Cubus Lux Plc

(the `Company')

Posting of Admission Document

The Company today announces that, on 14 January 2008, it entered into

conditional agreements to acquire the Olive Island Companies, and that an

Admission Document has today been posted to shareholders convening a General

Meeting at which resolutions will be proposed to, inter alia, approve the

Acquisitions. Further to the posting of the Admission Document to shareholders,

the suspension of trading in the shares of the Company on AIM has been lifted.

On 13 March 2007, the Company announced that it had entered into an option

agreement which gave it the right to acquire certain development land known as

the Olive Island Resort on the coast of Dalmatia in Croatia, which is intended

to be developed into a village resort and a four star hotel. The Company

announced extensions to this option on 13 July 2007 and 1 October 2007, and on

24 December 2007, it announced that it had exercised the option and that as the

Acquisitions constitute a reverse takeover under the AIM Rules, the Company had

requested that trading in its shares on AIM be suspended pending the

publication of an admission document.

The companies to be acquired (both of which are registered in Croatia) are:

* `DPUP' (Duboko Plavetnilo - Ugljan Projektant d.o.o.) - owns the Olive Island

Village project; and

* `DPH' (Duboko Plavetnilo - Hoteli d.o.o.) - owns the Olive Island Hotel

project.

The Acquisitions are effected by two separate agreements, the consideration for

which is, in aggregate approximately Euro27.45 million, as follows:

* For the acquisition of DPUP: Euro12 million to be satisfied by the issue of Loan

Notes and Euro9.45 million to be satisfied by the issue of 36,904,996 Ordinary

Shares in the capital of the Company, credited as fully paid.

* For the acquisition of DPH Euro1 million to be satisfied by the issue of Loan

Notes and Euro5 million to be satisfied by the issue of 7,028,993 Ordinary Shares

in the capital of the Company, credited as fully paid.

The size of the Olive Island Companies, in aggregate and relative to the

Company, means the Acquisitions taken together are considered a reverse

takeover for the purposes of the AIM Rules. Accordingly, the Proposals are

conditional on the approval of the Shareholders at the General Meeting.

Furthermore, since three directors of the Company (Gerhard Huber, Christian

Kaiser and Michael Janssen) are beneficial shareholders in the Olive Island

Companies (being interested, in aggregate, in approximately 36.8 per cent. of

the Consideration Shares and approximately 30.8 per cent. of the Loan Notes),

the Acquisition is also a related party transaction (as defined) under the AIM

Rules and, as Gerhard Huber, Christian Kaiser and Michael Janssen are all

directors of the Company, a substantial property transaction involving

directors under section 190 of the Companies Act 2006.

Gerhard Huber, Chairman of Cubus Lux, commented:

"We are delighted to have entered into agreements in respect of the acquisition

of the Olive Island companies which will allow us to further our ambitions of

establishing a major resort operation on the Dalmatian coast of Croatia.

Croatia is experiencing one of the steepest rises in tourism in the world and

we expect to be well placed to serve this demand.

"Cubus Lux has set its target of becoming the pre-eminent tourist and leisure

business in Croatia and this major acquisition will certainly help us achieve

this aim. In addition, the Company continues to pursue additional developments

which will enhance this offering."

For further information, the full Admission Document is available on the

Company's website at www.cubuslux.com, or please contact:

