TIDMCNS

RNS Number : 7393N

Corero Network Security PLC

07 September 2011

7 September 2011

Corero Network Security plc (AIM: CNS)

("Corero", the "Group" or the "Company")

Interim results for the six month period ended 30 June 2011

Corero Network Security plc, the AIM listed network security and

business software provider, announces its half yearly report for

the six month period ended 30 June 2011.

Financial Highlights:

-- Revenues of GBP4.6 million (H1 2010: revenue GBP1.4

million)

-- Operating profit* of GBP138,000 (H1 2010: GBP306,000)

-- Adjusted loss before tax of GBP51,000** (H1 2010: profit

before tax GBP48,000)

-- Loss per share 2.05p (H1 2010: earnings per share 1.38p)

-- Strong cash position of GBP5.3 million at 30 June 2011 (30

June 2010: GBP621,000)

* before depreciation, amortisation, exceptional costs and

financing

** excluding exceptional acquisition and restructuring costs and

amortisation of acquired intangible assets

Operating Highlights:

-- Acquired Top Layer Networks since rebranded Corero Network

Security ("CNS")

-- Group holding company renamed Corero Network Security plc

-- Launch of industry first network-layer and application-layer

DDoS defence system

-- CNS management reshaped and sales teams recruited across

Europe and Asia

-- Since acquisition CNS secured 40 new customers

-- Corero Business Systems ("CBS") performed strongly; 114

academy contracts won

Jens Montanana, Corero Chairman said: "The first six months of

2011 have been transformational for Corero with the acquisition of

Top Layer and successful integration of that business coupled with

the continuing growth of Corero Business Systems.

"The network security market is forecast to grow strongly,

fuelled by an escalating number of cyber crime attacks, associated

economic disruption and costs, and increasing security compliance

and business continuity requirements. Corero is well placed to

capitalise on this market trend with an increasing pipeline of

opportunities.

"The increased investment in CNS and CBS in the second half of

2011 will create businesses with greater scale and better longer

term profitable growth. The benefit of this investment in CNS

marketing, sales and product development, the launch of the DDoS

defence product, and accelerating revenue growth from CBS, is

expected to be seen in the second half of 2011 and 2012."

Enquiries:

Corero Network Security

plc

Andrew Miller, Chief Operating Tel: 01923 897 333

Officer

finnCap

Clive Carver/Henrik Persson Tel: 020 7600 1658

Walbrook PR Tel: 020 7933 8780

Bob Huxford (Media Relations) bob.huxford@walbrookpr.com

Paul Cornelius (Investor paul.cornelius@walbrookir.com

Relations)

About Corero Network Security

Corero Network Security is an international network security

business, and innovator in Intrusion Prevention Systems and leader

in DDoS defence solutions.

Corero Business Systems serves the education and business

sectors in the UK by delivering powerful, dynamic modular

accounting and business management software and services.

Overview

The first six months of 2011 have been transformational for

Corero with the acquisition of Top Layer Networks, Inc. ("Top

Layer") which closed on 2 March 2011 and successful integration of

that business coupled with the continuing growth of Corero Business

Systems. Top Layer was rebranded "Corero Network Security" in June

2011.

On 29 June 2011, Corero plc was renamed Corero Network Security

plc in order that the Company name is more closely aligned to its

principal trading subsidiary.

In the six months to 30 June 2011 the Group reported revenues of

GBP4,587,000 (H1 2010: GBP1,384,000) and operating profit before

depreciation, amortisation, exceptional costs and financing of

GBP138,000 (H1 2010: profit GBP306,000).

Corero Network Security

Corero's acquisition of Top Layer marked the first step in the

Company's strategy to build a network security technology business

focused on delivering software and hardware solutions to mid-market

commercial and enterprise customers and telecommunication service

providers, through international channels.

In the period since the acquisition closed, a number of

important milestones have been achieved:

-- Launch of DDoS Defence System ('DDS'), an industry first

network-layer and application-layer Distributed Denial of Service

('DDoS') defence product (which prevents malicious attacks causing

damaging business interruption)

-- Management team reshaped with the appointment of a General

Manager and CFO (who was appointed Chief Executive Officer of the

CNS subsidiary on 18 July 2011) and the recruitment of a Vice

President of Engineering, Chief Marketing Officer, and VP of

Finance

-- Sales teams recruited in France, Italy, Malaysia, Germany,

Spain and Taiwan (the latter covering Taiwan, Hong Kong and

China)

-- The rebranding of Top Layer to "Corero Network Security"

CNS reported revenue of GBP2,696,000 and an operating lossbefore

depreciation, amortisation, exceptional costs and financing of

GBP80,000 in the period since the 2 March 2011 acquisition

date.

