BlackRock Income Portfolio Update

March 15 2023 - 9:55AM

UK Regulatory

TIDMBRIG

The information contained in this release was correct as at 28 February 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK INCOME & GROWTH INVESTMENT TRUST PLC (LEI:5493003YBY59H9EJLJ16)

All information is at 28 February 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five Since

Month Months Year Years Years 1 April

2012

Sterling

Share price 0.3% 2.2% 11.2% 21.7% 17.8% 114.7%

Net asset value 1.8% 5.7% 8.1% 28.2% 29.0% 117.1%

FTSE All-Share Total Return 1.5% 4.6% 7.3% 28.9% 29.2% 111.4%

Source: BlackRock

BlackRock took over the investment management of the Company with effect from 1

April 2012.

At month end

Sterling:

Net asset value - capital only: 211.84p

Net asset value - cum income*: 213.02p

Share price: 190.50p

Total assets (including income): £48.7m

Discount to cum-income NAV: 10.6%

Gearing: 5.2%

Net yield**: 3.8%

Ordinary shares in issue***: 20,968,251

Gearing range (as a % of net assets): 0-20%

Ongoing charges****: 1.2%

* Includes net revenue of 1.18 pence per share

** The Company's yield based on dividends announced in the last 12 months as at

the date of the release of this announcement is 3.8% and includes the 2022

interim dividend of 2.60p per share declared on 22 June 2022 with pay date 1

September 2022 and the 2022 final dividend of 4.70p per share declared on 1

February 2023 with pay date 15 March 2023.

*** excludes 10,081,532 shares held in treasury.

**** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

October 2022.

Sector Analysis Total assets (%)

Support Services 11.0

Pharmaceuticals & Biotechnology 10.1

Oil & Gas Producers 9.5

Banks 9.4

Media 7.7

Financial Services 6.7

Mining 6.4

Household Goods & Home Construction 6.3

Personal Goods 4.0

General Retailers 4.0

Health Care Equipment & Services 3.1

Life Insurance 3.0

Tobacco 2.8

Electronic & Electrical Equipment 2.7

Food Producers 2.6

Nonlife Insurance 1.8

Gas, Water & Multiutilities 1.3

Fixed Line Telecommunications 1.2

Real Estate Investment Trusts 1.2

Leisure Goods 1.0

Travel & Leisure 0.7

Net Current Assets 3.5

-----

Total 100.0

=====

Country Analysis Percentage

United Kingdom 90.2

France 2.1

Switzerland 2.1

United States 2.1

Net Current Assets 3.5

-----

100.0

=====

Top 10 holdings Fund %

Shell 7.6

AstraZeneca 7.1

RELX 4.9

Rio Tinto 4.3

Reckitt Benckiser 4.0

3i Group 3.8

Standard Chartered 3.7

Smith & Nephew 3.1

Phoenix Group 3.0

Unilever 2.9

Commenting on the markets, representing the Investment Manager noted:

Performance Overview:

The Company returned 1.8% during the month, outperforming the FTSE All-Share

which returned 1.5%.

The FTSE All Share Index rose 1.5% during the month with Oil & Gas,

Telecommunications and Health Care as top performing sectors while Basic

Materials and Technology underperformed.

The bigger than expected fall in UK inflation prompted a repricing of Bank of

England rate expectations and helped the FTSE 100 to break the 8000 barrier1

for the first time.

The Oil & Gas sector saw strength despite a flat oil price as holdings

including Shell reported better than expected results.

The Bank of England hiked interest rates by 50bps2 as expected but signalled it

was closer to pausing. This move was matched by the European Central Bank as

the Euro area Q4 GDP data showed a marked slowing of growth in the second half

of the year and outright contraction in the four largest European economies.

In the US, the annual rate of the personal consumption expenditures (PCE) index

rose to 4.6%3 in January, missing economists' expectations for a moderation to

4.3%. The CPI for January also showed that core inflation is proving persistent

and is not consistent with prior market hopes of a quick return to the Federal

Reserve's 2% target. The labour market showed few signs of cooling with the

tightness persisting due to a lack of supply, leading to higher job postings.

There was a clear services story in the January payrolls report, with the

majority of the new jobs created in the services sector. In addition, the S&P

Global US Flash Composite purchasing managers' index (PMI) rose to its highest

level since June 2022. These CPI and PMI revisions and the payrolls data showed

the tightest labour market in half a century. The Fed went on to deliver a

25bps4 hike and asserted "it is only the early stage" of the disinflation

process.

Stocks:

Standard Chartered was the top positive contributor to performance during the

period. While short term results were a touch weaker on provisions, the shares

rose in response a mix of greater optimism from management in achieving their

return on equity targets through an expanding net interest margin alongside

further bid speculation.

RELX was another top positive contributor; organic growth for 2022 was ahead of

expectations as the Risk division continues to compound at a high rate while

Legal and STM are benefitting from new product investment in data analytics.

