RNS No 2788f

CELTIC PLC

5th August 1998

CHAIRMAN'S STATEMENT

I am pleased to report that the year just ended was one of solid progress for

Celtic, both in football success and the growth of our business activities.

The Scottish League Championship was secured for the 36th time and the League

Cup returned to Celtic Park after a 15-year absence although our European

campaign was halted by Liverpool on the away goals rule.

There was other evidence of progress, quality and strength within our football

operation. All the previous year's retained earnings of the Company,

together with the gains from sales of players, a total of #12.2 million, were

reinvested in transfer fees for nine new players. Five of them joined five

others already on our staff in representing their countries at the recent

World Cup Finals - for a total exceeded by only two other football clubs

world-wide. And the value of our youth development programme was shown recently

when seven Celtic players were involved at Under-16 international level for

Scotland and Ireland. In addition, Gerry Crossley, at 18 years of age made

his full Irish international debut and Mark Burchill, 17 years old, also made

his debut for Scotland, joining Barry Elliot, 19 years old, already in the

Under-21 squad. In-house coaching and supervision of player development at

the Club now extends down to 12-year olds, and the start of an Under-21

Scottish Division to replace the Scottish Premier Reserve League is a welcome

change.

The decision a year ago to move forward from the traditional 'Football

Manager' system of British clubs and to separate management from coaching was,

I am now convinced, the right one. With Jozef Venglos as our new Head Coach

a further dimension of knowledge, maturity and ability to teach and develop

our system has now been added.

Last season's full squad of 22 first-team players still are with us and on

continuing contracts so Jozef has an excellent pool to work with.

Nevertheless, I expect his assessment and strategy to reach our objectives

will lead to some changes in personnel as the new season gets under way.

Turnover of the Celtic group rose by 25% over 1997 to #27.8 million.

With only minor changes to admission prices and stadium capacity remaining

unchanged over the previous season, ticket sales revenue and match attendances

rose by only 9.4%. The average home League attendance of 48,532 occupied 97%

of available seats. Revenue from all other areas of Celtic's operations grew

by 41% and the strong growth in our various commercial activities was also

helped by sales generated by the new Celtic Superstore opened in November,

from mail order business, and strong rises in broadcasting and publishing,

hospitality operations and other marketing applications of the Celtic brand.

Operating costs rose faster than turnover, principally driven by football

employment costs, the largest item, which rose by 57%.

Accordingly, profits from operations declined by 14%. However, prudent

management of player contracts and a conservative accounting policy of writing

down transfer costs over the player's contract term brought overall net profit

up to #7.1 million, a rise of 38% over 1997.

On 21 July 1998 we completed construction of the West Stand, to be named in

honour of Jock Stein increasing the spectator capacity of Celtic Park for

football matches to 60,294. The new Celtic Park is now able to accommodate

the current total of 52,543 season ticket holders and this valuable asset

continues to be developed as a venue for further hospitality and leisure

services. Completion of Britain's largest and best football stadium, with no

mortgage or government funding in contrast to other less needed stadium

projects, is a Celtic milestone and an achievement of which all our supporters

and shareholders can be proud.

Revenues in the year just begun are expected to increase through use of the

full stadium capacity, a full year operation of the Superstore and Visitor

Centre, a new major Banqueting and Matchday Suite in the West Stand, a better

League television agreement with British Sky Broadcasting, and further

expansion of our retail and mail order division.

In common with other major clubs, our cost of salaries for top players is

forecast to continue to rise this year, but more slowly in view of the high

number of new contracts begun or renewed last season.

Supporters and shareholders alike will note with satisfaction that whilst the

Club was founded to help the poor and hungry of Glasgow's east end parishes,

it is now the largest employer in this area, and our staff has risen in number

over the last four years from 292 to 375 people.

I am also pleased to tell you that our efforts as a leading institution in

Scottish life both as promoters of socially responsible, hate-free behaviour

and attitudes and as a supporter of deserving causes through the Celtic

Charity fund are having a real impact.

In view of my intended departure in the spring of next year, your Board is now

engaged in recruiting a Chairman Designate to replace me in this position.

We are also working to appoint a new, full-time, Chief Executive of the

Company and assure an orderly transition. Meantime the Company intends to

seek a listing on the London Stock Exchange main market, and your approval is

being sought to split the nominal value of your shares in the ratio of 100 for

1.

Both these moves will benefit all shareholders, present and future, while

assisting in the change of ownership of my shareholding after I leave Celtic.

I intend that existing shareholders and season ticket holders will have an

opportunity to participate in that transaction.

As you study Celtic's record of the last few years, shown below, I encourage

you to share my confidence in a successful future for this great Club. Its

continued rapid growth as a leisure company built around football and a world-

wide brand will finance the on-field performance and achievements that both

shareholders and supporters desire.

I commend and thank those whose collective talents and commitment have brought

us to where we are now - players, fellow directors, management, staff and

especially supporters. With this level of dedication and ability and from so

many we can only succeed.

