RNS Number:8528F

Claims Direct PLC

26 June 2001

For Immediate Release 26 June 2001

Claims Direct plc

Preliminary Results for the Year Ending 31 March 2001

Claims Direct plc ("Claims Direct"), the premier UK personal injury

compensation company, announces its preliminary results for the year ended 31

March 2001.

Summary

- Turnover up 65% at #65.9m (2000: #40.0m)

- Underlying operating profit* #6.8m (2000: #11.7m)

- Loss before tax #20.2m (2000: profit #10.1m)

- Adjusted earnings per share*: 1.8p (2000: 5.1p)

- Total dividend of 0.5p for the year - no final dividend

- Year-end cash balances #23.2m of which #11.6m is available for general

working capital purposes (2000: #5.1m)

- Number of accepted cases up 58% to 48,914 (2000: 30,981)

- Cases in progress at 31 March 2001 70,589 (2000: 36,310)

* Before exceptional items, amortisation of goodwill and interest

- ends -

An analyst meeting will be held today at 9.30 a.m. at Golin/Harris Ludgate,

111 Charterhouse Street, London, EC1M 6AW.

For further information please contact:

Claims Direct plc (on 26th June) 0207 324 8888

Paul Doona, Managing Director thereafter 01952 284839

David Gravell, Chief Operating Officer

Web Site www.claimsdirect.com

Golin/Harris Ludgate Tel: 0207 324 8888

Reg Hoare/Robin Hepburn

Statement from the Board

Following a year of significant growth in 1999/2000 and after announcing

excellent results for the six months to 30 September 2000, these overall

results for 2000/2001 are very disappointing. As indicated in our year-end

trading statement of 28th March 2001, the results show a pre-tax loss of

#20.2m after the charging of exceptional items and amortisation of goodwill,

compared with a profit last year of #10.1m. Whilst the underlying operating

profit for the year was #6.8m (2000 #11.7m) the second half saw an underlying

operating loss of #6.9m. As is explained more fully in the Managing

Director's review and financial report, significant and challenging action

will continue to be taken.

Dividend

The company paid an interim dividend to shareholders in January but having

regard to the results for the year as a whole, your board considers that the

payment of a final dividend is not appropriate.

Strategy

As the company entered its last financial year the strategy was to strengthen

its market position and prepare for flotation in July 2000. Staff levels and

the number of claims managers and solicitors on our legal panel were built up

to meet increasing consumer demand. The company was successfully floated and

client demand continued to grow. In support of its mission to provide access

to justice to as many people as possible, a programme of training and

accreditation was rolled out to all claims managers and panel solicitors. In

this way the company set out to establish an industry standard.

The other prime concern was to make improvements to the business model. In

particular, enhancements to the insurance product, Claims Direct Protect,

were sought in order to ensure that successful clients always received a

minimum level of compensation. Unfortunately, the adverse and largely

ill-informed media comment in relation to the recoverability of insurance

premiums, held up the launch of this initiative until towards the end of the

financial year.

As stated in the Operational Review, the principle of recoverability now

appears to have been established, leaving open the question of the

"reasonableness" of the premium. A successful outcome to this process remains

a key issue.

Adverse media comment

The company and the claims management industry, in general, has suffered

considerably from adverse media comment. The attention the company received

was largely inaccurate and sensationalised but caused severe damage to its

reputation, and, as a consequence, the level of its case load. We have learnt

to our cost that once misinformation enters the public domain it is very

difficult to counter its effects. It has always been our purpose to protect

those who have suffered genuine injury rather than promote a compensation

culture. For this reason we set aside significant funds in order to make ex

gratia payments to clients who took out policies before 1 April 2000, when it

became clear that their premiums would not be recovered.

So much has occurred in recent months that it is easy to forget that as

recently as December 2000, Claims Direct received the CBI/Real Business Award

as the Company of the Year.

Board changes

During the year there were several changes to our main board. In December

2000, the Chairman relinquished his executive duties and became Non-Executive

Chairman. In February and March respectively, Paul Rew, Legal Director and

Company Secretary, and Roger Plantier, Marketing Director departed. Both have

gone on to new challenges after assisting us through the company's flotation

and subsequent period.

Following the year-end, Paul Doona was appointed Managing Director whilst

continuing to exercise his existing duties as Finance Director. Colin Poole,

former Chief Executive became Non-Executive Deputy Chairman. David Gravell

Chief Operating Officer joined us from Zurich Insurance in November 2000.

