Custodian REIT plc : Purchase of Property (1327723)

April 14 2022 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI) 14-Apr-2022 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

14 April 2022

Custodian REIT plc

("Custodian REIT" or "the Company")

Purchase of Property

Custodian REIT (LSE: CREI), the UK property investment company,

is pleased to announce a property purchase.

The Company has acquired a 86,922 sq ft industrial facility in

Grangemouth, adjacent to the M9. The unit is let Thornbridge

Sawmills for a further 18 years.

The unit has a passing rent of GBP388,261 per annum, with a

reversion in September 2023, linked to RPI, which is expected to

reflect a net reversionary yield1 of 5.5%.

The agreed purchase price of GBP7.49 million was funded from the

Company's existing debt facilities, resulting in net gearing2

increasing to 20.9% loan to value.

Commenting on the acquisition, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said:

"We are delighted to have secured this property which benefits

from excellent links to both Glasgow and Edinburgh but importantly

for the tenant, which imports timber, is in close proximity to

Scotland's largest container port. The relatively low risk, long

term lease to a strong tenant is further enhanced by rent reviews

linked to RPI, capped and collared at a maximum of 3% and minimum

1% per annum, providing a degree of inflation protection. The first

rent review is due in September 2023 and five-yearly

thereafter."

1 Reversionary rent divided by purchase price plus assumed

purchasers' costs.

2 Gross borrowings less cash (excluding tenant rental deposits

and retentions) divided by last published property portfolio

valuation.

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan/Nathan Brown Tel: +44 (0)20 7260 1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which

listed on the main market of the London Stock Exchange on 26 March

2014. Its portfolio comprises properties predominantly let to

institutional grade tenants on long leases throughout the UK and is

principally characterised by small lot sizes, with individual

property values of less than GBP10 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting smaller lot size properties, the

Company intends to provide investors with an attractive level of

income with the potential for capital growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCM

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 155540

EQS News ID: 1327723

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1327723&application_name=news

(END) Dow Jones Newswires

April 14, 2022 02:00 ET (06:00 GMT)

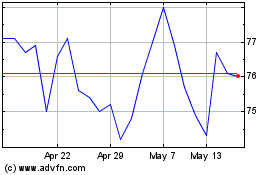

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

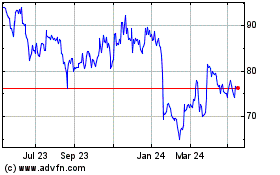

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024