TIDMBSE

AIM and Media Release

12 April 2017

BASE RESOURCES LIMITED

Quarterly Activities Report - March 2017

HIGHLIGHTS

* Further strong ilmenite price increases achieved and additional price

increase locked in for contracted April sales, resulting in June quarter

prices commencing approximately 200% higher than at the start of the

financial year.

* Record quarterly rutile production of 23,107 tonnes.

* No lost time injuries.

* Positive exploration drilling results clearly demonstrate the potential to

grow Resources and mine life to the north and south of existing Kwale

Operations Ore Reserves.

* Further cash "sweep" from the Kwale Operations.

* Net debt reduced by US$7.0m to US$122.5 million.

Base Resources Limited (ASX & AIM: BSE) ("Base Resources" or the "Company") is

pleased to provide a quarterly corporate and operational update for its Kwale

Mineral Sands Operations ("Kwale Operations") in Kenya, East Africa. The

quarter was again characterised by continuing improvement in ilmenite markets

and a positive outlook for both rutile and zircon. The continued strong

performance of Kwale Operations has reduced net debt by a further US$7.0

million* in the quarter.

[*The net debt reduction of US$7.0 million in the quarter was lower than the

previous quarter (US$18.1 million net debt reduction) due to the timing of bulk

rutile shipments, and particular customer payment terms, which impacted cash

receipts and therefore total net debt reduction.]

KWALE OPERATIONS

SUMMARY PHYSICAL Mar 2016 June 2016 Sept 2016 Dec 2016 Mar 2017

DATA Quarter Quarter Quarter Quarter Quarter

Ore mined (tonnes) 2,410,503 2,363,395 2,325,174 3,049,333 2,664,738

HM % 8.96 9.87 7.51 5.83 6.70

HMC produced 209,787 226,453 164,192 152,259 159,379

(tonnes)

HMC consumed 175,224 187,244 193,349 191,576 186,814

(tonnes)

MSP feed rate (tph) 86 88 92 91 91

Production (tonnes)

Ilmenite 110,760 119,340 121,821 116,982 112,368

Rutile 21,194 21,766 22,458 22,870 23,107

Zircon 7,865 9,471 9,050 8,591 8,212

Zircon low grade1 - - 2,160 2,550 2,474

Sales (tonnes)

Ilmenite 95,984 150,911 139,441 97,047 122,783

Rutile 14,500 32,454 23,023 19,773 21,416

Zircon 9,556 9,590 8,525 9,432 8,069

Zircon low grade1 - - - 3,397 3,059

1 Zircon low grade tonnes contained in concentrate, equivalent to approximately

70-80% of the value of primary zircon.

Mined tonnage reduced to 2.66 million tonnes ("Mt") from 3.05Mt in the previous

quarter, largely as a consequence of a slight curtailment of feed rates whilst

optimising concentrator efficiencies. At the beginning of March, mining

operations relocated to a high grade section of the Central Dune in line with

the current mine plan, resulting in an immediate increase in mined grade to >

10% heavy mineral ("HM") for the month.

Hydraulic mining operations progressed according to plan at the design rate of

400 tonnes per hour ("tph"). Additional equipment has been purchased to

increase hydraulic mining rates to 800tph in July 2017, during the next

scheduled hydraulic mining relocation. This will further decrease the

contribution from the dozer-trap mining unit and should contribute to a

reduction in operating costs.

The lowered mining rate in the quarter resulted in a 5% improvement in HM

recovery in the wet concentrator plant ("WCP") in line with recoveries achieved

prior to pushing mining rates higher in the December 2016 quarter. This is due

to capacity restrictions in the sand tails dewatering section of the

concentrator that mean that, at high WCP feed rates, HM recoveries fall due to

WCP feed densities exceeding design. De-constraining the WCP at higher mining

rates is one of the primary deliverables of the Kwale Phase 2 project,

discussed further below.

Heavy mineral concentrate ("HMC") production from the WCP increased slightly

over the prior quarter due to the higher grade of ore mined and stocks started

to increase again in March when mining high grade ore. HMC stocks at quarter

end were 43,455 tonnes. Concentrator availability during the quarter was high

at 88%, compared to 86% in the prior quarter.

The tailings storage facility ("TSF") sand wall stacking, lining and slimes

deposition continued according to plan, with the final wall lift now underway.

A 250-metre section of TSF wall, which has reached now full height, is being

prepared for rehabilitation with grass and indigenous shrubs, ahead of the

coming wet season rains.