Cubus Lux plc +44 (0)7900 683 683

Gerhard Huber, Chairman

City Financial Associates Limited, Nominated Adviser +44 (0)20 7492 4777

Liam Murray/Simon Sacerdoti

Ellis Stockbrokers Limited, Joint Broker +44 (0)1293 51 77 44

Neil Badger

Lewis Charles Securities Limited, Joint Broker +44 (0)20 7456 9100

Kealan Doyle

Threadneedle Communications, Financial PR +44 (0)20 7936 9605

Graham Herring/Alex White

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2008

Publication of this document 15 January

Latest time and date for receipt of proxy forms 10.30 a.m. on 5 February

General Meeting 10.30 a.m. on 7 February

Admission and dealings commence in the Existing 8 February

Ordinary Shares and the Subscription Shares on AIM

Issue of Consideration Shares and completion of the 31 May

Acquisitions expected by

ADMISSION AND PLACING STATISTICS

Number of Existing Ordinary Shares 97,662,518

Number of Ordinary Shares to be issued pursuant to 4,381,571

the Subscription

Number of Ordinary Shares in issue on Admission 102,044,089

Number of Consideration Shares 43,933,989

Number of warrants and options in issue on Admission 8,675,000

Maximum number of Ordinary Shares to be issued as a 37,604,860

result of the conversion of the Loan Notes

BACKGROUND TO AND REASONS FOR THE ACQUISITIONS

Cubus Lux is in the process of transition from a casino operator into a leisure

and development company in Croatia. The acquisition and construction of the

Olive Island Marina has been completed and the marina is fully operational. As

a further step the Company has entered into two option agreements to acquire

certain development land known collectively as the "Olive Island Resort" on the

Dalmatian coast of Croatia.

The Olive Island Resort development land is set in 384,000 sqm of land along

approximately 1.5km of beach, and is intended to be developed into:

(a) a village resort comprising 431 units, namely 126 villas and 305 apartments

as well as the accompanying facilities such as restaurants, shops, offices and

a marina (the "Villas Development"); and

(b) a 4 star hotel containing 500 beds (the "Hotel Development").

THE CROATIAN TOURISM MARKET

During the 1980s, Croatia developed as a popular holiday destination, which the

Directors believe was due to its Mediterranean climate, coastal scenery and low

cost of living. The Dalmatian coast, with its many islands, became especially

popular, particularly for sailing holidays. Political unrest in the Balkan

region, culminating in Croatia's declaration of independence from the Yugoslav

Federation in June 1991, erupted into violence which affected the country for

most of the next five years. Events such as the shelling of Dubrovnik, centre

of the country's developing tourism industry, had an inevitable impact and

tourism to Croatia plummeted. Following the intervention of the UN and

diplomatic efforts by the US, the Dayton Agreement of December 1995 signalled

the start of the restoration of stability and economic rehabilitation.

The Directors believe that Croatia's travel and tourism industry has been

recovering strongly since the early 1990s. The country was given official EU

membership candidate status in June 2004, which could pave the way for it to

become a fully-fledged EU member state in the foreseeable future.

Travel and tourism in Croatia had a projected growth of 7.8 per cent. in 2007,

and it is estimated to grow, in real terms, by 7.9 per cent. per annum between

2008 and 2017. (Source: World Travel & Tourism Council/Oxford Economic

Forecasting).

It has been estimated that there were 8.7 million foreign visitors to Croatia

in 2006, each staying on average for 5.4 nights. The total number of overseas

visitors increased by nearly 10 per cent. between 2004 and 2006.

In recent years an increase in tourists from wealthier western European

countries (notably France, the United Kingdom and the Netherlands) and North

America which, unlike Germany and Italy, has not traditionally been a major

source of tourism, can be observed. The average length of stay declined

slightly over the last year, possibly as a result of increased accessibility

and transportation links (for example, the growth in budget airlines) which

have made shorter breaks more practical. This may also explain the more rapid

growth in the number of visitors from further afield in Europe than the

traditional sources of visitors. (Source: "Statistical Information 2007",

Republic of Croatia - Central Bureau of Statistics)

INFORMATION ON THE GROUP

The Group currently comprises two main trading subsidiaries, as well as other

companies which hold or will be used to acquire development projects in the

future.

Casino operations

Cubus Lux doo, a wholly-owned subsidiary of the Company, was granted a 10 year

concession agreement for organising games of chance in casinos on 20 January

2000. The gaming licence held by Cubus Lux doo authorises it to open:

(a) as many full casinos (defined as an operation with a minimum of 7 tables

and an unlimited number of slot machines) as it desires;

(b) two seasonal automated casinos, containing only electronic gambling

machines, operating four to six months a year; and

(c) two seasonal casinos operating four to six months a year.

The Croatian Gaming Board retains the power to close down any casino for

failure to comply with the terms of its gaming licence or with regulatory

requirements. On expiry of the current casino concession agreement, Cubus Lux

doo may request an extension of the concession for a further eight years. The

Directors believe that as long as it complies with the terms of the gaming

licence, Cubus Lux doo will be successful in its request to have the gaming

licence extended.

