TIDMASPL

RNS Number : 0472M

Aseana Properties Limited

16 September 2021

16 September 2021

Aseana Properties Limited

("Aseana", the "Company" or, the "Group")

Half-Year Results for the Six Months Ended 30 June 2021

Aseana Properties Limited (LSE: ASPL), a property developer with

investments in Malaysia and Vietnam, listed on the Main Market of

the London Stock Exchange, announces its unaudited half-year

results for the six-month period ended 30 June 2021.

Operational summary:

-- The RuMa Residences have been approximately 71% sold to date

based on sale and purchase agreements signed.

-- The RuMa Hotel was temporarily closed for 60 days in two

different periods due to MCO and achieved an average occupancy rate

of approximately 11% in the first six months of 2021. Losses for

the six months ending 30(th) June was approximately 4.6m MYR in

line with the budget; second half results will decline resulting

from closure of the hotel due to MCO. The hotel has now re-opened

but uncertainty remains as the hotel may be subjected to further

closure under any future MCO's as mandated by Malaysian

government.

-- In the first half year of 2021, The Harbour Mall Sandakan

performance has exceeded expectations with occupancy rates at about

95%. The mall operator has continued to rebate rental lease

payments to tenants during the prevailing MCO as a measure to

support the tenants and to retain the occupancy levels. Financial

performance through June 30(th) , 2021 reflects expectations

however if MCO continues into the latter half of 2021 financial

performance will suffer.

-- City International Hospital has been negatively affected by

Covid, similar to other hospitals in Vietnam and specifically Ho

Chi Minh City ("HCM"). In the first 6 months, revenue decreased

about 27% against budget, with overall EBITDA declining by

approximately 57% against budget. Since December 2020, management

have undertaken cost cutting measures across the board including

instituting a hiring freeze, reviewing profit margins and

productivity of staff. Performance is expected to improve in the

second half as cost savings are realised, however, the Vietnam

government mandated total lockdown of HCM in August, this mandate

was expected to be gradually lifted starting 15(th) September, 2021

but has now been extended to month end.

-- As reported in our Annual Report issued 2nd August, 2021, it

is expected that the Group would be financed via the disposal of

its investments in Vietnam, the sale of the remaining existing

units of residential inventories at The RuMa Hotel & Residences

in West Malaysia, and through the disposals of the Sandakan hotel

asset (formerly Four Points Sheraton Sandakan Hotel), the Harbour

Mall Sandakan and the RuMa Hotel. The Divestment Team has been

actively seeking for potential purchasers.

Financial summary:

-- Other Income of US$7.7 million (H1 2020: US$8.6 million)

-- Loss before tax of US$3.2 million (H1 2020: loss of US$8.2 million)

-- Loss after tax of US$3.3 million (H1 2020: loss of US$8.3 million)

-- Total comprehensive loss of US$6.6 million (H1 2020: loss of US$11.1 million)

-- Net asset value of US$96.7 million (31 December 2020

(audited): US$101.3 million) or US$0.49 per share (31 December 2020

(audited): US$0.51 per share)

Subsequent Events:

On 25(th) August, 2021 the Company announced that it had entered

into a binding agreement to sell its entire interest in both the

City International Hospital and the adjacent International

Healthcare Park in HCM. The terms of the transaction are subject to

approvals from regulatory authorities as well as conditions to

completion. It is expected the completion will take several months.

Once completed, the Company will have no assets in Vietnam.

On 9(th) September, 2021 the Company announced it had entered

into a conditional agreement to sell the remaining 58 unsold

residential units at The Ruma Hotel & Residences in Kuala

Lumpur. Gross sale price is MYR 85.3m (approximately US $20.5m) and

is subject to final due diligence by the Buyer as well as receipt

of government approval for the sale to a foreign investor. Expected

completion will take place within 8 months.

Commenting on the results, Nick Paris, Chairman of Aseana,

said:

"The H1 2021 results show that Aseana has still had to deal with

challenging market conditions in both Malaysia and Vietnam

resulting from the negative impact of COVID 19 and the movement

controls introduced by the respective governments to contain the

spread of the virus. Nonetheless, the Company has continued to

focus on improving the operational performance and narrowing the

losses of its operating assets. Since the end of this period we

have started to see the results of our divestment activities and we

have signed two sale and purchase agreements covering our assets in

Vietnam and our high end residences in Kuala Lumpur, Further asset

sales are being actively worked on."

For further information:

Aseana Properties Limited Tel: 020 3325 7050

Nick Paris (Chairman) Email: nick.paris@limadvisors.com

Liberum Capital Tel: 020 3100 2000

Darren Vickers / Owen Matthews Email: aseana@liberum.com

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer with investments in Malaysia and Vietnam which

is in the process of realising its assets.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report on the results of Aseana Properties

Limited and its Group of companies for the six months ended 30 June

2021.

Interim Results for the Half Year ended 30 June 2021

Our interim results in this period continue to reflect the

significant impact of the COVID virus on our various operating

businesses. Our operating revenue on our assets continued to be

reduced and despite significant ongoing cost cutting initiatives,

operating losses and cash outflows were inevitable. However, the

comprehensive loss for Aseana for the half year did decrease to

US$6.6 million (1H 2020: US$11.1 million), our net cash used in

operating activities was US$4 million (1H 2020: US$11.0 million)

and our cash balance at the end of the period was US$9.7 million

(1H 2020: US$2.7 million) after we drew down some further

financing. The loss which we are reporting for the six months ended

30 June 2021 has reduced our Net Asset Value per Share from 51 US

cents at 31 December 2020 to 49 US cents (30 June 2020: 50 US

cents).

Our Business Focus and Recent Property Divestments

Our business focus for the Group continues to be on reducing our

operating costs and on improving the operational performances of

our remaining assets in order to preserve our cash balances.

In Vietnam, Hoa Lam Corporation, our long standing joint venture

partner, has agreed to buy our interests in the City International

Hospital and the International Healthcare Park. This transaction is

now subject to completion conditions including local regulatory

approvals.

In Kuala Lumpur, a foreign investor has contracted to buy our

remaining residential units in The RuMa Hotel & Residences.

Completion of this sale is subject to approval of various

conditions and multiple regulatory authorities, and will take up to

eight months.

These two sale transactions will eliminate the majority of debt

owed by the Company. In addition, further sale discussions are

underway on some of our other assets and we remain alert for any

interest for any of our assets from prospective buyers. Our aim

continues to be to seek asset sales in a controlled, orderly and

timely manner, to pay off our project debts and then to return

surplus sale proceeds to our shareholders.

