TIDMFSFL

Foresight Solar Fund Limited ("FSFL" "The Company")

Audited Half Year Results to 30 June 2014 & Initial Dividend

Announcement 20 August 2014

Net Asset Value GBP155.43m

Net Asset Value per Share 103.62p

Dividend GBP4.5m

Dividend per Share 3 pence

Highlights

-- GBP150m of equity capital raised (before expenses) through an issue of

150,000,000 shares at Initial Public Offering (IPO) in October 2013.

-- IPO proceeds used to acquire 111MW of operational UK solar capacity

comprising seven individual utility scale assets.

-- In accordance with the strategy set out at IPO, the Company, already the

largest dedicated UK listed solar investment company, will grow to 185MW

of UK solar generating capacity through the agreed acquisition, when

operational, of the Kencot and Bournemouth plants, totalling 74MW. These

two acquisitions will be financed utilising a GBP100m bank facility

previously announced in May 2014.

-- Further equity capital raises envisaged as assets secured utilising the

GBP100m acquisition facility become operational.

-- Interim dividend of 3 pence per share, in line with the objective

announced at the time of the IPO. The Company confirms its intent to

deliver a target dividend of 6 pence per ordinary share in respect of its

first financial year.

-- Strong pipeline of assets for further growth of the Company whilst

maintaining the lowest risk approach to the sector avoiding blind pool,

development, construction and subsidy risk in its acquisition of assets.

Commenting on today's results, Alexander Ohlsson, Chairman of Foresight

Solar Fund Limited, said:

"The Board and Foresight Group CI Limited, the Investment Manager,

believe that strong progress has been made in maintaining the Company's

position on the UK listed market as the largest solar specific renewable

infrastructure company. This position is expected to strengthen further

once the exchanged contracts to acquire the Kencot and Bournemouth

plants complete. Together this will lead to a combined enterprise value

of GBP250 million for the Company. This growth in scale gives us

confidence in further achieving the original objectives of the Company."

Dividend Timetable

Ex-dividend Date 27th August 2014

Record Date 29th August 2014

Payment Date 30th September 2014

For further information please contact:

Sarah Cole scole@foresightgroup.eu 0203 667 8154

Details of the conference call for analysts

A conference call for analysts will be held at 10am on 20 August 2014.

To register for the call please contact Malcolm Robertson at Citigate

Dewe Rogerson Malcolm.Robertson@citigatedr.co.uk or by phone: 0207 638

9571.

Foresight Solar Fund Limited (FSFL) Half-Yearly Results to 30 June 2014

Financial Highlights

For the period 13 August 2013 to 30 June 2014

-- Foresight Solar Fund Limited ("The Company") is a leading listed

renewable infrastructure company investing in ground based, operational

solar power plants, predominantly in the UK.

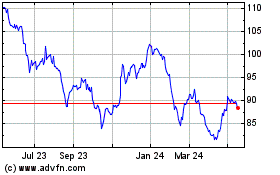

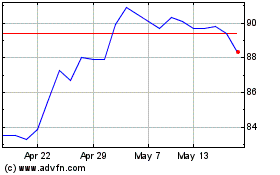

-- Net Asset Value per ordinary share of 103.6p at 30 June 2014, compared to

98p at Initial Public Offering ("IPO") a 5.7% increase. The basis of

investment valuation is a Discounted Cash Flow forecast ("DCF"). A

weighted average discount rate of 8.0% has been used.

-- Contracts exchanged on Kencot and Bournemouth assets, with grid

connections anticipated in Q3/Q4 2014.

-- Interim dividend of 3.0 pence per share approved on 19 August 2014 in

relation to the period to 30 June 2014.

-- Further equity capital raises envisaged as assets secured utilising a

GBP100m acquisition facility become operational.

-- The Company's 111MW, seven asset UK solar portfolio is fully operational.

Two of the seven assets have not yet reached financial completion.

-- 9 committed assets in total with capacity of 185MW expected to be fully

operational in Q3/Q4 2014.

-- The Company maintains the lowest risk approach to the sector taking no

blind pool, development, construction or subsidy risk in its acquisition

of assets.

-- Profit for the period was GBP8.088 million and earnings per share were

5.39 pence

Corporate Summary, Investment Objective and Dividends

Corporate Summary

Foresight Solar Fund Limited is a closed-end company with an indefinite

life, incorporated in Jersey under The Companies Law 1991 (Jersey), as

amended, on 13 August 2013, with registered number 113721.

The Company has a single class of 150,000,000 Ordinary Shares in issue

of nil par value which are listed on the premium segment of the Official

List and traded on the London Stock Exchange's Main Market.

The Company's shareholders include a substantial number of blue-chip

institutional investors.

Investment Objective

The Company seeks to provide investors with a sustainable dividend,

linked to the Retail Price Index ("RPI") together with the potential for

capital growth over the long-term by investing in a diversified

portfolio of predominantly UK ground based solar assets.

Investments outside the UK, and assets which are still under

construction when acquired, will be limited to 25 percent of the gross

asset value of the Company, calculated at the time of investment.

The Company is managed by an experienced team from Foresight Group, an

independent infrastructure and private equity investment management firm,

overseen by a strong, experienced and majority independent Board.

Dividends

The Company intends to target a 6p annual dividend per Ordinary Share

from 1 January 2014 which is expected to increase in line with inflation

annually thereafter, together with a target unlevered Internal Rate of

Return ("IRR") of between 7-8%, net of all fees and expenses. Dividends

on the Ordinary Shares are expected to be paid twice a year, in equal

instalments, normally in respect of the 6 months to 30 June and 31

December. The first dividend of 3 pence per Ordinary Share for the

period under review was declared on 19 August 2014 and will be paid on

30 September 2014.

Chairman's Statement

For the period 13 August 2013 to 30 June 2014

"The Board and Foresight Group CI Limited, the Investment Manager,

believe that strong progress has been made in maintaining the Company's

position on the UK listed market as the largest solar specific renewable

infrastructure company. This position is expected to strengthen further

once the exchanged contracts to acquire the Kencot and Bournemouth

plants complete. Together this will lead to a combined enterprise value

of GBP250 million for the Company. This growth in scale gives us

confidence in further achieving the original objectives of the Company."

Results

I am pleased to be able to report strong progress in the formation of

the Company's portfolio of solar investments, both before and following

the period end, which is more fully described in the Investment

Manager's Report. The Placing and Offer for Subscription pursuant to the

Prospectus published by Foresight Solar Fund Limited on 20 September

2013 ("the Placing & Offer") proved attractive to investors with

GBP150,000,000 having been raised at the time the ordinary shares listed

on 29 October 2013.

The net asset value per Ordinary Share increased to 103.62p at 30 June

2014 from 98.0p per Ordinary Share at launch on 29 October 2013. The

performance of the underlying portfolio is more fully described in the

Investment Manager's Report.

Dividend Policy

As noted in the Prospectus published on 20 September 2013 and subject to

market conditions, the Company's performance, financial position and

financial outlook, it is the Directors' intention to pay a sustainable

and RPI-linked level of dividend income to Shareholders on a semi-annual

basis. Whilst not forming part of its Investment Policy, the Company

targeted the payment of an initial annual dividend of 6p per Share from

the year commencing 1 January 2014. Given the nature of the Company's

income streams, the Directors anticipate being able to increase the

annual dividend in line with RPI for the period commencing 1 January

2015.

