TIDMAEP

RNS Number : 2047B

Anglo-Eastern Plantations PLC

28 February 2014

28 February 2014

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Restatement of Prior Year Results

Anglo-Eastern Plantations Plc and its subsidiaries, which owns,

operates and develops plantations in Indonesia and Malaysia,

amounting to some 128,000 hectares producing mainly palm oil and

some rubber of which approximately 61,000 hectares are planted.

The 2012 accounts stated that the Company was in the process of

resolving a query from the Financial Reporting Council ("FRC")

concerning the measurement of the notional rent used in the

valuation of the Group's biological assets.

AEP has applied a notional rent equivalent to 9% of the value of

planted land in the valuation of their biological assets and this

has resulted in a reduction in the value of its biological assets

at 31 December 2012 by $37 million (2011: $38 million) from $245

million (2011: $235 million) to $208 million (2011: $197 million),

although the profit before biological asset adjustment of the Group

remains unchanged. The Group's profit after biological asset

adjustment for the years ended 31 December 2012 and 2011 were

reduced by $1.6 million and $4.0 million respectively as a result

of the restatement. The effect of these prior year adjustments has

no impact on the cash flows of the Group. As a result of this

change, the FRC has confirmed that it regards its enquiries into

the Company's annual report and accounts for the year ended 31

December 2010 as concluded.

Financial Highlights

Restated Restated

2012 2011

$ m $ m

Revenue 237.4 259.0

Profit before tax

- before biological asset ("BA")

adjustment 88.6 101.9

- after BA adjustment 81.9 117.7

EPS before BA adjustment 133.99cts 154.15cts

EPS after BA adjustment 119.41cts 186.35cts

Dividend (cents) 4.5cts 6.0cts

The restated results for the financial years ended 31 December

2012 and 31 December 2011 are enclosed with this announcement.

For further enquiry, contact:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Charles Stanley Securities

Russell Cook

Karri Vuori +44 (0)20 7149 6000

Consolidated income statement

for the year ended 31 December 2012

(Restated) (Restated)

2012 2011

Result Result

before before

Continuing BA BA BA BA

operations Notes adjustment adjustment Total adjustment adjustment Total

$000 $000 $000 $000 $000 $000

--------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Revenue 237,352 - 237,352 259,037 - 259,037

Cost of sales (142,755) - (142,755) (155,147) - (155,147)

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Gross profit 94,597 - 94,597 103,890 - 103,890

Biological asset

revaluation movement - (6,729) (6,729) - 15,763 15,763

Administration

expenses (9,201) - (9,201) (5,372) - (5,372)

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Operating profit 85,396 (6,729) 78,667 98,518 15,763 114,281

Exchange profits (24) - (24) 213 - 213

Finance income 3,336 - 3,336 3,891 - 3,891

Finance expense (117) - (117) (707) - (707)

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Profit before tax 88,591 (6,729) 81,862 101,915 15,763 117,678

Tax expense (22,476) 1,682 (20,794) (26,809) (3,940) (30,749)

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Profit for the

year 66,115 (5,047) 61,068 75,106 11,823 86,929

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Attributable to:

- Owners of the

parent 53,108 (5,777) 47,331 60,949 12,732 73,681

- Non-controlling

interests 13,007 730 13,737 14,157 (909) 13,248

---------------------------- -------------- -------------- ----------- -------------- -------------- -----------

66,115 (5,047) 61,068 75,106 11,823 86,929

--------------------------- -------------- -------------- ----------- -------------- -------------- -----------

Earnings per share

for profit attributable

to the owners of

the parent during

the year

3 119.41cts 186.35

* basic cts

3 119.27cts 185.69

* diluted cts

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2012

(Restated) (Restated)

2012 2011

$000 $000

-------------------------------------------- ------------ --- ------------

Profit for the year 61,068 86,929

-------------------------------------------- ------------ --- ------------

Other comprehensive income:

Unrealised loss on revaluation of land (4,064) (48,932)

Loss on exchange translation of foreign

operations (25,337) (4,959)

Deferred tax on revaluation 1,015 12,233

Other comprehensive expenses for the year (28,386) (41,658)

Total comprehensive income for the year 32,682 45,271

Attributable to:

- Owners of the parent 23,172 41,805

- Non-controlling interests 9,510 3,466

-------------------------------------------- ------------ --- ------------

32,682 45,271

-------------------------------------------- ------------ --- ------------

Consolidated Statement of Financial Position

As at 31 December 2012

(Restated) (Restated) (Restated)

2012 2011 2010

Notes $000 $000 $000

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Non-current assets

Biological assets 4 207,679 197,410 153,915

Property, plant and equipment 4 212,177 214,840 249,610

Receivables 5,033 1,551 1,494

424,889 413,801 405,019

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Current assets

Inventories 6,075 9,439 6,820

Tax receivables 4,734 5,098 7,342

Trade and other receivables 7,419 4,877 3,356

Cash and cash equivalents 116,250 90,482 70,871

134,478 109,896 88,389

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Current liabilities

Loans and borrowings (52) (6,465) (15,650)

Trade and other payables (15,635) (20,878) (15,170)

Tax liabilities (6,996) (11,019) (5,130)

(22,683) (38,362) (35,950)

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Net current assets 111,795 71,534 52,439

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Non- current liabilities

Loans and borrowings (25,026) (58) (6,438)

Deferred tax liabilities (37,236) (43,098) (50,982)

Retirement benefits - net liabilities (3,057) (1,593) (2,305)

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Net assets 471,365 440,586 397,733

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Issued capital and reserves

attributable to owners of the

parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,507) (1,507)

Share premium 23,935 23,935 23,935

Capital redemption reserve 1,087 1,087 1,087

Revaluation reserves 36,799 39,480 67,303

Exchange reserves (88,838) (67,360) (63,307)

Retained earnings 401,006 355,914 284,165

---------------------------------------- ------- ------------ ---- ------------ --- ------------

388,322 367,053 327,180

Non-controlling interests 83,043 73,533 70,553

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Total equity 471,365 440,586 397,733

---------------------------------------- ------- ------------ ---- ------------ --- ------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2012

Capital Foreign

Share Treasury Share redemption Revaluation exchange Retained Non-controlling Total

capital shares premium reserve reserve reserve earnings Total interests equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Balance as at

31 December

2010 15,504 (1,507) 23,935 1,087 67,303 (63,307) 305,683 348,698 73,665 422,363

Restatement

(note 2) - - - - - - (21,518) (21,518) (3,112) (24,630)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Balance at 31

December 2010

after

restatement 15,504 (1,507) 23,935 1,087 67,303 (63,307) 284,165 327,180 70,553 397,733

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Items of other

comprehensive

income

-Unrealised

gain on

revaluation

of land - - - - (37,097) - - (37,097) (11,835) (48,932)

-Deferred tax

on

revaluation

of assets - - - - 9,274 - - 9,274 2,959 12,233

-Loss on

exchange

translation - - - - - (4,053) - (4,053) (906) (4,959)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Net loss

recognised

directly

in equity - - - - (27,823) (4,053) - (31,876) (9,782) (41,658)

Profit for

year - - - - - - 73,681 73,681 13,248 86,929

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Total

comprehensive

income and

expense for

the year - - - - (27,823) (4,053) 73,681 41,805 3,466 45,271

Issue of

subsidiary

shares to

minority

shareholder - - - - - - - - 2,054 2,054

Share options

exercised /

Share

based payment

expense - - - - - - 45 45 - 45

Dividends paid - - - - - - (1,977) (1,977) (2,540) (4,517)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Balance at 31

December 2011

after

restatement 15,504 (1,507) 23,935 1,087 39,480 (67,360) 355,914 367,053 73,533 440,586

