TIDMCRPR

RNS Number : 8072T

Cropper(James) PLC

19 November 2019

The advanced materials and paper products group, is pleased to

announce its

Half year results to 28 September 2019

Half year Half year Full year

to 28 September to 29 September to 30 March

2019 2018 2019

GBPm GBPm GBPm

Revenue 52.8 50.3 101.1

Adjusted operating profit (excluding

IAS19 impact) 2.8 2.0 4.3

Operating profit 2.6 1.8 3.4

Adjusted profit before tax (excluding

IAS19 impact) 2.6 1.9 4.0

Impact of IAS 19 (0.6) (0.5) (1.4)

Profit before tax 2.0 1.4 2.6

Earnings per share - basic and

diluted 17.0p 12.9p 24.3p

Dividend per share declared 2.5p 2.5p 13.5p

Net borrowings (excluding IFRS

16) (10.8) (6.6) (8.6)

Net borrowings (including IFRS

16) (15.3) (6.6) (8.6)

Equity shareholders' funds 21.9 23.0 21.3

Gearing % - before IAS 19 deficit

and IFRS 16 27% 17% 21%

Gearing % - after IAS 19 deficit

and IFRS 16 70% 29% 40%

Capital expenditure 3.3 1.9 5.2

Highlights

-- Revenue growth in all divisions with total revenue up 5% on prior period comparative

-- Adjusted PBT (excluding IAS 19 impact) at GBP2.6m, up 31% on prior period comparative

-- PBT at GBP2.0m, up 42% on prior period comparative

-- EPS (diluted) 17.0p up 32% on prior period comparative

-- Colourform(TM) revenues exceed GBP1m in the period

-- Mix improvements and pulp price softening returns paper to profitability

-- Expansion of TFP non-woven capacity on schedule, increasing

capacity by 50% by end of the 2020 calendar year

Mark Cropper, Chairman, commented:

"TFP has delivered its best ever sales performance for a half

year and is set to continue growth in the second half. Plans to

provide an additional 50% capacity in TFP by the end of the 2020

calendar year are on track. Paper sales are projected to grow year

on year with the benefits of an improved mix and a softening of

pulp price leading to a return to profit. Continued

commercialisation for Colourformä is projected as the business

gains further traction in the market. We have instituted an

Environmental, Social and Corporate Governance (ESG) sub-committee

and will commence formal measurement and reporting in line with ESG

objectives in 2020.

We invest significantly in people, innovation and capability.

This will ensure that over the long term the Group has the

potential to sustain growth across all its businesses. In the

nearer term, the full year results are anticipated to be in line

with management expectations."

Enquiries:

Isabelle Maddock, Group Robert Finlay, Anita Ghanekar ,

Finance Director Henry Willcocks

James Cropper PLC (AIM:CRPR.L) Shore Capital

Telephone: +44 (0) 1539 Telephone: +44 (0) 207 408 4090

722002

www.jamescropper.com

Half year Half year Full year

to 28 September to 29 September to 30 March

2019 2018 2019

Summary of results GBP'000 GBP'000 GBP'000

Revenue 52,792 50,300 101,095

Adjusted operating profit (excluding

IAS19 impact) 2,826 2,054 4,262

Operating profit 2,554 1,782 3,408

Adjusted profit before tax (excluding

IAS19 impact) 2,557 1,956 3,962

Impact of IAS19 (548) (542) (1,386)

Profit before tax 2,009 1,414 2,576

--------------------------------------- ----------------- ----------------- -------------

Half year Half year Full year

to 28 September to 29 September to 30 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Revenue

James Cropper Paper 37,992 37,227 74,318

James Cropper 3D Products 1,211 135 290

Technical Fibre Products 13,589 12,938 26,487

---------------------------------------- ----------------- ----------------- -------------

52,792 50,300 101,095

Adjusted operating profit (excluding

IAS19 impact) 2,826 2,054 4,262

Net interest (excluding IAS19 impact) (269) (98) (300)

---------------------------------------- ----------------- ----------------- -------------

