TIDMBSRT

RNS Number : 9128R

Baker Steel Resources Trust Ltd

31 August 2010

BAKER STEEL RESOURCES TRUST LIMITED

HALF YEARLY MANAGEMENT REPORT AND UNAUDITED INTERIM

CONDENSED FINANCIAL STATEMENTS

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

31 August 2010

Baker Steel Resources Trust Limited ("BSRT" or the "Company"), the closed-ended

investment company managed by Baker Steel Capital Managers LLP (the "Investment

Manager") and established to invest in natural resources companies, presents its

unaudited interim financial results for period from 9 March 2010 (date of

incorporation) to 30 June 2010.

HIGHLIGHTS

Company

· Raised GBP30.5 million via placing and open offer

· 62.6% invested at 30 June 2010

· Listing on London Stock Exchange 28 April 2010

· NAV 95.5p (GBP0.955) per share at 30 June 2010

· Acquisition of majority of non-cash assets of Genus Capital Fund

Investments

· All cash offer for Copperbelt Minerals Limited

· Postponement of listing of Ferrous Resources Limited

Further enquiries:

Baker Steel Resources Trust Limited

enquiries@bakersteelresourcestrust.com

Francis Johnstone

+44 (0)20 7389 8237

Trevor Steel

RBC Capital Markets, Broker

Martin Eales

+44 (0)20 7653 4000

Winterfloods Investment Trusts, Broker

James Moseley

+44 (0)20 3100 0250

Robert Peel

+44 (0)20 3100 0291

HSBC Securities Services (Guernsey) Limited, Administrator

Tel:

+44 (0) 1481 707 000

Pelham Bell Pottinger, Media Adviser

Damian Beeley

+44 (0) 20 7861 3139

Charles Vivian

+44 (0) 20 7337 1538

End

Notes to Editors

The Company is a closed-ended investment company with limited liability

incorporated on 9 March 2010 in Guernsey under The Companies (Guernsey) Law 2008

with registration number 51576.

www.bakersteelresourcestrust.com.

Directors' Statement to the Shareholders of Baker Steel Resources Trust Limited

The Board is pleased to present the Company's first Half-Yearly Financial Report

since listing on the London Stock Exchange on 28 April 2010.

This Chairman's Statement has been produced solely to provide additional

information to Shareholders as a body, as required by the UK Listing Authority's

Disclosure and Transparency Rules. It should not be relied upon by Shareholders

or any other party for any other purpose.

This Chairman's Statement relates to the period from the date of formation of

the Company to 30 June 2010 and contains information that covers this period and

up to the date of publication of this Half-Yearly Report. Please note that more

up to date performance information, including the monthly report for the period

ending 31 July 2010, is available on the Company's website

www.bakersteelresourcestrust.com.

The objective of the Company is to seek capital growth over the long term by

investing through a focused global portfolio consisting principally of the

equities, or related instruments, of natural resources companies. These

investments will be predominantly in private companies with strong development

projects and focused management, but also in listed securities to exploit value

inherent in market inefficiencies.

Financial Performance

The unaudited net asset value ("NAV") per Ordinary Share as at 30 June 2010 was

95.5p per share, down 2.5% from the Company's first NAV calculated on 30 April

2010. During this period the HSBC World Mining Index was down approximately 15%.

For the purpose of calculating the NAV per share, unquoted investments are

carried at fair value as at 30 June 2010 as determined by the Directors and

quoted investments are carried at last traded price as at 30 June 2010.

Net assets at 30 June 2010 comprised the following:

GBPm % net

assets

Unquoted Investments 39.1

62.0

Quoted Investments 0.4

0.6

Net Current Assets 23.6

37.4

------

------

63.1

100.0

Issue of Shares

The Company was admitted to trading on the London Stock Exchange on 28 April

2010. On that date, 30,468,865 Ordinary Shares and 6,093,772 Subscription Shares

were issued pursuant to a placing and offer for subscription and 35,554,224

Ordinary Shares and 7,110,822 Subscription Shares were issued pursuant to a

scheme of reorganisation of Genus Capital Fund.

In addition 10,000 Management Ordinary Shares were issued. On 9 March 2010, 1

Management Ordinary Share was issued and on 26 March 2010, 9,999 Management

Ordinary Shares were issued.

No further Ordinary Shares or Subscription Shares have been issued since that

time and as a result, the Company has 66,033,089 Ordinary Shares and 13,204,594

Subscription Shares in issue.

Going Concern

The Directors have made an assessment of the Company's ability to continue as a

going concern and are satisfied that it has the resources to continue in

business for the foreseeable future. Furthermore, the Directors are not aware of

any material uncertainties that may cast significant doubt upon the Company's

ability to continue as a going concern. Therefore, the financial statements have

been prepared on a going concern basis.

3

Related Party Transactions

Transactions with related parties are based on terms equivalent to those that

prevail in an arm's length transaction. The following transactions with related

parties took place for the period ended 30 June 2010.

On 30 March 2010 the Company agreed to acquire the majority of the non- cash

assets of Genus Capital Fund as set out in the Prospectus issued by the Company

dated 31 March 2010. Charles Hansard and Edward Flood were also directors of

Genus Capital Fund and so had an actual or potential conflict of interest.

Edward Flood and Charles Hansard resigned from Genus Capital Fund's Board of

Directors on 12 July 2010 and on 26 July 2010 respectively.

