TIDMBHP

RNS Number : 9855W

BHP Group Limited

21 April 2023

A version of this document with diagrams related to the Ocelot

project referred to as Figure 1, Figure 2 and Figure 3 in Appendix

1: BHP Copper Exploration Ocelot is available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Release Time IMMEDIATE

Date 21 April 2023

Release Number 9/23

BHP OPERATIONAL REVIEW

FOR THE NINE MONTHSED 31 MARCH 2023

-- A colleague, Jody Byrne, tragically was fatally injured in a

rail incident in our Port Hedland operations in February.

-- Production guidance for the 2023 financial year remains

unchanged for iron ore, metallurgical coal and energy coal. Strong

performance means Olympic Dam and Pampa Norte are expected to be

toward the upper end of their guidance ranges, while BHP Mitsubishi

Alliance (BMA) is expected to be at the bottom of its range.

-- Production guidance at Escondida has been lowered to between

1,050 and 1,080 kt (from between 1,080 and 1,180 kt). Given the

strong performance at the other copper assets, full year total

copper production guidance remains unchanged at between 1,635 and

1,825 kt. Full year nickel production has been lowered to between

75 and 85 kt (from between 80 and 90 kt).

-- Western Australia Iron Ore (WAIO) achieved record production

of 212 .6 Mt (100% basis) for the nine month period. Pleasingly,

there was no significant damage or reported injuries at our WAIO

sites as a result of Tropical Cyclone Ilsa. Our Port Hedland

operations were suspended in coordination with the Pilbara Ports

Authority.

-- Full year unit cost guidance(1) remains unchanged from the

half year period ended 31 December 2022. Escondida and WAIO are

expected to be at the top of their respective ranges.

-- On 13 April 2023, shareholders of OZ Minerals Ltd (OZL) voted

to approve the scheme of arrangement for BHP to acquire 100 per

cent of the shares in OZL . The Scheme became effective on 18 April

2023 and is expected to be implemented on 2 May 2023.

-- The South Australian government has granted environmental

approval for the next phase of exploration drilling at Oak Dam.

-- BHP has identified a new copper porphyry mineralised system,

Ocelot, in the Miami-Globe copper district in Arizona, United

States.

BHP Chief Executive Officer, Mike Henry:

"Safety is paramount, and we are deeply saddened by the tragic

death of Jody Byrne in an incident at Port Hedland in February. An

investigation into the cause of the incident is underway, the

findings of which will be shared widely.

"Our WA iron ore business achieved record production, and total

copper output for the Group was up for the nine months, while

metallurgical coal volumes were down slightly due to significant

wet weather. Overall copper production for the year remains on

track, however we've reduced production guidance at Escondida and

also at Nickel West. We continue to focus on safety, productivity

and costs as we navigate ongoing challenges and inflationary

impacts.

1

"Last week, OZ Minerals shareholders voted overwhelmingly in

favour of BHP's offer. We are now focused on the safe integration

of the two businesses and we look forward to building an

internationally competitive copper business in South Australia and

incorporating West Musgrave into our nickel options in Western

Australia. We are pursuing growth options in copper and nickel

globally - we aim to have up to 10 drill rigs on the ground at Oak

Dam in South Australia in the next few months and have seen

promising results from a potential new copper prospect in Arizona.

In Canada, we signed $260 million (CAD) in new contracts with

Indigenous suppliers in March, and construction of the Jansen

potash project is on track.

"Recent engagements with customers in China and India have

reaffirmed our positive outlook for commodity demand, with China's

economic rebound and solid momentum in India's steelmaking growth

helping to offset the impact of slowing growth in the US, Japan and

Europe."

Summary

Operational performance

Production and guidance are summarised below.

Mar YTD23 Mar Q23 Mar Q23 Previous Current

Mar Mar vs vs vs FY23 FY23

Production YTD23 Q23 Mar YTD22 Mar Q22 Dec Q22 guidance guidance

--------------------------- -------- ----- ---------- -------- -------- ------------- -------------

Copper (kt) 1,240.3 405.9 12% 10% (4%) 1,635 - 1,825 1,635 - 1,825 Unchanged

Escondida (kt) 762.3 251.6 7% 11% (2%) 1,080 - 1,180 1,050 - 1,080 Lowered

Pampa Norte (kt) 220.3 73.0 8% 7% (5%) 240 - 290 240 - 290 Upper end

Olympic Dam (kt) 155.8 51.7 88% 33% (5%) 195 - 215 195 - 215 Upper end

Antamina (kt) 101.9 29.6 (8%) (18%) (16%) 120 - 140 120 - 140 Unchanged

Iron ore (Mt) 191.7 59.8 1% 0% (11%) 249 - 260 249 - 260

WAIO (Mt) 188.5 58.7 1% 0% (11%) 246 - 256 246 - 256 Unchanged

WAIO (100% basis) (Mt) 212.6 66.2 1% (1%) (11%) 278 - 290 278 - 290 Unchanged

Samarco (Mt) 3.3 1.0 7% 5% (4%) 3 - 4 3 - 4 Top end

Metallurgical coal - BMA

(Mt) 20.5 6.9 (2%) (13%) 0% 29 - 32 29 - 32

BMA (100% basis) (Mt) 41.1 13.9 (2%) (13%) 0% 58 - 64 58 - 64 Bottom end

Energy coal - NSWEC (Mt) 9.4 3.9 (4%) 53% 38% 13 - 15 13 - 15 Unchanged

Nickel (kt) 58.0 19.6 0% 5% 11% 80 - 90 75 - 85 Lowered

Mar YTD23 Mar Q23

Production (vs Mar YTD22) (vs Dec Q22) Mar Q23 vs Dec Q22 commentary

----------------------- --------------- ------------- ------------------------------------------------------------------------------------------

Copper (kt) 1,240.3 405.9 Lower concentrate volumes at Escondida reflect the impact of different ore feed sources on

throughput and recovery performance, and lower volumes at Olympic Dam as a result of reduc

ed

refinery productivity following the tie-in of minor upgrade works.

12% (4%)

Iron ore (Mt) 191.7 59.8 Lower volumes at WAIO due to the temporary shutdown of all operations following the tragic

fatality in February, and the planned tie-in activity of the Port Debottlenecking Project

1 (PDP1).

1% (11%)

Metallurgical coal (Mt) 20.5 6.9 Production in line with the prior period despite continued significant wet weather.

(2%) 0%

Energy coal (Mt) 9.4 3.9 Higher production following improved weather, labour stability and strip ratios, and a red

uced

proportion of washed coal.

(4%) 38%

Nickel (kt) 58.0 19.6 Higher volumes due to planned maintenance at the smelter and refinery in the prior quarter

and increased purchases of third party products.

0% 11%

2

Corporate update

Portfolio

In February, BHP issued US$2.75 billion in senior unsecured

bonds in the US market comprising: US$1.0 billion in three-year

bonds; US$1.0 billion in five-year bonds; and US$0.75 billion in

10-year bonds with the proceeds intended for general corporate

purposes.