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2012

Capital Foreign

Share Treasury Share redemption Revaluation exchange Retained Non-controlling Total

capital shares premium reserve reserve reserve earnings Total interests equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Balance as at

31 December

2011 15,504 (1,507) 23,935 1,087 39,480 (67,602) 380,633 391,530 77,369 468,899

Restatement

(note 2) - - - - - 242 (24,719) (24,477) (3,836) (28,313)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Balance at 31

December 2011

after

restatement 15,504 (1,507) 23,935 1,087 39,480 (67,360) 355,914 367,053 73,533 440,586

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Items of other

comprehensive

income

-Unrealised

loss on

revaluation

of land - - - - (3,574) - - (3,574) (490) (4,064)

-Deferred tax

on

revaluation

of assets - - - - 893 - - 893 122 1,015

-Loss on

exchange

translation - - - - - (21,478) - (21,478) (3,859) (25,337)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Total other

comprehensive

income - - - - (2,681) (21,478) - (24,159) (4,227) (28,386)

Profit for

year - - - - - - 47,331 47,331 13,737 61,068

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Total

comprehensive

income and

expense for

the year - - - - (2,681) (21,478) 47,331 23,172 9.510 32,682

Share option

exercised - 336 - - - - 133 469 - 469

Dividends paid - - - - - - (2,372) (2,372) - (2,372)

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Balance at 31

December 2012

after

restatement 15,504 (1,171) 23,935 1,087 36,799 (88,838) 401,006 388,322 83,043 471,365

---------------- --------- ---------- --------- ------------ ------------- ---------- ---------- ---------- ----------------- ----------

Notes

1. Accounting policies

Anglo-Eastern Plantations Plc ("AEP") is a company incorporated

in the United Kingdom under the Companies Act 2006 and is listed on

the London Stock Exchange. The registered office of AEP is located

at Quadrant House, 6(th) Floor, 4 Thomas More Square, London E1W

1YW, United Kingdom. The principal activity of the Group is

plantation agriculture.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with IFRSs as adopted by the European

Union. The financial information for the year ended 31 December

2012 included within this report does not constitute the full

statutory accounts for that period. The statutory Annual Report and

Financial Statements for 2012 have been filed with the Registrar of

Companies. The Independent Auditors' Report on that Annual Report

and Financial Statement for 2012 was qualified on the basis of a

limitation in scope, did not draw attention to any matters by way

of emphasis, and contained statements under 498(2) or 498(3) of the

Companies Act 2006.

Except for the measurement of notional rent, the same accounting

policies, presentation and methods of computation are followed in

these restated consolidated financial statements as were applied in

the Group's annual audited financial statements. The Company's

accounting policy for biological assets, set out below, is

unchanged.

The 2012 Annual Report stated that the Company was in the

process of resolving a query from the Financial Reporting Council

("FRC") concerning the measurement of the notional rent used in the

valuation of the Group's biological assets. Following further

discussion with the FRC, the Group has changed the determination of

notional rent, one of the assumptions used in the valuation of the

Group's biological assets in accordance with its stated policy to

reflect current market data in the estimate of the cost for the use

of the land. The change in measurement of the notional rent has

significant impact on the carrying amount of biological asset and

thus the accounts for years ended 31 December 2012 and 2011 were

restated. The restatements and related adjustments are disclosed in

these accounts in note 2.

Biological assets

Biological assets comprise oil palm trees and nurseries. The

biological process commences with the initial preparation of land

and planting of seedlings and ceases with the delivery of crop in

the form of fresh fruit bunches ("FFB") to the manufacturing

process in which crude palm oil and palm kernel are extracted from

the FFB.

Biological assets are carried at fair value less costs to sell

determined on the basis of the net present value of cash flows

arising in producing FFB. No account is taken in the valuation of

future replanting. Biological assets are valued at each accounting

date based upon a valuation of the planted areas using a discounted

cash flow method by reference to the FFB expected to be harvested

over the full remaining productive life of the trees up to 20

years. Areas are included in the valuation once they are planted.

