TIDMAEP

RNS Number : 1390L

Anglo-Eastern Plantations PLC

30 August 2012

Anglo-Eastern Plantations Plc

("AEP" or the "Group")

Interim results for the six months ended 30 June 2012

Anglo-Eastern Plantations Plc (AEP.L), which owns approximately

130,000 hectares of plantation land, primarily in Indonesia, and

operates approximately 58,200 hectares of developed plantations, is

pleased to announce the interims results for the six months to 30

June 2012.

Financial Highlights

-- Revenue of $116.0 million (1H 2011: $128.9 million), a decline of 10%;

-- Operating profit of $37.3 million (1H 2011: $52.1 million*), a fall of 28%;

-- Profit before tax $38.5 million (1H 2011: $54.1 million*) a reduction of 29%;

-- Basic earnings per share of 51.24 cts (1H 2011: 90.00 cts) down by 43%;

-- Total cash balance at 30 June 2012 was $71.5 million compared

with $85.0 millionat 30 June 2011*;

-- Total borrowings at the period end of $1.6 million, compared to $15.4m at 30 June 2011.

* The 2011 figures have been restated following a review and

amendment to the Company's accounting policies relating to the

proportionate values attributed to the Group's biological and

non-biological assets.

Commercial Highlights

-- The market average price for crude palm oil for the period

was 9% lower at $1,095/mt compared to an average of $1,198/mt for

the same period in 2011.

-- Total own crop production was 340,350mt, an increase of 8%

compared to the same period last year.

-- Bought-in crop volumes was 2% lower at 255,386mt compared to the same period in 2011.

For further information, contact:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Charles Stanley Securities

Russell Cook

Karri Vuori +44 (0)20 7149 6000

Chairman's Interim Statement

Operational and financial performance

For the six months ended 30 June 2012, revenue was 10% lower at

$116.0 million compared to $128.9 million for the same period in

2011. The operating profit was 28% lower at $37.3 million (1H 2011:

$52.1 million) while profit before tax was $38.5 million, 29% lower

compared to $54.1 million for the same period in 2011.

The revenue and operating profit were reported lower mainly due

to a 9% drop in average Crude Palm Oil ("CPO") price for the 1H

2012 coupled with a 5% weakening of Indonesian Rupiah against U$

Dollar for the same period. CPO price averaged $1,095/mt for 1H

2012 compared to $1,198/mt for 1H 2011. However fresh fruit bunch

("FFB") production for the first six months of 2012 was 340,350mt,

8% higher compared to 315,787mt for 1H 2011. Bought-in crops for

the same period was 255,386mt, 2% lower than last year of

258,956mt.

The Group's balance sheet remains strong and cash flow remains

healthy despite considerable expenditure to maintain the immature

trees and new planting. As at 30 June 2012 the Group's total cash

balance was $71.5 million (1H 2011: $85.0 million) with total

borrowings of $1.6 million (1H 2011: $15.4 million), giving a net

cash position of $69.9 million, an improved position when compared

to 30 June 2011 of $69.6 million.

Earnings per share were down 43% at 51.24cts (1H 2011:

90.00cts).

Operating costs

The operating costs for the Indonesian operations were higher in

1H 2012 compared to the same period in 2011 mainly due to increase

in wages, fertilisers and general upkeep of plantations

Prior period adjustments

During the period the Company has revisited the bases of valuing

and accounting for its estate assets. As a result of this review

the directors have concluded that although the policy previously

applied gave rise to a materially accurate valuation of the

combined assets, the proportionate values attributed to the

biological and non-biological assets need to be restated.

Accordingly, the directors have concluded that prior period

adjustments are required to restate the figures previously

reported. Further details are provided in note 2.

Production and Sales

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

mt mt mt

Oil palm production

FFB

- all estates 340,350 315,787 707,000

- bought-in or processed for

third parties 255,386 258,956 546,800

Saleable CPO 117,749 113,854 248,000

Saleable palm kernels 29,364 28,386 62,300

Oil palm sales

CPO 116,534 112,865 248,900

Palm kernels 29,111 28,238 62,200

FFB sold outside 11,194 15,356 34,300

Rubber production 365 355 870

The total FFB processed in 1H 2012 was 595,736mt, a 4% increase

compared to 574,743mt for the same period last year.

Internal crop production was higher by 8% due mainly to a 6%

increase in matured planted area to 39,771ha from 37,525ha.