On 13 April, BHP announced that OZ Minerals Ltd (OZL)

shareholders approved the scheme of arrangement for BHP to acquire

100 per cent of the shares in OZL (the Scheme). The Scheme became

effective on 18 April 2023 and is expected to be implemented on 2

May 2023. Once effective, the acquisition of OZL and its assets

will provide BHP with further exposure to copper, nickel and

uranium. OZL's shareholders will be paid total cash consideration

of A$28.25 per OZL share, comprising the scheme consideration paid

by BHP of A$26.50 for each OZL share held at the scheme record

date, which is 24 April 2023, and a fully franked special dividend

paid by OZL of A$1.75 for each OZL share held on the special

dividend record date, which is 21 April 2023. The cash payment by

BHP will be funded using a combination of BHP's existing cash

reserves and the proceeds of a debt facility.

Decarbonisation

Throughout the March 2023 quarter we continued to make progress

towards our decarbonisation targets and goals and supported efforts

to reduce greenhouse gas (GHG) emissions across our value chain.

For example:

-- BHP signed an agreement with Hatch to design an electric

smelting furnace (ESF) pilot plant to demonstrate a pathway to

lower carbon dioxide (CO(2) ) intensity in steel production using

iron ore from our WAIO mines. Estimates show that reductions of

more than 80 per cent in CO(2) emissions intensity are potentially

achievable processing Pilbara iron ores through a Direct Reduced

Iron (DRI)-ESF pathway, compared to the current industry average

using the conventional blast furnace route.

-- BHP expanded its Memorandum of Understanding (MoU) with

China's HBIS Group , one of the world's largest steelmakers and a

major iron ore customer of BHP, to incorporate a pilot of carbon

capture and utilisation technology at HBIS's steel operations in

China.

-- BHP announced the trial of Hydrotreated Vegetable Oil (HVO)

to power haul trucks and other mining equipment over an initial

three-month trial period at the Yandi iron ore operations in

Western Australia in collaboration with BP. The HVO has

internationally recognised certification as being sourced from more

sustainable feedstocks such as waste products.

Copper

Production

Mar YTD23 Mar Q23 Mar Q23

vs vs vs

Mar YTD23 Mar Q23 Mar YTD22 Mar Q22 Dec Q22

--------- ------- ---------- -------- --------

Copper (kt) 1,240.3 405.9 12% 10% (4%)

Zinc (t) 86,226 23,612 (10%) (28%) (21%)

Uranium (t) 2,593 833 62% 7% (12%)

Copper - Total copper production increased by 12 per cent to

1,240 kt. Guidance for the 2023 financial year remains unchanged at

between 1,635 and 1,825 kt.

3

Escondida copper production increased by seven per cent to 762

kt primarily due to higher concentrator feed grade of 0.79 per

cent, compared to 0.74 per cent in the nine months to March 2022.

The positive impact of higher grade was partially offset by the

impact of road blockades across Chile in the December 2022 quarter,

which reduced availability of some key mine supplies. Full year

production has been lowered to between 1,050 and 1,080 kt (from

between 1,080 and 1,180 kt) as we manage geotechnical risk in a

high grade section of the Escondida pit. This has led to a

resequencing of the mine plan, resulting in lower volumes of mined

ore and increased processing of lower grade stockpiles through the

concentrators. Concentrator feed grade is expected to improve in

the June 2023 quarter, compared to the nine months ended March

2023. Medium term guidance of 1.2 Mtpa of copper production on

average over the next five years remains unchanged.

Pampa Norte copper production increased by eight per cent to 220

kt as a result of higher concentrator throughput at the Spence

Growth Option (SGO). Full year production is expected to be towards

the upper end of the guidance range of between 240 and 290 kt. The

SGO plant modifications which commenced in August 2022 are planned

to be completed in the 2023 calendar year. Expected capital

expenditure for the works remains unchanged at approximately US$100

million. Further studies are ongoing for additional capacity uplift

at SGO. Cerro Colorado continues to transition towards planned

closure at the end of the 2023 calendar year.

Olympic Dam copper production of 156 kt was an increase of 88

per cent on the prior period, primarily as a result of the major

smelter maintenance campaign (SCM21) across the December 2021 and

March 2022 quarters. Continued strong concentrator and smelter

performance has delivered record concentrate smelted for the nine

month period. The March 2023 quarter was also a record gold

production quarter, contributing to a record nine months for both

gold and silver production following the implementation of

debottlenecking initiatives in the prior year. Copper production is

expected to be towards the upper end of the guidance range for the

2023 financial year at between 195 and 215 kt.

Antamina copper production decreased by eight per cent to 102 kt

reflecting expected lower copper feed grades, partially offset by

higher throughput. Zinc production was 10 per cent lower at 86 kt

reflecting expected lower zinc feed grades, partially offset by

higher throughput. Production guidance remains unchanged for the

2023 financial year, with copper production of between 120 and 140

kt, and zinc production of between 115 and 135 kt.

4

Iron ore

Production

Mar YTD23 Mar Q23 Mar Q23

vs vs vs

Mar YTD23 Mar Q23 Mar YTD22 Mar Q22 Dec Q22

------------- -------------- ---------- -------- --------

Iron ore production (kt) 191,748 59,773 1% 0% (11%)

Iron ore - Total iron ore production increased by one per cent

to 192 Mt. Guidance for the 2023 financial year remains unchanged

at between 249 and 260 Mt.

WAIO production increased by one per cent to a nine month record

of 188 Mt (213 Mt on a 100 per cent basis), reflecting continued

strong supply chain performance, including improved car dumper

utilisation and lower COVID--19 related impacts than the prior

period. This was partially offset by a 24 hour safety stop across

the WAIO business and a further two day suspension of rail

operations following the tragic fatality, and the planned tie-in of

PDP1, which remains on track to be completed in the 2024 calendar

year.

The production ramp up at South Flank remains on track to reach

full capacity of 80 Mtpa (100 per cent basis) by the end of the

2024 financial year. Current year performance has contributed to

record year to date WAIO lump sales. Additionally, the deployment

of autonomous haul trucks is well progressed and is expected to be

completed by the end of the 2023 calendar year.

WAIO production guidance for the 2023 financial year remains

unchanged at between 246 and 256 Mt (278 and 290 Mt on a 100 per

cent basis). There has been no significant damage or reported

injuries at our WAIO sites as a result of Tropical Cyclone Ilsa in

April 2023. Our Port Hedland operations were suspended in

coordination with the Pilbara Ports Authority, but have since

ramped up to full capacity. Full year unit cost guidance at WAIO of

between $18 and $19 per tonne is expected to be at the top of the

range.

Samarco production increased by seven per cent to 3.3 Mt (BHP

share), reflecting strong concentrator performance. Production for

the 2023 financial year is expected to be at the top of the

guidance range of between 3 and 4 Mt (BHP share).