The share prices of Tate & Lyle and Smith & Nephew also rose after both

companies delivered strong results.

Watches of Switzerland was a top detractor from performance during the month as

the company's share price fell on the back of their Q3 results. While the sales

growth slowed down in Q3 versus H1, this was predominantly driven by jewellery,

which fell mainly on the back of the company's own decision not to discount and

to hold its price premium versus competition.

Rio Tinto and BHP also detracted from performance as miners saw general

weakness during the period.

Changes:

Trading activity was limited during the period; we reduced positions in British

American Tobacco and Moonpig.

Outlook:

Inflation has consistently surprised in its depth and breadth, driven by

resilient demand, supply chain constraints, and most importantly by rising

wages in more recent data. Central banks across the developed world continue to

unwind ten years of excess liquidity by tightening monetary policy, desperate

to prevent the entrenchment of higher inflation expectations. Meanwhile, the

risk of policy error from central banks or politicians remains high, as

evidenced by the turmoil created by the 'mini-budget' in the UK that sent gilts

spiralling. The cost and availability of credit has changed and strengthens our

belief in investing in companies with robust balance sheets capable of funding

their own growth. The rise in the risk-free or discount rate also challenges

valuation frameworks especially for long duration, high growth or highly valued

businesses. We are mindful of this and feel it is incredibly important to focus

on companies with strong, competitive positions, at attractive valuations that

can deliver in this environment.

The political and economic impact of the war in Ukraine has been significant in

uniting Europe and its allies, whilst exacerbating the demand/supply imbalance

in the oil and soft commodity markets. We are conscious of the impact this has

on the cost of energy, and we continue to expect divergent regional monetary

approaches with the US being somewhat more insulated from the impact of the

conflict, than for example, Europe. Complicating this further, is the continued

impact COVID is having on certain parts of the world, notably China, which has

used lockdowns to control the spread of the virus impacting economic activity.

We also see the potential for longer-term inflationary pressure from

decarbonisation and deglobalisation, the latter as geopolitical tensions rise

more broadly across the world.

We would expect broader demand weakness as we enter 2023 although the 'scars'

of supply chain disruption are likely to support parts of industrial capital

expenditure demand as companies seek to enhance the resilience of their supply

chains. A notable feature of our conversations with a wide range of corporates

has been the ease with which they have been able to pass on cost increases and

protect or even expand margins during 2022, as evidenced by US corporate

margins reaching 70-year highs. We believe that as demand weakens and as the

transitory inflationary pressures start to fade during 2023 (e.g. commodity

prices, supply chain disruption) then pricing conversations will become more

challenging, despite pressure from wage inflation which may prove more

persistent. While this does not bode well for margins in aggregate, we believe

that 2023 will see greater differentiation as corporates' pricing power will

come under intense scrutiny.

The UK's policy has somewhat diverged from the G7 in fiscal policy terms as the

present government attempts to create stability after the severe reaction from

the "mini-budget". The early signs of stability are welcome as financial market

liquidity has increased and the outlook, whilst challenged, has improved.

Although the UK stock market retains a majority of internationally weighted

revenues, the domestic facing companies have continued to be impacted by this

backdrop, notably financials, housebuilders and property companies. The

valuation of the UK market remains highly supportive as currency weakness

supports international earnings, whilst domestic earners are in many cases at

COVID or Brexit lows in share price or valuation terms. Although we anticipate

further volatility ahead as earnings estimates moderate, we know that in the

course of time, risk appetites will return and opportunities are emerging.

We continue to focus the portfolio on cash generative businesses with durable,

competitive advantages boasting strong leadership as we believe these companies

are best-placed to drive returns over the long-term. We anticipate economic

and market volatility will persist in 2023 and we are excited by the

opportunities this will likely create by identifying those companies using this

cycle to strengthen their long-term prospects as well as attractive turnarounds

situations.

1 Source: Investment Week, February 2023: https://www.investmentweek.co.uk/news

/4074541/ftse-100-breaks-historic-barrier#::text=

The%20FTSE%20100%20has%20broken,8%2C045.89%20at%20time%20of%20writing.

2 Source: Bank of England, February 2023: https://www.bankofengland.co.uk/

monetary-policy-summary-and-minutes/2023/february-2023

3 Source: Financial Times, February 2023: https://www.ft.com/content/

87593f86-501d-4e28-ac1f-bb72127bcc7f

4 Source: Financial Times, February 2023: https://www.ft.com/content/

03b5354d-ad3c-4bfd-b1cc-c64d46dfdf28

15 March 2023

END

(END) Dow Jones Newswires

March 15, 2023 09:55 ET (13:55 GMT)

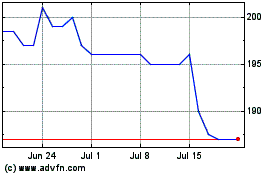

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Blackrock Income And Gro... (LSE:BRIG)

Historical Stock Chart

From Sep 2023 to Sep 2024