TIDMFFX TIDMCRS

RNS Number : 1790R

FAIRFX Group PLC

07 March 2016

7 March 2016

FairFX Group plc

("FairFX" or "the Group" or "the Company")

Proposed Placing, strategic investment by Crystal Amber Fund and

2015 trading statement

GBP5.25 million investment to accelerate marketing strategy

Strong overall performance in 2015 due to focus on growing

FairFX Card businesses

FairFX, the low cost multi--currency payments service, is

pleased to announce a proposed placing to raise GBP5.25 million

(before expenses), including a significant strategic investment

from Crystal Amber Fund Limited ("Crystal Amber") of GBP5.0

million. The Company also provides an update ahead of its full year

2015 results.

Highlights of proposed investment:

- Proposed Placing totaling GBP5.25 million at 20p per share from new and existing investors;

- Crystal Amber investing GBP5.0 million as part of the Placing;

- Conditional Issue of Warrant to Crystal Amber over 7,500,000 new Ordinary Shares;

- Strategic investment will be used to accelerate FairFX's

marketing activities and aggressively target the Corporate Card

segment in 2016;

- FairFX will be funded to execute its proposed marketing and organic expansion strategy; and

- Crystal Amber will hold approximately 24.24% of the enlarged

issued share capital following the issuance of the Placing

Shares*.

* Conditional upon the FCA Condition being satisfied as further

described in this announcement.

2015 trading highlights:

- Full year 2015 turnover up 32% to approximately GBP625 million;

- 75,039 new currency card customers acquired during the year, up 56% on 2014; and

- Across all product segments, a total of 103,338 new customers

acquired during the year, up 20% on 2014.

An explanatory circular containing a notice of General Meeting

of the Company to be held at the offices of Berwin Leighton Paisner

LLP, Adelaide House, London Bridge, London, EC4R 9HA on 29 March

2016 at 11.00am, will shortly be posted to Shareholders (the

"Circular") and will be made available to view on the Company's

website at www.fairfxplc.com/investors. Unless otherwise defined,

defined terms within this announcement have the same meanings as

those to be set out within the circular. Definitions are also set

out at the end of this announcement.

Introduction

FairFX, the low cost multi--currency payments service, today

announces a conditional Placing of 26,250,000 new Ordinary Shares

with Crystal Amber and other institutional investors to raise

approximately GBP5.25 million (before expenses).

The Placing is conditional, inter alia, upon the Company

obtaining approval from its Shareholders to grant the Directors

authority to allot the Placing Shares and to dis-apply statutory

pre-emption rights which would otherwise apply to the allotment of

the Placing Shares. The Placing Shares will be issued in two

tranches; the First Placing Shares and the Second Placing Shares,

in order to provide the FCA with the appropriate notification and

period of time to raise any objection, as required by the Payment

Services Regulations 2009, prior to Crystal Amber acquiring a

Qualifying Holding (as defined in such regulations) in the

Company's subsidiary fairfxplc ("FCA Condition").

Background to and reasons for the Placing

The Directors believe that the strategic investment by Crystal

Amber and other placees will enable FairFX to significantly

accelerate its growth plans combining a more aggressive land-grab

in both the retail and corporate customer segments, as well as

rolling out its offering to other locations.

Accordingly, it is intended that the net proceeds of the Placing

will be deployed by the Company across its key strategic

initiatives. Specifically, marketing spend for all retail customers

across TV and digital platforms will be bolstered, sales effort to

corporates for the market-leading FairFX platform will be expanded

and I.T. resources will be selectively added to speed up new

product developments and overseas roll-outs.

The investment also provides FairFX with a key strategic

institutional investor who can provide insight and advice to the

business, as well as access to a business network which can help

accelerate top-line sales growth.

Trading update for 2015

The Company is pleased to report that 2015 was another year of

commendable progress, with turnover increasing by 32% to

approximately GBP625 million. During the year 103,338 new customers

were acquired across all of the Company's product segments (up 20%

on 2014), taking its total number of customers to 508,048.

