Custodian REIT plc (CREI) Custodian REIT plc : Unaudited net

asset value as at 31 December 2021 10-Feb-2022 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

10 February 2022

Custodian REIT plc

("Custodian REIT" or "the Company")

Unaudited net asset value as at 31 December 2021

Custodian REIT (LSE: CREI), the UK commercial real estate

investment company focused on smaller lot-sizes, today reports its

unaudited net asset value ("NAV") as at 31 December 2021 and

highlights for the period from 1 October 2021 to 31 December 2021

("the Period").

Financial highlights

-- Dividend per share approved for the Period of 1.375p, a 10%

increase from the quarter ended 30 September2021 of 1.25p

-- Target dividends per share of no less than 5.25p for the year

ending 31 March 2022 and 5.5p for the yearending 31 March 2023

-- NAV total return per share1 for the Period of 8.5%,

comprising 1.2% dividends paid and a 7.3% capitalincrease

-- NAV per share of 113.7p (30 Sept 2021: 106.0p)

-- NAV increased to GBP501.4m (30 Sept 2021: GBP445.9m) due to

valuation increases of GBP36.2m during the Periodand issuing

GBP19.1m new equity for the corporate acquisition of DRUM Income

Plus REIT plc ("DRUM REIT")

-- Dividend cover2 for the year ending 31 March 2022 to date of

109%

-- EPRA earnings per share3 for the Period decreased to 1.3p

(quarter ended 30 Sept 2021: 1.6p) primarilydue to;? Net gearing4

of 19.5% loan-to-value (30 Sept 2021: 19.6%) remaining below the

25% target as wecontinue to redeploy the proceeds from profitable

disposals in September and October 2021; and ? EPRA occupancy5

decreasing to 90.9% (30 Sept 2021: 91.6%). Of the vacant space, 34%

is currentlyunder offer to let and a further 32% is planned vacancy

to enable redevelopment or refurbishment.

Portfolio highlights

-- Property portfolio value of GBP637.9m (30 Sept 2021:

GBP565.3m)

-- GBP36.2m aggregate valuation increase for the Period

comprising:? GBP6.2m from successful asset management initiatives;

? GBP22.7m of general valuation increases, primarily in the

industrial and logistics sector; and ? GBP7.3m increase from

acquiring DRUM REIT at a c.28% discount to its NAV

-- GBP49.2m6 invested during the Period in DRUM REIT's

portfolio, an industrial unit in York and a retailwarehouse in

Cromer

-- GBP1.1m profit on disposal from the sale of four properties

for an aggregate consideration of GBP14.8m7

1 NAV per share movement including dividends paid during the

Period.

2 Profit after tax, excluding net gains or losses on investment

property, divided by dividends approved relating to the period.

3 Profit after tax excluding net gains or losses on investment

property divided by weighted average number of shares in issue.

4 Gross borrowings less cash (excluding rent deposits) divided

by portfolio valuation.

5 Estimated rental value ("ERV") of let property divided by

total portfolio ERV.

6 Before acquisition costs.

7 Before disposal costs.

Net asset value

The unaudited NAV of Custodian REIT at 31 December 2021 was

GBP501.4m, reflecting approximately 113.7p per share, an increase

of 7.7p (7.3%) since 30 September 2021:

Pence per share GBPm

NAV at 30 September 2021 106.0 445.9

Issue of equity8 (0.5) 19.1

Valuation increase having acquired DRUM REIT at a discount to valuation 1.6 7.3

Corporate acquisition and equity issuance costs (0.2) (0.9)

Net increase from the DRUM REIT acquisition 0.9 25.5

Valuation movements relating to:

- Asset management activity 1.4 6.2

- General valuation increases 5.2 22.7

- Profit on disposal 0.2 1.1

Net valuation movement 6.8 30.0

Asset acquisition costs - (0.2)

6.8 29.8

EPRA earnings for the Period 1.3 5.7

Interim dividend paid9 during the Period (1.3) (5.5)

NAV at 31 December 2021 113.7 501.4

8 Issue of 20,247,040 new shares at their market value on 3

November 2021 of 94.5p.

9 An interim dividend of 1.25p per share relating to the quarter

ended 30 September 2021 was paid on 30 November 2021.

The NAV attributable to the ordinary shares of the Company is

calculated under International Financial Reporting Standards and

incorporates the independent portfolio valuation as at 31 December

2021 and net income for the Period. The movement in NAV reflects

the payment of an interim dividend of 1.25p per share during the

Period, but does not include any provision for the approved

dividend of 1.375p per share for the Period to be paid on 28

February 2022.

Investment Manager's market commentary

Inflation is a clear and present risk in the market today and

traditionally investors have looked to real estate as a hedge

against the negative impact of inflation on investment returns.

