25 June 2007

Cubus Lux plc

Preliminary Results

Cubus Lux plc, the Croatian leisure and tourism company, announces final

results for the 15 months ended 31 March 2007.

Cubus Lux plc currently has completed the construction of, and now has fully

operational the first Plava Vala marina, a 200 plus berth marina in the bay of

Sutomiscica on the island of Ugljan near Zadar. In addition, the group includes

the second largest casino operator in Croatia, Cubus Lux d.o.o. with casinos in

Pula and Rabac.

Highlights in the period:

- Achievement of pre tax profit of �160,000.

- Strengthening of the management team with the appointment of Christian Kaiser

and Steve McCann as Executive Directors and Francisco Alvarez-Molina as a

Non-Executive Director.

- Completion of a world class marina, Olive Island Marina, which is already

being labeled a `destination place'.

- Further successful development of casino junkets business

- The purchase of two plots of land in Zadar for development of top quality

holiday apartments.

Since the year end:

- Entered into two Option Agreements to acquire companies that own development

land on Ugljan where we will build the Olive Island Resort and Hotel. The

development includes 431 Villas and Apartments, a 500 bed 4 plus star Hotel and

a marina. Exercise of these options would be classified as a reverse takeover

under the AIM Rules.

- Placing raised �1,557,000 for working capital and to fund future strategy

- Consolidated casino operations by the transfer of equipment from Medulin

casino to the enlarged and extended Pula casino to take advantage of the new

air routes introduced by the low fare airlines from the UK and Ireland.

Gerhard Huber, Executive Chairman of Cubus Lux, commented:

"Cubus Lux has continued to see much change over the year transforming from a

pure casino business into a leisure and tourism company. The acquisition of

Plava Vala has created a three pillar strategy of casinos, marinas and other

leisure opportunities such as hotels and golf courses and this sets us on our

way to achieving our goal of becoming the pre-eminent tourist and leisure

business in Croatia"

"The Olive Island marina is now fully operational and we are now starting to

focus on exciting new opportunities such as the Olive Island Resort and Hotel."

For further information please contact:

Cubus Lux Plc

Gerhard Huber, Chairman: 07900 683 683

City Financial Associates Limited

Simon Sacerdoti, Corporate Finance: 020 7090 7800

Threadneedle Communications

Graham Herring, Financial PR: 020 7936 9605/07793 839 024

Chairman's statement

I am pleased to submit results for the 15 months ended 31 March 2007.

Operations

Cubus Lux d.o.o. - the gaming company:

Cubus Lux d.o.o. owns a gaming concession in Croatia. During the period, the

company operated three casinos in Pula, Medulin and Rabac. The operations are

inspected and audited regularly by the Croatian Ministry of Finance, and all

inspections to date have been satisfactorily completed. Management is

continuing its objectives of enhancing profitability and, as a result, as of

the end of the period, the company has expanded its Pula operation and closed

the Medulin casino.

The second half of the year is traditionally our stronger one and this year

shows the same trend. August was a record month for the company with more than

12,500 visitors in our casino in Pula. September and October continued strongly

as the new management has attracted a number of junkets.

Plava Vala d.o.o. - the marina company:

The marina in Sutomiscica, near Zadar is thought by some to be a jewel on the

Adriatic coast. The autumn season of the European boat fairs showed a solid

demand for our berths, and we are looking to our first period of operation in

2007 with confidence.

As part of the requirements of IFRS 3, the management asked Brand Finance Plc

to value the marina concession that is owned by Plava Vala d.o.o.. This has

been separately disclosed in note 8 to the financial statements, and the asset

is shown on the balance sheet as an intangible asset acquired as part of the

acquisition of Plava Vala d.o.o..

Recent expansion:

We have purchased two plots of land in Zadar at a cost of Euro5.8 million for the

development of top quality apartments. The first project is a 6 storey mixed

commercial/residential building close to the city centre of Zadar. The second

project is a 5 storey residential building that is in close proximity to the

Borik hotel and resort area and the Borik marina. Each of these developments

will have around 80 units. We believe that demand for these will be strong and

that the developments will be successful.

Financial

For the 15 months ended 31 March 2007, the company is reporting revenues of �

1,017,000 and a profit before tax of �160,000. The trading activity within this

result shows the progress made in the last period in turning around our

operations.

