RNS Number:6255D

Derwent London PLC

11 September 2007

11 September 2007

DERWENT LONDON PLC ("Derwent" / "Group")

Interim Results for the six months to 30th June 2007

DERWENT LONDON ANNOUNCES EXCELLENT PROGRESS AND STRONG RESULTS

Derwent London is pleased to announce excellent progress across all areas of

activity and extremely strong results for the six months to 30th June 2007.

Highlights

* Adjusted net asset value per share increased by 12.5% to 1,931p (1st

February 2007 proforma: 1,717p); excluding the REIT conversion charge of #54.7

million, this rise would have been 15.7%.

* Interim dividend up 77.5% to 7.5p.

* Value of core Central London portfolio rose 10.7% to #2.53 billion.

* Total valuation surplus of #298.4 million: #245.2 million from the

investment portfolio and #53.2 million from assets under construction.

* Investment portfolio valued at #2.8 billion (1st February 2007: #2.5

billion).

* Adjusted profit before tax increased by 26.8% to #12.3 million.

IFRS loss before tax of #20.3 million, after a #297.3 million charge for

goodwill impairment (30th June 2006 profit: #122.6 million).

* Conversion to a REIT achieved on 1st July. Subsequent sales of

non-core assets have realised in excess of #300 million and produced a gross

surplus of #125 million over the proforma values.

* 61,000 sq m of development or refurbishment projects underway with

an estimated completed rental income of #22 million - 51% of which is pre-let.

* #21 million acquisition in Noho in the reporting period; two further

acquisitions made since the half year at a cost of #104 million.

Financial Highlights

Half year Half year to Year to Change

to 30.06.07 30.06.06 31.12.06 %

Adjusted net asset value per share (p)** 1,931 1,540 1,770 12.5*

Gross property income (#m) 50.5 26.1 51.3 93.5

Adjusted profit before tax (#m) *** 12.3 9.7 16.4 26.8

IFRS (loss)/profit before tax (#m) (20.3) 122.6 242.8 n.a.

Adjusted earnings per share (p)*** 10.95 23.56 24.83 (53.5)

Dividend per share (p) 7.5 4.225 14.75 77.5

Total return (%) 9.7 16.1 33.6 -

* Change based on proforma figure at 1st February 2007 of 1,717p.

** As defined in note 16 of the following statement.

*** As defined in note 7 of the following statement.

Robert Rayne, Chairman, commented:

"Derwent London has made excellent progress since the formal completion of the

acquisition of London Merchant Securities in February and I am pleased to

announce an extremely strong set of results.

"After a very active and successful first half, your Group is extremely well

positioned to take further major steps in its chosen markets. Investor interest

in acquiring Central London assets remains high, and occupier demand continues

to be robust.

"By applying management's design-led refurbishment and redevelopment skills and

diligent asset management, we believe that shareholders will benefit as we

continue to unlock the value in the enlarged portfolio. Consequently, in spite

of the current uncertainties in the global financial markets, we look forward to

the future with confidence."

For further information, please contact:

Derwent London Financial Dynamics

John Burns, Chief Executive Stephanie Highett/Dido Laurimore/Lauren Mills

Tel: 020 7659 3000 Tel: 020 7831 3113

CHAIRMAN'S STATEMENT

Derwent London has made excellent progress since the formal completion of the

acquisition of London Merchant Securities in February and I am pleased to

announce an extremely strong set of results for the six months to 30th June

2007.

It has been a very active and challenging time for management with emphasis

being placed on achieving a rapid and smooth integration, rationalising the

combined portfolio, and converting to REIT status. You will see from my detailed

comments that considerable progress has been made on all these fronts.

Results overview

Adjusted net asset value per share, one of the principal measures of the group's

performance, increased by 12.5% to #19.31 per share, against a proforma figure

at 1st February (the date of the acquisition) of #17.17 per share. This result

is calculated after charging the REIT conversion charge of #54.7 million.

Excluding this, the increase would have been 15.7%.

The investment portfolio was valued at #2.8 billion and achieved a valuation

surplus of #245.2 million, before the lease incentive adjustment of #2.0

million. The underlying valuation increase, excluding development properties,

was #204.3 million with #29.0 million from yield compression and #175.3 million

from rental growth and asset management. The revaluation of the development

properties added #40.6 million as schemes progressed towards completion. The

balancing surplus of #0.3 million came from the single acquisition made in the

first half.

The overall valuation increase was 9.6%. The Central London portfolio, with a

value of #2.53 billion, increased by 10.7%. Within this, the West End

properties, valued at #1.96 billion and representing 70% of the investment

portfolio, increased by 10.6%. Here, Belgravia and Victoria were particularly

strong performers with growth of 29.0% and 15.1% respectively.

The balance of the Central London portfolio (#0.57 billion), which is almost

exclusively located in the City borders, represented 20% of the investment

portfolio and rose by 11.1%.

The remaining 10% of the investment portfolio, with a value of #0.29 billion,

increased by 0.6%. This is located outside Central London and has been

identified for disposal.

In addition, there was a revaluation surplus of #53.2 million on assets under

construction, giving a total surplus of #298.4 million.

Adjusted profit before tax for the enlarged group, which only includes the

recurring elements of profit, was #12.3 million. This profit incorporates five

months of results of London Merchant Securities and compares with #9.7 million

for Derwent Valley in the half year to 30th June 2006. The result under IFRS is

a loss of #20.3 million against a profit of #122.6 million for the comparable

period. There are a number of adjustments made to arrive at the IFRS result, the

most significant of which this year relates to the charge of #297.3 million

resulting from the impairment of goodwill. Adjustment has also been made for the

#6.8 million development income from the Telstar project. These are in addition

to the usual adjustments in respect of the net revaluation surplus, (#243.2

million), profit on disposal of investment properties and other investments,

(#10.0 million), and the movement in the fair value of derivative financial

instruments, (#6.7 million). Total return for the six month period was 9.7%

compared to 16.1% for the six months to 30th June 2006.

Dividend

As a result of the acquisition and conversion to a REIT, the board has reviewed

the company's dividend policy. It concluded that the dividend would be based on

the policies of the two companies prior to the acquisition, plus a substantial

proportion of the tax on income saved through REIT conversion. However, as the

group only converted on 1st July, the dividend for 2007 will reflect only six

months tax saving. The board has declared an interim dividend of 7.5p per

share. This represents an increase of 78% on the 4.225p per share paid at this

stage last year. Further details concerning the dividend are given in note 15 of

the interim results.

Market Review

The group's activities are focused in Central London which has continued to

perform well. In the West End, against a background of limited supply, tenant

demand has resulted in strong rental growth. These market conditions are ideally

suited to Derwent London's primary focus on reversionary, high potential growth

assets, and have enabled us to make a number of lettings in the first half at

record levels for the properties.

With the recent upward movement in interest rates, it is likely that the days of

yield compression across all sectors of the commercial property sector are

drawing to a close. However, strong investor demand persists in our markets

and for our assets, a fact clearly endorsed by the prices we have secured on

sales completed since the half year.

Conversely, in these market conditions, value adding opportunities are rare and

the only acquisition made in the first half was of a 3,200 m(2) office building

in Noho for #21 million. Since 30th June 2007, two further acquisitions have

been made for a combined consideration of #104 million. One of the properties is

located in Clerkenwell and the other in Euston, two of our targeted London '

villages'. These reversionary assets both offer future opportunities for value

enhancement.

During the first half, we incurred #31 million of capital expenditure on the

group's pipeline of projects, with #20 million being spent at Horseferry House,

2-4 Fitzroy Street (Arup) and 90 Whitfield Street (Qube). The first two of these

are already fully pre-let and marketing of the third is due to commence in the

Autumn.

