TIDMCCP

RNS Number : 2463D

Celtic PLC

26 October 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Celtic PLC

Announcement of Results for the year ended 30 June 2020

SUMMARY OF THE RESULTS

Operational Highlights

-- Winner of our 9(th) consecutive SPFL Premiership title and

our 11(th) consecutive domestic trophy success

-- Winner of the Scottish League Cup for the 4(th) season in a row

-- Finished top of our Europa League group, qualifying for the

Round of 32 for the third year in a row

-- 26 (1) home matches played at Celtic Park (2019: 30 games)

Financial Highlights

-- Group revenue decreased by 15.8% to GBP70.2m (2019: GBP83.4m)

-- Operating expenses including labour decreased by 7.3% to GBP80.5m (2019: GBP86.9m)

-- Gain on sale of player registrations of GBP24.2m (2019: GBP17.7m)

-- Acquisition of player registrations of GBP20.7m (2019: GBP6.2m)

-- Profit before taxation of GBP0.1m (2019: GBP11.3m)

-- Year-end cash net of bank borrowings of GBP18.2m (2019: GBP28.6m)

(1) due to the early curtailment of the Scottish domestic

season, 4 home SPFL Premiership matches were unfulfilled.

For further information contact:

Celtic plc

Ian Bankier, Celtic Tel: 0141 551 4235

plc

Peter Lawwell,

Celtic plc

Iain Jamieson,

Celtic plc

Canaccord Genuity Limited, Nominated

Adviser

Simon Bridges Tel: 0207 523 8000

CHAIRMAN'S STATEMENT

The overwhelming event in the year under review was the

emergence of Covid-19 and the attendant restrictions on social

movement and trade. This has had an adverse impact on our

operations and our balance sheet. At the time of writing we, like

many football clubs and indeed many businesses, are still grappling

with the challenges the pandemic presents including the near term

uncertainty. However, the Board continues to monitor the situation

closely, taking proactive measures to ensure the Club and our

colleagues remain safe and is in the best position to allow

football to continue.

The SFA and the SPFL suspended football at all levels on 13(th)

March 2020. By this time, we had retained the Betfred Cup for the

fourth successive season and had reached the semi-final of the

Scottish Cup. In addition, we enjoyed a 13-point lead in the

Scottish Premiership.

As a club we were involved in discussions with the SFA and SPFL

concerning the plans for Scottish Football. Like many of our peers,

our strongest desire was to finish season 2019/20. As it became

increasingly obvious that a compromise would have to be made in

order to protect the seasonal calendar for 2020/21 and remove the

financial burden on many Scottish Clubs of an extensive and

uncertain delay, we accepted, reluctantly, that the current

season's football would have to be curtailed. This view was widely

shared across Scottish Football and we supported an SPFL resolution

which afforded the SPFL Board the power to call an end to the

season. The resolution also gave the SPFL Board the power to award

the league title based on an average points basis. On 18(th) May

2020 the SPFL formally ended the season and Celtic were declared

Champions for the ninth consecutive season. We warmly congratulate

Neil and the team for this record equalling achievement.

Unsurprisingly, Covid-19 has had a material detrimental effect

on the financial results and the year ended 30 June 2020 saw

revenue fall to GBP70.2m (2019: GBP83.4m) and profit before tax

fall to GBP0.1m (2019: GBP11.3m). As discussed in more detail in

the Strategic Report, this was largely attributable to the value

destructive impact of the pandemic across many aspects of our

business. Nevertheless, these results are satisfactory in the

circumstances at hand. Our year end cash net of bank borrowings was

GBP18.2m (2019: GBP28.6m). Post year end we also took the

opportunity to increase our existing revolving credit facility from

GBP2m to GBP13m to provide a further buffer should it ever be

required

Following the suspension of football, the Club's executive

worked successfully on developing protocols and engaging with both

the football authorities and Government authorities to have our

players return to training and to then commence season 2020/21 on

time. Additionally, they focussed on protecting our key revenue

streams and retaining our people infrastructure. I am pleased to

report that all of our commercial sponsorship arrangements are

intact and season 2020/21 saw us welcome Adidas as our new kit

supplier. The response to the launch of the Adidas products in

August was outstanding and exceeded our expectations.