Our listing on the London Stock Exchange

We had to temporarily suspend the listing of our shares on the

London Stock Exchange in late June as the audit of our Annual

Accounts for the year ended 31st December 2020 had been held up by

the movement controls in Malaysia and Vietnam and the deadline for

their publication was 30(th) June. Our Annual Report was

subsequently published on 3(rd) August and we are in discussions

with Financial Conduct Authority in the UK to get our listing

restored and hope that this will happen shortly.

Acknowledgements

I would like to take this opportunity to thank my colleagues on

the Board and throughout our Group and our external advisors,

bankers and service providers for their tireless efforts on behalf

of the Group and its Shareholders.

This has been another very challenging period in the corporate

life of Aseana but with our recently announced divestments I

believe that we are now heading into the final stages of the life

of the Company.

NICK PARIS

Chairman

16 September 2021

PROPERTY PORTFOLIO AS AT 30 JUNE 2021

Project Type Effective Approximate Approximate

Ownership Gross Land Area

Floor (sq m)

Area

(sq m)

-------------------------- -------------------------- ----------- ------------ ------------

The RuMa Hotel & Luxury residential

Residences tower and bespoke

Kuala Lumpur, Malaysia hotel 70.0% 40,000 4,000

-------------------------- -------------------------- ----------- ------------ ------------

Sandakan Harbour

Square

Sandakan, Sabah, Hotel and retail

Malaysia mall 100.0% 126,000 48,000

-------------------------- -------------------------- ----------- ------------ ------------

City International

Hospital, International

Healthcare Park,

Ho Chi Minh City, Private general

Vietnam hospital 73.04%* 48,000 25,000

-------------------------- -------------------------- ----------- ------------ ------------

Undeveloped projects

-------------------------- -------------------------- ----------- ------------ ------------

Other developments

in International

Healthcare Park,

Ho Chi Minh City, Commercial and

Vietnam (formerly residential development

International Hi-Tech with healthcare

Healthcare Park) theme 73.04%* 972,000 351,000

-------------------------- -------------------------- ----------- ------------ ------------

Kota Kinabalu Seafront

resort & residences

Kota Kinabalu, Sabah,

Malaysia Resort homes 80.0% n/a 327,000

-------------------------- -------------------------- ----------- ------------ ------------

*Shareholding as at 30 June 2021

n/a: Not available/ Not applicable

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

Notes 30 June 30 June 31 December

2021 2020 2020

Continuing activities US$'000 US$'000 US$'000

Revenue 3 516 - 1,329

Cost of sales 5 (416) (3) (950)

---------------------------------------- ------ ----------- ----------- -------------

Gross profit/(loss) 100 (3) 379

Other income 7,743 8,581 18,271

Administrative expenses (418) (637) (1,658)

Foreign exchange gain/(loss) 6 852 (1,023) (1,051)

Loss on disposal of subsidiaries - - (784)

Marketing expenses - (11) -

Other operating expenses (8,585) (11,647) (20,657)

---------------------------------------- ------ ----------- ----------- -------------

Operating loss (308) (4,740) (5,500)

----------- ----------- -------------

Finance income 1,399 882 3,323

Finance costs (4,311) (4,426) (11,152)

----------- ----------- -------------

( 7,829

Net finance costs (2,912) (3,544) )

Net loss before taxation (3,220) (8,284) (13,329)

Taxation 7 (38) (4) (187)

---------------------------------------- ------ ----------- ----------- -------------

Loss for the period/year (3,258) (8,288) (13,516)

---------------------------------------- ------ ----------- ----------- -------------

Other comprehensive (loss)/

income, net of tax

Items that are or may be reclassified

subsequently to profit or

loss

---------------------------------------- ------ ----------- ----------- -------------

Foreign currency translation

differences

for foreign operations (3,316) (2,873) 2,078

---------------------------------------- ------ ----------- ----------- -------------

Total other comprehensive

(loss)/income for the period/year (3,316) (2,873) 2,078

---------------------------------------- ------ ----------- ----------- -------------

Total comprehensive loss

for the period/year (6,574) (11,161) (11,438)

---------------------------------------- ------ ----------- ----------- -------------

Loss attributable to:

Equity holders of the parent (1,733) (6,485) (10,260)

Non-controlling interests (1,525) (1,803) (3,256)

---------------------------------------- ------ ----------- ----------- -------------

Total (3,258) (8,288) (13,516)

---------------------------------------- ------ ----------- ----------- -------------

Total comprehensive loss

attributable to:

Equity holders of the parent (4,690) (9,345) (8,371)

Non-controlling interests (1,884) (1,816) (3,067)

---------------------------------------- ------ ----------- ----------- -------------

Total (6,574) (11,161) (11,438)

---------------------------------------- ------ ----------- ----------- -------------

Loss per share

Basic and diluted (US cents) (0.87) (3.26) (5.16)

---------------------------------------- ------ ----------- ----------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

Unaudited Unaudited Audited

As at As at As at

Notes 30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Non-current assets

Property, plant and equipment 527 593 565

Intangible assets 4,097 4,097 4,097

Right of use 17 360 160

Deferred tax assets 4,944 4,842 5,111

------------------------------- ------ ---------- ------------ -------------

Total non-current assets 9,585 9,892 9,933

------------------------------- ------ ---------- ------------ -------------

Current assets

Inventories 232,576 232,753 237,394

Trade and other receivables 15,400 17,746 16 , 211

Prepayments 35 4 606 415

Current tax assets 923 3 956

Cash and cash equivalents 9,722 5,226 5,948

------------------------------- ------ ---------- ------------ -------------

Total current assets 258,97 5 256,334 260,924

------------------------------- ------ ---------- ------------ -------------

TOTAL ASSETS 268,56 0 266,226 270,857

------------------------------- ------ ---------- ------------ -------------

Equity

Share capital 10,601 10,601 10,601

Share premium 208,925 208,925 208,925

Capital redemption reserve 1,899 1,899 1,899

Translation reserve (22,612) (24,504) (19,655)

(102,16

Accumulated losses 6 ) (96,630) (100,433)

------------------------------- ------ ---------- ------------ -------------

Shareholders' equity 96,64 7 100,291 101,337

Non-controlling interests (8,761) (5,654) (6,877)

------------------------------- ------ ---------- ------------ -------------

Total equity 87,88 6 94,637 94,460

------------------------------- ------ ---------- ------------ -------------

Non-current liabilities

Trade and other payable 38,507 37,518 39,789

Loans and borrowings 9 26,634 25,318 21,926

Total non-current liabilities 65,141 62,836 61,715

------------------------------- ------ ---------- ------------ -------------

Current liabilities

Trade and other payables 33,511 30,681 33,300

Amount due to non-controlling

interests 11,588 10,923 11,371

Loans and borrowings 9 26,986 28,182 29,811

Medium term notes 10 43,448 37,878 40,200

Current tax liabilities - 1,089 -

------------------------------- ------ ---------- ------------ -------------

Total current liabilities 115,533 108,753 114,682

------------------------------- ------ ---------- ------------ -------------

Total liabilities 180,674 171,589 176,397

------------------------------- ------ ---------- ------------ -------------

TOTAL EQUITY AND LIABILITIES 268,56 0 266,226 270,857

------------------------------- ------ ---------- ------------ -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the SIX MONTHS ended 30 June 2021 - Unaudited