Directors' Interests

The Directors' interests in the share capital of the Company at 30 June 2010

were as follows:

+-------------+----------+--------------+

| | Number | Number |

| | of | of |

| | Ordinary | Subscription |

| | Shares | Shares |

+-------------+----------+--------------+

| Edward | 65,000 | 13,000 |

| Flood | | |

+-------------+----------+--------------+

| Christopher | 25,000 | 5,000 |

| Sherwell | | |

+-------------+----------+--------------+

| Clive | 25,000 | 5,000 |

| Newall | | |

+-------------+----------+--------------+

Howard Myles

Chairman

31 August 2010

4

BAKER STEEL RESOURCES TRUST LIMITED

INVESTMENT MANAGER'S REPORT

For the period from 9 March 2010 (date of incorporation) to 30 June 2010

Investment Update

Largest Investments

+-------------------------------------+------------+

| | % of NAV |

+-------------------------------------+------------+

| Ferrous Resources Limited | 19.5% |

+-------------------------------------+------------+

| Ivanhoe Nickel and Platinum Limited | 18.1% |

| | |

+-------------------------------------+------------+

| Gobi Coal & Energy Limited | 11.0% |

+-------------------------------------+------------+

| Copperbelt Minerals Limited | 5.7% |

+-------------------------------------+------------+

| First Coal Corporation | 3.5% |

+-------------------------------------+------------+

| Other Investments | 4.8% |

+-------------------------------------+------------+

Events of note occurred with two of the Company's portfolio companies during the

period. Ferrous Resources announced its decision to float on the London Stock

Exchange, which might have seen it enter the FTSE 100 Index. However, due to

"volatile markets" the listing was postponed and the Investment Manager is

engaging with Ferrous management to ascertain their plans for the company.

Following postponement of the IPO, it was decided that it would be appropriate

to reduce the carrying value from US$3.50 per share to US$3.00 per share, which

had a 3% negative effect on NAV.

Copperbelt Minerals has agreed an all cash offer from a consortium of Chinese

investors, valuing the company at US$26.50 per share compared with the carrying

value of US$20/share at 30 June 2010. This is awaiting approval by the Congolese

government. The date to conclude the offer has been extended to 31 August 2010.

Outlook

The market environment which saw the postponement of the Ferrous float has also

meant that other companies have struggled to float or raise equity. This has

provided a number of new opportunities for the Company and the Investment

Manager is evaluating potential investments in gold, silver and coal mining

companies. Additional precious metals mining exposure would be welcome to

balance Baker Steel Resources Trust's commodity exposure.

Principal Risks and Uncertainties

The principal risks facing the Company relate to the Company's investment

activities. These risks are mainly market risk (comprising currency risk,

commodity price risk and other price risks), liquidity risk, mining development

risk, licensing risk, and emerging market risk. The Ordinary Shares are also

subject to discount risk. An explanation of these risks is contained in the

Company's prospectus dated 31 March 2010, available on the Company's website

www.bakersteelresourcestrust.com.

The principal risks and uncertainties set out above have not significantly

changed since the publication of the Company's prospectus and are not

anticipated to change for the remainder of 2010.

Baker Steel Capital Managers LLP

August 2010

5

BAKER STEEL RESOURCES TRUST LIMITED

DIRECTORS' RESPONSIBILITY STATEMENT

For the period from 9 March 2010 (date of incorporation) to 30 June 2010

To the best of the knowledge of the Directors:

The Chairman's Statement and the Investment Manager's Report comprise the

Half-Yearly Management Report.

This Half-Yearly Management Report and CondensedInterim Financial Statements

give a true and fair view of the assets, liabilities, financial position and

profit or loss of the Company and have been prepared in accordance with

International Accounting Standard (IAS) 34 Interim Financial Reporting.

The Half-Yearly Management Report includes a fair review of the information

required by:

(a) DTR 4.2.7 of the Disclosure and Transparency Rules, being an indication of

important events that have occurred in the period from 9 March 2010 (date of

incorporation) to 30 June 2010 and their impact on the set of financial

statements; and a description of the principal risks and uncertainties for the

remainder of the year; and

(b) DTR 4.2.8 of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the period from 9 March 2010 (date of

incorporation) to 30 June 2010 and that have materially affected the financial

position or performance of the entity during that period.

Signed on behalf of the Board of Directors by:

Howard Myles

Christopher Sherwell

31 August 2010

6

BAKER STEEL RESOURCES TRUST LIMITED

UNAUDITED PORTFOLIO STATEMENT

AT 30 JUNE 2010

+-----------+----------------------------------------------+------------+--------+

| Shares | Investments | Fair | % of |

| | | value | Net |

+-----------+----------------------------------------------+------------+--------+

| /Warrants | | GBP | assets |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Listed equity shares | | |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Canadian Dollars | | |

+-----------+----------------------------------------------+------------+--------+

| 358,333 | MBAC Fertilizer Corporation | 374,538 | 0.59 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Total investments in listed equity shares | 374,538 | 0.59 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Unlisted equity shares and warrants | | |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Canadian Dollars | | |

+-----------+----------------------------------------------+------------+--------+

| 500 | BacTech Mining | 314,826 | 0.50 |

+-----------+----------------------------------------------+------------+--------+

| 2,571,429 | First Coal Corporation | 2,218,173 | 3.52 |

+-----------+----------------------------------------------+------------+--------+

| | | 2,532,999 | 4.02 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Great Britain Pounds | | |

+-----------+----------------------------------------------+------------+--------+

| 1,594,646 | Celadon Mining | 297,720 | 0.47 |

+-----------+----------------------------------------------+------------+--------+

| | | 297,720 | 0.47 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | United States Dollars | | |

+-----------+----------------------------------------------+------------+--------+

| 268,889 | Copperbelt Minerals | 3,592,852 | 5.70 |

+-----------+----------------------------------------------+------------+--------+

| 6,123,642 | Ferrous Resources | 12,273,467 | 19.46 |

+-----------+----------------------------------------------+------------+--------+

| 5,169,550 | Gobi Coal and Energy | 6,907,469 | 10.95 |

+-----------+----------------------------------------------+------------+--------+

| 500,000 | Ivanhoe Nickel and Platinum | 2,922,902 | 4.63 |

+-----------+----------------------------------------------+------------+--------+

| 791,666 | Ivanhoe Nickel Platinum warrants 1 for 1.2 | 5,553,510 | 8.80 |

| | ordinary | | |

+-----------+----------------------------------------------+------------+--------+

| 507,500 | Ivanhoe Nickel Platinum warrants 1 for 1 | 2,966,746 | 4.70 |

| | ordinary | | |

+-----------+----------------------------------------------+------------+--------+

| 6,500,000 | South American Ferro Metals | 2,051,877 | 3.25 |

+-----------+----------------------------------------------+------------+--------+

| | | 36,268,823 | 57.49 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Total investment in unlisted equity shares | 39,099,542 | 61.98 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Financial assets held at fair value through | 39,474,080 | 62.57 |

| | profit or loss | | |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Other assets and liabilities | 23,613,606 | 37.43 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

| | Total Equity | 63,087,686 | 100.00 |

+-----------+----------------------------------------------+------------+--------+

| | | | |

+-----------+----------------------------------------------+------------+--------+