Over the longer term history suggests property values and rents

will increase broadly in line with inflation. Following a period of

growth, the challenge for managers is to own properties with

further rental growth potential whose valuation will most closely

keep pace with rising prices.

Over the 12 months to 31 December 2021 Custodian REIT's

like-for-like10 portfolio has seen rental growth and sharp

valuation increases across its principal investment sectors as

shown below:

12 months to 31 December 21 3 months to 31 December 21

Capital value change Rental value change Capital value change Rental value change

Sector

Industrial +23.2% +9.7% +8.2% +2.6%

Retail warehouse +12.0% -2.6% +4.7% 0.0%

Office -0.7% +0.9% -0.3% -0.6%

Other +5.0% -3.3% +1.8% +0.7%

High street retail -11.3% -6.6% +4.3% +1.9%

10 Adjusting for the impact of acquisitions and disposals.

Across the industrial and logistics portfolio, notwithstanding

the rental growth to date, the average rent stands at only GBP5.27

per sq ft with an estimated rental value of GBP6.20 per sq ft,

suggesting a latent rental uplift of c.18%. Furthermore, both

passing rents and estimated rental values are some way below the

rent required to bring forward new development, indicating further

growth potential.

Retail warehousing and high street retail rents appear to be

bottoming out and we are even seeing some recent demand led rental

growth in these sectors. Importantly these rents are growing from a

low base making them affordable for tenants. By way of example, the

average retail warehouse rent across the portfolio stands at circa

GBP13.50, in line with current estimated rental values, and much

lower than previous market levels.

In select locations, notably prime regional city centres, we are

seeing office rents increasing. This is by no means applicable to

all regional offices but is focused on high quality, flexible

office space with strong environmental credentials. The recent

acquisition of 60 Fountain Street in Manchester is an example of

how Custodian REIT is taking advantage of the opportunity to

reposition property to meet the expected demands of tenants, post

pandemic, and to pick up the higher rents attributable to

refurbished space.

The greater driver of inflation appears to be cost-push rather

than demand-pull as the economy struggles with supply chain

constraints, labour shortages and the aftermath of pandemic

restrictions. These factors all mitigate against widespread, low

cost, speculative development which would otherwise help resolve

the demand/supply imbalance that is promoting rental growth.

We believe Custodian REIT's portfolio is particularly well

positioned to see rental growth as it is focused on smaller

regional properties:

In the industrial and logistics sector, which accounts for 50%

of the portfolio by value, smaller properties are more expensive to

develop, pro-rata, so require higher rents to justify development.

Rents will continue to grow until they balance out inflation in

build costs.

The retail warehouse portfolio is almost exclusively focused on

DIY, homewares, discounters and food, all let off affordable rents.

This occupier profile is best matched with current market demand

and so well placed to pick up rental growth.

We have reorganised our high street retail portfolio over the

last two years, exiting most of the secondary retail locations. We

completed three new lettings in the Period and have terms agreed or

are seeing active demand for the very limited vacant space we have

in the high street portfolio from both retail and leisure

occupiers. Low vacancy rates in prime locations and occupier demand

should be supportive of future rental growth.

In the office portfolio we have identified, or are progressing,

a number of refurbishment opportunities with a keen eye on

environmental improvements. Owners of smaller regional offices are

often not sufficiently well resourced to create high quality small

suite offices that are a match for the larger floorplates. However,

we believe that occupier demand will be focused on higher quality

space to support businesses in attracting their employees back into

the office. We believe that by positioning our office portfolio to

meet occupier demand we will reduce vacancy and drive rental

growth.

Dividends

During the Period the Company paid an interim dividend of 1.25p

per share relating to the quarter ended 30 September 2021, fully

covered by EPRA earnings, and approved an interim dividend per

share of 1.375p for the Period.

The Board intends to pay further quarterly dividends per share

of at least 1.375p to achieve a target dividend11 per share for the

year ending 31 March 2022 of at least 5.25p and for the year ending

31 March 2023 of at least 5.5p.

The Board's objective is to grow the dividend on a sustainable

basis, at a rate which is fully covered by net rental income and

does not inhibit the flexibility of the Company's investment

strategy.

11 This is a target only and not a profit forecast. There can be

no assurance that the target can or will be met and it should not

be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

Acquisitions

On 3 November 2021 the Company acquired 100% of the ordinary

share capital of DRUM REIT for consideration of 20,247,040 new

ordinary shares in the Company, calculated on an 'adjusted

NAV-for-NAV basis', adjusting each company's 30 June 2021 NAV for

respective acquisition costs and adjusting DRUM REIT's property

portfolio valuation to the agreed purchase price of GBP43.5m (31

December 2021 valuation: GBP49.0m).