Strategy

Following the acquisition, our two immediate objectives were to convert to a

REIT and to reshape the portfolio in order to focus entirely on Central London.

These are clearly linked, since one of the major benefits of REIT status is that

the tax on the disposal of investment properties is extinguished, thereby

allowing the tax-efficient disposal of non-core properties.

The group became a REIT on 1st July 2007, after an Extraordinary General Meeting

on 26th June 2007. The resulting conversion charge, which was based on the value

of the investment portfolio, is #54.7 million and was included in the first half

tax charge.

With the change in status completed, our disposal programme increased momentum.

Significant progress has been made to date with the completion of the disposal

of #103 million of investment properties and #112 million of residential sites.

In addition, contracts have been exchanged for the sale of a further #99 million

of investment properties. The proceeds show a substantial gross uplift in value

of #125 million from that included in the proforma balance sheet. Details of the

disposals are given in the operating review.

The proceeds from both the above sales and the ongoing disposal programme will

be recycled into our refurbishment and redevelopment programme and further

additions to the portfolio.

With the integration of the businesses now complete, the enlarged management

team is utilising its combined expertise to drive the group's core ongoing

strategy - to own and manage a portfolio of Central London property that offers

significant opportunities to enhance and extract value. To this end, we are

rationalising the portfolio, focusing on larger projects and acquisitions, as

well as taking early possession of certain properties which allow redevelopment

schemes to be brought forward.

In the operating review, we have commented on our refurbishment, redevelopment

and management activity.

Financing

Following the acquisition, group net debt at 30th June 2007 has risen to #948

million, an increase of #598 million from the #350 million reported at the

December year end. Most of the increase (#553 million) relates directly to the

acquisition: the issue of loan notes as consideration (#32.5 million); cash

consideration and expenses (#20 million) and the net debt within London Merchant

Securities itself (#501 million, inclusive of #30 million arising from the fair

value of the secured bonds upon acquisition). The June figure shows an increase

of #52 million from that shown in the post acquisition proforma balance sheet

included at the end of this announcement. In addition to loan notes and cash,

ordinary shares to the value of #913 million were issued as consideration to

London Merchant Securities shareholders.

Outside of the acquisition of London Merchant Securities, other notable cash

flows are due to property acquisitions and capital expenditure (#67 million) and

disposals (#29 million). Balance sheet gearing at 49.1% shows only a modest

increase from the last year end while profit and loss gearing has risen from the

2006 figure of 54% to 67% for the current half year. The latter reflects the

higher operational gearing of London Merchant Securities. At the end of August,

62% of net debt, which had fallen as a result of the disposal programme to

approximately #803 million, was either at fixed rates or hedged, mainly through

the use of swaps. Despite rising interest rates, the current spot average

weighted cost of debt was 6.3%.

While the fair value movement of the derivative instruments since acquisition is

included in the results for the half year, that for the #175 million secured

bonds is not required to be adjusted. The fair value adjustment of the secured

bonds at 30th June 2007 was #13.2 million, compared with the #22.1 million on

acquisition.

The board

Since the half year, Nick Friedlos, who, prior to the acquisition, was London

Merchant Securities' finance director, has left the board. Nick made a

considerable contribution to the efficient integration of the two groups and to

the conversion of Derwent London to a REIT and we would like to wish him success

in his new endeavours.

Prospects

After a very active and successful first half, your group is extremely well

positioned to take further major steps in its chosen markets. Investor interest

in acquiring Central London assets remains high and occupier demand continues to

be robust. In such circumstances, the group's portfolio, which is balanced

between properties providing recurring and reversionary income and those which

provide a pipeline of redevelopment projects, is particularly well placed to

deliver superior returns.

By applying management's design-led refurbishment and redevelopment skills and

diligent asset management, we believe that shareholders will benefit as we

continue to unlock the value in the enlarged portfolio. Consequently, in spite

of the current uncertainties in the global financial markets, we look forward to

the future with confidence.

R.A. Rayne

11th September 2007

OPERATING REVIEW

The merger of the businesses of Derwent Valley Holdings and London Merchant

Securities was formally completed on 1st February 2007. The renamed group,

Derwent London, is now the UK's 7th largest listed property company and,

following its conversion to REIT status, the world's largest Central London

focused REIT.

A key objective for the first half was the integration of the management of the

two property portfolios. This process has been completed smoothly with all

personnel now located at Savile Row. The outcome is an enlarged asset

management team, focused on applying its experience and entrepreneurial skills

to the merged portfolio. This has immediately generated many new ideas and

opportunities to maximise the potential, both of the assets and their locations.

Portfolio

The group owns and manages an investment portfolio of over #2.8 billion, of

which #2.5 billion or 90% is located in Central London. There is a specific

focus on the West End, making up 70% of the portfolio, and the areas bordering

the City, which comprise 20% of the portfolio.

The balancing 10% comprises non-core, provincial properties which are subject to

an orderly disposal programme. Progress on this is set out in the final section

of the review.

Our strategy is to acquire and own a portfolio that has reversionary rents and

scope to add value through refurbishment and redevelopment. In this regard, our

Central London properties offer excellent potential for rental growth, being let

at a low average level of #259 per m2, with the West End properties at #270 per

m2. Furthermore, approximately 50% of the London portfolio is identified as

having the opportunity, through development, to achieve significant gains in

floor area and increase in value.

Redevelopment and refurbishment

The portfolio contains a phased development pipeline of over 310,000m2. Of

this, projects committed and under construction will provide in excess of

61,000m2 of new space and deliver a rental income approaching #22.0 million per

annum. This includes #11.3 million of pre-let income.

Projects under construction include:

* Horseferry House, Victoria, SW1

A comprehensive refurbishment and remodelling of this building, which will cost

#27 million, is progressing on schedule and will create 15,200m2 of high

quality, air conditioned, office space centred around a striking reception

atrium. The property, which was pre-let last year to Burberry, the

international fashion group, at a rent of #5.3 million per annum, will be

completed early next year. The headline rent of #410 per m2 will ensure that

this asset is well positioned to deliver future rental and capital growth

performance.

* Arup Phase II & III, 2-4 Fitzroy Street, Fitzrovia, W1

Phase II of this 13,200m2 development is well advanced, with the external

envelope cladding system being installed, revealing an inspirational design.

Completion of this phase is scheduled for later this year and phase III in 2009.

The complex is pre-let to Arup, an international firm of engineers, on a 25

year lease at a current income of #2.7 million per annum, which will rise to

#6.0 million per annum on completion of both phases. The latter equates to #450

per m2, with a rent review in 2011 and presents excellent future prospects for

rental growth in a location where rents are approaching #645 per m2.

* Qube, 90 Whitfield Street, Fitzrovia, W1

Along with the Arup project, the nearby Qube development is set to transform the

heart of our Fitzrovia holdings (representing 21% of the investment portfolio)

by providing 9,300m2 of exciting, high quality office space. Due to be

completed later this year, this will be one of the few new office buildings of

this size and quality available in the West End. This building offers flexible

space within a panelled glass cladding system and large floor plates of 1,700m2

around a central atrium which incorporates the circulation core. In addition,

700m2 of retail space has been created at street level to provide a new and

vibrant profile for this section of Tottenham Court Road.

* 16-19 Gresse Street, Noho, W1

This 4,400m(2) office development offers an opportunity to improve the area and

create an attractive environment through modern design solutions. Located close

to the group's Holden House property, we expect strong interest from media and

communication companies when this project is completed in early 2009.