CNS sales order intake in the period post the Top Layer

acquisition was $5.0 million (GBP3.0 million). The benefit of

investment in marketing and sales is expected to be seen in the six

months to 31 December 2011.

In the period since the acquisition, CNS secured 40 new

customers including material orders from BWIN (one of the world's

largest on-line gaming companies), City of Baltimore, a leading

national newspaper in the US, and Bridgepoint Education (an on-line

& campus based Higher Education provider). In addition,

material upgrade and renewal orders were secured from existing

customers including a leading national insurer and Party Gaming

(which was acquired by BWIN).

Corero Business Systems

Revenues increased by 37% in the first half of 2011 to

GBP1,891,000 (H1 2010: GBP1,384,000). CBS' sales order intake in

the six month period ended 30 June 2011 was GBP2.5 million

(compared to GBP1.5 million in the same period in 2010).

CBS reported an operating profit before depreciation,

amortisation, exceptional costs and financing in the six months to

30 June 2011 of GBP620,000 (H1 2010: GBP481,000).

Key achievements in the first half of 2011 include:

-- Continued success in the education Academy market winning

contracts from 114 academies (H1 2010: 17, FY 2010: 70) underlying

a strong position in this growth market with c. 30% market

share

-- Two new contract wins with sixth form colleges in the period

for Resource EMS, CBS' Learner Management Information System

('MIS'). After evaluating a number of alternative MIS systems,

Resource EMS was selected by these two colleges to meet their

financial and business requirements.

-- Strategic partnership with the Schools Partnership Trust, a

leading 'multi academy' group and one of only four organisations

nationally to be awarded 'Accredited Schools Group Status', to

supply Resource Financials to all of their schools

-- Strengthening of the management team by appointment of HR

manager to aid expansion

-- Launch of new web site to focus on key products and

sectors

-- Launch of Resource Financials v7, CBS' next generation

financial software solution. The new version, initially aimed at

colleges, incorporates a number of enhancements including an

improved user interface, extended general ledger coding and

budgeting, a completely revamped reporting engine with support for

multiple output scenarios, closer integration with MS Office and a

dynamic hierarchy manager for more in-depth analysis and

reporting.

The education sector in the UK offers CBS an excellent

opportunity for growth, particularly in light of the significant

increase in the demand for schools to convert to Academies. Over

the coming year, CBS will make further investment to drive growth,

enhance the service offering and increase market share.

Financial Review

In the six months to 30 June 2011, the Group reported revenues

of GBP4,587,000 (H1 2010: GBP1,384,000) and operating profit before

depreciation, amortisation, exceptional costs and financing of

GBP138,000 (H1 2010: profit GBP306,000).

CNS revenues were GBP2,696,000 in the period since the 2 March

2011 acquisition closing date. CNS reported an operating loss

before depreciation, amortisation, exceptional costs and financing

of GBP80,000 in the period.

CBS revenues were GBP1,891,000 (H1 2010: GBP1,384,000). CBS

reported an operating profit before depreciation, amortisation,

exceptional costs and financing of GBP620,000 (H1 2010:

GBP481,000).

Central costs before depreciation, amortisation, exceptional

costs and financing were GBP402,000 (H1 2010: GBP175,000).

The Group operating profit before depreciation, amortisation,

exceptional costs and financing was GBP138,000 (H1 2010: profit

GBP306,000) and loss before taxation was GBP849,000 (H1 2010:

profit GBP48,000). The Group reported a loss per share of 2.05p (H1

2010: earnings per share 1.38p).

The Company changed the presentation of the Statement of

Comprehensive Income in the period in line with best practice and

other software companies. Note 5 sets out the presentation of the

Statement of Comprehensive Income on the basis adopted in prior

years and a reconciliation of the 2011 loss before tax to the

presentation format adopted in prior years.

In the period, the Company changed its accounting policy for

cost of sales to include all direct costs associated with revenue

generation, including services delivery and support costs. The cost

of sales reported for the six month period to 30 June 2011 has been

determined based on the new policy and the comparatives for the six

months to 30 June 2010 and year ended 31 December 2010 restated in

accordance with the new policy.

The Group had cash balances of GBP5.3 million at 30 June 2011

(2010: GBP621,000). Net cash from operating activities was

(GBP1,059,000) (H1 2010: GBP241,000).