7

BAKER STEEL RESOURCES TRUST LIMITED

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2010

+------------------------------------------------------+-------+-------------+

| | | Unaudited |

| | | 30 June |

| | | 2010 |

+------------------------------------------------------+-------+-------------+

| |Notes | GBP |

+------------------------------------------------------+-------+-------------+

| Assets | | |

+------------------------------------------------------+-------+-------------+

| Cash and cash equivalents | 8 | 26,113,077 |

+------------------------------------------------------+-------+-------------+

| Financial assets held at fair value through profit | 3 | 39,474,080 |

| or loss (Cost: GBP41,063,333) | | |

+------------------------------------------------------+-------+-------------+

| Other receivables | | 4,415 |

+------------------------------------------------------+-------+-------------+

| Total assets | | 65,591,572 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Liabilities | | |

+------------------------------------------------------+-------+-------------+

| Due to broker | | 2,134,975 |

+------------------------------------------------------+-------+-------------+

| Bank overdraft | 8 | 334 |

+------------------------------------------------------+-------+-------------+

| Management fees payable | 7 | 204,514 |

+------------------------------------------------------+-------+-------------+

| Administration fees payable | 6 | 8,588 |

+------------------------------------------------------+-------+-------------+

| Formation expenses payable | | 105,721 |

+------------------------------------------------------+-------+-------------+

| Directors' fees payable | | 24,867 |

+------------------------------------------------------+-------+-------------+

| Audit fees payable | | 11,429 |

+------------------------------------------------------+-------+-------------+

| Other payables | | 13,458 |

+------------------------------------------------------+-------+-------------+

| Total liabilities | | 2,503,886 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Equity | | |

+------------------------------------------------------+-------+-------------+

| Management Ordinary Shares | 9 | 10,000 |

+------------------------------------------------------+-------+-------------+

| Ordinary Shares | 9 | 64,641,914 |

+------------------------------------------------------+-------+-------------+

| Total deficit | | (1,564,228) |

+------------------------------------------------------+-------+-------------+

| Total equity | | 63,087,686 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Total equity and liabilities | | 65,591,572 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Ordinary Shares in issue | | 66,033,089 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Net asset value per Ordinary Share (in Pence) - | 4 | 95.5 |

| Basic & Diluted | | |

+------------------------------------------------------+-------+-------------+

The accompanying notes form an integral part of these condensed interim

financial statements

8

BAKER STEEL RESOURCES TRUST LIMITED

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

+------------------------------------+-------+-----------+-------------+-------------+

| | | Unaudited | Unaudited | Unaudited |

| | | period | period | period |

| | | ended | ended | ended |

| | | 30 June | 30 June | 30 June |

| | | 2010 | 2010 | 2010 |

+------------------------------------+-------+-----------+-------------+-------------+

| | | Revenue | Capital | Total |

+------------------------------------+-------+-----------+-------------+-------------+

| |Notes | GBP | GBP | GBP |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Income | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Net loss on financial assets and | 3 | - | (1,589,253) | (1,589,253) |

| liabilities at fair value through | | | | |

| profit or loss | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Net foreign exchange gain | | - | 460,613 | 460,613 |

+------------------------------------+-------+-----------+-------------+-------------+

| Net income | | - | (1,128,640) | (1,128,640) |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Expenses | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Formation expenses | | 152,870 | - | 152,870 |

+------------------------------------+-------+-----------+-------------+-------------+

| Management fees | 7 | 204,514 | - | 204,514 |

+------------------------------------+-------+-----------+-------------+-------------+

| Directors' fees and expenses | | 25,414 | - | 25,414 |

+------------------------------------+-------+-----------+-------------+-------------+

| Administration fees | 6 | 21,600 | - | 21,600 |

+------------------------------------+-------+-----------+-------------+-------------+

| Audit fees | | 11,429 | - | 11,429 |

+------------------------------------+-------+-----------+-------------+-------------+

| Custody fees | | 7,331 | - | 7,331 |

+------------------------------------+-------+-----------+-------------+-------------+

| Other expenses | | 12,430 | - | 12,430 |

+------------------------------------+-------+-----------+-------------+-------------+

| Total expenses | | 435,588 | - | 435,588 |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Total comprehensive income for the | | (435,588) | (1,128,640) | (1,564,228) |

| period | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Net loss for the period per | | | | |

| Ordinary Share: | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Basic (in pence) | 4 | (0.66) | (1.71) | (2.37) |

+------------------------------------+-------+-----------+-------------+-------------+

| Diluted (in pence) | 4 | (0.65) | (1.71) | (2.36) |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Weighted Average Number of | | | | |

| Ordinary Shares Outstanding: | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

| Basic | 4 | | | 66,033,089 |

+------------------------------------+-------+-----------+-------------+-------------+

| Diluted | 4 | | | 66,194,820 |

+------------------------------------+-------+-----------+-------------+-------------+

| | | | | |

+------------------------------------+-------+-----------+-------------+-------------+

