FAIRFX Group PLC Trading Update (0728O)

January 25 2019 - 2:00AM

UK Regulatory

TIDMFFX

RNS Number : 0728O

FAIRFX Group PLC

25 January 2019

25 January 2019

FairFX Group plc

("FairFX" or "the Group" or "the Company")

Trading Update

Another year of significant growth and investment

FairFX, the e-banking and international payments group, is

pleased to announce the following trading update for the year ended

31(st) December 2018 ("FY18").

Full year turnover for the Group was GBP2.36 billion, an

increase of 111% on the prior year (2017: GBP1.12 billion) and in

line with management expectations. Turnover was up 22% excluding

the effect of the acquisitions of CardOne Banking in August 2017

and City Forex in February 2018.

The Group has demonstrated strong growth during FY18 and expects

to report adjusted EBITDA of approximately GBP7.5 million for the

12 month period (FY17: GBP1.0 million).

Growth was again driven by the Group's continued focus on its

core products of International Payments (up 134%) and Prepaid Cards

(up 8%). In keeping with the Group's stated strategic objective of

growing the Corporate segment of the business, usage of the

Company's corporate card platform rose by 30% compared to 2017.

Furthermore, during FY18, 315,000 new UK domiciled retail customers

were acquired bringing the total to 1,040,000 customers.

The Group has continued to invest in the CardOne business and

platform to pursue identified opportunities which are expected to

be realised during the current financial year.

The other key area of strategic focus for the Company has been

to invest in the platform and rationalise the supply chain.

Pleasingly, further advances were made during the year, including

self-issuance of CardOne corporate cards under our Mastercard

membership. One area of focus was the removal of a layer of the

supply chain and improve margins across the corporate card

division, and whilst good progress was made this was slower than

the Board would have liked. The Board expects this to be finalised

and to contribute improved margins during the current financial

period.

Outlook

Whilst Brexit uncertainty depressed Sterling against the Dollar

and Euro during FY18 weighing on customer sentiment and activity,

the Group demonstrated significant growth through the year.

Ongoing, and even potentially lengthened, Brexit negotiations

continue to provide macro-economic headwinds for the business. The

Board is pleased to confirm, however, it expects 2019 to be another

year of significant growth.

All figures contained in this announcement are subject to

audit.

This announcement contains inside information.

For more information, please contact:

FairFX Group plc +44 (0) 20 7778

Ian Strafford-Taylor, CEO 9308

Cenkos Securities plc - Nominated Advisor

and Joint Broker

Max Hartley (Nomad)

Callum Davidson +44 (0) 20 7397

Nick Searle - Sales 8900

Canaccord Genuity Limited - Joint Broker

Bobbie Hilliam

David Tyrrell +44 (0) 20 7523

Alex Aylen - Sales 8150

Yellow Jersey

Charles Goodwin

Joe Burgess +44 (0) 7747 788

Annabel Atkins 221

About FairFX

FairFX is a leading challenger brand in banking and payments

that disintermediates the incumbent banks with a superior user

experience and low-cost operating model. This enables personal and

business customers to make easy, low-cost multi-currency payments

in a broad range of currencies and across a range of FX products

all via one integrated system. The FairFX platform facilitates

payments either direct to Bank Accounts or at 30 million merchants

and over 1 million ATM's in a broad range of countries globally via

Mobile apps, the Internet, SMS, wire transfer and MasterCard/VISA

debit cards.

FairFX provides banking and payment services to both personal

and business customers through four channels: Currency Cards,

Physical Currency, International Payments and Bank Accounts. The

Currency Card and Physical Currency offerings facilitate multiple

overseas payments at points of sale and ATM's whereas the

International Payments channel supports wire transfer foreign

exchange transactions direct to Bank Accounts. For Corporates,

FairFX has a market-leading business-expenses solution based around

its corporate prepaid platform and card that can yield significant

savings on a Corporate's procurement through better controls and

improved transparency and also streamline the procurement process

thus saving administrative costs. Through the recent acquisition of

CardOne, FairFX now has the capability to offer retail and business

Bank Accounts with all the functionality you would expect from a

Bank, namely faster payments, BACs, direct debits, international

payments and a debit card.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBIMJTMBMTTFL

(END) Dow Jones Newswires

January 25, 2019 02:00 ET (07:00 GMT)

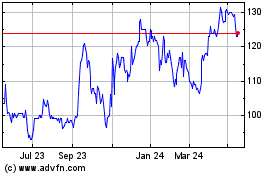

Equals (LSE:EQLS)

Historical Stock Chart

From Jun 2024 to Jul 2024

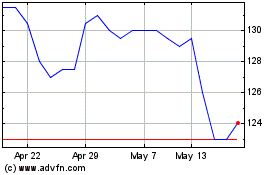

Equals (LSE:EQLS)

Historical Stock Chart

From Jul 2023 to Jul 2024