TIDMCBX

Cubus Lux plc

("Cubus Lux" or the "Company")

Final Results for the Year Ended 31 March 2009

Cubus Lux plc, the operator and developer of premier tourism and leisure

facilities in Croatia, announces its results for the year ended 31 March 2009.

HIGHLIGHTS

- Trading at operating companies - Plava Vala d.o.o. (marina) and Cubus Lux

d.o.o. (casinos) - meet expectations

- Continued progress and new hotel development at Olive Island Marina.

- Land secured and the Board believes it is close to finalising construction

finance for flagship project as credit markets remain difficult.

- Major new tender won - 3.4 million square metres for a Golf/Wellness/Beach

resort at Valdanos, Montenegro

- In the final stages of Istrian Resort Tender

- Entered construction stage for commercial/residential development in Zadar.

Saleable space includes 1,216 sqm of commercial and 5,232 sqm of apartments

- Pre-tax loss of GBP2.1 million * (2008 - GBP4.9 million profit)

- Headline loss reported as a result of exchange rate impact - which may

reverse - of GBP1,895,000

- Adjusted net loss per share of 14.2p ** versus EPS of 47.8p at 31 March 2008

- GBP1.314 million additional equity raised

* Pre-tax loss before negative goodwill arising from Hotel Sutomiscica

acquisition and adjustment in Duboko Plavetnilo Hoteli d.o.o. deferred

consideration was GBP4,819,000 (2008: profit before negative goodwill GBP357,000)

** Loss per share before negative goodwill was 33p

Commenting on the results, executive chairman Dr. Gerhard Huber said:

"Against a background of turmoil in the financial, currency and commercial

markets, your company has continued to progress its portfolio of development

projects, albeit at a slower pace than originally expected.

The Board believes a final agreement on project finance for OIR is close to

completion. The land for the resort has been secured. The Company has made

significant progress in several other areas, including the winning of a major

tender in Montenegro. Trading at our operating companies, our casinos and

marinas, is meeting our expectations."

A copy of the accounts, which has today been posted to shareholders, is

available from the Company's website, www.cubuslux.com.

For further information please see www.cubuslux.com or contact:

Steve McCann

Cubus Lux plc

+44 (0) 7787 183184

Lindsay Mair / Jo Turner

Dowgate Capital Advisers Limited

+44 (0)20 7492 4777

Claire Louise Noyce/Stephen Austin, Broker

Hybridan LLP

+44 (0)20 3159 5085

Pam Spooner

City Road Communications

+44 (0) 207 248 8010 / +44 (0)7858 477 747

Chairman's Statement

I am pleased to submit results for the financial year ended 31 March 2009.

Against a background of turmoil in financial, currency and commercial markets,

your company has continued to progress its portfolio of development projects,

albeit at a slower pace than originally expected.

The past 12 months have been difficult for many companies, and particularly

difficult for businesses needing to raise finance to complete their projects.

Cubus Lux, therefore, is not alone in having to report considerable delays in

financing of its premier project, the Olive Island Resort ("OIR"). The original

source of construction loan finance for OIR was unable to proceed in early

2009, so that new sources of finance had to be found.

The Board has made strenuous efforts since the start of 2009, and has made

significant progress, despite the very difficult credit conditions which

persist. The Board believes a final agreement on project finance for OIR is

close to completion. The land for the resort has been secured, and stage

payments are on track and will continue through the project construction.

Construction is now expected to commence in our last quarter of 2009/10, which

is almost one year later than originally envisaged.

Away from that particular task, the Company has made significant progress in

several other areas, including the winning of a major tender in Montenegro,

which was announced after the year ended 31 March 2009. Cubus Lux succeeded

against strong opposition in winning the tender process to build a major resort

at Valdanos, Montenegro. This project will include a golf course, 5-star golf

hotel, a 5-star beach hotel, a 4-star hotel and wellness centre, as well as a

wide range of villas and apartments for sale and a full range of tourist and

leisure facilities.

In total, the Valdanos resort will cover 3.4 million sq metres, with some 3km

of coastline, and have 2,500 beds overall. Detailed negotiations for the

concession contract are well underway, and should be completed during November

2009. Similarly the project planning and development has now started.

In Croatia, your company has also advanced its proposed Hotel Sutomiscica

development adjacent to the Olive Island Marina, progressed a combined

commercial and residential development project to the start of construction in

Zadar and won through to the final stage of two other resort tenders near Pula,

Istria.