Outlook

The network security market is forecast to continue to grow

strongly, fuelled by escalating cyber crime attacks, the economic

disruption and associated costs as cyber attacks multiply, and

increasing security compliance and business continuity

requirements. In order to capitalise on this opportunity, CNS

expects to accelerate its investment in sales, marketing and

product development. The investment is planned to be mainly

headcount and would see the number of CNS employees increase from

54 at 30 June 2011 to approximately 80 by 31 December 2011.

Consequently, CNS will see an increase in its second half operating

costs of $2.5 million (GBP1.6 million) compared to the first half

of 2011. The benefit of this increased investment and the launch of

the DDoS defence product, which will be available in October 2011,

is expected to be seen in the second half of 2011 and into

2012.

The Academy market in which CBS operates is expected to continue

to grow, encouraged by government support. Like CNS, CBS intends to

capitalise on the opportunity in its marketplace by accelerating

investment mainly in headcount in the second six months of the year

and into 2012 to drive revenue growth, enhance its service offering

and increase market share. Consequently, CBS expects to increase

the number of employees from 40 at 30 June 2011 to approximately 60

by 31 December 2011. The strong order intake in the six months to

30 June 2011 is expected to result in revenue growth in the second

six months of the year.

The Board believes this investment in CNS and CBS will create

businesses with greater scale and better longer-term profitable

growth. Full year Group operating profit (before depreciation,

amortisation, exceptional costs and financing) is expected to be in

line with market expectations.

The Board remains confident in the Company's prospects.

Consolidated Interim Statement of Comprehensive Income

For the six months ended 30 June 2011

Unaudited Unaudited*

six months six months Audited*

ended ended year ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Revenue 4,587 1,384 3,020

Cost of sales (967) (232) (593)

------------ ------------ -------------

Gross profit 3,620 1,152 2,427

Operating expenses (3,479) (846) (1,963)

Share options charge (3) - (131)

------------ ------------ -------------

Operating profit before

depreciation, amortisation,

exceptional costs and financing 138 306 333

Depreciation and amortisation of

intangible assets (354) (94) (198)

------------ ------------ -------------

Operating (loss)/profit before

exceptional costs and financing (216) 212 135

Exceptional costs - acquisition

and restructuring costs (576) (1) (60)

------------ ------------ -------------

(Loss)/profit before financing (792) 211 75

Finance income 30 - 32

Finance costs (87) (163) (199)

------------ ------------ -------------

(Loss)/profit before taxation (849) 48 (92)

Taxation - - -

------------ ------------ -------------

(Loss)/profit for the period from

continuing operations (849) 48 (92)

(Loss)/profit for the period from

discontinued operations - (27) 4

Profit from sale of discontinued

operations - - 492

------------ ------------ -------------

(Loss)/profit for the period (849) 21 404

Other comprehensive loss (369) - -

------------ ------------ -------------

(Loss)/profit and total

comprehensive (loss)/income for

the period - attributable to

equity holders of the parent (1,218) 21 404

============ ============ =============

* restated for change in cost of sales accounting policy as set

out in note 1

The unaudited Statement of Comprehensive Income as at 30 June

2011 split between continuing and acquired operations is set out on

page 7.

Basic and diluted earnings/(loss) per share

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2011 2010 2010

Basic (loss)/earnings per share

from continuing and acquired

operations (2.05p) 3.16p (0.7p)

Basic (loss)/earnings from - (1.78p) 3.7p

discontinued operations

------------ ------------ -------------

Total (2.05p) 1.38p 3.0p

============ ============ =============

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 30 June 2010

2011 2010

Diluted (loss) per share from (1.89p) n/a (0.62p)*

continuing and acquired

operations

Diluted earnings from discontinued - n/a 3.35p*

operations

Total (1.89p) n/a 2.73p*

============ ============ =============

* restated to include options issued which were dilutive,

previously not reported as such.