In late March, the Fourth Federal Court in Brazil ordered BHP

Brasil and Vale to deposit a total of BRL 10.3 billion

(approximately US$1.0 billion, BHP Brasil share) in 10 instalments

to be paid every 40 days, with the first instalment due on 20 May.

The decision relates to a dispute as to whether certain territories

in the State of Espírito Santo were affected by the dam failure.

The Fourth Federal Court ordered that the deposit be paid to ensure

that funds are available if required for reparation in those

territories. BHP Brasil has appealed the decision.

The Group's provisions related to the Samarco dam failure and

Germano dam decommissioning are subject to ongoing assessment and

totalled US$3.3 billion as at 31 December 2022, including an

expected cash outlay for the 2023 calendar year of US$1.95

billion.

There are a number of matters related to the Samarco dam failure

which are disclosed as contingent liabilities and given the status

of proceedings it is not possible to provide a range of possible

outcomes or a reliable estimate of potential future exposures for

BHP. Please refer to the financial results for the period ending 31

December 2022 for further information.

5

Coal

Production

Mar YTD23 Mar Q23 Mar Q23

vs vs vs

Mar YTD23 Mar Q23 Mar YTD22 Mar Q22 Dec Q22

--------------- --------------- ---------- -------- --------

Metallurgical coal (kt) 20,543 6,929 (2%) (13%) 0%

Energy coal (kt) 9,408 3,934 (4%) 53% 38%

Metallurgical coal - BMA production decreased by two per cent to

21 Mt (41 Mt on a 100 per cent basis) as a result of significant

wet weather. This was partially offset by continued improvement in

underlying truck productivity, in particular at Goonyella and

Daunia following the completion of their autonomous fleet

transitions, as well as reduced COVID-19 related labour

constraints. In the nine months to March 2023, BMA has experienced

the highest level of rainfall in the past 10 years, significantly

impacting production.(2)

Full year production is expected to be at the bottom of the

guidance range of between 29 and 32 Mt (58 and 64 Mt on a 100 per

cent basis), with further wet weather in the June 2023 quarter

posing a risk to this outcome. The additional long wall move at

Broadmeadow noted in the December 2022 Operational Review is

planned to commence in June 2023.

While we will continue to sustain and optimise our existing

assets, BMA is not making significant new investments in Queensland

given the changes to the royalty regime imposed by the current

government which have increased risk and reduced competitiveness of

investments in the State.

Energy coal - New South Wales Energy Coal (NSWEC) production

decreased by four per cent to 9 Mt reflecting the impacts of the

wet weather experienced in the December 2022 half, and the

increased proportion of washed coal. This was partially offset by

improved stability in labour, particularly reduced absenteeism

which impacted stripping performance and mine productivity in the

prior period. Higher quality products made up approximately 85 per

cent of sales, compared to approximately 90 per cent in the prior

period. Production guidance for the 2023 financial year remains

unchanged at between 13 and 15 Mt.

Following the NSW Government Directions to local thermal coal

producers, NSWEC has started delivering their domestic allocation

of 0.175 Mt per quarter from April 2023. The full allocation for

the June 2023 quarter has been sold at 100 per cent of the current

price cap of A$125 per tonne. The reservation allocation for the

2024 financial year is expected to be 0.7 Mt in line with the

Directions.

Other

Nickel production

Mar YTD23 Mar Q23 Mar Q23

vs vs vs

Mar YTD23 Mar Q23 Mar YTD22 Mar Q22 Dec Q22

--------- ------- ---------- -------- --------

Nickel (kt) 58.0 19.6 0% 5% 11%

Nickel - Nickel West production was in line with the prior

period at 58 kt, with the ramp up of the refinery following planned

maintenance in the December 2022 quarter offset by the increased

proportion of concentrate and matte products.

In March, Nickel West advised one of its third party product

providers, Mincor Resources, that it will no longer accept

off-specification product containing high levels of arsenic due to

the issues with processing this ore. Further, a heavy rain event

was experienced at the Mt Keith operations in early April 2023

impacting mine progression. As a result, production guidance for

the 2023 financial year has been revised to between 75 and 85 kt

(from between 80 and 90 kt).

6

Potash - Our major potash project under development at Jansen is

tracking to plan. In the March 2023 quarter, we commenced blasting

and excavation work at the bottom of the shafts. For the remainder

of the 2023 financial year, we will continue to focus on civil and

mechanical construction on the surface and underground, as well as

equipment procurement and port construction. The feasibility study

for Jansen Stage 2 continues to progress and is on track to be

completed during the 2024 financial year.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

------------ ------------ ----------- ------------------------------- --------------

Jansen Stage 5,723 End-CY26 Design, engineering and Project is 20%

1 construction of an underground complete

potash mine and surface

infrastructure, with capacity

to produce 4.35 Mtpa.

(Canada)

100%

Minerals exploration

Minerals exploration expenditure for the nine months to 31 March

2023 was US$239 million, of which US$196 million was expensed.

BHP has identified a new copper porphyry mineralised system,

Ocelot, located 140 km east of Phoenix, Arizona, United States in

the Miami-Globe copper district. From 2019 to present, BHP has

drilled 12 holes in the project area, totalling 17,748 metres with

10 holes intersecting porphyry copper style mineralisation. Ten of

the holes resulted in 12 intervals of significant intercepts with

laboratory assay results average copper grades ranging from 0.44 to

0.92 per cent copper. The project remains at an early exploration

stage with two holes to be completed from the current exploration

drill program and is expected to be completed by May 2023. For

further details refer to Appendix 1.

At Oak Dam in South Australia we continue to work in close

partnership with traditional owners, and the South Australian

government have recently granted environmental approval for the

next phase of exploration drilling. The approval permits up to 14

drill rigs, more than double the current approval, an accommodation

camp for up to 150 people and core processing facilities. We

currently operate 6 drills rigs in the area and expect to increase

this to 10 drill rigs by the end of the September 2023 quarter.

Following the execution of the Option Agreement with Mundoro

Capital in January 2023, covering three exploration projects in

Serbia (Trstenik, Borsko and South Timok), Mundoro has commenced

initial drilling on the Borsko project.

The inaugural BHP Xplor accelerator program, supporting

early-stage mineral exploration companies to find critical

resources, such as copper and nickel, is now underway. Seven

companies were selected into the program, which offers participants

in-kind services, mentorship and networking opportunities.

Elsewhere, we continue to progress exploration activities in

Canada, Chile, Ecuador, and Peru.

7

Variance analysis relates to the relative performance of BHP

and/or its operations during the nine months ended March 2023

compared with the nine months ended March 2022, unless otherwise

noted. Production volumes, sales volumes and capital and

exploration expenditure from subsidiaries are reported on a 100 per

cent basis; production and sales volumes from equity accounted

investments and other operations are reported on a proportionate

consolidation basis. Numbers presented may not add up precisely to

the totals provided due to rounding.

The following footnotes apply to this Operational Review:

1 2023 financial year unit cost guidance: Escondida

US$1.25-1.45/lb, WAIO US$18-19/t, BMA US$100-105/t and NSWEC

US$84-91/t; based on exchange rates of AUD/USD 0.72 and USD/CLP

830.