* Portobello Dock and Kensal House, Ladbroke Grove, W10

The transformation of these redundant buildings will provide 6,400m2 of space in

this mixed-use scheme. It includes 19 canal-side apartments, a blend of studio

offices and a new air-conditioned office building. The residential units will

be sold on completion later this year and the offices leased. This project

demonstrates Derwent London's philosophy of creating value by regenerating an

area through a thoughtful, contemporary scheme.

Planning permissions and applications

We are advancing a number of key planning opportunities to deliver the next

generation of schemes and development surpluses and are also actively appraising

and evaluating other important holdings where we have identified the opportunity

to increase floor areas substantially.

These include:

* 55-65 North Wharf Road, Paddington, W2

In June, a planning application was submitted for a landmark office development

of 22,300m2 and 100 residential units in a self-contained building. A striking

office building of 15 storeys will incorporate the latest environmental design

and technology and create a distinct new development that will complement and

add to the evolution of Paddington Basin. In addition, the scheme has been

deliberately positioned to open up the canal side to the public as part of a

number of public realm improvements to the location. The quality of the

development, which will replace an existing 7,800m2 low rise 1960's building,

will be a further endorsement to this now established West End office location.

* The Angel Centre, 403 St John Street, Islington, EC1

This property is leased to BT until 2010. In March, we completed a restructure

to gain control of this prominent 15,000m2 building, whereby the #4.2 million

per annum rent will continue to be paid by the tenant until expiry. We are now

finalising comprehensive refurbishment proposals, and architectural studies have

identified a number of opportunities which would allow us to extend the size of

the building to 23,200m2, an increase of over 50%. A planning application is to

be submitted before the end of the year, with anticipated delivery of the space

by the end of 2009.

* 40-43 Chancery Lane, Holborn, WC2

A planning decision is expected later this year for a 9,600m2 office

development. This will be a much welcomed addition to this improving location

where there is a shortage of new, grade A buildings, as evidenced by the rapid

take-up of space in nearby schemes. The proposal includes a courtyard setting

and an improved street frontage. This application is made in conjunction with

the freeholder and includes their adjacent ownership. The earliest possible

start of construction will be 2008.

* City Road Estate, EC1

It was disappointing to have recently received a planning refusal for our

9,300m2 office and 235 residential apartment scheme, despite having planning

officer recommendation. However, the existing 9,300m2 buildings, which produce

#1.3 million of income per annum, offer other alternatives for substantial

redevelopment and the design is being re-appraised to identify other exciting

avenues for the scheme.

* Wedge House, 30-40 Blackfriars Road, Southbank, SE1

Planning permission is in place for the redevelopment of this 1950's 3,600m2

building to provide 8,200m2 of offices. The detailed design is now being

finalised and there is the opportunity to commence the development in 2008 when

the occupational lease expires.

* 18-30 Leonard Street, EC2

A planning permission exists for 2,000m2 of offices and 47 private residential

apartments. Subject to the site not being required for planning use in

connection with our proposals for the nearby City Road Estate, construction is

expected to commence later this year.

Lettings

Despite the enlarged size of the group's portfolio as a result of the merger,

the amount of available vacant space is low after last year's record level of

lettings, which included the pre-letting of two major schemes.

However, we have achieved a number of important transactions, which delivered

strong rental growth and added value to the portfolio. In total, 12,500m2 of

lettings were completed in the first half producing a combined rental of #2.6

million per annum. As a result of this activity, available vacant space is only

13,600m2, or under 2% of the portfolio's total rental value. In addition to

this, and excluding pre-let schemes, vacant space under development/

refurbishment totals 33,000m2 with a potential rental value of over #13 million

per annum.

Principal achievements included:

* The final space of 1,030m2 was let at the recently completed

13,900m2 Johnson Building, Hatton Garden at a record level of rent for the

building. The tenant is paying a headline rent of #460 per m2, rising to #480

per m2 on first review which is 26% above our initial lettings last year of #380

per m2.

* Following refurbishment of 6-7 St Cross Street, 1,750m2 was

let in three transactions. At #375 per m(2), these achieved rental levels 27%

above those of #295 per m2 anticipated at the outset of the project.

The strong letting market also enabled us to implement a number of active

management opportunities, whereby leases were surrendered and the space

subsequently re-let at improved levels. As an example, at Holden House, Noho,

following a surrender, we let 630m2 to H&M Hennes, the principal tenant in the

building. The rent achieved was #511 per m2, a substantial increase of 36% over

the #375 per m2 passing rent. In addition, at 4 Grosvenor Place, Belgravia, a

re-letting achieved #745 per m2, the highest rent achieved in this building.

Both these lettings will provide the basis of rent review evidence to drive

values forward at these major holdings.

Acquisitions and disposals

Demand for Central London investments remains strong in an environment where

there is buoyant economic activity, healthy tenant take-up and low vacancy

rates. These conditions are delivering rental growth and make Central London

property the most sought after property asset class in the UK. Consequently,

value-adding acquisitions are difficult to find, whilst the market's strength

provides an ideal opportunity for disposals.

Only one acquisition was made during the first half, that of Castle House, 75

Wells Street, W1 for #20.0 million excluding costs. This prominent corner

building in the Noho village comprises 3,200m2 of multi-let space and offers

refurbishment and lease management potential. The average passing rent is low

at #255 per m2, providing an excellent base for future growth.

We continue to seek acquisitions, concentrating particularly on larger buildings

which provide opportunities to apply our design-led skills to increase floor

area and rents, in both our existing villages and new, improving locations in

Central London. The following two acquisitions have been made since the half

year:

* Woodbridge House, 30 Aylesbury Street, Clerkenwell, EC1

This 7,000m2 office building, located in the heart of Clerkenwell, was acquired

for #46.3 million, excluding costs. It is let to Pinsent Masons, solicitors, at

#2.45 million per annum on a lease expiring in 2015 with a rent review in 2010.

The rent passing is #350 per m2 and offers good reversionary growth prospects.

In addition, there is the opportunity to create additional space and improve the

building configuration.

* 132-142 Hampstead Road, Euston, NW1

This acquisition, for #52.5 million, excluding costs, comprises two substantial

buildings providing 21,500m2 of warehouse and office accommodation and a petrol

filling station on a site of 1.85 acres. They are leased to three tenants,

British Home Stores, University College Hospital and BP Oil at a combined rent

of #2.0 million per annum. There is an existing planning permission for a new

office building of 19,700m(2) and 4,600m(2) of industrial space. We believe

that we can considerably improve on this consent by increasing the amount of

office accommodation and introducing residential units to the site. This is an

improving location adjacent to the important Euston transport interchange, where

there are comprehensive proposals to turn this into a core London office

location.

Disposals from the investment portfolio in the first half totalled #19.6

million, with further sales held back pending REIT conversion. The principal

sale was a residential site at 2-20 Winchester Road, Swiss Cottage, NW3 for

#18.25 million, before costs. This figure was 82% above the 31st January 2007

value, but the nature of the asset fell outside the opportunity for REIT tax

savings. Other sales included the Swinton Shopping Centre, Manchester in June

for #36.8 million. This was held in a joint venture and sold at approximately

book value.

Since the half year, disposal activity has dramatically increased with a further

#314 million of disposals completed or contracted. These assets produced a

total rental income of #5.4 million per annum, representing a gross disposal

yield of 1.7%. Combined, the gross proceeds were 66% or #125 million above the

proforma book values of #189 million.

These properties were all identified as non-core assets at the time of the

acquisition and we have been able to capitalise successfully on the strength of

the market and the benefit of our REIT status.

The principal London disposals were:

* Greenwich Reach, Greenwich, SE10 - Proceeds: #111.8 million.

Value at 31st January 2007: #53.1 million.

An eight acre cleared site on the south bank of the Thames, overlooking Canary

Wharf, with planning consent for apartments and commercial space.

