TIDMDLN

RNS Number : 9640V

Derwent London PLC

09 November 2017

9 November 2017

Derwent London plc ("Derwent London" / "the Group")

THIRD QUARTER BUSINESS UPDATE

ANOTHER RECORD LETTING YEAR

Highlights

-- In 2017 to date we have let or pre-let 674,800 sq ft achieving GBP41.2m pa of rent:

o This is a 16% increase from the GBP35.5m announced in

September 2017

o Lettings year to date are 1.3% above December 2016 ERV

(Estimated Rental Value)

o Second half lettings to date are 2.3% above June 2017 ERV

o EPRA vacancy rate has fallen from 1.9% in June 2017 to

1.4%

-- 401,000 sq ft of developments completed in 2017 and are now 94% let:

o White Collar Factory EC1 completed in H1 and is now 92%

let

o The Copyright Building W1 was completed and sold for GBP166.2m

in Q4

-- 620,000 sq ft is under construction, with a minimum of 45% pre-let:

o At least 86% of the office space at 80 Charlotte Street W1 is

now pre-let

-- Property disposals in the year to date total GBP496m,10% above December 2016 values

-- At 30 September 2017 cash and undrawn facilities were GBP422m and the LTV was 15.3%

-- The proforma LTV adjusting for disposals since September 2017 is 12.7%

John Burns, Chief Executive Officer, commented:

"Good occupier and investment demand means that 2017 will be a

record year for Derwent London's lettings and investment disposals

even with lower UK economic growth and political uncertainty. The

continuing positive letting momentum reinforces our earlier

decision to move forward with our next major project at Soho Place

W1."

Webcast and conference call

There will be a conference call for investors and analysts at

09:00 GMT today.

To participate in the call, please dial the following number:

+44 (0)20 3059 8125

A recording of the conference call will also be made available

following the conclusion of the call on www.derwentlondon.com

For further information, please contact:

Derwent London John Burns, Chief Executive

Tel: +44 (0)20 7659 3000 Officer

Damian Wisniewski, Finance

Director

Quentin Freeman, Head

of Investor Relations

Brunswick Group Simon Sporborg

Tel: +44 (0)20 7404 5959 Tim Danaher

Active demand for our product leads to another record letting

year (see Appendix 1)

In the year to date we have let or pre-let 674,800 sq ft or

GBP41.2m pa in gross rent (GBP41.0m net of ground rents), 43% of

which has been agreed since 30 June 2017. The overall total is a

GBP5.7m increase from our previous announcement on 11 September

2017. Second half transactions included the major pre-let to The

Boston Consulting Group and Arup committing to further space at 80

Charlotte Street W1. On average our new lettings have been 1.3%

above December 2016 ERV, with second half lettings 2.3% above June

2017 ERV. Our EPRA vacancy rate has fallen from 1.9% to 1.4% since

June 2017 reflecting our product's broad appeal.

Good progress on developments (see Appendix 2)

The completions of White Collar Factory and The Copyright

Building meant that we have now delivered 401,000 sq ft this year,

reducing our development exposure by 39% to 620,000 sq ft. The two

remaining projects, Brunel Building W2 and 80 Charlotte Street W1,

are due for delivery in 2019. We have pre-let a minimum 86% of the

office space at the latter so at least 45% of our on-site programme

is pre-let, and we are seeing some good early interest at Brunel

Building. As noted in our interim results we intend to start a

further 285,000 sq ft at Soho Place W1 in H2 2018. This is one of

the most strategically important sites in central London, located

above the Tottenham Court Road Crossrail station at the eastern end

of Oxford Street. Additionally we are moving ahead with preparatory

works at Monmouth House EC1 next to White Collar Factory where

possession could be obtained from 2019 onwards.

Significant disposals activity (see Appendix 3)

With the sale of The Copyright Building completed, we have now

disposed of GBP496m gross of investment properties this year

representing a 10% premium to December 2016 book values.

Finance

Capital expenditure in the first three quarters totalled

GBP128.4m including GBP7.1m of capitalised interest. This took net

debt to GBP758.1m at 30 September, an increase of GBP24.4m in the

quarter, and the loan-to-value ratio (LTV) to 15.3% based on June

2017 property values. It is expected that approximately GBP50m will

be spent on capital expenditure in Q4. Net proceeds of GBP150.1m

were received on 1 November 2017 from the disposal of The Copyright

Building and a further GBP2.3m has also been received in October

from the sale of an additional small property. After adjusting for

these disposals, the pro-forma LTV at 30 September 2017 was 12.7%.