Adjusted profit before tax (excluding

IAS19 impact) 2,557 1,956 3,962

IAS19 pension adjustments

Net current service charge against

operating profits (273) (272) (854)

Finance costs charged against interest (275) (270) (532)

---------------------------------------- ----------------- ----------------- -------------

(548) (542) (1,386)

---------------------------------------- ----------------- ----------------- -------------

Profit before tax 2,009 1,414 2,576

---------------------------------------- ----------------- ----------------- -------------

Balance sheet summary Half year Half year Full year

to 28 September to 29 September to 30 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Non-pension assets - excluding

cash 67,304 61,820 64,871

Right of use assets* - net book 4,016 - -

value

Non-pension liabilities - excluding

borrowings (15,704) (15,709) (16,236)

Right of use leases* (4,506) - -

------------------------------------- ----------------- ----------------- -------------

51,110 46,111 48,635

Net IAS19 pension deficit (after

deferred tax) (18,351) (16,447) (18,798)

------------------------------------- ----------------- ----------------- -------------

32,759 29,664 29,837

Net borrowings (excluding Right

of use leases*) (10,817) (6,626) (8,561)

------------------------------------- ----------------- ----------------- -------------

Equity shareholders' funds 21,942 23,038 21,276

------------------------------------- ----------------- ----------------- -------------

Gearing % - before IAS19 deficit

and IFRS 16* 27% 17% 21%

Gearing % - after IAS19 deficit

and IFRS 16* 70% 29% 40%

Capital expenditure 3,284 1,9,44 5,229

* refer to Note 1 and Note 9 for adoption of IFRS 16 adopted 31

March 2019.

Dear Shareholders

I am pleased to report that James Cropper PLC recorded a 5%

increase in revenue for the first half, compared to the prior year

comparative, with growth in all divisions. Adjusted profit before

tax (excluding the impact of IAS 19) was GBP2.6m for the first half

of the current financial year, compared to GBP1.9m in the prior

comparative period. After the impact of IAS19, profit before tax is

GBP2.0m, up from GBP1.4m in the prior comparative period.

In Paper, the product portfolio mix improvement strategy is

progressing and pulp prices have softened bringing the division

back to a profitable position. Meanwhile, TFP profits have grown in

the period on record first half sales. For the first time,

Colourform(TM) revenue exceeded the GBP1m milestone.

Technical Fibre Products ("TFP")

TFP has delivered its best sales performance for a first half

year, with 5% revenue growth over the comparable period last year

and is expected to deliver further growth in the second half. There

was growth across all the targeted global market sectors, with

notable performances in the aerospace, defence and fuel cell

markets. Plans for additional non-woven capability at Burneside,

which will increase capacity by a further 50% by the end of the

2020 calendar year, are on track.

James Cropper Paper ("Paper")

Paper revenues have grown by 2% compared to the comparable

period last year, with growth seen in all geographical markets -

except the UK. Further improvement in value of the product

portfolio and the softening of pulp prices over the first half of

the year has returned the division to profitability.

Further commercialisation of CupCyclingä has increased the

output of the existing coffee cup recycling plant, providing

further independence from virgin pulp. As the proportion of

recycled coffee cup pulp currently used is relatively low compared

to virgin pulp, we are actively working on increasing recycling

capacity and capability to make greater use of waste fibres.

Colourform(TM) ("3D Products")

Colourformä revenues in the first half exceeded the GBP1m

milestone and have been generated predominantly in Europe in the

beauty and cosmetics market. The Colourform(TM) business is fully

engaged with a pipeline of projects that demonstrate strong

interest in high quality replacements for single use plastics. The

ability to provide a full range of colour is proving to be a unique

and defining feature.

Pension

The Group operates three pension schemes with close to 60% of

employees holding a defined contribution personal payment plan. The

two funded pension schemes provide defined benefits - for a

decreasing number of its employees. The IAS19 valuations, for the

defined benefit schemes as at 28 September 2019, revealed a

combined deficit of GBP22.1m, compared with GBP22.6m as at 30 March

2019. After deferred taxation the net deficit stands at

GBP18.4m.