Appreciation

The board is grateful for the very hard work put in by our staff during both

the period of business growth that characterised the first half of the year

and the difficult trading conditions we faced in the second half. We also

wish to thank the solicitors on our legal panel, our claims managers and

other business partners for their hard work and fortitude in difficult times.

Current Trading and Prospects

The number of accepted cases has continued to decline since the year-end

resulting in operating losses being sustained in the new financial year. It

is not yet possible to ascertain at what level the number of accepted cases

will stabilise. Accordingly, we are continuing the process of aligning the

operational base and overhead structure to lower volumes of business.

Inevitably, this year has taught us lessons. The setbacks that we have

experienced have forced us to assess and tackle our weaknesses, reconsider

our operations and make appropriate changes. The Managing Director's Review

and the Operational Review that follow explain the results of these

deliberations and the plans we have laid for the future. The changes and

innovations that we are implementing are necessary steps which we need to

make in order to restore our reputation and rebuild our market strength, as

we seek to return the company to profitability in due course.

Managing Director's Review and Financial Report

A year ago we were preparing for the flotation of the company and faced the

challenge of rapidly rising demand for our product. Our strategy was a

relatively narrow one driven by the need to meet the phenomenal growth in

demand while trying to ensure that any competition had little or no chance of

catching up. Subsequently, as the Board reports, we were dogged by adverse

publicity. And while a number of competitor companies have fallen foul of the

same bad publicity, we do now face serious competition and our market share

has reduced. Our current challenge is to regain lost ground by emphasising

the quality of our service and product.

In this review I will focus on matters that underpin our strategy and then

present my financial report. David Gravell, Chief Operating Officer then

provides a review of operations.

Appropriate change

My determination and that of all our staff is to rebuild our leadership in

the market and to demonstrate that Claims Direct stands for quality,

integrity, efficient service and, above all, delivery of the best deal in

terms of compensation to our clients. In order to do this, we have

re-engineered the core of our business operations, and are addressing the

very important aspect of branding and reputation. We intend to develop new

products outside the realm of personal injury compensation, and are also

focusing attention on the relationship with our business partners to

strengthen co-operation in taking the business forward.

These changes, and the changes that have been made to the main board, reflect

the evolution of the existing business and emphasise our increased focus on

operational issues. They also provide a platform upon which to consider

future strategic opportunities.

Strengthening image and reputation

With hindsight it is clear that while we were extremely successful in

marketing the Claims Direct brand name, primarily through television

advertising, the brand itself meant little to our target audience over and

above a way of accessing compensation. We did not build the brand and develop

a more rounded notion of what Claims Direct stood for in the process.

As the events of the second half of the year showed, brand name recognition

is not enough.

We have always had a good story to tell concerning the ultimate aim of our

business, which is to provide access to justice for as many people as

possible. Each refinement we have made to our business model was geared to

this end but we are aware that we did not maximise the opportunities to

promote these developments and successes through a co-ordinated marketing

programme.

Looking forward

We are continuing to pursue improvements in our business model to seek to

ensure that clients receive the best possible deal.

We also intend to introduce other, highly innovative products related to

legal services but no longer exclusively concerning personal injury. Our

vision is to provide consumers in both domestic and business markets with a

range of products which empower individuals to find solutions to various

legal and financial problems. These products are likely to be developed as

joint ventures.

I wish to reiterate the Board's appreciation for all the hard work put in by

Claims Direct staff at every level during the last year, and by our business

partners throughout the UK.

Despite set backs which have affected us all, I remain determined to rebuild

our market share, leadership and good name in the UK. In time, I believe that

innovative products will add to improving fortunes.

Financial Report

Results

Group turnover for the year to 31 March 2001 was #65.9m, representing an

increase of 65% on the previous year (#40.0m). Underlying operating profit,

the definition of which is explained below, was #6.8m. This compares with

#11.7m in the previous year. The loss before tax for the year was #20.2m

(2000 profit, #10.1m).