I am pleased to announce that, as targeted in the Prospectus, the first

interim dividend of 3p per Ordinary Share will be paid on 30 September

2014 in respect of the period from 1 January 2014 to 30 June 2014. The

dividend will have a record date of 29 August 2014 and an ex- dividend

date of 27 August 2014. The second interim dividend of 3p per Ordinary

Share is targeted to be paid in March 2015 in respect of the period from

1 July 2014 to 31 December 2014.

The target dividend should not be taken as an indication of the

Company's expected future performance or results.

Share Issues

During the period from incorporation on 13 August 2013 to 30 June 2014,

the Board allotted 150,000,000 Ordinary Shares at a nil par value of

100.0p per share.

Valuation Policy

Investments held by the Company have been valued in accordance with IAS

39 and IFRS 13, using Discounted Cash Flow principles. The portfolio

valuations are prepared by Foresight Group, reviewed and approved by the

Board quarterly and subject to audit at least annually.

Outlook

The Board and Foresight Group is encouraged that all of the GBP100m

acquisition facility, secured through Royal Bank of Canada, Royal Bank

of Scotland and Santander, has been fully committed against two

significant solar projects.

Although the Government has confirmed changes to the Renewable

Obligations ("RO") incentive from March 2015, the Board and Investment

Manager both believe that a combination of the investments made to date

and the pipeline of potential opportunities currently being considered

will continue to provide attractive returns together with the associated

benefits of scale to shareholders over the longer term.

Alexander Ohlsson Chairman

19 August 2014

Investment Portfolio

Acquired:

Grid

connection Solar Construction

Asset Location MW ROCs date panels Hectares part y

Wymeswold Leicestershire 32.2 2.0 March 2013 134,000 78 Lark Energy

Castle

Eaton Wiltshire 17.8 1.6 March 2014 60,000 40 SunEdison

Chelmsford,

Highfields Essex 12.2 1.6 March 2014 40,000 37 SunEdison

High Penn Wiltshire 9.6 1.6 March 2014 34,000 30 SunEdison

Pitworthy North Devon 15.6 1.4 April 2014 49,000 44 SunEdison

Operational, awaiting financial completion

Solar Construction

Asset Location MW ROCs Grid connection date panels Hectares party

Spriggs March 2014 Bester

Farm Essex 12.0 1.6 (accre dit at ion received) 50,000 31 Generation

Hunters West

Race Sussex 10.7 1.4 July 2014 41,000 12 Hareon Solar

Under construction, awaiting financial completion (expected

acquisition):

Grid

connection Solar Construction

Asset Location MW ROCs date panels Hectares party

Kencot Oxfordshire 37.0 1.4 Q3/4 2014 144,000 52 Conergy

Bournemouth Dorset 37.0 1.4 Q3/4 2014 146,000 77 Goldbeck

Investment Manager's Report

For the period 13 August 2013 to 30 June 2014

Foresight Group - The Investment Manager

Formed in 1984, Foresight's track record was initially built by focusing

on unquoted investments in the UK. As we have grown, our investment

approach has since evolved to encompass private equity, infrastructure

and environmental investments in the UK, US and Italy.

Foresight is now a leading infrastructure and private equity Investment

Manager wholly owned by its Partners. Foresight manage nine dedicated

Solar Funds valued at over GBP775 million including over 154MW of

existing operational capacity in the UK. The Solar team has been active

since 2007 and consists of 22 investment professionals.

With current assets under management of over GBP1.2 billion, raised from

pension funds and other institutional investors, UK and international

private and high net-worth individuals and family offices, Foresight

strives to deliver strong, risk-adjusted, returns to its investors.

Foresight's head office is located in The Shard at London Bridge with

satellite offices in Rome and San Francisco.

The Company

The Company's IPO on 24 October 2013 raised GBP150 million, creating the

largest dedicated solar investment company listed in the UK at this

time. The Company has maintained its strategy of taking no development,

construction or subsidy risk in the acquisition of assets while fully

allocating its IPO proceeds across seven fully operational UK assets

with a combined capacity of 111MW.

The acquisition of two of these assets, Hunters Race and Spriggs Farm,

has not yet been recognised in the financial statements. The vendors

have entered into sale agreements contingent on certain conditions being

met, including ROC accreditation being received. It is the prudent

policy of the Company not to recognise acquisition, or revenue

generation, of assets until this accreditation is achieved.

On 19 May 2014, the Company entered into a GBP100 million debt

acquisition facility. This facility will be drawn to fund the further

binding agreements entered into for the large scale Kencot and

Bournemouth assets which will see the Company reach 185MWs of total

capacity later in 2014. It is expected that the facility will be repaid

through a combination of excess dividend cover and further equity

issuance (when the assets are operational) and/or refinancing with a

long-term debt facility.

Following the completion of the acquisition of Kencot and Bournemouth,

the Company will own and manage three of the UK's largest operational

solar power plants.

Investment Portfolio

IPO proceeds used to acquire 111MW of operational UK solar capacity

comprising seven individual utility scale assets. These assets have been,

or will be, wholly acquired at attractive pricing and offer manufacturer

and geographical diversification within the portfolio.

Crucially, the portfolio has been designed to deliver the target return

profile without taking unnecessary risk. This is defined as the

avoidance of construction risk, which, in itself, can be managed

depending on the balance sheet strength of the construction contractor.

More difficult to manage is the risk of failing to meet the 31 March ROC

subsidy deadline which, in 2015, is a cliff-edge deadline given the

acceleration of the Contracts for Difference ("CfD") mechanism for

projects greater than 5MWs after this date.

Projects are not presently sustainable under this scenario as there is

no certainty that assets will be eligible for CfDs or that contractors

will be able to refund the construction finance.

Foresight have deliberately set out to execute a low risk strategy of

avoiding construction and subsidy risk and have negotiated these terms

accordingly with large and experienced contractors. This avoids

unnecessary risk exposure for shareholders.

Portfolio Performance

The Company does not take construction or subsidy

qualification/accreditation risk and although revenue will accrue to the

investment companies from connection, this will not be recognised until

financial completion of the acquisition. We expect this to happen for

each asset soon after subsidy qualification/accreditation is received.

We believe this prudent recognition approach mirrors the risk profile of

the Company although it does mean that the NAV calculation will only

reflect accrued benefits at this completion date when an acquisition has

occurred during the period.

In general, operational performance of the assets has been strong,

achieving higher than anticipated returns. This is despite poorer than

expected weather conditions during the first six months of the year. The

Wymeswold asset has produced 2.4% over and above base case forecasts

while irradiance has been 2.2% lower than expectations over the same

period. The difference is due to operational efficiencies achieved by

our in-house technical team. We do not expect short-term fluctuations in

power generation to affect the medium to long-term forecasts.

The focus of the period under review was deployment of the IPO proceeds

into a strong operational asset base. The Wymeswold asset is the only

asset that has been under our operational management for a significant

proportion of the period and therefore providing details of operational

performance across the whole portfolio would be less directly relevant

for the Company at this time.

Investment performance

The NAV at launch was 98p per share. The NAV per share as at 30 June

2014 had grown to 103.6p. The increase is driven by energy generation

and increases in asset valuation above the cost of the investment.

Valuation of the Portfolio

The Investment Manager is responsible for providing fair market

valuations of the Company's assets to the Directors. The Directors

review and approve these valuations following appropriate challenge and

examination. Valuations are carried out quarterly.

The current portfolio consists of non-market traded investments and

valuations are based on a Discounted Cash Flow methodology. This

methodology adheres to IAS 39 and IFRS 13.