In the second six months of 2006, the Company placed more than 2,000,000 shares

at 13.125p per share in order to finance further expansion. The market received

this well and we were able to place a further 9,570,000 shares in May of this

year at 16.275p to meet current expansion plans.

Our plans for the future

We are in the process of transition from a casino operator into a leisure and

development company in Croatia. As a first step in doing this we have entered

into two option agreements to acquire certain development land known as the

"Olive Island Resort" on the Dalmatian coast of Croatia.

The Olive Island Resort development land is set in 400,000sqm of land along

1.5km of beach, and is intended to be developed into:-

(a) a village resort comprising 431 units, namely 126 villas and 305 apartments

as well as the accompanying facilities such as restaurants, shops, offices and

a marina (the "Villas Development"); and

(b) a 4 star hotel containing 500 beds (the "Hotel Development").

I believe that this potential acquisition could be a milestone event for the

company moving forward with our plan to transform the company from being solely

a casino operator to being a company developing and managing leisure facilities

in Croatia.

GERHARD HUBER

Chairman

Executive Director

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE 15 MONTHS ENDED 31 MARCH 2007

Period ended Year ended 31

31

March 2007 December 2005

Notes �'000 �'000

TURNOVER 1,017 571

Cost of sales (150) (70)

------------- -------------

GROSS PROFIT 867 501

Administrative expenses (1,957) (981)

Other income 1,451 -

------------- -------------

OPERATING PROFIT/(LOSS) 361 (480)

Finance expenditure (201) (17)

------------- -------------

PROFIT/(LOSS) ON ORDINARY

ACTIVITIES BEFORE TAXATION 160 (497)

Tax on loss on ordinary activities 1 (290) -

------------- -------------

LOSS FOR THE PERIOD 2 (130) (497)

====== ======

LOSS PER SHARE

Basic 6 (0.19)p (2.15)p

====== ======

Diluted 6 (0.18)p (2.14p)

====== ======

All activities arose from continuing activities.

CONSOLIDATED BALANCE SHEET

31 March 31 December

2007 2005

Notes �'000 �'000

FIXED ASSETS

Non-current assets

Intangible assets 3 5,372 -

Property, plant and equipment 4 3,315 590

------------- -------------

8,687 590

------------- -------------

CURRENT ASSETS

Stock 41 10

Trade and other receivables 950 301

Cash at bank 5 1,375 431

------------- -------------

2,366 742

------------- -------------

11,053 1,332

====== ======

EQUITY

Capital and reserves attributable to the

Company's

equity shareholders

Called up share capital 881 249

Share premium account 7,239 1,321

Merger reserve 347 347

Profit and loss account (1,565) (1,650)

------------- -------------

TOTAL EQUITY 6,902 267

====== ======

LIABILITIES

Non-current liabilities

Deferred tax liabilities 290 -

Loans 3,138 311

Amounts due under finance leases 7 14

------------- -------------

3,435 325

====== ======

Current liabilities

Trade and other payables and deferred 589 464

income

Loans 122 271

Amounts due under finance leases 5 5

------------- -------------

716 740

====== ======

TOTAL LIABILITIES 4,151 1,065

====== ======

TOTAL EQUITY AND LIABILITIES 11,053 1,332

====== ======

PARENT COMPANY BALANCE SHEET

31 March 31 December

2007 2005

Notes �'000 �'000

FIXED ASSETS

Non-current assets

Investments 3,819 319

CURRENT ASSETS

Trade and other receivables 2,919 703

Cash at bank 5 616 15

------------- -------------

3,535 718

------------- -------------

7,354 1,037

====== ======

EQUITY

Capital and reserves attributable to the

Company's

equity shareholders

Called up share capital 881 249

Share premium account 7,239 1,321

Profit and loss account (920) (616)

------------- -------------

TOTAL EQUITY 7,200 954

====== ======

LIABILITIES

Current liabilities

Trade and other payables 154 83

------------- -------------

TOTAL LIABILITIES 154 83

====== ======

TOTAL EQUITY AND LIABILITIES 7,354 1,037

====== ======

CONSOLIDATED CASH FLOW STATEMENT

Period ended Year ended 31

31

March 2007 December 2005

�'000 �'000

Cash flows from operating activities

Operating profit/(loss) 361 (480)

Profit/(loss) on disposal of fixed assets 45 (4)