However oil palm which are not yet mature at the accounting date,

and hence are not producing FFB, are valued on a similar basis but

with the discounted value of the estimated cost to complete

planting and to maintain the assets to maturity being deducted from

the discounted FFB value. Movement in valuation surplus of

biological assets is charged or credited to the income statement

for the relevant period (BA adjustment).

2. Prior year restatement

The 2012 Annual Report stated that the Company was in the

process of resolving a query from the Financial Reporting Council

("FRC") concerning the measurement of the notional rent used in the

valuation of the Group's biological assets. In October 2013, the

Group engaged a professional valuer in the United Kingdom ('UK

valuer') for an independent opinion on the measurement of the

notional rent. As a result, the Group has adopted a notional rent

equivalent to 9% of the value of planted land value as proposed by

the UK valuer in valuing its biological asset. This resulted in the

accounts for the years ended 31 December 2012 and 2011 being

restated and the closure of discussions with the FRC. The effect of

the restatements is summarised below.

The impact of these prior year adjustments:-

(Restated) (Restated)

2012 2011

$000 $000

After Biological Assets

-------------------------------------------------- ------------- ----- -------------

Profit for the year before restatement 62,703 90,898

Effect of change in restatement:

------------- -------------

Biological asset revaluation movement (2,180) (5,293)

Tax 545 1,324

------------- -------------

(1,635) 3,969

Profit for the year after restatement 61,068 86,929

------------- -------------

Other comprehensive income for the year

before restatement (30,108) (41,944)

Effect of change in restatement:

Profit/(loss) on exchange translation of

foreign operations 1,722 286

-------------

Other comprehensive income for the year

after restatement (28,386) (41,658)

------------- -------------

The effect of these prior year adjustments had a negative impact

on the earnings per share of 3.69cts (2011: 8.10cts) for the year

to 31 December 2012.

The following table summarises the impact of these prior year

adjustments on the Consolidated Statement of Financial

Position:-

Deferred

Biological tax Exchange Retained Non-controlling

assets liabilities reserve earnings interest

$000 $000 $000 $000 $000

Balance as reported 1 January 2011 186,755 (59,192) (63,307) 305,683 73,665

Effect of restatement (32,840) 8,210 - (21,518) (3,112)

Restated balance as at 1 January

2011 153,915 (50,982) (63,307) 284,165 70,553

------------ ------------- ---------- ------------- -------------------

Balance as reported 31 December

2011 235,158 (52,533) (67,602) 380,633 77,369

Effect of restatement up to 1 January

2011 (32,840) 8,210 - (21,518) (3,112)

Effect of restatement during the

year (4,908) 1,225 242 (3,201) (724)

Restated balance as at 31 December

2011 197,410 (43,098) (67,360) 355,914 73,533

------------ ------------- ---------- ------------- -------------------

Balance as reported 31 December

2012 245,313 (46,644) (90,571) 427,186 86,822

Effect of restatement up to 1 January

2012 (37,748) 9,435 242 (24,719) (3,836)

Effect of restatement during the

year 114 (27) 1,491 (1,461) 57

Restated balance as at 31 December

2012 207,679 (37,236) (88,838) 401,006 83,043

---------- ---------- ---------- ---------- ---------

3 Earning per ordinary share (EPS)

(Restated) (Restated)

2012 2011

$000 $000

Profit for the year attributable to owners

of the Company before BA adjustment 53,108 60,949

Net BA adjustment (5,777) 12,732

------------ ------------

Earnings used in basic and diluted EPS 47,331 73,681

------------ ------------

Number Number

'000 '000

Weighted average number of shares in issue

in year

- used in basic EPS 39,636 39,539

- dilutive effect of outstanding share options 48 141

------------ ------------

- used in diluted EPS 39,684 39,680

------------ ------------

Basic EPS before BA adjustment 133.99cts 154.15cts

Basic EPS after BA adjustment 119.41cts 186.35cts

Dilutive EPS before BA adjustment 133.83cts 153.60cts

Dilutive EPS after BA adjustment 119.27cts 185.69cts

4 Biological assets, property, plant and equipment

Biological Estate Office PPE

assets plant, plant, Total

equipment equipment Construction

Mill Land Buildings & vehicle & vehicle in progress Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