Undrawn bank facilities and cash at 30 September 2017 totalled

GBP422m before adjusting for the subsequent disposals. The weighted

average interest rate was 3.95% on an IFRS basis or 3.66% based on

the cash coupon payable on our 2019 convertible bonds.

Values

Central London office values remain firm reinforced by

significant letting activity and strong investor demand especially

from foreign capital, despite the continuing political and economic

uncertainties. The IPD Central London Offices Quarterly Index for

Q3 2017 showed capital values rising 0.9% with rents up 0.2% in the

same period.

Appendix 1: Principal lettings in 2017

Min

/ fixed

uplift

at

Total first

Area Rent annual review Lease Lease Rent free

sq GBP rent GBP term break equivalent

Property Tenant ft psf GBPm psf Years Year Months

------------------ -------------- -------- ------ -------- --------- ------- ------- -------------

Q1

80 Charlotte

Street W1 Arup 133,600 72.90 9.7(1) 81.50 20 - 33

White Collar

Factory EC1 Adobe 14,900 67.50 1.0 74.50 11.5 - 22

Angel Building

EC1 Expedia 12,500 62.50 0.8 - 13.3 - 18

Greencoat

& Gordon House

SW1 VCCP 12,800 55.00 0.7 - 8.5 - 13

9, plus

9

20 Farringdon if no

Road EC1 Accenture 11,500 55.00 0.6 - 10 5 break

------------------ -------------- -------- ------ -------- --------- ------- ------- -------------

Q2

The White

Chapel Building

E1 30, plus

Phase 2 - 6

lower ground if no

floors Fotografiska 89,000 27.00 2.4 27.70 15 12 break

18, plus

5

White Collar if no

Factory EC1 Box.com 28,500 75.00 2.1 - 15 10 break

The White

Chapel Building

E1 Wilmington 27,000 52.00 1.4 - 10 - 20

11, plus

The White 8

Chapel Building if no

E1 ComeOn! 12,700 50.00 0.6 - 10 5 break

9.5, plus

5

White Collar Red if no

Factory EC1(2) Badger 7,700 62.50 0.5 65.60 10 5 break

78 Whitfield Made

Street W1 Thought 4,800 63.50 0.3 - 10 4.5 8

78 Whitfield Yoyo

Street W1 Wallet 4,800 63.00 0.3 - 4.5 - 8

78 Chamber

Street E1(3) NetBooster 6,700 40.00 0.3 - 10 5 10

------------------ -------------- -------- ------ -------- --------- ------- ------- -------------

Q3

The

Boston

80 Charlotte Consulting

Street W1 Group 123,500 85.50 10.6 - 15 12 Confidential

80 Charlotte

Street W1 Arup 19,800 75.00 1.5(1) 83.80 20 - 33

90 Whitfield

Street W1 Freightliner 12,100 71.00 0.9 - 10 - 22

Holden House Russell

W1 & Bromley 3,800 - 0.7 - 10 5 3

12-16 Fitzroy

Street W1 Ergonom 8,800 54.00 0.5 57.00 15 10 15

9, plus

White Collar 9 if no

Factory EC1 Egress 6,700 67.50 0.5 - 10 5 break

(1) Annual increases of 2.25% for the first 15 years (2) Low

rise buildings (3) Joint venture - Derwent London share

Appendix 2: Major developments pipeline

Property Area Delivery Capex Comment

sq to

ft complete

GBPm(1)

------------------------- ----------- --------- ---------- -------------------------

Completed projects

White Collar Factory, 293,000 H1 265,000 sq ft

Old Street Yard 2017 offices, 20,000

EC1 sq ft retail,

8,000 sq ft residential

- 92% let

The Copyright Building, 108,000 H2 88,000 sq ft

30 Berners Street 2017 offices and 20,000

W1 sq ft retail

- 100% let. Sold

Q4 2017.