Bought-in crops on the other hand was 2% lower than last year

due to more intense competition for FFB supply from small

holders.

Commodity prices

CPO price remains volatile for the 1H 2012. CPO price surged to

a new 13-month high of US$1,195/mt in April 2012 from $1,045/mt at

the beginning of the year. But the price has since dropped to

around $1,000/mt on the back of concerns over a slowing economy in

China and the European debt crisis which we anticipate may further

reduce commodity demand. The average CPO price for 1H 2012 was

$1,095/mt (1H 2011:$1,198/mt).

Rubber price averaged around $3,346/mt (1H 2011: $4,887/mt).

Development

The Group's planted areas at 30 June 2012 comprised:-

Total Mature Immature

ha ha ha

North Sumatra 19,237 15,698 3,539

Bengkulu 18,495 15,308 3,187

Riau 4,952 4,952 -

South Sumatra 3,021 - 3,021

Kalimantan 8,847 353 8,494

------- ------- ---------

Indonesia 54,552 36,311 18,241

Malaysia 3,646 3,460 186

------- ------- ---------

Total : 30 June 2012 58,198 39,771 18,427

------- ------- ---------

Total : 31 Dec 2011 57,113 39,105 18,008

------- ------- ---------

Total : 30 June 2011 54,506 37,525 16,981

------- ------- ---------

The Group's new planting for the first six months ended 30 June

2012 totalled 1,085 hectares. The slower rate of new planting is

due to a host of reasons including delay in the issuance of land

release permit (Izin Pelepasan) for two plantations in

Indonesia.

The Group plans to plant 9,000ha over the next two years from 1

January 2012. The Group's total landholding comprises 130,000ha, of

which the planted area now stands around 58,198ha (1H 2011:

54,506ha).

The construction of the two palm oil mills in North Sumatra and

Central Kalimantan announced previously will commence by 3Q

2012.

A biogas and biomass project planned for the mill in North

Sumatra costing $4.5m will also start in the 3Q 2012 upon

conclusion of agreements with the selected contractor. This project

will enhance our waste management treatment and at the same time

mitigate the emissions of biogas.

Dividend

As in previous years no interim dividend has been declared. A

final dividend of 6.0 cents per share in respect of the year to 31

December 2011 was paid on 9 July 2012.

Outlook

It is generally expected that the imminent El Nino weather

phenomenon will lead to a weaker palm oil output in Southeast Asia

and lift the CPO price from its current level during the second

half of 2012. Furthermore with India's recent purchase of palm oil

climbing to new levels and this year's soyabean output in North

America affected by unfavourably hot weather, there is room for

palm oil price to move higher still. The board remains cautiously

confident of reporting a satisfactory level of profitability and

cash flow for the second half of 2012.

Principal risks and uncertainties

The directors do not consider that the principal risks and

uncertainties have changed since the publication of the annual

report for the year ended 31 December 2011.

A more detailed explanation of the risks relevant to the Group

is on pages 13 to 16 and from 50 to 53 of the 2011 annual report

which is available at www.angloeastern.co.uk.

Madam Lim Siew Kim

Chairman

30 August 2012

Condensed Consolidated Income Statement

Restated Restated

2012 2011 2011

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited) (unaudited*)

----------------------------------- ----------------------------------- ------------------------------------

Result Result Result

before before before

BA BA BA BA BA BA

Continuing adjustment adjustment Total adjustment adjustment Total adjustment adjustment Total

operations Notes $000 $000 $000 $000 $000 $000 $000 $000 $000

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Revenue 115,988 - 115,988 128,896 - 128,896 259,037 - 259,037

Cost of sales (76,816) - (76,816) (75,804) - (75,804) (155,147) - (155,147)

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Gross profit 39,172 - 39,172 53,092 - 53,092 103,890 - 103,890

Biological asset

revaluation

movement (BA

adjustment) 2 - 655 655 - 1,338 1,338 - 21,056 21,056

Administration

expenses (2,567) - (2,567) (2,331) - (2,331) (5,372) - (5,372)

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Operating profit 36,605 655 37,260 50,761 1,338 52,099 98,518 21,056 119,574

Exchange (loss) /

profits 3 (152) - (152) 875 - 875 213 - 213

Finance income 1,469 - 1,469 1,546 - 1,546 3,891 - 3,891

Finance expense 4 (110) - (110) (415) - (415) (707) - (707)