+-------------+

| In the |

| current |

| period |

| there |

| were no |

| gains |

| or |

| losses |

| other |

| than |

| those |

| recognised |

| above. |

+-------------+

| |

+-------------+

| The |

| Directors |

| consider |

| all |

| results |

| to derive |

| from |

| continuing |

| activities. |

+-------------+

The accompanying notes form an integral part of these condensed interim

financial statements

9

BAKER STEEL RESOURCES TRUST LIMITED

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

+--------------------------+------------+-------------+-------------+-------------+

| | Management | | | Period |

| | Ordinary | Ordinary | Total | ended |

| | Shares | | deficit | 30 June |

| | | Shares | | 2010 |

+--------------------------+------------+-------------+-------------+-------------+

| | GBP | GBP | GBP | GBP |

+--------------------------+------------+-------------+-------------+-------------+

| | | | | |

+--------------------------+------------+-------------+-------------+-------------+

| Balance at 9 March 2010 | - | - | - | - |

+--------------------------+------------+-------------+-------------+-------------+

| Proceeds on issue of | 10,000 | 66,023,089 | - | 66,033,089 |

| Ordinary Shares | | | | |

+--------------------------+------------+-------------+-------------+-------------+

| Share issue costs | - | (1,381,175) | - | (1,381,175) |

+--------------------------+------------+-------------+-------------+-------------+

| Net loss for the period | - | - | (1,564,228) | (1,564,228) |

+--------------------------+------------+-------------+-------------+-------------+

| | | | | |

+--------------------------+------------+-------------+-------------+-------------+

| Balance as at 30 June | 10,000 | 64,641,914 | (1,564,228) | 63,087,686 |

| 2010 | | | | |

+--------------------------+------------+-------------+-------------+-------------+

| | | | | |

+--------------------------+------------+-------------+-------------+-------------+

The accompanying notes form an integral part of these condensed interim

financial statements

10

BAKER STEEL RESOURCES TRUST LIMITED

CONDENSED INTERIM STATEMENT OF CASH FLOWS

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

+------------------------------------------------------+-------+-------------+

| | | Period |

| | | ended |

| | | 30 June |

| | | 2010 |

+------------------------------------------------------+-------+-------------+

| |Notes | GBP |

+------------------------------------------------------+-------+-------------+

| Cash flows from operating activities | | |

+------------------------------------------------------+-------+-------------+

| Net loss for the period | | (1,564,228) |

+------------------------------------------------------+-------+-------------+

| Adjustments to reconcile loss for the period to net | | |

| cash used in operating activities: | | |

+------------------------------------------------------+-------+-------------+

| Net change in fair value of financial assets and at | | 1,589,253 |

| fair value through profit or loss | | |

+------------------------------------------------------+-------+-------------+

| Net increase in other receivables | | (4,415) |

+------------------------------------------------------+-------+-------------+

| Net increase in other payables | | 368,577 |

+------------------------------------------------------+-------+-------------+

| Net cash provided by operating activities | | 389,187 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Cash flows from investing activities | | |

+------------------------------------------------------+-------+-------------+

| Purchase of financial assets of financial assets at | | (3,364,134) |

| fair value through profit or loss | | |

+------------------------------------------------------+-------+-------------+

| Net cash used in investing activities | | (3,364,134) |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Cash flows from financing activities | | |

+------------------------------------------------------+-------+-------------+

| Proceeds from shares issued | 9 | 30,468,865 |

+------------------------------------------------------+-------+-------------+

| Share issue costs | | (1,381,175) |

+------------------------------------------------------+-------+-------------+

| Net cash provided from financing activities | | 29,087,690 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Net increase in cash and cash equivalents | | 26,112,743 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Cash and cash equivalents at the beginning of the | | - |

| period | | |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

| Cash and cash equivalents at the end of the period | 8 | 26,112,743 |

+------------------------------------------------------+-------+-------------+

| | | |

+------------------------------------------------------+-------+-------------+

+------------------------------------------------------+------+------------+

| Represented by: | | |

+------------------------------------------------------+------+------------+

| Cash and cash equivalents | | 26,113,077 |

+------------------------------------------------------+------+------------+

| Bank overdraft | | (334) |

+------------------------------------------------------+------+------------+

| Cash and cash equivalents at the end of the period | 8 | 26,112,743 |

+------------------------------------------------------+------+------------+

| | | |

+------------------------------------------------------+------+------------+

The accompanying notes form an integral part of these condensed interim

financial statements

11

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

1. GENERAL INFORMATION

Baker Steel Resources Trust Limited (the "Company") is a closed-ended investment

company with limited liability incorporated on 9 March 2010 in Guernsey under

The Companies (Guernsey) Law 2008 with registration number 51576. The Company is

a Registered closed-ended investment scheme registered pursuant to the POI Law

and the Collective Investment Scheme Rules 2008 issued by the Guernsey Financial

Services Commission (GFSC). On 28 April 2010 the Ordinary Shares and

Subscription Shares of the Company were admitted to the Official List of the UK

Listing Authority and to trading on the Main Market of the London Stock

Exchange.

The Company is managed by Baker Steel Capital Managers (Cayman) Limited (the

"Manager"). The Manager has appointed Baker Steel Capital Managers LLP (the

"Investment Manager") as the investment manager to carry out certain duties. The

Company's investment objective is to seek capital growth over the long-term

through a focused, global portfolio consisting principally of the equities, or

related instruments, of natural resources companies. The Company invests

predominantly in unlisted companies (i.e. those companies that have not yet made

an initial public offering or "IPO") and also in listed securities (including

special situations opportunities and less liquid securities) with a view to

exploiting value inherent in market inefficiencies and pricing anomalies.

These condensed interim financial statements have not been audited or reviewed

by the auditors pursuant to the Auditing Practices Board Guidance on the Review

of the interim financial information performed by the independent auditor of the

Company.

2. SIGNIFICANT ACCOUNTING POLICIES

a) Basis of preparation

The unaudited condensed interim financial statements of the Company have been

prepared in accordance with International Accounting Standards (IAS) 34: Interim

Financial Reporting.

The financial statements have been prepared on a historic cost basis except for

financial assets and financial liabilities at fair value through profit or loss,

which are designated at fair value through profit or loss.