It is the policy of the Investment Manager to value with reference to

DCF immediately following acquisition. This is partly due to the long

periods between agreeing an acquisition price and financial completion

of the acquisition. Quite often this delay incorporates construction as

well as time spent applying for, and achieving ROC accreditation, which

the Company's acquisition of assets is contingent on. Whilst revenues

generally accrue for the benefit of the purchaser, revenues accrued do

not form part of the DCF calculation when making a fair and proper

valuation until ROC accreditation is achieved.

A broad range of assumptions are used in our valuation models. These

assumptions are based on long-term forecasts and are not affected by

short-term fluctuations in inputs, be it economic or technical.

Valuation Sensitivities

Where possible, assumptions are based on observable market and technical

data. In many cases, such as the forward power price, we make use of

external professional advisors to provide reliable and evidenced

information while often applying a more prudent approach to that of our

information providers. We have set out below the inputs we have

ascertained would have a material effect upon the NAV should they be

flexed. The following information assumes the relevant input is flexed

over the entire useful life of the assets. All sensitivities are

calculated independently of each other.

Discount Rate

- 0.5% - 0.25% Base + 0.25% + 0.5%

Directors' valuation (GBPm) 160.65 158.00 155.43 152.95 150.54

NAV per share (GBP) 1.071 1.053 1.036 1.020 1.004

Energy Yield

P10 (10 year) Base P90 (10 year)

Directors' valuation (GBPm) 158.97 155.43 151.71

NAV per share (GBP) 1.060 1.036 1.011

Power Price

+20% +10% Base -10% -20%

Directors' valuation 168.86 162.39 155.43 148.09 140.76

NAV per share (GBP) 1.126 1.083 1.036 0.987 0.938

Inflation

- 1% + 0.5% Base - 0.5% + 1%

Directors' valuation (GBPm) 156.50 155.97 155.43 154.86 154.30

NAV per share (GBP) 1.043 1.040 1.036 1.032 1.029

Operating costs (investment level)

- 10% - 5% Base + 5% + 10%

Directors' valuation (GBPm) 156.43 155.93 155.43 154.91 154.39

NAV per share (GBP) 1.043 1.040 1.036 1.033 1.029

Financial Results

The Company has prepared financial statements for the Interim Period

from incorporation to 30 June 2014. No meaningful activities took place

between incorporation and IPO. The first full accounting period of the

Company ends 31 December 2014.

As at 30 June 2014, the NAV of the Fund was GBP155.43 million or

GBP1.036 per share issued, an increase of 5.7% on the Launch NAV. Profit

before tax for the period was GBP8,087,934 and earnings per share were

5.39 pence.

The Directors have satisfied themselves with the valuation methodology

including the underlying assumptions used to approve the portfolio

valuation. Since inception, the Company has confirmed its intent to

deliver its target dividend of 6p per ordinary share in respect of its

first financial period. Strong underlying asset performance and

attractive pricing gives the Directors comfort that target distribution

levels will be met while maintaining capital in real terms.

Financing

The proposed acquisition facility outlined in the IPO Prospectus reached

financial close within the period for a total facility size of GBP100

million. This facility will be drawn to fund the future acquisition of

operational UK solar power plants. It is expected that the facility will

be repaid through utilisation of one or more of; excess dividend cover,

further equity issuance and/or refinancing with a long-term debt

facility.

The providers of the facility are RBC, RBS and Santander.

The first asset which will be formally acquired by the Company utilising

this debt facility is expected to be the 37MW Kencot asset which is

currently under construction.

The Articles provide that gearing, calculated as borrowings as a

percentage of the Company's Gross Asset Value will not exceed 50% at the

time of drawdown. It is intended that there will be no borrowings at the

level of each investment. It is the Board's current intention that

gearing, calculated as borrowings as a percentage of the Company's Gross

Asset Value, will not exceed 40 percent at the time of drawdown.

Risk Management

Reliance is placed on the internal systems and controls of external

service providers such as the Administrator and the Investment Manager

in order to effectively manage risk across the portfolio. The

identification, quantification and management of risk are central to the

role of the Investment Manager who, for this purpose, categorises risk

as follows:

Day to Day Risk Management

-- Monitoring performance of contractors

-- Promoting safe, compliant and reliable operating

environments

-- Levels of solar irradiation

-- Insurance

-- Land and property, including lease negotiations

-- Environmental, including health and safety concerns

-- Technology (supplier, warranties and quality)

Business and Strategic Risk

Management -- Integration of risk management into key business

processes such as acquisition identification,

performance management, resource allocation

-- Economic factors including power prices, interest

rates and inflation

-- Political factors including tax and energy subsidy

legislation

-- Financial and technical reporting accuracy and

timeliness

Corporate Oversight and -- The Board provide oversight to identify and mitigate

Governance significant risks. The Board

-- are responsible for monitoring the

-- Company's reliance on professional advisors

-- Conflicts of Interest

-- Performance against financial objectives

Outlook

The first asset which will be formally acquired by the Company utilising

the acquisition facility is expected to be the 37MW Kencot asset which

is currently under construction. Reflecting the Company's preferred risk

profile of acquiring only operating assets, Kencot is expected to become

operational in Q3/Q4 2014 and will qualify under the 1.4 ROC rate.

Kencot further demonstrates the Investment Manager's ability to source

large scale solar assets at prices that deliver on the return

proposition of the Company.

The Bournemouth asset, also in construction, will be acquired on a

similar basis to Kencot and is also expected to become operational in

Q3/Q4 2014.

A pipeline of additional 1.4 ROC assets that will be connected before 31

March 2015 is being pursued on behalf of the Company. The ROC regime is

due to end for UK solar assets over 5MWs in size in March 2015 and will

be replaced by a CfD mechanism. We have started, and will continue, to

work with developers to facilitate their participation in the CfD

auction process to lock-in subsidies and to put the Company in the best

position to secure assets under the CfD regime going forward. At the

same time, we have confidence that the secondary market in ROC (and

Feed-in-Tariff) assets will remain strong. We also expect portfolios of

up to 5MW ROC assets to deliver significant pipeline volume going

forward.

Foresight Group CI Limited

Investment Manager

19 August 2014

Statement of Directors' Responsibilities

The Directors of Foresight Solar Fund Limited (the "Directors") have

accepted responsibility for the preparation of these non-statutory

accounts for the period ended 30 June 2014 which are intended by them to

give a true and fair view of the state of affairs of the Company and of

the profit or loss for that period. They have decided to prepare the

non-statutory accounts in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the European Union ("EU").

In preparing these non-statutory accounts, the Directors have:

-- selected suitable accounting policies and applied them consistently;

-- made judgements and estimates that are reasonable and prudent;

-- stated whether they have been prepared in accordance with IFRS as adopted

by the EU; and

-- prepared the non-statutory accounts on the going concern basis as they

believe that the Company will continue in business.

The Directors have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and to

prevent and detect fraud and other irregularities.

For and on behalf of the Board

Alexander Ohlsson

Chairman

19 August 2014

Directors

The Directors, who are non-executive and, other than Mr Dicks,

independent of the investment manager and Foresight Group CI Limited,

are responsible for the determination of the investment policy of the

Company, have overall responsibility for the Company's activities

including its investment activities and for reviewing the performance

of the Company's portfolio. The Directors are as follows:

Alexander Ohlsson (Chairman)

Mr Ohlsson is managing partner for the law firm Carey Olsen in Jersey.

He is recognised as a leading expert in corporate and finance law in

Jersey and is regularly instructed by leading global law firms and

financial institutions. He is the independent chairman of the States of

Jersey's audit committee and an Advisory Board member of Jersey Finance,

Jersey's promotional body. He is also a member of the Financial and

Commercial Law Sub-Committee of the Jersey Law Society which reviews as

well as initiates proposals for legislative changes. He was educated at

Victoria College Jersey and at Queens' College, Cambridge, where he

obtained an MA (Hons) in law. He has also been an Advocate of the Royal

Court of Jersey since 1995.

