TIDMANGS

RNS Number : 4403X

Angus Energy PLC

20 December 2023

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO . 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMENDED . UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN .

20 December 2023

Angus Energy Plc

("Angus Energy", the "Company" or together with its

subsidiaries, the "Group")

(AIM:ANGS)

Non-binding Heads of Terms agreed for GBP20 million Global

Refinance

Appointment of Subsurface and Wells Lead

-- GBP20m debt facility agreed with Trafigura PTE Ltd

("Trafigura") to refinance all existing debt and fund additional

capex projects to raise production at Saltfleetby Field

-- 5 year amortising term with one year repayment grace period

and reduced cash sweep for accelerated repayment

-- Interest margin over SONIA of 8% compared to 12% on existing

senior debt and 15% on bridge facility

-- All existing senior and bridge debt to be repaid

-- Medium-term capex needs fulfilled

-- Trafigura to act as Offtaker

-- Existing hedge contract to be replaced with a fixed price offtake

-- Work on gas storage feasibility to be accelerated with funds

from the new facility and revised subsurface mapping

Further to the Company's announcement of 14 July 2023 and

subsequently, Angus is pleased to confirm that it has now entered

into detailed, non-binding, heads of terms ("Heads of Terms") for a

GBP20 million senior secured debt facility (the "Refinance

Facility") with Trafigura and has received indicative approval from

the lenders under the Company's existing senior secured loan

facility to proceed. The Company has now to agree definitive

documentation after which it will proceed to completion and

drawdown. Trafigura has provided an expected closing date during

the course of January 2024.

The Refinance Facility will be used to repay existing senior and

bridge debt (presently c. GBP5 million and GBP6.7 million

respectively) and reduce the deferred consideration due to Forum

Energy (presently c. GBP5 million) as well as to initiate

expenditure on a fourth well at Saltfleetby to be completed by Q1

2025.

As part of closing of the Refinance Facility, Trafigura will

work with the Company's existing hedge provider to organise an

orderly transfer of the existing hedge obligations which run until

June 2025. A dynamic rolling gas price protection programme has

been agreed which will provide protection at least until the

scheduled maturity date of the Refinance Facility. The offtake

arrangement with Trafigura will be substantially in line with the

existing gas sales agreement; physical fixed price contracts will

be entered into on part of the production to cover the existing

hedge position until June 2025 and for risk management beyond

that.

The headline term of the Refinance Facility is 5 years with even

quarterly amortisation payments after an initial repayment holiday

of 12 months. Additionally, there is a cash sweep whereby 50% of

Angus' revenues (after deducting all group wide costs, including

financing charges) are to be applied each quarter to redeem the

loan. To the extent that sweep repayments are made, the even

quarterly amortisation payments will be adjusted.

The Refinance Facility has been arranged by Aleph Commodities

Limited ("Aleph"). Total arrangement fees to Aleph and Trafigura

for the new facility are subject to final agreement. Final terms

will be confirmed in an announcement of the definitive agreement

and will be dealt with in accordance with AIM Rule 13 as

appropriate at that time. Similarly, the revised arrangement with

Forum Energy will be dealt with in accordance with AIM Rule 13 as

appropriate at that time.

The Heads of Terms also include standard terms on change of

control, covenants and events of default.

Detailed terms will be released on completion of documentation

which is expected to conclude early in the New Year.

New Appointment

The Company is pleased to announce that Ross Pearson, former

Technical Director of Star Energy plc (formerly IGAS plc) is

joining the Company as the lead on all wells and subsurface

activity. An options package of 25,000,000 options at 0.67p has

been agreed with vesting dates being subject to contract

milestones.

END

For further information on the Company, please visit www.angusenergy.co.uk or contact:

Enquiries:

Angus Energy Plc www.angusenergy.co.uk

Richard Herbert Tel: +44 (0) 208 899 6380

Beaumont Cornish Limited (Nomad) www.beaumontcornish.com

James Biddle / Roland Cornish Tel: +44 (0) 207 628 3396

WH Ireland Limited (Broker)

Katy Mitchell / Harry Ansell Tel: +44 (0) 207 220 1666

Flagstaff PR/IR angus@flagstaffcomms.com

Tim Thompson / Fergus Mellon Tel: +44 (0) 207 129 1474

Aleph Commodities info@alephcommodities.com

Disclaimers - this Announcement includes statements that are, or

may be deemed to be, "forward-looking statements". These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "forecasts", "plans", "prepares", "anticipates",

"projects", "expects", "intends", "may", "will", "seeks", "should"

or, in each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts. They

appear in a number of places throughout this Announcement and

include statements regarding the Company's and the Directors'

intentions, beliefs or current expectations concerning, amongst

other things, the Company's prospects, growth and strategy. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Company's actual performance, achievements and

financial condition may differ materially from those expressed or

implied by the forward-looking statements in this Announcement. In

addition, even if the Company's results of operations, performance,

achievements and financial condition are consistent with the

forward-looking statements in this Announcement, those results or

developments may not be indicative of results or developments in

subsequent periods. Any forward-looking statements that the Company

makes in this Announcement speak only as of the date of such

statement and (other than in accordance with their legal or

regulatory obligations) neither the Company, nor the Bookrunner nor

Beaumont Cornish nor any of their respective associates, directors,

officers or advisers shall be obliged to update such statements.

Comparisons of results for current and any prior periods are not

intended to express any future trends or indications of future

performance, unless expressed as such, and should only be viewed as

historical data.

Beaumont Cornish Limited, which is authorised and regulated in

the United Kingdom by the Financial Conduct Authority, is acting as

nominated adviser to the Company in relation to the matters

referred herein. Beaumont Cornish Limited is acting exclusively for

the Company and for no one else in relation to the matters

described in this announcement and is not advising any other person

and accordingly will not be responsible to anyone other than the

Company for providing the protections afforded to clients of

Beaumont Cornish Limited, or for providing advice in relation to

the contents of this announcement or any matter referred to in

it.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFLDFRLIFIV

(END) Dow Jones Newswires

December 20, 2023 02:17 ET (07:17 GMT)

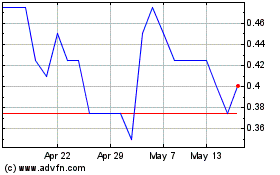

Angus Energy (LSE:ANGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

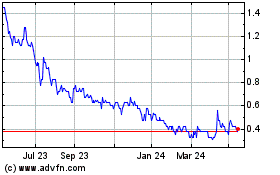

Angus Energy (LSE:ANGS)

Historical Stock Chart

From Nov 2023 to Nov 2024