The Company's strategic focus on higher value products is

delivering strong results with numbers of new Retail Card customers

up 40%, year on year, new Wholesale Dealing customers up 44% and

new Corporate Card customers up 40%. The combined total number of

new Retail and Corporate card customers was 75,039, up 56% on the

previous year (2014: 48,163). This growth correlated with the

Company's marketing strategy of focusing on acquiring card

customers over the lower margin cash-in-the-post customers.

FairFX expects to report its full year results in April 2016

Commenting on the strategic investment and 2015 trading, Chief

Executive Officer, Ian Strafford-Taylor, said: "2015 was notable

for the success of our stated strategy of a land-grab in the Retail

Card space. The growth across Retail and Corporate demonstrates the

success of the marketing strategy, in terms of focusing on

acquiring card customers over the lower margin cash-in-the-post

customers.

"We are also absolutely delighted with the strategic tie-up with

Crystal Amber. As well as representing a major endorsement of

FairFX's business model and success to date, this investment

provides the necessary resources to execute our land-grab strategy

in 2016 and beyond and push aggressively into the Corporate Card

space. We are extremely excited about what we will be able to

deliver."

Richard Bernstein, Investment Adviser to Crystal Amber,

commented: "We're delighted to conditionally acquire a significant

holding in FairFX, an online business with more than 500,000

customers utilising its peer-to-peer payments platform. We've

identified a hugely scalable business model and are looking forward

to assisting FairFX to capitalise on its potential."

FairFX Group plc

Ian Strafford-Taylor,

CEO +44 (0) 20 7778 9308

------------------------------ ---------------------

Cenkos Securities plc

Max Hartley/Callum Davidson +44 (0) 20 7397 8925

------------------------------ ---------------------

Yellow Jersey PR

Charles Goodwin +44 (0) 7747 788 221

------------------------------ ---------------------

The Placing

The Company has conditionally raised approximately GBP5.1

million (net of expenses) through the issue of the Placing Shares

at the Issue Price, which represents a discount of approximately

29.8 per cent. to the closing middle market price of 28.5p per

Existing Ordinary Share on 4 March 2016, being the last practicable

date prior to the publication of this announcement.

The Placing is conditional, inter alia, upon the Company

obtaining approval from its Shareholders to grant the Directors

authority to allot the Placing Shares and to dis-apply statutory

pre-emption rights which would otherwise apply to the allotment of

the Placing Shares. The Placing Shares will be issued in two

tranches; the First Placing Shares and the Second Placing Shares,

in order to allow for the required FCA Consent Condition to be

satisfied. The Placing is conditional upon the admission of the

Placing Shares to trading on AIM. The Placing Shares will represent

approximately 25.5 per cent. of the Company's issued ordinary share

capital immediately following Second Admission.

If the FCA Consent Condition is not satisfied or waived, the

Second Placing Shares will not be issued or admitted to trading on

AIM. If the Placing is limited to the issuance of the First Placing

Shares only, the gross proceeds of the Placing would be limited to

approximately GBP1.80 million.

The Placing Agreement

Pursuant to the terms of the Placing Agreement, Cenkos, as agent

for the Company, has conditionally agreed to use its reasonable

endeavours to procure subscribers for the Placing Shares at the

Issue Price.

The Placing Agreement is conditional upon, inter alia, the

Resolutions set out in the Notice of General Meeting being duly

passed at the General Meeting and First Admission becoming

effective on or before 8.00am on 30 March 2016 (or such later time

and/or date as the Company and Cenkos may agree, but in any event

by no later than 8.00am on 30 June 2016). In addition the placing

of the Second Placing Shares is conditional upon, inter alia,

satisfaction or waiver of the FCA Consent Condition and Second

Admission.

Settlement and dealings

Application will be made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that First Admission will occur on 30 March 2016. Application will

be made for the Second Placing Shares as soon as is practicable

following satisfaction or waiver of the FCA Consent Condition.

The Placing Shares will, when issued, rank in full for all

dividends and other distributions declared, made or paid on the

Ordinary Shares following Admission and otherwise pari-passu in all

respects with the Existing Ordinary Shares.