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Profit before tax 5 37,812 655 38,467 52,767 1,338 54,105 101,915 21,056 122,971

Tax expense 6 (9,951) (553) (10,504) (14,162) 292 (13,870) (26,809) (4,246) (31,055)

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Profit for the

period 27,861 102 27,963 38,605 1,630 40,235 75,106 16,810 91,916

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Attributable to:

- Owners of the

parent 22,573 (2,296) 20,277 31,568 4,019 35,587 61,093 16,843 77,936

- Non-controlling

interests 5,288 2,398 7,686 7,037 (2,389) 4,648 14,013 (33) 13,980

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

27,861 102 27,963 38,605 1,630 40,235 75,106 16,810 91,916

------------------- ------ ----------- ----------- --------- ----------- ----------- --------- ----------- ----------- ----------

Earnings per share

for profit

attributable

to the owners of

the

parent during the

period

- basic 8 51.24cts 90.00cts 197.11cts

- diluted 8 51.10cts 89.63cts 196.41cts

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

Condensed Consolidated Statement of Comprehensive Income

Restated Restated

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (unaudited*)

$000 $000 $000

----------------------------------------------- ------------ ------------ ---------------

Profit for the period 27,963 40,235 91,916

----------------------------------------------- ------------ ------------ ---------------

Other comprehensive income:

Unrealised loss on revaluation of the estates (1,850) (2,064) (48,932)

(Loss) / Profit on exchange translation of

foreign operations (13,229) 21,294 (5,670)

Deferred tax on revaluation (2,712) 12,370 23,933

----------------------------------------------- ------------ ------------ ---------------

Other comprehensive income / (expense) for

the period (17,791) 31,600 (30,669)

Total comprehensive income for the period 10,172 71,835 61,247

Attributable to:

- Owners of the parent 5,257 62,021 55,995

- Non-controlling interests 4,915 9,814 5,252

----------------------------------------------- ------------ ------------ ---------------

10,172 71,835 61,247

----------------------------------------------- ------------ ------------ ---------------

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

Condensed Consolidated Statement of Financial Position

Restated Restated Restated

2012 2011 2011 2010

as at 30 as at 31 December

as at 30 June June as at 31 December

Notes (unaudited) (unaudited) (unaudited*) (unaudited*)

$000 $000 $000 $000

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Non-current assets

Biological assets 2 246,372 212,645 235,158 186,755

Property, plant and equipment 212,464 265,214 214,840 249,610

Receivables 210 1,531 1,551 1,494

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

459,046 479,390 451,549 437,859

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Current assets

Inventories 10,306 9,143 9,439 6,820

Tax receivables 12,465 16,160 5,098 7,342

Trade and other receivables 8,650 4,723 4,877 3,356

Cash and cash equivalents 71,458 85,016 90,482 70,871

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

102,879 115,042 109,896 88,389

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Current liabilities

Loans and borrowings (1,513) (8,938) (6,465) (15,650)

Trade and other payables (16,696) (17,696) (20,878) (15,170)

Tax liabilities (9,648) (16,878) (11,019) (5,130)

Dividend payables (2,372) - - -

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

(30,229) (43,512) (38,362) (35,950)

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Net current assets 72,650 71,530 71,534 52,439

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Non-current liabilities

Loans and borrowings (56) (6,438) (58) (6,438)

Deferred tax liabilities (42,114) (49,808) (40,240) (59,192)

Retirement benefits - net liabilities (512) (2,673) (1,593) (2,305)

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Net assets 489,014 492,001 481,192 422,363

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Issued capital and reserves

attributable

to owners of the parent

Share capital 15,504 15,504 15,504 15,504

Treasury shares (1,401) (1,507) (1,507) (1,507)

Share premium reserve 23,935 23,935 23,935 23,935

Share capital redemption reserve 1,087 1,087 1,087 1,087

Revaluation and exchange reserves (32,965) 30,430 (17,945) 3,996

Retained earnings 399,508 339,293 381,687 305,683

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

405,668 408,742 402,761 348,698

Non-controlling interests 83,346 83,259 78,431 73,665

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

Total equity 489,014 492,001 481,192 422,363

---------------------------------------- ------ -------------- ------------ ------------------ ------------------

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

Share

capital Foreign

Share Treasury Share redemption Revaluation exchange Retained Non-controlling Total

capital shares premium reserve reserve reserve earnings Total interests equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Balance at 31