Earnings per share and Dividend

Diluted earnings per share increased to 17.0 pence, compared to

12.9 pence in the prior year comparative period.

The Board has declared an interim dividend of 2.5p per share

(2018: 2.5p). The final dividend for the year to 28 March 2020 will

be subject to shareholder approval at the AGM on 29 July 2020.

Outlook

TFP has delivered its best ever sales performance for a half

year and is set to continue growth in the second half. Plans to

provide an additional 50% capacity in TFP by the end of the 2020

calendar year are on track. Paper sales are projected to grow year

on year with the benefits of an improved mix and a softening of

pulp price leading to a return to profit. Continued

commercialisation for the Colourformä business is projected as the

business gains further traction in the market. We have instituted

an Environmental, Social and Corporate Governance (ESG)

sub-committee and will commence formal measurement and reporting in

line with ESG objectives in 2020.

We invest significantly in people, innovation and capability.

This will ensure that over the long term the Group has the

potential to sustain growth across all its businesses. In the

nearer term, the full year results are anticipated to be in line

with management expectations.

Mark Cropper

Chairman

UN-AUDITED CONDENSED CONSOLIDATED INCOME STATEMENT

26 week period 26 week period

to 28 September to 29 September 52 week period

2019 2018 to 30 March 2019

---------------------------------------- ---------------- ---------------- -----------------

GBP'000 GBP'000 GBP'000

Revenue 52,792 50,300 101,095

---------------------------------------- ---------------- ---------------- -----------------

Operating profit 2,554 1,782 3,408

Finance costs

Interest payable and similar charges (567) (486) (965)

Interest receivable and similar

income 22 118 133

Profit before taxation 2,009 1,414 2,576

Taxation (382) (190) (262)

---------------------------------------- ---------------- ---------------- -----------------

Profit for the period 1,627 1,224 2,314

Earnings per share - basic and

diluted 17.0p 12.9p 24.3p

Dividend declared in the period

- pence per share 2.5p 2.5p 13.5p

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

COMPREHENSIVE INCOME

Profit for the period 1,627 1,224 2,314

---------------------------------------- ---------------- ---------------- -----------------

Items that are or may be reclassified

to profit or loss

Foreign currency translation 96 137 (117)

Cash flow hedges - effective portion

of changes in fair value (32) 6 29

Items that will never be reclassified

to profit or loss

Retirement benefit liabilities

- actuarial

gain / (loss) 352 (509) (3,258)

Deferred tax on actuarial (gain)/loss

on retirement benefit liabilities (60) 87 554

Other comprehensive income/(expense)

for the period 356 (279) (2,850)

---------------------------------------- ---------------- ---------------- -----------------

Total comprehensive income for

the period attributable to equity

holders of the Company 1,983 945 (536)

---------------------------------------- ---------------- ---------------- -----------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

28 September 29 September 30 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

------------------------------- ------------ --------------- ----------------

Assets

Intangible assets 320 424 365

Property, plant and equipment 29,521 25,924 27,639

Right of use assets 4,016 - -

Deferred tax assets 3,759 2,112 2,234

------------------------------- ------------ --------------- ----------------

Total non-current assets 37,616 28,460 30,238

------------------------------- ------------ --------------- ----------------

Inventories 16,875 15,458 16,410

Trade and other receivables 19,337 18,771 19,012

Other financial assets - 53 24

Cash and cash equivalents 435 4,388 2,352

Current tax assets 1,251 1,190 1,421

Total current assets 37,898 39,860 39,219

------------------------------- ------------ --------------- ----------------

Total assets 75,514 68,320 69,457

------------------------------- ------------ --------------- ----------------

Liabilities

Trade and other payables 14,075 14,452 14,620

Other financial liabilities 12 - -

Loans and borrowings 1,275 1,672 1,545

Right of use leases 637 - -

Total current liabilities 15,999 16,124 16,162

Long-term borrowings 9,977 9,342 9,368

Right of use leases 3,869 - -

Retirement benefit liabilities 22,110 19,816 22,648

Deferred tax liabilities 1,617 - -

Total non-current liabilities 37,573 29,158 32,016

------------------------------- ------------ --------------- ----------------

Total liabilities 53,572 45,282 48,181

------------------------------- ------------ --------------- ----------------

Equity

------------------------------- ------------ --------------- ----------------

Share capital 2,389 2,386 2,389

Share premium 1,588 1,569 1,588

Translation reserve 499 657 403

Reserve for own shares (1,251) (1,246) (1,251)