Underlying Operating Profit

The table below provides shareholders with a measure of underlying profit or

loss after adjusting for exceptional items:

Six months to Six months to Year to Year to

30 Sep 2000 31 Mar 2001 31 Mar 2001 31 Mar 2000

Profit/(loss) before tax 10,309 (30,519) (20,210) 10,107

Interest (receivable)/

payable (689) (1,096) (1,785) 297

Goodwill 612 3,049 3,661 968

Exceptional costs:

Employee costs 1,611 (458) 1,153 350

New insurance

arrangements - 16,584 16,584 -

Ex-gratia payments 937 3,351 4,288 -

Payments to potential

litigants 976 972 1,948 -

Closure of Claims Direct

Retail - 1,196 1,196 -

-------- -------- -------- --------

Underlying operating

profit/(loss) 13,756 (6,921) 6,835 11,722

===== ===== ===== =====

Exceptional costs

Further details of the exceptional costs are as follows:

* Employee costs totalling #1.1m relate to flotation bonuses paid to

directors and staff following the company's listing of #0.5m and national

insurance paid by the company on share options exercised by company staff of

#0.6m.

* Additional premiums of #16.6m payable on existing business under revised

insurance arrangements.

* Ex gratia payments in respect of clients who had taken out Claims Direct

Protect policies before 1 April 2000 totalled #4.3m.

* Payments made to potential litigants totalled #1.9m.

* Closure of the Claims Direct Retail operation at a cost of #1.2m

Interest

Net interest received in the year was #1.8m. This compares with net interest

payable in the year to 31 March 2000 of #0.3m and results from the net cash

position which the group has enjoyed since its flotation in July 2000, as

well as the interest receivable from client loans which the group has funded.

Corporation Tax

The effective tax rate on the group loss before tax is 15%. This is lower

than the basic rate due, primarily, to the disallowance for tax of the

amortisation of goodwill and unrelieved losses that will be carried forward

for set off against future trading profits. As a consequence of the company's

results, the profit and loss account contains a taxation credit.

Corporation tax paid on account in respect of 2000/2001 (#2.9m) was recovered

subsequent to the year-end.

Cash

Despite the level of losses in the second half of the year, the company ended

the year with cash balances of #23.2m, of which #11.6m is held in a

restricted account, leaving free funds of #11.6m.

Shareholders' Funds

Shareholders' funds increased to #33.9m from #3.4m. Before the flotation in

July 2000 the number of ordinary shares in issue in the company was 159.7

million. The number of ordinary shares in issue now amounts to 193.9 million.

Flotation

In July 2000, the Claims Direct Group was listed on the London Stock

Exchange, placing a total of 27.8 million new shares, largely with

institutional shareholders. The group raised #48.5 million from the proceeds

of the flotation, thus strengthening the balance sheet.

The detailed cash flow statement shows the application of these funds in the

year to 31 March 2001. Significant expenditure included the acquisition of

the claims vetting operation of Poole & Company, which has now been absorbed

into the business. Flotation proceeds also enabled the company to provide

loans directly to clients, facilitating the transfer from Investec Bank, the

initial funder of client loans, to First National Bank.

New insurance arrangements

Following a period of intensive negotiation we were delighted to announce, in

March 2001, that we had completed a three-year, long-term insurance agreement

with existing and new insurance underwriters at Lloyd's. This agreement is

subject to regular review but provides the company with additional certainty

for the continuation of the business along with enhanced protection and

security for its clients. Following the launch of the new agreement the

margin on accepted cases which had been significantly reduced in the second

half of the year, was substantially restored.

Litigation

In our half-year statement we reported progress on the issue of litigation

with a number of former franchisees. This has been substantially dealt with

in a way which will have modest net cost to the company. Arbitration

proceedings have commenced in respect of a further 25 franchisees. The

amounts claimed totalled #16.6m but will be vigorously defended. The legal

advice given to the board is such that the board believe these claims to be

substantially exaggerated. Accordingly the board do not believe it is

possible to reliably quantify the likely financial effect of these actions,

and are unable to make a realistic assessment as to the likely impact on the

group's future costs.

Corporate Governance

The company has fully embraced the objectives of good corporate governance

and has taken steps to ensure that it complies in full with the

recommendations of the Turnbull committee. Your board believes in maintaining

high standards of corporate governance and intends to ensure that the company

always conducts business in accordance with best practice.

Paul Doona

Managing Director

Operational Review

Since joining the company, I have assumed responsibilities for the day-to-day

liaison with panel solicitors and the franchise network, for overseeing the

re-engineering of core business operations, and for leading discussions with

the insurance industry and the legal profession concerning the recoverability

of insurance premiums.