December

2010 15,504 (1,507) 23,935 1,087 149,396 (63,307) 229,060 354,168 74,495 428,663

Restatement

(Note 2) - - - - (82,093) - 76,623 (5,470) (830) (6,300)

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Balance at 31

December

2010 after

restatement 15,504 (1,507) 23,935 1,087 67,303 (63,307) 305,683 348,698 73,665 422,363

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Items of other

comprehensive

income

Unrealised

loss on

revaluation

of estates - - - - (37,097) - - (37,097) (11,835) (48,932)

Deferred tax

on

revaluation

of assets - - - - 19,840 - - 19,840 4,093 23,933

Loss on

exchange

translation - - - - - (4,684) - (4,684) (986) (5,670)

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Net loss

recognised

directly

in equity - - - - (17,257) (4,684) - (21,941) (8,728) (30,669)

Profit for

year - - - - - - 77,936 77,936 13,980 91,916

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Total

comprehensive

income

and expense

for the year - - - - (17,257) (4,684) 77,936 55,995 5,252 61,247

Acquisition of

subsidiary - - - - - - - - 2,054 2,054

Share options

exercised

/ Share based

payment

expense - - - - - - 45 45 - 45

Dividends paid - - - - - - (1,977) (1,977) (2,540) (4,517)

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Balance at 31

December

2011 15,504 (1,507) 23,935 1,087 50,046 (67,991) 381,687 402,761 78,431 481,192

Items of other

comprehensive

income

Unrealised

loss on

revaluation

of estates - - - - (1,743) - - (1,743) (107) (1,850)

Deferred tax

on

revaluation

of assets - - - - (2,669) - - (2,669) (43) (2,712)

Loss on

exchange

translation - - - - - (10,608) - (10,608) (2,621) (13,229)

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Net loss

recognised

directly

in equity - - - - (4,412) (10,608) - (15,020) (2,771) (17,791)

Profit for

period - - - - - - 20,277 20,277 7,686 27,963

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Total

comprehensive

income

and expense

for the

period - - - - (4,412) (10,608) 20,277 5,257 4,915 10,172

Share option

exercised - 106 - - - - (84) 22 - 22

Dividends

payable - - - - - - (2,372) (2,372) - (2,372)

------------ -----------

Balance at 30

June 2012 15,504 (1,401) 23,935 1,087 45,634 (78,599) 399,508 405,668 83,346 489,014

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Balance at 31

December

2010 15,504 (1,507) 23,935 1,087 149,396 (63,307) 229,060 354,168 74,495 428,663

Restatement

(Note 2) - - - - (82,093) - 76,623 (5,470) (830) (6,300)

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Balance at 31

December

2010 after

restatement 15,504 (1,507) 23,935 1,087 67,303 (63,307) 305,683 348,698 73,665 422,363

Items of other

comprehensive

income

Unrealised

loss on

revaluation

of estates - - - - (1,881) - - (1,881) (183) (2,064)

Deferred tax

on

revaluation

of assets - - - - 10,516 - 10,516 1,854 12,370

Gain on

exchange

translation - - - - - 17,799 - 17,799 3,495 21,294

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Net income

recognised

directly

in equity - - - - 8,635 17,799 - 26,434 5,166 31,600

Profit for

period - - - - - - 35,587 35,587 4,648 40,235

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Total

comprehensive

income

and expense

for the

period - - - - 8,635 17,799 35,587 62,021 9,814 71,835

Dividends paid - - - - - - (1,977) (1,977) (220) (2,197)

Balance at 30

June 2011 15,504 (1,507) 23,935 1,087 75,938 (45,508) 339,293 408,742 83,259 492,001

--------------- -------- --------- -------- ----------- ------------ ----------- --------- --------- ---------------- ---------

Condensed Consolidated Statement Cash Flows

Restated Restated

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (unaudited*)

$000 $000 $000

-------------------------------------- ------------ ------------ ---------------

Cash flows from operating

activities

Profit before tax 38,467 54,105 122,971

Adjustments for:

BA adjustment (655) (1,338) (21,056)

Loss on disposal of

tangible fixed assets 36 73 68

Depreciation 2,783 2,341 5,124

Retirement benefit provisions - 250 536

Net finance income (1,359) (1,131) (3,184)

