Net Asset Value(s)

July 06 2010 - 5:00AM

UK Regulatory

TIDMBSRT

RNS Number : 8833O

Baker Steel Resources Trust Ltd

06 July 2010

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the provisions of

The Companies (Guernsey) Law, 2008 as amended)

30 June 2010 NAV Statement

Net Asset Values

Baker Steel Resources Trust Limited ("the Company") announces its Net Asset

Value per share as at 30 June 2010:

Net asset value per Ordinary share: 95.5 pence

During the month the NAV fell by -5.3% partly as a result of a reduction in the

carrying value of Ferrous Resources and partly due to a strengthening in the

value of the pound against the US dollar and Canadian dollar in which the

majority of the Portfolio's assets are denominated.

The Company has a total of 66,023,089 Ordinary Shares and 13,204,594

Subscription Shares in issue.

Portfolio update

No sales or purchases were made during the month.

The Company is 63% invested with the top five shareholdings as follows as a

percentage of NAV:

+-------------------------------------+------------+

| Ferrous Resources Limited | 19.5% |

+-------------------------------------+------------+

| Ivanhoe Nickel and Platinum Limited | 18.1% |

| | |

+-------------------------------------+------------+

| Gobi Coal & Energy Limited | 11.0% |

+-------------------------------------+------------+

| Copperbelt Minerals Limited | 5.7% |

+-------------------------------------+------------+

| First Coal Corporation | 3.5% |

+-------------------------------------+------------+

| Other Investments | 4.8% |

+-------------------------------------+------------+

| Net Cash | 37.4% |

+-------------------------------------+------------+

Update on Investments

Ferrous Resources Limited ("Ferrous")

On 2 June 2010, Ferrous announced that it had decided to postpone its Initial

Public Offering "in the light of unfavourable market conditions". The Board of

the Company therefore considered it appropriate to review the carrying value of

Ferrous in the Portfolio. Due to the size and spread of shareholders, "grey

market" trading in Ferrous is reasonably liquid and the Investment Manager is

aware of a transaction in a sizeable tranche of shares being executed at

US$3.00/share subsequent to the news of the postponed IPO. In order to reflect

the current fair value of Ferrous shares in the Portfolio, it has been decided

to impair the carrying value from US$3.50/share to US$3.00/share. This is

reflected in a -3% fall in Net Asset Value of the Company. The Investment

Manager is engaging with Ferrous management to ascertain their revised plans for

the company and when a revised liquidity event might be anticipated.

BacTech Mining Corporation ("BacTech")

In April 2010, the Company acquired C$500,000 worth of subscription receipts in

BacTech Gold Corporation, a subsidiary of BacTech formed to exploit gold mining

opportunities utilising BacTech's proprietary bioleaching technology. During

June, this transaction was renegotiated and the Company has agreed to convert

its subscription receipts directly into 10.25 million shares in BacTech with

associated warrants on a one-for-one basis. BacTech is a Canadian company listed

on the TSX Venture Exchange which aims to acquire mining projects with difficult

to treat ore, whose value can be unlocked by the application of BacTech's

proprietary bioleaching technology.

Gobi Coal & Energy Limited ("Gobi")

During the month the Investment Manager visited Gobi's operations in Mongolia.

Development plans are well advanced and Gobi appears to be on course for a

listing on the Hong Kong Stock Exchange in the first quarter of 2011. The recent

site visit, supported by discussions with management, has led to the Investment

Manager increasing its internal "risk-adjusted value" of Gobi, although an

external event is required before this might be reflected in the carrying value.

A quarterly report to 30 June 2010 with further information on the Company's

investments is available on the Company's website

www.bakersteelresourcestrust.com

Ends

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8290

Francis Johnstone

Trevor Steel

Winterflood Investment Trusts +44 20 3100 0291/0250

Robert Peel

James Moseley

RBC Capital Markets +44 20 7653 4000

Martin Eales

Pelham Bell Pottinger

Damian Beeley +44 20 7861 3139

Charles Vivian +44 20 7861 3126

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVKMGGNRVLGGZG

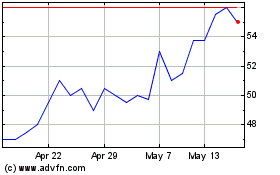

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024