Improved core products

During the last financial year, all these operational areas hinged on the

effectiveness of the company's core post-accident insurance policy, Claims

Direct Protect, and on the business model that made it work. Progress with

developing the core business product and in making refinements to the

business model were slowed considerably during the year, primarily as a

result of the factors outlined in the Managing Director's Review.

Nevertheless, by the end of the financial year we had developed and launched

an improved version of the Claims Direct Protect insurance policy.

Our upgraded version of Claims Direct Protect ring-fences the first #1,000 of

the damages awarded, ensuring that at least this much is restored to clients

who win compensation. The product is of course subject to the normal

limitations in insurance policies, and interest may still be required to be

paid by the client. This product is a significant improvement on its

predecessor and I believe that it offers one of the best possible deal to

claimants.

As with the previous policy claims are vetted thoroughly before they become

accepted, thereafter, a claimant loses nothing if his or her case is

unsuccessful in achieving compensation.

Establishing recoverability

We are playing a full role in the initiatives that are taking place following

the Court of Appeal decision in Callery v Gray to resolve the issue of

premium recoverability. Indications are that the principle of recoverability

is being accepted within the insurance industry. Nevertheless, we have

prepared a number of test cases, which we will pursue through the courts if

necessary, in order to confirm the principle of the recoverability and

protect our clients' position.

Re-engineering business operations

The re-engineering to which we have referred involves the creation of five

new multi-disciplinary teams based at our headquarters in Telford. Each team

handles claims associated with a specific region of the UK which are

progressed by claims managers and solicitors within this region. Previously,

we had a number of departments, each with a separate function and all of them

handling claims on a nationwide basis. We also had a system in which a client

and his solicitor were often located far apart. Within the new system the

teams are made up of staff from the former departments working closely

together to ensure complete and focused attention on the progress of claims.

For the first time we have a means of comparing team performance and

monitoring progress. This new structure has also improved customer care,

through closer communication between all parties involved in the process of

the claim.

The franchise network

During the year, as levels of business reduced in the face of competition and

adverse publicity, we have had to trim our sails, in particular reducing

expenditure on marketing. It also became clear that the business could not

support the number of franchises, which reached a level of approximately 370.

We therefore put together an exit package for franchisees. To date,

approximately 90 franchisees have taken the package or agreed to take it. By

the end of the current financial year there will be significantly fewer

claims managers than at present, and the revised network will represent a

core of those intent on building their businesses.

The retail sector

By the end of December 2000 we had established 17 Claims Direct retail

outlets as a pilot programme, and had been monitoring their subsequent

performance. The factors impacting on our core business, mentioned above,

also affected these outlets and there was some concern among franchisees that

the shops represented unwanted local competition. The outlets were also

limited in their level of activity because they offered only one product. As

a result, we took the decision to close them and by this action we reduced

our headcount by 49. The principal of developing a retail presence is not

totally discounted but the board does not consider the market to be right at

present, at least until new products have been successfully launched.

Consolidating strengths

I am confident that product enhancements, further refinements to the business

model and the re-engineering of headquarters operations will strengthen our

existing business.

David Gravell

Chief Operating Officer

Consolidated Profit and Loss Account

for the year ended 31 March 2001

2001 2001 2001 2000 2000 2000

Before Before

Except- Except- Except- Except-

ional ional ional ional

Items Items Total Items Items Total

Notes #'000 #'000 #'000 #'000 #'000 #'000

Turnover

- Continuing

operations 64,466 - 64,466 39,964 - 39,964

- Acquisition 1,388 - 1,388 - - -

-------- ---- ------ ----- ------ ------

- Total 1 65,854 - 65,854 39,964 - 39,964

Cost of sales 2 (48,185) (22,820) (71,005) (22,215) - (22,215)

----- ----- ----- ----- ----- --------

Gross

profit/(loss) 17,669 (22,820) (5,151) 17,749 - 17,749

Administrative

expenses (12,023) (4,821) (16,844) (6,995) (350) (7,345)

------ ------ ------ ----- ------- -------

Operating profit before

amortisation of goodwill

6,835 (25,169) (18,334) 11,722 (350) 11,372

Amortisation of

goodwill (1,189) (2,472) (3,661) (968) - (968)

------ ------ ------ ------- ------ -------

Operating profit/(loss)

- Continuing operations 4,752 (27,641) (22,889) 10,754 (350) 10,404

- Acquisition 894 - 894 - - -

----- ------ ------ ----- -------

------- Total 5,646 (27,641) (21,995) 10,754 (350)