Underlying trading at our operations in Croatia has proved resilient, with our

Olive Island Marina fully booked and utilised during the year, and its

restaurant continuing to gain plaudits for its cuisine and service from leading

restaurant guides. The casinos - at Pula and Selce - have performed in line

with our expectations, with visitor numbers higher in the year to 31 March 2009

versus the previous full year.

Financial

For the year to 31 March 2009 total operating profit was GBP1,317,000 before

foreign exchange losses on the group's loans. An exceptional charge of GBP

1,895,000 has been made to recognise a currency loss on loan notes as a result

of the year-end exchange rate of GBP/Euro 1.07798. However, there is a

possibility this could reverse which would mean a profit being recognised on

the loan notes.

An external net interest charge of GBP458,000 and the loan note interest charge

of GBP1,062,000 give an overall loss for the year of GBP2,098,000.

Loss per share amounted to 14.2p (2008: 47.8p profit per share).

During the year the Company consolidated the shares of 1p by a factor of 10,

converting the 146,143,660 ordinary shares in issue at the time of GBP0.01 each

to 14,614,366 new ordinary shares of GBP0.10 each.

The Company further issued 50,000 shares at 57.5p and 3,211,756 shares at 40p

during the year.

Since the year end the company has issued 1,060,000 shares at 20p.

GERHARD HUBER

Chairman

Executive Director

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 MARCH 2009

2009 2008

GBP'000 GBP'000

REVENUE 1,535 3,078

Cost of sales (181) (202)

------------- -------------

GROSS PROFIT 1,354 2,876

Administrative expenses (2,758) (2,399)

Negative goodwill 2,721 4,693

Foreign exchange losses (1,895) -

------------- -------------

OPERATING (LOSS)/PROFIT (578) 5,170

Finance income 17 46

Finance expenditure (1,537) (336)

------------- -------------

(LOSS)/PROFIT ON ORDINARY

ACTIVITIES BEFORE TAXATION (2,098) 4,880

Tax on ordinary activities - (9)

------------- -------------

(LOSS)/PROFIT FOR THE YEAR (2,098) 4,871

====== ======

Attributable to:

Equity holders of the company (2,098) 4,871

Minority interest - -

------------- -------------

(2,098) 4,871

====== ======

(LOSS)/EARNINGS PER SHARE

Basic (14.2)p 47.8p

====== ======

Diluted (14.2)p 45.4p

====== ======

All activities arose from continuing activities.

CONSOLIDATED BALANCE SHEET

AT 31 MARCH 2009

2009 2008

ASSETS GBP'000 GBP'000

Non-current assets

Intangible assets 39,093 35,902

Goodwill 1,575 940

Property, plant and equipment 5,147 4,702

-------------- --------------

45,815 41,544

-------------- --------------

Current assets

Inventories 4,560 3,172

Trade and other receivables 710 2,384

Cash at bank 3,365 2,372

-------------- --------------

8,635 7,928

-------------- --------------

TOTAL ASSETS 54,450 49,472

======= ======

EQUITY

Capital and reserves attributable to

the Company's

equity shareholders

Called up share capital 1,790 1,463

Share premium account 17,005 16,028

Merger reserve 347 347

Profit and loss account 923 3,120

--------------- ---------------

TOTAL EQUITY 20,065 20,958

-------------- --------------

MINORITY INTEREST IN EQUITY 233 -

-------------- --------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 7,818 7,180

Loans 8,127 5,053

Amounts due under finance leases 14 38

--------------- -------------

15,959 12,271

-------------- --------------

Current liabilities

Trade and other payables 3,440 5,433

Loans 14,745 10,805

Amounts due under finance leases 8 5

--------------- -------------

18,193 16,243

-------------- --------------

TOTAL LIABILITIES 34,152 28,514

======= =======

TOTAL EQUITY AND LIABILITIES 54,450 49,472

======= =======

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2009

2009 2008

GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit before taxation (2,098) 4,880

Adjustments for:

Net finance expense 1,520 290

Loss on disposal of fixed assets - 26

Exchange rate differences 1,077 578

Share based payments 220 222

Depreciation 349 256

Negative goodwill written back to income (2,721) (3,739)

statement

Movement in trade and other receivables 90 373

Movement in inventories 1,696 (2,571)