Mr Ohlsson was appointed as a non-executive Director and Chairman on 16

August 2013.

Christopher Ambler

Mr Ambler has been the Chief Executive of Jersey Electricity plc since 1

October 2008. He previously held various senior positions in the global

industrial, energy and materials sectors working for major corporations,

such as ICI/Zeneca, the BOC Group and Centrica/British Gas as well as in

strategic consulting roles. Mr Ambler is a Chartered Engineer and a

Member of the Institution of Mechanical Engineers. He holds a first

class Honours Degree from Queens' College Cambridge and an MBA from

INSEAD.

Mr Ambler was appointed as a non-executive Director on 16 August 2013.

Peter Dicks

Mr Dicks is currently a director of a number of quoted and unquoted

companies. In addition, he was the Chairman of Foresight VCT plc and

Foresight 2 VCT plc from their launch in 1997 and 2004 respectively

until 2009 and since then he has continued to serve on both of these

boards. He is also on the Board of Foresight 3 VCT plc, Foresight 4 VCT

plc, Graphite Enterprise Trust plc and Mears Group plc. He is also

Chairman of Unicorn AIM VCT plc and Private Equity Investor plc.

Mr Dicks was appointed as a non-executive Director on 16 August 2013.

Environmental and Social Governance

The Company invests in solar farms. The environmental benefits received

through the production of renewable energy are widely published.

Further to the obvious environmental advantages of large scale renewable

energy each investment is closely scrutinised for localised

environmental impact. Where improvements can be made we will work with

planning and local authorities to minimise the visual and auditory

impact of sites.

Foresight Group is a signatory to the United Nations Principles for

Responsible Investing ("UNPRI"). The UNPRI is a global, collaborative

network of investors established in 2006.

It is the intention of the Investment Manager to appoint a health and

safety consultant to review all portfolio assets to ensure they not only

meet but outclass industry and legal standards. The Kent Wildlife Trust

has also been appointed to review site operations across the UK with the

aim of minimising the impact all our sites may have on local wildlife.

Independent Auditor's Report to Foresight Solar Fund

We have audited the non-statutory accounts of Foresight Solar Fund for

the period ended 30 June 2014 set out on pages 11 to 28. These

non-statutory accounts have been prepared for the reasons set out in

note 2.1 to the non-statutory accounts and on the basis of the financial

reporting framework of International Financial Reporting Standards

(IFRSs) as adopted by the EU.

Our report has been prepared for the Company solely in connection with

these interim accounts. It has been released to the Company on the basis

that our report shall not be copied, referred to or disclosed, in whole

(save for the Company's own internal purposes) or in part, without our

prior written consent.

Our report was designed to meet the agreed requirements of the Company

determined by the Company's needs at the time. Our report should not

therefore be regarded as suitable to be used or relied on by any party

wishing to acquire rights against us other than the Company for any

purpose or in any context. Any party other than the Company who obtains

access to our report or a copy and chooses to rely on our report (or any

part of it) will do so at its own risk. To the fullest extent permitted

by law, KPMG LLP will accept no responsibility or liability in respect

of our report to any other party.

Respective responsibilities of directors and auditor

As explained more fully in the Directors' Responsibilities Statement set

out on page 9, the directors are responsible for the preparation of the

non-statutory accounts, which are intended by them to give a true and

fair view. Our responsibility is to audit, and express an opinion on,

the non-statutory accounts in accordance with the terms of our

engagement letter dated 8 August 2014 and International Standards on

Auditing (UK and Ireland). Those standards require us to comply with the

Auditing Practices Board's Ethical Standards for Auditors.

Scope of the audit of the non-statutory accounts

An audit involves obtaining evidence about the amounts and disclosures

in the non-statutory accounts sufficient to give reasonable assurance

that the non-statutory accounts are free from material misstatement,

whether caused by fraud or error. This includes an assessment of:

whether the accounting policies are appropriate to the entity's

circumstances and have been consistently applied and adequately

disclosed; the reasonableness of significant accounting estimates made

by the directors; and the overall presentation of the non-statutory

accounts.

In addition we read all the financial and non-financial information in

the interim accounts to identify material inconsistencies with the

audited non-statutory accounts and to identify any information that is

apparently materially incorrect based on, or materially inconsistent

with, the knowledge acquired by us in the course of performing the

audit. If we become aware of any apparent material misstatements or

inconsistencies we consider the implications for our report.

Opinion on non-statutory accounts

In our opinion the non-statutory accounts:

-- give a true and fair view of the state of the Company's affairs as at 30

June 2014 and of its profit for the period then ended; and

-- have been properly prepared in accordance with IFRSs as adopted by the

EU.

Gareth Horner (Senior Statutory Auditor)

for and on behalf of KPMG LLP, Statutory Auditor

Chartered Accountants

15 Canada Square

Canary Wharf

London E14 5GL

19 August 2014

Interim Consolidated Statement of Comprehensive

Income

For the period 13 August 2013 to 30 June 2014

Period 13 August

2013 to 30 June

2014

Notes GBP

Continuing operations

Revenue

Interest revenue 4 2.125.602

Gains on investments at fair value through profit

or loss 16 9.851.155

Total revenue 11.976.757

Expenditure

Finance costs 5 (2.064.105)

Management fees 6 (1.038.463)

Administration and accountancy expenses 7 (110.373)

Launch costs 8 (339.044)

Directors' fees 9 (109.247)

Other expenses 10 (227.592)

Total expenditure (3.888.824)

Profit before tax for the period 8.087.933

Taxation 11 -

Profit and total comprehensive income for the

period. 8.087.933

Earnings per Ordinary Share (pence per share) 12 5,39

All items above arise from continuing operations, there have been no

discontinuing operations during the period.

The accompanying notes on pages 15 to 28 form an integral part of these

interim Financial Statements.

Interim Consolidated Statement of Financial Position

As at 30 June 2014

30 June 2014

Notes GBP

Assets

Non-current assets

Investments held at fair value through profit or loss 16 124.794.372

Total non-current assets 124.794.372

Current assets

Trade and other receivables 13 1.299.100

Cash and cash equivalents 14 32.393.888

Total current assets 33.692.988

Total assets 158.487.360

Equity

Retained earnings 8.087.933

Stated capital 18 147.339.044

Total equity 155.426.977

Liabilities

Non-current liabilities

Long-term borrowings 21 2.100.000

Total non-current liabilities 2.100.000

Current liabilities

Trade and other payables 15 960.383

Total current liabilities 960.383

Total liabilities 3.060.383

Total Equity and Liabilities 158.487.360

Net Asset Value ("NAV") per Ordinary Share (GBP) 19 1,04

The interim Financial Statements on pages 11 to 28 were approved by the

Board of Directors and signed on its behalf on 19 August 2014 by:

Christopher Ambler

Director

The accompanying notes on pages 15 to 28 form an integral part of these

interim Financial Statements.

Interim Consolidated

Statement of Changes in

Equity

For the period 13 August 2013

to 30 June 2014

Stated Retained

Capital Earnings Total

Notes GBP GBP GBP

Balance as at 13 August 2013 - - -

Total comprehensive income

for the period:

Profit for

the period - 8.087.933 8.087.933

Transactions with owners,

recognised directly in

equity:

Issue of Ordinary Shares 18 150.000.000 150.000.000

Capitalised

issue costs 18 (2.660.956) - (2.660.956)

Balance as at 30 June 2014 147.339.044 8.087.933 155.426.977

The accompanying notes on pages 15 to 28 form an integral part of these

interim Financial Statements.

