Cubus Lux plc ("Cubus Lux" or the "Company")

Preliminary Announcement for results for the 12 months to 31 March 2008

Cubus Lux plc, the operator and developer of premier tourism and leisure

facilities in Croatia, announces its results for the year ended March 31 2008.

Key highlights:

* Turnover: 2008 �3.1 million (2007, 15 months - �1.0 million), up 203%

* Pre-tax profit of �4.9 million* (2007, 15 months - �160,000)

* Earnings per share of 4.78p** (2007, 15 months - loss of 0.19p per share)

* �2.3 million additional equity raised

* 31 March 2008 listing on the Frankfurt Stock Exchange (dual-listed with

London Stock Exchange AIM market)

* Acquisition of the Olive Island Resort and Hotel - reverse takeover and

consequent readmission to AIM

* Advanced sales in Olive Island Resort of Euro15.2 million, net of VAT

* Europe-wide focus on Croatia as a target for sustainable tourism and

leisure development accelerates demand and continues to present Cubus Lux

with new opportunities

* Pre-tax profit before negative goodwill arising from Olive Island acquisition

was �357,000 (2007: loss before negative goodwill �1,291,000)

** Earnings per share before negative goodwill arising from Olive Island

acquisition was 0.34p

Commenting on the results, executive chairman Dr. Gerhard Huber said:

"After a period of reconstruction our operations are now starting to mature and

reach targets on our investments. Furthermore, the `Olive Island' transactions

and projects have transformed our balance sheet and provide a strong foundation

for the Company's future development. We continue to focus on creating

sustainable shareholder value and remain committed to our strategy of

introducing new projects with strong potential to fulfil that aim."

For further information please see www.cubuslux.com or contact:

Steve McCann

Cubus Lux plc

+385 (0)99 214 9636

Simon Sacerdoti/Liam Murray, Nominated Adviser

Dowgate Capital Advisers Limited

+44 (0)20 7492 4777

Kealan Doyle, Broker

Lewis Charles Securities Limited

+44 (0)20 7456 9100

Pam Spooner

CityRoad Communications

+44 (0) 207 248 8010 / +44 (0)7858 477 747

CHAIRMAN'S STATEMENT

I am pleased to submit results for the year ended 31 March 2008.

After a period of reconstruction, our operations are now starting to mature and

reach targets on our investments. The Group's two principle operations are the

Istrian based casinos and Olive Island Marina.

Both of these businesses have developed strategic plans for continued

improvement as we move with enthusiasm into the third leg of our group

strategy, that of real estate development and sales.

Cubus Lux d.o.o. - the gaming company:

Currently, our main casino is located in Pula, Croatia. The casino is situated

in the Hotel Histria, a hotel which was known to be `on the market' and

consequently received limited refurbishment; as a result, we believe potential

clients were deterred. Investment by Park Plaza into this hotel will ensure a

new hotel management and significant efforts to attract new clientele. We

believe that the planned multi million pound improvement of the complex will

benefit our business, and, consequently, we have increased our floor space in

Hotel Histria by approximately 600 square metres, with the further addition of

a bistro and outside terrace. We have further improved our offering by bringing

in gaming equipment from our former Medulin location and believe Pula now to be

one of the largest casinos in Croatia.

Our casino operations had a strong year, turning around the operating loss �

196,000 for 2007 into a profit of �65,000 for 2008. We are now starting the

main season in the casino and expect a very buoyant summer.

We have a number of target locations for additional casinos, both seasonal and

all year round. Our first new casino will commence operations in Selce, close

to the city of Rijeka, Croatia, on 25 June 2008. Our experienced and

strengthened management team are very excited with this development and we

expect it to be immediately profitable. This location was considered to be

superior to that of our Rabac casino which was closed at the year end and we

were able to relocate both our equipment and some of our staff to this new

operation, thereby keeping investment low and commence operations with an

experienced team.