The group currently operates two annual casinos in hotels in Croatia, covering

almost 20,000 square feet.

Hotel Histria, Pula

The Group's first operation was the year-round casino in the Hotel Histria in

Pula, located at the southern part of the Istrian Peninsula. Hotel Histria is

situated above the sea coast, only four kilometres away from the historic

centre of Pula. It is open all year round, with 240 rooms on five floors. The

casino has recently been expanded from its former 8,000 square feet premises to

include a further 6,800 square feet, and reopened on 13 July 2007. The

Directors believed that this expansion would benefit the Group after certain

low-fare airlines started to fly to the International airport of Pula from

Dublin and London. The new facility now offers 97 slot machines, 6 horse racing

machines, 2 electronic roulette machines, 5 American roulette tables, 3 Black

Jack tables, 3 Poker tables and 1 Texas Holdem table. There is also an outside

terrace with tables providing light refreshments and drinks.

This expansion of the casino at the Hotel Histria was effected by transferring

equipment from a third casino that the Group previously operated in a nearby

hotel (Hotel Belvedere in Medulin), which was no longer considered by the

Directors to be a suitable location for the operation of a casino. The move has

increased both the floor space and offering of the Hotel Histria casino, and

the Directors believe that this may result in an increased number of visitors

to the Hotal Histria casino and an increase in the average length of stay.

Narcis Hotel, Rabac

On 11 July 2005, the Group announced the opening of a casino located in the

Narcis hotel in Rabac, which lies approximately 30 miles northeast of Pula. The

Group entered into a three-year agreement to operate the casino complex at the

Rabac hotel, with an option for an additional three-year extension. The hotel

complex has more than 670 rooms and there is is a caravan park with 3,000

camping places adjacent to the hotel. The hotel complex stretches over 200,000

square metres. The casino occupies 5,900 square feet and has 31 slot machines,

1 electronic roulette machine and 7 tables, offering Blackjack, Poker and

Chemin de Fer.

Marina operations - Olive Island Marina

Plava Vala was acquired by the Group in February 2006 and, pursuant to a

concession granted to Plava Vala by the Government of the Republic of Croatia,

is the owner and operator of the Olive Island Marina, situated in Sutomi*s�cica

on the island of Ugljan, which is approximately 4 miles from the city of Zadar.

The 3,000-year-old city of Zadar is the capital of Northern Dalmatia and, along

with its international airport, offers numerous restaurants and cafes, cinemas,

theatres, galleries, libraries, museums and sports centres.

Ugljan is considered to be a suburb of Zadar, owing to its frequent travel

connections. It is approximately 30 minutes from Zadar by regular ferry lines.

Ugljan has a mild and healthy Mediterranean climate, with an average air

temperature from May to October of 22�C, and an average of 2,500 annual hours

of sunshine.

The Olive Island Marina currently has around 200 berths and the Directors

believe it to be one of the most attractive marinas along the Croatian coast.

All berths have international standard electricity and water supply. The land

facilities include a restaurant operated by Plava Vala together with bar

facilities, wireless internet access throughout the marina, as well as high

standard shower and toilet facilities. In addition, service facilities for

boats are offered in the marina, together with a ship supply shop and a small

supermarket.

The Marina is marketed as a destination marina with easy access to the city of

Zadar by a regular shuttle service for guests to and from the marina. As a

result, the Directors believe that guests have a choice of the more relaxed and

peaceful atmosphere of the marina, or the more energetic city life in Zadar.

The more secluded location of the marina has attracted owners of super yachts,

providing them with the required privacy.

Zadar apartment developments

The Group currently owns a plot of land in Zadar, the former capital of

Dalmatia, on which it intends to build residential and commercial properties

for resale. The project is located in the select resort of Borik and is a mixed

commercial/residential building. It is located within walking distance of the

Borik hotel and resort area and the Borik marina. The total land space is

approximately 70,000 square feet. Total land acquisition costs are Euro2.9

million. Saleable space is expected to be 98,000 square feet. Construction is

planned to start in May 2008 and to be completed by October 2009. The Group

also acquired another development site in Zadar which it has since sold at a

profit of Euro1.1 million.