* 160-166 Brompton Road, Knightsbridge, SW3 - Proceeds: #45.0

million. Value at 31st January 2007: #19.2 million.

A 2,300m2 retail and office property producing short-term income of #0.8 million

per annum.

* Argosy House, 215 Great Portland Street, W1 - Proceeds: #23.0

million. Value at 31st December 2006: #16.0 million.

A vacant 2,800m2 office building requiring refurbishment.

* 3-4 South Place, EC2 - Proceeds: #18.2 million. Value at 31st

January 2007: #10.9 million.

Two adjacent vacant office buildings situated close to Broadgate and totalling

3,500m2.

* Broadmead House and Westcombe House, 19-23 Panton Street, SW1

- Proceeds: #17.5 million. Value at 31st December 2006: #9.0 million.

A multi-let 1,500m2 office and restaurant building located adjacent to Leicester

Square and providing short-term income of #0.3 million per annum.

In addition, disposals of provincial assets included:

* Lion and Lamb Yard, Farnham - Proceeds: #32.3 million. Value

at 31st January 2007: #29.4 million.

A 6,500m2 shopping centre producing #1.6 million per annum and anchored by a

Waitrose supermarket. The property was held in a joint venture with the Portman

Estate.

* 32-38 High Street, Dorking - Proceeds: #6.5 million. Value at

31st January 2007: #4.5 million.

A 2,500m2 supermarket, let to J Sainsbury at a rent of #0.3 million per annum.

* Dukes Lane and Middle Street, Brighton - Proceeds: #20.0

million. Value at 31st January 2007: #13.1 million.

A multi-let central shopping centre and entertainment venue totalling 5,950m2

and producing #0.9 million per annum.

* Turnford Triangle, Cheshunt - Proceeds: #5.0 million. Value

at 31st January 2007: #2.3 million.

A three acre cleared site where we had obtained outline residential planning

permission.

* Quadrant Arcade and South Street, Romford - Proceeds: #16.0

million. Value at 31st January 2007: #17.5 million.

A 5,700m2 multi-let retail arcade in the centre of Romford producing #1.0

million per annum.

Further disposals are planned in line with our strategy to focus on larger

Central London properties. The capital generated is being reinvested in our

substantial redevelopment programme which we believe offers high returns and in

significant acquisitions to the portfolio when value enhancing opportunities are

found.

J.D.Burns

11th September 2007

GROUP INCOME STATEMENT (UNAUDITED)

Half year to Half year Year

30.06.07 to 30.06.06 to 31.12.06

Note #m #m #m

Gross property income 50.5 26.1 51.3

Development income 2 6.8 6.3 11.6

Property outgoings (4.4) (2.5) (4.9)

_______ _______ _______

Net property income 52.9 29.9 58.0

Administrative expenses (10.4) (4.2) (10.1)

Goodwill impairment 10 (297.3) - -

_______ _______ _______

(254.8) 25.7 47.9

Revaluation surplus 243.2 99.2 223.3

Profit on disposal of investment properties 3 9.0 1.7 2.9

Profit on disposal of investments 1.0 - -

_______ _______ _______

(Loss)/profit from operations (1.6) 126.6 274.1

Finance income 0.6 0.2 0.4

Finance costs (24.0) (9.9) (20.4)

Exceptional finance costs 4 (1.8) - (18.1)

Movement in fair value of derivative

financial instruments 6.7 2.2 3.2

Share of results of joint ventures 5 (0.2) 3.5 3.6

_______ _______ _______

(Loss)/profit before tax (20.3) 122.6 242.8

Tax credit/(expense) 6 224.0 (30.4) (60.6)

_______ _______ _______

Profit for the period 14 203.7 92.2 182.2

_______ _______ _______

Attributable to:

- Equity shareholders 202.2 92.2 182.2

- Minority interest 1.5 - -

_______ _______ _______

Earnings per share 7 220.75p 172.42p 340.13p

______ _______ _______

Diluted earnings per share 7 219.42p 170.98p 337.21p

______ _______ _______

GROUP STATEMENT OF RECOGNISED INCOME AND EXPENSE (UNAUDITED)

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

Profit for the period 203.7 92.2 182.2

Deferred tax in respect of share-based payments - - 0.6

Revaluation of assets under construction 53.2 - -

Deferred tax in respect of assets under construction (16.0) - -

Pension gains 1.5 - -

_______ _______ _______

Total recognised income and expense relating to the

period 242.4 92.2 182.8

_______ _______ _______

Attributable to:

- Equity shareholders 240.9 92.2 182.8

- Minority interest 1.5 - -

_______ _______ _______

GROUP BALANCE SHEET (UNAUDITED)

30.06.07 30.06.06 31.12.06

Note #m #m #m

Non-current assets

Investment property 8 2,804.6 1,144.6 1,274.0

Property, plant and equipment 9 110.7 0.3 0.3

Investments 8.1 5.3 5.4

Pension scheme surplus 2.9 - -

Financial assets 12 13.0 - 0.1

Other receivables 21.6 13.7 13.7

_______ _______ _______

2,960.9 1,163.9 1,293.5

_______ _______ _______

Current assets

Trading properties 11 9.4 - -

Trade and other receivables 34.1 16.6 39.4

Corporation tax asset - - 1.4

Cash and cash equivalents 20.9 7.2 -

_______ _______ _______

64.4 23.8 40.8

_______ _______ _______

Total assets 3,025.3 1,187.7 1,334.3

Current liabilities

Bank overdraft and loans 12 38.6 - 2.2

Trade and other payables 30.4 21.0 32.5

Corporation tax liability 62.2 3.8 -

Provisions 0.8 0.1 0.1

_______ _______ _______

132.0 24.9 34.8

_______ _______ _______

Non-current liabilities

Financial liabilities 12 929.9 335.1 347.6

Provisions 4.3 1.3 1.3

Deferred tax 13 26.0 131.8 167.2

_______ _______ _______

960.2 468.2 516.1

_______ _______ _______

Total liabilities 1,092.2 493.1 550.9

_______ _______ _______

Total net assets 1,933.1 694.6 783.4

_______ _______ _______

Equity 14

Share capital 5.0 2.6 2.6

Share premium 156.1 156.1 156.1

Revaluation reserve 37.2 - -

Other reserves 914.8 2.7 3.8

Retained earnings 818.5 533.2 620.9

_______ _______ _______

Equity shareholders' funds 1,931.6 694.6 783.4

Minority interest 1.5 - -

_______ _______ _______

Total equity 1,933.1 694.6 783.4

_______ _______ _______

GROUP CASH FLOW STATEMENT (UNAUDITED)

Half year to Half year Year

30.06.07 to 30.06.06 to 31.12.06

Note #m #m #m

Operating activities

Cash received from tenants 63.8 29.5 48.7

Direct property expenses (7.6) (2.2) (5.5)

Cash paid to and on behalf of employees (5.7) (2.9) (4.5)

Other administrative expenses (5.5) (1.6) (3.9)

Exceptional administrative expenses 17 (17.3) - -

Interest received 1.0 0.2 0.4

Interest paid (26.5) (10.6) (21.9)

Exceptional finance costs 17 (3.3) - (17.6)

Tax expense paid in respect of operating

activities (1.4) (2.2) (1.3)

_______ _______ _______

Net cash (used in)/from operating activities (2.5) 10.2 (5.6)

_______ _______ _______

Investing activities

Acquisition of investment properties (20.9) (32.3) (48.9)

Capital expenditure on investment properties (42.9) (8.4) (18.9)

Capital expenditure on assets under

construction (3.2) - -

Disposal of investment properties 19.4 12.0 31.2

Acquisition of subsidiaries (net of cash

acquired) (38.4) - (6.6)