Unrealised (loss) / gain

in foreign exchange 152 (1,145) (927)

Tangible fixed assets written

off 786 - -

Share based payments expense - - 45

Operating cash flow before

changes in working capital 40,210 53,155 103,577

Increase in inventories (939) (1,981) (2,665)

Increase in trade and other

receivables (2,432) (1,404) (1,578)

(Decrease) / Increase in

trade and other payables (4,072) 2,124 4,818

--------------------------------------- ------------ ------------ ---------------

Cash inflow from operations 32,767 51,894 104,152

Interest paid (137) (494) (759)

Retirement benefit paid - (4) (1,289)

Overseas tax paid (18,710) (10,524) (17,917)

--------------------------------------- ------------ ------------ ---------------

Net cash flow from operations 13,920 40,872 84,187

--------------------------------------- ------------ ------------ ---------------

Investing activities

Property, plant and equipment

- purchase (29,463) (22,614) (50,086)

- sale 249 7 237

Interest received 1,469 1,546 3,891

Net cash used in investing

activities (27,745) (21,061) (45,958)

--------------------------------------- ------------ ------------ ---------------

Financing activities

Dividends paid by Company - (1,977) (1,977)

Share options exercised 22 - -

Repayment of existing long

term loans (4,855) (6,712) (15,555)

Dividends paid to non-controlling

interests - (220) (2,540)

Issue of subsidiary shares

to minority shareholder - - 2,054

Net cash used in financing

activities (4,833) (8,909) (18,018)

--------------------------------------- ------------ ------------ ---------------

Increase / (Decrease) in

cash and cash equivalents (18,658) 10,902 20,211

Cash and cash equivalents

At beginning of period 90,482 70,871 70,871

Foreign exchange (366) 3,243 (600)

--------------------------------------- ------------ ------------ ---------------

At end of period 71,458 85,016 90,482

--------------------------------------- ------------ ------------ ---------------

Comprising:

Cash at end of period 71,458 85,016 90,482

--------------------------------------- ------------ ------------ ---------------

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34,"Interim Financial Reporting",

as adopted by the European Union. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2011 Annual Report. The financial information for the half years

ended 30 June 2012 and 30 June 2011 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and has been neither audited nor reviewed pursuant to guidance

issued by the Auditing Practices Board.

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with IFRSs as adopted by the European

Union. The comparative financial information for the year ended 31

December 2011 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2011 have been filed with the

Registrar of Companies. The Independent Auditors' Report on that

Annual Report and Financial Statement for 2011 was unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Other than noted below, the same accounting policies,

presentation and methods of computation are followed in these

condensed consolidated financial statements as were applied in the

Group's latest annual audited financial statements.

After making enquiries, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue operations for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

financial statements.

2. Prior year restatement

During the period the Company has revisited its policies and

methodologies for valuing and accounting for its estate assets. As

a result, the directors have concluded that although the policies

and methodologies previously applied gave rise to a materially

accurate valuation of the combined assets, the proportions of the

total value attributed to the biological and non-biological assets

need to be restated. Accordingly, the directors have concluded that

in accordance with the requirements of IAS 8 (Accounting Policies,

Changes in Accounting Estimates and Errors), prior period

adjustments are required to restate the figures previously

reported.

Former policy and methodology

Estates comprise biological assets and non-biological plantation

assets including land, infrastructure and mills. In previous

periods, an overall estate valuation was determined based upon a

valuation of the planted and unplanted areas using a discounted

cash flow method. The value of the biological assets was estimated

as a proportion of the overall estate value using percentages

derived from historic data. For a plantation with a mill, the

biological asset portion was estimated at 18% of the estate value

while for a plantation without a mill, it was estimated at 23%. The

movement in valuation of biological assets was charged or credited

to the income statement for the relevant period. The movement in

valuation of non-biological assets (excluding mills which were

carried at depreciated cost) was transferred to the revaluation

reserve.

Revised policy and methodology

For the current period, rather than valuing the entire estate

and then estimate the amount attributable to its biological and

non-biological components using the percentages noted above, the

group has changed to an approach of valuing and accounting for the

components separately, as follows:

-- Biological assets - are carried at fair value less costs to

sell determined on the basis of the net present value of cash flows

arising in producing FFB. Areas are included in the valuation once

they are planted, however oil palm which are not yet mature at the

accounting date, and hence are not producing FFB, are valued on a

similar basis but with the discounted value of the estimated cost

to complete planting and to maintain the assets to maturity being

deducted from the discounted FFB value. No account is taken in the

valuation of future replanting. As in previous periods, the

movement in valuation surplus of biological assets is charged or

credited to the income statement for the relevant period.