Shareholdings post transaction and Concert Party

(MORE TO FOLLOW) Dow Jones Newswires

March 07, 2016 02:00 ET (07:00 GMT)

Following First Admission, it is expected that Crystal Amber

will hold 7,750,000 Ordinary Shares, representing approximately

9.03 per cent. of the Company's enlarged issued share capital

immediately following First Admission assuming no further shares

are issued by the Company or purchased by Crystal Amber in the

market. Following Second Admission, it is expected that Crystal

Amber will hold 25,000,000 Ordinary Shares, representing

approximately 24.24 per cent. of the Company's then issued share

capital assuming no further shares are issued by the Company or

purchased by Crystal Amber in the market. Following Second

Admission and exercise of the Warrant in full, it is expected that

Crystal Amber will hold 32,500,000 Ordinary Shares, representing

approximately 29.38 per cent. of the Company's then issued share

capital, assuming no further shares are issued by the Company or

purchased by Crystal Amber in the market.

Following Second Admission and the exercise of the Warrant in

full, it is expected that the Concert Party, further details of

which are disclosed in the Company's Admission Document dated 1

August 2014 and is available to view on the Company's website at

www.fairfxplc.com/investors, will hold approximately 51.2 per cent.

of the Company's then issued share capital, assuming no further

shares are issued.

Warrant

In consideration of Crystal Amber's strategic investment in the

Company by way of its participation in the Placing, the Company has

conditionally agreed with Crystal Amber to issue a warrant to

subscribe for up to 7,500,000 Ordinary Shares at a price of 27

pence per Ordinary Share (the "Warrant") to Crystal Amber.

The issue of the Warrant is conditional upon granting of

authority to issue shares and disapplication of pre-emption rights

by Shareholders at the General Meeting and upon Second Admission

occurring.

The Warrant, which will represent approximately 7.3 per cent. of

the Company's issued share capital as enlarged by the Placing, can

be exercised in up to three tranches, and must be exercised by the

third anniversary of its issue, failing which it will lapse.

Board appointment

Following Second Admission, Crystal Amber will have the right to

appoint a director to the board of the Company. This right shall

cease if Crystal Amber holds less than 15 per cent. of the

Company's issued share capital.

General Meeting

Set out at the end of the Circular will be a notice convening

the General Meeting to be held at 11.00 am at the offices of Berwin

Leighton Paisner LLP, Adelaide House, London Bridge, London, EC4R

9HA on 29 March 2016 for the purposes of considering and, if

thought fit, passing the Resolutions.

Resolution 1, which will be proposed as an ordinary resolution,

is to authorise the Directors

(a) to allot the Placing Shares in connection with the

Placing;

(b) to issue the Warrant;

(c) to allot Ordinary Shares up to an aggregate nominal amount

of GBP256,220.13 being an amount equal to one third of the

Company's issued share capital (excluding treasury shares) as at 4

March 2016. The Directors may exercise this authority to issue

shares as consideration in any future business acquisitions carried

out by the Company or any of its subsidiaries, from time to time.

However the authority will only be exercised if the Directors

consider that it is in the best interests of the Company at that

time; and;

(d) to issue an additional aggregate nominal amount of up to

GBP256,220.13 being an amount equal to one third of the Company's

issued share capital (excluding treasury shares) as at 4 March

2016. This additional authority is to be applied to rights issues

only and is in accordance with the recommendations of the Rights

Issue Review Group and the Association of British Insurers (the

'ABI'). Should the Directors exercise such further authority, they

intend to comply with the ABI recommendations and stand for

re-election at the next AGM of the Company if they wish to remain

in office.

The authorities granted under this resolution replace those put

in place at the last Annual General Meeting and will expire at the

conclusion of the next Annual General Meeting of the Company or, if

earlier, 30 June 2016.