Interim Consolidated Statement of Cash

Flows

For the period 13 August 2013 to 30

June 2014

Period 13 August 2013 to 30 June

2014

GBP

8.087.933

Adjustments for:

Unrealised gains on investments (9.851.155)

Financing income (263.700)

Investment income (1.857.618)

Finance costs 2.064.105

Tax expense -

Operating cash flows before movements

in working capital (1.820.435)

Decrease/(increase) in trade and other

receivables (7.245)

(Decrease)/increase in trade and other

payables 662.178

Net cash outflow from operating

activities (1.165.502)

Investing activities

Advances for future investments (276.077)

Acquisition of subsidiaries (114.943.217)

Investment income 1.135.211

Net cash outflow from investing

activities (114.084.083)

Financing activities

Finance costs paid (1.765.900)

Bank facility drawn down 2.100.000

Net excess launch costs paid (29.671)

Capitalised issue costs paid (2.660.956)

Proceeds from issues of shares 150.000.000

Net cash inflow from financing 147.643.473

activities

Net increase in cash and cash 32.393.888

equivalents

Cash and cash equivalents at beginning -

of period

Effects of foreign exchange rates -

Cash and cash equivalents at end of 32.393.888

period

The accompanying notes on pages 15 to 28 form an integral part of these

interim Financial Statements.

Notes to the Interim Consolidated Financial Statements

For the period 13 August 2013 to 30 June 2014

1 Company information

Foresight Solar Fund Limited (the "Company") is a closed-ended company

with an indefinite life and was incorporated in Jersey under the

Companies Law (Jersey) 1991, as amended, on 13 August 2013, with

registered number 113721. The address of the registered office is shown

on page 29.

The principal activity of the Company and its special purpose vehicles

("SPVs") (together "the Group") is investing in operational UK ground

based solar power plants.

The Company has one investment, Foresight Solar (UK Hold Co) Limited

("UK Hold Co"). UK Hold Co invests in further holding companies (the

SPVs) which then invest in the underlying investments. The Company

ultimately has serveral investments which is in accordance with IFRS 10.

See note 2.5 for details on the subsidiaries.

2 Summary of significant accounting policies

The principal accounting policies applied in the preparation of these

interim consolidated Financial Statements (the "Financial Statements")

are set out below.

2.1 Basis of preparation

The Financial Statements of the Group have been prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union ("IFRS") which comprise standards and interpretations

issued by the International Accounting Standards Board ("IASB"), and

International Accounting Standards and Standing Interpretations approved

by the International Financial Reporting Interpretation Committee that

remain in effect and to the extent they have been adopted by the

European Union. The Financial Statements have been prepared on the

historical cost convention as modified for the measurement of certain

financial instruments at fair value through profit or loss and in

accordance with the provisions of the Companies (Jersey) Law 1991.

The preparation of Financial Statements in conformity with IFRS requires

the use of certain critical accounting estimates. It also requires

management to exercise its judgement in the process of applying the

Group's accounting policies. The estimates and associated assumptions

are based on historical experience and various other factors that are

believed to be reasonable under the circumstances, the results of which

form the basis of making judgments about the carrying value of assets

and liabilities that are not readily apparent from other sources. Actual

results may differ from these estimates and underlying assumptions are

reviewed on an ongoing basis. Judgements made by management in the

application of IFRS that have a significant effect on the Financial

Statements and estimates with a significant risk of material adjustment

in the next year are disclosed in note 3.

2.2 Comparative information

There are no comparative figures within these Financial Statements as

there is no comparable comparative as defined in IAS 1 paragraph 38

given the Group was created on 13 August 2013.

2.3 Going concern

The Directors have considered the Group's cash flow projections for a

period of no less than twelve months from the date of approval of these

consolidated Financial Statements together with the Group's borrowing

facilities. These projections show that the Group will be able to meet

its liabilities as they fall due.

The Directors have therefore prepared the Financial Statements under the

going concern basis.

2.4 Changes in accounting policies and disclosures

Application of new and revised International Financial Reporting

Standards ("IFRSs")

As this is the Group's first period of preparing Financial Statements

there are no new/revised standards relevant to the Group which have been

adopted in the preparation of these Financial Statements given that

there are no comparative amounts as stated in note 2.2 above.

New and revised IFRSs in issue but not yet effective

The Group has chosen to early adopt the following standards and

interpretations in the preparation of the Financial Statements which

have a material impact on the Group:

-- Investment Entities' (Amendments to IFRS 10, IFRS 12

and IAS 27) (effective for accounting periods commencing on or after 1

January 2013, EU endorsement from 1 January 2014'). An exemption from

consolidation of subsidiaries is now provided under the amended IFRS 10

'Consolidated Financial Statements' for entities which meet the

definition of an 'investment entity'. Instead, investments in particular

subsidiaries can be measured at fair value through profit or loss in

accordance with IFRS 9 'Financial Instruments' or IAS 39 'Financial

Instruments: Recognition and Measurement'. See note 2.5 for further

details.

At the date of authorisation of these Financial Statements, the

following standards and interpretations, which have not been applied in

these Financial Statements, were in issue but not yet effective:

-- IFRS 9, 'Financial Instruments - Classification and Measurement'. There

is currently no mandatory effective date, however the IASB has

tentatively proposed effective accounting periods commencing on or after

1 January 2018.

-- Amendment to IAS 32 'Offsetting Financial Assets and Financial

Liabilities'. This amendment is effective for accounting periods

commencing on or after 1 January 2014.

-- At the date of approval of these Financial Statements, the following

standards and interpretations, which have not been applied, were in issue

but not yet effective and have not been applied by the Group:

-- Amendments to IFRS 7 and IFRS 9 'Mandatory Effective Date and Transition

Disclosures'. These amendments are effective for accounting periods

commencing on or after 1 January 2015.

These standards and interpretations will be adopted when they become

effective.

The Directors are currently assessing the impact of these standards and

interpretations on the Financial Statements and anticipate that the

adoption of the majority of these standards and interpretations in

future periods will not have a material impact on the Financial

Statements or results of the Company.

Notes to the Interim Consolidated Financial Statements (continued)

For the period 13 August 2013 to 30 June 2014

2 Summary of significant accounting policies (continued)

2.5 Consolidation

(a) Subsidiaries

All subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has the rights

to, variable returns from its involvement with the entity and has the

ability to affect those returns through its power over the entity.

The Company has elected the early adoption of IFRS 10 "Consolidated

Financial Statements" which relieves an entity that meets the definition

of an investment entity of the obligation to produce a consolidated set

of Financial Statements. The Company has been classified as an

investment entity for the purpose of consolidation requirements.

The Company has one investment, a 100% controlling interest in UK Hold

Co. UK Hold Co itself invests in holding companies (the SPVs) which then

invest into the underlying investments. The Company has consolidated its

holding in UK Hold Co for the purposes of these financial statements as

UK Hold Co provides investment related services to the Company therefore

UK Hold Co is viewed simply as an extension of the investment entity's

investing activities. The Company does not meet all the defined criteria

of an investment entity as the Company has only one investment, a 100%

controlling interest in UK Hold Co. However management deem that the

Company is nevertheless an investment entity as the remaining

requirements have been met and through UK Hold Co, there is a diverse

investment portfolio which will fulfil the criteria of having more than

one investment.