Total Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

1 January 2021 10,601 - 208,925 1,899 (19,655) (100,433) 101,337 (6,877) 94,460

Loss for the

period - - - - - (1,733) (1,733) (1,525) (3,258)

Total other

comprehensive

loss - - - - (2,957) - (2,957) (359) (3,316)

----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss - - - - (2,957) (1,733) (4,690) (1,884) (6,574)

--------------- ----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

Shareholders'

equity

at 30 June (22,61 (102,16

2021 10,601 - 208,925 1,899 2 ) 6 ) 96,647 (8,761) 87,886

=============== =========== =========== ========= =========== ============ ============ ============= ============ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the SIX MONTHS ended 30 JuNE 2020 - Unaudited

Total Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

1 January 2020 10,601 - 208,925 1,899 (21,644) (90,135) 109,646 (3,848) 105,798

Loss for the

period - - - - - (6,485) (6,485) (1,803) (8,288)

Total other

comprehensive

loss - - - - (2,860) - (2,860) (13) (2,873)

----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss - - - - (2,860) (6,485) (9,345) (1,816) (11,161)

Change in

ownership

of

subsidiaries - - - - - (10) (10) 10 -

Shareholders'

equity

at 30 June

2020 10,601 - 208,925 1,899 (24,504) (96,630) 100,291 (5,654) 94,637

=============== =========== =========== ========= =========== ============ ============ ============= ============ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2020 - audited

Total

Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

Consolidated US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Balance at 1

January 2019 10,601 - 208,925 1,899 (22,265) (63,005) 136,155 (966) 135,189

Changes in

ownership

interests

in

subsidiaries - - - - - (24) (24) 24 -

Loss for the

year - - - - - (27,106) (27,106) (2,900) (30,006)

Total other

comprehensive

loss for the

year - - - - 621 - 621 (6) 615

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss for

the year - - - - 621 (27,106) (26,485) (2,906) (29,391)

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

As at 31

December

2019/ 1

January 2020 10,601 - 208,925 1,899 (21,644) (90,135) 109,646 (3,848) 105,798

Adjusted

balance at 31

December

2019 / 1

January 2020 10,601 -# 208,925 1,899 (21,644) (90,135) 109,646 (3,848) 105,798

Changes in

ownership

interests

in

subsidiaries - - - - - (38) (38) 38 -

Loss for the

year - - - - - (10,260) (10,260) (3,256) (13,516)

Total other

comprehensive

loss for the

year - - - - 1,889 - 1,889 189 2,078

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss for (11,4

the year - - - - 1,889 (10,260) (8,371) (3,067) 38 )

Disposal of

subsidiaries - - - - 100 - 100 - 100

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Shareholders'

equity at 31

December 2020 10,601 -# 208,925 1,899 (19,655) (100,433) 101,337 (6,877) 94,460

=========== =========== ======== =========== ============ ============ ============= ============ =========

# Represents 2 management shares at US$0.05 each

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Cash Flows from Operating Activities

Loss before taxation (3,220) (8,284) (13,329)

Finance income (1,399) (882) (3,323)

Finance costs 4,311 4,426 11,151

Loss on disposal of subsidiaries - - 784

Unrealised foreign exchange gain 1,736 998 (546)

Write down/Impairment of goodwill - - -

Depreciation of property, plant

and equipment and right-of-use asset 187 46 479

Net realisation value adjustments

of inventory - - -

Operating (loss)/profit before changes

in working capital 1,615 (3,696) (4,784)

Changes in working capital:

Decrease /(Increase) in inventories (753) (4,287) 856

Decrease /(Increase) in trade and

other receivables and prepayments 716 (5,442) (2,607)

(Decrease) /Increase in trade and

other payables (1,326) 6,929 8,164

---------------------------------------- ----------- ----------- -------------

Cash used in operations 252 (6,496) 1,629

Interest paid (4,299) (4,426) (9,932)

Tax paid (36) (122) (2,309)

---------------------------------------- ----------- ----------- -------------

Net cash used in operating activities (4,083) (11,044) (10,612)

---------------------------------------- ----------- ----------- -------------

Cash Flows From Investing Activities

Proceeds from disposal of property,

plant and

equipment - 6 -

Purchase of property, plant and

equipment (14) (25) (39)

Proceeds from disposal of subsidiaries - - 3,936

Finance income received 1,399 882 3,012

---------------------------------------- ----------- ----------- -------------

Net cash from investing activities 1,385 863 6,910

---------------------------------------- ----------- ----------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS (CONT'D)

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

------------------------------------------ ----------- ----------- -------------

Cash Flows From Financing Activities

Advances (from)/to non-controlling

interests 303 578 728

Repayment of finance lease liabilities (227) (40) (463)

Repayment of loans and borrowings (481) (2,496) (4,879)

Drawdown of loans and borrowings

and medium term notes 7,085 9,603 6,526

Net decrease in pledged deposits

for loans and borrowings and Medium

Term Notes - 1,703 75

Net cash from financing activities 6,680 9,348 1,987

------------------------------------------ ----------- ----------- -------------

Net changes in cash and cash equivalents

during the period/year 3,982 (833) (1,715)

Effect of changes in exchange rates (208) 322 48

Cash and cash equivalents at the

beginning of the period/year (i) 5,948 3,235 7,615

------------------------------------------ ----------- ----------- -------------

Cash and cash equivalents at the

end of the period/year (i) 9,722 2,724 5,948

------------------------------------------ ----------- ----------- -------------

(i) Cash and Cash Equivalents

Cash and cash equivalents included in the consolidated statement

of cash flows comprise the following consolidated statement of

financial position amounts:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

----------------------------- ----------- ----------- -------------

Cash and bank balances 7,261 2,105 3,052

Short term bank deposits 2,461 3,121 2,896

----------------------------- ----------- ----------- -------------

9,722 5,226 5,948

Less: Deposits pledged (ii) (2,174) (2,502) (2,619)

----------------------------- ----------- ----------- -------------

Cash and cash equivalents 7,548 2,724 3,329

----------------------------- ----------- ----------- -------------

(ii) Included in short term bank deposits and cash and bank

balance is US$2,174,000 (31 December 2020:US$2,619,000; 30 June

2020: US$2,502,000) pledged for loans and borrowings and Medium

Term Notes of the Group.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX

MONTHSED 30 JUNE 2021

1 General Information

The principal activities of the Group are the development of

upscale residential and hospitality projects, sale of development

land and operation and sale of hotels, a shopping mall and a

hospital in Malaysia and Vietnam.

