TIDMCBX

Cubus Lux plc

("the Company" or "the Group")

Half-yearly Report for the Six Months to 30 September 2009

Cubus Lux plc, the operator and developer of premier tourism and leisure

facilities in Croatia, announces its results for the half year ended 30th

September 2009.

KEY HIGHLIGHTS

Revenues: GBP965,000 versus GBP963,000 in 2008

Operating Profit/(Loss): (GBP602,000) versus loss of GBP719,000* in 2008

Marinas: Olive Island Marina contributes GBP46,000 trading profit (GBP2,000 2008),

has full waiting list and plans to extend number of berths by 50%. Six other

potential Marina investment opportunities identified.

Commercial/Residential Real Estate property developments: Zadar `Milk Factory'

site under construction to provide 74 apartments and five levels of commercial

space; excavation to provide two levels of underground parking completed, and

on schedule for project to complete in early 2011.

Casinos: profit from operations reduced to GBP9,000 at trading level as a result

of low hotel occupancy and impact on tourist spending from economic downturn -

signs of improvement post period end.

Major Leisure/ Tourism Projects in Croatia and Montenegro continue progress:

1) Olive Island Resort, Croatia, construction financing plans close to

resolution;

2) Valdanos, Montenegro, final contract negotiations expected to complete in

January 2010, when detailed planning can commence.

*excluding GBP1.686 million of negative goodwill

The full report, and further information, is available from the Company's

website, www.cubuslux.com.

Steve McCann

Cubus Lux plc

+44 (0)7787 183184

Luke Cairns / Jo Turner, Nominated Adviser

Astaire Securities plc

+44 (0)20 7448 4400

Claire Louise Noyce/Stephen Austin, Broker

Hybridan LLP

+44 (0)20 3159 5085

Pam Spooner

City Road Communications

+44 (0) 20 7248 8010

+44 (0)7858 477 747

CHAIRMAN'S STATEMENT

I am pleased to present the results for the six months ended 30 September 2009.

Operations

We continue to pursue our strategy of creating value in leisure-related and

general real estate projects in Croatia and neighbouring countries. High

quality development opportunities exist along the Adriatic coast, and the Board

retains confidence in the long-term attractions and potential of this part of

southern Europe.

Nevertheless, the effects of the wider economic slowdown have been apparent

throughout the six months to the end of September, and indeed throughout 2009.

Cubus Lux d.o.o. - Casinos

Although visitor numbers in Croatia held up well in the main holiday season,

the proportion of `short breaks' rose, leaving hotel occupancy averages lower

for the year, and spending by visitors appears also to have fallen. Trading at

our casinos was impacted by these symptoms of the recession, resulting in

significantly reduced profits in the six months. However, we have already begun

to see signs of an improvement in economic conditions and remain confident that

the casinos will bounce back as tourism recovers.

Plava Vala d.o.o. - Marina

In contrast, tourist activity for marinas - where high quality facilities are

in short supply - has remained robust, and we are experiencing heavy demand for

berths at our Olive Island location. As a result, we plan to extend our marina

there by 50% - an extra 100 berths - and are actively looking for new

investments for this segment of the Group. A total of six prospective

opportunities have so far been identified.

Real estate

Our small and medium scale commercial and residential property developments

continue to progress, with our `Molatska' site in Zadar on schedule to complete

in early 2011. Having removed 25,000 cubic metres of rock and earth to allow

for two levels of underground parking, foundations for the complex are

currently being put in place. Pre-selling of the 74 apartments and ground floor

retail/office space is expected to get underway in Q1 2010.

Credit market conditions for our large-scale projects continue to be

restrictive. However, financial conditions are improving and our own

negotiations in regard to the Olive Island Resort are making significant

progress. Sufficient financing was arranged in time to meet all stage payments

so far and we are in the process of finalising a full package to secure the

full financing of the construction costs.