2 767mm of rainfall recorded at Moranbah in the nine months

ended 31 March 2023 compared to 498mm in the nine months ended 31

March 2022. The first nine months of financial year 2023 are the

wettest in the last ten years, and the fifth wettest in the last

fifty years.

The following abbreviations may have been used throughout this

report: cost and freight (CFR); cost, insurance and freight (CIF);

dry metric tonne unit (dmtu); free on board (FOB); grams per tonne

(g/t); kilograms per tonne (kg/t); kilometre (km); megawatt (MW);

metre (m); millimetre (mm); million tonnes (Mt); million tonnes per

annum (Mtpa); ounces (oz); pounds (lb); thousand ounces (koz);

thousand tonnes (kt); thousand tonnes per annum (ktpa); thousand

tonnes per day (ktpd); tonnes (t); and wet metric tonnes (wmt).

In this release, the terms 'BHP', the 'Group', 'BHP Group',

'we', 'us', 'our' and 'ourselves' are used to refer to BHP Group

Limited and, except where the context otherwise requires, our

subsidiaries. Refer to note 28 'Subsidiaries' of the Financial

Statements in BHP's 30 June 2022 Appendix 4E for a list of our

significant subsidiaries. Those terms do not include non-operated

assets. Notwithstanding that this release may include production,

financial and other information from non-operated assets,

non-operated assets are not included in the BHP Group and, as a

result, statements regarding our operations, assets and values

apply only to our operated assets unless stated otherwise. Our

non-operated assets include Antamina and Samarco. BHP Group

cautions against undue reliance on any forward-looking statement or

guidance in this release, particularly in light of the current

economic climate and significant volatility, uncertainty and

disruption arising in connection with COVID-19. These

forward-looking statements are based on information available as at

the date of this release and are not guarantees or predictions of

future performance and involve known and unknown risks,

uncertainties and other factors, many of which are beyond our

control and which may cause actual results to differ materially

from those expressed in the statements contained in this

release.

8

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley John-Paul Santamaria

Tel: +61 3 9609 3830 Mobile: Mobile: +61 499 006 018

+61 411 071 715

Europe, Middle East and Africa

Europe, Middle East and Africa

James Bell

Neil Burrows Tel: +44 20 7802 7144 Mobile:

Tel: +44 20 7802 7484 Mobile: +44 7961 636 432

+44 7786 661 683

Americas

Americas

Monica Nettleton

Renata Fernandez Mobile: +1 416 518 6293

Mobile: +56 9 8229 5357

BHP Group Limited ABN 49 004

028 077

LEI WZE1WSENV6JSZFK0JC28

Registered in Australia

Registered Office: Level 18,

171 Collins Street

Melbourne Victoria 3000 Australia

Tel +61 1300 55 4757 Fax +61

3 9609 3015

BHP Group is headquartered in Australia

Follow us on social media

9

Production summary

Year to

Quarter ended date

--------------------------------------------------------------- ------------------------

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2022 2022 2022 2022 2023 2023 2022

--------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Copper (1)

Copper

Payable metal in

concentrate (kt)

Escondida (2) 57.5% 178.2 233.5 203.1 208.3 200.8 612.2 569.1

Pampa Norte (3) 100.0% 32.4 28.2 28.6 32.5 32.0 93.1 83.0

Antamina 33.8% 36.1 39.6 37.1 35.2 29.6 101.9 110.3

Total 246.7 301.3 268.8 276.0 262.4 807.2 762.4

Cathode (kt)

Escondida (2) 57.5% 48.2 55.8 49.6 49.7 50.8 150.1 145.6

Pampa Norte (3) 100% 35.8 49.0 42.0 44.2 41.0 127.2 121.0

Olympic Dam 100% 39.0 55.7 49.7 54.4 51.7 155.8 82.7

Total 123.0 160.5 141.3 148.3 143.5 433.1 349.3

Total copper (kt) 369.7 461.8 410.1 424.3 405.9 1,240.3 1,111.7

Lead

Payable metal in

concentrate (t)

Antamina 33.8% 282 181 228 114 169 511 937

Total 282 181 228 114 169 511 937

Zinc

Payable metal in

concentrate (t)

Antamina 33.8% 32,732 27,576 32,685 29,929 23,612 86,226 95,624

Total 32,732 27,576 32,685 29,929 23,612 86,226 95,624

Gold

Payable metal in

concentrate (troy

oz)

Escondida (2) 57.5% 36,303 45,770 38,236 48,402 48,954 135,592 121,202

Pampa Norte (3) 100% 7,929 8,198 5,521 3,875 8,152 17,548 20,672

Olympic Dam

(refined

gold) 100% 29,355 26,080 47,184 43,280 49,086 139,550 93,437

Total 73,587 80,048 90,941 95,557 106,192 292,690 235,311

Silver

Payable metal in

concentrate (troy

koz)

Escondida (2) 57.5% 1,270 1,311 1,210 1,510 1,346 4,066 4,023

Pampa Norte (3) 100% 261 262 252 245 409 906 749

Antamina 33.8% 1,191 1,212 1,190 923 801 2,914 3,866

Olympic Dam

(refined

silver) 100% 149 145 295 261 277 833 598

Total 2,871 2,930 2,947 2,939 2,833 8,719 9,236

10

Production summary

Year to

Quarter ended date

--------------------------------------------- ------------------

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2022 2022 2022 2022 2023 2023 2022

---------- ------- ------- ------- ------- --------- -------- --------

Uranium

Payable metal in

concentrate (t)

Olympic Dam 100% 781 776 817 943 833 2,593 1,599

Total 781 776 817 943 833 2,593 1,599

Molybdenum

Payable metal in

concentrate (t)

Pampa Norte (3) 100% - 71 34 216 407 657 -

Antamina 33.8% 190 249 262 348 229 839 549

Total 190 320 296 564 636 1,496 549

Iron Ore

Iron Ore

Production (kt) (4)

Newman 85% 11,940 14,063 14,053 16,172 11,925 42,150 42,978

Area C Joint Venture 85% 24,888 27,685 26,971 26,302 25,284 78,557 66,746

Yandi Joint Venture 85% 8,418 6,409 5,497 5,613 4,941 16,051 32,513

Jimblebar (5) 85% 13,444 15,005 17,404 17,720 16,575 51,699 43,777

Samarco 50% 994 1,000 1,148 1,095 1,048 3,291 3,071

Total 59,684 64,162 65,073 66,902 59,773 191,748 189,085

Coal

Metallurgical coal

Production (kt) (6)

BHP Mitsubishi Alliance

(BMA) 50% 7,944 8,183 6,662 6,952 6,929 20,543 20,959

Total 7,944 8,183 6,662 6,952 6,929 20,543 20,959

Energy coal

Production (kt)

NSW Energy Coal 100% 2,577 3,919 2,623 2,851 3,934 9,408 9,782

Total 2,577 3,919 2,623 2,851 3,934 9,408 9,782

Other

Nickel

Saleable production

(kt)

Nickel West 100% 18.7 18.8 20.7 17.7 19.6 58.0 58.0

Total 18.7 18.8 20.7 17.7 19.6 58.0 58.0

Cobalt

Saleable production

(t)

Nickel West 100% 125 110 238 93 175 506 522

Total 125 110 238 93 175 506 522

1 Metal production is reported on the basis of payable metal.

2 Shown on a 100% basis. BHP interest in saleable production is 57.5%.

3 Includes Cerro Colorado and Spence.

4 Iron ore production is reported on a wet tonnes basis.

5 Shown on a 100% basis. BHP interest in saleable production is 85%.

6 Metallurgical coal production is reported on the basis of

saleable product. Production figures may include some thermal

coal.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

11

Production and sales report

Quarter ended Year to

date

------------------------------------------------ ------------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

-------- -------- -------- -------- -------- -------- --------

Copper

Metals production is payable metal

unless otherwise stated.