2 Summary of Significant Accounting Policies

2.1 Basis of Preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2021 have been prepared in accordance with

IAS 34, Interim Financial Reporting.

The interim condensed consolidated financial statements should

be read in conjunction with the annual financial statements for the

year ended 31 December 2020 which have been prepared in accordance

with IFRS.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The interim results have not been audited nor reviewed and do

not constitute statutory financial statements.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of expenses during

the reporting period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2020 as

described in those annual financial statements.

The interim report and financial statements were approved by the

Board of Directors on 16 September 2021.

3 SegmentAL Information

Segmental information represents the level at which financial

information is reported to the Board of Directors, being the chief

operating decision makers as defined in IFRS 8. The Directors

determine the operating segments based on reports reviewed and used

by their staff for strategic decision making and resource

allocations. For management purposes, the Group is organised into

project units.

The Group's reportable operating segments are as follows:

(i) Investment Holding Companies - investing activities;

(ii) Ireka Land Sdn. Bhd. - developed Tiffani ("Tiffani") by i-ZEN;

(iii) ICSD Ventures Sdn. Bhd. - owns and operates the Harbour

Mall Sandakan ("HMS") and the Sandakan hotel asset ("SHA", formerly

Four Points by Sheraton Sandakan Hotel);

(iv) Amatir Resources Sdn. Bhd. - developed the SENI Mont' Kiara ("SENI");

(v) The RuMa Hotel KL Sdn Bhd - operates the RuMa Hotel

(vi) Urban DNA Sdn. Bhd.- developed and owns the RuMa Hotel and Residences ("The RuMa") and

(vii) Hoa Lam-Shangri-La Healthcare Group - master developer of

the International Healthcare Park ("IHP"); owns and operates the

City International Hospital ("CIH").

Other non-reportable segments comprise the Group's other

development projects. None of these segments meets any of the

quantitative thresholds for determining reportable segments in 2020

and 2019.

Information regarding the operations of each reportable segment

is included below. The Board of Directors monitors the operating

results of each segment for the purpose of performance assessments

and making decisions on resource allocation. Performance is based

on segment gross profit/(loss) and profit/(loss) before taxation,

which the Directors believes are the most relevant in evaluating

the results relative to other entities in the industry. Segment

assets presented inclusive of inter-segment balances and

inter-segment pricing is determined on an arm's length basis.

The Group's revenue generating development projects are located

in Malaysia and Vietnam.

3 SegmentAL Information (continued)

Operating Segments ended 30 June 2021 - Unaudited

Hoa

Investment Ireka ICSD Amatir The RuMa Urban Lam-Shangri-La

Holding Land Ventures Resources Hotel KL DNA Healthcare

Companies Sdn. Sdn. Sdn. Bhd. Sdn. Sdn. Bhd. Group Total

Bhd. Bhd. Bhd.

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ ---------- ---------- ----------- ---------- ----------- --------------- --------

Segment

(loss)/profit

before

taxation (1,745) - (223) 227 (1,128) (1,143) (1,795) (5,807)

=============== ============ ========== ========== =========== ========== =========== =============== ========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - - - - - 516 - 516

Cost of sales - - - - - (416) - (416)

Revenue from

hotel

operations - - - - 1,005 - - 1,005

Revenue from

mall

operations - - 945 - - - - 945

Revenue from

hospital

operations - - - - - - 5,574 5,574

Expenses from

hotel

operations - - (27) - (1,967) - - (1,994)

Expenses from

mall

operations - - (636) - - - - (636)

Expenses from

hospital

operations - - - - - - (5,304) (5,304)

Depreciation

of property,

plant and

equipment - - (26) - (139) - (16) (181)

Finance costs - - (585) (102) - (869) (2,037) (3,593)

Finance income 356 - 22 336 - 11 1 726

=============== ============ ========== ========== =========== ========== =========== =============== ========

Segment assets 5,141 132 58,906 3,192 648 103,929 86,423 258,371

=============== ============ ========== ========== =========== ========== =========== =============== ========

Segment

liabilities 11,500 3 1,806 2,806 2,091 49,686 67,793 135,685

=============== ============ ========== ========== =========== ========== =========== =============== ========

3 SegmentAL Information (continued)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (5,807)

Other non-reportable segments 2,632

Finance income 673

Others (718)

(5,807)

------------------------------------ --------

Consolidated loss before taxation (3,220)

==================================== ========

3 SegmentAL Information (continued)

Operating Segments ended 30 June 2020 - Unaudited

Ireka ICSD The RuMa Urban Hoa

Investment Land Ventures Amatir Hotel KL DNA Lam-Shangri-La

Holding Sdn. Sdn. Resources Sdn. Sdn. Healthcare

Companies Bhd. Bhd. Sdn. Bhd. Bhd. Bhd. Group Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ ---------- ---------- ----------- ---------- ---------- --------------- ---------

Segment

(loss)/profit

before

taxation (1,660) 4 (1,470) 18 (1,518) (1,227) (2,397) (8,250)

=============== ============ ========== ========== =========== ========== ========== =============== =========

Included in

the measure

of segment

profit/(loss)

are:

Revenue - - - - - - - -

Revenue from

hotel

operations - - 647 - 1,504 - - 2,151

Revenue from

mall

operations - - 731 - - - - 731

Revenue from

hospital

operations - - - - - - 5,615 5,615

Marketing

expenses - - - - - (11) - (11)

Expenses from

hotel

operations - - (1,744) - (2,814) - - (4,558)

Expenses from

mall

operations - - (473) - - - - (473)

Expenses from

hospital

operations - - - - - - (5,680) (5,680)

Depreciation

of property,

plant and

equipment - - - - (23) - (23) (46)

Finance costs - - (701) (169) - (1,383) (2,173) (4,426)

Finance income - 1 49 209 - 21 7 287

=============== ============ ========== ========== =========== ========== ========== =============== =========

Segment assets 3,833 351 57,231 6,025 1,486 82,387 86,754 2387,067

=============== ============ ========== ========== =========== ========== ========== =============== =========

Segment

liabilities 164 180 2,783 3,867 2,399 9,993 66,857 86,243

=============== ============ ========== ========== =========== ========== ========== =============== =========

3 SegmentAL Information (continued)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (8,250)

Other non-reportable segments (34)

Consolidated loss before taxation (8,284)

==================================== ========

3 SegmentAL Information (continued)

Operating Segments - Year ended 31 December 2020 - Audited

Hoa Lam

Investment Ireka ICSD Amatir The RuMa Urban Shangri-La

Holding Land Sdn. Ventures Resources Hotel KL DNA Healthcare

Companies Bhd. Sdn. Sdn. Bhd. Sdn. Bhd. Sdn. Group Total

Bhd. Bhd.