Purchase of property, plant and equipment (0.1) - (0.2)

Proceeds from sale of property, plant and

equipment 0.2 - -

Proceeds from sale of investments 9.2 - -

Distributions received from joint ventures 5.7 - -

Tax expense paid in respect of investment

activities (0.3) (0.8) (2.9)

_______ _______ _______

Net cash used in investment activities (71.3) (29.5) (46.3)

_______ _______ _______

Financing activities

Movement in bank loans 91.5 18.0 78.5

Movement in loan notes 32.5 - -

Redemption of debenture (26.6) - (35.0)

Net proceeds of share issue - 1.0 1.0

Dividends paid (5.6) (5.2) (7.5)

_______ _______ _______

Net cash from financing activities 91.8 13.8 37.0

_______ _______ _______

Increase/(decrease) in cash and cash

equivalents in the period 18.0 (5.5) (14.9)

Cash and cash equivalents at the beginning

of the period (2.2) 12.7 12.7

_______ _______ _______

Cash and cash equivalents at the end of the

period 15.8 7.2 (2.2)

_______ _______ _______

NOTES TO THE FINANCIAL STATEMENTS

1 This statement does not comprise statutory accounts as defined in Section

240 of the Companies Act 1985. The results for the half year to 30th June 2007

and the comparative period for the half year to 30th June 2006 have not been

audited. The results to 31st December 2006 are extracted from the financial

statements for that year. These received an unqualified independent auditor's

report which did not refer to any matter to which the auditors drew attention by

way of emphasis without qualifying their report, nor contain a statement under

s237(2)-(3) of the Companies Act 1985 and have been filed with the Registrar of

Companies.

The results for the half year to 30th June 2007 include those for the

holding company and all of its subsidiaries, together with the group's share of

the results of its joint ventures. The results are prepared on the basis of the

accounting policies set out in the 2006 annual report and financial statements

with the addition of the policies below. These new policies relate to new asset

and liability classes arising as a result of the acquisition of London Merchant

Securities plc.

Business combinations

Business combinations are accounted for under the acquisition method.

Any excess of the purchase price of business combinations over the fair value of

the assets, liabilities and contingent liabilities acquired and resulting

deferred tax thereon is recognised as goodwill. Any discount is credited to the

group income statement in the period of acquisition. Goodwill is recognised as

an asset and reviewed for impairment. Any impairment is recognised immediately

in the group income statement and is not subsequently reversed. Any residual

goodwill is reviewed annually for impairment.

Assets under construction

Property assets acquired with the intention of subsequent development as

investment properties are included as "Assets under construction" within

property, plant and equipment, until the construction or development is

completed, at which time they are reclassified as investment properties. Assets

under construction are included in the balance sheet at fair value, determined

by an independent valuer on the same basis as used for investment properties.

If the fair value increases, this increase is credited directly to the

revaluation reserve, except to the extent that it reverses a revaluation

decrease of the same asset which previously had been charged to the group income

statement. If the fair value decreases, this decrease is recognised in the

group income statement, except to the extent that it reverses previous

revaluation increases of the same asset which have been credited to the

revaluation reserve, in which case it is charged against the revaluation

reserve.

Trading property

Trading property includes those properties which were acquired

exclusively with a view to resale or development and resale and are held at the

lower of cost or transfer value and net realisable value.

Employee benefits

(i) Pensions

a) Defined contribution plans

Obligations for contributions to defined contribution

pension plans are recognised as an expense in the group income statement in the

period to which they relate.

b) Defined benefit plans

The group's net obligation in respect of defined benefit

post-employment plans, including pension plans, is calculated separately for

each plan by estimating the amount of future benefit that employees have earned

in return for their service in the current and prior periods. That benefit is

discounted to determine its present value, and the fair value of any plan assets

is deducted. The discount rate is the yield at the balance sheet date on AA

credit rated bonds that have maturity dates approximating the terms of the

group's obligations. The calculation is performed by a qualified actuary using

the projected unit credit method. Any actuarial gain or loss in the period is

recognised in full in the statement of recognised income and expense.

(ii) Cash settled share-based remuneration

For cash-settled share-based payments, a liability is recognised

based on the current fair value determined at each balance sheet date. The

movement in the current fair value is taken to the group income statement.

As permitted under IFRS, the group has chosen not to adopt early IAS 34,

Interim Financial Reporting, in preparing this interim report and therefore the

financial information is not in full compliance with the presentational and

disclosure requirements of IFRS.

The preparation of financial statements requires management to make

judgements, assumptions and estimates that affect the application of accounting

policies and amounts reported in the group income statement and group balance

sheet. Such decisions are made at the time the financial statements are

prepared and adopted based on the best information available at the time.

Actual outcomes may be different from initial estimates and are reflected in the

financial statements as soon as they become apparent.

2 Development income

The amount of #6.8 million (half year to 30th June 2006: #6.3 million; year to

31st December 2006: #11.6 million) is the proportion of the total profit share

estimated to have been earned by the group in the half year to 30th June 2007

from the construction and letting of a property on behalf of a third party.

3 Profit on disposal of investment properties

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

Disposal proceeds 19.6 12.0 31.2

Carrying value (10.6) (10.3) (30.7)

Leasehold liabilities - - 2.4

_______ _______ _______

9.0 1.7 2.9

_______ _______ _______

4 Exceptional finance costs

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

Cost of acquisition facility 3.3 - -

(Profit)/loss on redemption of (1.5) - 18.1

debenture

_______ _______ _______

1.8 - 18.1

_______ _______ _______

A debenture was fair valued at #8.1 million on the acquisition of London

Merchant Securities plc. On redemption, the premium paid was #6.6 million

generating a profit of #1.5 million.

5 Share of results of joint ventures

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

(Loss)/profit from operations before (0.2) - 0.1

revaluation surplus

Revaluation surplus - 3.5 3.5

_______ _______ _______

(0.2) 3.5 3.6

_______ _______ _______

6 Tax (credit)/expense

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

Corporation tax expense

UK corporation tax and income tax on profits for

the period 10.2 3.8 0.7

REIT conversion charge 54.7 - -

Adjustment for over provision in prior periods - - (1.0)

_______ _______ _______

64.9 3.8 (0.3)

_______ _______ _______

Deferred tax expense

Origination and reversal of temporary (288.9) 26.6 60.6

differences

Adjustment for under provision in prior periods - - 0.3

_______ _______ _______

(288.9) 26.6 60.9

_______ _______ _______

_______ _______ _______

(224.0) 30.4 60.6

_______ _______ _______

The tax for all periods is lower than the standard rate of corporation tax in

the UK. The differences are explained below:

Half year Half year Year

to 30.06.07 to 30.06.06 to 31.12.06

#m #m #m

(Loss)/profit before tax (20.3) 122.6 242.8

_______ _______ _______

Expected tax (credit)/charge based on the

standard rate of corporation tax in the UK of

30% (2006: 30%) (6.1) 36.8 72.8

Indexation relief on investment properties - (6.7) (11.1)

Difference between tax and accounting profit on

disposals 1.0 0.3 0.2

Goodwill impairment 89.2 - -

Deferred tax write-back on REIT conversion (361.8) - -

REIT conversion charge 54.7 - -

Other differences (1.0) - (0.6)

_______ _______ _______

Tax (credit)/expense on current period's profit (224.0) 30.4 61.3

Adjustments in respect of prior periods' tax - - (0.7)

_______ _______ _______

(224.0) 30.4 60.6

_______ _______ _______

Tax charged/(credited) directly to reserves

Deferred tax on revaluation of assets under

construction 16.0 - -

Deferred tax on share-based payments - - (0.6)

