Trading Statement

January 25 2001 - 3:21AM

UK Regulatory

RNS Number:8068X

Claims Direct PLC

25 January 2001

Claims Direct plc ("the Company")

Trading Statement and Board Changes

Following yesterday's meeting of the Board of Claims

Direct plc, the Company is today making a trading

statement and announcing changes to the Board.

Trading statement

Following the fall in consumer confidence which was

experienced after autumn's negative publicity and despite

encouraging increases in call centre enquiries in recent

days, the run rate of accepted cases has not maintained

the levels seen up to the end of November. It is still

too early to forecast whether the recent increases in

enquiry levels will continue.

As a result, the Board anticipates that the level of

accepted cases for the remainder of the financial year

ending 31 March 2001 will be significantly below market

expectations.

Since the half year end, the run rates of accepted cases

have been as follows:

October 4,379

November 5,002

December 2,411

January (to date) 2,523

Due to delays in the introduction of the enhanced

insurance policy product (which was announced in the

statement dated 24 November 2000), the Company has to

date been unable to recover from its clients the

increased premium costs payable to underwriters.

Accordingly, gross margins have been significantly

reduced during this period. The Board anticipates that

previous gross margins will be restored when the enhanced

insurance policy is introduced in the near future.

Discussions continue with the underwriters and the

Company anticipates that it will be required to make

substantial advanced payments in order to secure

underwriting capacity on a longer term basis (three

years). This will be reflected in the accounts for the

full year to 31 March 2001.

The Company has continued its substantial budgeted

marketing spend and has recently, within this budget,

launched a new advertising campaign designed to develop

its brand proposition further. The Board believes that

this campaign will lead to a recovery in the number of

accepted cases, although the full impact will not be seen

until the new financial year commencing 1 April 2001.

As a result of the reduced caseload, the associated

increased advertising spend per accepted case and the

increased insurance cost, the Company expects that its

results for the six months ending 31 March 2001 will be

substantially below market expectations. A further

trading update will be provided around the time of the

year end.

Board Changes

As a result of the above and recognising the new

operating environment, the Board has decided that Mr Tony

Sullman, currently Executive Chairman, will be better

able to serve the Company in a non-executive capacity.

Mr Sullman will therefore become non-executive Chairman

with immediate effect. The Board intends to appoint an

independent non-executive Chairman in due course.

The Board intends to appoint David Gravell to the Board

as Operations Director in the near future. Mr Gravell,

who joined the Company in November 2000, has 22 years

experience in the defendant insurance industry. Before

joining the Company, Mr Gravell was the Claims Director

of the commercial division of Zurich Insurance (part of

Zurich Financial Services, the fourth largest insurer in

the UK with approximately 9,000 employees and a turnover

in excess of #2 billion). Mr Gravell was jointly

responsible for running a business with an annual

turnover of #600 million and 2,500 employees.

Paul Rew, Legal Director and Company Secretary, having

assisted the Company through its flotation process, has

indicated his intention to leave Claims Direct to seek

new challenges. On his departure, Paul Doona, Finance

Director, will assume the role of Company Secretary.

Commenting on today's statement, Colin Poole, Chief

Executive of Claims Direct, said:

"We recognise that we underestimated the negative impact

on Claims Direct's business from the autumn publicity.

In addition, competition has grown and rates and capacity

within the relatively immature personal injury

underwriting market have hardened.

"We believe we have taken the steps necessary to remedy

these issues, whilst acknowledging that our actions will

not bear fruit until the next financial year.

"The Board continues to have confidence in the Company's

ability to operate in the personal injury market and

related market places."

For further information, please contact:

Claims Direct plc (Today) 0207 253 2252

Colin Poole, Chief Executive

Paul Doona, Finance Director

Web Site www.claimsdirect.com

Golin/Harris Ludgate 0207 253 2252

Reg Hoare/Robin Hepburn/Trish Featherstone

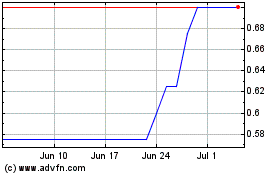

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

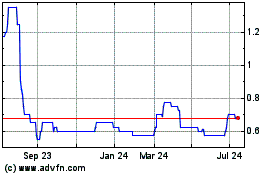

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024