------------------------- ----------- --------- ---------- -------------------------

401,000

On-site projects

Brunel Building,

2 Canalside Walk H1

W2 240,000 2019 85 Offices

332,000 sq ft

offices, 45,000

sq ft residential

and 3,000 sq

80 Charlotte Street H2 ft retail - 73%

W1 380,000 2019 194 pre-let overall

------------------------- ----------- --------- ---------- -------------------------

620,000 279

------------------------- ----------- --------- ---------- -------------------------

Other major planning

consents

Soho Place W1 285,000 209,000 sq ft

offices, 36,000

sq ft retail

and 40,000 sq

ft theatre

Monmouth House EC1 125,000 Offices, workspaces

and retail

------------------------- ----------- --------- ---------- -------------------------

410,000

------------------------- ----------- --------- ---------- -------------------------

Planning applications

19-35 Baker Street 293,000(2) 206,000 sq ft

W1 offices, 52,000

sq ft residential

and 35,000 sq

ft retail

Holden House W1 150,000 Retail flagship

or retail and

office scheme

------------------------- ----------- --------- ---------- -------------------------

Grand total (excluding

completed projects) 1,473,000

------------------------- ----------- --------- ---------- -------------------------

(1) As at 30 June 2017 (2) Total area - Derwent London has a 55% share of the joint venture

Appendix 3: Major disposals in 2017

Gross Gross Net

Property Date Area proceeds proceeds yield Rent

sq GBPm GBP to purchaser GBPm

ft psf % pa

------------------- ------- -------- ---------- ---------- -------------- -------

132-142 Hampstead

Road NW1 Q1 219,700 130.1 590 1.2 1.7

8 Fitzroy Street

W1 Q2 147,900 197.0 1,330 3.4 7.2

The Copyright

Building W1 Q4 108,000 166.2(1) 1,540 4.2 8.5(2)

------------------- ------- -------- ---------- ---------- -------------- -------

(1) GBP150.1m net of rental incentives and guarantees (2) Gross rent

Notes to editors

Derwent London plc

Derwent London plc owns 89 buildings in a commercial real estate

portfolio predominantly in central London valued at GBP4.8 billion

(including joint ventures) as at 30 June 2017, making it the

largest London-focused real estate investment trust (REIT).

Our experienced team has a long track record of creating value

throughout the property cycle by regenerating our buildings via

development or refurbishment, effective asset management and

capital recycling.

We typically acquire central London properties off-market with

low capital values and modest rents in improving locations, most of

which are either in the West End or the Tech Belt. We capitalise on

the unique qualities of each of our properties - taking a fresh

approach to the regeneration of every building with a focus on

anticipating tenant requirements and an emphasis on design.

Reflecting and supporting our long-term success, the business

has a strong balance sheet with modest leverage, a robust income

stream and flexible financing.

Landmark schemes in our 5.6 million sq ft portfolio include

Angel Building EC1, The Buckley Building EC1, White Collar Factory

EC1, 1-2 Stephen Street W1, Horseferry House SW1 and Tea Building

E1.

In 2017 the Group won the Property Week Developer of the Year

award, was listed 12th out of 4,000 in the Corporate Knights Global

100 of the world's most sustainable companies and achieved EPRA

Gold for corporate and sustainability reporting. In 2016 the Group

won Estates Gazette National Company of the Year and London awards

as well as awards from Architects' Journal, British Council for

Offices, Civic Trust and RIBA.

As part of its wider sustainability programme, in 2013 Derwent

London launched a dedicated GBP250,000 voluntary Community Fund

and, in 2016, made a further commitment of GBP300,000 for the next

three years for Fitzrovia and the Tech Belt.

The Company is a public limited company, which is listed on the

London Stock Exchange and incorporated and domiciled in the UK. The

address of its registered office is 25 Savile Row, London, W1S

2ER.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon

Forward-looking statements

This document contains certain forward-looking statements about

the future outlook of Derwent London. By their nature, any

statements about future outlook involve risk and uncertainty

because they relate to events and depend on circumstances that may

or may not occur in the future. Actual results, performance or

outcomes may differ materially from any results, performance or

outcomes expressed or implied by such forward-looking

statements.

No representation or warranty is given in relation to any

forward-looking statements made by Derwent London, including as to

their completeness or accuracy. Derwent London does not undertake

to update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTUWANRBOAARAA

(END) Dow Jones Newswires

November 09, 2017 02:00 ET (07:00 GMT)

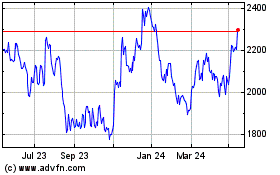

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

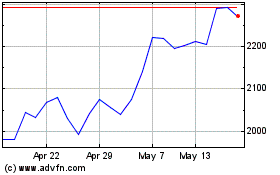

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024