The governmental restrictions imposed to protect public health

continue to have a negative financial impact on the football

industry. Our hard work and measured approach to investment in

recent years has provided a degree of protection, but given the

inherent uncertainty of the current environment, we must proceed

and invest with a degree of caution. Nevertheless, we remain

confident in the fundamentals of our football model and since the

Balance Sheet date we have strengthened our player squad. Following

the year end we invested in the registrations of Vasilis Barkas,

Albian Ajeti, David Turnbull and brought in loan signings Shane

Duffy and Diego Laxalt. We also extended the loan of Mohamed

Elyounoussi. Moreover, we have retained all of our key players from

last season.

As we look ahead, our immediate priorities are to work with the

football authorities and Government to have fans return to watching

football in our stadium in a safe manner. Having qualified for the

2020/21 UEFA Europa League against a challenging backdrop of single

leg qualification ties, we are matched against AC Milan, Lille and

Sparta Prague in what is sure to be both a testing and exciting,

group stage. Domestically, the overriding objective is to win our

tenth consecutive league title.

In closing, I sincerely thank our supporters for their

commitment to buying season tickets and also our sponsors, partners

and all of the colleagues at Celtic Football Club for their

steadfast support in these most difficult of times. Please be

assured that the Board recognises the challenges and sacrifices

made and is determined to balance the objective of success with the

strategy of long term sustainability.

Ian P Bankier, Chairman

26 October 2020

CHIEF EXECUTIVE'S REVIEW

The last six months have been an extremely challenging time for

the global economy, the global health environment, the football

industry and the Club. The adverse effect of Covid-19 has been both

deep and prolonged and the outlook is still uncertain on many

levels. Your Board has always managed the Club by balancing the

objective of delivering football success and retaining sufficient

reserves to manage downturns. Whilst the scale and impact of the

current Covid-19 crisis could never conceivably have been

predicted, our prudent strategy puts us in a better position than

many as we seek to navigate an exit from the current crisis with

the Club intact.

Being crowned champions for the ninth season in a row, winning

the Betfred Cup and reaching the semi-final of the Scottish Cup had

put us on a trajectory for yet another record breaking season

through the potential to secure a quadruple treble. We also reached

the last 32 of the Europa League for the third consecutive season.

My thanks go to Neil, his backroom team and all of the players for

their tremendous achievements. We also recognise the efforts made

by the players and coaching staff following the curtailment of

football in March in maintaining high professional standards during

"lockdown", thus putting themselves and the Club in the best

possible position when football resumed.

The last 18 months saw the Club invest record sums into the

playing squad with the key objective of maintaining our domestic

dominance and making an impact in European competition and this

strategy has been successful to date. At the beginning of last

season, we also welcomed our new head of football operations, Nick

Hammond. Nick brings a wealth of experience and has developed and

enhanced our recruitment processes yet further. The Club is now

seeing the benefits and we expect more to come. We continue to

invest into our academy to bring through the best talent in

Scotland and the transfer of Kieran Tierney to Arsenal F.C.

demonstrates the quality that our academy can produce. As football

evolves, we also strive to be at the forefront in investing into

world class technology to support football analysis, sports science

and medical care. We will continue to invest into key areas where

we believe it enhances our ability to compete at a high level. This

strategy has served us well and has resulted in us having

significant value in our playing squad that will serve us this

season and beyond. We believe that we have built a modern,

internationally recognised football club that operates to the

highest standards and one that our fans can be proud of.

The commencement of season 2020/21 has presented many

challenges; from demonstrating to the football and Government

authorities our ability to safely play matches behind closed doors,

to developing and implementing a rigorous Covid-19 player testing

regime, to negotiating single leg European qualification matches

all without the crucial backing of our fans in our stadium. Our

immediate objective was Champions League qualification, and whilst

we were disappointed not to progress to the group stages this year,

we secured Europa League football and find ourselves in a group

alongside quality opposition. We also look forward to completing

season 2019/20's Scottish Cup tournament. This involves playing a

semi-final against Aberdeen and, should we overcome this, a final

against either Heart of Midlothian F.C. or Hibernian F.C. We do not

underestimate the scale of the task at hand but if we are

successful then the history books will show an historic quadruple

treble.

