Custodian Property Income REIT plc (CREI) Custodian Property

Income REIT plc: Fourth quarter trading update shows strong leasing

momentum driving income and supporting fully covered dividend as

well as value stabilisation 10-May-2023 / 07:00 GMT/BST

-----------------------------------------------------------------------------------------------------------------------

10 May 2023

Custodian Property Income REIT plc

("Custodian Property Income REIT" or "the Company")

Fourth quarter trading update shows strong leasing momentum

driving income and supporting fully covered dividend as well as

value stabilisation

Custodian Property Income REIT (LSE: CREI), which seeks to

deliver a strong income return by investing in a diversified

portfolio of smaller regional properties across the UK, today

provides a trading update for the fourth quarter ended 31 March

2023 ("Q4" or the "Quarter") and the year ended 31 March 2023

("FY23").

Strong leasing activity continues to support rental growth and

underpin fully covered dividends

-- 1.375p dividend per share approved for the Quarter achieving

aggregate FY23 dividends per share of 5.5p,in line with target,

102% covered by unaudited EPRA earnings

-- Target dividends per share of no less than 5.5p for the year

ending 31 March 2024

-- EPRA earnings per share[1] of 1.4p for Q4 (Q3: 1.5p) and 5.6p

for FY23 (FY22: 5.9p) with the impact ofpositive asset management

outcomes offset by increases in interest rates and Q3 disposals

-- GBP2.5m of new rental income secured during the Quarter

through leasing, renewals and rental upliftsreflecting a 5%

aggregate premium to ERV and comprising:

-- Six new leases and two agreements for lease signed across a

range of property sectors at an aggregate 5%ahead of ERV, adding

GBP2.4m of annual rent for a weighted average of 9.5 years to first

break (Q3: 10 new leasesadding GBP1.2m of annual rent for 7.3

years)

-- 24% (GBP0.1m) aggregate rental increase across three open

market rent reviews settled during the Quarter,at an aggregate 5%

ahead of ERV

-- 1.4% increase in like-for-like[2] ERV since 31 December 2022.

ERV now exceeds passing rent by 16%

-- EPRA occupancy[3] improved to 90.3% (31 December 2022: 89.9%)

primarily due to letting a vacant leisureunit in Milton Keynes on a

25 year lease at an annual rent of GBP320k during the Quarter,

which had been vacant since2019

-- 84% of current vacancy is subject to refurbishment or

redevelopment (57%) or is under offer to let (27%)

Valuation movements

-- GBP2.2m (-0.7% like-for-like) valuation decrease, net of a

GBP2.6m (0.4%) valuation increase from activeasset management

activity (Q3: GBP3.0m increase from asset management), moves the

Company's diversified portfolio of161 assets to GBP613.6m

-- Q4 net asset value ("NAV") total return per share[4] of

0.9%

-- NAV per share of 99.3p (31 December 2022: 99.8p) with a NAV

of GBP437.6m (31 December 2022: GBP440.0m)

Sales continued at above book value while GBP5.8m was invested

in the development and refurbishment of existing assets

-- During the Quarter:

-- A high street retail unit in Bury St Edmunds was sold at

auction in January 2023 for GBP0.54m, GBP0.14m (35%)ahead of

valuation

-- GBP5.8m of capital expenditure was undertaken, primarily on

the redevelopment of an industrial unit inRedditch and the

refurbishment, including improving the environmental credentials,

of an industrial unit inWinsford and offices in Manchester, which

are expected to enhance valuation, and rents once complete and

let

Gearing remains low and in line with target, with significant

borrowing headroom

-- Net gearing[5] remains low at 27.4% loan-to-value as of 31

March 2023 (31 December 2022: 27.1%), broadlyin line with the

Company's 25% target

-- GBP173.5m of drawn debt with an aggregate weighted average

cost of 3.8% and of which 81% is at a fixed rateof interest

-- Fixed rate debt facilities have a weighted average term of

7.0 years and a weighted average cost of 3.4%offering significant

medium-term interest rate risk mitigation

-- The Company's GBP50m variable rate revolving credit facility,

of which GBP33.5m is drawn, expires inSeptember 2024 and

discussions are underway regarding an extension to the facility

Richard Shepherd-Cross, Managing Director of Custodian Capital

Limited, said: "We are beginning to see some optimism returning to

real estate markets following six months of economic turbulence,

which had a direct impact on real estate values. Property pricing

has reacted quickly to the new interest rate environment allowing

the market to continue to function despite transaction levels

remaining low. As a result, and assisted by our asset management

initiatives, valuations have largely stabilised during the Quarter

allowing delivery of a positive quarterly NAV total return.