Movement in trade and other payables (1,019) 957

-------------- ---------------

Cash outflow from operating activities (892) 1,272

Interest paid - net (459) (290)

Taxation paid - (9)

-------------- ---------------

Net cash (outflow)/inflow from operating (1,351) 973

activities

-------------- ---------------

Cash flow from investing activities

Purchase of property, plant and equipment (190) (982)

and intangibles

Proceeds from sale of property 34 66

Purchase of subsidiaries - Net - (795)

Cash acquired with subsidiary - 18

-------------- ---------------

Net cash outflow from investing activities (156) (1,693)

-------------- ---------------

Cash flows from financing activities

Issue of shares 1,304 2,341

Capital element of finance lease repaid (21) -

Net loans undertaken less repayments 706 499

-------------- ---------------

Cash inflow from financing activities 1,989 2,840

-------------- ---------------

Net cash inflow from all activities 482 2,120

Cash and cash equivalents at beginning of 2,372 1,375

period

Non-cash movement arising on foreign 511 (1,123)

currency translation

-------------- ---------------

Cash and cash equivalents at end of period 3,365 2,372

====== =======

Cash and cash equivalents comprise

Cash and cash equivalents 3,365 2,372

====== ======

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MARCH 2009

Share Share Merger Retained Translation

Capital Premium Reserve Earnings Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2007 881 7,239 347 (1,574) 9 6,902

Share based - - - 222 - 222

payments

Total recognised

income

and expenses - - - 4,871 (408) 4,463

Issue of shares

(net of

costs) 141 2,199 - - - 2,340

Acquisition of

subsidiaries (net 441 6,590 - - - 7,031

of costs)

----------- ------------ ----------- --------- ---------- ------------

At 31 March 2008 1,463 16,028 347 3,519 (399) 20,958

Share based - - - 220 - 220

payments

Total recognised

income

and expenses - - - (2,098) (319) (2,417)

Issue of shares

(net of costs) 327 977 - - - 1,304

------------ -------------- ----------- ------------ ---------- ---------------

At 31 March 2009 1,790 17,005 347 1,641 (718) 20,065

------------ -------------- ----------- ------------ ---------- ---------------

NOTES TO THE REPORT AND FINANCIAL STATEMENTS

ACCOUNTING POLICIES

Basis of Preparation

These financial statements have been prepared in accordance with those IFRS

standards and IFRIC interpretations issued and effective or issued and early

adopted as at the time of preparing these statements (September 2009). The

policies set out below have been consistently applied to all the years

presented.

These consolidated financial statements have been prepared under the historical

cost convention. No separate income statement is presented for the parent

company as provided by Section 250, Companies Act 1985.

Going concern

Since the year end, the company has improved the cash position through a

profitable summer season and a share placing in July. Furthermore 1,060,000

shares were issued at 20p since the year end. Despite this there are concerns

over meeting future liabilities.

The Directors are fully expecting to receive the Olive Island project loans

currently being negotiated which would include a payment directly into the

Parent company. The value of the loan would also allow all liabilities to be

paid.

Contingency plans are however prepared and include negotiations to bring in a

major investor on the Olive Island project level and a partner for the marina

company. Furthermore the loan note holders of the EUR13 million loan notes have

indicated that they will not seek repayment from the company in December 2009

unless the group has sufficient funds to do so and continue trading.

Subject to the successful completion of these events, and on this basis, the

directors consider that it is appropriate to prepare the financial statements

on the going concern basis.

Basis of Consolidation

On 20 May 2004, the company purchased 100% of the issued share capital of Cubus

Lux d.o.o., a company registered in the Commercial Court in Rijeka, Croatia, by

way of a share for share exchange. Merger accounting was adopted as the basis

of consolidation.

On 6 March 2006, the company purchased 100% of the issued share capital of

Plava Vala d.o.o., a company registered in Croatia, by way of a share for share

exchange. The results of the companies have been consolidated using the

purchase method.

On 22 February 2008, the company purchased 100% of the issued share capital of

Duboko Plavetnilo Ugljan Projektant d.o.o. and Duboko Plavetnilo Hoteli d.o.o.,

two companies registered in Croatia, by way of a share for share exchange and

the issue of Cubus Lux Plc loan notes. The results have been consolidated using

the purchase method.

On 17 March 2008, the company purchased 100% of the issued share capital of

Adriatic Development LLC and Worldwide Leisure Holding LLC, two companies

registered in the U.S. The results have been consolidated using the purchase

method.