The year ahead is unpredictable and Celtic are not immune to the

extent of the challenges that we could face at many levels. Whilst

we will continue to invest and not deviate from our strategy, we

are also cognisant that we may have to endure the Covid-19

restrictions for longer than we would all hope and therefore must

balance our desire to progress the Club against long-term

sustainability. The transfer market is likely to be unpredictable

as clubs around Europe struggle to adapt and many of the key

stakeholders in European football are expected to be inward facing

and adopting defensive strategies. It is important that Celtic's

interests and that of Scotland's are represented within European

football and through my role at the European Club Association, I

will continue to promote these interests.

In closing, I sincerely thank our fans for backing us in the

summer of 2020 with a remarkable response to our season ticket

campaign and the outstanding generosity shown in backing Celtic FC

Foundation's Football For Good initiative, all against a backdrop

of being unable to attend matches and an uncertain economic

environment. Your support has arguably never been more important

than the present. The dedication and sacrifices made by the support

are fully understood by both your Board and myself and are not

underestimated or taken for granted. Finally, I would like to thank

our employees for whom this has been a deeply unsettling and

uncertain time. Their commitment and dedication in the face of the

numerous challenges has been an outstanding reflection of their

character and the values of our Club.

Peter Lawwell, Chief Executive

26 October 2020

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2020 2019

Notes GBP000 GBP000

Revenue 2 70,233 83,410

Operating expenses (before intangible asset

transactions and exceptional items) (80,549) (86,904)

Loss from trading before intangible asset transactions

and exceptional items (10,316) (3,494)

Exceptional operating expenses 3 (1,957) (1,789)

Amortisation of intangible assets (12,244) (9,709)

Profit on disposal of intangible assets 24,188 17,717

Other income - 8,795

Operating (loss) / profit (329) 11,520

Finance income 1,479 1,059

Finance expense (1,049) (1,267)

Profit before tax 101 11,312

Tax expense 5 (469) (2,574)

--------- ---------

(Loss) / profit and total comprehensive (loss)

/ income for the year (368) 8,738

Basic (loss) / earnings per Ordinary Share

for the year 6 (0.39)p 9.30p

Diluted (loss) / earnings per Share for the

year 6 (0.39)p 6.78p

CONSOLIDATED BALANCE SHEET

2020 2019

GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 58,752 58,690

Intangible assets 19,828 14,156

Trade receivables 13,527 8,089

92,107 80,935

======== ========

Current assets

Inventories 1,269 2,643

Trade and other receivables 28,478 25,426

Cash and cash equivalents 22,406 34,057

--------

52,153 62,126

======== ========

Total assets 144,260 143,061

======== ========

Equity

Issued share capital 27,166 27,157

Share premium 14,849 14,785

Other reserve 21,222 21,222

Accumulated profits 18,230 18,598

--------

Total equity 81,467 81,762

======== ========

Non-current liabilities

Borrowings 2,844 4,108

Debt element of Convertible Cumulative

Preference Shares 4,174 4,183

Trade and other payables 3,542 6,943

Lease liabilities 637 -

Provisions 272 455

Deferred tax liabilities 1,366 1,139

Deferred income 29 57

--------

12,864 16,885

======== ========

Current liabilities

Trade and other payables 20,744 13,957

Lease liabilities 604 -

Borrowings 1,364 1,364

Provisions 5,942 3,479

Deferred income 21,275 25,614

--------

49,929 44,414

======== ========

Total liabilities 62,793 61,299

======== ========

Total equity and liabilities 144,260 143,061

======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Accumulated

Share Share Other (losses)/

capital premium reserve profit Total

GBP000 GBP000 GBP000 GBP000 GBP000

Equity shareholders'

funds

as at 1 July 2018 27,132 14,720 21,222 9,860 72,934

Share capital issued 1 65 - - 66

Reduction in debt element

of convertible cumulative

preference shares following

conversion 24 - - - 24

Profit and total comprehensive

income for

the year - - - 8,738 8,738

Equity shareholders'

funds

as at 30 June 2019 27,157 14,785 21,222 18,598 81,762

Share capital issued - 64 - - 64

Reduction in debt element

of convertible cumulative

preference shares following

conversion 9 - - - 9

Loss and total comprehensive

income for the year - - - (368) (368)