Consolidated Interim Statement of Comprehensive Income

For the six months ended 30 June 2011

Unaudited

six months ended

30 June 2011

GBP'000 GBP'000 GBP'000

Continuing Acquired Total

Revenue 1,891 2,696 4,587

Cost of sales (362) (605) (967)

----------- --------- --------

Gross profit 1,529 2,091 3,620

Operating expenses (1,308) (2,171) (3,479)

Share options charge (3) - (3)

----------- --------- --------

Operating profit/(loss) before

depreciation, amortisation, exceptional

costs and financing 218 (80) 138

Depreciation and amortisation of intangible

assets (96) (258) (354)

----------- --------- --------

Operating profit/(loss) before exceptional

costs and financing 122 (338) (216)

Exceptional costs - acquisition and

restructuring costs (284) (292) (576)

----------- --------- --------

Loss before financing (162) (630) (792)

Finance income 30 - 30

Finance costs - (87) (87)

----------- --------- --------

Loss before taxation (132) (717) (849)

Taxation - - -

----------- --------- --------

Loss for the period (132) (717) (849)

Other comprehensive loss (369) - (369)

----------- --------- --------

Loss and total comprehensive loss for

the period - attributable to equity

holders of the parent (501) (717) (1,218)

=========== ========= ========

Basic and diluted loss per share

Basic loss for the period - - (2.05p)

=========== ========= ========

Diluted loss for the period - - (1.89p)

=========== ========= ========

Consolidated Interim Statement of Financial Position

As at 30 June 2011

Unaudited Unaudited Audited

as at as at as at

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Goodwill 10,430 1,677 509

Acquired intangible assets 3,180 251 5

Capitalised development expenditure 815 872 591

Property, plant and equipment 381 59 36

---------- ---------- -------------

14,806 2,859 1,141

---------- ---------- -------------

Current assets

Stock 213 - -

Trade and other receivables 3,164 1,194 756

Other short term financial

assets 143 - 64

Cash and cash equivalents 5,315 621 7,186

---------- ---------- -------------

8,835 1,815 8,006

Liabilities

Current liabilities

Trade and other payables (2,680) (722) (735)

Provisions (4) (4) (4)

Deferred income (5,549) (1,500) (1,485)

(8,233) (2,226) (2,224)

Net current assets/(liabilities) 602 (411) 5,782

---------- ---------- -------------

Non-current liabilities

Deferred income (659) - -

Other long term financial liabilities (256) - -

8% loan notes (3,122) - -

Convertible 8% unsecured loan

stock ("CULS") - (4,216) -

(4,037) (4,216) -

Net assets/(liabilities) 11,371 (1,768) 6,923

---------- ---------- -------------

Shareholders' equity

Ordinary share capital 477 15 319

Deferred share capital 4,542 4,542 4,542

Share premium 19,846 6,369 14,341

Merger reserve 1,023 1,023 1,023

Convertible unsecured loan

stock equity reserve - 146 -

Share options reserve 149 14 146

Translation exchange difference

on foreign subsidiary (369) - -

Retained earnings (14,297) (13,877) (13,448)

---------- ---------- -------------

Total surplus/(deficit) attributable

to equity holders of the parent 11,371 (1,768) 6,923

---------- ---------- -------------

Consolidated Interim Statement of Cash Flow

For the six months ended 30 June 2011

Unaudited Unaudited Audited

six months ended six months ended year ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Net cash from

operating activities (1,059) 241 768

------------------ ------------------ -------------

Cash flows from

investing activities

Acquisition of

subsidiaries net of

cash acquired (2,106) - -

Purchase of intangible

assets (308) (222) (367)

Purchase of property,

plant and equipment (242) (3) (24)

------------------ ------------------ -------------

Net cash used in

investing activities (2,656) (225) (391)

Cash flows from

financing activities

Proceeds from issue of

share capital 2,125 - 6,383

Interest paid - (81) (292)

Interest received 30 - 32

Repayment of credit

facility (306) - -

Capital element of

finance lease

payments (5) - -

------------------ ------------------ -------------

Net cash used in

financing activities 1,844 (81) 6,123

Net

(decrease)/increase

in cash and cash

equivalents (1,871) (65) 6,500

Cash and cash

equivalents at 1

January 7,186 686 686

------------------ ------------------ -------------

Cash and cash

equivalents at

balance sheet date 5,315 621 7,186

------------------ ------------------ -------------

Consolidated Statement of Changes in Shareholders' Equity

For six months ended 30 June 2011

Share CULS Share Profit

options equity Translation Merger premium and loss

Capital reserve reserve reserve reserve account reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

1 January

2010 4,557 14 146 - 1,023 6,369 (13,898) (1,789)