Retained earnings 18,717 19,672 18,147

------------------------------- ------------ --------------- ----------------

Total shareholders' equity 21,942 23,038 21,276

------------------------------- ------------ --------------- ----------------

Total equity and liabilities 75,514 68,320 69,457

------------------------------- ------------ --------------- ----------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

26 week period 26 week period

to 28 September to 29 September 52 week period

2019 2018 to 30 March 2019

--------------------------------------------- ---------------- ---------------------------- ---------------------

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Net profit 1,627 1,224 2,314

Adjustments for:

Tax 382 190 262

Depreciation and amortisation 1,911 1,394 2,952

Net IAS 19 pension adjustments within

Statement of comprehensive income 548 542 1,386

Past service pension deficit payments (734) (707) (1,468)

Foreign exchange differences (77) (190) (312)

Profit on disposal of property, plant

and equipment - (11) (12)

Net bank interest expense 269 98 300

Share based payments 188 (24) (49)

Changes in working capital:

Increase in inventories (454) (585) (1,529)

Decrease / (Increase) in trade and other

receivables 1,644 214 (2,072)

(Decrease) / increase in trade and other

payables (2,331) (699) 1,659

Tax paid (177) 272 (65)

--------------------------------------------- ---------------- ---------------------------- ---------------------

Net cash generated from operating activities 2,796 1,718 3,366

Cash flows from investing activities

Purchase of intangible assets (34) (7) (67)

Purchases of property, plant and equipment (3,250) (1,937) (5,162)

Proceeds from sale of property, plant

and equipment - 11 12

Net cash used in investing activities (3,284) (1,933) (5,217)

Cash flows from financing activities

Proceeds from issue of ordinary shares - 113 135

Proceeds from issue of new loans 913 1,194 1,568

Repayment of borrowings (864) (845) (1,311)

Repayment of right of use leases (358) - -

Interest received 22 118 133

Interest paid (212) (216) (391)

Purchase of LTIP investments - (315) (315)

Sale of own shares - - 130

Dividends paid to shareholders (1,038) (1,027) (1,263)

--------------------------------------------- ---------------- ---------------------------- ---------------------

Net cash used in financing activities

financingactactivitiesactivities (1,537) (978) (1,314)

Net decrease in cash and cash equivalents (2,025) (1,193) (3,165)

Effect of exchange rate fluctuations

on cash held 108 24 (40)

--------------------------------------------- ---------------- ---------------------------- ---------------------

Net decrease in cash and cash equivalents (1,917) (1,169) (3,205)

Cash and cash equivalents at the start

of the period 2,352 5,557 5,557

Cash and cash equivalents at the end

of the period 435 4,388 2,352

Cash and cash equivalents consists of:

Cash at bank and in hand 435 4,388 2,352

--------------------------------------------- ---------------- ---------------------------- ---------------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Share Translation Retained

capital Share premium reserve Own shares earnings Total

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

At 30 March 2019 2,389 1,588 403 (1,251) 18,147 21,276

Impact of IFRS 16 - - - - (467) (467)

At 30 March 2019 restated* 2,389 1,588 403 (1,251) 17,680 20,809

Profit for the period - - - - 1,627 1,627

Exchange differences - - 96 - - 96

Loss on cash flow hedges - - - - (32) (32)

Actuarial gain on retirement

benefit liabilities (net of

deferred tax) - - - - 292 292

Total other comprehensive

income - - 96 - 260 356

Dividends paid - - - - (1,038) (1,038)

Share based payments - - - - 188 188

Proceeds from issue of

ordinary

shares - - - - - -

Distribution of own shares - - - - - -

Consideration paid for own

shares - - - - - -

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

Total contributions by and

distributions to owners of

the Group - - - - (850) (850)