UK Hold Co has chosen to early adopt the amendment to IFRS 10

"Consolidated Financial Statements" discussed above. UK Hold Co does not

meet all the defined criteria of an investment entity as UK Hold Co is

100% owned by Foresight Solar Fund Limited. However management deem that

UK Hold Co is nevertheless an investment entity as the remaining

requirements have been met and the Company that holds 100% of the share

capital has a number of investors. Therefore, as noted above, together

the Company and UK Hold Co meet the requirements. The entity accounts

for subsidiaries at fair value through profit or loss in accordance with

IAS 39 "Financial Instruments: Recognition and Measurement". The

financial assets at fair value through profit or loss carried in the

Statement of Financial Position represents the Group's investments in

the SPVs as described above. See note 16 for details on the investments

held at fair value through profit or loss.

The Group applies the acquisition method to account for business

combinations. The consideration transferred for the acquisition of a

subsidiary is the fair values of the assets transferred, the liabilities

incurred to the former owners of the acquiree and the equity interests

issued by the Group. The consideration transferred includes the fair

value of any asset or liability resulting from a contingent

consideration arrangement. Identifiable assets acquired and liabilities

and contingent liabilities assumed in a business combination are

measured initially at their fair values at the acquisition date. The

Group recognises any non-controlling interest in the acquiree on an

acquisition-by-acquisition basis, either at fair value or at the

non-controlling interest's proportionate share of the recognised amounts

of acquiree's identifiable net assets.

Acquisition costs of assets are capitalised on purchase of assets.

If the business combination is achieved in stages, the acquisition date

carrying value of the acquirer's previously held equity interest in the

acquiree is re-measured to fair value at the acquisition date; any gains

or losses arising from such re-measurement are recognised in profit or

loss.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent changes to

the fair value of the contingent consideration that is deemed to be an

asset or liability is recognised in accordance with IAS 39 either in

profit or loss or as a change to other comprehensive income. Contingent

consideration that is classified as equity is not re-measured, and its

subsequent settlement is accounted for within equity.

Inter-company transactions, balances and unrealised gains on

transactions between Group companies are eliminated. Unrealised losses

are also eliminated. When necessary amounts reported by subsidiaries

have been adjusted to conform with the Group's accounting policies.

Details of the subsidiary undertakings which the Company held as at 30

June 2014 are listed below:

Direct or

indirect Country of Principal Proportion

Name holding incorporation activity of shares and voting rights held

Foresight Solar (UK Holding

Hold Co) Limited Direct United Kingdom Company 100%

Wymeswold Solar Farm

Limited ("Wymeswold

Solar") Indirect United Kingdom SPV 100%

Castle Eaton Solar

Farm Limited

("Castle Eaton

Solar") Indirect United Kingdom SPV 100%

Pitsworthy Solar Farm

Limited ("Pitsworthy

Solar") Indirect United Kingdom SPV 100%

Highfields Solar Farm

Limited ("Highfields

Solar") Indirect United Kingdom SPV 100%

High Penn Solar Farm

Limited ("High Penn

Solar") Indirect United Kingdom SPV 100%

2.6 Segment reporting

Operating segments are reported in a manner consistent with the internal

reporting provided to the chief operating decision-maker. The chief

operating decision-maker, who is responsible for allocating resources

and assessing performance of the operating segments, has been identified

as the Board of Directors, as a whole. For management purposes, the

Group is organised into one main operating segment. All of the Group's

income derives from the United Kingdom and Jersey. All of the Group's

non-current assets are located in the United Kingdom.

2.7 Income

Income comprises interest income (bank interest and loan interest) and

dividend income. Interest income is recognised when it is probable that

the economic benefits will flow to the Group and the amount of revenue

can be measured reliably. Loan interest income is accrued on a time

basis, by reference to the principal outstanding and at the effective

interest rate applicable, which is the rate that exactly discounts

estimated future cash receipts through the expected life of the

financial asset to that asset's net carrying amount on initial

recognition.

Dividend income is recognised on the date that the related investments

are marked ex-dividend. Dividends receivable on equity shares where no

ex- dividend date is quoted are brought into account when the Company's

right to receive payment is established.

Notes to the Interim Consolidated Financial Statements (continued) For

the period 13 August 2013 to 30 June 2014

2 Summary of significant accounting policies (continued)

2.8 Expenses

Operating expenses are the Group's costs incurred in connection with the

on-going management of the Company's investments and administrative

costs. Operating expenses are accounted for on an accruals basis.

The Group's management and administration fees, finance costs and all

other expenses are charged through the Consolidated Statement of

Comprehensive Income.

Acquisition costs of assets are capitalised on purchase of assets.

Costs directly relating to the issue of Ordinary Shares are charged to

the Group's special reserve.

2.9 Taxation

The Company is currently registered in Jersey. With effect from 1

January 2009, Jersey abolished the exempt company regime for existing

companies. Therefore, the Company is taxed at 0% for which it pays an

annual fee of GBP250.

UK Hold Co and the SPVs are UK registered companies and as such are

subject to corporation tax at the small profits rate of 20%.

Current tax arising in jurisdictions other than Jersey is based on

taxable profit for the period and is calculated using tax rates that

have been enacted or substantially enacted.

The tax currently payable is based on taxable profit for the year.

Taxable profit differs from net profit as reported in the Consolidated

Statement of Comprehensive Income because it excludes items of income

and expense that are taxable or deductible in other periods or that are

never taxable or deductible. The Group's liability for current tax is

calculated using tax rates that have been enacted by the year-end date.

Deferred tax is the tax arising on differences on the carrying amounts

of assets and liabilities in the Financial Statements and the

corresponding tax bases used in the computation of taxable profit, and

is accounted for using the liability method. Deferred tax liabilities

are generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is probable

that taxable profits will be available against which deductible

temporary differences can be utilised. Such assets and liabilities are

not recognised if the temporary difference arises from goodwill or from

the initial recognition (other than in a business combination) of other

assets and liabilities in a transaction that affects neither the taxable

profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries, except where the

Group is able to control the reversal of the temporary difference and it

is probable that the temporary difference will not reverse in the near

future.

The carrying amount of deferred tax assets is reviewed at each year end

date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the

asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply

in the period when the liability is settled or the asset realised.

Deferred tax is charged or credited in the consolidated statement of

comprehensive income, except when it relates to items charged or

credited directly to equity, in which case the deferred tax is also

dealt with in equity.

2.10 Foreign currency translation

(a) Functional and presentational currency

The Directors consider the Group's functional currency to be Pounds

Sterling ("GBP") as this is the currency in which the majority of the

Group's assets and liabilities and significant transactions are

denominated. The Directors have selected GBP as the Group's presentation

currency.

(b) Transactions and balances

Transactions in currencies other than GBP are recorded at the rates of

exchange prevailing on the dates of the transactions. At each year-end

date, monetary assets and liabilities that are denominated in foreign

currencies are revalued at the rates prevailing at the year-end date.

Non-monetary assets and liabilities carried at fair value which are

denominated in foreign currencies are revalued at the rates prevailing

at the date when the fair value was determined. Gains and losses arising

on revaluation are recognised in the Consolidated Statement of

Comprehensive Income.

2.11 Financial assets

2.11.1 Classification

The Group classifies its financial assets in the following categories:

at fair value through profit or loss; and loans and receivables. The

classification depends on the nature and purpose for which the financial

assets and is determined at the time of initial recognition by

Management.

(a) Financial assets at fair value through profit or

loss

Financial assets at fair value through profit or loss comprise the

investments made in the SPVs. Assets in this category are classified as

current assets if they are expected to be settled within 12 months,

otherwise they are classified as non-current.