4th August 1998 Fergus McCann

FIVE YEAR RECORD

YEARS ENDED 30 JUNE

1994 1995 1996 1997 1998

#000 #000 #000 #000 #000

FINANCIAL

Turnover 8,736 10,376 16,005 22,189 27,821

Profit

from 282 669 2,735 5,899 5,094

Operations

(Loss)/

Profit

After (1,404) (401) (1,013) 5,152 7,101

Taxation

Dividends - - - 533 533

Shares in

Issue 226 453 475 475 475

('000)

(Loss)/

Earnings

per

Ordinary (35.03) (1.73) (3.49) 15.93 22.65

Share

(#)

Fully

Diluted

(Loss)/

Earnings (32.58) (1.29) (2.24) 10.83 14.90

per Share

(#)

Net Assets 16,316 29,095 31,388 36,007 42,575

Number of

Employees 292 237 288 320 375

FOOTBALL

League

Position Fourth Fourth Second Second Champions

League 65 51 83 75 74

Points

Scottish Third Rd Winners Semi Final Semi Final Semi Final

Cup

League Cup Semi Final Final Fourth Rd Fourth Rd Winners

European

Ties 2 0 2 2 3

Played

CELTIC

PARK

Stadium

Investment

to Date 8,694 23,335 34,690 37,011 46,764

(#000)

Stadium

Capacity 49,856 34,082 37,944 50,552 50,552

Seating

Capacity 13,200 34,082 37,944 50,552 50,552

Average

Home 22,888 25,347 33,225 46,317 46,415

Attendance

Season

Ticket 7,162 18,029 29,370 40,529 42,322

Sales

The attendance and capacity figures for 1995 are for Hampden Park.

GROUP PROFIT AND LOSS ACCOUNT

YEAR ENDED 30 JUNE 1998

1998 1997

#000 #000

TURNOVER 27,821 22,189

OPERATING EXPENSES (22,727) (16,290)

_______ _______

PROFIT FROM OPERATIONS 5,094 5,899

AMORTISATION OF INTANGIBLE FIXED (5,348) (3,302)

ASSETS

NET GAIN ON SALE OF INTANGIBLE 7,410 2,606

FIXED ASSETS ______ ______

OPERATING PROFIT 7,156 5,203

INTEREST RECEIVABLE AND SIMILAR 97 27

INCOME

INTEREST PAYABLE AND SIMILAR (121) (78)

CHARGES ______ ______

PROFIT ON ORDINARY ACTIVITIES

BEFORE TAXATION 7,132 5,152

TAX ON ORDINARY ACTIVITIES (31) -

_____ _____

PROFIT FOR THE YEAR 7,101 5,152

PREFERENCE DIVIDEND (533) (533)

______ ______

RETAINED PROFIT FOR THE YEAR 6,568 4,619

----- -----

EARNINGS PER ORDINARY SHARE #22.65 #15.93

FULLY DILUTED EARNINGS PER SHARE #14.90 #10.83

All amounts relate to continuing operations.

There were no gains or losses recognised in 1998 other than the profit for the

year.

GROUP BALANCE SHEET

30 JUNE 1998

1998 1997

#000 #000 #000 #000

FIXED ASSETS

Tangible assets 41,724 32,606

Intangible assets 14,441 8,958

_______ _______

56,165 41,564

CURRENT ASSETS

Stocks 495 126

Debtors 2,642 3,367

Cash at bank and in 21 3,478

hand ______ ______

3,158 6,971

------ ------

CREDITORS - Amounts

falling due within (8,621) (6,223)

one year

Income deferred less

than one year (7,918) (6,000)

_______ _______

(16,539) (12,223)

------- -------

NET CURRENT (13,381) (5,252)

LIABILITIES ________ ________

TOTAL ASSETS LESS

CURRENT LIABILITIES 42,784 36,312

CREDITORS - Amounts

falling due after (209) (305)

more than one year _____ _____

NET ASSETS 42,575 36,007

------ ------

CAPITAL AND RESERVES

Called up share

capital (includes non- 11,390 11,390

equity)

Share premium 17,361 17,361

Profit and loss 13,824 7,256

account _______ _______

SHAREHOLDERS' FUNDS 42,575 36,007

------- -------

Copies of the Preliminary Results can be obtained from the Company's

Registered office at

95, Kerrydale Street, Glasgow, G40 3RE.

Telephone Number 0141 556 2611

END

FR SSASUIUAUFEA

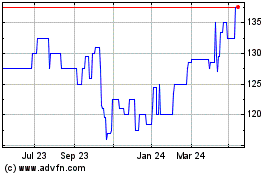

Celtic (LSE:CCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

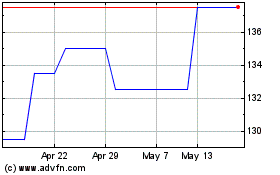

Celtic (LSE:CCP)

Historical Stock Chart

From Jul 2023 to Jul 2024