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

At 28 September 2019 2,389 1,588 499 (1,251) 18,717 21,942

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

At 31 March 2018 2,370 1,472 520 (1,445) 20,429 23,346

Profit for the period - - - - 1,224 1,224

Exchange differences - - 137 - - 137

Gain on cash flow hedges - - - - 6 6

Actuarial loss on retirement

benefit liabilities (net of

deferred tax) - - - - (422) (422)

Total other comprehensive

income - - 137 - (416) (279)

Dividends paid - - - - (1,027) (1,027)

Share based payment charge - - - - (154) (154)

Proceeds from issue of

ordinary

shares 16 97 - - - 113

Distribution of own shares - - - 514 (384) 130

Consideration paid for own

shares - - - (315) - (315)

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

Total contributions by and

distributions to owners of

the Group 16 97 - 199 (1,565) (1,253)

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

At 29 September 2018 2,386 1,569 657 (1,246) 19,672 23,038

----------------------------- --------- ------------- ---------------- ---------- --------------- --------------

* Please refer to note 9 for adjustments on transition following

adoption of IFRS 16 - Leases.

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 BASIS OF PREPARATION

James Cropper Plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and listed on the

Alternative Investment Market (AIM). The condensed consolidated

half year financial statements of the Company for the twenty six

weeks ended 28 September 2019, which have not been audited or

reviewed, comprise the Company and its subsidiaries (together

referred to as the Group).

Basis of preparation

The condensed consolidated financial statements for the 26 week

periods ending 28 September 2019 and 29 September 2018 are

unaudited and were approved by the Directors on 18 November 2019.

They do not constitute statutory accounts as defined in s434 of the

Companies Act 2006. The financial statements for the year ended 30

March 2019 were prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The report of the auditor on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis of matter. The Group's financial

statements consolidate the financial statements of James cropper

Plc and its subsidiaries.

Applicable standards

These unaudited consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union, under the historical

cost convention. They have not been prepared in accordance with IAs

34, the application of which is not required to the interim

financial statements of companies trading on the Alternative

Investment Market (AIM companies). The interim financial statements

have been prepared in accordance with the accounting policies

applied in the preparation of the Group's published consolidated

financial statements for the 52 week period ended 30 march 2019,

with the exception of the changes due to the adoption of IFRs 16,

which are discussed in the new standards adopted section and note 9

below.

The consolidated financial statements of the Group for the 52

week period ended 30 March 2019 are available upon request from the

Company's registered office Burneside Mills, Kendal, Cumbria, LA9

6PZ or at www.jamescropper.com.

The half year financial information is presented in Sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except where otherwise indicated.

Going concern

The Directors have performed a robust assessment, including

review of the forecast for the 52 week period ending 28 March 2020

and longer term strategic forecasts and plans, including

consideration of the principal risks faced by the Group and the

Company, as detailed in the Group's Annual Report 2019. Following

this review the Directors are satisfied that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly they continue to adopt the

going concern basis in preparing the condensed consolidated

financial statements.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the 52 week period ended 30 March 2019.

New and amended standards adopted by the Group

In the current year, the Group for the first time, has applied

IFRS 16 - Leases. The Group has adopted IFRS 16 - Leases using the

modified retrospective approach, with the cumulative effect of

adopting IFRS 16 being recognised as an adjustment to the opening

balance of retained earnings at 31 March 2019 with no restatement

of comparative information.

For contracts in place at the date of adoption, the Group

recognised liabilities in relation to leases which had previously

been classified as operating leases under the principles of IAS 17-

Leases. These liabilities were measured at the present value of the

remaining lease payments, discounted using the borrowing rate as of

31 March 2019. For leases previously accounted for as operating

leases with a remaining lease term of less than 12 months and for

leases of low-value assets (less than $5,000), the Group has

applied the optional exemptions to not recognise the right of use

assets but to account for the lease expense on a straight line

basis over the remaining lease term.

On transition to IFRS 16 the weighted average incremental

borrowing rate applied to lease liabilities recognised under IFRS

16 was 3.6%.

