BioPharma Credit PLC Notice of Results (9384O)

August 24 2017 - 10:15AM

UK Regulatory

TIDMBPCR

RNS Number : 9384O

BioPharma Credit PLC

24 August 2017

24 August 2017

BIOPHARMA CREDIT PLC

("BPC" or the "Group")

NOTICE OF RESULTS - PLEASE NOTE NEW TIMINGS FOR THE MEETING

BioPharma Credit PLC (LSE: BPC), the life sciences debt

investment trust, will announce its audited Half Year Results for

the period ending 30 June 2017, on Thursday 21 September 2017.

A management presentation will be held at 10:30 at Goldman

Sachs, Peterborough Court, 133 Fleet Street, London EC4A 2BB. A

conference call facility will also be available.

To confirm your attendance, or request conference call details,

RSVP to tmitchell@bellpottinger.com by Wednesday 13 September

2017.

-Ends-

For further information, please contact:

BioPharma Credit

Alex v. Perfall (Royalty

Pharma)

Jeff Caprio (Pharmakon

Advisors) +1 (212) 883 2263

J.P. Morgan Cazenove

William Simmonds

Oliver Kenyon +44 (0)20 7742 4000

Goldman Sachs

Shomick Bhattacharya

Charlie Lytle

Tom Hartley +44 (0)20 7774 1000

Bell Pottinger

David Rydell

Ian Shackleton +44 (0)20 3772 2602

About BioPharma Credit:

Shares of BioPharma Credit PLC were successfully admitted to

trading on the Specialist Fund Segment of the Main Market of the

London Stock Exchange on 27 March 2017: one of the largest IPO's in

the London market this year with a market capitalisation just under

$800m. Gross proceeds included a portfolio of $338.6 million in

seed assets, comprised of loans secured by royalties and other cash

flows from sales of close to 30 life sciences products.

The company provides investors with an opportunity to gain

uncorrelated returns and exposure to the fast-growing life sciences

industry, through a diversified portfolio of loans and other

instruments backed by royalties or other cash flows derived from

sales of approved life sciences products.

BioPharma Credit's primary objective is to generate predictable

income for shareholders over the long term. Once substantially

invested, BioPharma Credit will target an annual dividend yield of

7 per cent. (calculated by reference to the Issue Price), and a net

total return on NAV of 8 to 9 per cent. per annum in the medium

term. Pharmakon Advisors, the fund's Investment Manager, was

founded in 2009 and has invested US$1.3 billion in 20 transactions

across four funds. The first three funds are now fully invested.

Drawing upon the expertise and successful track record of Pharmakon

Advisors, the fund enjoys access to its extensive, life sciences

industry-focused knowledge and contacts to source, analyse and

structure attractive debt investments.

Through a shared services agreement with Royalty Pharma, founded

in 1996, the Investment Manager will be able to rely on the

complementary expertise of the team behind the market leading

investor in pharmaceutical royalties.

More details are available on www.bpcruk.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NORMMGZRDDFGNZM

(END) Dow Jones Newswires

August 24, 2017 10:15 ET (14:15 GMT)

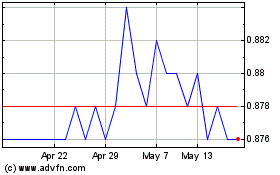

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From Apr 2024 to May 2024

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From May 2023 to May 2024