Share based payments 178 -

Depreciation 148 113

Negative goodwill written back to profit and loss (1,451) -

account

(Increase) in debtors (559) (247)

(Increase) in stock (31) (4)

Increase in creditors 14 111

------------- -------------

Net cash used in operating activities (1,295) (511)

------------- -------------

Cash flows from investing activities

Interest payable (256) (18)

Interest receivable 55 1

Purchase of fixed assets (2,472) (120)

Proceeds from the sale of fixed assets - 15

Cash acquired with subsidiary 114 -

------------- -------------

Net cash used in investing activities (2,559) (122)

------------- -------------

Cash flows from financing activities

Issue of shares (net of issue costs) 3,050 246

Capital element of finance lease repaid (5) -

New loans undertaken less repayments 1,690 453

------------- -------------

Net cash generated from financing activities 4,735 699

------------- -------------

INCREASE IN CASH IN THE PERIOD 881 66

====== ======

RECONCILIATION OF NET CASH FLOW TO NET DEBT

Period ended Year ended 31

31

March 2007 December 2005

�'000 �'000

Increase in cash in the period 881 66

Exchange differences 63 (20)

Cash inflow from movement in debt (1,690) (448)

Capital element of finance leases repaid 5 -

Debt acquired on acquisition of subsidiary (988) -

------------- -------------

Movement in net funds in the period (1,729) (402)

Net (debt)/funds at beginning of period (170) 232

------------- -------------

Net debt at end of period (1,899) (170)

====== ======

ANALYSIS OF CHANGES IN NET DEBT

At 1 January Cash Other Exchange At 31 March

2006 movements

flows differences 2007

�'000 �'000 �'000 �'000 �'000

Cash at bank and in 431 881 - 63 1,375

hand

------------ ------------ ------------ ------------ ------------

431 881 - 63 1,375

Debt due in less than

one period

Finance leases (5) (1) - - (6)

Loans (271) (149) - - (122)

------------ ------------ ------------ ------------ ------------

155 1,029 - 63 1,247

Debt due in more than

one year

Finance leases (14) 6 - - (8)

Loans (311) (1,839) (988) - (3,138)

------------ ------------ ------------ ------------ ------------

(170) (804) (988) 63 (1,899)

====== ====== ====== ====== ======

RECONCILIATION OF MOVEMENTS IN GROUP SHAREHOLDERS' FUNDS

Period ended 31 Year ended 31

March 2007 December 2005

�'000 �'000

Loss for the period (130) (497)

--------------- ---------------

(130) (497)

Exchange rate differences 37 (20)

Share based payments 178 -

New shares issued in Cubus Lux plc (net of issue 6,550 246

costs)

--------------- ---------------

Net movement in shareholders' funds 6,635 (271)

Opening shareholders' funds 267 538

--------------- ---------------

Closing shareholders' funds 6,902 267

======= =======

NOTES

1. TAXATION

The Company is controlled and managed by its Board in The Republic of Croatia.

Accordingly, the interaction of UK domestic tax rules and the taxation

agreement entered into between the U.K. and The Republic of Croatia operate so

as to treat the Company as solely resident for tax purposes in The Republic of

Croatia. The Company undertakes no business activity in the UK such as might

result in a Permanent Establishment for tax purposes and accordingly has no

liability to UK corporation tax

(a) The taxation charge comprises

Period ended 31 Year ended 31

March 2007 December 2005

�'000 �'000

Current corporation tax for the period - -

Deferred tax 290 -

--------------- ---------------

290

======= =======

(b) Factors affecting tax charge for the period

The tax assessed for the period is different than the standard rate of

corporation tax. The differences are explained below:

Period ended 31 Year ended 31

March 2007 December 2005

�'000 �'000

Profit/(loss) on ordinary activities before 160 (497)

taxation

======== ========

Multiplied by the standard rate of 48 (149)

corporation tax of 30%

Effects of:

Utilisation of tax losses brought forward (48) -

Losses carried forward - 149

------------------ ------------------

Current period tax charge - -

======== ========

(c) Factors affecting future tax charges

The directors believe that the future tax charges will be reduced by the use of

tax losses carried forward in Croatia.