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ ------------- ---------- ----------- ----------- ---------- ----------- ---------

Segment

(loss)/profit

before

taxation (1,483) 14 (1,314) 171 (2,774) (1,976) (4,208) (11,570)

=============== ============ ============= ========== =========== =========== ========== =========== =========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - - - - - 1,329 - 1,392

Other income

from hotel

operations - - 655 - 2,323 - - 2,978

Other income

from mall

operations - - 1,754 - - - - 1,754

Other income

from hospital

operations - - - - - - 11,800 11,800

Expenses from

hotel

operations - - (1,814) - (4,638) - - (6,452)

Expenses from

mall

operations - - (1,380) - - - - (1,380)

Expenses from

hospital

operations - - - - - - (11,094) (11,094)

Depreciation

of property,

plant and

equipment - - - - (48) - (47) (95)

Finance costs - - (1,517) (326) - (1,635) (6,425) (9,903)

Finance income 310 - 68 456 - 22 1,218 2,074

=============== ============ ============= ========== =========== =========== ========== =========== =========

Segment assets 4,464 203 60,999 3,094 1,255 104,524 86,169 260,708

=============== ============ ============= ========== =========== =========== ========== =========== =========

Segment

liabilities 596 3 1,911 1,138 2,277 51,087 16,568 73,580

=============== ============ ============= ========== =========== =========== ========== =========== =========

3 SegmentAL Information (continued)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ ---------

Total loss for reportable segments (11,570)

Other non-reportable segments (1,759)

Finance income 1,249

Others (1,249)

Consolidated loss before taxation (13,329)

==================================== =========

3 SegmentAL Information (continued)

Six months ended 30 June 2021 - Unaudited

Addition

to

Finance Segment Segment non-current

US$'000 Revenue Depreciation Finance costs income assets liabilities assets

----------------- -------- ------------- -------------- ------------- ------------- ------------- -------------

Total reportable

segment 516 96 (3,593) 680 258,372 126,003 15

Other

non-reportable

segments - (144) (718) 719 10,189 54,673 -

----------------- -------- ------------- -------------- ------------- ------------- ------------- -------------

Consolidated

total 516 (48) (4,311) 1,399 268,561 180,676 15

================= ======== ============= ============== ============= ============= ============= =============

3 SegmentAL Information (continued)

Six months ended 30 June 2020 - Unaudited

Addition

Finance Finance Segment to non-current

US$'000 Revenue Depreciation costs income Segment assets liabilities assets

----------------- --------- ------------- -------- -------- ------------------ ------------------ ----------------

Total reportable

segment - (46) (4,426) 287 238,067 86,243 -

Other

non-reportable

segments - - - 595 28,159 85,346 25

----------------- --------- ------------- -------- -------- ------------------ ------------------ ----------------

Consolidated

total - (46) (4,426) 882 266,226 171,589 25

================= ========= ============= ======== ======== ================== ================== ================

3 SegmentAL Information (continued)

Year ended 31 December 2020 -Audited

Additions

to

Finance Segment Segment non-current

US$'000 Revenue Depreciation Finance costs income assets liabilities assets

---------------- -------- ------------- -------------- ------------- -------------- ------------- -------------

Total

reportable

segment 1,329 (461) (9,903) 2,074 260,708 73,580 39

Other

non-reportable

segments - 366 (1,249) 1,249 10,149 102,817 -

---------------- -------- ------------- -------------- ------------- -------------- ------------- -------------

Consolidated

total 1,329 (95) (11,152) 3,323 270,857 176,397 39

================ ======== ============= ============== ============= ============== ============= =============

3 SegmentAL Information (continued)

Geographical Information - six months ended 30 June 2021 -

Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 516 - 516

Non-current assets 9,164 422 9,586

==================== ========= ======== =============

Geographical Information - six months ended 30 June 2020 -

Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue - - -

Non-current assets 5,907 3,985 9,892

==================== ========= ======== =============

Geographical Information - year ended 31 December 2021 -

Audited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 1,329 - 1,329

Non-current assets 9,489 444 9,933

==================== ========= ======== =============

In the financial period/year ended 30 June 2021; 30 June 2020;

31 December 2020, no single customer exceeded 10% of the Group's

total revenue.

4 Seasonality

The Group's business operations were not materially affected by

seasonal factors for the period under review but was affected by

the MCO resulting from the Covid 19 pandemic.

5 Cost of Sales

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Direct costs attributable

to:

Completed Units 416 3 950

416 3 950

--------------------------- ----------- ----------- -------------

6 Foreign exchange (LOSS)/GAIN

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

-------------------------------- ----------- ----------- -------------

Foreign exchange gain/(loss)

comprises:

Realised foreign exchange loss (3) (25) (24)

Unrealised foreign exchange

gain/(loss) 855 (998) (1,027)

852 (1,023) (1,051)

-------------------------------- ----------- ----------- -------------

7 Taxation

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Current tax expense 38 4 139

Deferred tax credit - - 48

-------------------------------- ----------- ----------- --------------

Total tax expense/(income) for

the period/year 38 4 187

-------------------------------- ----------- ----------- --------------

The numerical reconciliation between the income tax expense and

the product of accounting results multiplied by the applicable tax

rate is computed as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Net loss before taxation (3,220) (8,284) (13,329)

--------------------------------------- ----------- ----------- -------------

Income tax at rate of 24% (773) (1,988) (3,199)

Add :

Tax effect of expenses not deductible

in determining taxable profit 759 3,274 3,781

Current year losses and other

tax benefits for which no deferred

tax asset was recognised 406 687 3,076

Tax effect of different tax rates

in subsidiaries 361 476 162

Less :

Tax effect of income not taxable

in determining taxable profit (715) (2,064) (3,752)

(Under)/Over provision in respect

of prior period/year - (381) 119

--------------------------------------- ----------- ----------- -------------

Total tax expense for the period/year 38 4 187

--------------------------------------- ----------- ----------- -------------

7 Taxation (Continued)

The applicable corporate tax rate in Malaysia is 24%.

The applicable corporate tax rates in Singapore and Vietnam are

17% and 20% respectively.

A subsidiary of the Group, CIH is granted preferential corporate

tax rate of 10% for the results of the hospital operations. The

preferential income tax is given by the government of Vietnam due

to the subsidiary's involvement in the healthcare industry.

The Company is treated as a tax resident of Jersey for the

purpose of Jersey tax laws and is subject to a tax rate of 0%. The

Company is also registered as an International Services Entity so

it does not have to charge or pay local Goods and Services Tax. The

cost for this registration is GBP200 per annum.