"Much of the optimism in real estate is due to the prospect of

rental growth which is the key component of anticipated total

returns. In an inflationary environment, real returns from real

assets can be achieved when rents are growing. The Company's

portfolio has an EPRA net initial yield[6] of 5.8% and an

equivalent yield[7] of 7.3%, demonstrating the reversionary

potential of the Company's properties, which we continue to

capture.

"Our asset management of the portfolio and the types of assets

we own are focused on where occupational demand is strongest,

allowing us to lease vacant space across all sectors and deliver

rental growth. This has supported EPRA earnings per share and

underpins the Company's long term track record of paying a fully

covered dividend.

"Custodian Property Income REIT's balance sheet resilience, with

low gearing and a longer-term fixed rate debt profile, has left the

Company well insulated from the negative impact of interest rate

rises. Rental growth feeding into the portfolio will create

headroom for eventual refinancing.

"As energy performance certificate ("EPC") requirements of the

Minimum Energy Efficiency Standards ("MEES") tighten we expect to

maintain a compliant portfolio of properties. With energy

efficiency a core tenet of the Company's asset management strategy

and with tenant requirements aligning with our energy efficiency

goals we see the advance of MEES as an opportunity to secure

greater tenant engagement and higher rents.

"We remain confident that our ongoing intensive asset management

of the portfolio, which still offers a number of wide-ranging

opportunities to add value, will maintain cash flow and support

consistent returns. Coupled with the strength of the Company's

balance sheet, this will continue to support our high income return

strategy."

Net asset value

The Company's unaudited NAV at 31 March 2023 was GBP437.6m, or

approximately 99.3p per share, a marginal decrease of 0.5p (-0.5%)

since 31 December 2022:

Pence per share GBPm

NAV at 31 December 2022 99.8 440.0

Valuation movements relating to:

- Asset management activity 0.6 2.6

- General valuation decreases (1.1) (4.8)

Net valuation movement (0.5) (2.2)

Profit on disposal[8] 0.0 (0.2)

(0.5) (2.4)

EPRA earnings for the Quarter 1.4 6.1

Interim dividend paid[9] during the Quarter (1.4) (6.1)

NAV at 31 March 2023 99.3 437.6

The NAV attributable to the ordinary shares of the Company is

calculated under International Financial Reporting Standards and

incorporates the independent portfolio valuation at 31 March 2023

and net income for the Quarter. The movement in NAV reflects the

payment of an interim dividend of 1.375p per share during the

Quarter, but does not include any provision for the approved

dividend of 1.375p per share for the Quarter to be paid on 31 May

2023.

Investment Manager's commentary

UK property market

In the 12 months to 31 March 2023 the UK commercial property

market saw valuations decline by 17% with the bulk of the rerating

in the quarter to December 2023. The Company's portfolio

experienced a more muted fall of only 11.8% like-for-like and we

believe this lower volatility is primarily due to Custodian

Property Income REIT's smaller regional property strategy and focus

on income returns. Firstly, the Company's valuations did not

'overheat' during mid-2022 to the same extent as, say, prime

logistics. Secondly, the diversified strategy provided a softer

landing as sub-sectors such as high street retail, drive through

restaurants and car showrooms saw much less pricing volatility than

logistics. With valuations appearing to have stabilised it is

possible to see the rapid correction due to the new interest rate

environment as strongly positive for the market, maintaining

liquidity and providing future acquisition opportunities.

The table below shows the reversionary potential of the

portfolio by sector once asset management initiatives are complete,

by comparing EPRA net initial yields to the equivalent yield, which

factors in expected rental growth and the letting of vacant units.

Across the whole portfolio, valuers' estimated rental values are

16% ahead of passing rent and while part of the reversionary

potential is due to vacancy, the balance is this latent rental

growth which will be unlocked at rent review and lease renewal.

EPRA Topped-up NIY[11]

Equivalent yield[10]

31 Mar 2023 EPRA NIY[12]

31 Mar 2023

Sector 31 Mar 2023

Industrial 6.6% 5.1% 4.9%

Retail warehouse 7.3% 7.2% 6.7%

Other 8.0% 6.8% 6.3%

Office 8.9% 6.4% 5.4%

High street retail 8.6% 9.6% 9.4%

Portfolio total 7.3% 6.2% 5.8%

Retail warehousing has been a key sector for acquisitions for

some time and it demonstrated extraordinary resilience through the

pandemic, particularly in our favoured sub-sectors of food,

homewares, DIY and the discounters. Vacancy rates are very low and

future rental growth appears affordable for occupiers.

In the office sector, a much clearer picture is emerging of how

tenants will use and occupy offices in the new world of hybrid

working. Occupiers are demanding much higher levels of amenity both

from their offices and from their office locations. This favours

modern, flexible office space in city centre locations with strong

transport links and high environmental credentials. Where this

space can be provided there appears to be meaningful rental growth,

but conversely office space that cannot meet these criteria risks

becoming obsolete and will need to be re-purposed. In our portfolio

we have seen strong rental growth in Oxford and central Manchester

where we are currently refurbishing offices to meet the new market

demand.

