UPDATE: Admiral In Talks To Sell German Car Insurance Business

December 07 2010 - 12:10PM

Dow Jones News

U.K. car insurer Admiral Group PLC (ADM.LN) said Tuesday it is

in exclusive talks to sell its loss-making AdmiralDirekt insurance

business in Germany to German insurer Itzehoer Versicherung,

signalling an exit after just three years in that market.

The company said AdmiralDirekt, which was launched in October

2007, "continues its operations as normal" and that Admiral

"remains focused on continuing the profitable growth of U.K.

operations and on building profitable, growing, sustainable

businesses in Spain, Italy, the U.S. and France."

Admiral spokeswoman Louisa Scadden told Dow Jones Newswires: "We

concluded that the specific characteristics of the German market

made it a less attractive option for the investment of both money

and management resources than the many other exciting growth

opportunities open to the group, both in the U.K. and

internationally."

"Each new operation requires a period of investment of money and

management time as it moves from start-up to a reasonable scale,"

she said.

The company didn't say how much it had invested in AdmiralDirekt

and how much it is being sold for. "Neither the operating losses

incurred to date in Germany nor the value realized on the sale of

AdmiralDirekt are material in the context of overall group

profits," Scadden said.

In its interim report in August, Admiral said AdmiralDirekt

"experienced a very tough year in 2009" and its management "pulled

back on new business acquisition in Germany by raising rates

substantially before the busy season" in the fourth quarter of

2009.

This led to a 25% fall in first-half premiums written by the

unit to GBP8.6 million from GBP11.4 million. The number of cars

insured also fell, by 17% to 31,300, it said.

Admiral said in August that its four international businesses in

Germany, Spain, Italy and the U.S., collectively made a loss of

GBP4.1 million, "which is in line with the first half of 2009."

"To put this result into context, it equates to only 3% of the

profits in our U.K. car insurance business and demonstrates our

cautious approach to expansion," it said.

After a presentation by Admiral to analysts last month, Keefe,

Bruyette & Woods said: "We expect it to exit from

Germany--management says it is "looking at all options here." KBW

also said Admiral's presentation on the Italian market "implies

that the company is unlikely to accelerate growth here in the near

term."

In August, Admiral posted a 21% rise in first-half pretax profit

to GBP126.9 million on a continued rise in the number of customers

signing up for car insurance.

Its share price has risen 35% since the start of the year. At

1634 GMT, Admiral shares were up 0.1% at 1,612 pence while the

FTSE100 index was up 0.7%.

-By Vladimir Guevarra, Dow Jones Newswires; +44 (0) 2078429486,

vladimir.guevarra@dowjones.com

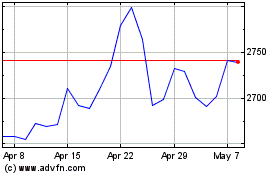

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024