The Directors intend to conduct the Group's affairs such that

the central management and control is not exercised in the United

Kingdom and so that neither the Company nor any of its subsidiaries

carries on any trade in the United Kingdom. The Company and its

subsidiaries will thus not be residents in the United Kingdom for

taxation purposes. On this basis, they will not be liable for

United Kingdom taxation on their income and gains other than income

derived from a United Kingdom source.

8 LOSS Per Share

Basic and diluted loss per ordinary share

The calculation of basic and diluted loss per ordinary share for

the period/year ended was based on the loss attributable to equity

holders of the parent and a weighted average number of ordinary

shares outstanding, calculated as below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Loss attributable to equity

holders of the parent ( US$'000) (1,732) (6,485) (10,216)

Weighted average number of

shares 198,691,000 198,691,000 198,691,000

Loss per share

Basic and diluted (US cents) (0.87) (3.26) (5.16)

----------------------------------- ------------------- ------------------- -----------------

9 Loans and Borrowings

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

--------------------------- ---------- ---------- -------------------

Non-current

Bank loans 26,634 25,165 21,925

Finance lease liabilities - 153 1

26,634 25,318 21,926

--------------------------- ---------- ---------- -------------------

Current

Bank loans 26,94 3 27,949 29,631

Finance lease liabilities 43 233 180

---------------------------- ---------- ---------- -------------------

26,98 6 28,182 29,811

--------------------------- ---------- ---------- -------------------

53,62 0 53,500 51,737

--------------------------- ---------- ---------- -------------------

The effective interest rates on the bank loans and finance lease

arrangement for the period ranged from 5.79% to 11.30% (30 June

2020: 5.55% to 12.50%; 31 December 2020: 6.10% to 11.30%) per annum

respectively.

Borrowings are denominated in Malaysian Ringgit, United States

Dollars and Vietnamese Dong.

Bank loans are repayable by monthly, quarterly or semi-annual

instalments.

Bank loans are secured by land held for property development,

work-in-progress, operating assets of the Group, pledged deposits

and some by the corporate guarantee of the Company.

Reconciliation of movement of loans and borrowings to cash flows

arising from financing activities:

As at 1 Foreign

January Drawdown Repayment exchange As at 30

2021 of loan of loan movements June 2021

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------ --------- --------- ---------- ----------- -----------

Bank loans 51,556 2,674 (481) (17 2 ) 53,57 7

Total 51,556 2,674 (481) (17 2 ) 53,57 7

========= ========= ========== =========== ===========

As at 1 Foreign

January Drawdown Repayment exchange As at 30

2020 of loan of loan movements June 2020

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------ --------- --------- ---------- ----------- -----------

Bank loans 53,070 6,998 (2,496) (4,072) 53,500

Total 53,070 6,998 (2,496) (4,072) 53,500

========= ========= ========== =========== ===========

9 Loans and Borrowings (Continued)

As at 1 Foreign As at 31

January Drawdown Repayment exchange December

2020 of loan of loan movements 2020

Audited US$'000 US$'000 US$'000 US$'000 US$'000

------------ --------- --------- ---------- ----------- ----------

Bank loans 53,070 3,148 (4,879) 217 51,556

Total 53,070 3,148 (4,879) 217 51,556

========= ========= ========== =========== ==========

As at 1 Repayment Foreign As at 30

January of lease Interest exchange June

2021 payment expenses movements 2021

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- --------- ---------- ---------- ----------- ---------

Lease Liabilities 181 (227) 12 77 43

Total 181 (227) 12 77 43

========= ========== ========== =========== =========

As at 1 Repayment Foreign As at 30

January of lease Interest exchange June

2020 payment expenses movements 2020

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- --------- ---------- ---------- ----------- ---------

Lease Liabilities 611 (224) - (1) 386

Total 611 (224) - (1) 386

========= ========== ========== =========== =========

As at 1 Repayment Foreign As at 31

January of lease Interest exchange December

2020 payment expenses movements 2020

Audited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- --------- ---------- ---------- ----------- ----------

Lease Liabilities 611 (463) 23 10 181

Total 611 (463) 23 10 181

========= ========== ========== =========== ==========

10 Medium Term Notes

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

------------------------------- ---------- ---------- ------------

Outstanding medium term notes 43,609 (38,060) 40,570

Net transaction costs (161) (182) (370)

Less:

Repayment due within twelve

months* (43,448) (37,878) (40,200)

------------------------------- ---------- ---------- ------------

Repayment due after twelve - - -

months

------------------------------- ---------- ---------- ------------

10 Medium Term Notes (continued)

* Includes net transaction costs in relation to medium term

notes due within twelve months of US$0.67 million. (30 June 2020:

US$0.18 million; 31 December 2020: US$0.37 million)

Reconciliation of movement of medium term notes to cash flows

arising from financing activities:

As at 1 Foreign As at

January Drawdown Non-cash exchange 30 June

2021 of loan adjustment movements 2021

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

--------------------- --------- --------- ------------ ----------- ---------

Medium Term Notes 40,200 4,411 200 (1,363) 43,448

--------- --------- ------------ ----------- ---------

As at 1 Foreign

January Drawdown Repayment exchange As at 30

2020 of loan of loan movements June 2020

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

--------------------- --------- --------- ---------- ----------- -----------

Medium Term Notes 36,142 2,605 - (869) 37,787

--------- --------- ---------- ----------- -----------

As at 1 Foreign As at 31

January Drawdown Repayment exchange December

2020 of loan of loan movements 2020

Audited US$'000 US$'000 US$'000 US$'000 US$'000

--------------------- --------- --------- ---------- ----------- ----------

Medium Term Notes 36,142 3,378 - 680 40,200

========= ========= ========== =========== ==========

The medium term notes ("MTNs") were issued pursuant to a

programme with a tenor of ten (10) years from the first issue date

of the notes. The MTNs were issued by a subsidiary, to fund two

development projects known as Sandakan Harbour Square and Aloft

Kuala Lumpur Sentral ("AKLS") in Malaysia.

In 2016, the Group completed the sale of the AKLS. The net

adjusted price value for the sale of AKLS, which included the sale

of the entire issued share capital of ASPL M3B Limited and Iringan

Flora Sdn. Bhd. (the "Aloft Companies") were used to redeem the MTN

Series 2 and Series 3. Following the completion of the disposal of

AKLS, US$96.25 million (RM394.0 million) of MTN associated with the

AKLS (Series 3) and the Four Points Sheraton Sandakan (Series 2)

were repaid on 19 August 2016. The charges in relation to AKLS was

also discharged following the completion of the disposal.