2. PROFIT FOR THE FINANCIAL PERIOD

The parent company has taken advantage of section 230 of the Companies Act 1985

and has not included its own profit and loss account in these financial

statements. The group profit for the period includes a loss after taxation of �

482,000 (2005: loss �283,000) which is dealt with in the financial statements

of the company.

3. INTANGIBLE FIXED ASSETS

Marina licence

�'000

Cost or valuation

At 1 January 2006 -

Acquired on acquisition 5,372

------------------

At 31 March 2007 5,372

========

On 6 March 2006, the company purchased the entire issued share capital of Plava

Vala d.o.o., a company registered in Croatia for a consideration of 35,000,000

ordinary shares of �0.01 each valued at �0.10 each. At this date. the fair

value of Plava Vala d.o.o.'s assets was �3,921,000 creating negative goodwill

of �1,451,000 which, in accordance with IFRSs, has been credited to the profit

in the period. A deferred tax liability of �290,000 against this profit has

been provided for. In adopting IFRSs, the company obtained an external

valuation by Brand Finance Plc of the marina licences acquired with Plava Vala

d.o.o. which were valued at �5,372,000 and are included in the above net asset

figure.

4. TANGIBLE FIXED ASSETS

Casino Marina Casino assets Marina Total

leasehold leasehold assets

premises premises

�'000 �'000 �'000 �'000 �'000

Cost or valuation

At 1 January 2006 51 - 801 - 852

Additions 7 2,103 217 145 2,472

Acquired on acquisition - 472 - 3 475

Disposals - (26) (24) - (50)

Exchange rate movements 1 (33) 8 (2) (26)

------------ -------------- --------------- ------------ ----------------

At 31 March 2007 59 2,516 1,002 146 3,723

------------- -------------- --------------- ------------ ---------------

Depreciation

At 1 January 2006 16 - 246 - 262

Acquired on acquisition - - - 1 1

Charge for the period 19 2 106 21 148

Disposals - - (5) - (5)

Exchange rate movements - - 2 - 2

------------ -------------- -------------- ------------ --------------

At 31 March 2007 35 2 349 22 408

------------- -------------- -------------- ------------ --------------

Net Book Value

At 31 March 2007 24 2,514 653 124 3,315

====== ======= ======= ======= =======

At 31 December 2005 35 - 555 - 590

====== ======= ======= ======= =======

5. CASH AT BANK

Group Company Group Company

31 March 31 March 31 December 31 December

2007 2007 2005 2005

�'000 �'000 �'000 �'000

Cash at bank 1,375 616 431 15

======= ======= ======= =======

Included within the cash at bank and in hand at 31 March 2007 is �221,000

(2005: �221,000) which is held by the Croatian Ministry of Finance as a bond to

cover any large casinos wins. Cubus Lux d.o.o. is required to keep this bond in

place in order to maintain its gaming licence.

Cubus Lux d.o.o. is also required by law to maintain cash on site of Euro50,000

and HRK 150,000 at each casino, which is included within the above.

6. LOSS PER SHARE

The loss per share of 0.19p (31 December 2005: loss 2.15p) has been calculated

on the weighted average number of shares in issue during the period namely

68,681,402 (31 December 2005: 23,120,334) and losses of �130,013 (31 December

2005: losses �496,852).

The calculation of diluted losses per share of 0.18p (31 December 2005: loss

2.14p) is based on the losses on ordinary activities after taxation and the

diluted weighted average of 73,896,786 (31 December 2005: 23,190,334) shares.

7. FINANCIAL INFORMATION

The financial information set out in this announcement does not constitute the

Group's statutory accounts within the meaning of Section 240 of the Companies

Act 1985 and has been extracted from the full accounts for the 15 months ended

31 March 2007.

The full report and accounts for the 15 months ended 31 March 2007 have been

sent to shareholders, and a copy will be delivered to the Registrar of

Companies in due course. The auditors' report on the financial statements was

unqualified and did not include a statement under section 237(2) or (3) of the

Companies Act 1985.

The annual report and accounts will be available on the Company's website at

www.cubuslux.com

END

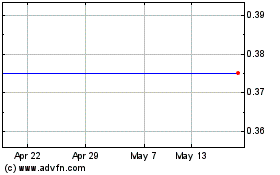

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

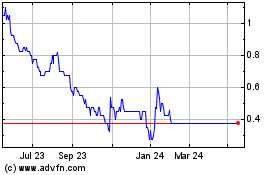

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024