Chairman's Address

May 22 2007 - 8:01AM

UK Regulatory

RNS Number:0240X

FBD Holdings PLC

22 May 2007

At the Annual General Meeting of FBD Holdings plc being held in Dublin at 12

noon today, 22nd May 2007, the Chairman will make the following Address.

CHAIRMAN'S ADDRESS

As I have stated in our Annual Report, FBD Holdings plc delivered another

outstanding performance in the year under review.

A key measure of this performance is the net earnings figure of Euro246.8m for the

period. These earnings resulted from the strong operating performance, the

land sale at La Cala in Spain and the significant returns on our investment

portfolio.

Shareholders' funds increased to Euro497.5m, after repatriations to shareholders

totalling Euro207.0m, consisting of Euro77.8m in dividends and Euro129.2m in a share

buyback.

Based on the excellent results and in keeping with our stated policy to increase

the dividend payout ratio, the Board is recommending a final dividend of 45.0c

per ordinary share, bringing the total dividend for the year to 69.0c. This

represents a 20% increase on the 2005 figure, which itself was an increase of

43.75% over 2004.

In addition to the ordinary dividend just mentioned, on 17th April 2007 last the

Board announced its decision to distribute a further Euro177 million of reserves to

shareholders, subject to shareholder approval at a forthcoming EGM, scheduled

for 31st May. We estimate that this will impact 2007 operating EPS by

approximately 12 cent per share. The distribution will be made on 27th June to

shareholders on the register on 8th June 2007. The decision to distribute was

taken following the Board's assessment of the capital required by the Group to

deliver its ambitious development plans; and, the mode of repatriation was

determined by the Board after due deliberation as to the option it believes is

in the best interests of shareholders. The decision to return capital deemed

surplus to requirements is further evidence of the Group's disciplined capital

management and will enhance the return on equity for shareholders. In

mentioning returns to shareholders, I would remind you that the average total

shareholder returns per annum over the last 5 years were 52%, an outstanding

performance by any measure.

You will have received your documentation for the EGM and I urge you to complete

and return your proxy form to the Registrar, if you are not attending, no later

than Tuesday morning, 29th May 2007.

UNDERWRITING

As in previous years, the performance of FBD Insurance, our primary business,

underpinned the Group's results. I am pleased to report that in a highly

competitive market we succeeded in growing our market share and are now

Ireland's fourth largest general insurer. We have achieved this position

through organic growth based on sustainable development of our customer focused,

direct sell, business model.

It is widely recognised that insurers and policyholders have benefited from the

positive insurance environment that has pertained in Ireland in recent years.

It is equally important to recognise that the key element that has made this

possible is the reduction in accident claim costs that has occurred, relative to

what they were a few short years ago. The heartening reality is that accident

frequency and average claim costs have reduced. The factors that have brought

about the improved situation are well known; the reduction in fraudulent

claims, the road safety and law enforcement measures that have been implemented,

and the reduction in legal costs arising from the establishment of the Personal

Injuries Assessment Board (PIAB). If further savings in claim costs are to be

achieved, it is essential that progress on all these fronts is sustained.

Concerted efforts by some lawyers to thwart the PIAB in its objectives continue.

The government must remain firm in its support for PIAB and ensure that any

legislative changes that are necessary to underpin its capacity to deliver on

the purposes for which it was established, are implemented.

NON-UNDERWRITING

You are all aware that the Group's non-underwriting interests encompass leisure/

property development, financial services and the investment of non-allocated

capital. As our results show, these activities reported satisfactory outcomes

in 2006.

In relation to our property business, I wish to refer to the disposal of the

major portion of the development land owned by the Group at La Cala Resort in

Spain. This land sale was agreed in February of last year and effected in June.

The net profit arising from the transaction, when finally concluded, is

estimated to be Euro90m. The Board decided when entering into the transaction

that the entire net proceeds of the sale would be distributed to shareholders.

Accordingly, a special dividend, amounting to Euro55m, was paid in August 2006 in

respect of the Tranche I land. Payment by the purchaser for the second Tranche

of land is due on final approval being granted by the Regional Planning

Authority. Whilst we had initially expected an earlier outcome, due to delays

being experienced in this final approval process, we are of the view that it is

unlikely to be received before year end. A distribution of the remaining net

sale proceeds, estimated at Euro65m, will be made when payment of the final monies,

triggered by the planning approval, is received. The land disposal evidences

the ongoing commercial assessment the Group undertakes in relation to all its

businesses and the focus it maintains on optimising shareholder returns.

CORPORATE

On the corporate front, a significant change in the Group's shareholding

structure occurred in 2006 when Farmer Business Developments plc placed 4.5m

shares (i.e. 12% of FBD Holdings plc's issued capital at that time) on the

market in June. As stated earlier, the Group bought, and subsequently

cancelled, 3.8m. of these shares and the remainder were purchased by other

investors. This transaction resulted in the shares' free float moving to 67%

and Farmer Business Developments' shareholding reducing to 24.4%, thereby

increasing share liquidity. I welcome the new investors who have joined the

Company and acknowledge your confidence in us.

OUTLOOK

As the results have reflected, 2006 was a year in which the growth momentum that

the Group established over the years was maintained. This is borne out across

all our businesses by the increase in customer numbers, the new markets that

have been sourced and the organisational and infrastructural developments that

have been implemented to underpin our progress. These latter developments,

including the establishment of our Business Support Centre in Mullingar, Co.

Westmeath, which opened in February of this year, ensure that our platform for

success continues to be strengthened.

Outlook continued overleaf.......

As regards the current year, I am pleased to report that we have continued to

make solid progress to date. We are vigorously pursuing our strategies for

growth and, albeit that price competition remains intense across all our areas

of business, I am confident that the progress we have made will be built on and

that we will fulfil our full year earnings expectations.

CONCLUSION

In conclusion, I extend my sincere thanks to the Board, Management and Staff for

their efforts and dedication in, once again, delivering an outstanding

performance for the Group. By maintaining our focus on maximising benefits for

all our stakeholders, I am confident that FBD is very well positioned to

continue developing successfully.

This announcement has been issued through the Companies Announcement Service of

The Irish Stock Exchange

This information is provided by RNS

The company news service from the London Stock Exchange

END

ISEILFSLETIFFID

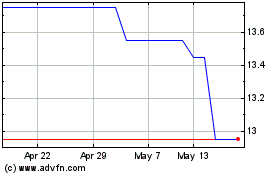

Fbd (LSE:FBH)

Historical Stock Chart

From Jun 2024 to Jul 2024

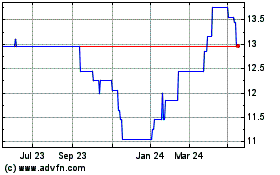

Fbd (LSE:FBH)

Historical Stock Chart

From Jul 2023 to Jul 2024