On 30 May 2008, the company purchased 100% of the issued share capital of Deep

Blue Developments Liegenschaftserschliessungs GmbH, a company registered in

Austria. The results have been consolidated using the purchase method.

On 30 September 2008, the company purchased 100% of the issued share capital of

Tiha Uvala d.o.o., a company registered in Croatia. The results have been

consolidated using the purchase method.

On 1 March 2009, the company acquired 50% of the issued share capital of Cubus

Lux Projektiranje d.o.o., a company registered in Croatia. The company has the

power to exercise control over the entity's financial operating policies and as

such it has been treated as a subsidiary and consolidated using the purchase

method.

Group accounts consolidate the accounts of the company and its subsidiary

undertakings made up to 31 March 2009. All intercompany balances and

transactions have been eliminated in full. Subsidiary undertakings are

accounted for from the effective date of acquisition until the effective date

of disposal.

Segment reporting

The Group has the separately identifiable business segments of the Casino,

Marina, Property, Resorts and Central Overheads for which an analysis of the

activity and associated assets are shown within these financial statements.

Revenue recognition

Revenue comprises the fair value of the sale of goods and services, net of

value added tax, rebates and discounts.

The group recognises revenue when the amount of revenue can be reliably

measured, it is probable that future economic benefits with flow to the entity

and when specific criteria have been met for each of the group's activities.

Casino operations

Income is recognised when received once the daily reconciliations have been

performed.

Marina income

The rental of berths is accounted for on an accrual basis over the period of

the rental commitment. Ancillary income from the restaurant and service

facilities is recognised when received.

Property development income

The group uses the percentage of completion method in accounting for its

construction contracts. Use of the percentage of completion method requires the

group to estimate the construction performed to date as a proportion of the

total construction to be performed.

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation.

Depreciation is calculated to write down the cost of all tangible fixed assets

by equal monthly instalments over their estimated useful lives at the following

rates:-

Motor vehicles - 25% per annum

Furniture, fittings, casino equipment and marina assets - 10 - 25% per annum

Casino, marina and resort leasehold premises - over the life of the lease

Goodwill and business combinations

Business combinations on or after 1 January 2005 are accounted for under IFRS 3

using the purchase method. Any excess of the cost of business combinations over

the Group's interest in the net fair value of the identifiable assets,

liabilities and contingent liabilities is recognised in the balance sheet as

goodwill and is not amortised.

After initial recognition, goodwill is not amortised but is stated at cost less

any accumulated impairment loss, with the carrying value being reviewed for

impairment, at least annually and whenever events or changes in circumstances

indicate that the carrying value may be impaired. For the purpose of impairment

testing, goodwill is allocated to the related cash generating units monitored

by management. Where the recoverable amount of the cash generating unit is less

than its carrying amount, including goodwill, an impairment loss is recognised

in the income statement.

Intangible assets include the licence of the Marina which has a carrying value

of GBP5,372,000. The Marina licence has an indefinite useful economic life as it

is expected to be automatically renewed after the initial 32 year concession

expires.

No amortisation is charged on intangible assets relating to the Olive Island

Resort, Hotel Sutomiscica and Olive Island Hotel. Amortisation will commence

once the projects have been completed and assets brought into use. The charge

will be in proportion to the sales of the properties in the resort and life of

management contract of the hotel. Assets that have an indefinite useful life

are not subject to amortisation. When amortisation commences it will be charged

to administrative expenses in the Income Statement.

Assets that are subject to amortisation are reviewed for impairment whenever

events or changes in circumstances indicate that the carrying amount may not be

recoverable. An impairment loss is recognised for the amount by which the

asset's carrying amount exceeds it recoverable amount. The recoverable amount

is the higher of an asset's fair value and value in use.

The Group assesses whether there are any indicators of impairment to the

intangible assets. Goodwill and intangible assets with indefinite lives are

tested for impairment annually. All other intangible assets are tested for

impairment when there are indicators that the carrying amounts may not be

recovered.

The Group's impairment test for goodwill and intangible assets with indefinite

useful lives is based on value in use calculations that use a discounted cash

flow model. The cash flows are derived from the financial forecasts for the

ensuing years and do not include restructuring activities that the Group is not

yet committed to or significant investments that will enhance the asset base of

the cash generating unit being tested. The recoverable amount is most sensitive

to the discount rate used for the discounted cash flow model as well as the

expected future cash-inflows and the growth rate used for extrapolation

purposes. The key assumptions used to determine the recoverable amount,

including a sensitivity analysis, are further explained further in the notes.