-- Estate land - is initially recognised at cost, including

related transaction costs. It is subsequently carried at fair value

on an open market basis. Land is not depreciated. As in previous

periods, any surplus or deficit on revaluation of estate land is

transferred to the revaluation reserve, except that a deficit which

is in excess of any previously recognised surplus relating to the

same property is charged to the income statement. On the disposal

of a revalued estate, any balance remaining in the revaluation

reserve is transferred to retained earnings as a movement in

reserves.

-- Non-biological assets (excluding land) comprise oil mills,

plant, machinery and estate infrastructure - the group's historic

accounting policy in respect of oil mills was to carry them at

depreciated cost and there has been no change to that policy.

However, under the group's former policy plant, machinery and

estate infrastructure was valued as an integral part of the estate

and, along with estate land, carried at valuation in the

consolidated balance sheet as 'non-biological assets'. As noted

above, the group has now moved to a methodology whereby the

biological assets and estate land are valued as separate

components. In the opinion of the directors, it is not possible to

measure reliably the fair value of plant, machinery and estate

infrastructure as separate components. The group has therefore

changed to a policy of carrying plant, machinery and estate

infrastructure at cost less depreciation which they believe is a

more appropriate policy for the nature of the assets. Depreciation

is calculated on a straight line basis.

The Company has obtained independent valuations of its

biological assets as at 31 December 2011 and as at those relevant

period ends to support the reflection of the prior year

adjustments. In addition, the Company has obtained independent

valuations of its estate land as at 31 December 2011 on an open

market basis.

The change to a methodology of obtaining separate valuations of

the biological assets and estate land has highlighted that

biological assets and estate land need to be restated in prior

periods as a consequence of using the percentage allocation method.

A prior period adjustment has therefore been made to restate the

comparative figures to reflect the revised methodology.

Revised policy and methodology

The impact of this prior period adjustment :-

2012 2011

6 months 6 months 2011

to 30 June to 30 June Year to

31 December

After Biological Assets $000 $000 $000

------------------------------------ ------------ ------------ -------------

Profit for the period before

restatement 27,963 36,126 79,628

Change in accounting policy - 2,659 2,497

Restatement - 1,450 9,791

------------ ------------ -------------

Profit for the period after

restatement 27,963 40,235 91,916

------------ ------------ -------------

Other comprehensive income

for the period before restatement (17,791) 36,550 (53,886)

Change in accounting policy - (4,784) 23,844

Restatement - (166) (627)

------------ ------------ -------------

Other comprehensive income

for the period after restatement (17,791) 31,600 (30,669)

------------ ------------ -------------

The consequential change to carrying non-biological assets

excluding land and oil mills at cost less depreciation rather than

at a valuation represents a change in accounting policy. A prior

period adjustment has therefore been made to restate the

comparative figures in accordance with the new policy.

The impact of this prior period adjustment:-

2012 2011

6 months 6 months 2011

to 30 June to 30 June Year to

31 December

Before Biological Assets $000 $000 $000

------------------------------ ------------ ------------ -------------

Profit for the period before

restatement 27,861 35,946 72,609

Change in accounting policy - 2,659 2,497

Profit for the period after

restatement 27,861 38,605 75,106

------------ ------------ -------------

This change of accounting policy had a positive impact on the

earnings per share of 15.05cts for the period to 30 June 2011 and

32.81cts for the year to 31 December 2011.

The following table summarises the impact of these prior period

adjustments due to the implementation of the new accounting

policy:-

Property, Revaluation

Biological plant and Deferred and exchange Retained Non controlling

assets equipment tax liabilities reserve earnings interest

$000 $000 $000 $000 $000 $000

Balance as reported 1

January 2011 68,593 376,173 (61,293) 86,089 229,060 74,495

Effect of changes in

accounting policy - (126,563) 31,642 (82,093) - (12,830)

Effect of restatement 118,162 - (29,541) - 76,623 12,000

Restated balance as at 1

January 2011 186,755 249,610 (59,192) 3,996 305,683 73,665

----------- ----------- ----------------- -------------- ---------- ----------------