_______ _______ _______

16.0 - (0.6)

_______ _______ _______

7 Earnings per share

Weighted

average

Profit for number of Earnings

the period shares per share

#m '000 p

Half year ended 30th June 2007 203.7 92,275 220.75

Adjustment for dilutive share-based payments - 561 (1.33)

_______ _______ _______

Diluted 203.7 92,836 219.42

_______ _______ _______

Half year ended 30th June 2006 92.2 53,475 172.42

Adjustment for dilutive share-based payments - 451 (1.44)

_______ _______ _______

Diluted 92.2 53,926 170.98

_______ _______ _______

Year ended 31st December 2006 182.2 53,567 340.13

Adjustment for dilutive share-based payments - 464 (2.92)

_______ _______ _______

Diluted 182.2 54,031 337.21

_______ _______ _______

Half year ended 30th June 2007 203.7 92,275 220.75

Adjustment for:

Disposal of investment properties and (7.0) - (7.59)

investments

Group revaluation surplus (170.3) - (184.55)

Derivative fair value movement (6.7) - (7.26)

Deferred tax released on REIT conversion (361.8) - (392.09)

REIT conversion charge 54.7 - 59.28

Goodwill impairment 297.3 - 322.19

Disposal of joint venture property 0.2 - 0.22

_______ _______ _______

Adjusted 10.1 92,275 10.95

_______ _______ _______

Half year ended 30th June 2006 92.2 53,475 172.42

Adjustment for:

Deferred tax on capital allowances 1.6 - 2.99

Disposal of investment properties (1.0) - (1.87)

Group revaluation surplus (75.7) - (141.56)

Share of joint venture's revaluation surplus (2.9) - (5.43)

Derivative fair value movement (1.6) - (2.99)

_______ _______ _______

Adjusted 12.6 53,475 23.56

_______ _______ _______

Year ended 31st December 2006 182.2 53,567 340.13

Adjustment for:

Deferred tax on capital allowances 2.7 - 5.04

Disposal of investment properties (1.7) - (3.17)

Group revaluation surplus (167.0) - (311.76)

Share of joint venture's revaluation surplus (2.9) - (5.41)

_______ _______ _______

Adjusted 13.3 53,567 24.83

_______ _______ _______

The adjusted earnings per share excludes the after tax effect of fair value

adjustments to the carrying value of assets and liabilities, and the profit or

loss arising from the disposal of investment properties and investments in order

to show the underlying trend. In addition, the conversion charge and the

release of deferred tax related to the transfer to REIT status and the

impairment of goodwill resulting from the acquisition of London Merchant

Securities plc have also been excluded. For the 2006 figures, the adjusted

earnings per share figure also excludes the deferred tax charge in respect of

capital allowances claimed on the basis that it was unlikely that a liability

would ever crystallise.

8 Investment property

Freehold Leasehold Total

#m #m #m

Carrying value

At 1st January 2007 1,025.2 248.8 1,274.0

Additions 1,134.7 163.3 1,298.0

Disposals (10.6) - (10.6)

Revaluation 209.1 34.1 243.2

_______ _______ _______

At 30th June 2007 2,358.4 446.2 2,804.6

_______ _______ _______

At 1st January 2006 724.2 291.4 1,015.6

Transfer 2.5 (2.5) -

Additions 40.1 0.4 40.5

Disposals (10.3) - (10.3)

Revaluation 81.5 17.7 99.2

Movement in grossing up of headlease liabilities - (0.4) (0.4)

_______ _______ _______

At 30th June 2006 838.0 306.6 1,144.6

_______ _______ _______

At 1st January 2006 724.2 291.4 1,015.6

Transfer 38.5 (38.5) -

Additions 76.1 0.9 77.0

Disposals (10.3) (20.4) (30.7)

Revaluation 196.7 26.6 223.3

Movement in grossing up of headlease liabilities - (11.2) (11.2)

_______ _______ _______

At 31st December 2006 1,025.2 248.8 1,274.0

_______ _______ _______

Adjustments from fair value to carrying value

At 30th June 2007

Fair value 2,381.4 437.7 2,819.1

Adjustment for rents recognised in advance (23.0) (1.0) (24.0)

Adjustment for grossing up of headlease - 9.5 9.5

liabilities

_______ _______ _______

Carrying value 2,358.4 446.2 2,804.6

_______ _______ _______

At 30th June 2006

Fair value 851.8 287.8 1,139.6

Adjustment for rents recognised in advance (13.8) (0.9) (14.7)

Adjustment for grossing up of headlease - 19.7 19.7

liabilities

_______ _______ _______

Carrying value 838.0 306.6 1,144.6

_______ _______ _______

At 31st December 2006

Fair value 1,039.7 243.0 1,282.7

Adjustment for rents recognised in advance (14.5) (0.8) (15.3)

Adjustment for grossing up of headlease - 6.6 6.6

liabilities

_______ _______ _______

Carrying value 1,025.2 248.8 1,274.0

_______ _______ _______

The investment property was revalued at 30th June 2007 at #2,819.1 million (30th

June 2006: #1,139.6 million; 31st December 2006: #1,282.7 million) by CB Richard

Ellis Limited and Smiths Gore (2006: CB Richard Ellis Limited and Keith Cardale

Groves (Commercial) Limited), as external valuers, on the basis of market value

as defined by the Appraisal and Valuation Standards published by the Royal

Institution of Chartered Surveyors.

At 30th June 2007, the historical cost of investment property owned by the group

was #1,126.1 million (30th June 2006: #667.4 million; 31st December 2006: #688.9

million).

Additions for the half year ended 30th June 2007 include #1,104.6 million of

freehold property and #141.0 million of leasehold property acquired as a result

of the acquisition of London Merchant Securities plc on 1st February 2007 (see

note 10).

9 Property, plant and equipment

Assets under Plant and

construction equipment Total

#m #m #m

Net book value

At 1st January 2006 - 0.4 0.4

Depreciation - (0.1) (0.1)

_______ _______ _______

At 30th June 2006 - 0.3 0.3

Additions - 0.2 0.2

Disposals - (0.2) (0.2)

_______ _______ _______

At 31st December 2006 - 0.3 0.3

Arising on acquisition of subsidiary 53.1 1.6 54.7

Additions 2.7 0.1 2.8

Disposals - (0.2) (0.2)

Depreciation - (0.1) (0.1)

Revaluation 53.2 - 53.2

_______ _______ _______

At 30th June 2007 109.0 1.7 110.7

_______ _______ _______

Net book value at 30th June 2007

Cost or valuation 109.0 3.2 112.2

Accumulated depreciation - (1.5) (1.5)

_______ _______ _______

109.0 1.7 110.7

_______ _______ _______

Net book value at 30th June 2006

Cost or valuation - 1.3 1.3

Accumulated depreciation - (1.0) (1.0)

_______ _______ _______

- 0.3 0.3

_______ _______ _______

Net book value at 31st December 2006

Cost or valuation - 1.2 1.2

Accumulated depreciation - (0.9) (0.9)

_______ _______ _______

- 0.3 0.3

_______ _______ _______

Assets under construction were revalued at 30th June 2007 at #109.0

million (30th June 2006: #nil; 31st December 2006: #nil) by CB Richard Ellis

Limited, as external valuers, on the basis of market value as defined by the

Appraisal and Valuation Standards published by the Royal Institution of

Chartered Surveyors.

10 Acquisition of subsidiaries

The whole of the issued share capital of London Merchant Securities plc,

a property investment company, was acquired on 1st February 2007 for a total

cost of #965.6 million.