(b) Loans and receivables

These assets are non-derivative financial assets with fixed or

determinable payments that are not quoted in an active market. They

comprise trade and other receivables and cash and cash equivalents.

2.11.2 Recognition and measurement

Purchases and sales of financial assets are recognised on the trade-date

(the date on which the Group commits to purchase or sell the asset).

Investments are initially recognised at cost, being the fair value of

consideration given. It is the policy of the Investment Manager to value

with reference to discounted cash flows immediately following

acquisition. Investments treated as 'financial assets at fair value

through profit or loss' are subsequently measured at fair value. Loans

and receivables are initially recognised at fair value plus transaction

costs that are directly attributable to the acquisition, and

subsequently carried at amortised cost using the effective interest rate

method, less provision for impairment. The effect of discounting on

these financial assets is not considered to be material. Financial

assets (in whole or in part) are derecognised either:

-- when the Group has transferred substantially all

the risks and rewards of ownership; or

-- when it has neither transferred nor retained

substantially all the risks and rewards and when it no longer has

control over the assets or a portion of the asset; or

-- when the contractual right to receive cash flow

has expired.

Notes to the Interim Consolidated Financial Statements (continued) For

the period 13 August 2013 to 30 June 2014

2 Summary of significant accounting policies (continued)

2.11.2 Recognition and measurement (continued)

Fair value is defined as the amount for which an asset could be exchange

between knowledgeable willing parties in an arm's length transaction.

The Directors base the fair value of the investments based on

information received from the Investment Manager. The Investment

Manager's assessment of fair value of investments is determined in

accordance with IAS 39 and IFRS 13, using unlevered Discounted Cash Flow

principles (unless a more appropriate methodology is applied).

Gains or losses arising from changes in the fair value of the 'financial

assets at fair value through profit or loss' category are presented in

the Consolidated Statement of Comprehensive Income within 'other

gains/(losses) - net' in the period in which they arise. Dividend income

from financial assets at fair value through profit or loss is recognised

in the Consolidated Statement of Comprehensive Income as part of other

income when the Group's right to receive payments is established.

2.12 Financial liabilities

Financial liabilities consist of trade and other payables and bank

loans. The classification of financial liabilities at initial

recognition depends on the purpose for which the financial liability was

issued and its characteristics. All financial liabilities are initially

recognised at fair value net of transaction costs incurred. All

purchases of financial liabilities are recorded on trade date, being the

date on which the Group becomes party to the contractual requirements of

the financial liability. Unless otherwise indicated the carrying amounts

of the Group's financial liabilities approximate to their fair values.

The Group's financial liabilities consist of only financial liabilities

measure at amortised cost.

2.12.1 Financial

These include trade payables and other short-term monetary liabilities,

which are initially recognised at fair value and subsequently carried at

amortised cost using the effective interest rate method.

2.12.2

A financial liability (in whole or in part) is derecognised when the

Group has extinguished its contractual obligations, it expires or is

cancelled. Any gain or loss on derecognition is taken to the

Consolidated Statement of Comprehensive Income.

2.12.3 Bank

Interest-bearing bank loans and overdrafts are recorded at the proceeds

received, net of direct issue costs. Finance charges, including premiums

payable on settlement or redemption and direct issue costs, are

accounted for on an accruals basis in the Consolidated Statement of

Comprehensive Income using the effective interest rate method and are

added to the carrying amount of the instrument to the extent that they

are not settled in the period in which they arise.

2.13 Offsetting financial instruments

Financial assets and liabilities are offset and the net amount reported

in the Statement of Financial Position when there is a legally

enforceable right to offset the recognised amounts and there is an

intention to settle on a net basis or realise the asset and settle the

liability simultaneously.

2.14 Impairment of financial assets

Assets carried at amortised cost

The Group assesses at the end of each reporting period whether there is

objective evidence that a financial asset or group of financial assets

is impaired. A financial asset or a group of financial assets is

impaired and impairment losses are incurred only if there is objective

evidence of impairment as a result of one or more events that occurred

after the initial recognition of the asset (a 'Loss Event') and that

Loss Event (or Events) has an impact on the estimated future cash flows

of the financial asset or group of financial assets that can be reliably

estimated.

Evidence of impairment may include indications that the debtors or a

group of debtors is experiencing significant financial difficulty,

default or delinquency in interest or principal payments, the

probability that they will enter bankruptcy or other financial

reorganisation, and where observable data indicate that there is a

measurable decrease in the estimated future cash flows, such as changes

in arrears or economic conditions that correlate with defaults.

For loans and receivables category, the amount of the loss is measured

as the difference between the asset's carrying amount and the present

value of estimated future cash flows (excluding future credit losses

that have not been incurred) discounted at the financial asset's

original effective interest rate. The carrying amount of the asset is

reduced and the amount of the loss is recognised in the Statement of

Comprehensive Income. If a loan or held-to-maturity investment has a

variable interest rate, the discount rate for measuring any impairment

loss is the current effective interest rate determined under the

contract. As a practical expedient, the Group may measure impairment on

the basis of an instrument's fair value using an observable market

price.

If, in a subsequent period, the amount of the impairment loss decreases

and the decrease can be related objectively to an event occurring after

the impairment was recognised (such as an improvement in the debtor's

credit rating), the reversal of the previously recognised impairment

loss is recognised in the Consolidated Statement of Comprehensive

Income.

2.15 Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand deposits and

other short-term highly liquid investments with an original maturity of

three months or less that are readily convertible to a known amount of

cash and are subject to an insignificant risk of changes in value.

2.16 Trade payables

Trade payables are obligations to pay for goods or services that have

been acquired in the ordinary course of business from suppliers.

Accounts payable are classified as current liabilities if payment is due

within one year or less (or in the normal operating cycle of the

business if longer). If not, they are presented as non-current

liabilities.

2.17 Share capital

Ordinary shares are classified as equity. Incremental costs directly

attributable to the issue of new ordinary shares are shown in equity as

a deduction, net of tax, from the proceeds. Ordinary shares have a nil

par value.

2.18 Dividend distribution

Dividend distribution to the Company's shareholders is recognised as a

liability in the Group's Financial Statements in the period in which the

dividends are approved by the Company's shareholders and are paid from

the revenue reserve.

Notes to the Interim Consolidated Financial Statements (continued)

For the period 13 August 2013 to 30 June 2014

3 Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future. The

resulting accounting estimates will, by definition, seldom equal the

related actual results. Revisions to accounting estimates are recognised

in the year in which the estimate is revised if the revision only

affects that year, or in the year of the revision and future years if

the revision affects both current and future years. The estimates and

assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within the

next financial year are addressed below.

3.1 Fair value of investments

The fair value of the investments is determined by using discounted cash

flow valuation techniques. The Directors base the fair value of the

investments on information received from the Investment Manager. The

Investment Manager's assessment of fair value of investments is

determined in accordance with IAS 39 and IFRS 13, using Discounted Cash

Flow principles. As described more fully on pages 23 and 24, valuations

such as these entail assumptions about solar irradiance, power prices,

technological performance, discount rate, operating costs and inflation

over a 25 year period.

3.2 Income and deferred tax

The Group is subject to income and capital gains taxes in the United

Kingdom through the UK Hold Co Significant judgement is required in

determining the total provision for income and deferred taxes. There are

many transactions and calculations for which the ultimate tax

determination and timing of payment is uncertain during the ordinary

course of business. The Group has arranged its affairs with the

intention of maximising tax efficiency and has assumed these

arrangements will be effective. For this reason, no tax charge has been

included in the Discounted Cash Flow valuation referred to in 3.1 above.