As a consequence of the severe drought conditions experienced throughout the

region in the past year, the Mukurumudzi Dam volume dropped from 4.6 gigalitres

("GL") to 3.1GL, or 37% of capacity, during the quarter. Water conservation

measures implemented at the Kwale Operations in 2016 have ensured sufficient

water volume to continue to operate at full capacity through to, and beyond,

the anticipated 'long rains' wet season between April and June. To help

mitigate future risks with water supply, regulatory approval is being sought to

increase borefield extraction from 5,280 to 9,060 cubic meters per day.

The mineral separation plant ("MSP") maintained an average feed rate of 91tph

for the quarter and availability remained at 95% with a total of 187 thousand

tonnes ("kt") processed. Optimisation and debottlenecking continues, aimed at

improving recoveries and to ensure value is maximised through the balancing of

primary final product production and zircon concentrate production (for sale).

Rutile production set another quarterly record of 23.1kt (22.9kt last quarter)

due to recoveries increasing to 99% (98% last quarter) and the higher rutile

content in the mineral assemblage of lower grade ore.

Ilmenite production dropped to 112.4kt (117.0kt last quarter) due to lower

ilmenite content in the mineral assemblage in lower grade ore. Average

recoveries for the quarter were 101%*, slightly lower than the previous

quarter's 102%.

[*The presence of altered ilmenite species that are not defined as either

"rutile" or "ilmenite" in the Resource but are recovered in the production of

both, results in calculated recoveries above 100% being achievable for both

products.]

Zircon production for the quarter was lower at 8.2kt (8.6kt last quarter) due

to lower zircon content in the feed. Average zircon recovery of 74% was

slightly higher than last quarter's 73%, but lower than the design target of

78%. Circuit optimisation and modifications continue.

In addition to primary zircon, in July 2016 Kwale Operations commenced

production of a lower grade zircon product ("zircon low grade") from

re-processing of zircon tails into a zircon rich concentrate. Zircon low grade

typically realises 70-80% of the value of each contained tonne of zircon.

Reported zircon low grade represents the volume of zircon contained in the

concentrate. To date, zircon low grade has been produced from the

re-processing of run-of-production and stockpiled zircon circuit tails and this

is anticipated to continue for the remainder of the financial year. During the

quarter 2.5kt of zircon low grade was produced (2.6kt last quarter) and a

single shipment containing 3.1kt of zircon low grade was made to China (3.4kt

last quarter). When combined with primary zircon recoveries, the production of

zircon low grade effectively lifts total zircon recoveries well above the

design target of 77.8%.

The MSP product recoveries shown in the graph below reflect the primary product

recoveries only and do not include any uplift for the production of zircon low

grade.

Bulk loading operations at Base Resources' Likoni Port facility continued to

run smoothly, dispatching more than 152kt of ilmenite, rutile and zircon low

grade during the quarter (125kt last quarter). Containerised shipments of

rutile and zircon through the Mombasa Port proceeded according to plan.

SUMMARY OF UNIT COSTS Mar 2016 June 2016 Sept 2016 Dec 2016 Mar 2017

& REVENUE PER TONNE (US$) Quarter Quarter Quarter Quarter Quarter

Unit operating costs per tonne produced $84 $93 $77 $84 $87

Unit cost of goods sold per tonne sold $106 $111 $91 $102 $119

Unit revenue per tonne of product sold $208 $201 $200 $250 $258

Revenue : Cost of goods sold ratio 2.0 1.9 2.2 2.5 2.2

Total operating costs were in line with last quarter, but the slightly lower

production volumes resulted in a marginally higher unit operating cost of US$87

per tonne produced (rutile, ilmenite, zircon and zircon low grade) (US$84 per

tonne last quarter). Cost of goods sold of US$119 per tonne sold (operating

costs, adjusted for stockpile movements, and royalties) were also higher than

last quarter (US$102 per tonne sold) due the impact of product sales mix.

Revenue per tonne of product sold varies significantly each quarter depending

on the number of bulk rutile sales during that quarter. In a normal year,

there are usually seven or eight bulk rutile sales of approximately 10kt each,

which means any given quarter will typically contain either one or two of these

sales. As annual rutile sales account for approximately 50% of revenue but

only 15% of volume, the number of bulk rutile sales in a quarter has a

significant bearing on revenue, but not sales volume. The March quarter saw

two bulk rutile sales of 8.8kt and 10.0kt, and total rutile sales of 21.4kt,

slightly higher than the prior quarter's 19.8kt total rutile sales, which, when

combined with the higher ilmenite sales volume, higher ilmenite prices and

zircon low grade sales, contributed to the increase in average revenue per

tonne to US$258 per tonne (US$250 last quarter).