Rental growth remains strong in the industrial and logistics

sector which accounts for 40% of the Company's rent roll and 48% of

the portfolio by value. Lack of supply, limited development of

smaller and mid-box industrial units and construction cost

inflation have all combined to heighten occupational demand and

produce low vacancy rates, driving rental growth for new-build

regional industrial units and well specified, refurbished

space.

Asset management

The Investment Manager has remained focused on active asset

management during the Quarter, completing leasing initiatives, with

a weighted average unexpired term to first break or expiry

("WAULT") of 9.5 years, increasing the portfolio total to 5.0

years:

-- A five year reversionary lease to B&M on a retail

warehouse unit in Ashton Under Lyme at an annual rentof GBP421k,

increasing valuation by GBP0.7m (13%);

-- A 25 year lease with a 15 year tenant break option to Ten Pin

Bowling on a leisure unit in Milton Keyneswhich had been vacant

since July 2019 at an annual rent of GBP320k, increasing valuation

by GBP0.7m (22%);

-- A 10 year lease to CB Printforce on an industrial unit in

Biggleswade with annual rent increasing fromGBP330k to GBP400k,

increasing valuation by GBP0.6m (13%);

-- A five year lease to Intelligent Facility Solutions on an

industrial unit in Sheffield at an annual rentof GBP35k, increasing

valuation by GBP0.1m;

-- A five year lease renewal with a year three break to

Portakabin on an industrial unit in Knowsley at anannual rent of

GBP64k, increasing valuation by GBP0.1m;

-- A five year lease renewal with a year three break to Lush on

a retail unit in Colchester at an annualrent of GBP36k with no

impact on valuation; and

-- Exchanging agreements for lease with First Title Limited (t/a

Enact Conveyancing) on two office buildingsin Leeds. The

transaction will see CREIT fund the comprehensive refurbishment of

both buildings to achieve A ratedEPCs at a total cost of circa

GBP3.9m, with the tenant taking on new 10 year leases without break

on completion.Following completion of the refurbishment the

aggregate annual passing rent is set to increase from GBP649k to

GBP942k,a 45% increase, with an expected increase in valuation of

c. GBP1m above expenditure once completed.

During the Quarter rent reviews were settled with:

-- Synertec at an industrial unit in Warrington with annual rent

increasing by 62% to GBP190k, increasingvaluation by GBP0.4m

(5%);

-- Edmundson Electrical at a trade counter unit in Crewe with

annual rent increasing by 11% to GBP31k, with noimpact on

valuation; and

-- Pendragon at a car dealership unit in York with annual rent

increasing by 6% to GBP255k, with no impact onvaluation.

The positive impact of letting vacant space has increased EPRA

occupancy to 90.3% (31 December 2022: 89.9%). Of the Company's

remaining vacant space 57% is subject to refurbishment or

redevelopment and 27% is under offer to let.

The weighted average EPC score of the portfolio has improved

during the last 12 months from 61 (C) at 31 March 2022 to 58 (C) at

the Quarter end.

Fully covered dividend

The Company paid an interim dividend of 1.375p per share on 28

February 2023 relating to the quarter ended 31 December 2022. The

Board has approved another interim dividend per share of 1.375p for

the Quarter, fully covered by EPRA earnings, payable on 31 May

2023. The Board is targeting aggregate dividends per share[13] of

at least 5.5p for the year ending 31 March 2024. The Board's

objective is to grow the dividend on a sustainable basis, at a rate

which is fully covered by net rental income and does not inhibit

the flexibility of the Company's investment strategy.

Additional details on disposals

During the Quarter the Company sold a high street retail unit in

Bury St Edmunds at auction for GBP0.54m, GBP0.14m (35%) ahead of

valuation. The lease term had been recently increased by five years

but with annual rent decreasing from GBP53k to GBP40k, and rents

were not anticipated to recover in the short-medium term.

Borrowings

At 31 March 2023 the Company had GBP173.5m of debt drawn at an

aggregate weighted average cost of 3.8% with no expiries until

September 2024. This debt comprised:

-- GBP33.5m (19%) at a variable prevailing interest rate of

5.83% and a facility maturity of 1.5 years; and

-- GBP140m (81%) at a weighted average fixed rate of 3.4% with a

weighted average maturity of 7.0 years.