Our 3.4 million sq metre project in Montenegro - `Valdanos' - is also

progressing satisfactorily. Final contracts are expected to be agreed in early

2010, at which point detailed planning for the site can commence.

In addition to the above major projects other opportunities are being reviewed

to further strengthen the Group. Further information will be provided as we

progress.

Whilst the first half of our year has not been easy, the Board remains

confident of fulfilling its vision for the future and the Group's leading role

in developing tourism and leisure in the region.

Financial:

For the six months ended 30 September 2009 the Company reports revenues of GBP

965,000 and a pre-tax loss of GBP599,000.

Loss per share amounted to 3.2p.

The Company further issued 1,060,000 shares at 20p during the half year.

Plans for the future:

As the first of our `resort' projects, the `Olive Island' project continues to

be our main focus. This resort along with the extensive accompanying real

estate development is providing a strong foundation for the Group's future

development. In addition, we are strongly pursuing other projects in all

divisions of the Group.

The Board continues to focus on creating sustainable shareholder value, through

a firm strategy of introducing and developing profitable new projects. The

Group is well known and well positioned in both Croatia and now in Montenegro

and is able to compete effectively for a wide variety of projects. As a result,

we look forward to the Group's future with excitement.

GERHARD HUBER

Chairman

Executive Director

22 December 2009

INDEPENDENT REVIEW REPORT TO CUBUS LUX PLC

We have been engaged by the Company to review the condensed set of financial

statements in the interim report for the six months ended 30 September 2009

which comprises the consolidated income statement, consolidated interim balance

sheet, consolidated interim statement of changes in shareholders' equity,

consolidated interim cash flow statement, and related notes. We have read the

other information contained in the interim report and considered whether it

contains any apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Directors' Responsibilities

The interim report is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the interim report in

accordance with the AIM Rules. The condensed set of financial statements

included in this interim report has been prepared in accordance with

International Accounting Standard 34, "Interim Financial Reporting," as

adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on the condensed

set of financial statements in the interim report based on our review.

Our report has been prepared in accordance with the terms of our engagement to

assist the company in meeting the requirements of the rules of the London Stock

Exchange for companies trading securities on AIM and for no other purpose. No

person is entitled to rely on this report unless such a person is a person

entitled to rely on this report by virtue of and for the purpose of our terms

of engagement or has been expressly authorised to do so by our prior consent.

Save as above, we do not accept responsibility for this report to any other

person or for any other purpose and we hereby expressly disclaim any and all

such liability.

Scope of Review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK and Ireland) and

consequently does not enable us to obtain assurance that we would become aware

of all significant matters that might be identified in an audit. Accordingly,

we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the interim report

for the six months ended 30 September 2009 is not prepared, in all material

respects, in accordance with International Accounting Standard 34 as adopted by

the European Union.

Going Concern

In forming our opinion, which is not qualified, we have considered the adequacy

of the disclosures made within the accounting policies concerning the Group's

ability to continue as a going concern. The Group incurred a net loss of GBP

602,000 during the period ended 30 September 2009 at the period end the Group's

current liabilities exceed its current assets by GBP10,631,000. This along with

the other matters explained in note 1 to the condensed consolidated interim

financial statements, indicates the existence of a material uncertainty which

may cast significant doubt about the Group's ability to continue as a going

concern. The directors are expecting to receive the Olive Island project loans

currently being negotiated. The directors also have contingency plans in place

which include negotiations to bring in a major investor on the Olive Island

project level and a partner for the marina company. The condensed consolidated

interim financial statements do not include the adjustments that would result

if the Group was unable to continue as a going concern.

haysmacintyre

Chartered Accountants Fairfax House

Registered Auditors 15 Fulwood Place

London

22 December 2009 WC1V 6AY

GROUP INCOME STATEMENT

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2009

Six months to Six months to Year ended

30 September 30 September 31 March

2009 2008 2009

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

REVENUE 2 965 963 1,535

Cost of sales (106) (106) (181)