In 2017, Silver Sparrow Berhad ("SSB") obtained consent from the

lenders to utilise proceeds of US$4.64 million in the Sales

Proceeds Account and Debt Service Reserve Account to partially

redeem the MTNs in November 2017. SSB also secured "roll-over" for

the remaining MTNs of US$24.43 million which is due on 10 December

2019 and 8 December 2020, it is now repayable on 8 December 2021.

The MTNs are rated AAA.

No repayments were made in the current financial period.

10 Medium Term Notes (continued)

The weighted average interest rate of the MTN was 6.02% per

annum at the statement of financial position date. The effective

interest rates of the MTN and their outstanding amounts are as

follows:

Interest rate

Maturity Dates % per annum US$'000

---------------------- ------------------ -------------- ----------

Series 1 Tranche FGI 8 Dec 2021 6.02 13,726

Series 1 Tranche BG 8 Dec 2021 6.02 10,354

24,080

----------------------------------------- -------------- ----------

The medium term notes are secured by way of:

(i) bank guarantee from two financial institutions in respect of the BG Tranches;

(ii) financial guarantee insurance policy from Danajamin

Nasional Berhad ("Danajamin") in respect to the FG Tranches;

(iii) a first fixed and floating charge over the present and

future assets and properties of Silver Sparrow Berhad and ICSD

Ventures Sdn. Bhd. by way of a debenture;

(iv) a third party first legal fixed charge over ICSD Ventures Sdn. Bhd.'s assets and

land;

(v) a corporate guarantee by the Company;

(vi) letter of undertaking from the Company to provide financial

and other forms of support to ICSD Ventures Sdn. Bhd. to finance

any cost overruns associated with the development of the Sandakan

Harbour Square;

(vii) assignment of all its present and future rights, interest

and benefits under the ICSD Ventures Sdn. Bhd.'s Put Option

Agreements in favour of Danajamin, Malayan Banking Berhad and OCBC

Bank (Malaysia) Berhad (collectively as "the guarantors") where

once exercised, the sale and purchase of HMS and SHA shall take

place in accordance with the provision of the Put Option Agreement;

and the proceeds from HMS and SHA will be utilised to repay the

MTNs;

(viii) assignment over the disbursement account, revenue

account, operating account, sale proceed account, debt service

reserve account and sinking fund account of Silver Sparrow Berhad;

revenue account of ICSD Venture Sdn. Bhd;

(ix) assignment of all ICSD Ventures Sdn. Bhd's present and

future rights, title, interest and benefits in and under the

insurance policies; and

(x) a first legal charge over all the shares of Silver Sparrow

Berhad, ICSD Ventures Sdn. Bhd. and any dividends, distributions

and entitlements.

10 Medium Term Notes (continued)

Potensi Angkasa Sdn Bhd ("PASB"), a subsidiary incorporated on

25 February 2019, has secured a commercial paper and/or medium term

notes programme of not exceeding US$21.02 mil (R M90.0 million)

("CP/MTN Programme") to fund a project known as The RuMa Hotel and

Residences. PASB may, from time to time, issue commercial paper

and/or medium term notes ("Notes") whereby the nominal value of

outstanding Notes shall not exceed US$21.02 million (RM90.0

million) at any one time. The details of the drawdown schedule were

as follow s :

Initial Issue First Rolled-over Second Rolled-over

----------------------------------- ---------------------------------- -------------------------------

Tranche RM Tranche RM Tranche RM

Number Date ('000) Number Date ('000) Number Date ('000)

----------- -------- ------------ ---------- ------- ------------- ---------- ------- ----------

Tranche 10 Jun Tranche 10 Jun Tranche 10 Jun

1-23 2019 22,850 63-83 2020 20,950 124-142 2021 20,950

Tranche 30 Sep Tranche 30 Sep

24-31 2019 9,600 84-91 2020 9,600

Tranche 7 Oct Tranche 7 Oct

32-49 2019 17,100 92-109 2020 17,100

Tranche 25 Feb Tranche 25 Feb

50-62 2020 15,350 110-122 2021 15,350

Tranche 9 Jun

123 2021 18,100

----------- -------- ------------ ---------- ------- ------------- ---------- ------- ----------

The weighted average interest rate of the loan was 6.2% per

annum at the statement of financial position date. The effective

interest rates of the medium term notes and their outstanding

amounts were as follows:

Maturity

Interest rate

Maturity Dates % per annum US$'000

----------------- ------------------ -------------- ----------

Tranche 84-91 1 Oct 2021 6.0 2,312

Tranche 92-109 8 Oct 2021 6.0 4,118

Tranche 110-122 28 Feb 20 22 6.0 3,696

Tranche 123 10 Jun 202 2 7.0 4,358

Tranche 124-142 13 Jun 202 2 6.0 5,045

19,529

------------------------------------ -------------- ----------

Security for CP/MTN Programme

(a) A legal charge over the Designated Accounts by the PASB

and/or the Security Party (as defined below) (as the case may be)

and assignment of the rights, titles, benefits and interests of the

PASB and/or the Security Party (as the case may be) thereto and the

credit balances therein on a pari passu basis among all Notes,

subject to the following:

(i) In respect of the 75% of the sale proceeds of a Secured

Asset ("Net Sale Proceeds") arising from the disposal of a Secured

Asset, the Noteholders of the relevant Tranche secured by such

Secured Asset shall have the first ranking security over such Net

Sale Proceeds;

(j)

10 Medium Term Notes (continued)

(ii) In respect of the insurance proceeds from the Secured

Assets ("Insurance Proceeds"), the Noteholders of the relevant

Tranche secured by such Secured Asset shall have the first ranking

security over such Insurance Proceeds;

(iii) In respect of the sale deposits from the Secured Assets

("Sale Deposits"), the Noteholders of the relevant Tranche secured

by such Secured Asset shall have the first ranking security over

such Sale Deposits;

(iv) In respect of the amount at least equivalent to an amount

payable in respect of any coupon payment of that particular Tranche

for the next six (6) months to be maintained by the Issuer

("Issuer's DSRA Minimum Required Balance"), the Noteholders of the

relevant Tranche shall have the first ranking security over such

Issuer's DSRA Minimum Required Balance;

(v) In respect of the proceeds from the Collection Account ("CA

Proceeds"), the Noteholders of the relevant Tranche shall have the

first ranking security over such CA Proceeds; and

(vi) In respect of any amount deposited by the Guarantor which

are earmarked for the purposes of an early redemption of a

particular Tranche of the Notes and/or principal payment of a

particular Tranche of the Notes ("Deposited Amount"), the

Noteholders of the relevant Tranche shall have the first ranking

security over such Deposited Amount;

(b) An irrevocable and unconditional guarantee provided by the

Urban DNA Sdn Bhd for all payments due and payable under the CP/MTN

Programme ("Guarantee"); and

(c) Any other security deemed appropriate and mutually agreed

between the PASB and the Principal Adviser/Lead Arranger ("PA/LA"),

the latter being Kenanga Investment Bank Berhad.