Plava Vala d.o.o. - the marina company:

Our marina in Sutomiscica, near Zadar continues to advance in popularity as a

venue in Adriatic sailing, with a growing reputation for both our facilities

and restaurant. Rather earlier than expected, we have already reached our

target of 180 berths contracted. This is a tremendous achievement considering

that construction of the marina was delayed and that it was not officially

opened and fully operational until May 2007, with the restaurant opening

several weeks later in July 2007. Despite recovering very well, we did suffer

from the constructors' delays and consequently fell short of our initial

targets for overnight transit business. These delays resulted in a loss in this

start up period. However, we are now seeing continuous trading improvement and

have started the new season positively.

We are working towards phase two for this marina which will involve further

facilities and additional berths. In addition, we are actively tendering to

construct further marinas in locations extending down the Adriatic coast and

its islands. We believe we have the right management team in place - one that

has very quickly transformed this business into a significant destination for

Mediterranean seafarers. Already this season, management has organised thirty

regattas for our marina, with participants coming from Hungary, Czech Republic,

Slovenia, Poland, Belgium, Germany, Austria, Italy and indeed, Croatia.

Cubus Lux Projektiranje d.o.o. - residential/commercial development:

In the half year report, I talked about the start of our new business venture

into real estate development. In 2007 we purchased a 6,000 sq metre plot of

land in Zadar, close to the City centre, for development. We created the

project and obtained all necessary permissions for building 72 apartments and

attracted an international bank to buy the ground floor commercial space. We

were pleased to announce that this project has proved successful, and, as

previously reported, we have sold the project at a profit. . This was an

excellent opportunity for us and will enable our teams to focus more fully on

new projects, in particular the Olive Island Resort and Hotel.

Financial:

For the year ended 31 March 2008, the Company reports revenues of �3,078,000

and a pre-tax profit of �4,880,000. Earnings per share amounted to 4.78p. �

4,523,000 of the profit is attributable to negative goodwill from the

acquisition of the Olive Island companies which arose as a result of the

Company adopting IFRS accounting conventions. Excluding this adjustment profits

(on a like for like basis) amounted to �357,000 (2007 - loss �1,291,000).

During this period, the Company carried out two equity fundraisings of

9,570,000 shares at 16.275p per share and 4,547,148 shares at 17p, enabling

further expansion and development of other projects.

With effect from 31 March 2008 the Company's shares were listed on the

Frankfurt Stock Exchange in addition to AIM. It has long been our objective to

make our shares accessible to buyers in both sterling and euro and we are

pleased to report high interest from our Euro based investors.

Olive Island Resort:

Our main focus in the last year, away from the current operating businesses,

was the acquisition of the `Olive Island Resort' on the Dalmatian coast of

Croatia. We successfully completed this transaction, resulting in a `reverse

take-over' and subsequent readmission of our shares to AIM on 22 February 2008.

We immediately started to implement realisation of the project, which will

include 126 villas, 305 apartments, as well as accompanying facilities, such as

restaurants, shops, a marina and four star hotel with 500 beds. We expect to

begin construction in the coming months. The villas and apartments will be sold

and the hotel operated by the Company in association with our partner Sol

Melia.

Plans for the future:

The `Olive Island' transaction and projects have already transformed our

balance sheet, to provide a strong foundation for the Company's future

development. We continue to focus on creating sustainable shareholder value and

remain committed to our strategy of introducing new projects with strong

potential to fulfil that aim. We are well placed in Croatia and its

neighbouring countries, to be able to compete effectively for a wide variety of

prospective projects. Indeed, we are pleased to report that we now have a

pipeline of such projects and are actively engaged in tendering for several

developments. As a result, we look forward to the Company's future with

optimism.