------------- ------------- -------------

GROSS PROFIT 859 857 1,354

Administrative expenses (827) (1,576) (2,758)

Other income 4 190 1,686 826

------------- ------------- -------------

OPERATING PROFIT/(LOSS) 222 967 (578)

Net finance expense (821) (738) (1,520)

-------------- -------------- -------------

(LOSS)/PROFIT ON ORDINARY

ACTIVITIES BEFORE TAXATION (599) 229 (2,098)

Tax on ordinary activities 3 (3) (3) -

------------- ------------- -------------

(LOSS)/PROFIT FOR THE PERIOD (602) 226 (2,098)

====== ====== ======

ATTRIBUTABLE TO:

Equity holders of the company (585) 226 (2,098)

Minority interest (17) - -

------------- ------------- -------------

(602) 226 (2,098)

====== ====== ======

EARNINGS PER SHARE

Basic 5 (3.2)p 1.6p (14.2)p

====== ====== ======

Diluted 5 (3.2)p 1.5p (14.2)p

====== ====== ======

GROUP BALANCE SHEET

AT 30 SEPTEMBER 2009

As at 30 As at 30 As at 31

September 2009 September 2008 March 2009

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 39,093 39,093 39,093

Goodwill 1,576 689 1,575

Property, plant and equipment 5,077 4,748 5,147

-------------- -------------- --------------

45,746 44,530 45,815

-------------- ------------- --------------

Current Assets

Inventories 5,725 3,310 4,560

Trade and other receivables 974 2,098 710

Cash at bank 2,782 2,251 3,365

------------- ------------- ------------

9,481 7,659 8,635

------------- --------------- ---------------

TOTAL ASSETS 55,227 52,189 54,450

====== ======= =======

EQUITY

Capital and reserves attributable to

the Company's

equity shareholders

Called up share capital 1,892 1,463 1,790

Share premium account 17,114 16,028 17,005

Merger reserve 347 347 347

Retained earnings and translation 265 3,377 923

reserves

------------- ------------- --------------

TOTAL EQUITY 19,618 21,215 20,065

-------------- -------------- --------------

MINORITY INTEREST IN EQUITY 216 - 233

-------------- -------------- --------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 7,818 7,819 7,818

Loans 7,463 16,161 8,127

Amounts due under finance leases - 24 14

-------------- ------------- -------------

15,281 24,004 15,959

--------------- -------------- -------------

Current liabilities

Trade and other payables and deferred 3,712 6,228 3,440

income

Loans 16,396 737 14,745

Amounts due under finance leases 4 5 8

------------- ------------- --------------

20,112 6,970 18,193

-------------- -------------- --------------

TOTAL LIABILITIES 35,393 30,974 34,152

-------------- --------------- ----------------

TOTAL EQUITY AND LIABILITIES 55,227 52,189 54,450

======= ======= ========

GROUP CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2009

Six months to Six months to Year ended

30 September 30 September 31 March

2009 2008 2009

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit before taxation (599) 229 (2,098)

Adjustments for:

Net finance expense/(income) 821 (738) 1,520

Exchange rate difference (202) 8 1,077

Share based payments 28 110 220

Depreciation and amortisation 178 167 349

Negative goodwill written back to (190) (1,686) (2,721)

income statement

Movement in trade and other (265) 289 84

receivables

Movement in inventories (1,165) (138) 1,696

Movement in trade and other payables 46 163 (1,019)

-------------- -------------- ---------------

Cash flow from operating activities (1,348) (1,596) (892)

Interest (paid)/received - net (456) 738 (459)