Cost or valuation

At 1 January 2011

(restated) 153,915 39,080 200,977 15,859 11,883 1,212 2,114 271,125 425,040

Exchange

translations (2,601) (354) (308) (370) (15) (24) (44) (1,115) (3,716)

Decrease due to

harvest (14,905) - - - - - - - (14,905)

Revaluations 30,668 - (48,932) - - - - (48,932) (18,264)

Additions 10,437 3,404 2,637 6,142 2,357 163 693 15,396 25,833

Development costs

capitalised 19,896 - 3,016 966 248 - 216 4,446 24,342

Disposals - (243) - (23) (222) - - (488) (488)

------------ --------- ---------- ----------- ----------- ----------- -------------- ---------- ----------

At 31 December

2011 (restated) 197,410 41,887 157,390 22,574 14,251 1,351 2,979 240,432 437,842

Exchange

translations (11,531) (2,546) (8,643) (1,527) (769) (30) (156) (13,671) (25,202)

Reclassification 848 - (848) 4,350 - - (4,350) (848) -

Decrease due to

harvest (20,522) - - - - - - - (20,522)

Revaluations 13,793 - (4,064) - - - - (4,064) 9,729

Additions 3,749 2,509 4,246 7,674 2,571 81 2,165 19,246 22,995

Development costs

capitalised 23,932 - - - - - 2,151 2,151 26,083

Disposals - (97) - (142) (462) (2) (690) (1,393) (1,393)

------------ ----------

At 31 December

2012 207,679 41,753 148,081 32,929 15,591 1,400 2,099 241,853 449,532

------------ --------- ---------- ----------- ----------- ----------- -------------- ---------- ----------

Accumulated

depreciation

and impairment

At 1 January 2011

(restated) - 8,951 - 4,575 7,411 578 - 21,515 21,515

Exchange

translations - (123) - (88) (640) (13) - (864) (864)

Charge for the

year - 2,167 - 1,112 1,666 179 - 5,124 5,124

Disposal - (183) - - - - - (183) (183)

------------ --------- ---------- ----------- ----------- ----------- -------------- ---------- ----------

At 31 December

2011 (restated) - 10,812 - 5,599 8,437 744 - 25,592 25,592

Exchange

translations - (704) - (305) (431) (23) - (1,463) (1,463)

Charge for the

year - 2,344 - 1,640 1,963 188 - 6,135 6,135

Disposal - (77) - (102) (408) (1) - (588) (588)

At 31 December

2012 - 12,375 - 6,832 9,561 908 - 29,676 29,676

------------ --------- ---------- ----------- ----------- ----------- -------------- ---------- ----------

Carrying amount

At 31 December

2010 (restated) 153,915 30,129 200,977 11,284 4,472 634 2,114 249,610 403,525

At 31 December

2011 (restated) 197,410 31,075 157,390 16,975 5,814 607 2,979 214,840 412,250

At 31 December

2012 207,679 29,378 148,081 26,097 6,030 492 2,099 212,177 419,856

Net (loss)/gain

arising

from changes in

fair value

of biological

assets

At 31 December

2011 (restated) 15,763 - - - - - - - 15,763

At 31 December

2012 (6,729) - - - - - - - (6,729)

--------- ---------- ----------- ----------- ----------- --------------

The fair value less costs to sell of FFB harvested during the

period, determined at the point of harvest is exhibited below:

2012 2011

Fair value of FFB

Crop production and yield - FFB (mt) 783,000 707,000

Fair value of FFB ($000) 128,750 131,987

Fair value of FFB less costs to sell ($000) 122,783 124,373

The fair value of FFB at the point of harvest is recognised in

the income statement within the biological asset revaluation. A

reconciliation of the amount included within the income statement

and the biological asset has been included below:

(Restated) (Restated)

2012 2011

$000 $000

Harvest included in the biological asset

valuation from estimated production and

pricing assumptions less costs to sell

in the prior year 20,522 14,905

Gain from actual production and pricing 102,261 109,468

-------------- --------------

Fair value of FFB harvested from own production 122,783 124,373

-------------- --------------

The decrease due to harvest of $20,522,000 (2011: $14,905,000)

is the amount included within the prior year valuation for the

current year and is therefore deducted from biological asset

valuation in the current year as the FFB is harvested. The actual

fair value of harvested FFB varies to that forecast due to the

changes in; actual production, actual FFB price and actual costs

incurred. The gain on fair value of the harvested FFB is written

off as the FFB is processed in to CPO.

The biological asset revaluation movement included within the

income statement is calculated as follows:

(Restated) (Restated)

2012 2011

$000 $000

Decrease due to harvest (20,522) (14,905)

Revaluations 13,793 30,668

------------ ------------

Net (loss)/gain arising in the income

statement from changes in fair value of

biological assets (6,729) 15,763

------------ ------------

The carrying amount of the Group's biological assets was based

on independent valuations undertaken by independent valuers, Doli

Siregar & Rekan which its head office is located in Jakarta,

Indonesia except for an adjustment on discount rate and the

measurement of the notional rent which is determined by the

directors and the UK valuer respectively. Both firms have the

appropriate professional qualifications and recent experience in

the location and category of the properties being valued. Further

information of the Indonesian firm can be obtained from

'www.ds-r.co.id'. The Group's land as at 31 December 2012 has been

valued by directors with the last independent valuation undertaken

as at 31 December 2011.

The methodology of the valuations undertaken was using

discounted cash flow over the expected 20-year economic life of the

asset. The assumption applied in the valuation were, inter alia, an

assumed CPO selling price of $675/mt (2011: $625/mt), discount rate

of 17.5% (2011: 16.5%) and notional rent equivalent to 9% (2011:

9%) of the value of planted land value. The discount rates were

determined by the directors based on their assessment of various

risks including financial, business and country risk of where the

plantations are located as well as taking into account the

Company's weighted average cost of capital. The CPO price is taken

to be the 10-year average (2011: 10-year average) based on

historical widely-quoted commodity price for CPO and represents the

directors' best estimate of the price sustainable over the longer

term. The CPO price assumed is revised to reflect a price which is

closer to the market price of $810/mt as at 31 December 2012. The

notional rent charge is based on key capital market and property

indicators in the countries and regions of operations.

The following table exhibits the sensitivity of the Group's

biological assets to the fluctuation in CPO price and discount

rate:

(Restated)

2012

$000

A change of $50 in the price assumption for CPO

-$50 in the price assumption (43,991)

+$50 in the price assumption 45,273

A change of 1% in the discount rate

-1% in the discount rate 12,079

+1% in the discount rate (11,084)

A change of notional rent equivalent to 1% of

the value of planted land

-1% of the value of planted land 4,840

+1% of the value of planted land (4,716)

The estates include nil (2011: $14) of interest and $9,308,000

(2011: $6,074,000) of overheads capitalised during the year in

respect of expenditure on estates under development.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCQKFDNCBKKBBB

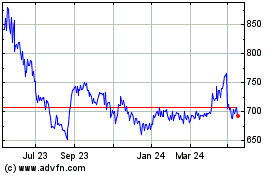

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jun 2024 to Jul 2024

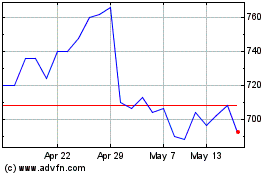

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jul 2023 to Jul 2024