The Company has adopted the United Kingdom pound sterling ("GBP") as its

presentation currency, being the currency in which its Ordinary Shares and

Subscription Shares are issued. The presentation currency is the same as the

functional currency.

The statement of comprehensive income is presented in accordance with the

Statement of Recommended Practice 'Financial Statements of Investment Trust

Companies and Venture Capital Trusts' issued in January 2009 by the Association

of Investment Companies, to the extent that it does not conflict with

International Financial Reporting Standards (IFRS).

Significant accounting judgements and estimates

The preparation of the Company's financial statements requires Directors to make

judgements, estimates and assumptions that affect the amounts recognised in the

financial statements. However, uncertainty about these assumptions and estimates

could result in outcomes that could require a material adjustment to the

carrying amount of the asset or liability affected in the future. The most

significant judgement relates to the valuation of the Company's unlisted

investments.

b) Financial assets and liabilities at fair value through profit or loss

The Company designates its investments other than derivatives at fair value

through profit or loss, at initial recognition. All derivatives are classified

as held for trading and included in financial assets at fair value through

profit or loss.

Recognition and derecognition

The Company recognises financial assets and financial liabilities on the date it

becomes a party to the contractual provisions of the instruments. Routine

purchases and sales of investments are accounted for on the trade date.

Financial assets and financial liabilities at fair value through profit or loss

are initially recognised at fair value. Transaction costs are expensed in the

Statement of Comprehensive Income. Subsequent to initial recognition, all

financial assets and financial liabilities at fair value through profit or loss

are measured at fair value. Gains and losses arising from changes in the fair

value of the 'financial assets or financial liabilities at fair value through

profit or loss' are recognised in the Statement of Comprehensive Income in the

period in which they arise.

12

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

2.SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

b) Financial assets and liabilities at fair value through profit or loss

(continued)

Recognition and derecognition (continued)

A financial asset is derecognised when the Company no longer has control over

the contractual rights that comprise that asset. This occurs when the rights are

realised, expired or are surrendered. A financial liability is derecognised when

it is extinguished or when the obligation specified in the contract is

discharged, cancelled or expired.

Determination of fair value

Fair value is the amount for which an asset could be exchanged, or a liability

settled, between knowledgeable, willing parties in an arm's length transaction.

The fair value for financial instruments traded in active markets at the

reporting date is based on their quoted price or binding dealer price quotations

(bid price for long positions and ask price for short positions), without any

deduction for transaction costs.

For all other financial instruments not traded in an active market, the fair

value is determined by using appropriate valuation techniques. Valuation

techniques include: using recent arm's length market transactions; reference to

the current market value of another instrument that is substantially the same;

discounted cash flow analysis and option pricing models making as much use of

available and supportable market data as possible. An analysis of fair values of

financial instruments and further details as to how they are measured are

provided in note 3.

c) Interest income and expense

Bank interest income and interest expense is recognised on an accrual basis

based on the effective interest method.

d) Cash and cash equivalents, margin accounts with brokers and cash

overdrawn

Cash and cash equivalents comprise cash balances held at banks. For cash flow

statement purposes cash and cash equivalents includes bank overdrafts. The bank

overdrafts are repayable on demand and form an integral part of the Company's

cash management.

e) Expenses

All expenses are recognised on an accruals basis.

f) Translation of foreign currencies

Foreign currency transactions during the period are translated into GBP at the

rate of exchange ruling at the dates of the transaction. Assets and liabilities

denominated in foreign currencies are translated into GBP at the rate of

exchange ruling at the Statement of Financial Position date. Exchange

differences are included in the Statement of Comprehensive Income.

g) Segment information

IFRS 8 'Operating Segments' was issued by the IASB in November 2006 and is

effective for annual periods beginning on or after 1 January 2009, with early

application permitted. This standard requires disclosures on the financial

performance of the operating segments of the entity. The Directors are of the

opinion that the Company is engaged in a single segment of business, being

investing in natural resources companies.

h) Net asset value per share

Net Asset Value per share disclosed on the face of the Statement of Financial

Position is calculated in accordance with the Company's Prospectus by dividing

the net assets of the Company on the Statement of Financial Position date by the

number of Ordinary Shares outstanding at that date.

13

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

2.SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

i) New accounting pronouncements not yet effective

The following standards, amendments and interpretations are not effective. No

assessment of the impact on the financial position or performance of the Company

has yet been made:

IFRS 9 Financial Instruments: Classification and Measurement

The IASB issued IFRS 9 Financial Instruments in November 2009 which is effective

for annual periods beginning on or after 1 January 2013 with early adoption

permitted starting in 2009. The issue of this standard represents the completion

of the first part of a three-part project to replace IAS 39 Financial

Instruments: Recognition and Measurement with a new standard-IFRS 9 Financial

Instruments.

IFRIC Interpretation 19 Extinguishing Financial Liabilities and Equity

Instruments

The IFRIC issued IFRIC Interpretation 19 in November 2009. IFRIC 19 provides

guidance on how to account for the extinguishment of a financial liability by

the issue of equity instruments. An entity shall apply this Interpretation for

annual periods beginning on or after 1 July 2010 with earlier application

permitted.

Amendment to IAS 24 Related Party Disclosures

The revised standard was issued in November 2009 and is effective for annual

periods beginning on or after 1 January 2011. The revised standard simplifies

the disclosure requirements for entities that are controlled, jointly controlled

or significantly influenced by a government (referred to as government related

entities) and clarifies the definition of a related party.

Amendments to IFRIC 14 - Prepayments of a Minimum Funding Requirement

The amendment was issued in November 2009 and is effective for annual periods

beginning on or after 1 January 2011 with earlier application permitted. The

amendments correct an unintended consequence of IFRIC 14 IAS 19 - The Limit on a

Defined Benefit Asset, Minimum Funding Requirements and their Interaction.

3. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS

+-------------+-----------+-------------+-----------+-------------+

| 30 | Listed | Unlisted | Warrants | Total |

| June | equity | equity | | |

| 2010 | shares | shares | | |

+-------------+-----------+-------------+-----------+-------------+

| | GBP | GBP | GBP | GBP |

+-------------+-----------+-------------+-----------+-------------+

| Financial | | | | |

| assets at | | | | |

| fair | | | | |

| value | | | | |

| through | | | | |

| profit or | | | | |

| loss | | | | |

+-------------+-----------+-------------+-----------+-------------+

| Cost | 567,717 | 32,087,429 | 8,408,187 | 41,063,333 |

+-------------+-----------+-------------+-----------+-------------+

| Unrealised | (193,179) | (1,508,142) | 112,068 | (1,589,253) |

| (loss)/gain | | | | |

+-------------+-----------+-------------+-----------+-------------+

| Market | 374,538 | 30,579,287 | 8,520,255 | 39,474,080 |

| value | | | | |

| at 30 | | | | |

| June | | | | |

| 2010 | | | | |

+-------------+-----------+-------------+-----------+-------------+

| | | | | |

+-------------+-----------+-------------+-----------+-------------+

The following table analyses investments by type and by level within the fair

valuation hierarchy at 30 June 2010.

+------------------------+------------+-------------+--------------+------------+

| | Quoted | Quoted | Unobservable | |

| | prices in | market | | |

| | active | based | inputs | |

| | markets | observables | | |

+------------------------+------------+-------------+--------------+------------+

| | Level 1 | Level 2 | Level 3 | Total |

+------------------------+------------+-------------+--------------+------------+

| | GBP | GBP | GBP | GBP |

+------------------------+------------+-------------+--------------+------------+

| Financial assets at | | | | |

| fair value through | | | | |

| profit or loss | | | | |

+------------------------+------------+-------------+--------------+------------+

| Listed equity shares | 374,538 | - | - | 374,538 |

+------------------------+------------+-------------+--------------+------------+

| Unlisted equity shares | - | - | 30,579,287 | 30,579,287 |

+------------------------+------------+-------------+--------------+------------+

| Warrants | - | - | 8,520,255 | 8,520,255 |

+------------------------+------------+-------------+--------------+------------+

| | 374,538 | - | 39,099,542 | 39,474,080 |

+------------------------+------------+-------------+--------------+------------+

14

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

3. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS (CONTINUED)

+----------------------+-----------+-------------+-----------+-------------+

| | Listed | Unlisted | Warrants | Total |

| | equity | equity | | |

| | shares | shares | | |

+----------------------+-----------+-------------+-----------+-------------+

| | | GBP | GBP | GBP |

+----------------------+-----------+-------------+-----------+-------------+

| Balance at beginning | - | - | - | - |

| of period | | | | |

+----------------------+-----------+-------------+-----------+-------------+

| Purchases during the | 567,717 | 32,087,429 | 8,408,187 | 41,063,333 |

| period | | | | |

+----------------------+-----------+-------------+-----------+-------------+

| Unrealised | (193,179) | (1,508,142) | 112,068 | (1,589,253) |

| (loss)/gains | | | | |

+----------------------+-----------+-------------+-----------+-------------+

| | | | | |

+----------------------+-----------+-------------+-----------+-------------+

| Closing balance | 374,538 | 30,579,287 | 8,520,255 | 39,474,080 |

+----------------------+-----------+-------------+-----------+-------------+

Investments

In determining an investment's placement within the fair value hierarchy, the

Directors take into consideration the following.

Investments whose values are based on quoted market prices in active markets,

and are therefore classified within level 1, include listed equities. The

Directors do not adjust the quoted price for such instruments, even in

situations where the Company holds a large position and a sale could reasonably

impact the quoted price.

Investments that trade in markets that are not considered to be active, but are

valued based on quoted market prices, dealer quotations or alternative pricing

sources supported by observable inputs are classified within level 2. These

include certain less liquid listed equities. As level 2 investments include

positions that are not traded in active markets and/or are subject to transfer

restrictions, valuations may be adjusted to reflect illiquidity and/or

non-transferability, which are generally based on available market information.

The Company did not hold any such investments at 30 June 2010.

Investments classified within level 3 have significant unobservable inputs. They

include unlisted equity shares and warrants. Level 3 investments are valued

using valuation techniques explained in the Company's accounting policies. The

inputs used by the Directors in estimating the value of level 3 investments

include the original transaction price, recent transactions in the same or

similar instruments, completed or pending third-party transactions in the

underlying investment or comparable issuers, subsequent rounds of financing,

recapitalisations and other transactions across the capital structure, offerings

in the equity or debt capital markets, and changes in financial ratios or cash

flows. Level 3 investments may also be adjusted to reflect illiquidity and/or

non-transferability, with the amount of such discount estimated by the Directors

in the absence of market information.

4. NET ASSET VALUE PER SHARE AND EARNING PER SHARE

Basic net asset value per share is based on the net assets of GBP63,087,686 and

66,033,089 Ordinary Shares, being the number of shares in issue at the period

end. Diluted net asset value is the same as the basic net asset value, as the

exercise price of the Subscription Shares is above the net asset value at the

period end.

The calculation for basic net asset value is as below:-

+----------------------------------------------------+------------+--------------+

| 30 June 2010 | Ordinary | Subscription |

| | Shares | Shares |

+----------------------------------------------------+------------+--------------+

| Net assets at the period end (GBP) | 63,087,686 | 13,204,594 |

+----------------------------------------------------+------------+--------------+

| Number of shares | 66,033,089 | 13,204,594 |

+----------------------------------------------------+------------+--------------+

| Basic net asset value per share (in pence) | 95.5 | |

+----------------------------------------------------+------------+--------------+

The basic earnings per share is based on the net loss for the period of the

Company of GBP1,564,228 and on 66,033,089 Ordinary Shares, being the weighted

average number of shares in issue during the period. Diluted earnings per

ordinary share is calculated by adjusting basic earnings per ordinary share to

reflect the notional exercise of the number of dilutive subscription shares

outstanding during the period, using a weighted average calculation based on the

average market price per ordinary share during the period. The diluted earnings

per share figure is similar to the basic earnings per share figure because the

average market share price during the period of 101.24p is only 1.24% greater

than the exercise price. This calculation is done in accordance with the IFRS.