10,404

------ ------ ------- ----- ------

Net Interest receivable/

(payable) 1,785 (297)

----- ------

(Loss)/profit on ordinary activities

before taxation (20,210) 10,107

Tax on (loss)/profit on

ordinary activities 3,027 (3,457)

------- ------

(Loss)/profit on ordinary activities

after taxation (17,183) 6,650

Equity dividends 3 (963) (2,858)

------ -------

Retained (loss)/profit for

the year (18,146) (3,792)

======= =======

(Loss)/earnings per ordinary share

- Basic 4 (9.4)p 4.2p

- Diluted 4 (9.4)p 4.2p

- Adjusted 4 1.8p 5.1p

Dividend per ordinary share 0.5p 47.8p

Consolidated Balance Sheet

as at 31 March 2001

2001 2000

#'000 #'000

Fixed assets

Intangible assets 9,800 3,472

Tangible assets 958 466

Investments 43 -

---------- ---------

10,801 3,938

--------- ---------

Current assets

Debtors 32,671 19,103

Investments 10,804 -

Cash at bank and in hand 23,240 5,059

---------- ----------

66,715 24,162

Creditors : amounts falling due

within one year 10 (33,925) (17,450)

Net current assets 32,790 6,712

--------- ---------

Total assets less current liabilities 43,591 10,650

Provisions for liabilities and charges (9,828) (7,296)

---------- ----------

Net assets 33,763 3,354

====== ======

Capital and Reserves

Called up share capital 1,926 94

Share premium 48,223 -

Merger reserve 265 401

Profit and loss account (16,651) 2,859

---------- ----------

Equity shareholders' funds 33,763 3,354

====== ======

Consolidated Cash Flow Statement

for the year ended 31 March 2001

2001 2000

Notes #'000 #'000 #'000 #'000

Net Cash (outflow)/inflow

from operating Activities 5 (4,907) 4,813

Returns on investments & servicing of

finance

Interest received 1,693 44

Interest paid (755) (341)

-------- --------

Net cash inflow/(outflow)

from returns on investments

and servicing of finance 938 (297)

Taxation (2,875) (76)

Capital expenditure

Purchase of tangible fixed assets (1,442) (426)

Acquisitions and disposals

Poole & Company vetting operations (9,789) -

Deferred consideration in relation to

acquisition in previous period (2,028) -

Equity dividends paid (1,734) (1,605)

-------- --------

Net cash (outflow)/inflow before use of

liquid resources and financing (21,837) 2,409

Management of liquid resources

Increase in short term debt (7,378) (4,259)

Current asset investments (10,804) -

---------- --------

Net cash outflow from management

of liquid resources 6 (18,182) (4,259)

Financing

Issue of ordinary shares (net

of costs) 48,552 -

Decrease in bank loans (8) (8)

Capital element of finance lease

payments (6) (9)

Increase in invoice discounting

facility 2,358 3,144

Net cash inflow from financing - 50,896 - 3,127

-------- -------- -------- ------

Increase in cash 6 10,877 1,277

-------- --------

1 Turnover

Turnover, which excludes value added tax, principally represents the amounts

invoiced upon acceptance of each individual claimant's case by a member of

the panel of solicitors and, where applicable, completion of a satisfactory

proposal form in connection with an after the event insurance policy to

provide insurance to the claimant in respect of the costs of the claim. All

other turnover is recognised as it is earned and is, in general, taken to

accrue evenly over the expected life of each case.

2 Cost of sales

Cost of sales comprises the fees payable to franchisees and other

infrastructure costs, including marketing.

3 Dividends

An interim dividend of 0.5p was paid. The directors recommend that no final

dividend is paid.

4 (Loss)/earnings per ordinary share

Basic and diluted earnings per share, the latter which allows for the

exercise of outstanding share options are calculated by dividing the loss

attributable to ordinary shareholders of #17,183,000 (2000:profit of

#6,650,000) by the weighted average number of ordinary shares.

In the case of basic earnings per share, the weighted number of ordinary

shares, excluding the shares held by the long-term share incentive scheme

which are held by the company, totals 183,160,856 (2000:159,706,993) and for

diluted earnings per share, totals 183,160,856 (2000: 160,069,997).