FY2017 PRODUCTION GUIDANCE

Kwale Operations production guidance for financial year 2017 ("FY17") remains

unchanged at:

* Rutile - 88,000 to 93,000 tonnes.

* Ilmenite - 450,000 to 480,000 tonnes.

* Zircon - 33,000 to 37,000 tonnes.

* Zircon contained in zircon low grade - 8,000 to 10,000 tonnes.

The above production targets are based on the following assumptions for FY17:

* Mining of 10.6Mt at an average HM grade of 7.12%, all from Ore Reserves*.

* MSP feed rate at an average of 91tph, consistent with recent performance.

* MSP product recoveries of 101% for ilmenite and 98% for rutile, and 74% for

zircon, consistent with past performance and planned recovery improvements

from MSP optimisation.

[*The Ore Reserves estimates underpinning the above production targets were

prepared by Competent Persons in accordance with the JORC Code (2012 edition).

The above production targets are the result of detailed studies based on the

actual performance of the Kwale mine and processing plant. These studies

include the assessment of mining, metallurgical, ore processing, environmental

and economic factors.]

MARKETING

The TiO2 pigment industry continued to go from strength to strength through the

March quarter and in the lead-up to the traditionally seasonally strong June

quarter. This has resulted in further price improvement and ongoing strong

demand for TiO2 feedstock. Global pigment producers announced price increases

through the early part of 2017, with several major pigment producers recently

announcing a further price increase effective from 1 April 2017.

Prices for Base Resources' ilmenite have now increased by over 130% between May

2016 and March 2017. A Base Resources ilmenite shipment recently contracted

for mid-April 2017 will see prices start the June quarter at approximately 200%

higher than the mid-2016 level.

Political disruption to ilmenite exports from Tamil Nadu in India and

suppressed ilmenite production in China's main ilmenite producing region,

Sichuan province, due to increased environmental inspections has continued

through the March quarter. These events, together with the ongoing strength in

pigment demand, is expected to result in further improvements in ilmenite

prices through the coming quarters.

Despite strong demand, an overhang of high grade TiO2 feedstock capacity

through most of 2016 and early 2017 has resulted in only moderate price

improvement for rutile in recent quarters. However, there are increasing signs

of an emerging supply deficit in this high grade sector and Base Resources now

expects rutile prices to experience increased upward momentum through mid-2017.

Zircon demand remained firm through the March quarter resulting in Base

maintaining only a minimum working stock position throughout the period.

Modest price improvement was achieved through the March quarter, however, lower

than anticipated global zircon production for 2017 has reduced inventories and

created increasing supply tightness resulting in a strong price improvement (of

approximately US$50/t) being secured for the June quarter contracted sales.

With zircon customers concerned about securing future zircon supply, many

buyers are attempting to build some safety stocks. Further solid price

improvements are now expected through the remainder of calendar 2017.

SAFETY

With no serious injuries occurring during the quarter, Kwale Operations' lost

time injury frequency rate ("LTIFR") remains at zero. Base Resources'

employees and contractors have now worked 8.9 million man-hours LTI free, with

the last LTI recorded in the March quarter of 2014. The total recordable

injury frequency rate ("TRIFR") has been maintained at 0.35 in quarter.

COMMUNITY AND ENVIRONMENT

Agricultural livelihood programmes, run in conjunction with partners Business

for Development, DEG, FMO, DFAT and Kenya Red Cross, continue to develop with

encouraging support from both national and county Kenyan governments. These

programmes, covering cotton, potato, sorghum and poultry, are expanding in the

run-up to the long rains planting season, with the intention of reaching

commercial scale and providing increased incomes to local families which can be

sustained beyond the life of the Kwale Operations.

Harvesting has been completed and logistics are underway for a consignment of

30 tonnes of Kenyan cotton lint to be exported to Bangladesh for further

processing into garments for Cotton On. Five tonnes of this shipment have been

produced through the Kwale Cotton project, a positive outcome in challenging

drought conditions. Land preparation and seed procurement are underway for the

planting season in the next quarter.