GERHARD HUBER

Chairman

Executive Director

24 June 2008

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 MARCH 2008

Year ended 15 months

ended

31 March 2008 31 March 2007

�'000 �'000

REVENUE 3,078 1,017

Cost of sales (202) (150)

------------- -------------

GROSS PROFIT 2,876 867

Administrative expenses (2,399) (1,957)

Other income 4,693 1,451

------------- -------------

OPERATING PROFIT 5,170 361

Finance expenditure (290) (201)

------------- -------------

PROFIT ON ORDINARY

ACTIVITIES BEFORE TAXATION 4,880 160

Tax on ordinary activities (9) (290)

------------- -------------

PROFIT/(LOSS) FOR THE PERIOD 4,871 (130)

====== ======

EARNINGS/(LOSS) PER SHARE

Basic (see note below) 4.78p (0.19)p

====== ======

Diluted (see note below) 4.54p (0.18)p

====== ======

CONSOLIDATED BALANCE SHEET

AT 31 MARCH 2008

31 March 2008 31 March 2007

�'000 �'000

ASSETS

Non-current assets

Intangible assets 35,902 5,372

Goodwill 940 -

Property, plant and equipment 4,702 3,315

-------------- --------------

41,544 8,687

-------------- --------------

Current assets

Inventories 3,172 41

Trade and other receivables 2,384 950

Cash at bank 2,372 1,375

-------------- --------------

7,928 2,366

-------------- --------------

49,472 11,053

======= ======

EQUITY

Capital and reserves attributable to

the Company's

equity shareholders

Called up share capital 1,463 881

Share premium account 16,028 7,239

Merger reserve 347 347

Profit and loss account 3,120 (1,565)

-------------- -------------

TOTAL EQUITY 20,958 6,902

======= ======

LIABILITIES

Non-current liabilities

Deferred tax liabilities 7,180 290

Loans 5,053 3,138

Amounts due under finance leases 38 7

--------------- -------------

12,271 3,435

======= ======

Current liabilities

Trade and other payables 5,433 589

Loans 10,805 122

Amounts due under finance leases 5 5

--------------- -------------

16,243 716

======= ======

TOTAL LIABILITIES 28,514 4,151

======= =======

TOTAL EQUITY AND LIABILITIES 49,472 11,053

======= ======

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2008

Year ended 15 months ended

31 March 2008 31 March 2007

�'000 �'000

Cash flows from operating activities

Profit before taxation 4,880 160

Adjustments for:

Net finance expense (290) 201

Net interest paid 290 (201)

Loss on disposal of fixed assets 26 45

Exchange rate difference 578 -

Share based payments 222 178

Depreciation and amortisation 256 148

Negative goodwill written back to income (3,739) (1,451)

statement

Movement in trade and other receivables 373 (559)

Movement in inventories (2,571) (31)

Movement in trade and other payables 957 14

-------------- ---------------

Cash outflow from operating activities 982 (1,496)

Taxation paid (9) -

-------------- ---------------

Net cash outflow from operating activities 973 (1,496)

-------------- ---------------

Cash flow from investing activities

Purchase of property, plant and equipment (982) (2,472)

and intangibles

Proceeds from sale of property 66 -

Purchase of subsidiaries (795) -

Cash acquired with subsidiary 18 114

-------------- ---------------

Net cash outflow from investing activities (1,693) (2,358)

-------------- ---------------

Cash flows from financing activities

Issue of shares 2,341 3,050

Capital element of finance lease repaid - (5)

Net loans undertaken less repayments 499 1,690

-------------- ---------------

Cash inflow from financing activities 2,840 4,735

-------------- ---------------

Cash and cash equivalents at beginning of 1,375 431

period

Net cash inflow from all activities 2,120 881

Non-cash movement arising on foreign (1,123) 63

currency translation

-------------- ---------------

Cash and cash equivalents at end of period 2,372 1,375

====== ======

Cash and cash equivalents comprise

Cash (excluding overdrafts) and cash 2,372 1,375

equivalents

====== ======

RECONCILIATION OF NET CASH FLOW TO NET DEBT

Increase in cash in the period 2,120 881

Exchange rate differences (1,701) 63

Cash inflow from movement in debt (499) (1,690)

New finance leases (29) 5

Loan notes issued on purchase of (9,796) -

subsidiaries

Debt acquired on acquisition of subsidiary (1,725) (988)