Current trading and prospects

Although the three months that have been complete since the financial half-read

(30 September 2007) are traditionally the low season, the Group's operations

have maintained steady activity and in the nine months to 31 December 2007 have

returned results in line with management expectations. The remainder of the

financial year is expected to be relatively quiet in the run-up to Easter, as

management of the Group;s businesses continue to focus on marketing initiatives

to ensure that the new tourist season fulfils its potential.

INFORMATION ON THE OLIVE ISLAND PROJECTS

Introduction

The island of Ugljan is known as the garden of the city of Zadar. The island,

which is covered with pine trees, fig trees, vineyards and olive groves,

received its name in connection with the abundance of olive oil, which has been

extracted for over 2,000 years from the numerous olive trees.

The Directors believe that the island's close proximity to the mainland and

frequent travel connections make it a convenient destination for tourists. The

island has a number of sandy beaches. There are several restaurants on Ugljan,

in which local specialties are offered. The first recorded use of the island's

current name was in 1325, and it is believed that the island has been inhabited

since the Stone Age. During Roman times, it is understood that the island was

densely populated, particularly in the north-western part, where the remains

Development profile

The Olive Island Resort is being developed as one of the first integrated

holiday developments on Ugljan Island on the Dalmatian Riviera. Properties

built for resale by the Group are expected to include 126 villas and 305

apartments. Amenities are expected to include swimming pools, tennis courts, a

marina, shops, bars, restaurants and a spa hotel.

It is intended that the resort will be built in five zones, with some sales

being off plan so that the sales and construction complete at approximately the

same time. It is intended that construction of the five zones will be staggered

and the project is anticipated to be fully completed by March 2010.

The Directors intend that the construction of the Olive Island Resort will be

financed through three loans with external banks. The Directors believe that

the Group will be able to repay these loans through the revenues which they

anticipate will be obtained from the Olive Island Resort. The loans are

expected to include (i) a land loan of Euro4 million, projected to be repaid by 31

March 2009; (ii) a construction loan, which is expected to be for a maximum

amount of Euro10 million and which is projected to be fully repaid by March 2010,

and (iii) a hotel loan of Euro17 million.

The Directors believe that the Olive Island Resort will, if successfully

implemented, prove to be profitable for the Group. The Directors believe that

it will be possible to generate turnover in excess of Euro169 million (including

VAT) from the sale of the 431 properties which it is anticipated will be built

at the Olive Island Resort.

As at the date of this announcement, 58 apartments and 12 villas have been

pre-sold, generating total initial payments, which are held in escrow, of

approximately Euro1.7 million. The total sales value (excluding VAT) of these

pre-sales is approximately Euro13.1 million. Reservations have been taken in

respect of a further 19 properties with a total sales value (excluding VAT) of

approximately Euro7.5 million.

From December 2007, the Olive Island Resort employed a sales director, Kyle

Koenig. Mr Koenig has a background in property sales, knowledge of the Olive

Island Resort, the market and a broad knowledge of marketing and sales

techniques.

Valuation

The Company has obtained an external valuation of the target assets by King

Sturge doo, International Property consultants, which is included in the full

Admission document. King Sturge values the development site at Euro42,940,000.

FUTURE STRATEGY

The Directors intend to pursue a strategy to provide Shareholders with

long-term income and capital growth from a balanced portfolio of business and

property investments in the leisure and tourism industry in Croatia.

Specific strategies in respect of the various activities of the Group include:

* growing the casino business in and outside Croatia by leveraging the existing

license and/or by acquisition;

* growing the marina business by creating a series of small to medium sized

4-star plus marinas along the coast of Croatia;

* the development of managed holiday resorts in Croatia which create recurring

revenue and net assets for the Group as well as one-off real-estate development

profits, whereby the directors intend that:

o the hotel, commercial space and common areas are retained by the Company;

o the villas and apartments are sold to customers and then taken back into the

rental pool; and

o an international hotel operator is engaged to manage the entire resort.

DETAILS OF THE ACQUISITIONS

The Company has entered into two separate agreements to acquire two Croatian

companies, DPUP and DPH, both of which have an interest in the Olive Island

Projects. GP Limited is the Vendor of the entire issued share capital of DPUP.