The Company also invested GBP7.5m in the following asset

acquisitions during the Period:

-- A 29k sq ft industrial unit in York for GBP3.0m occupied by

Menzies Distribution with an annual passingrent of GBP186k,

reflecting a net initial yield12 ("NIY") of 5.9%; and

-- A 46k sq ft retail warehouse in Cromer for GBP4.5m occupied

by Homebase with an annual passing rent ofGBP300k, reflecting a NIY

of 6.3%.

12 Passing rent divided by property valuation plus purchaser's

costs.

Disposals

Owning the right properties at the right time is a key element

of effective property portfolio management, which necessarily

involves periodically selling properties to balance the property

portfolio. Custodian REIT is not a trading company but identifying

opportunities to dispose of assets ahead of valuation or that no

longer fit within the Company's investment strategy is

important.

The Company sold the following properties during the Period for

an aggregate consideration of GBP14.8m:

-- A 42k sq ft car showroom in Stockport for GBP9.0m, GBP1.4m

(18%) ahead of the 30 June 2021 valuation;

-- A 23k sq ft car showroom in Stafford for GBP4.9m, GBP1.15m

(31%) ahead of the 30 June 2021 valuation; and

-- High street retail units in Kings Lynn and Cheltenham at

valuation for an aggregate GBP0.9m.

Asset management

The Investment Manager has remained focused on active asset

management during the Period, completing the following

initiatives:

-- A new 10 year lease with a fifth year tenant break option

with Harbour International Freight on anindustrial unit in

Manchester with an annual rent of GBP316k, increasing valuation by

GBP2.1m;

-- A new 10 year lease with a fifth year tenant break option

with PDS Group on a newly refurbishedindustrial unit in West

Bromwich with an annual rent of GBP395k, increasing valuation by

GBP2.0m;

-- Exchanging agreements for lease for 15 year leases with Tim

Hortons on former Pizza Hut restaurants inLeicester and Watford,

which are to be converted to drive-through restaurants following

Pizza Hut's CVA withaggregate annual rent of GBP275k, increasing

valuations by GBP1.9m;

-- A new 10 year lease with third and fifth year tenant break

options with Ramsdens Financial on a vacantretail unit in Glasgow

with an annual rent of GBP55k, increasing valuation by GBP0.1m;

-- A new 10 year lease with fifth and seventh year tenant break

options with Industrial Control Distributorson an industrial unit

in Kettering with an annual rent of GBP25k, increasing valuation by

GBP0.1m;

-- A new 15 year lease without break with Loungers on a retail

unit in Shrewsbury, with an annual rent ofGBP90k, with no impact on

valuation;

-- A 15 year lease renewal with a tenth year tenant break option

with Smyths Toys on a retail warehouse unitin Gloucester with an

annual rent of GBP130k, with no impact on valuation;

-- A new 10 year lease with a fifth year tenant break option

with Diamonds of Chester Camelot on a vacantretail unit in Chester,

with an annual rent of GBP35k, with no impact on valuation;

-- A new five year lease without break with Midon on an

industrial unit in Knowsley, with an annual rent ofGBP37k, with no

impact on valuation;

-- A new five year lease with a third year tenant break option

with Clogau on a vacant retail unit inShrewsbury with an annual

rent of GBP50k, with no impact on valuation;

-- A six month lease extension with Saint Gobain on an

industrial unit in Milton Keynes, with passing rentincreasing from

GBP265k to a 'premium rent' of GBP441k, with no impact on

valuation; and

-- A short-term four month licence with Royal Mail on a vacant

industrial unit in Redditch for a licence feeof GBP135k, with no

impact on valuation.

Despite the positive impact of these asset management outcomes

EPRA occupancy decreased from 91.6% at 30 September 2021 to 90.9%

primarily due to the acquisition of DRUM REIT which had an EPRA

occupancy rate of 86.1% on acquisition.

In line with the Company's environmental objectives, during the

previous quarter we completed a GBP1.4m refurbishment of an

industrial unit in West Bromwich which involved installing six

electric vehicle charging points, solar photovoltaic coverage to

over 700 sq m of the roof area, air source heat pumps to provide

heating and hot water, new energy efficient radiators and LED

lights with passive infrared sensors. Letting this property during

the Period meant rents increased from GBP280k pa (c.GBP4.80 per sq

ft) to GBP395k pa (c.GBP6.75 per sq ft) with valuation increasing

by GBP2.0m.