The following is a reconciliation of total operating lease

commitments at 30 March 2019 to the lease liabilities recognised at

31 March 2019:

GBP'000

------------------------------------------------------------- --------

Total operating lease commitments disclosed at 30 March

2019 4,352

Discounted using the lessee's incremental borrowing rate

at 31 March 2019 (1,322)

Less: short term leases recognised on a straight line basis

as expense (6)

Add: Adjustments as a result of a different treatment of

extension and termination options 1,143

Total lease liability recognised under IFRS 16 as at 31

March 2019 4,167

------------------------------------------------------------- --------

For any new contracts entered into on or after 31 March 2019,

the Group considered whether a contract is, or contains a lease. A

lease is defined as a contract, or part of a contract, that conveys

the right to use of an asset for a period of time in exchange for

consideration. To apply this definition the Group assess whether

the contract meets three key evaluations which are whether:

-- the contract contains an identified asset, which is either

explicitly identified in the contract or implicitly specified by

being identified at the time the asset is made available to the

Group;

-- the Group has the right to obtain substantially all of the

economic benefits from use of the identified asset throughout the

period of use, considering its rights within the defined scope of

the contract; and

-- the Group has the right to direct the use of the identified

asset throughout the period of use. The group assesses whether it

has the right to direct the use of the identified assets throughout

the period of use. The Group assesses whether it has a right to

direct how and for what purpose the asset is used throughout the

period of use.

Measurement and recognition of leases

At the lease commencement date, the group recognises a right of

use asset and a lease liability on the balance sheet. The right of

use asset is measured at cost, which is made up of the initial

measurement of the lease liability, any initial direct costs

incurred by the Group, an estimate of any costs to dismantle and

remove the asset at the end of the lease, and any lease payments

made in advance of the lease commencement date. The Group

depreciates the right of use assets on a straight line basis from

the lease commencement date to the earlier of the end of the useful

life of the right to use asset or the end of the lease term. The

Group also assesses the right of use asset for impairment where

such indicators exist.

Lease payments included in the measurement of the lease

liability are made up of fixed payments, variable payments based on

an index or rate, amounts expected to be payable under a residual

guarantee and payments arising from options reasonably certain to

be exercised. Subsequent to initial measurement, the liability will

be reduced for payments made and increased for interest. It is

remeasured to reflect any reassessment or modification, or if there

are changes in payments. When the lease liability is remeasured,

the corresponding adjustment is reflected in the right of use

asset, or profit and loss if the right of use asset is already

reduced to zero.

The Group has elected to account for short term leases and

leases of low value assets using the practical expedients. Instead

of recognising a right of use asset and lease liability, the

payments in relation to these are recognised as an expense in

profit or loss on a straight line basis over the term of the

lease.

Where fixed assets are financed by leasing arrangements, which

gives rights approximating to ownership, the assets are treated as

if they had been purchased and the capital element of the leasing

commitments are shown as obligations under finance leases. Assets

acquired under finance leases are initially recognised at the

present value of the minimum lease payments. The rentals payable

are apportioned between interest, which is charged to the income

statement, and liability, which reduces the outstanding obligation

so as to give a constant rate of charge on the outstanding lease

obligations.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the 52 week period ended 30

March 2019.

3 Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2019 Annual Report on pages 21-25. The

principal risks set out in the 2019 Annual Report were:

Employee health & safety; Energy price volatility; Pulp

price volatility and sustainability; Exchange rate volatility;

Pension; Brexit and Information security and cyber risk.

The Board considers that the principal risks and uncertainties

set out in the 2019 Annual report have not changed and remain

relevant for the second half of the financial year.

4 Alternative performance measures

The Company uses alternative performance measures to allow users

of the financial statements to gain a clearer understanding of the

underlying performance of the business.

Profit before tax represents the Group's overall performance and

financial position, however it contains significant non-operational

items relating to IAS 19 that the directors believe obscure an

understanding of the key performance trend.