Balance as reported 31

December 2011 77,066 340,786 (37,299) 44,567 292,092 76,309

Effect of changes in

accounting policy and

restatement up to 1

January 2011 118,162 (126,563) 2,101 (82,093) 76,623 (830)

Effect of changes in

accounting policy during

the year - 617 (3,135) 20,155 1,892 4,241

Effect of restatement

during the year 39,930 - (1,907) (574) 11,080 (1,289)

Restated balance as at 31

December 2011 235,158 214,840 (40,240) (17,945) 381,687 78,431

----------- ----------- ----------------- -------------- ---------- ----------------

Balance as reported 30

June 2011 72,125 424,967 (61,900) 118,223 256,717 85,183

Effect of changes in

accounting policy and

restatement up to 1

January 2011 118,162 (126,563) 2,101 (82,093) 76,623 (830)

Effect of changes in

accounting policy during

the year - (33,190) 9,639 (5,571) 2,097 1,312

Effect of restatement

during the year 22,358 - 352 (129) 3,856 (2,406)

Restated balance as at 30

June 2011 212,645 265,214 (49,808) 30,430 339,293 83,259

----------- ----------- ----------------- -------------- ---------- ----------------

3. Foreign exchange

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Average exchange rates

Rp : $ 9,171 8,743 8,763

$ : GBP 1.58 1.62 1.60

RM : $ 3.09 3.03 3.06

Closing exchange rates

Rp : $ 9,393 8,576 9,068

$ : GBP 1.57 1.61 1.55

RM : $ 3.18 3.02 3.17

4. Finance costs

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Payable 110 415 707

------------ ------------ ---------------

5. Segment information

North South Total

Sumatra Bengkulu Sumatra Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30

June

2012

(unaudited)

Total sales

revenue

(all external) 46,401 37,835 - 28,265 - 119 112,620 2,521 - 115,141

Other income 425 76 - 303 - 4 808 39 - 847

-------- --------- -------- ------- ------- ----------- ---------- ---------

Total revenue 46,826 37,911 - 28,568 - 123 113,428 2,560 - 115,988

-------- --------- -------- ------- ------- ----------- ---------- --------- -------- --------

Profit / (loss)

before

tax 19,671 10,498 53 8,022 - 39 38,283 398 (869) 37,812

BA Movement 655

--------

Profit for the

period

before tax per

consolidated

income

statement 38,467

--------

Total Assets 181,745 174,773 47,847 60,859 11,843 52,731 529,798 24,106 8,021 561,925

Non-Current

Assets 144,168 153,554 45,101 38,164 11,217 49,813 442,017 17,029 - 459,046

6 months to 30 June 2011 (restated

& unaudited)

Total sales

revenue

(all external) 51,052 46,320 - 26,563 - - 123,935 3,970 - 127,905

Other income 359 194 - 311 - - 864 123 4 991

Total revenue 51,411 46,514 - 26,874 - - 124,799 4,093 4 128,896

-------- --------- -------- ------- ------- ----------- ---------- --------- -------- --------

Profit / (loss)

before

tax 24,181 18,055 - 9,524 - - 51,760 1,687 (680) 52,767

BA Movement 1,338

--------

Profit for the

period

before tax per

consolidated

income

statement 54,105

--------

Total Assets 204,450 175,634 41,040 58,776 7,073 64,717 551,690 40,641 2,101 594,432

Non-Current

Assets 161,723 134,124 39,384 42,091 6,917 62,394 446,633 31,394 1,363 479,390

Year to 31 December 2011 (restated

& unaudited*)

Total sales

revenue

(all external) 100,154 91,678 - 57,265 - - 249,097 7,929 - 257,026

Other income 513 485 15 811 - - 1,824 183 4 2,011

Total revenue 100,667 92,163 15 58,076 - - 250,921 8,112 4 259,037

-------- --------- -------- ------- ------- ----------- ---------- --------- -------- --------

Profit / (loss)

before

tax 45,928 34,065 18 20,377 - - 100,388 3,475 (1,948) 101,915

BA Movement 21,056

--------

Profit for the

year

before tax per

consolidated

income

statement 122,971

--------

Total Assets 174,623 167,265 51,219 64,503 11,701 59,398 528,709 26,138 6,598 561,445

Non-Current

Assets 137,086 146,433 48,904 32,189 11,629 56,917 433,158 17,028 1,363 451,549

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in note 2.