Borrowings

Custodian REIT and its subsidiaries operate the following loan

facilities:

-- A GBP35m revolving credit facility ("RCF") with Lloyds Bank

plc ("Lloyds") expiring on 17 September 2024with interest of

between 1.5% and 1.8% above SONIA13, determined by reference to the

prevailing LTV ratio of adiscrete security pool. The RCF facility

limit can be increased to a maximum of GBP50m with Lloyds'

approval;

-- A GBP25m RCF with The Royal Bank of Scotland expiring on 30

September 2022 with interest of 1.75% aboveSONIA;

-- A GBP20m term loan with Scottish Widows plc ("SWIP")

repayable on 13 August 2025 with interest fixed at3.935%;

-- A GBP45m term loan with SWIP repayable on 5 June 2028 with

interest fixed at 2.987%; and

-- A GBP50m term loan with Aviva Investors Real Estate Finance

comprising:a. A GBP35m tranche repayable on 6 April 2032 with fixed

annual interest of 3.02%; and b. A GBP15m tranche repayable on 3

November 2032 with fixed annual interest of 3.26%.

Each facility has a discrete security pool, comprising a number

of individual properties, over which the relevant lender has

security and covenants:

-- The maximum LTV of the discrete security pool is between 45%

and 50%, with an overarching covenant on theproperty portfolio of a

maximum 35% LTV; and

-- Historical interest cover, requiring net rental receipts from

each discrete security pool, over thepreceding three months, to

exceed 250% of the facility's quarterly interest liability.

The Company and its subsidiaries complied with all loan

covenants during the Period.

13 The sterling overnight index average ("SONIA") which has

replaced LIBOR as the UK's main interest rate benchmark.

Portfolio analysis

At 31 December 2021 the property portfolio comprised 160 assets

with a NIY of 6.1% (30 Sept 2021: 6.2%). The portfolio is split

between the main commercial property sectors, in line with the

Company's objective to maintain a suitably balanced investment

portfolio. Sector weightings are shown below:

Valuation

Period valuation

31 Dec movement14 Weighting by Weighting by

2021 Weighting by value 31 Period valuation14 income15 income15

Dec 2021 GBPm movement 31 Dec 2021 30 Sep 2021

GBPm

Sector

Industrial 302.4 47% 21.8 8.3% 39% 40%

Retail 120.9 19% 4.8 4.5% 21% 21%

warehouse

Office 88.4 14% (0.3) (0.5%) 16% 13%

Other16 75.0 12% 2.2 2.6% 12% 16%

High street 51.2 8% 0.4 1.1% 12% 10%

retail

Total 637.9 100% 28.9 5.2% 100% 100%

14 Excluding the GBP7.3m increase from acquiring DRUM REIT at a

discount to its NAV.

15 Current passing rent plus ERV of vacant properties.

16 Comprises drive-through restaurants, car showrooms, trade

counters, gymnasiums, restaurants and leisure units.

The Company and its subsidiaries operate a geographically

diversified property portfolio across the UK, seeking to ensure

that no one region represents more than 50% of portfolio income.

The geographic analysis of the property portfolio at 31 December

2021 was as follows:

Valuation

Period valuation Weighting Weighting

31 Dec Weighting by value 31 Dec movement14 by income by income

2021 2021 Period valuation14 15 15

GBPm movement 31 Dec 30 Sep

GBPm 2021 2021

Location

West Midlands 124.9 20% 9.2 8.0% 18% 20%

North-West 114.5 18% 5.3 5.7% 19% 19%

South-East 83.0 13% 2.1 2.6% 13% 14%

East Midlands 78.3 12% 4.4 6.0% 13% 14%

Scotland 70.5 11% 2.0 4.1% 10% 8%

North-East 64.8 10% 2.1 4.3% 12% 9%

South-West 63.6 10% 1.9 3.2% 9% 10%

Eastern 32.4 5% 1.8 6.9% 5% 5%

Wales 5.9 1% 0.1 1.7% 1% 1%

Total 637.9 100% 28.9 5.2% 100% 100%

For details of all properties in the portfolio please see

custodianreit.com/property-portfolio.

- Ends -

Further information:

Further information regarding the Company can be found at the

Company's website custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which

listed on the main market of the London Stock Exchange on 26 March

2014. Its portfolio comprises properties predominantly let to

institutional grade tenants on long leases throughout the UK and is

principally characterised by properties with individual values of

less than GBP10m at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By principally targeting sub GBP10m lot-size,

regional properties, the Company seeks to provide investors with an

attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit custodianreit.com and

custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 142056

EQS News ID: 1278811

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1278811&application_name=news

(END) Dow Jones Newswires

February 10, 2022 02:00 ET (07:00 GMT)

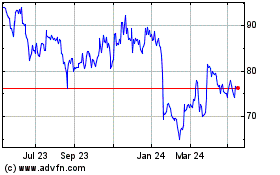

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

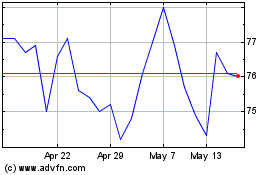

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024