Resolution 2, which will be proposed as a special resolution and

which is subject to the passing of Resolution 1, dis-applies

Shareholders' statutory pre-emption rights in relation to

(a) the issue of the Placing Shares pursuant to the Placing;

(b) the issue of the Warrant; and

(c) the allotment of equity securities or sale of treasury

shares for cash up to an aggregate nominal value of GBP76,866.04

(being approximately 10 per cent. of the Company's issued ordinary

share capital (excluding treasury shares) as at 4 March 2016)

without first offering the securities to existing shareholders. The

resolution also dis-applies the statutory pre-emption provisions in

connection with a rights issue and allows the Directors, in the

case of a rights issue, to make appropriate arrangements in

relation to fractional entitlements or other legal or practical

problems which might arise. The authority provides the Company with

the flexibility to allot shares or other securities for cash

without first offering the securities to existing Shareholders;

however the authority will only be exercised if the Directors

consider it to be in the best interests of the Company at the

time.

The disapplication replaces those put in place at the last

Annual General Meeting and will expire at the conclusion of the

next Annual General Meeting or, if earlier, 30 June 2016.

Action to be taken

A Form of Proxy for use at the General Meeting will accompany

the Circular. The Form of Proxy should be completed and signed in

accordance with the instructions thereon and returned to the

Company's registrars, Capita Registrars Limited, The Registry, 34

Beckenham Road, Beckenham, Kent BR3 4TU as soon as possible, but in

any event so as to be received by no later than 11.00am on 23 March

2016. The completion and return of a Form of Proxy will not

preclude Shareholders from attending the General Meeting and voting

in person should they so wish.

Directors' Recommendation

The Directors consider the Placing and Warrant issue to be in

the best interests of the Company and its Shareholders as a whole

and accordingly unanimously recommend Shareholders to vote in

favour of the Resolutions to be proposed at the General Meeting as

they intend to do so in respect of their own beneficial holdings

amounting, in aggregate, to 2,127,750 Existing Ordinary Shares,

representing approximately 2.8 per cent. of the existing issued

ordinary share capital of the Company.

Placing Statistics

Issue Price 20 p

Number of Placing Shares to

be issued 26,250,000

Total gross proceeds of the GBP5.25 million

Placing

Gross proceeds to be raised GBP1.80 million

on First Admission

Gross proceeds to be raised GBP3.45 million

on Second Admission

Proceeds receivable by the GBP5.1 million

Company, net of expenses*

Number of Existing Ordinary

Shares 76,866,039

Number of Ordinary Shares in

issue following First Admission 85,866,039

Number of Ordinary Shares in

issue following Second Admission 103,116,039

Placing Shares as a percentage

of the Existing Ordinary Shares 34.15%

*assuming Second Admission becomes effective

Expected timetable of principal events

Announcement of the Placing 7 March 2016

Explanatory Circular and Form by 11 March 2016

of Proxy posted to Shareholders

(by first class post)

Latest time and date for receipt 11.00am on 23

of Form of Proxy March 2016

General Meeting 11.00am on 29

March 2016

First Admission

8.00am on 30 March

2016

Second Admission within 5 business

days following

satisfaction or

waiver of the

FCA Consent Condition

Where applicable, expected date 30 March 2016

for CREST accounts to be credited

in respect of First Placing Shares

in uncertificated form

Where applicable, expected date by 13 April 2016

for posting of share certificates

for First Placing Shares

Definitions

"Act" the Companies Act 2006

"AIM" the market of that name operated

by the London Stock Exchange

"AIM Rules" the AIM Rules for Companies

published by the London Stock

Exchange, as amended from time

to time

"Board" or "Directors" the directors of the Company

"Cenkos" Cenkos Securities plc, the

Company's nominated adviser

and broker

"Company" or FAIRFX Group plc, a company

"FAIRFX" incorporated and registered

in England and Wales under

the Companies Act 1985 with

registered number 8922461

"CREST" the relevant system (as defined

in the Uncertificated Securities

Regulations 2001 SI 2001:No.3755

(as amended)) in respect of

which Euroclear UK & Ireland

Limited is the operator (as

defined in those regulations)

"Crystal Amber" Crystal Amber Fund Limited,

(MORE TO FOLLOW) Dow Jones Newswires

March 07, 2016 02:00 ET (07:00 GMT)

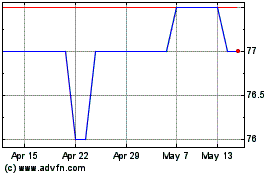

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Nov 2023 to Nov 2024