Escondida, Chile

(1)

Material mined (kt) 107,676 115,409 110,248 101,987 106,170 318,405 338,834

Concentrator throughput (kt) 30,235 34,318 32,894 33,911 33,309 100,114 99,550

Average copper grade

- concentrator (%) 0.80% 0.88% 0.83% 0.76% 0.78% 0.79% 0.74%

Production ex mill (kt) 191.5 239.5 214.6 212.8 210.0 637.4 596.3

Production

Payable copper (kt) 178.2 233.5 203.1 208.3 200.8 612.2 569.1

Copper cathode (EW) (kt) 48.2 55.8 49.6 49.7 50.8 150.1 145.6

- Oxide leach (kt) 12.2 17.5 15.2 17.6 14.7 47.5 40.1

- Sulphide leach (kt) 36.0 38.3 34.4 32.1 36.1 102.6 105.5

Total copper (kt) 226.4 289.3 252.7 258.0 251.6 762.3 714.7

(troy

Payable gold concentrate oz) 36,303 45,770 38,236 48,402 48,954 135,592 121,202

(troy

Payable silver concentrate koz) 1,270 1,311 1,210 1,510 1,346 4,066 4,023

Sales

Payable copper (kt) 177.0 230.4 196.7 216.0 197.3 610.0 567.7

Copper cathode (EW) (kt) 47.2 58.9 45.9 53.5 43.8 143.2 143.6

(troy

Payable gold concentrate oz) 36,303 45,770 38,236 48,402 48,954 135,592 121,202

(troy

Payable silver concentrate koz) 1,270 1,311 1,210 1,510 1,346 4,066 4,023

1 Shown on a 100% basis. BHP interest in saleable production is 57.5%.

12

Production and sales report

Quarter ended Year to

date

------------------------------------------------ ----------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

--------- ------- ------- ------- ---------- ------- -------

Pampa Norte, Chile

Cerro Colorado

Material mined (kt) 3,516 3,604 3,179 583 172 3,934 13,676

Ore stacked (kt) 3,181 4,259 4,373 4,119 3,567 12,059 10,776

Average copper grade

- stacked (%) 0.53% 0.55% 0.54% 0.56% 0.57% 0.56% 0.59%

Production

Copper cathode (EW) (kt) 11.6 14.7 12.8 12.2 12.0 37.0 40.3

Sales

Copper cathode (EW) (kt) 10.5 16.2 13.3 12.2 10.9 36.4 38.6

Spence

Material mined (kt) 24,040 26,749 26,956 26,980 24,858 78,794 69,219

Ore stacked (kt) 5,055 5,099 5,577 5,155 4,947 15,679 15,384

Average copper grade

- stacked (%) 0.67% 0.66% 0.70% 0.66% 0.64% 0.67% 0.66%

Concentrator throughput (kt) 6,512 6,311 6,433 7,602 7,290 21,325 18,532

Average copper grade

- concentrator (%) 0.65% 0.66% 0.63% 0.60% 0.61% 0.61% 0.63%

Production

Payable copper (kt) 32.4 28.2 28.6 32.5 32.0 93.1 83.0

Copper cathode (EW) (kt) 24.2 34.3 29.2 32.0 29.0 90.2 80.7

Total copper (kt) 56.6 62.5 57.8 64.5 61.0 183.3 163.7

(troy

Payable gold concentrate oz) 7,929 8,198 5,521 3,875 8,152 17,548 20,672

(troy

Payable silver concentrate koz) 261 262 252 245 409 906 749

Payable molybdenum (t) - 71 34 216 407 657 -

Sales

Payable copper (kt) 28.1 28.1 26.0 22.0 39.6 87.6 81.4

Copper cathode (EW) (kt) 20.2 35.4 29.1 33.4 25.1 87.6 79.1

(troy

Payable gold concentrate oz) 7,929 8,198 5,521 3,875 8,152 17,548 20,672

(troy

Payable silver concentrate koz) 261 262 252 245 409 906 749

Payable molybdenum (t) - 25 25 216 492 733 -

13

Production and sales report

Quarter ended Year to

date

-------------------------------------------- ------------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

------- ------- ------- ------- -------- -------- --------

Copper (continued)

Metals production is payable metal unless otherwise stated.

Antamina, Peru

Material mined (100%) (kt) 58,118 64,026 63,865 68,750 57,939 190,554 182,878

Concentrator throughput

(100%) (kt) 13,135 13,131 13,858 14,272 12,349 40,479 39,365

Average head grades

- Copper (%) 0.94% 1.02% 0.93% 0.86% 0.88% 0.89% 0.97%

- Zinc (%) 1.13% 1.05% 1.09% 0.99% 1.06% 1.05% 1.13%

Production

Payable copper (kt) 36.1 39.6 37.1 35.2 29.6 101.9 110.3

Payable zinc (t) 32,732 27,576 32,685 29,929 23,612 86,226 95,624

(troy

Payable silver koz) 1,191 1,212 1,190 923 801 2,914 3,866

Payable lead (t) 282 181 228 114 169 511 937

Payable molybdenum (t) 190 249 262 348 229 839 549

Sales

Payable copper (kt) 32.9 40.7 37.6 34.7 32.4 104.7 107.5

Payable zinc (t) 29,920 30,847 33,820 29,127 25,851 88,798 95,068

(troy

Payable silver koz) 1,078 1,230 1,015 850 768 2,633 3,586

Payable lead (t) 269 363 130 91 181 402 845

Payable molybdenum (t) 199 205 250 298 297 845 455

Olympic Dam, Australia

Material mined (1) (kt) 2,424 2,477 2,412 2,264 2,317 6,993 6,357

Ore milled (kt) 2,122 2,436 2,570 2,687 2,433 7,690 5,251

Average copper grade (%) 2.21% 2.15% 2.13% 2.08% 1.95% 2.06% 2.13%

Average uranium grade (kg/t) 0.62 0.56 0.58 0.58 0.59 0.58 0.58

Production

Copper cathode (ER

and EW) (kt) 39.0 55.7 49.7 54.4 51.7 155.8 82.7

Payable uranium (t) 781 776 817 943 833 2,593 1,599

(troy

Refined gold oz) 29,355 26,080 47,184 43,280 49,086 139,550 93,437

(troy

Refined silver koz) 149 145 295 261 277 833 598

Sales

Copper cathode (ER

and EW) (kt) 36.3 55.8 45.9 56.8 50.5 153.2 83.3

Payable uranium (t) 236 1,031 272 1,127 683 2,082 1,313

(troy

Refined gold oz) 30,935 24,622 49,542 41,900 47,300 138,742 94,357

(troy

Refined silver koz) 182 87 320 233 307 860 598

1 Material mined refers to underground ore mined, subsequently hoisted or trucked to surface.

14

Production and sales report

Quarter ended Year to

date

----------------------------------------------- ----------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