Equity shareholders'

funds

as at 30 June 2020 27,166 14,849 21,222 18,230 81,467

======== ======== ======== =========== ======

CONSOLIDATED CASH FLOW STATEMENT

2020 2019

Notes GBP000 GBP000

Cash flows from operating activities

(Loss) / profit for the year (368) 8,738

Taxation charge 469 2,574

Depreciation 2,640 2,064

Amortisation of intangible assets 12,244 9,709

Impairment of intangible assets 2,217 1,837

Reversal of prior period impairment charge (413) -

Profit on disposal of intangible assets (24,188) (17,717)

Net finance (income)/costs (430) 208

--------- ---------

(7,829) 7,413

Decrease / (increase) in inventories 1,374 (236)

Increase in receivables (1,656) (3,225)

Increase / (decrease) in payables and

deferred income 4,486 (6,654)

--------- ---------

Cash used in operations (3,625) (2,702)

Tax paid 5 (405) (2,435)

Net Interest received 14 7

--------- ---------

Net cash flow used in operating activities (4,016) (5,130)

--------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (1,175) (2,257)

Purchase of intangible assets (23,508) (13,671)

Proceeds from sale of intangible assets 19,603 14,040

--------- ---------

Net cash used in investing activities (5,080) (1,888)

--------- ---------

Cash flows from financing activities

Repayment of debt (1,280) (1,010)

Payments on leasing activities (798) -

Dividend on Convertible Cumulative Preference

Shares (477) (478)

--------- ---------

Net cash used in financing activities (2,555) (1,488)

--------- ---------

Net decrease in cash equivalents (11,651) (8,506)

Cash and cash equivalents at 1 July 2019 34,057 42,563

--------- ---------

Cash and cash equivalents at 30 June

2020 22,406 34,057

========= =========

NOTES TO THE FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

The principal accounting policies applied in the preparation of

these Financial Statements are set out below. With the exception of

the change in accounting treatment for leases following the

implementation of IFRS16 (see below), these policies have been

consistently applied to financial years 2020 and 2019, presented,

for both the Group and the Company.

IFRS 16 Leases

IFRS 16 become effective for accounting periods beginning on or

after 1 January 2019. The Group has therefore applied the standard

for the first time for the year ended 30 June 2020 using the

modified retrospective transitional approach, whereby comparative

numbers are not restated. The reclassifications and the adjustments

arising from the new leasing rules are recognised in the opening

balance sheet on 1 July 2019.

On adoption of IFRS 16, the Group has recognised lease

liabilities in relation to leases which had previously been

classified as 'operating leases' under the principles of IAS 17

'Leases'. These liabilities were measured at the present value of

the remaining lease payments, discounted using the Group's

incremental borrowing rate as at 1 July 2019. The weighted average

incremental borrowing rate applied to the lease liabilities at 1

July 2019 was 3.82%.

The Group had no finance leases in place as at 1 July 2019 and

30 June 2020.

The Group has taken advantage of the following practical

expedients upon transition:

-- A single discount rate to be applied to a portfolio of leases

with reasonably similar characteristics, being 3.82%;

-- Reliance on its assessment of whether a lease is onerous by

applying IAS 37 immediately before the date of initial

application;

-- Exclusion of leases whose term ends within 12 months of the

date of initial application; and

-- Exclude initial direct costs from the right of use assets at

the date of initial application.

Accounting approach

From 1 July 2019, leases have been recognised as a right-of-use

asset and a corresponding liability at the date at which the leased

asset is available for use by the Group. Each lease payment is

allocated between the liability and finance cost. The finance cost

is charged to profit or loss over the lease period so as to produce

a constant periodic rate of interest on the remaining balance of

the liability for each period. The right-of-use asset is

depreciated over the shorter of the asset's useful life and the

lease term on a straight-line basis. The lease payments are

discounted using the Group's incremental borrowing rate as noted

above.