The Company's borrowing facilities are:

Variable rate borrowing

-- A GBP40m RCF with Lloyds Bank plc expiring on 17 September

2024 with interest of between 1.5% and 1.8%above SONIA determined

by reference to the prevailing LTV ratio of a discrete security

pool. At 31 March 2023GBP33.5m was drawn under the revolving credit

facility ("RCF"). The RCF limit can be increased to GBP50m with

Lloyds'consent. Discussions are underway regarding an extension to

the facility. Fixed rate borrowing

-- A GBP20m term loan with Scottish Widows plc ("SWIP")

repayable on 13 August 2025 with interest fixed at3.935%;

-- A GBP45m term loan with SWIP repayable on 5 June 2028 with

interest fixed at 2.987%; and

-- A GBP75m term loan with Aviva comprising:? A GBP35m tranche

repayable on 6 April 2032 with fixed annual interest of 3.02%; ? A

GBP25m tranche repayable on 3 November 2032 with fixed annual

interest of 4.10%; and ? A GBP15m tranche repayable on 3 November

2032 with fixed annual interest of 3.26%.

Each facility has a discrete security pool, comprising a number

of individual properties, over which the relevant lender has

security and covenants:

-- The maximum LTV of the discrete security pool is between 45%

and 50%, with an overarching covenant on theproperty portfolio of a

maximum 35% LTV; and

-- Historical interest cover, requiring net rental receipts from

each discrete security pool, over thepreceding three months, to

exceed 250% of the facility's quarterly interest liability.

Portfolio analysis

At 31 March 2023 the property portfolio comprised 161 assets.

The portfolio is split between the main commercial property

sectors, in line with the Company's objective to maintain a

suitably balanced investment portfolio. Sector weightings are shown

below:

Valuation

Quarter valuation

31 Mar movement

2023 Weighting by value 31 Quarter valuation Weighting by value 31

Mar 2023 GBPm movement Dec 2022

GBPm

Sector

Industrial 295.1 48% 1.4 1% 48%

Retail 131.8 21% (0.3) - 22%

warehouse

Other[14] 78.6 13% 0.9 1% 12%

Office 71.7 12% (3.3) (4%) 12%

High street 36.4 6% (0.9) (3%) 6%

retail

Total 613.6 100% (2.2) - 100%

For details of all properties in the portfolio please see

custodianreit.com/property-portfolio.

- Ends -

Further information:

Further information regarding the Company can be found at the

Company's website custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

FTI Consulting

Richard Sunderland / Ellie Sweeney / Andrew Davis Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian Property Income REIT plc is a UK real estate

investment trust, which listed on the main market of the London

Stock Exchange on 26 March 2014. Its portfolio comprises properties

predominantly let to institutional grade tenants on long leases

throughout the UK and is principally characterised by properties

with individual values of less than GBP15m at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By principally targeting sub GBP15m, regional

properties, the Company seeks to provide investors with an

attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit custodianreit.com and

custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

[1] Profit after tax excluding net gains or losses on investment

property divided by weighted average number of shares in issue.

[2] Adjusting for property acquisitions, disposals and capital

expenditure.

[3] Estimated rental value ("ERV") of let property divided by

total portfolio ERV.

[4] NAV per share movement including dividends paid during the

Quarter.

[5] Gross borrowings less cash (excluding rent deposits) divided

by portfolio valuation.

[6] Annualised cash rents at the Quarter-end, less estimated

non-recoverable property operating expenses, divided by the gross

property valuation plus estimated purchaser's costs.

[7] Weighted average of annualised cash rents at the Quarter-end

date and ERV, less estimated non-recoverable property operating

expenses, divided by property valuation plus estimated purchaser's

costs.

[8] Net of GBP0.3m movements in prior period disposal cost and

rent top-up accruals.

[9] An interim dividend of 1.375p per share relating to the

quarter ended 31 December 2022 was paid on 28 February 2023.

[10] Weighted average of annualised cash rents at the

Quarter-end date and ERV, less estimated non-recoverable property

operating expenses, divided by property valuation plus estimated

purchaser's costs.

[11] Annualised cash rents at the Quarter-end date, adjusted for

the expiration of lease incentives, less estimated non-recoverable

property operating expenses, divided by property valuation plus

estimated purchaser's costs.

[12] Annualised cash rents at the Quarter-end, less estimated

non-recoverable property operating expenses, divided by the

property valuation plus estimated purchaser's costs.

[13] This is a target only and not a profit forecast. There can

be no assurance that the target can or will be met and it should

not be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

[14] Comprises drive-through restaurants, car showrooms, trade

counters, gymnasiums, restaurants and leisure units.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 242493

EQS News ID: 1628513

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1628513&application_name=news

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

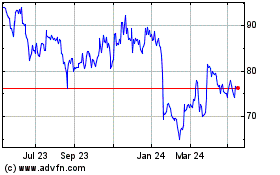

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

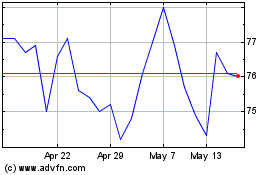

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024