rated office park in the Indian Oceanregion),

-- Curepipe Artemis Hospital, Mauritius.

The financial results of GREA and APDM are to be consolidated

with Grit's and are expected to have a positive impact on both the

value of reported investment properties, Group LTV and future

growth rates and income distributions to the Group.

Bronwyn Knight, CEO of Grit Real Estate Income Group Limited,

commented:

"Concluding the acquisition of controlling interests in GREA and

APDM are significant milestones towards our Grit 2.0 vision of

setting global benchmarks in Africa. The acquisitions support

Grit's ongoing transition towards a more resilient, accretive and

African impact focussed asset base. These are expected to deliver

value creation and growth opportunites in net asset value and

income to the benefit of all our stakeholders, including the people

of Africa.

Grit additionally gains access to GREA's substantial pipeline of

accretive development opportunities while the controlling interest

in APDM provides Grit with an opportunity to earn substantial

development and asset management fees from internal, joint venture

partners and third-party clients."

Further detail on Phase 3 of the acquisition of controlling

interests in GREA and APDM:

Phase 3 of the acquisition, whereby Grit acquired Gateway

Partners' remaining 13.61% interest in GREA and 1% interest in APDM

for a combined cash payment of USD33.9 million, became

unconditional and share transfer was lodged, following receipt of

the Mauritius Prime Minister's Office consent which was the final

condition precedent.

Additionally, Grit has acquired a 2.85% interest in GREA from

Prudential for USD5.5 million.

Immediately after these acquisitions, and prior to the vesting

of the APDM incentive, Grit owns 51.48% of GREA and a 78.95%

shareholding in APDM.

Across the three phases, Grit has paid an aggregate of USD77.6

million for the total increased 31.50% shareholding in GREA,

settled through a combination of cash and share issuance (covered

under the prospectus and circular issued in Q4 2021).

Details of Phase 3 of the transaction 1. Acquisition of the

additional 16.47% interest in GREA:

??The Gross Assets the subject of the transaction are USD174.1

million.

??The profits attributable to the transaction are USD2.9

million. 2. Acquisition of additional 1% interest in ADPM:

??Gross Assets the subject of the transaction are USUSD0.01

million. 3. Impact on Grit

Grit now has the ability to direct additional activities in GREA

that are expected to create value, including:

-- Balance sheet optimisation and disposal of non-core assets

specifically reducing exposures to the retailsegment. Such asset

recycling would be expected to free up for redeployment into new

project opportunities withinGREA.

-- When combined with Grit's balance sheet, GREA's current low

leverage would be expected to result in areduction of consolidated

Grit Group LTV by approximately 2.90 percentage points.

-- Whilst GREA is expected to remain relatively lowly geared,

its construction debt facilities areamortising and are relatively

expensive compared to Grit's debt facilities. There is potential to

utilise Grit'scredit standing to provide GREA with cheaper debt

funding and, crucially, the ability to recycle operationalcashflow

into new projects rather than debt repayments, thereby securing

enhanced levels of growth. 4. GREA key individuals

-- Gregory Pearson, Chief Executive Officer

-- Krishnen Kistnen, Chief Financial Officer

-- Andre Janari, Chief Investment Officer

-- Craig Glutz, Head of Developments

-- Shevira Bissessor, Chief Operating Officer

The management team and staff have become employees of the Group

and are now participants of the Grit long-term incentive plan.

By Order of the Board

26 July 2023

FOR FURTHER INFORMATION, PLEASE CONTACT:

Grit Real Estate Income Group Limited

Bronwyn Knight, Chief Executive Officer +230 269 7090

Darren Veenhuis, Investor Relations +44 779 512 3402

finnCap Ltd - UK Financial Adviser

William Marle/Teddy Whiley (Corporate Finance) +44 20 7220 5000

Mark Whitfeld/Pauline Tribe (Sales) +44 20 3772 4697

Monica Tepes (Research) +44 20 3772 4698

Perigeum Capital Ltd - SEM Authorised Representative and Sponsor

Shamin A. Sookia +230 402 0894

Kesaven Moothoosamy +230 402 0898

Capital Markets Brokers Ltd - Mauritian Sponsoring Broker

Elodie Lan Hun Kuen +230 402 0280

NOTES:

Grit Real Estate Income Group Limited is the leading pan-African

impact real estate company focused on investing in, developing and

actively managing a diversified portfolio of assets in carefully

selected African countries (excluding South Africa). These

high-quality assets are underpinned by predominantly USUSD and Euro

denominated long-term leases with a wide range of blue-chip

multi-national tenant covenants across a diverse range of robust

property sectors.

The Company is committed to delivering strong and sustainable

income for shareholders, with the potential for income and capital

growth.

The Company holds its primary listing on the Main Market of the

London Stock Exchange (LSE: GR1T and a dual currency trading

secondary listing on the Stock Exchange of Mauritius (SEM:

DEL.N0000 (USD) / DEL.C0000 (MUR))

Further information on the Company is available at

www.grit.group

Directors: Peter Todd (Chairman), Bronwyn Knight (Chief

Executive Officer)*, Leon van de Moortele (Chief Financial

Officer)*, David Love+, Sir Samuel Esson Jonah+, Catherine

McIlraith+, Jonathan Crichton+, Cross Kgosidiile and Lynette

Finlay+.

(* Executive Director) (+ independent Non-Executive

Director)

Company secretary: Intercontinental Fund Services Limited

Registered office address: PO Box 186, Royal Chambers, St

Julian's Avenue, St Peter Port, Guernsey GY1 4HP

Registrar and transfer agent (Mauritius): Intercontinental

Secretarial Services Limited

SEM authorised representative and sponsor: Perigeum Capital

Ltd

UK Transfer secretary: Link Assets Services Limited

Mauritian Sponsoring Broker: Capital Markets Brokers Ltd

This notice is issued pursuant to the FCA Listing Rules, SEM

Listing Rule 15.24 and the Mauritian Securities Act 2005. The Board

of the Company accepts full responsibility for the accuracy of the

information contained in this communiqué.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GG00BMDHST63

Category Code: ACQ

TIDM: GR1T

LEI Code: 21380084LCGHJRS8CN05

Sequence No.: 260103

EQS News ID: 1688071

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1688071&application_name=news

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

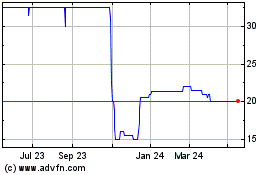

Grit Real Estate Income (LSE:GR1T)

Historical Stock Chart

From Dec 2024 to Jan 2025

Grit Real Estate Income (LSE:GR1T)

Historical Stock Chart

From Jan 2024 to Jan 2025