Total

comprehensive

income for

period ended

30 June 2010 - - - - - - 21 21

-------- -------- -------- ------------ -------- -------- --------- --------

30 June 2010 4,557 14 146 - 1,023 6,369 (13,877) (1,768)

Share based

payments 132 132

Redemption

of CULS (146) 146 -

CULS fair

value

adjustments - - - - - - 567 567

Issue of

share capital 304 - - - - 7,972 (667) 7,609

Total

comprehensive

income for

period ended

31 December

2010 - - - - - - 383 383

-------- -------- -------- ------------ -------- -------- --------- --------

31 December

2010 4,861 146 - - 1,023 14,341 (13,448) 6,923

Share based

payments - 3 - - - - - 3

Issue of

share capital 158 - - - - 5,505 - 5,663

Translation

difference on

translation

of foreign

subsidiary - - - (369) - - - (369)

Total

comprehensive

loss for

period ended

30 June 2011 - - - - - - (849) (849)

-------- -------- -------- ------------ -------- -------- --------- --------

30 June 2011 5,019 149 - (369) 1,023 19,846 (14,297) 11,371

-------- -------- -------- ------------ -------- -------- --------- --------

Notes to the interim financial statements

1. General information and basis of preparation

The consolidated interim financial statements have been prepared

in accordance with the AIM Rules for Companies and in accordance

with International Financial Reporting Standard (IFRS) IAS 34

Interim Financial Reporting.

The interim financial statements have not been audited or

reviewed pursuant to guidance issued by the Auditing Practices

Board and do not constitute statutory accounts within the meaning

of Section 435 of the Companies Act 2006. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2010.

Corero's consolidated interim financial statements are presented

in Pounds Sterling (GBP), which is also the functional currency of

the parent company.

The financial information for the year ended 31 December 2010

has been derived from the published statutory accounts as amended

to reflect the change in presentation of the Comprehensive

Statement of Income in line with best practice and other software

companies and the change in the accounting policy for cost of

sales. A copy of the full accounts for that period, on which the

auditors issued an unqualified report, has been delivered to the

Registrar of Companies.

Apart from the change in the accounting policy for cost of sales

to include all direct costs associated with revenue generation,

including services delivery and support costs, these interim

financial statements have been prepared in accordance with the

accounting policies applied in the financial statements for the

year ended 31 December 2010. They have been prepared under the

historical cost convention except for the valuation of financial

instruments. The financial statements have been prepared on a going

concern basis as the Directors believe that the current sales

prospects combined with existing working capital resources should

ensure that Corero has adequate working capital to service its

existing business for the foreseeable future. The directors have

made this assessment based on internal forecasts and cash flow

projections.

These consolidated interim financial statements were approved by

the Board on 6 September 2011 and approved for issue on 7 September

2011.

2. Segment reporting

Business segments

The Group is managed according to two business units: Corero

Network Security and Corero Business Systems. These divisions are

the basis on which the Group reports its primary segment

information. The principal activity of Corero Network Security is

the design, development and delivery of network security products.

The principal activity of Corero Business Systems is the design,

development and delivery of accounting and management information

software to the academy, school, further education and commercial

markets.

There are no inter-segment sales. Segment results, assets and

liabilities include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis.

Unallocated assets and liabilities comprise items such as cash and

cash equivalents, taxation, accruals, prepayments and

borrowings.

Notes to the interim financial statements

continued

2. Segment reporting (continued) - Statement of Comprehensive

Income

Corero Network Corero Business

Security Systems Central Costs Total

--------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6m 6m 12m 6m 6m 12m 6m 6m 12m 6m 6m 12m

30 30 31 30 30 31 30 30 31 30 30 31

Jun Jun Dec Jun Jun Dec Jun Jun Dec Jun Jun Dec

2011 2010 2010 2011 2010 2010 2011 2010 2010 2011 2010 2010

--------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Revenue

to external

customers

Product

and licence 1,195 - - 496 244 556 - - - 1,691 244 556

Professional

services 62 - - 483 278 699 - - - 545 278 699

Support 1,439 912 862 1,765 - - - 2,351 862 1,765

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Total 2,696 - - 1,891 1,384 3,020 - - - 4,587 1,384 3,020

Cost of

sales -605 - - -362 -232 -593 - - - -967 -232 -593

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Gross profit 2,091 - - 1,529 1,152 2,427 - - - 3,620 1,152 2,427