Adjusted earnings per ordinary share before amortisation of goodwill,

interest and exceptional items is calculated by adjusting the (loss)/profit

attributable to ordinary shareholders by the after-tax effect of those items

(#20,388,600) (2000: #1,420,900) and then dividing the adjusted earnings by

the weighted average number of ordinary shares (183,160,856) (2000:

159,706,993).

5 Reconciliation of operating (loss)/profit to net cash (outflow)/inflow from

operating activities

2001 2000

#'000 #'000

Operating (loss)/profit (21,995) 10,404

Depreciation charge 946 89

Loss on sale of fixed assets 3 15

Amortisation of goodwill 3,661 968

(Increase) in debtors (9,690) (15,197)

Increase in creditors 17,803 6,756

Increase in provisions 4,365 1,523

UTIF 17 charge - 255

-------- -------

Net cash (outflow)/inflow from

operating activities (4,907) 4,813

===== =====

6 Reconciliation of increase in net cash flow in net cash / (debt)

At 1 April At 31 March

2000 Cashflow 2001

#'000 #'000 #'000

Cash at bank and in hand 800 10,803 11,603

Overdrafts (74) 74 -

-------- -------- --------

726 10,877 11,603

-------- -------- --------

Debt due within one year (3,848) (2,350) (6,198)

Finance leases (6) 6 -

-------- -------- --------

(3,854) (2,344) (6,198)

-------- -------- --------

Liquid resources 4,259 18,182 22,441

-------- -------- --------

1,131 26,715 27,846

===== ==== =====

7 Statement of total recognised gains and losses

For the year ended 31 March 2001 2000

(Loss)/profit for the financial year (17,076) 6,650

Prior year adjustments - (1,939)

---------- ---------

Total gains and losses recognised in

the period (17,076) 4,711

====== ======

8 Exceptional items

Full details of the exceptional costs can be found on pages 6 and 7 of the

financial report.

9 Merger accounting

The combination with Medical Legal Support Services Limited has been

accounted for as a merger and accordingly the financial information for the

current year has been presented as if Medical Legal Support Services has been

a subsidiary of the company throughout.

10 Litigation

Note for inclusion in provisions note to the accounts

At 31 March 2001 a subsidiary company, Claims Incorporated Plc, had received

notification from approximately 10 franchisees of their intention to issue

proceedings for breach of contract and misrepresentation. Whilst full

particulars of claim have yet to be detailed to the company the total claimed

is approximately #5.7m. These actions should they proceed will be vigorously

defended. The directors believe based on legal advice and in line with the

company's experience of concluding claims of this type, that they may be

concluded at amounts substantially below those claimed.

Note for inclusion in contingent liabilities note to the accounts

Arbitration proceedings have been commenced in respect of a further 25

franchisees. The majority of these claims, which total #16,574,425 were

notified to the company prior to the year end. The actions will be vigorously

defended. Following advice from the company's legal advisers, the Directors

believe that it is not possible to reliably quantify the likely financial

effort of these actions in current circumstances, and on this basis, are

unable to make a realistic assessment as to the likely impact on the group's

future costs.

11 Post Balance Sheet Events

Certain past and present executive directors of the company have received

notice before action from three shareholders in respect of their intention to

pursue an action against the directors under Section 459 of the Companies Act

1985.

Should the claim proceed and be successful, the costs of such action would be

borne by the company. The board does not consider, however, that such costs

are likely to have a significant impact on the Group's financial position.

12 Financial information

The preliminary results for the year ended 31 March 2001 are unaudited. The

financial information set out in the announcement does not constitute the

group's statutory accounts for the years ended 31 March 2001 or 31 March

2000. The financial information for the year ended 31 March 2000 is derived

from the statutory accounts for that year which have been delivered to the

Registrar of Companies. The auditors reported on those accounts; their report

was unqualified and did not contain a statement under either Section 237 (2)

or (3) of the Companies Act 1985. The statutory accounts for the year ended

31 March 2001 will be finalised on the basis of financial information

presented by the directors in this preliminary announcement and will be

delivered to the Registrar of Companies in due course.

The company's report and accounts will be posted to shareholders by 31 July

2001.

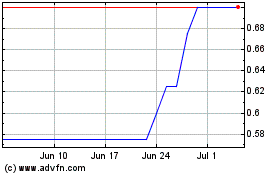

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

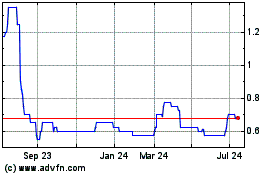

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jul 2023 to Jul 2024