Taxation paid (3) (3) -

-------------- -------------- ---------------

Net cash outflow from operating (1,807) (861) (1,351)

activities

-------------- -------------- ---------------

Cash flow from investing activities

Purchase of property, plant and (67) (111) (190)

equipment and intangibles

Proceeds from sale of property 20 16 34

-------------- -------------- ---------------

Net cash outflow from investing (47) (95) (156)

activities

-------------- -------------- ---------------

Cash flows from financing activities

Issue of shares 211 - 1,304

Capital element of finance lease (18) - (21)

repaid

Net loans undertaken less repayments 1,090 1,018 706

-------------- -------------- ---------------

Cash inflow from financing activities 1,283 1,018 1,989

-------------- -------------- ---------------

Cash and cash equivalents at 3,365 2,372 2,372

beginning of period

Net cash (outflow)/inflow from all (571) 62 482

activities

Non-cash movement arising on foreign (12) (183) 511

currency translation

--------------- -------------- ---------------

Cash and cash equivalents at end of 2,782 2,251 3,365

period

======= ======= ======

Cash and cash equivalents comprise

Cash and cash equivalents 2,782 2,251 3,365

======= ====== ======

GROUP STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2009

Share Share Merger Retained Translation

Capital Premium Reserve Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2008 1,463 16,028 347 3,519 (399) 20,958

Profit/(loss) for the - - - 226 (79) 147

period

Share based payments - - - 110 - 110

------------- ------------- ------------- ------------- ------------- -------------

At 30 September 2008 1,403 16,028 347 3,855 (478) 21,215

Loss for the period - - - (2,324) (240) (2,564)

Issue of shares 327 977 - - - 1,304

Share based payments - - - 110 - 110

------------- -------------- ------------- -------------- ---------- --------------

At 31 March 2009 1,790 17,005 347 1,641 (718) 20,065

Loss for the period - - - (585) (101) (686)

Issue of shares 102 109 - - - 211

Share based payments - - - 28 - 28

------------- -------------- ------------- -------------- ---------- --------------

1,892 17,114 347 1,084 (819) 19,618

====== ======= ====== ====== ====== =======

NOTES TO THE REPORT AND FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2009

1. BASIS OF PREPARATION

These interim consolidated financial statements are for the six months ended 30

September 2009. They have been prepared in accordance with IAS 34, Interim

Financial Reporting. These interim financial statements have been prepared in

accordance with those IFRS standards and IFRIC interpretations issued and

effective or issued and early adopted as at the time of preparing these

statements (December 2009). The IFRS standards and IFRIC interpretations that

will be applicable at 31 March 2010, including those that will be applicable on

an optional basis, are not known with certainty at the time of preparing these

interim financial statements. The policies set out below have been consistently

applied to all the years presented.

These consolidated interim financial statements have been prepared under the

historical cost convention.

The information set out in this interim report for the six months ended 30

September 2009 does not constitute statutory accounts as defined by section 434

of the Companies Act 2006. The statutory accounts for the year ended 31 March

2009, incorporating an unqualified auditors' report, have been filed with the

Registrar of Companies.

Going concern

The Group has continued to make losses since the year end and cashflow has

required careful management.

The directors are fully expecting to receive the Olive Island project loans

currently being negotiated which would include a payment directly into the

parent company. The value of the loan would also allow all liabilities to be

paid.

Contingency plans are however prepared and include negotiations to bring in a

major investor on the Olive Island project level and a partner for the marina

company.

Since the period end the Group has renegotiated the repayment terms of the EUR13

million loan notes, extending the repayment date to 30 April 2011.

In light of the above, subject to the successful completion of the

aforementioned events, and on this basis, the directors consider that it is

appropriate to prepare the condensed consolidated interim financial statements

on the going concern basis.

.