Operating

expenses -2,171 - - -909 -671 -1,406 -399 -175 -557 -3,479 -846 -1,963

Share options

charge - - - - - - -3 - -131 -3 - -131

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Operating

(loss)/profit

before

depreciation,

amortisation,

exceptional

costs and

financing -80 - - 620 481 1,021 -402 -175 -688 138 306 333

Depreciation

and

amortisation

of intangible

assets -258 - - -93 -92 -193 -3 -2 -5 -354 -94 -198

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Operating

(loss)/profit

before

exceptional

costs and

financing -338 - - 527 389 828 -405 -177 -693 -216 212 135

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Acquisition

and

restructuring

costs -292 - - - - - -284 -1 -60 -576 -1 -60

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

before

financing -630 - - 527 389 828 -689 -178 -753 -792 211 75

Finance

income - - - - - - 30 - 32 30 - 32

Finance

costs -87 - - - - - - -163 -199 -87 -163 -199

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

before

taxation -717 - - 527 389 828 -659 -341 -920 -849 48 -92

Taxation - - - - - - - - - - - -

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

(Loss)/profit

for the

period -717 - - 527 389 828 -659 -341 -920 -849 48 -92

--------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Notes to the interim financial statements

continued

2. Segment reporting (continued) - Statement of Comprehensive

Income

Discontinued Operations

Financial Markets and

Total

------------------- ----------------------------

GBP'000 GBP'000 GBP'000

6m 6m 12m

30 Jun 30 Jun 31 Dec

2011 2010 2010

------------------- -------- -------- --------

Revenue to

external

customers - 830 986

(Loss)/profit

before financing - -27 4

------------------- -------- -------- --------

Notes to the interim financial statements

continued

2. Segment reporting (continued) - Statement of Financial

Position

Corero Network Corero Business

Security Systems Unallocated Total

---------------------- ---------------------------- ---------------------------- ---------------------------- ----------------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6m 6m 12m 6m 6m 12m 6m 6m 12m 6m 6m 12m

30 30 31 30 30 31 30 30 31 30 30 31

Jun Jun Dec Jun Jun Dec Jun Jun Dec Jun Jun Dec

2011 2010 2010 2011 2010 2010 2011 2010 2010 2011 2010 2010

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Goodwill 9,921 - - 509 509 509 - - - 10,430 509 509

Acquired intangible

assets 3,175 - - 5 8 5 - - - 3,180 8 5

Capitalised

development

expenditure 94 - - 721 541 591 - - - 815 541 591

Property,

plant & equipment 340 - - 41 27 36 - - - 381 27 36

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Non current

assets 13,530 - - 1,276 1,085 1,141 - - - 14,806 1,085 1,141

Stock 213 - - - - - - - - 213 - -

Trade and

other receivables 1,582 - - 1,560 498 532 22 313 288 3,164 811 820

Other short

term financial

assets 85 - - 2 - - 56 - - 143 - -

Cash and cash

equivalents 276 - - 159 - - 4,880 621 7,186 5,315 621 7,186

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Total assets 15,686 - - 2,997 1,583 1,673 4,958 934 7,474 23,641 2,517 9,147

Trade, other

payables and

provisions -1,734 - - -783 -157 -252 -167 -496 -487 -2,684 -653 -739

Deferred income -3,538 - - -2,011 -1,208 -1,485 - - - -5,549 -1,208 -1,485

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Total current

liabilities -5,272 - - -2,794 -1,365 -1,737 -167 -496 -487 -8,233 -1,861 -2,224

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Non current

liabilities -4,037 - - - - - - -4,216 - -4,037 -4,216 -

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Net

assets/(liabilities) 6,377 - - 203 218 -64 4,791 -3,778 6,987 11,371 -3,560 6,923

---------------------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- -------- --------

Notes to the interim financial statements

continued

2. Segment reporting (continued) - Statement of Financial

Position

Segmental net assets/(liabilities)

Total

----------------------- ----------------------------

GBP'000 GBP'000 GBP'000

6m 6m 12m

30 31

30 Jun Jun Dec

2011 2010 2010

----------------------- -------- -------- --------

Segmental

assets 23,641 2,517 9,147

Discontinued

operations - 2,157 -

Segmental

liabilities -12,270 -6,077 -2,224

Discontinued

operations - -365 -

----------------------- -------- -------- --------

Group net

assets/(liabilities) 11,371 -1,768 6,923

----------------------- -------- -------- --------

3. Earnings/(loss) per share

Basic earnings/(loss) per share is calculated by dividing the

earnings attributable to ordinary shareholders by the weighted

average of ordinary shares outstanding during the period.