In the 6 months to 30 June 2012, revenues from 4 customers of

the Indonesian segment represent approximately $62.0m of the

Group's total revenues. An analysis of these revenues is provided

below:

2012 2011

6 months 6 months

to 30 June to 30 June

(unaudited) (unaudited)

Major Customers $m % $m %

Customer 1 20.0 17.2 23.9 18.5

Customer 2 17.1 14.7 20.9 16.2

Customer 3 13.6 11.7 18.9 14.7

Customer 4 11.3 9.7 12.1 9.4

--------------------- ------- ----------- ---------- --------

Total 62.0 53.3 75.8 58.8

--------------------- ------- ----------- ---------- --------

In year 2011, revenues from 4 customers of the Indonesian

segment represent approximately $139.4m of the Group's total

revenues. An analysis of these revenues is provided below:

2011

Year

to 31 December

(audited)

Major Customers $m %

Customer 1 37.3 14.4

Customer 2 36.3 14.0

Customer 3 32.9 12.7

Customer 4 32.9 12.7

----------------------- ---------- --------

Total 139.4 53.8

----------------------- ---------- --------

6. Tax

Restated Restated

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (unaudited*)

$000 $000 $000

Foreign corporation tax 9,950 13,550 26,318

Deferred tax adjustment 554 320 4,737

------------ ------------ ---------------

10,504 13,870 31,055

------------ ------------ ---------------

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

7. Dividend

The final and only dividend in respect of 2011, amounting to

6.0cts per share, or $2,372,344, was paid on 9 July 2012 (2010:

5.0cts per share, or $1,976,954, paid on 28 June 2011). As in

previous years no interim dividend has been declared.

8. Earnings per ordinary share (EPS)

Restated Restated

2012 2011 2011

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (unaudited*)

Profit for the period attributable

to owners of the Company before

BA adjustment 22,573 31,568 61,093

Net BA adjustment (2,296) 4,019 16,843

------------ ------------ ---------------

Earnings used in basic and

diluted EPS 20,277 35,587 77,936

------------ ------------ ---------------

Number Number Number

'000 '000 '000

Weighted average number of

shares in issue in period

- used in basic EPS 39,570 39,539 39,539

- dilutive effect of outstanding

share options 111 166 141

------------ ------------ ---------------

- used in diluted EPS 39,681 39,705 39,680

------------ ------------ ---------------

Shares in issue at period end 39,976 39,976 39,976

Less: Treasury shares (406) (437) (437)

------------ ------------ ---------------

Shares in issue at period end

excluding treasury shares 39,570 39,539 39,539

------------ ------------ ---------------

Basic EPS before BA adjustment 57.05cts 79.84cts 154.51cts

Basic EPS after BA adjustment 51.24cts 90.00cts 197.11cts

Dilutive EPS before BA adjustment 56.89cts 79.51cts 153.96cts

Dilutive EPS after BA adjustment 51.10cts 89.63cts 196.41cts

*The 31 December 2011 comparative period is based on the audited

financial statements for the year end as amended for prior year

adjustments as set out in Note 2.

9. Post balance sheet events

On 6 May 2011, SPPT Development Sdn. Bhd. ("the Petitioner"), a

minority shareholder of Anglo-Eastern Plantations (M) Sdn Bhd,

filed a petition in the Kuala Lumpur High Court to wind-up

Anglo-Eastern Plantations (M) Sdn Bhd based on inter-alia some

alleged shareholders' disputes between the Petitioner and

Anglo-Eastern Plantations Plc. The winding-up petition is being

defended and the continued hearing on 4 July 2012 was adjourned to

September 2012 by the Court.

Apart from the above mentioned, no other major events or

transactions have occurred between 30 June 2012 and the date of

this report.

10. Report and Financial Information

Copies of the interim report for the Group for the period ended

30 June 2012 are available on the AEP website at

www.angloeastern.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GMGFRKGGGZZM

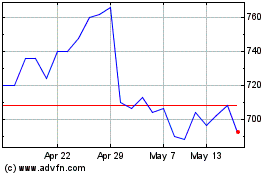

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jun 2024 to Jul 2024

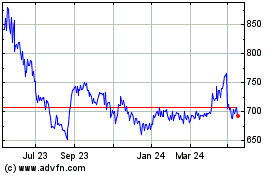

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jul 2023 to Jul 2024