Foresight Slr Fnd Ld Foresight Solar Fund Limited :tr-1: Notification Of Major Interest In Shares

June 17 2015 - 8:56AM

UK Regulatory

TIDMFSFL

TR-1: NOTIFICATION OF MAJOR INTEREST IN SHARES(i)

1. Identity of the issuer or the underlying issuer

of existing shares to which voting rights are

attached: (ii) Foresight Solar Fund Limited

2 Reason for the notification (please tick the appropriate

box or boxes):

An acquisition or disposal of voting rights

An acquisition or disposal of qualifying financial

instruments which may result in the acquisition of

shares already issued to which voting rights are attached

An acquisition or disposal of instruments with similar

economic effect to qualifying financial instruments

An event changing the breakdown of voting rights X

Other (please specify):

3. Full name of person(s) subject to the

notification obligation: (iii) Baillie Gifford & Co

4. Full name of shareholder(s)

(if different from 3.):(iv)

5. Date of the transaction and date on

which the threshold is crossed or

reached: (v) 16 June 2015

6. Date on which issuer notified: 17 June 2015

7. Threshold(s) that is/are crossed or

reached: (vi, vii) 5%

8. Notified details:

A: Voting rights attached to shares (viii, ix)

Class/type of

shares Situation previous

if possible using to the triggering

the ISIN CODE transaction Resulting situation after the triggering transaction

Number

Number of

of Voting Number Number of voting

Shares Rights of shares rights % of voting rights (x)

Direct Direct (xi) Indirect (xii) Direct Indirect

Ordinary

Share 10,500,000

JE00BD3QJR55 10,500,000 15,206,620 15,206,620 5.40%

B: Qualifying Financial Instruments

Resulting situation after the triggering transaction

Number of voting

rights that may be

acquired if the

Type of financial Expiration Exercise/ instrument is % of voting

instrument date (xiii) Conversion Period (xiv) exercised/ converted. rights

N/A

C: Financial Instruments with similar economic effect

to Qualifying Financial Instruments (xv, xvi)

Resulting situation after the triggering transaction

Type of financial Expiration Exercise/ Conversion

instrument Exercise price date (xvii) period (xviii) Number of voting rights instrument refers to % of voting rights (xix, xx)

N/A Nominal Delta

Total (A+B+C)

Number of voting rights Percentage of voting rights

15,206,620 5.40%

9. Chain of controlled undertakings through which

the voting rights and/or the

financial instruments are effectively held, if applicable:

(xxi)

In the narrative below, the figures in [ ] indicate

the amount of voting rights and the percentage held

by each controlled undertaking where relevant.

Baillie Gifford & Co, a discretionary investment manager,

is the parent undertaking of an investment management

group.

Its wholly-owned subsidiary undertaking Baillie Gifford

& Co Limited [15,206,620:5.40%] is an OEIC Authorised

Corporate Director and Unit Trust Manager which has

delegated its discretionary investment management

role to Baillie Gifford & Co.

Proxy Voting:

10. Name of the proxy holder: N/A

11. Number of voting rights proxy holder will cease

to hold:

12. Date on which proxy holder will cease to hold

voting rights:

13. Additional information:

14. Contact name: Susie McBay

15. Contact telephone number: 0131 275 3032

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1929243

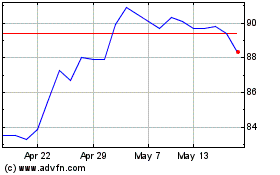

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

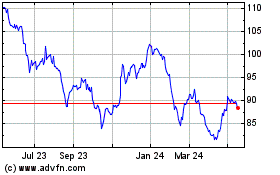

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024