------- ------- ------- ------- ----------- ------ --------

Iron Ore

Iron ore production and sales are reported on a wet tonnes basis.

Western Australia

Iron Ore, Australia

Production

Newman (kt) 11,940 14,063 14,053 16,172 11,925 42,150 42,978

Area C Joint Venture (kt) 24,888 27,685 26,971 26,302 25,284 78,557 66,746

Yandi Joint Venture (kt) 8,418 6,409 5,497 5,613 4,941 16,051 32,513

Jimblebar (1) (kt) 13,444 15,005 17,404 17,720 16,575 51,699 43,777

Total production (kt) 58,690 63,162 63,925 65,807 58,725 188,457 186,014

Total production

(100%) (kt) 66,674 71,660 72,135 74,292 66,163 212,590 211,113

Sales

Lump (kt) 16,966 20,006 19,561 20,375 18,021 57,957 52,339

Fines (kt) 42,187 44,308 42,696 44,121 41,183 128,000 134,035

Total (kt) 59,153 64,314 62,257 64,496 59,204 185,957 186,374

Total sales (100%) (kt) 67,110 72,796 70,276 72,688 66,580 209,544 211,147

1 Shown on a 100% basis. BHP interest in saleable production is 85%.

Samarco, Brazil

Production (kt) 994 1,000 1,148 1,095 1,048 3,291 3,071

Sales (kt) 943 991 1,146 1,097 1,111 3,354 3,004

15

Production and sales report

Quarter ended Year to

date

-------------------------------------------- ----------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

------- ------- ------- ------- -------- ------- -------

Coal

Coal production is reported on the basis of saleable product.

BHP Mitsubishi Alliance (BMA), Australia

Production (1)

Blackwater (kt) 1,478 1,751 1,283 1,160 1,107 3,550 4,083

Goonyella (kt) 2,336 2,429 1,780 1,997 2,185 5,962 5,931

Peak Downs (kt) 1,395 1,366 1,325 1,480 1,251 4,056 3,578

Saraji (kt) 1,366 1,168 1,020 1,243 1,007 3,270 3,446

Daunia (kt) 338 472 324 441 607 1,372 1,019

Caval Ridge (kt) 1,031 997 930 631 772 2,333 2,902

Total production (kt) 7,944 8,183 6,662 6,952 6,929 20,543 20,959

Total production (100%) (kt) 15,888 16,366 13,324 13,904 13,858 41,086 41,918

Sales

Coking coal (kt) 6,334 6,734 5,615 5,872 5,372 16,859 16,624

Weak coking coal (kt) 805 1,118 600 727 710 2,037 2,293

Thermal coal (kt) 484 765 267 428 104 799 1,515

Total sales (kt) 7,623 8,617 6,482 7,027 6,186 19,695 20,432

Total sales (100%) (kt) 15,246 17,234 12,964 14,054 12,372 39,390 40,864

1 Production figures include some thermal coal.

16

Production and sales report

Quarter ended Year to

date

---------------------------------------- ---------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

------ ------ ------ ------ -------- ------ -------

NSW Energy Coal, Australia

Production (kt) 2,577 3,919 2,623 2,851 3,934 9,408 9,782

Sales - export (kt) 2,703 3,923 2,441 2,862 3,667 8,970 10,201

Quarter ended Year to

date

------------------------------------------------ ----------------

Mar Jun Sep Dec Mar Mar Mar

2022 2022 2022 2022 2023 2023 2022

------------ ------- ------- ------- ------- ------- -------

Other

Nickel production is reported on

the basis of saleable product

Nickel West, Australia

Mt Keith

Nickel concentrate (kt) 47.1 48.0 42.6 39.6 38.8 121.0 147.8

Average nickel grade (%) 14.4 16.1 17.0 15.5 16.5 16.3 14.1

Leinster

Nickel concentrate (kt) 78.0 76.0 66.8 47.9 68.4 183.1 229.2

Average nickel grade (%) 8.9 10.3 9.9 9.4 8.6 9.3 9.0

Saleable production

Refined nickel (1) (kt) 13.3 11.7 17.5 10.8 13.2 41.5 45.9

Nickel sulphate (2) (kt) 0.7 0.5 1.2 0.4 0.9 2.5 1.1

Intermediates and nickel

by-products (3) (kt) 4.7 6.6 2.0 6.5 5.5 14.0 11.0

Total nickel (kt) 18.7 18.8 20.7 17.7 19.6 58.0 58.0

Cobalt by-products (t) 125 110 238 93 175 506 522

Sales

Refined nickel (1) (kt) 15.3 11.7 18.1 10.2 13.0 41.3 46.0

Nickel sulphate (2) (kt) 0.7 0.5 0.8 0.5 0.9 2.2 0.8

Intermediates and nickel

by-products (3) (kt) 2.7 6.4 1.8 7.7 5.7 15.2 9.7

Total nickel (kt) 18.7 18.6 20.7 18.4 19.6 58.7 56.5

Cobalt by-products (t) 125 110 238 93 175 506 522

1 High quality refined nickel metal, including briquettes and powder.

2 Nickel sulphate crystals produced from nickel powder.

3 Nickel contained in matte and by-product streams.

17

Appendix 1: BHP Copper Exploration Ocelot

Project summary

The Ocelot project is located 140 kilometres east of Phoenix,

Arizona in the prolific Miami-Globe copper district (Figure 1). The

project area has a long exploration history with exploratory work

by BHP commencing in 2011, including ground geophysical surveys and

drilling campaigns.

BHP completed drill programs at Ocelot between January 2019 and

December 2022, which consisted of 12 broad-spaced diamond drill

holes to test the lateral extents, depth, and variability of

mineralisation (Figure 2) of 18 km in drilling. The drill program,

in conjunction with regional structural mapping and data

integration has led to a follow-up drill program that is expected

to be completed by May 2023.

[Figure 1: Regional geology of the Globe-Miami District showing

known porphyry copper deposits and the Ocelot project.]