As mentioned earlier, work has commenced on the rehabilitation of TSF slopes,

with water retention layers and top soil deposition complete for a 250 metre

stretch. Grass seeding will start in the coming quarter during the "long

rains" wet season. Seed collected by, and top soil erosion control materials

sourced from, local women's groups are providing significant incomes for

villages surrounding the mine site.

During the quarter, Base Resources also provided an additional 12 tonnes of

relief food in collaboration with the Kwale County Government, local civil

society organisations and Kenya Red Cross to alleviate hunger in the region

resulting from the drought conditions.

BUSINESS DEVELOPMENT

EXTENSIONAL EXPLORATION - KENYA

The Company completed its planned aircore drilling programme within its Special

Prospecting License 173 ("SPL 173") in the SW Sector during this quarter. A

total of 773 holes for 11,738 metres were drilled made up as follows:

Location Holes Metres

SW Sector (Kwale South Dune Extension & 368 5,801

Mafisini)

NE Sector 43 1,119

Kwale Central Dune Deposit edge 23 303

definition

Kwale South Dune Deposit edge 199 2,456

definition

Kwale South Dune Deposit infill 140 2,059

drilling

Totals 773 11,738

As previously reported on 2 March 2017, drilling results show a substantial

increase in the dimensions of the South Dune Deposit (950m at an average of

700m across strike) and the discovery of the Mafisini Deposit (1,240m and up to

480m in width), separated from the South Dune by a narrow alluvial lowland.*

[*Refer to Base Resources' market announcement on 2 March 2017. Base Resources

confirms that it is not aware of any new information or data that materially

affects the information included in its announcement on 2 March 2017.]

Substantial edge definition drilling, along the eastern margins of the South

Dune Deposit, has also indicated the potential for a significant extension of

this deposit.

An infill drilling programme on the Kwale South Dune Deposit was also

completed, bringing it up to a 100m X 100m drill pattern, to facilitate the

upgrade of Inferred and part of the Indicated Resource areas to a Measured

status.

Detailed mineralogy and Resource estimation are targeted for completion in the

September quarter.

As previously reported, drilling in the NE sector was suspended due to

increasing political positioning ahead of Kenya's general elections, currently

scheduled for August 2017, which has produced community tensions not conducive

to exploration. Resumption of drilling in this area is likely to be after the

elections.

In addition, the Company has also applied for a further Special Prospecting

License covering an area of 136km2 extending south west from SPL 173 towards

the Tanzanian border. While this application has been approved by the Ministry

of Mines, issuance of the license remains subject to the final recommendation

of the Mineral Rights Board which has only recently been constituted and is

expected to become functional in May 2017.

EXPLORATION - TANZANIA

The Company now holds five prospecting licenses in northern Tanzania with a

combined area of 475km2. The areas of interest were identified through a

prospectivity review and subsequent confirmatory ground reconnaissance.

The Company has progressed the necessary consents and clearances ahead of a

planned preliminary drilling programme across all five licenses, which is

scheduled to commence during the September quarter, after the completion of

mineralogical analysis and Resource estimation from the recent drill program at

Kwale.

Total exploration expenditure for the quarter, across all licenses in Kenya and

Tanzania, was US$0.49 million.

KWALE PHASE 2 PROJECT

Base Resources initiated the Kwale Phase 2 project in 2015 with its focus being

an optimised mining methodology, increased mining rates in lower grade zones

and increased concentrate production. Following a positive Pre-Feasibility

Study completed in July 2016, a Definitive Feasibility Study ("DFS") is

underway. The hydraulic mining units currently being used successfully in

mining operations have delivered encouraging results and work is underway to

increase hydraulic mining rates from 400tph to 800tph. The DFS is scheduled

for completion in the June quarter of 2017.

CORPORATE

KENYAN VAT RECEIVABLE

As previously announced, Base Resources has refund claims for VAT paid in

Kenya, relating to both the construction of the Kwale Project and the period

since operations commenced, totalling approximately US$19.0 million at 31 March

2017. These claims are proceeding through the Kenya Revenue Authority process,

with operational period claims, totalling approximately US$0.3 million, settled

during the quarter. Base Resources is continuing to engage with the Kenyan

Treasury and the Kenya Revenue Authority, seeking to expedite the remainder of

the refund.