15

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

5. TAXATION

The Company is a Guernsey Exempt Company and is therefore not subject to

taxation on its income under the Income Tax (Exempt Bodies) (Guernsey)

Ordinance, 1989. An annual exempt fee of GBP600 has been paid.

6. ADMINISTRATION FEES

The Administrator, HSBC Securities Services (Guernsey) Limited, is paid fees for

acting as administrator of the Company at the rate of 7 basis points of gross

asset value up to US$250 million, the rate reduces to 5 basis points of gross

asset value above US$250 million, subject to a minimum of EUR48,000 per annum or

such other amount as may be agreed with the Company from time to time in

accordance with the Administration Agreement. The Administrator is also

reimbursed by the Company for reasonable out-of-pocket expenses. These fees

accrue and are calculated as at the last Business Day of each month and paid

monthly in arrears.

The Administrator is also entitled to a fee for its provision of corporate

secretarial services provided to the Company on a time spent basis and subject

to a minimum annual fee of GBP40,000. The Company is also responsible for any

sub-administration fees as agreed in writing from time to time, and reasonable

out-of-pocket expenses.The Administrator is also entitled to fees of EUR5,000 for

preparation of the financial statements of the Company.

The administration fees paid for the period ended 30 June 2010 were GBP21,600 of

which GBP8,588 was payable at 30 June 2010.

7. MANAGEMENT AND PERFORMANCE FEES

The Manager was appointed pursuant to a management agreement with the Company

dated 31 March 2010 (the "Management Agreement"). The Company pays to the

Manager a 'base fee' which is equal to 1/12th of 1.75% of the Net Asset Value

per month. The management fee is calculated and accrued as at the last Business

Day of each month and is paid monthly in arrears.

The Manager may in certain circumstances also be entitled to be paid a

performance fee if the Net Asset Value at the end of any Performance Period

exceeds the Hurdle as at the end of the Performance Period. For this purpose the

"Hurdle" means an amount equal to the Issue Price of GBP1 multiplied by the

number of shares in issue as at Admission, as increased at a rate of 8% per

annum compounded to the end of the relevant Performance Period. In respect of

the first Performance Period and any other Performance Period which is less than

a full 12 months, the Hurdle will be applied pro rata. The performance fee is

subject to adjustments for any issue and/or repurchase of Ordinary Shares.

The amount of the performance fee (if any) will be 15 per cent. of the total

increase in the Net Asset Value at the end of the relevant Performance Period

over the highest previously recorded Net Asset Value as at the end of a

Performance Period in respect of which a performance fee was last accrued, (or

the Issue Price multiplied by the number of shares in issue as at Admission, if

no performance fee has been so accrued), having made adjustments for numbers of

Ordinary Shares issued and/or repurchased as described above.

The first performance period commenced on the date of Admission and ends on 31

December 2010 and thereafter, is each 12 month period ending on 31 December in

each year (the "Performance Period"). The last Performance Period will end on

the date on which the Management Agreement is terminated or the Company is wound

up.

The Manager's base fees paid for the period ended 30 June 2010 were GBP204,514

all of which was outstanding at the period end.

16

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

8. CASH AND CASH EQUIVALENTS

+------------------------------------------------------------+------------+

| | 30 June |

| | 2010 |

+------------------------------------------------------------+------------+

| | GBP |

+------------------------------------------------------------+------------+

| Cash and cash equivalents | 26,113,077 |

+------------------------------------------------------------+------------+

| Bank overdraft | (334) |

+------------------------------------------------------------+------------+

| Total | 26,112,743 |

+------------------------------------------------------------+------------+

| | |

+------------------------------------------------------------+------------+

| Represented by: | |

+------------------------------------------------------------+------------+

| Cash and cash equivalents | |

+------------------------------------------------------------+------------+

| HSBC Bank plc | 26,113,077 |

+------------------------------------------------------------+------------+

| | |

+------------------------------------------------------------+------------+

| Bank overdraft* | |

+------------------------------------------------------------+------------+

| HSBC Bank plc | (334) |

+------------------------------------------------------------+------------+

* Bank overdrafts represent negative cash balances in non GBP brokerage

accounts.

9. SHARE CAPITAL

The authorised share capital of the Company on incorporation was represented by

an unlimited number of Ordinary Shares of no par value. The Company raised

GBP30,468,865 through the issue of 30,468,865 Ordinary Shares and 6,093,772

Subscription Shares via a Placing and Offer. In addition, the Company issued

35,554,224 Ordinary Shares and 7,110,822 Subscription Shares to the holders of

shares in Genus Capital Fund pursuant to a scheme of reorganisation of Genus

Capital Fund, in exchange for substantially all the non-cash assets of Genus

Capital Fund which are detailed below:

+-----------+-------------------------------------------------+-------------+

| Quantity | Investments | Transfer |

| | | value |

+-----------+-------------------------------------------------+-------------+

| | | GBP |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| | Listed equity shares | |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| 358,333 | MBAC Fertilizer Corporation | 567,717 |

+-----------+-------------------------------------------------+-------------+

| | | 567,717 |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| | Unlisted equity shares and warrants | |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| 500 | BacTech Mining | 328,699 |