2. BUSINESS SEGMENT ANALYSIS

Period ended 30 September Casino Marina Property Resort Central Total

2008:

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External sales 533 387 - 43 - 963

====== ====== ===== ======= ==== ======

Profit/(loss)

Segment operating profit/ (30) 2 12 (67) 1,050 967

(loss)

Net finance costs (738)

-------------

Profit before taxation 229

======

Assets and liabilities

Segment assets 1,421 4,012 2,666 2,566 41,524 52,189

Segment liabilities (304) (4,421) (2,039) (2,093) (22,117) (30,974)

------------ ------------- -------------- --------------- ------------- ---------------

Net assets/(liabilities) 1,117 (409) 627 473 19,407 21,215

====== ====== ====== ======== ====== =======

Casino Marina Property Resort Central Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 31 March 2009:

Revenue

External sales 864 660 - - 11 1,535

====== ====== ====== ====== ====== =======

Profit/(loss)

Segment operating profit/ (10) (158) 1,544 799 (2,753) (578)

(loss)

Net finance costs (1,520)

-------------

Profit before taxation (2,098)

=======

Assets and liabilities

Segment assets 1,273 10,690 8,405 33,746 336 54,450

Segment liabilities (296) (6,269) (4,344) (22,098) (1,145) (34,152)

------------ ------------ ------------- --------------- ------------- ------------

Net assets/(liabilities) 977 4,421 4,061 11,648 (809) 20,298

====== ====== ====== ======== ====== =======

Period ended 30 September

2009:

Revenue

External sales 500 447 - - 18 965

====== ====== ===== ======= ==== ======

Profit/(loss)

Segment operating (loss)/ 9 46 73 301 (207) 222

profit

Net finance costs (821)

-------------

Loss before taxation (599)

======

Assets and liabilities

Segment assets 1,320 10,236 8,471 34,814 386 55,227

Segment liabilities (371) (6,037) (4,364) (22,852) (1,769) (35,393)

------------ ------------- -------------- --------------- ------------- ---------------

Net assets/(liabilities) 949 4,199 4,107 11,962 (1,383) 19,834

====== ====== ====== ======== ====== =======

The group currently operates in one geographical market, Croatia and therefore

no secondary segmentation is provided.

3. TAXATION

The Company is controlled and managed by its Board in Croatia. Accordingly,

the interaction of UK domestic tax rules and the taxation agreement entered

into between the U.K. and Croatia operate so as to treat the Company as

solely resident for tax purposes in Croatia. The Company undertakes no

business activity in the UK such as might result in a Permanent

Establishment for tax purposes and accordingly has no liability to UK

corporation tax.

4. OTHER INCOME

Other income of GBP190,000 in the period ended 30 September 2009, arise

in respect of the reduction of deferred consideration payable for

Duboko Plavetnilo Hotels d.o.o. and as such this adjustment of negative

goodwill has been recognised in the consolidated income statement.

5. EARNINGS PER SHARE

The loss per share of 3.2p (year ended 31 March 2009: loss 14.2p; six

months ended 30 September 2008: earnings 1.6p) has been calculated on the

weighted average number of shares in issue during the year namely

18,449,564 (year ended 31 March 2009: 14,785,356; six months ended 30

September 2008: 14,614,365) and losses of GBP585,000 (year ended 31 March

2009: loss GBP2,098,000; six months ended 30 September 2008: profit GBP

226,000).

The calculation of diluted loss per share of 3.2p (year ended 31 March

2009: loss 14.2p) is based on the loss on ordinary activities after

taxation and the weighted average of 18,449,564 (year ended 31 March

2009: 14,785,356) shares. For a loss making group with outstanding share

options, net loss per share would only be increased by the exercise of

out-of-the money options. Since it is inappropriate to assume that option

holders would act irrationally no adjustment has been made to diluted EPS

for out-of-the-money share options. Diluted earnings per share for six

months ended 30 September 2008 of 1.5p is calculated on profit of GBP

226,450 and the diluted weighted average of 15,481,865 shares.

END

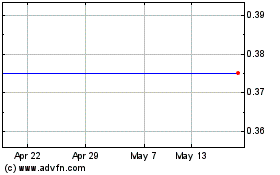

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

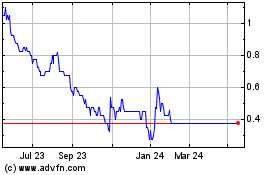

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024