Geology and mineralisation

Ocelot has a similar regional setting to the Resolution deposit,

which is approximately 32 km to the southwest, and is located in

the Globe-Miami mining district, known to host a cluster of

Laramide-age porphyry copper deposits including Miami-Inspiration,

Pinto Valley and Copper Cities.

Mineralisation occurs under approximately 700 m of post-mineral

cover and adjacent to the historic Old Dominion mine, which was

primarily focused on high-grade mineralisation of the Old Dominion

vein system and ceased production in 1931.

This drilling has intersected Laramide porphyry style alteration

and mineralisation related to the Schultze Granite intrusive

complex. The main copper sulphide species are chalcopyrite and

bornite, with lesser chalcocite. The copper sulphides occur

disseminated and vein-hosted, favouring permeable and chemically

reactive host lithologies including Dripping Spring Quartzite,

Pioneer Formation, and Proterozoic diabase. Assay results of

significant intercepts are presented in Table 1 with a simplified

geological cross section in Figure 3.

Further details relating to the drilling program are included

within this appendix.

Table 1 : Significant copper intercepts at Project Ocelot

From To Length(1) Copper

Hole ID (m) (m) (m) %

----------- ------ ------ ----------- --------

OCLT1902D 838 1,197 359 0.60

OCLT1903D 714 816 102 0.92

OCLT1903D 844 923 79 0.60

OCLT1903D 978 1,112 134 0.44

OCLT2104D 936 1,212 276 0.63

OCLT2105D 786 1,083 297 0.65

OCLT2106D 992 1,226 234 0.73

OCLT2107D 1,200 1,390 190 0.47

OCLT2209D 1,379 1,464 85 0.71

OCLT2210D 921 1,196 275 0.59

OCLT2211D 787 1,289 502 0.80

OCLT2212D 1,165 1,377 192 0.80

1. Downhole intercept lengths, true widths not known.

18

Further work

BHP's Metals Exploration team is currently completing a

follow-up drilling program, to test the presence and continuity of

a high-grade core of the mineralisation and BHP will continue to

evaluate the results as the program progresses. Additional work

also includes the interpretation and modeling of a recently

completed passive seismic, and borehole electromagnetic (EM)

surveys. This will be integrated into the structural interpretation

and geologic modelling.

[Figure 2: Plan of the Ocelot project area showing drill hole

collar locations and section A - A'.]

[Figure 3: Section A - A' (using a 150m projection from section

line as seen in Figure 2) looking northwest. Downhole traces

showing copper grade for drill holes OCLT2107D, OCLT2105D,

OCLT2104D and OCLT1901D.]

Table 2: Drill hole collar locations and depths in World

Geodetic System 1984 (WGS84 UTMZ12N)

Easting Northing RL Total Depth

Hole ID Drill Hole Type (m) (m) (m) Azimuth Dip (m)

----------- ----------------- -------- --------- ------ -------- ------ ------------

OD108 Historic(1) 519301 3696597 1,070 360 -90 909.8

OD109 Historic(1) 519064 3696453 1,085 360 -90 917.6

OD-13-1 Historic(1) 519505 3696448 1,082 120 -88 1,044.3

OD-13-2 Historic(1) 519204 3696998 1,073 92 -89 1,059.2

OCLT1901D DD 518857 3697648 1,072 178 -80 1,477.9

OCLT1902D DD 518286 3696293 1,131 41 -85 1,517.5

OCLT1903D DD 518779 3696813 1,104 135 -85 1,326.2

OCLT2104D DD 517943 3696902 1,133 245 -85 1,271.5

OCLT2105D DD 517972 3696564 1,104 190 -80 1,036.6

OCLT2106D DD 517908 3696050 1,122 0 -85 1,364.9

OCLT2107D DD 517242 3696368 1,031 355 -85 1,389.9

OCLT2108D DD 516531 3698255 1,100 175 -85 1,440.8

OCLT2209D DD 517996 3695796 1,144 185 -80 1,517.0

OCLT2210D DD 518184 3696067 1,134 0 -85 1,324.7

OCLT2211D DD 518779 3696796 1,104 160 -59 1,372.2

OCLT2212D DD 518001 3695800 1,144 2 -85.5 1,649.3

1. Historic drill holes include Phelps Dodge holes (OD108 and OD

109) drilled in 1965 to 1966 and BHP holes (OD-13-1 and OD-13-2)

drilled in 2013.

Sampling techniques

All samples were obtained from diamond drilling. The diamond

core analysed was predominantly HQ size, and core samples were

split using a core saw with half of the core being submitted for

assaying and the other half returned to BHPs custody.

19

Drilling techniques

All drill holes were completed using diamond drilling from

surface, initially as PQ sized, followed by HQ and some holes ended

in NQ.

PWT casing was typically set within the first 100m of the drill

hole. Depending on ground condition additional HWT casing or PQ

rods may be set when the hole was reduced to HQ (between 500m and

1,100m).

Each hole was surveyed using a north seeking gyroscopic camera

or equivalent, run within the drill rods at 200 foot (61 m)

intervals. Core was oriented using a True North or REFLEX ACT III

orientation tool.

Drill sample recovery

Drill core recovery was measured and recorded continuously from

the start of casing to the end of the hole for each drill hole. The

end of each run was marked on a wooden block which indicates the

end of the run depth, the total length drilled, and total length

recovered for that run.

Drill core recoveries are measured at the drill site, with an

average recovery of greater than 96%, and the majority of holes

recovering greater than 98%.

There is no known relationship between sample loss and grade to

indicate a sample bias may have occurred.

Logging

The following observations were recorded prior to sampling:

lithologic descriptions, including rock type and texture,

alteration mineral assemblages, sulphide abundance and

distribution, structural measurements and feature descriptions, and

the abundance and descriptions of any veining.

Handheld XRF readings were taken periodically on the whole core

at site using an Olympus Delta or Vanta XRF.

Magnetic susceptibility readings were taken systematically on

the whole core at site using a KT-10 Terraplus magnetic

susceptibility meter.

All recovered drill core was logged to depth.

All drill holes were logged in qualitative detail.

All core was photographed wet and dry as whole core inside the

core trays.

Sub-sampling techniques and sample preparation

Diamond core was split using a core saw with half of the core

being submitted to ALS Laboratory for assaying and the other half

returned to BHPs custody.

Submitted sample intervals were approximately 3 m in length

unless geological variability dictated smaller intervals.

All samples were crushed to 2 mm with 250 g being split off and

pulverized further to better than 85% passing 75 microns.

Duplicates were collected at each preparation stages where a

reduction in sample mass occurred. The combined duplicates taken

reflect approximately 3.5 to 5% total of the overall drill

core.

Sample size is considered appropriate for the style of

mineralisation.

Quality of assay data and laboratory tests

All samples were prepared using ALS laboratories in Tucson,

Arizona. Sample pulps are then shipped to ALS laboratories in Reno,

Nevada or Vancouver, Canada for analysis.

20

48 element suite was analysed using 4-acid digestion followed by

ICP-MS (ME-MS61).

30g or 50g fire assay was used to analyse Au.