Measures used to evaluate business performance are 'Adjusted

operating profit' (operating profit excluding the impact of IAS

19), and 'Adjusted profit before tax' (profit before tax excluding

the impact of IAS 19). The alternative performance measures are

reconciled in note 8.

The adjustment, which we refer to in these accounts as the "IAS

19 impact" represents the difference between the pension charge as

calculated under IAS 19 and the cash contributions for the current

service cost only as determined by the latest triennial valuation.

The Directors consider that the adjusted pension charge better

reflects the actual pension costs for ongoing service compared to

the IAS 19 charge. This adjustment is made internally when we

assess performance and is also used in the EBITDA and EPS targets

used in management incentive schemes.

5 Earnings per share

Six months ended Six months ended Year ended

28 September 29 September 30 March

2019 2018 2019

--------------------------------- ----------------- ----------------- -----------

Earnings per share - basic

and diluted 17.0p 12.9p 24.3p

Profit for the financial period

(GBP'000) 1,627 1,224 2,314

--------------------------------- ----------------- ----------------- -----------

Weighted average number of

shares -

basic and diluted 9,554,803 9,483,193 9,516,325

6 Dividends

The proposed interim dividend of 2.5p (2018: 2.5p) per 25p

ordinary share is payable on 10 January 2020 to those shareholders

on the register of the Company at the close of business on 29

November 2019, with the last day for DRIP elections being 13

December 2019. The dividend recognised in the condensed

consolidated statement of changes in equity is the final dividend

for the 52 week period ended 30 March 2019 of 11.0p which was paid

on 9 August 2019.

7 Retirement benefit obligations

Movements during the period in the Group's defined benefit

pension schemes are set out below:

26 week period 26 week period 52 week period

ended 28 September ended 29 September ended 30 March

2019 2018 2019

------------------------------- ----------------------- ----------------------- -------------------

GBP'000 GBP'000 GBP'000

Obligation brought forward (22,648) (19,472) (19,472)

Expense recognised in the

income statement (806) (826) (1,955)

Contributions paid to the

schemes 992 991 2,037

Remeasurement gains and

(losses) 352 (509) (3,258)

------------------------------- ----------------------- ----------------------- -------------------

Obligation carried forward (22,110) (19,816) (22,648)

------------------------------- ----------------------- ----------------------- -------------------

8 Alternative performance measures

26 week period 26 week period 52 week period

ended 28 September ended 29 September ended 30 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Adjusted operating profit 2,826 2,054 4,262

Net IAS 19 pension adjustments

- current service

costs (547) (542) (1,386)

- finance costs 275 270 532

----------------------------------------------- ----------------------- ----------------------- -------------------

Operating profit 2,554 1,782 3,408

----------------------------------------------- ----------------------- ----------------------- -------------------

26 week period 26 week period 52 week period

ended 28 September ended 29 September ended 30 March

2019 2018 2019

GBP'000 GBP'000 GBP'000

Adjusted profit before tax 2,557 1,956 3,962

Net IAS 19 pension adjustments

- current service

costs (531) (556) (1,423)

- future service

contributions

paid 258 284 569

- finance costs (275) (270) (532)

----------------------------------------------- ----------------------- ----------------------- -------------------

Profit before tax 2,009 1,414 2,576

----------------------------------------------- ----------------------- ----------------------- -------------------

9 IFRS 16 - Right of use assets and leases

Right of use assets

Carrying amount

--------------------------------- -------------------------------------

Land and Plant, equipment

Buildings and vehicles Total

--------------------------------- ---------- ---------------- -------

GBP'000 GBP'000 GBP'000

Balance at 30 March 2019 - - -

Adjustment on transition to IFRS

16 3,378 321 3,699

--------------------------------- ---------- ---------------- -------

Balance at 31 March 2019 after

adoption of IFRS 16 3,378 321 3,699

Additions 441 - 441

Depreciation (235) (66) (301)