+-----------+-------------------------------------------------+-------------+

| 1,594,646 | Celadon Mining | 297,720 |

+-----------+-------------------------------------------------+-------------+

| 268,889 | Copperbelt Minerals | 3,545,594 |

+-----------+-------------------------------------------------+-------------+

| 6,123,642 | Ferrous Resources | 14,130,705 |

+-----------+-------------------------------------------------+-------------+

| 2,571,429 | First Coal Corporation | 2,315,920 |

+-----------+-------------------------------------------------+-------------+

| 3,350,285 | Gobi Coal and Energy | 4,417,716 |

+-----------+-------------------------------------------------+-------------+

| 500,000 | Ivanhoe Nickel and Platinum | 2,884,457 |

+-----------+-------------------------------------------------+-------------+

| 791,666 | Ivanhoe Nickel Platinum warrants 1 for 1.2 | 5,480,463 |

| | ordinary | |

+-----------+-------------------------------------------------+-------------+

| 306,980 | Ivanhoe Nickel Platinum warrants 1 for 1 | 1,770,941 |

| | ordinary | |

+-----------+-------------------------------------------------+-------------+

| 6,500,000 | South American Ferro Metals | 2,024,889 |

+-----------+-------------------------------------------------+-------------+

| | | 37,197,104 |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| | Total assets transferred | 37,764,821 |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| | Less Cash | (2,210,597) |

+-----------+-------------------------------------------------+-------------+

| | | |

+-----------+-------------------------------------------------+-------------+

| | Value of shares issued | 35,554,224 |

+-----------+-------------------------------------------------+-------------+

17

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

9. SHARE CAPITAL (CONTINUED)

The Company has in issue 66,023,089 Ordinary Shares and 13,204,594 Subscription

Shares denominated in Sterling.

The subscription rights conferred by the Subscription Shares are exercisable

every six months from 30 September 2010 until 31 March 2013. Each Subscription

Share carries the right to subscribe for one Ordinary Share at a price of 100

pence.

On 28 April 2010 the Ordinary Shares and Subscription Shares were admitted to

the Official List of the UK Listing Authority and to trading on the Main Market

of the London Stock Exchange.

In addition, the Company has 10,000 Management Ordinary Shares in issue, which

are held by the Investment Manager. No application has been or will be made to

have the Management Ordinary Shares admitted to listing on the Official List or

to trading on the London Stock Exchange's Main Market for listed securities.

Holders of Ordinary Shares will have the right to receive notice of and to

attend and vote at general meetings of the Company. Each holder of Ordinary

Shares being present in person or by proxy at a meeting will, upon a show of

hands, have one vote and upon a poll each such holder of Ordinary Shares present

in person or by proxy will have one vote for each Ordinary Share held by him.

Holders of Subscription Shares are not entitled to attend or vote at meetings of

Shareholders.

Holders of Ordinary Shares and Management Ordinary Shares are entitled to

receive, and participate in, any dividends or other distributions out of the

profits of the Company available for dividend and resolved to be distributed in

respect of any accounting period or other income or right to participate

therein. The Subscription Shares carry no right to any dividend or other

distribution by the Company.

The details of issued share capital of the Company are as follows:

+------------------------------------------------------------+------------+

| | 30 June |

| | 2010 |

+------------------------------------------------------------+------------+

| Issued and fully paid share capital | |

+------------------------------------------------------------+------------+

| Ordinary Shares of no par value | 66,023,089 |

+------------------------------------------------------------+------------+

| Subscription Shares of no par value | 13,204,594 |

+------------------------------------------------------------+------------+

The issue of Ordinary Shares during the period ended 30 June 2010 took place as

follows:

+----------------------------------+--+--------------+--------------+

| | | Ordinary | Subscription |

| | | Shares* | Shares |

+----------------------------------+--+--------------+--------------+

| Issued during the period via | | 30,468,865 | 6,093,772 |

| Placing and Offer | | | |

+----------------------------------+--+--------------+--------------+

| Issued during the period to | | 35,554,224 | 7,110,822 |

| holders of Genus Capital Fund | | | |

+----------------------------------+--+--------------+--------------+

| Balance at 30 June 2010 | | 66,023,089 | 13,204,594 |

+----------------------------------+--+--------------+--------------+

* In addition 10,000 Management Ordinary Shares were issued. On 9 March 2010, 1

Management Ordinary Share was issued and on 26 March 2010, 9,999 Management

Ordinary Shares were issued.

10. RELATED PARTY TRANSACTIONS

Transactions with related parties are based on terms equivalent to those that

prevail in an arm's length transaction. The following transactions with related

parties took place for the period ended 30 June 2010.

On 30 March 2010 the Company agreed to acquire the majority of the non-cash

assets of Genus Capital Fund as set out in the Prospectus issued by the Company

dated 31 March 2010. Charles Hansard and Edward Flood were also directors of

Genus Capital Fund and so had an actual or potential conflict of interest.

Edward Flood and Charles Hansard resigned from Genus Capital Fund's Board of

Directors on 12 July 2010 and on 26 July 2010 respectively.

18

BAKER STEEL RESOURCES TRUST LIMITED

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE PERIOD FROM 9 MARCH 2010 (DATE OF INCORPORATION) TO 30 JUNE 2010

11. DIRECTORS' INTERESTS

The Directors' interests in the share capital of the Company at 30 June 2010

were as follows:

+-------------+----------+--------------+

| | Number | Number |

| | of | of |

| | Ordinary | Subscription |

| | Shares | Shares |

+-------------+----------+--------------+

| Edward | 65,000 | 13,000 |

| Flood | | |

+-------------+----------+--------------+

| Christopher | 25,000 | 5,000 |

| Sherwell | | |

+-------------+----------+--------------+

| Clive | 25,000 | 5,000 |

| Newall | | |

+-------------+----------+--------------+

12. SUBSEQUENT EVENTS

There were no significant subsequent events since the period end.

13. APPROVAL OF HALF-YEARLY REPORT AND UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

The Half-Yearly Report and Unaudited Condensed Interim Financial Statements to

30 June 2010 were approved by the Board of Directors on 31 August 2010.

19

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DMGFRKMMGGZM

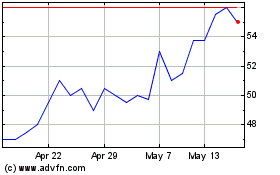

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024