Samples exceeding 1 wt% Cu were rerun utilising an analytical

method with higher accuracy (Cu-OG62).

Certified reference materials sourced from OREAS and duplicates

were inserted on a regular basis, and where dictated by geological

variability within each sample batch. Reference samples represent

at least 10% of the samples submitted for analysis.

Verification of sampling and assaying

Significant intercepts were identified from the assay results

and validated against visual inspection of drill core and logging

data.

The drilling programs were early-stage exploration with no

twinned holes drilled.

Geological logging of drill holes is captured digitally and

combined with the laboratory analysis in a drill hole database to

ensure consistency between the datasets. All drill hole data is

managed internally via a SQL server hosted database with strict

validation rules.

The database has a security model which requires user access

approval and is backed up regularly by standard backup

procedures.

There have been no adjustments to the assay data that is

uploaded to the database.

Location of data points

Drill hole collars were surveyed by handheld GPS with an

accuracy of 5 m. The data was manually entered in the acQuire

database.

All coordinates are recorded in the World Geodetic System 1984

coordinate system (WGS84 UTM Z12N).

Downhole surveys were completed every 200 ft (61 m) using either

a north seeking gyroscopic camera or equivalent.

The topography is slightly hilly, with elevations varying

between 1,025 m and 1,225 m.

Data spacing and distribution

The drill hole spacing ranged from 250 m to 1,955 m with an

average spacing of 646m as shown in Figure 2.

At the time of this release there is insufficient data to

provide an estimate of Mineral Resources.

No compositing has been applied to the samples.

Orientation of data in relation to geological structure

Drill holes have been drilled with varying dips throughout the

project area, ranging between 60deg and 90deg, with directions

spanning north, northeast, southeast, southwest, and west to avoid

biased trends due to structural features.

Mineralisation at this stage is not well defined but is

interpreted to drop down in depth to the southwest by a series of

post mineralised normal faults.

Sample security

Core was logged and sample intervals determined by the

supervising geologist. All drill core was sent directly from BHP

sites to the ALS laboratory via contracted transport company.

21

At the laboratory preparation facility in Tucson, Arizona, the

core was cut and sampled by the laboratory personnel based on BHP

staff identified sample intervals. The laboratory completed all

photography, cutting, and sample preparation. Once the samples were

prepared, the laboratory staff inserted the QA/QC samples based on

BHP requirements and transported all samples to the secondary

laboratories for analysis. Chain of custody was recorded to enable

verification of the samples.

Audits or reviews

The ALS laboratory sample preparation and analysis procedures

were audited by BHPs internal Practice Lead Geochemistry at the

beginning of calendar year 2022 with no significant issues

identified. Outcomes of the audit was communicated to ALS and

recommendations implemented.

Additional protocols relating to sample security were identified

and implemented for future drill programs.

Section 2 Reporting of Exploration Results

Mineral tenement and land tenure status

BHP holds 21 active mineral lode claims issued by the Bureau of

Land Management (BLM) in 2017 and 2022 which are renewed on an

annual basis and in good standing. Mineral lode claims are public

record and information on claimant, location, and tenure is

preserved for individual claims by the Bureau of Land Management's

Mineral & Land Records System.

In addition, BHP owns or has under license, approximately 72% of

the mineral rights and 40% of surface rights via direct ownership

or active access agreements in the project area of interest.

All drill holes have been located on privately owned surface, on

which BHP either owns or has an access agreement, and over BHP held

mineral rights. Prior to any ground disturbance, archeological and

biological clearance studies were completed by third parties to

ensure no sites of cultural importance nor protected flora and

fauna would be impacted.

Exploration done by other parties

The Ocelot project area and surrounding region has a long

history of exploration activity dating back to 1880s by multiple

companies including but not limited to Phelps Dodge, Magma Copper,

Freeport McMoRan, Bronco Creek Exploration and BHP.

BHP has records of 26 known drill holes, of which 14 were

assayed, in the areas adjacent to the Ocelot project. In addition,

there were 4 drill holes found at the eastern edge of the current

project area drilled in the early 2010s. The four "historical"

drill holes were not subjected to the same quality assurance

processes and therefore uncertainties can exist, and the results

are not part of this disclosure.

Drill hole Information

Tables 1 and 2 presented above summarise the drill hole

information.

Data aggregation methods

All significant intersections are length weighted downhole

widths. True widths are not known at this stage of the exploration

program.

Significant intercepts were defined as intersections greater

than 50 m with a minimum of 0.3% Cu and a maximum of 4 m of

continuous internal dilution (<0.15% Cu).

Metal equivalent calculations have not been used in this

report.

22

Relationship between mineralisation widths and intercepts

lengths

Insufficient data is available to confirm the geological model

or mineralised zones. Intercepts are reported based on downhole

length, true width not known.

Diagrams

Figure 1 provides regional location and context for the Ocelot

project location.

Figure 2 provided in this report shows all drill hole collar

locations with hole traces including historic drill holes in the

project area.

Figure 3 provided in this report is a northeast - southwest

oblique section through drill holes OCLT2107D, OCLT2105, OCLT2104D

and OCLT1901D looking northwest.

Balanced reporting

All drill holes available in the project area are included in

this report.

Only significant intercepts from drill holes completed after

2018 are shown in Table 1. Historic drill holes intercepts have not

been included as they have no supporting QAQC results and are yet

to be verified.

OCLT1901D and OCLT2108D were drilled but did not meet the

significant intercepts threshold as described in the data

aggregation methods section above.

Other substantive exploration data

Two ground direct current induced polarization with passive

magnetotelluric (DCIP-MT) geophysical survey were completed in 2016

and 2017 with an additional ground magnetotelluric (MT) survey

completed 2019. All surveys had varying results due do passive

noise in the area and local town infrastructure.

Downhole pulse electro magnetics (EM) surveys were run on 9 of

the 12 exploration holes drilled.

A ground passive seismic survey was completed in 2022, with

results still pending.

Competent Person statement

The information in the report to which this statement is

attached that relates to Exploration Results is based on

information compiled by Francisco Crignola, a Competent Person who

is a Member of The Australasian Institute of Mining and Metallurgy

(MAusIMM). Mr Crignola is a full-time employee of BHP. Mr Crignola

has sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity being undertaken to qualify as a Competent Person as

defined in the 2012 Edition of the 'Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves'. Mr

Crignola consents to the inclusion in the report of the matters

based on his information in the form and context in which it

appears.

23

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDXBLLLXZLLBBF

(END) Dow Jones Newswires

April 21, 2023 02:00 ET (06:00 GMT)

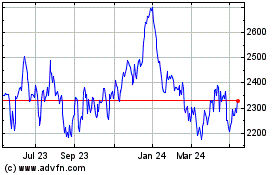

Bhp (LSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

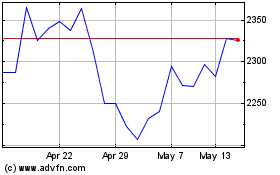

Bhp (LSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024