Right-of-use assets are measured at cost comprising the

following:

-- the committed lease payments due from date of recognition to the end of the lease term;

-- any other committed payments in relation to the leases

including service charges and dilapidation commitments; and

-- an applied discount factor on the above commitments equal to

the Group's cost of borrowing as noted above;

1. BASIS OF PREPARATION (CONTINUED)

On the adoption of IFRS 16 the Group recognised the right-of-use

assets and lease liabilities. This table shows the measurement

methods adopted on transition:

Classification under Right-of-use assets Lease liabilities

IAS 17

-------------------------- ---------------------------------

Operating leases Right-of-use assets are Measured at the present

that do not meet measured at an value of the

the definition of amount equal to the lease remaining lease payments,

investment property liability discounted

in IAS 40 adjusted by the amount of using the Group's incremental

any prepaid or borrowing rate as at 1 July

accrued lease payments. 2019. The Group's incremental

borrowing rate is the rate

at which a similar borrowing

could be obtained from an

independent creditor under

comparable terms and conditions.

The weighted-average rate

applied was

3.82%.

-------------------- -------------------------- ---------------------------------

The following table presents the impact of adopting IFRS 16 on

the statement of financial position as at 1 July 2019:

Adjustments As originally IFRS16 1 July 2019

presented

GBP000 GBP000 GBP000

Assets

Property, plant

and equipment 58,690 - 58,690

Right of use assets

(cost) (a) - 1,704 1,704

Impairment of right

of use asset (b) - (486) (486)

Liabilities

Onerous lease provision (b) 486 (486) -

Lease liabilities (c) - 1,704 1,704

Equity

Retained earnings - - -

(a) The right of use assets adjustment reflect those items

previously classified as operating leases.

(b) An onerous lease provision existed at 30 June 2019 relating

to 2 retail units. As at 1 July 2019 this was recorded as an

impairment against the related assets in line with the practical

expedient available under the modified retrospective approach. Note

that during the year, a re-assessment of one of the properties

resulted in this impairment being reversed and released to the

statement of comprehensive income.

1. BASIS OF PREPARATION (CONTINUED)

(c) The following table reconciles the minimum lease commitments

disclosed in the Group's financial statements for the year end 30

June 2019, to the amount of lease liabilities recognised on 1 July

2019:

GBP000

Minimum operating lease commitment at 30

June 2019 1,545

Less: short term leases not recognised under

IFRS16 (45)

Use of practical expedient regarding lease

extensions 380

-------

Undiscounted lease payments 1,880

Less: effect of discounting using 3.82% as

at the date of initial application (176)

Lease liabilities for leases classified as

operating type under IAS17 1,704

=======

The net impact on retained earnings on 1 July 2019 was

GBPnil.

The additions to the 'Land & Buildings' and 'Plant &

Vehicles' categories within 'Property, plant & equipment' are

shown separately on a separate line on Note 16. The depreciation on

the right-of-use assets is included within the total for those

categories in Note 16.

As noted above the Group had no finance leases in place as at 1

July 2019 and therefore no reclassifications took place on

transition.

Other considerations

(i) Variable lease payments

Estimation uncertainty arising from variable lease payments

One retail property lease contains variable payment terms that

are linked to sales generated from the store. The initial

measurement of the lease payment terms are based on the minimum

guaranteed payments which are in-substance fixed payments. The

variability in lease terms based on sales levels over a certain

amount will be recognised in the profit or loss when such

conditions are triggered. As such, any decrease in sales would not

affect the lease liability. The variable element of this lease is

not considered material to the financial statements.

(ii) Extension and termination options

Extension and termination options are included in a number of

the property leases. These terms are used to maximise operational

flexibility in terms of managing contracts. The majority of

extension and termination options held are exercisable only by the

Company and not by the respective lessor.

In determining the lease term, management considers all facts

and circumstances that create an economic incentive to exercise an

extension option, or not exercise a termination option. Extension

options (or periods after termination options) are only included in

the lease term if the lease is reasonably certain to be extended

(or not terminated). In all leases recognised as at 31 December

2019, the lease end date has been taken as the first available

termination date per the lease agreements.