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2011 2010 2010

(Loss)/earnings GBP'000

after taxation - continuing

and acquired operations (849) 48 (92)

------------ ------------ -------------

Basic (loss)/earnings

per share - continuing

and acquired operations (2.05p) 3.16p (0.7p)

------------ ------------ -------------

(Loss)/earnings GBP'000

after taxation - discontinued

operations - (27) 496

------------ ------------ -------------

(Loss)/earnings per share

- discontinued operations - (1.78p) 3.7p

------------ ------------ -------------

Total (2.05p) 1.38p 3.0p

------------ ------------ -------------

Weighted average number

of ordinary shares 42,390,142 1,518,990 13,529,948

------------ ------------ -------------

Notes to the interim financial statements

continued

3. Earnings/(loss) per share (continued)

Diluted earnings/(loss) per share is calculated by dividing the

earnings attributable to ordinary shareholders by the weighted

average of ordinary shares outstanding during the period plus

applicable share options.

The CULS were non-dilutive for periods ending 30 June 2010 and

31 December 2011 and the share options were non-dilutive for the

period ending 30 June 2010 (therefore the diluted and basic

(loss)/earnings per share were the same).

Unaudited

six months Audited

ended year ended

30 June 31 December

2011 2010

Loss GBP'000 after taxation

- continuing and acquired operations (849) (92)

------------ -------------

Diluted loss per share - continuing

and acquired operations (1.89p) (0.62p)*

------------ -------------

Earnings GBP'000 after taxation

- discontinued operations - 496

------------ -------------

Diluted earnings per share -

discontinued operations - 3.35p*

------------ -------------

Total (1.89p) 2.73p*

------------ -------------

Weighted average number of ordinary

shares and options 44,994,225 14,786,948

------------ -------------

* restated to include options issued which were dilutive,

previously not reported as such.

Notes to the interim financial statements

continued

4. Cash flows from operations

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

2011 2010 2010

GBP'000 GBP'000 GBP'000

(Loss)/profit before taxation (849) 21 (92)

Adjustments for:

Depreciation 48 22 22

Amortisation of intangibles 306 218 175

Finance income (30) - (32)

Finance expense 87 163 199

Decrease in provisions - (8) (8)

Share based payment charge 3 - 131

Changes in working capital

(Increase) in stock (74) - -

(Increase) in trade and other

receivables (1,511) (309) (344)

Increase in payables 961 134 424

------------ ------------ -------------

Net cash generated from continuing

and acquired operations (1,059) 241 475

Net cash from discontinued

operations - - 293

------------ ------------ -------------

Net cash from operating activities (1,059) 241 768

------------ ------------ -------------

Notes to the interim financial statements

continued

5. Statement of comprehensive income - restatement

The statement of comprehensive income below illustrates the

statement of comprehensive income prepared on the same basis and

applying the cost of sale accounting policy adopted in the 31

December 2010 financial statements.

Unaudited Unaudited Audited

six months six months year ended

ended ended 31

30 June 30 June December

2011 2010 2010

GBP'000 GBP'000 GBP'000

Revenue 4,587 1,384 3,020

Cost of sales (715) (73) (230)

------------ ------------ ------------

Gross profit 3,872 1,311 2,790

Trading expenses (4,287) (1,205) (2,675)

Trading (loss)/profit (415) 106 115

Share options charge (3) - (131)

Other non trading items* (374) 105 91

(Loss)/profit before financing (792) 211 75

Finance income 30 - 32

Finance costs (87) (163) (199)

------------ ------------ ------------

(Loss)/profit before taxation (849) 48 (92)

Taxation - -

------------ ------------ ------------

(Loss)/profit for the period from

continuing operations (849) 48 (92)

(Loss)/profit for the period from

discontinued operations - (27) 4

Profit from sale of discontinued

operations - - 492

------------ ------------ ------------

(Loss)/profit for the period (849) 21 404

Other comprehensive loss (369) - -

------------ ------------ ------------

(Loss)/profit and total

comprehensive (loss)/income for

the period - attributable to

equity holders of the parent (1,218) 21 404

============ ============ ============

* holiday pay accrual, capitalisation and amortisation of

research and development costs and exceptional costs Notes to the

interim financial statements

continued

5. Statement of comprehensive income - restatement

(continued)

The statement of comprehensive income below illustrates the

statement of comprehensive income for the six month period to 30

June 2011 prepared on the same basis and applying the cost of sale

accounting policy adopted in the 31 December 2010 financial

statements as shown in the column "Old Basis" and the effect of the

new cost of sales accounting policy and reclassification of costs

in the statement of comprehensive income as presented in the

interim financial statements above shown in the column "New

Basis".