Foreign currencies

Transactions in foreign currencies are recorded at the rate ruling at the date

of the transaction. Monetary assets and liabilities denominated in foreign

currencies are retranslated at the rate of exchange ruling at the balance sheet

date. All exchange differences are dealt with through the income statement.

Items included in the financial statements of the group's entities are measures

using the currency of the primary economic environment in which the entity

operates (the `functional currency'). The consolidated financial statements are

presented in sterling, which is the company's functional currency.

The exchange rates used at 31 March 2009 was GBP1 = Euro 1.07798, GBP1 = HRK 8.0744

Operating lease agreements

Rentals applicable to operating leases where substantially all of the benefits

and risks of ownership remain with the lessor are charged to the income

statement as incurred.

Deferred taxation

Deferred tax is provided in full, using the liability method, on temporary

differences arising between the tax bases of assets and liabilities and their

carrying values in the financial statements. The deferred tax is not accounted

for if it arises from initial recognition of an asset or liability in a

transaction, other than a business combination, that at the time of the

transaction affects neither accounting nor taxable profit or loss. Deferred tax

is determined using tax rates (and laws) that have been enacted or

substantially enacted by the balance sheet date and are expected to apply when

the related deferred tax asset is realised or the deferred tax liability is

settled.

Deferred tax assets are recognised to the extent that it is probable that

future taxable profit will be available against which temporary differences can

be utilised.

Trade and other receivables

Trade and other receivables are recognised and carried at original invoice

value less an allowance for any uncollectible amounts. An estimate for doubtful

debts is made when collection of the full amount is no longer probable. Bad

debts are written off when identified.

Share based payments

IFRS 2 ("Share based payments") requires the Group to recognise an expense in

respect of the granting over shares to employees and directors. This expense,

which is calculated by reference to the fair value of the options granted, is

recognised on a straight line basis over the vesting year based on the Group's

estimate of options that will eventually vest. The Directors have used the

Black Scholes model to estimate the value of options granted in the current and

prior years.

Investments

Investments in subsidiary undertakings are stated at cost less provisions for

impairment.

Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposit held at call with

banks, other short-term highly liquid investments with original maturities of

three months or less, and bank overdrafts. Bank overdrafts are shown within

borrowings in current liabilities on the balance sheet.

Inventories

Inventories represent land held for development and associated development

costs incurred to date. Inventories are held at lower of cost and net

realisable value.

Borrowing costs

Borrowing costs are recognised in the income statement in the year incurred.

FOREIGN EXCHANGE LOSSES 2009 2008

GBP'000 GBP'000

Exchange rate differences 1,895 -

====== ======

The company has issued EUR13 million of loan notes in respect of the acquisitions

of Duboko Plavetnilo-Ugljan Projektant d.o.o. and Duboko Plavetnilo Hoteli

d.o.o.. As a result of the exchange rate at 31 March 2009, GBP1 = EUR1.07798 (31

March 2008: GBP1 = EUR1.25945) the company suffered a translation loss of GBP

1,737,708 and the liability was increased from GBP10,321,884 to GBP12,059,592.

In addition, the deferred consideration of EUR1,080,706 payable for Tiha Uvala

d.o.o. stated to be GBP858,712 as at the acquisition date of 30 September 2008

(30 September: GBP1 = EUR1.25852) has been adjusted to GBP1,002,528 resulting in a

translation loss of GBP143,817.

Other loans when translated resulted in exchange losses of GBP13,737.

There is a possibility that these losses could reverse in the future.

FINANCE EXPENDITURE 2009 2008

GBP'000 GBP'000

Interest payable on overdrafts 475 284

Interest payable on loan notes 1,062 52

------------- -------------

1,537 336

======= ======

LOSS FOR THE FINANCIAL YEAR

The parent company has taken advantage of section 230 of the Companies Act 1985

and has not included its own profit and loss account in these financial

statements. The parent company loss after taxation was GBP3,703,817 (2008: loss GBP

35,813).