(iii) Leases not recognised under IFRS16

Short-term leases and leases of low-value assets are recognised

on a straight-line basis as an expense in profit or loss.

Short-term leases are leases with a lease term of 12 months or

less. There is therefore no change in the treatment of these within

the consolidated statement of comprehensive income.

1. BASIS OF PREPARATION (CONTINUED)

Going Concern

As part of the Directors' consideration of the going concern

assumption used in preparing the Financial Statements, different

scenarios have been analysed for a minimum period of 12 months from

the date of approval of the Financial Statements with outlook

assumptions used beyond this time frame. The main factors

considered were:

-- Current financial stability of the Group and on-going access to funds;

-- Continuing restrictions on trading conditions as a result of

Covid-19, primarily the attendance of fans in football stadia;

-- Security of revenue streams;

-- First team football performance and success; and

-- Player transfer market conditions.

The Directors have adopted a prudent approach in the assumptions

used in relation to the above, in order to provide additional

comfort around the viability of the Group going forward.

At 30 June 2020 the cash net of bank borrowings was GBP18.2m. In

addition, the Group had a net receivables position with respect to

player trading payables/receivables. This provides a strong

financial base over the short to medium term. At the time of

writing the Group has secured season ticket revenues for the

financial year ended 30 June 2021, retail outlets are fully

operational and performing strongly as a result of the new

partnership with Adidas, participation in the Europa League group

stages has been secured guaranteeing a minimum level of income, and

we have clear visibility over committed labour costs and transfer

outgoings. The Group has established contracts with a number of

commercial partners and suppliers providing assurance over future

revenues and costs. In addition, the Group has in recent years,

achieved significant gains in relation to player trading and

manages the movement of players in and out of the team

strategically to ensure maximising of value where required while

maintaining a squad of appropriate quality to ensure, as far as

possible, continued on field success.

The added complexity in forecasting which has been brought on by

Covid-19 primarily relates to the attendance of football fans in

stadia, however as noted above our assumptions on this matter are

considered to be appropriately prudent and do not consider there to

be a significant risk in the medium term.

Subsequent to the end of the financial year, the Group agreed an

amended and restated GBP13m RCF with the Co-operative Bank which

remains undrawn. This provides additional access to funds in the

short to medium term should these be required. The current cash

flow forecasts over the period of the going concern review do not

show a requirement to utilise this facility.

The Group continues to perform a detailed budgeting process each

year which looks ahead four years from the current financial year,

and is reviewed and approved by the Board. The Group also

re-forecasts each month and this is distributed to the Board. As a

consequence, and in conjunction with the additional forecasting and

sensitivity analysis which has taken place, the Directors believe

that the Company is well placed to manage its business risks

successfully despite the continuing uncertain economic outlook.

In consideration of all of the above, the Directors have a

reasonable expectation that the Group and Company has adequate

resources to continue in operational existence for the foreseeable

future. Thus they continue to adopt the going concern basis of

accounting in preparing the annual Financial Statements.

2. REVENUE

2020 2019

GBP000 GBP000

The Group's revenue comprised:

Football and Stadium Operations 35,797 43,252

Merchandising 15,042 18,076

Multimedia and Other Commercial Activities 19,394 22,082

--------- ---------

70,233 83,410

========= =========

3. EXCEPTIONAL OPERATING EXPENSES

The exceptional operating expenses of GBP1.96m (2019: GBP1.79m)

can be analysed as follows:

2020 2019

GBP000 GBP000

Impairment of intangible assets and other prepaid

costs 2,351 2,017

Reversal of prior period impairment charges (423) (52)

Onerous employment contracts - 383

Onerous employment contract releases (51) (580)

Settlement agreements on contract termination 80 21

-------- --------

1,957 1,789

======== ========

The impairment of intangible assets relate to adjustments

required as a result of management's assessment of the carrying

value of certain player registrations relative to their current

market value. The carrying value of intangible assets are reviewed

against criteria indicative of impairment and, where the carrying

value exceeds their current market value, impairment is

recognised.

Onerous employment contract costs result from a situation where

the committed costs under that contract are assessed as exceeding

the economic benefits expected to be received by the Group over the

term of the contract.