The Group recognises liabilities for anticipated tax issues based on

estimates of whether additional taxes will be due. Where the final tax

outcome of these matters is different from the amounts that were

initially recorded such differences will impact the income and deferred

tax provisions in the period in which the determination is made.

3.3 Recoverability of VAT

Regulations regarding VAT are subject to frequent changes. These changes

can result in differences in opinion regarding the legal interpretation

of tax regulations both between government bodies, and between

government bodies and companies. Tax may be subject to inspection by

administrative bodies authorised to impose high penalties and fines, and

any additional taxation liabilities calculated as a result must be paid

together with high interest. Tax settlements may become subject to

inspection by tax authorities within a period of five years. Accordingly,

the amounts shown in the Financial Statements may change at a later date

as a result of the final decision of the tax authorities.

4 Interest revenue

Period 13 August 2013

to 30 June 2014

GBP

Loan interest receivable 1.857.618

Fixed deposit interest receivable 263.700

Bank interest receivable 4.284

2.125.602

5 Finance costs

Period 13 August 2013

to 30 June 2014

GBP

Credit facility agreement arrangement fees (see note

21) 2.057.224

Interest on credit facility drawn down (see note 21) 6.881

2.064.105

6 Management fees

The Manager of the Group, Foresight Group CI Limited, receives an annual

fee of 1% of the Net Asset Value ("NAV") of the Group. This is payable

quarterly in arrears and is calculated based on the published quarterly

NAV. For the period, the Manager was entitled to a management fee of

GBP1,038,463 of which GBP389,541 was outstanding as at 30 June 2014.

7 Administration and accountancy fees

Under an Administration Agreement, the Administrator of the Company, JTC

(Jersey) Limited, is entitled to receive a minimum annual administration

fee of GBP80,000 payable quarterly in arrears. This minimum fee also

includes accountancy fees. For the period 13 August 2013 to 30 June

2014, the Administrator was entitled to total administration and

accountancy fees of GBP110,373 of which GBP35,999 was outstanding as at

30 June 2014.

Notes to the Interim Consolidated Financial Statements (continued) For

the period 13 August 2013 to 30 June 2014

8 Launch costs

Period 13 August 2013

to 30 June 2014

GBP

Administration fees 23.257

Legal and professional fees 440.342

Other fees 377

Listing fees 88.712

Excess launch costs paid by Foresight Group LLP (see

explanation below) (213.644)

339.044

In line with the Prospectus, the total launch costs to be borne by the

Shareholders of the Company was capped at 2% of the launch proceeds of

GBP150,000,000 (i.e. GBP3,000,000) with any excess launch costs being

reimbursed to the Company from Foresight Group LLP. Of this

GBP3,000,000, GBP2,660,956 was attributed to issue costs and therefore

offset against the share proceeds in the stated capital reserve.

9 Directors' fees

Remuneration of the Directors of the Group is currently paid at a rate

of GBP125,000 per annum. All of the Directors are Non-Executive

Directors.

Remuneration of Directors due for the period 13 August 2013 to 30 June

2014 were as follows:

Company UK Hold Co Group

GBP GBP GBP

Peter Dicks 26.219 - 26.219

Alexander Ohlsson 48.069 - 48.069

Christopher Ambler 34.959 - 34.959

109.247 - 109.247

10 Other expenses

Period 13 August 2013 to 30 June 2014

GBP

Bank charges 479

Annual fees 72.019

Legal and professional fees 155.094

227.592

Included in legal and professional fees, are audit fees of GBP32,190

payable to KPMG LLP for the period. As at the period-end, GBP32,190 was

outstanding.

11 Taxation

The Company is currently registered in Jersey and is subject to the

Jersey standard tax rate of 0% for which it pays an annual fee of

GBP250.

Tax arises in the United Kingdom in respect of UK Hold Co and the SPVs

for which they are subject to the small profits tax rate of 20%. For the

period 13 August 2013 to 30 June 2014 this taxation amounted to GBPnil.

The components of income tax expense for the period 13 August 2013 to 30

June 2014 are as follows:

Period 13

August 2013 to

30 June 2014

GBP

Consolidated statement of comprehensive income

Current tax:

Current income tax charge -

Deferred tax:

Deferred tax charge -

Income tax expense reported in the statement of comprehensive -

income

Notes to the Interim Consolidated Financial Statements (continued)

For the period 13 August 2013 to 30 June 2014

11 Taxation (continued)

Period 13

August 2013

to 30 June

2014

GBP

Reconciliation of tax expense and the loss for the

year multiplied by Jersey's domestic tax rate for

2014:

Profit for the year before tax from continuing operations 8.087.933

At Jersey's statutory income tax rate of 0% -

At the effective income tax rate of 0% -

Income tax recognised in the statement of comprehensive -

income

Deferred taxation

As at 30 June 2014 the Fund did not recognise a deferred

taxation asset or liability.

Deferred taxation Consolidated

statement of

comprehensive

income

Consolidated

statement of

financial position

30 June 2014 13 August

2013 to 30

June 2014

GBP GBP

Deferred tax provision/(liability)

Deferred tax provision - -

- -

12 Earnings per Ordinary share - basic and diluted

The basic and diluted profits per Ordinary Share for the Company are

based on the profit for the period of GBP8,087,933 and on 150,000,000

ordinary shares. The total number of Ordinary Shares in issue is equal

to the weighted average number of shares in issue during the period.

13 Trade and other receivables

30 June 2014

GBP

Accrued income 986.107

Prepaid expenses 7.245

Advances for future investments 276.077

Other receivables 29.671

1.299.100

14 Cash and cash equivalents

30 June 2014

GBP

Cash at bank 3.277.734

Escrow accounts 29.116.154

32.393.888

15 Trade and other payables

30 June 2014

GBP

Accrued expenses 960.383

Notes to the Interim Consolidated Financial Statements (continued)

For the period 13 August 2013 to 30 June 2014

16 Investments held at fair value through profit or loss

Wymeswold Castle Pitsworthy Highfields High Penn Total

Solar Eaton Solar Solar Solar

Solar

GBP GBP GBP GBP GBP GBP

Opening cost - - - - - -

Additions - 12.804.828 2.039.214 1.834.895 1.265.913 1.051.596 18.996.446

equity

Additions - 32.195.172 20.512.830 17.474.644 14.167.639 11.596.486 95.946.771

shareholder

loans

Closing cost 45.000.000 22.552.044 19.309.539 15.433.552 12.648.082 114.943.217

Unrealised 3.567.770 1.465.805 2.760.198 1.257.548 799.834 9.851.155

gain

Fair value 48.567.770 24.017.849 22.069.737 16.691.100 13.447.916 124.794.372

Notes to the Interim Consolidated Financial Statements (continued)

For the period 13 August 2013 to 30 June 2014

17 Fair value of assets and liabilities Fair value

hierarchy

IFRS 13 "Fair Value Measurement" requires disclosures relating to fair

value measurements using a three-level fair value hierarchy. The level

within which the fair value measurement is categorised in its entirety

is determined on the basis of the lowest level input that is significant

to the fair value measurement. Assessing the significance of a

particular input requires judgement, considering factors specific to the

asset or liability. The following table shows investment properties

recognised at fair value, categorised between those whose fair value is

based on:

(a) Level 1 - Quoted (unadjusted) market prices in

active markets for identical assets or liabilities;

(b) Level 2 - Valuation techniques for which the

lowest level input that is significant to the fair value measurement is

directly or indirectly observable;

(c) Level 3 - Valuation techniques for which the

lowest level input that is significant to the fair value measurement is

unobservable. All investments held at fair value through profit or loss

are classified as level 3 within the fair value hierarchy.