Unaudited Unaudited

six months Change in six months

ended cost of sales ended

30 June accounting 30 June

2011 policy and 2011

Old Basis reclassification New Basis

GBP'000 GBP'000 GBP'000

Revenue 4,587 - 4,587

Cost of sales (715) (252) (967)

Trading/operating expenses (4,287) 808 (3,479)

Share options charge (3) - (3)

Depreciation and amortisation

of intangible assets - (354) (354)

Exceptional costs -

acquisition and

restructuring costs - (576) (576)

Other non trading items (374) 374 -

------------ ------------------ ------------

Loss before financing (792) - (792)

------------ ------------------ ------------

Notes to the interim financial statements

continued

6. Goodwill

Unaudited

six months

ended

30 June

2011

GBP'000

Cost

At 1 January 509

Additions 9,921

------------

At 30 June 10,430

------------

Impairment -

At 1 January -

Period -

------------

At 30 June -

------------

Carrying amount at 30 June 10,430

============

7. Acquisition

On 2 March 2011, the Company acquired the entire issued share

capital of Top Layer which has since been renamed Corero Network

Security, Inc.

The aggregate consideration for the acquisition was $15,288,160

satisfied as follows:

-- $6,304,602 by the issue, credited as fully paid, of 9,038,855

new Ordinary shares Corero;

-- $5,000,000 by the issue of loan notes by Top layer. These

loan notes bear interest at 8% per annum and are repayable on 2

March 2014;

-- $3,860,000 in cash (of which $500,000 was paid into an escrow

account); and

-- Deferred consideration of $123,558, to be satisfied by the

issue of 177,145 new Ordinary shares Corero to be issued on 2

September 2012 subject to adjustment for set off against any

warranty claims brought by the Company in accordance with the terms

of the acquisition agreement.

Notes to the interim financial statements

continued

7. Acquisition (continued)

The assets and liabilities of Top Layer at the date of

acquisition were:

Fair value

GBP'000

Property, plant and equipment 159

Other non-current assets 84

Inventory 136

Trade and other receivables 820

Cash and cash equivalents 130

Trade and other payables (1,323)

Other short term financial liabilities (362)

Deferred income (3,874)

Other non-current liabilities (185)

-----------

Net liabilities (4,415)

Goodwill 9,921

Customer contracts and related

customer relationships 121

Software 3,266

Satisfied by consideration 8,893

-----------

Consideration comprises:

Completion consideration shares 3,344

Loan notes 3,071

Cash 2,413

Deferred consideration shares 65

Total consideration 8,893

-----------

The Company's strategy as set out in the Circular to

shareholders dated 14 July 2010 is to build a network security

technology focused business. The acquisition of Top Layer is the

first step in executing the Company's acquisition strategy and

provides a core platform on which to build a leading network

security business. The goodwill arising from the acquisition

includes Top Layer's 12 years of deep domain expertise in security

and networking and its proprietary technology offering with a

multi-core processing platform to support high performance security

applications and scalable architecture. The Company plans to add

functionality to the Top Layer platform to broaden its network

security offering to deliver revenue growth.

The costs relating to the acquisition of Top Layer (a reverse

takeover under the AIM Rules) and associated placing referred to in

note 8 below were GBP551,000, of which GBP284,000 has been

recognised as an expense in the statement of comprehensive income

in the six months ended 30 June 2011 and included under Exceptional

costs, and GBP267,000 has been charged to the share premium arising

from the issue of the consideration and placing shares.

The revenue and loss of Top Layer since the acquisition date

included in the consolidated statement of comprehensive income for

the six months to 30 June 2011 is shown in note 2 under the heading

Corero Network Security. The consolidated revenue and operating

loss before depreciation, amortisation of intangible assets,

exceptional costs and financing for the

Notes to the interim financial statements

continued

7. Acquisition (continued)

six months ended 30 June 2011 as though the acquisition date had

been effective as of the beginning of the annual reporting period,

would have been GBP3,595,000 and GBP288,000 respectively.

8. Placing

On 2 March 2011, the Company raised GBP2.3 million (before

costs) by way of a placing of 6,571,429 new ordinary shares at a

price of 35p per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGGLKVDGMZM

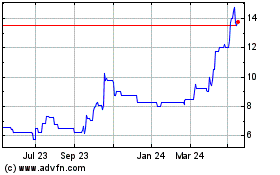

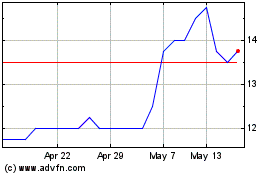

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Corero Network Security (LSE:CNS)

Historical Stock Chart

From Jul 2023 to Jul 2024