Settlement agreements on contract termination are costs in

relation to exiting certain employment contracts.

4. DIVID ON CONVERTIBLE CUMULATIVE PREFERENCE SHARES

A 6% non-equity dividend of GBP0.51m (2019: GBP0.51m) was paid

on 28 August 2020 to those holders of Convertible Cumulative

Preference Shares on the share register at 31 July 2020. A number

of shareholders elected to participate in the Company's scrip

dividend reinvestment scheme for the financial year to 30 June

2020. Those shareholders have received new Ordinary Shares in lieu

of cash. No dividends were payable or proposed to be payable on the

Company's Ordinary Shares.

During the year, the Company reclaimed GBPnil (2019: GBP0.07m)

in respect of statute barred preference dividends in accordance

with the Company's Articles of Association.

5. TAX ON ORDINARY ACTIVITIES

The corporation tax receivable as at 30 June 2020 was GBP0.02m

(2019: payable of GBP0.14m). The current year tax expense was

GBP0.24m and total tax payments in the year were GBP0.40m, of which

GBP0.38m related to the current financial year and the remainder

relating to prior years. The balance potentially due from HMRC for

the current year has been offset against prior periods. The

available capital allowances pool is approximately GBP7.53m (2019:

GBP9.00m). These estimates are subject to the agreement of the

current year's corporation tax computations with H M Revenue and

Customs.

The standard rate of corporation tax for the year in the United

Kingdom is 19% (2019: 19%).

2020 2019

GBP000 GBP000

Current tax expense

UK corporation tax 262 1,355

Adjustments in respect of prior periods (20) (80)

-------- --------

Total current tax expense 242 1,435

======== ========

Deferred tax expense

Origination of temporary timing differences

(Note 20) 254 1,196

Adjustments in respect of prior periods (27) (57)

-------- --------

Total deferred tax 227 1,139

-------- --------

Total tax expense 469 2,574

======== ========

6. EARNINGS PER SHARE

Reconciliation of basic earnings to diluted 2020 2019

earnings:

GBP000 GBP000

Basic earnings (368) 8,738

Non-equity share dividend 569 570

Reclaim of statute barred non-equity share

dividends - (67)

Diluted earnings 201 9,241

========== ==========

No.'000 No.'000

Reconciliation of basic weighted average

number of ordinary shares to

diluted weighted average number of ordinary

shares:

Basic weighted average number of ordinary

shares 94,276 93,977

Dilutive effect of convertible shares 42,358 42,410

---------- ----------

Diluted weighted average number of ordinary

shares 136,634 136,387

========== ==========

Loss per share and diluted loss per share of 0.39p (2019:

earnings per share of 9.30p) has been calculated by dividing the

loss for the period of GBP0.37m (2019: profit GBP8.74m) by the

weighted average number of Ordinary Shares of 94.3m (2019: 94.0m)

in issue during the year.

7. ANNUAL REPORT & FINANCIAL STATEMENTS

Copies of the Annual Report & Financial Statements together

with the Notice and Notes of the 2020 AGM will be issued to all

shareholders in due course.

The financial information set out above does not constitute the

Company's statutory financial statements for the years ended 30

June 2020 or 30 June 2019. The Independent Auditor's Reports on the

statutory financial statements for 2020 and 2019 were unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006. The statutory financial statements for 2019 have been filed

with the Registrar of Companies and those for 2020 will be

delivered to the Registrar of Companies in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MFBFTMTJTBJM

(END) Dow Jones Newswires

October 26, 2020 12:35 ET (16:35 GMT)

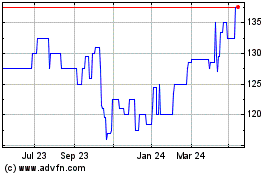

Celtic (LSE:CCP)

Historical Stock Chart

From Dec 2024 to Jan 2025

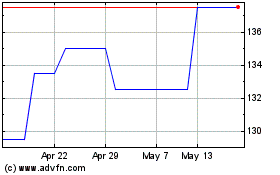

Celtic (LSE:CCP)

Historical Stock Chart

From Jan 2024 to Jan 2025