-------------- -------------

Movement in net funds in the period (11,630) (1,729)

Net debt at beginning of period (1,899) (170)

------------- -------------

Net debt at end of period (13,529) (1,899)

====== ======

NOTES TO THE CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2008

ANALYSIS OF At 31 March Cash Other Exchange At 31 March

CHANGES 2007 movements

flows differences 2008

IN NET DEBT

�'000 �'000 �'000 �'000 �'000

Cash at bank and 1,375 2,120 - (1,123) 2,372

in hand

------------ ------------ ------------ ------------ ------------

1,375 2,120 - (1,123) 2,372

Debt due in less

than one year

Finance leases (6) - 1 - (5)

Loans (122) (309) - - (431)

Loan notes - - (9,796) (578) (10,374)

------------ ------------ ------------- ------------ --------------

1,247 1,811 (9,795) (1,701) (8,438)

Debt due in more

than one year

Finance leases (8) - (30) - (38)

Loans (3,138) (190) (1,725) - (5,053)

------------ ------------ ------------ ------------ --------------

(1,899) 1,621 (11,550) (1,701) (13,529)

====== ====== ====== ====== ======

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MARCH 2008

Share Share Merger Retained Translation

Capital Premium Reserve Earnings Reserve Total

�'000 �'000 �'000 �'000 �'000 �'000

At 1 January 2006 249 1,321 347 (1,622) (28) 267

Share based - - - 178 - 178

payments

Total recognised

income

and expenses - - - (130) 37 (93)

Issue of shares

(net of

costs) 282 2,819 - - - 3,101

Acquisition of

subsidiaries (net 350 3,099 - - - 3,449

of costs)

----------- ------------ ----------- --------- ---------- ------------

At 31 March 2007 881 7,239 347 (1,574) 9 6,902

Share based - - - 222 - 222

payments

Total recognised

income

and expenses - - - 4,871 (408) 4,463

Issue of shares

(net of costs) 141 2,199 - - - 2,340

Acquisition of

subsidiaries

(net of costs) 441 6,590 - - - 7,031

----------- ------------ ----------- ------------ ---------- --------------

At 31 March 2008 1,463 16,028 347 3,519 (399) 20,958

----------- ------------ ----------- ------------ ---------- --------------

1. BASIS OF PREPARATION

The financial information set out above does not constitute the Group's

statutory accounts within the meaning of section 240 of the Companies Act 1985.

The balance sheet at 31 March 2008 and the income statement and cash flow

statement for the year then ended have been extracted from the Group's

unaudited financial statements.

These financial statements have been prepared in accordance with those IFRS

standards and IFRIC interpretations issued and effective or issued and early

adopted as at the time of preparing these statements.

These consolidated financial statements have been prepared under the historical

cost convention.

2. ACCOUNTING POLICIES

Basis of Consolidation

On 20 May 2004, the company purchased 100% of the issued share capital of Cubus

Lux d.o.o., a company registered in the Commercial Court in Rijeka, Croatia, by

way of a share for share exchange. Under Financial Reporting Standard 6, merger

accounting has been adopted as the basis of consolidation.

On 6 March 2007, the company purchased 100% of the issued share capital of

Plava Vala d.o.o., a company registered in Croatia, by way of a share for share

exchange. Under Financial Reporting Standard 6, acquisition accounting has been

accepted as the basis of consolidation for the transaction.

On 22 February 2008, the company purchased 100% of the issued share capital of

Duboko Plavetnilo Ugljan Projektant d.o.o. and Duboko Plavetnilo Hoteli d.o.o.,

two companies registered in Croatia, by way of a share for share exchange and

the issue of Cubus Lux Plc loan notes. Under Financial Reporting Standard 6,

acquisition accounting has been accepted as the basis of consolidation for the

transaction.