Hans Steinbichler and Milan Kotur are the Vendors of the entire issued share

capital of DPH.

DPUP

The first Acquisition Agreement relates to DPUP which is interested in the

Olive Island Project. The acquisition agreement entered into by the Company to

acquire DPUP provides that in consideration of the Acquisition the Company will

issue, in aggregate, Euro12 million of Loan Notes and 36,904,996 Consideration

Shares to the Covenantors. Completion of the Acquisition of DPUP is conditional

upon, inter alia, the acquisition by the Vendor of 100 per cent of the issued

share capital of DPUP.

The interest of DPUP arises pursuant to a tender bid made to the Municipality

of Preko to acquire 384,370 sqm of development land located on Ugljan Island.

The tender bid was made on 7 October 2005 and DPUP was informed that its tender

was successful on 21 October 2005. The acquisition of the land by DPUP from the

Municipality of Preko has not been completed because of a dispute relating to

the ownership of the land. This dispute arose when the Croatian Forestry

Agency, a Croatian company duly empowered by the Government of Croatia to

manage Croatian forests, took measures which resulted in ownership of the land

being registered with the Croatian Forestry Agency, thereby preventing the

Municipality of Preko from transferring title to the land to DPUP.

The directors of the Company have been advised that the Municipality of Preko

is in the process of arranging for title to the Olive Island Resort Development

Land to be registered in the name of the Municipality of Preko. The

Municipality of Preko has confirmed that it intends to honour the terms of the

successful tender made by DPUP and that it will transfer title to the Olive

Island Resort Development Land to DPUP once title has been obtained by the

Municipality of Preko and subject to payment by DPUP of an amount to be

determined.

The directors of the Company understand that there are a number of approvals

and conditions to be obtained and fulfilled before the Municipality of Preko

obtains title to the Olive Island Resort Development Land. The most significant

of these are as follows:

* the submission of the final version of the detailed urban plan, for adoption,

to the executive of the Municipality;

* presentation of the detailed urban plan for approval to the Ministry of

Construction, Environmental Protection and Area Planning;

* submission of the detailed urban plan to the Council of the Municipality for

the formal enactment thereof;

* submission of the enacted detailed urban plan to the Administrative

Commission which is authorised to return ownership in the Olive Island Resort

development land to the Municipality;

* once the Administrative Commission has reinstated title, to the Olive Island

Resort Development Land, in the Municipality of Preko, the Municipality of

Preko and DPUP will execute a purchase agreement in terms of the tender and

this purchase agreement requires the State Attorney's consent for the transfer

of ownership from the Municipality of Preko to DPUP.

The Directors believe that subject to the necessary approvals and conditions

being obtained and fulfilled in a timely manner, title to the Olive Island

Resort Development Land will be obtained by DPUP in March/April 2008.

In the event that DPUP does not enter into agreements to obtain good title to

or a constituted construction right over the land within nine months of the

date of the Acquisition Agreement, a condition subsequent contained in the

Acquisition Agreement enables the Acquisition to be unwound.

DPH

The second Acquisition Agreement relates to DPH which is interested in the

Olive Island Hotel Project. The Acquisition Agreement entered into by the

Company to acquire DPH provides that in consideration of the Acquisition the

Company will issue, in aggregate, Euro1 million of Loan Notes and 7,028,993

Consideration Shares to the Vendors.

Completion of the Acquisition of DPH is conditional upon, inter alia, the

acquisition by the Vendors of 100 per cent of the issued share capital of DPH.

The interest of DPH in the Olive Island Hotel Project is dependant upon title

to the Olive Island Resort Development Land being acquired by DPUP (as

discussed above). Subject to title to the Olive Island Resort Development Land

being acquired by DPUP, DPH will acquire an interest in the Olive Island Resort

Development Land and develop and operate a hotel and related activities.

END

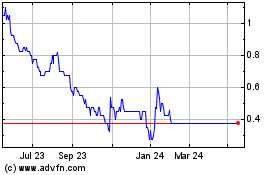

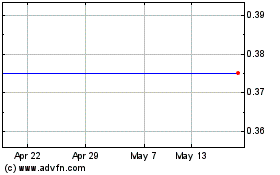

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024