ACCELERATED DEBT REPAYMENT FROM SURPLUS CASH

On 16 January 2017, and in accordance with the terms of the Kwale Operations

Debt Facility, US$14.6 million of surplus cash was 'swept' from Kwale

Operations. Half of the cash sweep (US$7.3 million) went towards mandatory

repayment of the Kwale Operations Debt Facility, with the other half

distributed up to the group's Australian parent entity, Base Resources. From

the cash sweep portion received by Base Resources, a mandatory 75% (US$5.5

million) was applied to repayment of the Taurus Facility, with the balance

available to the Company for general corporate funding.

EXPANDED BASE TITANIUM LIMITED BOARD OF DIRECTORS

During the quarter, Base Titanium, the Company's wholly-owned Kenyan operating

subsidiary, appointed three additional members to its Board of Directors.

These new members, in investment banker John Ngumi, prominent Kenyan lawyer

Desterio Oyatsi and financial market analyst, advisor and commentator Aly-Khan

Satchu, bring vast experience from the private and public sectors and detailed

knowledge of the East African business environment. They join existing

Chairman Professor Joseph Maitha and Base Resources Executive Directors Tim

Carstens and Colin Bwye on the expanded Board.

In summary, at 31 March 2017:

* Net debt of US$122.5 million, consisting of:

+ Cash and cash equivalents were US$23.3 million (unrestricted) and an

additional US$18.6 million (restricted - debt service reserve account).

+ Debt of US$164.4 million.

* 742,231,956 shares on issue.

* 61,425,061 options (exercise price of A$0.40, expiring 31 December 2018).

* 67,085,620 performance rights issued pursuant to the terms of the Base

Resources Long Term Incentive Plan.

A full PDF version of this release is available from the Company's website:

www.baseresources.com.au.

ENDS.

CORPORATE PROFILE

Directors

Keith Spence (Non-Executive Chairman)

Tim Carstens (Managing Director)

Colin Bwye (Executive Director)

Sam Willis (Non-Executive Director)

Michael Anderson (Non-Executive Director)

Michael Stirzaker (Non-Executive Director)

Malcolm Macpherson (Non-Executive Director)

Company Secretary

Chadwick Poletti

NOMINATED ADVISOR & BROKERS

RFC Ambrian Limited

As Nominated Adviser:

Andrew Thomson / Stephen Allen

Phone: +61 (0)8 9480 2500

As Joint Broker:

Jonathan Williams

Phone: +44 20 3440 6800

Numis Securities Limited

As Joint Broker:

John Prior / James Black / Paul Gillam

Phone: +44 20 7260 1000

SHARE REGISTRY: ASX

Computershare Investor Services Pty Limited

Level 11, 172 St Georges Terrace

PERTH WA 6000

Enquiries: 1300 850 505 / +61 (3) 9415 4000

www.computershare.com.au

SHARE REGISTRY: AIM

Computershare Investor Services PLC

The Pavilions

Bridgwater Road

BRISTOL BS99 6ZZ

Enquiries: +44 (0) 870 702 0003

www.computershare.co.uk

AUSTRALIAN MEDIA RELATIONS

Cannings Purple

Annette Ellis / Andrew Rowell

Email: aellis@canningspurple.com.au /

arowell@canningspurple.com.au

Phone: +61 (0)8 6314 6300

UK MEDIA RELATIONS

Tavistock Communications

Jos Simson / Emily Fenton

Phone: +44 (0) 207 920 3150

KENYA MEDIA RELATIONS

Africapractice (East Africa)

Evelyn Njoroge / James Njuguna/Joan Kimani

Phone: +254 (0)20 239 6899

Email: jkimani@africapractice.com

PRINCIPAL & REGISTERED OFFICE

Level 1, 50 Kings Park Road

West Perth, Western Australia, 6005

Email: info@baseresources.com.au

Phone: +61 (0)8 9413 7400

Fax: +61 (0)8 9322 8912

END

(END) Dow Jones Newswires

April 12, 2017 02:00 ET (06:00 GMT)

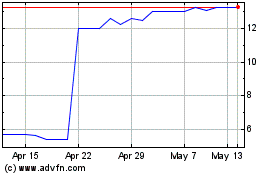

Base Resources (LSE:BSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

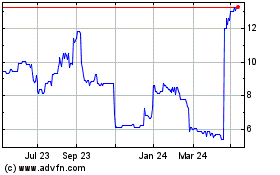

Base Resources (LSE:BSE)

Historical Stock Chart

From Apr 2023 to Apr 2024