On 17 March 2008, the company purchased 100% of the issued share capital of

Adriatic Development LLC and Worldwide Leisure Holding LLC, two companies

registered in the U.S. Under Financial Reporting Standard 6, acquisition

accounting has been accepted as the basis of consolidation for the transaction.

Group accounts consolidate the accounts of the company and its subsidiary

undertakings made up to 31 March 2008. As provided by section 230 of the

Companies Act 1985, a separate income statement for the parent company has not

been presented.

All intercompany balances and transactions have been eliminated in full.

Subsidiary undertakings are accounted for from the effective date of

acquisition until the effective date of disposal.

Segment reporting

The Group has the separately identifiable business segments of the Casino,

Marina, Property, Resorts and Central Overheads for which an analysis of the

activity and associated assets are shown within these financial statements.

Revenue recognition

Revenue comprises the fair value of the sale of goods and services, net of

value added tax, rebates and discounts.

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation.

Depreciation is calculated to write down the cost of all tangible fixed assets

by equal monthly instalments over their estimated useful lives at the following

rates:-

Motor vehicles - 25% per annum

Furniture, fittings, casino equipment and marina assets - 10 - 25% per annum

Casino, marina and resort leasehold premises - over the life of the lease

During the 15 months to 31 March 2007 the marina was under construction and

therefore no depreciation was charged.

Goodwill and business combination

Business combinations on or after 1 January 2005 are accounted for under IFRS 3

using the purchase method. Any excess of the cost of business combinations over

the Group's interest in the net fair value of the identifiable assets,

liabilities and contingent liabilities is recognised in the balance sheet as

goodwill and is not amortised.

After initial recognition, goodwill is not amortised but is stated at cost less

any accumulated impairment loss, with the carrying value being reviewed for

impairment, at least annually and whenever events or changes in circumstances

indicate that the carrying value may be impaired.

For the purpose of impairment testing, goodwill is allocated to the related

cash generating units monitored by management. Where the recoverable amount of

the cash generating unit is less than its carrying amount, including goodwill,

an impairment loss is recognised in the income statement.

Intangible assets are tested annually for impairment and other non-current

assets are tested where an indication of impairment arises. The assessment of

impairment is made by comparing the carrying amount of cash generating units

(including any associated goodwill) to the higher of their value in use and

their fair value.

Value in use represents the net present value of future discounted cash flows.

Any impairment of non-current assets are recognised in the income statement.

Intangible assets include the licence of the Marina. The Marina licence has an

indefinite useful economic life as the Marina Licence is expected to be

automatically renewed after the initial 32 year concession expires.

No amortisation is charged on intangible assets relating to the Olive Island

Resort.

Amortisation will commence and the charge will be in proportion to the sales of

the properties.

Assets that have an indefinite useful life are not subject to amortisation and

are tested for impairment.

Assets that are subject to amortisation are reviewed for impairment whenever

events or changes in circumstances indicate that the carrying amount may not be

recoverable. An impairment loss is recognised for the amount by which the

asset's carrying amount exceeds it recoverable amount. The recoverable amount

is the higher of an asset's fair value and value in use.

When amortisation commences it will be charged to Administrative expenses in

the Income Statement.

Foreign currencies

Transactions in foreign currencies are recorded at the rate ruling at the date

of the transaction. Monetary assets and liabilities denominated in foreign

currencies are retranslated at the rate of exchange ruling at the balance sheet

date. The factual currency of the Group is Euro, however, Sterling is currently

used as the presentational currency to give comparability on AIM.

The exchange rates used at 31 March 2008 was �1 = Euro 1.25946, �1 = HRK

9.1711.

Operating lease agreements

Rentals applicable to operating leases where substantially all of the benefits

and risks of ownership remain with the lessor are charged to the income

statement as incurred.

Deferred taxation

Deferred tax is provided in full, using the liability method, on temporary

differences arising between the tax bases of assets and liabilities and their

carrying values in the financial statements. The deferred tax is not accounted

for if it arises from initial recognition of an asset or liability in a

transaction, other than a business combination, that at the time of the

transaction affects neither accounting nor taxable profit or loss. Deferred tax

is determined using tax rates (and laws) that have been enacted or

substantially enacted by the balance sheet date and are expected to apply when

the related deferred tax asset is realised or the deferred tax liability is

settled.

