Option Agreement

March 13 2007 - 6:18AM

UK Regulatory

RNS Number:8309S

Cubus Lux plc

13 March 2007

CUBUS LUX PLC

"Cubus Lux" or "the Company"

Option to acquire G&P Limited

Option to acquire Duboko Plavetnilo Hoteli d.o.o.

On 12 March 2007 Cubus Lux, the Croatian leisure and tourism company, entered

into two option agreements to acquire certain development land known as the

"Olive Island Resort" on the coast of Dalmatia in Croatia.

The Olive Island Resort development land is set in 400,000sqm of land along

1.5km of beach, and is intended to be developed into:-

(a) a village resort comprising 431 units, namely 126 villas and 305 apartments

as well as the accompanying facilities such as restaurants, shops, offices

and a marina (the "Villas Development"); and

(b) a 4 star hotel containing 500 beds (the "Hotel Development").

Highlights

* Option to acquire Villas Development for Euro10 million in cash and the issue

of 33m ordinary shares in the Company, which may be satisfied at the option

of the Company by the issue of ordinary shares credited as fully paid

* Option to acquire Hotel Development for Euro5 million in ordinary shares of

the Company

* Villas Development and Hotel Development valued at Euro39m and Euro5m

respectively*

* Independent valuation of both operations by UK based surveyors Kings Sturge.

Options subject to a number of conditions including the grant of the necessary

planning permissions.

Haggai Ravid, Director of Cubus Lux, commented:

"This is an extremely exciting opportunity for Cubus Lux which represents a

significant evolution in our operations. The Olive Island Resort is an idyllic

stretch of land and the resort has already attracted widespread interest. The

Villas and the Hotel are fully synergetic. Pre sales figures have been very

encouraging with units having already been acquired by people across Europe and

in the US. In the event that Cubus Lux decides to exercise the Options, we hope

that these investments will prove to be lucrative for Cubus Lux."

The option agreement in respect of the Villas Development has been entered into

between the Company and the shareholders of G&P Limited, a company registered in

the British Virgin Islands. This option agreement provides that the Company may

exercise an option to acquire the Villas Development within 4 months from the

date of the option agreement. Completion of the acquisition of the Villas

Development is to proceed as soon as reasonably practicable following the

exercise of the option, subject to agreement of the terms of the relevant

acquisition agreement. Upon completion of the acquisition of the Villas

Development, the Company is obliged to pay Euro10 million in cash and to issue 33m

ordinary shares in the Company credited as fully paid.

The option agreement in respect of the Hotel Development has been entered into

between the Company and the shareholders of Duboko Plavetnilo Hoteli doo, a

Croatian company. This option agreement provides that the Company may exercise

an option to acquire the Hotel Development within 4 months from the date of the

option agreement. Completion of the acquisition of the Hotel Development is to

proceed as soon as reasonably practicable following the exercise of the option,

subject to agreement of the terms of the relevant acquisition agreement. Upon

completion of the acquisition of the Hotel Development, the Company is obliged

to pay Euro5 million, which may be satisfied at the option of the Company by the

issue of ordinary shares in the Company at a fixed price of 50 pence per share

(the "Consideration Shares"). The Option Agreement provides a formula for the

issue of warrants over additional ordinary shares exercisable at nominal value

in the event that the market value of the Company's ordinary shares is less than

50 pence per share on both the date of exercise of the option and on the date of

the issue of the Consideration Shares. This warrant formula is intended to

compensate the parties granting the Option in the event that the market value of

the Company's shares is less than 50 pence at the relevant time.

Both option agreements are conditional upon a number of factors, including

completion of due diligence to the Company's satisfaction, the agreement of the

detailed terms of acquisition agreements, and the raising of debt or equity

financing by the Company for at least Euro10 million. In particular, the Company

understands that the parties which have granted the options are in the process

of securing consent from the Croatian government to the develop the relevant

land, and exercise of the options is subject to such consent having been

granted.

In the event that the Company proceeds with the acquisition of the Villas

Development and the Hotel Development, then the transaction is expected to

constitute a reverse takeover for the purposes of the AIM Rules, and will

therefore require the issue of an admission document and shareholder approval.

In addition, the transaction would be considered to be a related party

transaction for the purposes of the AIM Rules, due to the connection between

Gerhard Huber and the counterparties to the option agreements.

The Company understands that the Villas Development and Hotel Development are

due for completion in 2010, subject to obtaining the relevant Croatian planning

permissions. The Company also understands that 87 of the 431 units contained

within the Villas Development have been pre-sold.

In an independent valuation of both operations by UK based surveyors Kings

Sturge, the Villas Development and the Hotel Development are estimated at Euro39m

and Euro5m respectively, subject to a number of conditions including the grant of

the necessary planning permissions.

- ends -

For further information please contact:

Cubus Lux Plc

Haggai Ravid +972 (544) 565 682

Corporate Synergy

Oliver Cairns/Romil Patel 020 7448 4400

Threadneedle Communications

Graham Herring/Josh Royston 020 7936 9605

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGREAEDDFFSXEFE

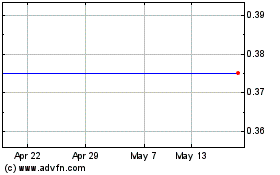

Cellular Goods (LSE:CBX)

Historical Stock Chart

From May 2024 to Jun 2024

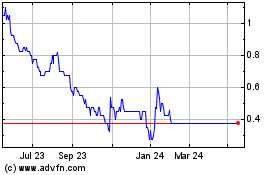

Cellular Goods (LSE:CBX)

Historical Stock Chart

From Jun 2023 to Jun 2024