#m

Cost of acquisition

Equity 912.9

Loan notes 32.5

Cash 12.2

Directly attributable acquisition costs 8.0

_______

965.6

_______

The equity consideration was satisfied by Derwent London plc issuing

46,910,232 ordinary shares at a price of #19.46 on 1st February 2007. This

issue price consists of the nominal value of the ordinary shares of #0.05 and a

share premium of #19.41.

Directly attributable acquisition costs are those charged by the

company's advisers in performing due diligence activities and producing the

acquisition documents.

The net assets acquired at 1st February were:

Book value of net Fair value of net

assets acquired assets acquired

#m #m

Non-current assets

Investment property 1,245.6 1,245.6

Property, plant and equipment 53.9 54.7

Investments 18.0 17.5

Pension scheme surplus 1.4 1.4

Deferred tax asset 12.0 12.0

Financial assets 6.1 6.1

Other receivables 6.2 6.2

_______ _______

1,343.2 1,343.5

_______ _______

Current assets

Trading property 1.3 9.4

Trade and other receivables 9.4 8.8

Cash and cash equivalents 13.9 13.9

_______ _______

24.6 32.1

_______ _______

Total assets 1,367.8 1,375.6

Current liabilities

Bank loans (4.6) (4.6)

Trade and other payables (39.8) (40.9)

_______ _______

(44.4) (45.5)

_______ _______

Non-current liabilities

Financial liabilities (480.4) (510.6)

Deferred tax liability (148.8) (144.4)

Other (6.8) (6.8)

_______ _______

(636.0) (661.8)

_______ _______

Total liabilities (680.4) (707.3)

_______ _______

Total net assets acquired 687.4 668.3

Goodwill on acquisition _______ 297.3

_______

Cost of acquisition 965.6

_______

Adjustments from book value to fair value include those arising from the

fair value adjustments to property, plant and equipment, trading property,

deferred tax and debt. Adjustments arising from the application of Derwent

London's accounting policies have been made to the book value figures.

A detailed review of the existence of intangible assets other than

goodwill has been concluded, and none were found to have any material value. An

impairment test has been carried out on the goodwill arising on the acquisition.

The properties acquired on the acquisition of London Merchant Securities

complement the existing portfolio of properties held by the group. It is

anticipated that, in future, the group will be capable of deriving significantly

enhanced cashflows from the acquired portfolio due to future lease management,

refurbishment and redevelopment, which are proposed to be made to the acquired

property portfolio. While the amount that the group has paid for London

Merchant Securities is justified by these anticipated enhancements and benefits

that will be brought to the group, IAS 36, Impairment of Assets, does not permit

such enhancements to be included in the cashflows used in estimating value in

use for the purposes of impairment testing, and instead requires the cashflows

to be based on the assets in their current condition.

In addition, the benefits arising from the acquired portfolio are specific

to the group and, consequently, the fair value, less costs to sell, of the

acquired business is unlikely to support the carrying amount of the goodwill

associated with the acquisition.

As a consequence, the goodwill associated with this transaction is deemed

to be fully impaired and has been written off to the group income statement.

If the date for this acquisition had been 1st January 2007 then the gross

property income for the combined entity would have increased by #4.6 million.

As the fair value adjustments and adjustments arising from the application of

Derwent London's accounting policies made above have not been made to the

results of London Merchant Securities for 31st December 2006 it is impractical

to assess the impact on the profit for the period arising from a 1st January

2007 acquisition date. The profit for the period ended 30th June 2007 of #203.7

million includes post acquisition profits of #195.6 million for London Merchant

Securities plc.

At the date of publishing the year end report and accounts, work was still

outstanding on the fair value verification exercise. This has now been

completed and a number of amendments were identified to both book value and fair

value.

11 Trading properties

The fair value of trading properties at 30th June 2007 is the same as

their book value.

12 Financial assets and liabilities

30.06.07 30.06.06 31.12.06

#m #m #m

Non-current assets

Derivative financial instruments 13.0 - 0.1

_______ _______ _______

Current liabilities

Bank loans 33.3 - -

Unsecured loans 0.2 - -

Overdraft 5.1 - 2.2

_______ _______ _______

38.6 - 2.2

_______ _______ _______

Non-current liabilities

6.5% Secured Bonds 2026 195.4 - -

10 1/8% First Mortgage Debenture Stock 2019 - 34.5 -

Loan notes 32.5 - -

Bank loans 689.0 280.0 341.0

Mortgages 2.2 - -

Unsecured loans 1.3 - -

Leasehold liabilities 9.5 19.7 6.6

Derivative financial instruments - 0.9 -

_______ _______ _______

929.9 335.1 347.6

_______ _______ _______

_______ _______ _______

Net financial liabilities 955.5 335.1 349.7

_______ _______ _______

13 Deferred tax

Revaluation Capital

surplus allowances Other Total

#m #m #m #m

At 1st January 2007 150.2 16.3 0.7 167.2

Arising on acquisition of 135.9 7.8 (11.3) 132.4

subsidiary

Transfer to investment in

joint ventures (0.7) - - (0.7)

Released during the period (343.7) (24.1) 6.0 (361.8)

Provided during the period in

the group income statement 72.9 - - 72.9

Provided during the period in

the revaluation reserve 16.0 - - 16.0

_______ _______ _______ _______

At 30th June 2007 30.6 - (4.6) 26.0

_______ _______ _______ _______

At 1st January 2006 91.6 13.6 - 105.2

Provided during the period in

the group income statement 24.1 1.6 0.9 26.6

_______ _______ _______ _______

At 30th June 2006 115.7 15.2 0.9 131.8

_______ _______ _______ _______

At 1st January 2006 91.6 13.6 - 105.2

Adjustment to reserves in

respect of deferred tax on

share-based payments - - (0.6) (0.6)

Arising on acquisition of 1.7 - - 1.7

subsidiary

Provided during the period in

the group income statement 56.9 2.7 1.3 60.9

_______ _______ _______ _______

At 31st December 2006 150.2 16.3 0.7 167.2

_______ _______ _______ _______

Deferred tax on the revaluation surplus is calculated on the basis of the

chargeable gains that would crystallise on the sale of the investment property

portfolio as at each balance sheet date. The calculation takes account of

indexation on the historic cost of the properties and any available capital

losses. Due to the group's conversion to REIT status on 1st July 2007, deferred

tax is only provided at 30th June 2007 on properties outside of the REIT regime.

14 Equity

Share Share Revaluation Other Retained

capital premium reserve reserves earnings

#m #m #m #m #m

At 1st January 2007 2.6 156.1 - 3.8 620.9

Issue of shares 2.4 - - - -

Premium on issue of shares - - - 910.5 -

Revaluation of assets under

construction - - 53.2 - -

Deferred tax on revaluation of

assets under construction - - (16.0) - -

Pension gains - - - - 1.5

Foreign exchange translation

differences - - - - (0.5)

Share-based payments expense

transferred to reserves - - - 0.5 -

Profit for the period - - - - 203.7

Dividend paid - - - - (5.6)

_______ _______ _______ _______ _______

5.0 156.1 37.2 914.8 820.0

Minority interest - - - - (1.5)

_______ _______ _______ _______ _______

At 30th June 2007 5.0 156.1 37.2 914.8 818.5

_______ _______ _______ _______ _______

At 1st January 2006 2.6 155.1 - 2.3 446.2

Premium on issue of shares - 1.0 - - -

Share-based payments expense

transferred to reserves - - - 0.4 -

Profit for the period - - - - 92.2

Dividend paid - - - - (5.2)

_______ _______ _______ _______ _______

At 30th June 2006 2.6 156.1 - 2.7 533.2

_______ _______ _______ _______ _______

At 1st January 2006 2.6 155.1 - 2.3 446.2

Premium on issue of shares - 1.0 - - -

Share-based payments expense

transferred to reserves - - - 0.9 -

Deferred tax in respect of

share based payments - - - 0.6 -

Profit for the period - - - - 182.2

Dividend paid - - - - (7.5)

_______ _______ _______ _______ _______

At 31st December 2006 2.6 156.1 - 3.8 620.9

_______ _______ _______ _______ _______

The #910.5 million movement in other reserves relates to the premium on

the issue of shares as equity consideration for the acquisition of London

Merchant Securities (see note 10).