Deferred tax assets are recognised to the extent that it is probable that

future taxable profit will be available against which temporary differences can

be utilised.

Trade and other receivables

Trade and other receivables are recognised and carried at original invoice

value less an allowance for any uncollectible amounts. An estimate for doubtful

debts is made when collection of the full amount is no longer probable. Bad

debts are written off when identified.

Share based payments

IFRS 2 ("Share based payments") requires the Group to recognise an expense in

respect of the granting over shares to employees and directors. This expense,

which is calculated by reference to the fair value of the options granted, is

recognised on a straight line basis over the vesting year based on the Group's

estimate of options that will eventually vest. The Directors have used the

Black Scholes model to estimate the value of options granted in the current and

prior years.

Investments

Investments in subsidiary undertakings are stated at cost less provisions for

impairment.

Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposit held at call with

banks, other short-term highly liquid investments with original maturities of

three months or less, and bank overdrafts. Bank overdrafts are shown within

borrowings in current liabilities on the balance sheet.

Inventories

Inventories represent work in progress and goods for resale and is stated at

the lower of cost and net realisable value.

EARNINGS/(LOSS) PER SHARE

The profit per share of 4.78p (31 March 2007: loss 0.19p) has been calculated

on the weighted average number of shares in issue during the year namely

101,810,025 (31 March 2007: 68,681,402) and profits of �4,871,401 (2007: losses

�130,013).

The calculation of diluted losses per share of 4.54p (2007: loss 0.18p) is

based on the losses on ordinary activities after taxation and the diluted

weighted average of 107,248,167 (2007: 73,896,786) shares.

End

NOTES FOR EDITORS

CUBUS LUX plc - AIM ticker: CBX; Frankfurt ticker: FWK

Originally a casino operator in Croatia, Cubus Lux has changed its strategic

focus to a more broad-based leisure and tourist operation since a new

management team joined the Company in 2005. It is now actively involved in the

development and operation of marinas, tourist resorts and hotels.

The Company aims to become the leading provider of leisure and tourism

facilities in Croatia and to participate fully in the inevitable development of

the north western Mediterranean region. Croatia has agreed prospective member

status with the EU.

Currently, Cubus Lux operates two all-year round casinos on the southern tip of

the Istrian peninsula, and a 200+berth marina on the island of Ugljan (more

commonly referred to as Olive Island) at Sutomi**ica. Its hotel and resort

development on Olive Island will see the commencement of construction in Q3

2008. These projects involve a 500-bed 4-star hotel and the provision of 431

villas and apartments, with accompanying shops, restaurants and bars and a 150

berth marina.

Corporate chronology:

2000: `Cubus Lux d.o.o.' granted licences to operate casinos in Croatia

(licences valid for an initial 10 years, with 8-year renewal option).

August 2004: Shares of Cubus Lux plc admitted to AIM

July 2005: Dr Gerhard Huber appointed executive chairman

February 2006: Acquisition of `Playa Vala d.o.o.' (Olive Island Marina) -

effective reverse takeover requiring re-admission of shares to AIM

May 2007: opening of marina on Olive Island at Sutomi**ica

February 2008: Acquisition of DPUP and DPH, The Olive Island Companies, (Olive

Island Resort and Olive Island Hotel, respectively) - effective reverse

takeover requiring readmission of shares to AIM

March 2008: Company's shares admitted to trading in Frankfurt

End

END

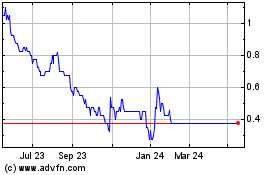

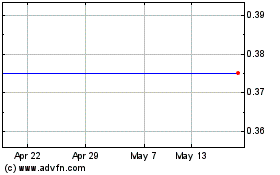

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024