Security for each medium term note:

Each Tranche shall be secured by assets ("Secured Assets") to be

identified prior to the issue date of the respective Tranche.

Such Secured Assets may be provided by third party(ies), (which,

together with the Guarantor, shall collectively be referred to as

"Security Parties" and each a "Security Party") and/or by the PASB.

Subject always to final identification of the Secured Asset prior

to the issue date of the respective Tranche, the security for any

particular Tranche may include but not limited to the

following:

(a) Legal assignment and/or charge by the PASB and/or the

Security Party (as the case may be) of the Secured Assets;

(b) An assignment over all the rights, titles, benefits and

interests of the PASB and/or the Security Party (as the case may

be) under all the sale and purchase agreements executed by

end-purchasers and any subsequent sale and purchase agreement to be

executed in the future by end-purchaser (if any), in relation to

the Secured Assets;

(k) A letter of undertaking from Aseana Properties Limited to,

amongst others, purchase the Secured Assets ("Letter of

Undertaking"); and/or

10 Medium Term Notes (continued)

(c) Any other security deemed appropriate and mutually agreed

between the Issuer and the PA/LA and/or Lead Manager prior to the

issuance of the relevant Tranche.

The security for each Tranche is referred to as "Tranche

Security".

11 Related Party Transactions

Transactions between the Group with Ireka Corporation Berhad

("ICB") and its group of companies are classified as related party

transactions based on ICB's 23.07% shareholding in the Company.

Related parties also include key management personnel defined as

those persons having authority and responsibility for planning,

directing and controlling the activities of the Group either

directly or indirectly. The key management personnel include all

the Directors of the Group, and certain members of senior

management of the Group.

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

------------------------------------- ----------- ----------- ------------------------

ICB Group of Companies

Accounting and financial reporting

services fee charged by an ICB - 208

subsidiary -

Accrued interest on shareholders

advance payable by ICB 356 - 227

Accrued interest on a contract

payment by an ICB subsidiary 70 - 83

Construction progress claim charged

by ICB subsidiary - 604 -

Hosting and IT support services

charged by an ICB subsidiary 2 38 -

Marketing commission charged

by an ICB subsidiary 7 8 -

Rental expenses charge by an

ICB subsidiary 29 36 -

Secretarial and administrative

services fee charged by an ICB 371 -

subsidiary -

Key management personnel

Remuneration of key management

personnel - Directors' fees 146 312 233

Remuneration of key management

personnel - Salaries 125 47 67

------------------------------------- ----------- ----------- ------------------------

11 Related Party Transactions (continued)

Transactions between the Group and other significant related

parties are as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

--------------------------------- ----------- ----------- -------------

Non-controlling interests

Advances - non-interest bearing

Other related parties 193 578 731

Disposal of subsidiaries - - 3,936

--------------------------------- ----------- ----------- -------------

The above transactions have been entered into in the normal

course of business and have been established on terms and

conditions that are not materially different from those obtainable

in transactions with unrelated parties.

The outstanding amounts due from/ (to) ICB and its group of

companies as at 30 June 2021, 30 June 2020 and 31 December 2020 are

as follows:

Unaudited Audited

As at Unaudited As at

30 June As at 31 December

2021 30 June 2020 2020

US$'000 US$'000 US$'000

---------------------------- ---------- -------------- -------------

Net amount due from an ICB

subsidiary 1,945 4,555 1,953

Net amount due from ICB 5,109 3,692 3,381

---------------------------- ---------- --------------

The outstanding amounts due from/ (to) the other significant

related parties as at 30 June 2021, 30 June 2020 and 31 December

2020 are as follows:

Audited

Unaudited Unaudited As at

As at As at 31 December

30 June 2021 30 June 2020 2020

US$'000 US$'000 US$'000

--------------------------------- -------------- -------------- -------------

Non-controlling interests

Advances - non-interest bearing (10,830) (10,923) (11,370)

--------------------------------- -------------- -------------- -------------

Transactions between the parent company and its subsidiaries are

eliminated in these consolidated financial statements.

12 Dividends

The Company has not paid or declared any dividends during the

financial period ended 30 June 2021.

13 Interim Statement

Copies of this interim statement are available on the Company's

website www.aseanaproperties.com or from the Company's registered

office at 12 Castle Street, St. Helier, Jersey, JE2 3RT, Channel

Islands.

14 EVENTS AFTER STATEMENT OF FINANCIAL POSITION DATE

On 25th August, 2021 the Company announced that it had entered

into a binding agreement to sell its entire interest in both the

City International Hospital and the adjacent International

Healthcare Park in HCM. The terms of the transaction are subject to

approvals from regulatory authorities as well as conditions to

completion. It is expected the completion will take several months.

Once completed, the Company will have no assets in Vietnam.

On 9th September, 2021 the Company announced it had entered into

a conditional agreement to sell the remaining 58 unsold residences

at The Ruma Hotel & Residences in Kuala Lumpur. Gross sale

price is MYR 85.3m (approximately US $20.5m) and is subject to

final due diligence by the Buyer as well as receipt of government

approval for the sale to a foreign investor. Expected completion

will take place within 8 months.

Principal Risks and Uncertainties

The Board has overall responsibility for risk management and

internal control. The following have been identified previously as

the areas of principal risk and uncertainty facing the Company, and

they remain relevant in the second half of the year.

-- Economic

-- Strategic

-- Regulatory

-- Law and regulations

-- Tax regimes

-- Management and control

-- Operational

-- Financial

-- Going concern

For greater detail, please refer to page 19 of the Company's

Annual Report for 2020, a copy of which is available on the

Company's website www.aseanaproperties.com .

RESPONSIBILITY STATEMENT

The Directors of the Company confirm that to the best of their

knowledge that:

a) The condensed consolidated financial statements have been

prepared in accordance with IAS 34 (Interim Financial

Reporting);

b) The interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) The interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

On behalf of the Board

Nicholas John Paris

Director

16 September 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKABPBBKDPCD

(END) Dow Jones Newswires

September 16, 2021 09:01 ET (13:01 GMT)

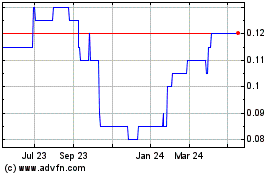

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

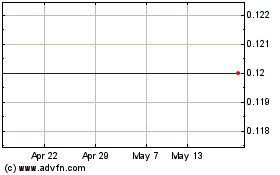

Aseana Properties (LSE:ASPL)

Historical Stock Chart

From Apr 2023 to Apr 2024