EARNINGS PER SHARE

The loss per share of 14.2p (2008: earnings 47.8p) has been calculated on the

weighted average number of shares in issue during the year namely 14,785,356

(year ended 31 March 2008: 10,181,002) and losses of GBP2,098,021 (year ended 31

March 2008: profit GBP4,871,401).

The calculation of diluted losses per share of 14.2p (year ended 31 March 2008:

earnings 45.4p) is based on the loss on ordinary activities after taxation and

the weighted average of 14,785,356 (2008: diluted average of 10,724,816)

shares. For a loss making group with outstanding share options, net loss per

share would only be increased by the exercise of out-of-the money options.

Since it is inappropriate to assume that option holders would act irrationally

no adjustment has been made to diluted EPS for out-of-the-money share options.

On 6 August 2008 the company's ordinary shares of GBP0.01 each were consolidated

by the factor 10:1 to ordinary shares of GBP0.10 each.

The previously reported comparative earnings per share of 31 March 2008 (basic

4.78p, diluted 4.54p) have been restated.

INVENTORIES - GROUP 2009 2008

GBP'000 GBP'000

Work in progress and goods held 4,560 3,172

for resale

======= =======

CASH AT BANK 2009 2008

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Cash at bank 3,365 29 2,372 64

===== ===== ====== =====

Included within the cash at bank and in hand at 31 March 2009 is GBP114,000

(2008: GBP224,000) which is held by the Croatian Ministry of Finance as a bond to

cover any large casinos wins. Cubus Lux d.o.o. is required to keep this bond in

place in order to maintain its gaming licence.

Cubus Lux d.o.o. is also required by law to maintain cash on site of EUR50,000

and HRK 150,000 at each casino, which is included within the above.

In addition, Plava Vala d.o.o. have GBP3,000 (2008: GBP3,000) on deposit with OTP

Leasing for security over a lease for a van and GBP8,000 (2008: GBP8,000) with

Erste Leasing securing for a boat and Duboko Plavetnilo Ugljan Projektant

d.o.o. have a deposit of GBP8,000 (2008: GBP8,000)with Erste Bank to secure a

vehicle lease.

NOTES FOR EDITORS

CUBUS LUX plc - AIM ticker: CBX; Frankfurt ticker: FWK

Originally a casino operator in Croatia, Cubus Lux has changed its strategic

focus to a more broad-based leisure and tourist operation since a new

management team joined the Company in 2005. It is now actively involved in the

development and operation of marinas, tourist resorts and hotels.

The Company aims to become the leading provider of leisure and tourism

facilities in Croatia and to participate fully in the inevitable development of

the north western Mediterranean region. Croatia has agreed prospective member

status with the EU.

Currently, Cubus Lux operates two all-year round casinos on the southern tip of

the Istrian peninsula, and a 200+berth marina at Sutomiscica, on the island of

Ugljan (more commonly referred to as Olive Island). Its hotel and resort

development on Olive Island will see the commencement of construction in Q4

2009/10. These projects involve a 500-bed 4-star hotel and the provision of 431

villas and apartments, with accompanying shops, restaurants and bars.

Cubus Lux is currently awaiting the outcome of its tenders to develop other

tourist facilities in this region of Croatia - involving two more marinas, golf

courses and hotels.

Corporate chronology:

2000: `Cubus Lux d.o.o.' granted licences to operate casinos in Croatia

(licences valid for an initial 10 years, with 8-year renewal option).

August 2004: Shares of Cubus Lux plc admitted to AIM

July 2005: Dr Gerhard Huber appointed executive chairman

February 2006: Acquisition of `Playa Vala d.o.o.' (Olive Island Marina) -

effective reverse takeover requiring re-admission of shares to AIM

May 2007: opening of marina on Olive Island, at Sutomiscica

February 2008: Acquisition of DPUP and DPH, the Olive Island Companies, (Olive

Island Resort and Olive Island Hotel, respectively) - effective reverse

takeover requiring readmission of shares to AIM

March 2008: Company's shares admitted to trading in Frankfurt

April 2009: Company announces tender win for 3.4sqm resort development at

Valdanos, Montenegro

END

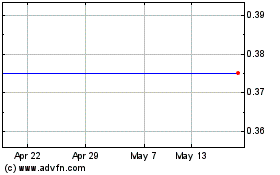

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

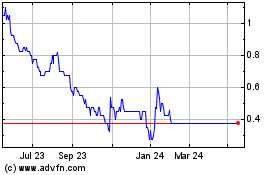

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024