15 Dividend

The results for the half year to 30th June 2007 do not include the

dividend declared after the end of the accounting period. In respect of these

results, a dividend of 7.5p per share (2006 interim: 4.225p; 2006 2nd interim:

10.525p) will be paid on 9th November 2007 to those shareholders on the register

at the close of business on 5th October 2007. The second interim dividend

payment of 10.525p for 2006 replaced the final dividend in respect of that year.

16 Net asset value per share

Net asset

Net Number of value per

assets shares share

#m '000 p

At 30th June 2007 1,933.1 100,574 1,922

Adjustment for deferred tax on revaluation 0.3 - -

surplus

Adjustment for fair value of derivative

financial instruments (13.0) - (13)

Adjustment for fair value adjustment of secured 22.1 - 22

bonds

_______ _______ _______

Adjusted 1,942.5 100,574 1,931

_______ _______ _______

At 30th June 2006 694.6 53,656 1,295

Adjustment for deferred tax on capital 15.2 - 28

allowances

Adjustment for deferred tax on revaluation 115.7 - 216

surplus

Adjustment for post tax fair value of derivative

financial instruments 0.6 - 1

_______ _______ _______

Adjusted 826.1 53,656 1,540

_______ _______ _______

At 31st December 2006 783.4 53,656 1,460

Adjustment for deferred tax on capital 16.3 - 30

allowances

Adjustment for deferred tax on revaluation 150.2 - 280

surplus

Adjustment for post tax fair value of derivative

financial instruments (0.1) - -

_______ _______ _______

Adjusted 949.8 53,656 1,770

_______ _______ _______

At 30th June 2006 and 31st December 2006, adjusted net assets excluded the

deferred tax provided in respect of capital allowances claimed, on the basis

that it was unlikely that this liability would ever crystallise. The deferred

tax on the revaluation surplus and the post tax fair value of derivative

financial instruments are also excluded, on the basis that these amounts are not

relevant when considering the group as an ongoing business.

At 30th June 2007, the majority of the deferred tax on the revaluation surplus

relates to a property which was disposed of shortly after the balance sheet date

crystallising the tax at that date. Therefore, the deferred tax on this

property has not been added back to arrive at the adjusted net assets. The

remaining deferred tax on the revaluation surplus together with the fair value

of derivative financial instruments and the secured bonds are excluded from

adjusted net assets.

17 Exceptional cash flows

The half year to 30th June 2007 contained exceptional administration

costs of #17.3 million (half year to 30th June 2006: #nil; year to 31st December

2006: #nil) which relate to costs incurred by London Merchant Securities plc

prior to the acquisition and accrued at 31st January 2007 in the fair value

balance sheet shown in note 10.

The half year to 30th June 2007 also contained exceptional finance costs

of #3.3 million (half year to 30th June 2006: #nil; year to 31st December 2006:

#17.6 million), which is the cost of acquisition finance (see note 4).

18 Total return

Total return for the half year to 30th June 2007 is 9.7% (half year to 30th June

2006: 16.1%; year to 31st December 2006: 33.6%). Total return is the movement

in adjusted net asset value per share, as derived in note 16, plus the dividend

per share paid during the period expressed as a percentage of the adjusted net

asset value per share at the beginning of the period.

19 Gearing

Balance sheet gearing at 30th June 2007 was 49.1% (30th June 2006: 47.1%; 31st

December 2006: 44.7%). This is defined as net debt divided by net assets.

Profit and loss gearing for the half year to 30th June 2007 was 1.50 (half year

to 30th June 2006: 2.07; year to 31st December 2006: 1.85). This is defined as

recurring net property income less administrative costs divided by net interest

payable, having reversed the reallocation of ground rent payable on leasehold

properties to interest payable of #0.3 million (half year to 30th June 2006:

#0.6 million; year to 31st December 2006: #0.9 million).

20 Post balance sheet events

Since the 30th June 2007, the group has completed the purchase of a

freehold property for #46.3 million, excluding costs, and exchanged contracts

for the purchase of a freehold property for #52.5 million, excluding costs. In

addition, the group has completed the disposal of 9 properties for a total of

#215.4 million, excluding costs, and exchanged contracts on the disposal of a

further 9 properties for a total of #98.8 million, excluding costs.

21 Copies of this announcement are being posted to shareholders on 20th

September 2007 and will be available on the company's website,

www.derwentlondon.com, from the date of this statement. Copies will also be

available from the Company Secretary, Derwent London plc, 25 Savile Row, London,

W1S 2ER.

Post acquisition proforma balance sheet (unaudited)

Derwent Group LMS Derwent

31.12.06 Group London

#m 31.01.07 Adjustments Group

#m #m #m

Non-current assets

Investment property 1,274.0 1,245.6 - 2,519.6

Property, plant and equipment 0.3 54.7 - 55.0

Investments 5.4 17.5 - 22.9

Pension scheme surplus - 1.4 - 1.4

Deferred tax asset - 12.0 - 12.0

Financial assets 0.1 6.1 - 6.2

Other receivables 13.7 6.2 - 19.9

_______ _______ _______ _______

1,293.5 1,343.5 - 2,637.0

_______ _______ _______ _______

Current assets

Trading property - 9.4 - 9.4

Corporation tax asset 1.4 - - 1.4

Trade and other receivables 39.4 8.8 (8.0) 40.2

Cash and cash equivalents - 13.9 - 13.9

_______ _______ _______ _______

40.8 32.1 (8.0) 64.9

_______ _______ _______ _______

Current liabilities

Bank overdraft and loans (2.2) (4.6) - (6.8)

Trade and other payables (32.5) (40.9) - (73.4)

Provisions (0.1) - - (0.1)

_______ _______ _______ _______

(34.8) (45.5) - (80.3)

_______ _______ _______ _______

Non-current liabilities

Financial liabilities (347.6) (510.6) (44.7) (902.9)

Deferred tax liability (167.2) (144.4) - (311.6)

Provisions (1.3) - - (1.3)

Other - (6.8) - (6.8)

_______ _______ _______ _______

(516.1) (661.8) (44.7) (1,222.6)

_______ _______ _______ _______

Total net assets 783.4 668.3 (52.7) 1,399.0

_______ _______ _______ _______

Equity

Share capital 2.6 82.6 (80.2) 5.0

Share premium 156.1 22.2 (22.2) 156.1

Other reserves 3.8 11.1 899.4 914.3

Retained earnings 620.9 496.4 (793.7) 323.6

Equity minority interests - 56.0 (56.0) -

_______ _______ _______ _______

Total equity 783.4 668.3 (52.7) 1,399.0

_______ _______ _______ _______

Net asset value per share 1,391p

_______

Adjusted net asset value per

share 1,717p

_______

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFIEFSSWSEEU

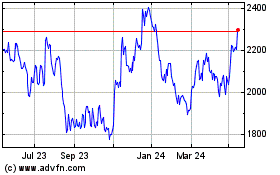

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2024 to Aug 2024

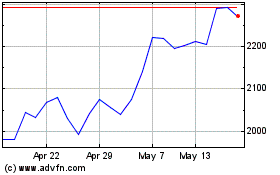

Derwent London (LSE:DLN)

Historical Stock Chart

From Aug 2023 to Aug 2024