Effects of movements in foreign

exchange 177 - 177

--------------------------------- ---------- ---------------- -------

Balance at 28 September 2019 3,761 255 4,016

--------------------------------- ---------- ---------------- -------

Right of use leases

28 September 29 September 30 March

2019 2018 2019

--------------------------------- ------------- ------------- ---------

GBP'000 GBP'000 GBP'000

Balance at 30 March 2019 - - -

Adjustment on transition to IFRS

16 4,167 - -

--------------------------------- ------------- ------------- ---------

Balance at 31 March 2019 after

adoption of IFRS 16 4,167 - -

New leases 441 - -

Interest charges 79 - -

Repayments (358) - -

Effects of movements in foreign

exchange 177 - -

--------------------------------- ------------- ------------- ---------

Balance at 28 September 2019 4,506 - -

--------------------------------- ------------- ------------- ---------

Lease liabilities (current) 637 - -

Lease liabilities (non-current) 3,869 - -

--------------------------------- ------------- ------------- ---------

4,506 - -

--------------------------------- ------------- ------------- ---------

Amounts recognised in profit and loss

The Group has elected not to recognise a lease liability for

short term leases (leases with an expected term of 12 months or

less) or for leases of low value assets. Payments made under such

leases are expenses on a straight line basis. During the six months

to 28 September 2019, in relation to leases under IFRS 16 the Group

recognised the following amounts in the consolidated income

statement:

26 weeks

to 28 September

2019

-------------------------- ------------------

GBP'000

Depreciation charge 301

Interest expense 79

Short term lease expense 44

-------------------------- ------------------

424

-------------------------- ------------------

The principal operating lease agreements in place that now fall

under IFRS16 include the following:

Factory and offices USA:

The Group entered into a building lease agreement for a

non-cancellable term of 10 years from September 2011, with an

option to extend for a further 5 years. In June 2018, the Group

re-negotiated the lease term to extend the lease until September

2031, with an option to extend for a further 5 years.

Factory and offices in Crewe:

The Group entered into a building lease agreement for a term of

6 years from December 2018. The lease agreement may be terminated

after December 2021 by giving the landlord not less than six

months' previous written notice on 6 June 2021.

Warehouse in Milnthorpe:

The Group entered into a building lease agreement for a term of

10 years from May 2015. The lease agreement may be terminated from

May 2020 subject to not less than six months' prior written

notice.

Warehouse in Milnthorpe:

The Group entered into a building lease agreement for a term of

5 years from February 2019.The lease agreement may be terminated

from February 2021 subject to not less than six months' prior

written notice.

Company cars:

The Group has entered into a number of lease agreements for

company cars with terms varying from 3 years to 5 years.

10 Related parties

There have been no significant changes in the nature of related

party transactions in the period ended 28 September 2019 from that

disclosed in the 2019 Annual report.

Statement of Directors' responsibilities

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

(i) An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(ii) Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual report.

During the period since approval of the Annual Report for the 52

weeks ended 30 March 2019, David Wilks retired as a Non-Executive

Director on 31 July 2019 and Lyndsey Scott was appointed as a

Non-Executive Director on 1 August 2019.

The Directors of James Cropper Plc are detailed on our Group

website www.jamescropper.com

Forward-looking statements

Sections of this half-yearly financial report may contain

forward-looking statements with respect to the Group's plans and

expectations relating to its future performance, results, strategic

initiatives, objectives and financial position, including liquidity

and capital resources. These forward-looking statements are not

guarantees of future performance. By their very nature, all

forward-looking statements involve risks and uncertainties because

they relate to events that may or may not occur in the future and

are or may be beyond the Group's control. Accordingly, the Group's

actual results and financial condition may differ materially from

those expressed or implied in any forward-looking statements.

Forward-looking statements in this half-yearly financial report are

current only as of the date on which such statements are made. The

Group undertakes no obligation to update any forward-looking

statements, save in respect of any requirement under applicable law

or regulation. Nothing in this announcement shall be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFLDLFLTLIA

(END) Dow Jones Newswires

November 19, 2019 02:00 ET (07:00 GMT)

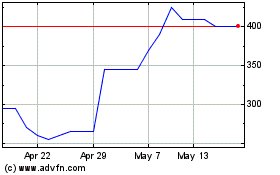

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jul 2023 to Jul 2024