UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

May 31, 2015

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period

from ___________to __________

Commission file number:

000-55082

YAPPN CORP.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

27-3848069 |

State

or other jurisdiction of

Incorporation or organization |

|

(I.R.S.

Employer

Identification No.) |

1001

Avenue of the Americas, 11th Floor

New York, NY |

|

10018 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: 888-859-4441

Securities registered

pursuant to Section 12(b) of the Act: None.

Securities registered

pursuant to section 12(g) of the Act:

Common Stock, $0.001

Par Value

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

Non-accelerated filer

|

☐ |

Smaller

reporting company |

☒ |

| (Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of November 30, 2014, the last day of registrant’s

second fiscal quarter, the aggregate market value of the registrant’s common stock, $0.001 par value, held by non-affiliates,

computed by reference to the closing sale price of the common stock reported on the OTCQB as of November 30, 2014, was approximately

$1,780,126. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be

affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of August 26, 2015, there were 134,228,139 shares of the registrant’s

common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

YAPPN CORP.

INDEX TO ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended May 31, 2015

| |

|

Page |

| |

|

|

| PART I |

| |

|

|

| Item 1. |

Business. |

4 |

| |

|

|

| Item 1A. |

Risk

Factors. |

10 |

| |

|

|

| Item 1B. |

Unresolved

Staff Comments. |

19 |

| |

|

|

| Item 2. |

Properties. |

20 |

| |

|

|

| Item 3. |

Legal

Proceedings. |

20 |

| |

|

|

| Item 4. |

Mine

Safety Disclosures. |

20 |

| |

|

|

| PART II |

| |

|

|

| Item 5. |

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

21 |

| |

|

|

| Item 6. |

Selected

Financial Data. |

23 |

| |

|

|

| Item 7. |

Management’s

Discussion and Analysis of Financial Condition and Results of Operations. |

23 |

| |

|

|

| Item 7A. |

Quantitative

and Qualitative Disclosures About Market Risk. |

29 |

| |

|

|

| Item 8. |

Financial

Statements and Supplementary Data. |

29 |

| |

|

|

| Item 9. |

Changes

in and Disagreements with Accountants on Accounting and Financial Disclosure. |

29 |

| |

|

|

| Item 9A. |

Controls

and Procedures. |

29 |

| |

|

|

| Item 9B. |

Other

Information. |

31 |

| |

|

|

| PART III |

| |

|

|

| Item 10. |

Directors,

Executive Officers, and Corporate Governance. |

32 |

| |

|

|

| Item 11. |

Executive

Compensation. |

37 |

| |

|

|

| Item 12. |

Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

39 |

| |

|

|

| Item 13. |

Certain

Relationships and Related Transactions, and Director Independence. |

41 |

| |

|

|

| Item 14. |

Principal

Accountant Fees and Services. |

42 |

| |

|

|

| Item 15. |

Exhibits,

Consolidated Financial Statement Schedules. |

F-1 |

| |

|

|

| |

Certification

Pursuant To Section 302 (A) Of The Sarbanes-Oxley Act Of 2002 |

|

| |

|

|

| |

Certification

Pursuant To 18 U.S.C. Section 1350 As Adopted Pursuant To Section 906 Of The Sarbanes-Oxley Act Of 2002 |

|

Forward Looking Statements

The discussion contained

in this Annual Report on Form 10-K (“Annual Report”) contains “forward-looking statements” within the

meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs,

plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements

are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,”

“management believes,” “we believe,” “we intend,” “we may,” “we will,”

“we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases.

We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the

industry in which we operate as of the date of this Annual Report. These forward-looking statements are subject to a number of

risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially

from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Annual Report

describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those

anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect. Because the factors discussed in this Annual Report could cause actual results or outcomes to differ

materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance

on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will

arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required

by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could

differ materially from those anticipated in these forward-looking statements, even if new information becomes available after

the date of this Annual Report or the date of documents incorporated by reference herein that include forward-looking statements.

Management’s Discussion

and Analysis of Results of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction

with our financial statements included herein. You should read this report and the documents that we reference in this report

and have filed as exhibits to the report completely and with the understanding that our actual future results may be materially

different from what we expect. Statements in this Annual Report describe factors, among others, that could contribute to

or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should

one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors

discussed in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking

statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors

emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact

of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly

revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the

date of documents incorporated by reference herein that include forward-looking statements.

Unless otherwise indicated

or the context otherwise requires, all references in this Form 10-K to “we,” “us,” “our,”

“our company,” “Yappn” or the “Company” refer to Yappn Corp. and its subsidiaries.

PART I

Item 1. BUSINESS

Business History

We were originally incorporated

under the laws of the State of Delaware on November 3, 2010 under the name of “Plesk Corp.” Our initial

business plan was to import consumer electronics, home appliances and plastic house wares. In March 2013, we filed an amended

and restated certificate of incorporation to change our name to “YAPPN Corp.” and increase our authorized capital

stock to 200,000,000 shares of common stock, par value $0.0001 per share and 50,000,000 shares of preferred stock, par value $0.0001

per share. Further, in March 2013, our Board of Directors declared a stock dividend, whereby an additional 14 shares

of our common stock was issued for each one share of common stock outstanding to each holder of record on March 25, 2013. All

per share information in this report reflect the effect of such stock dividend. On December 22, 2014, our shareholders approved

the increase of authorized and issued shares of common stock to 400,000,000 shares of common stock. We filed an amendment with

the State of Delaware to affect this change which was accepted effective December 31, 2014.

On March 28, 2013, we purchased

a prospective social media platform and related group of assets known as Yappn (“Yappn”) from Intertainment Media,

Inc. (“IMI”), a corporation organized under the laws of Canada, for 70,000,000 shares of our common stock, pursuant

to an asset purchase agreement (the “Purchase Agreement” and the transaction, the “Asset Purchase”) by

and among IMI, us, and our newly formed wholly owned subsidiary, Yappn Acquisition Sub., Inc., a Delaware corporation (“Yappn

Sub”). Mr. David Lucatch, our Chief Executive Officer and a director, is the Chief Executive Officer of IMI. IMI,

as a result of this transaction has a controlling interest in our company. Included in the purchased assets is a services

agreement (the “Services Agreement”) dated March 21, 2013 by and among IMI and its wholly owned subsidiaries Ortsbo,

Inc., a corporation organized under the laws of Canada (“Ortsbo Canada”), and Ortsbo USA, Inc., a Delaware corporation

(“Ortsbo USA” and, collectively with Ortsbo Canada, “Ortsbo”). Ortsbo is the owner of certain

multi-language real time translation intellectual property that we believe is a significant component of the Yappn business opportunity.

Immediately following the

Asset Purchase, under the terms of an Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations,

we transferred all of our pre-Asset Purchase assets and liabilities (consisting of our former business of import consumer electronics,

home appliances and plastic house wares ) to our wholly owned subsidiary, Plesk Holdings, Inc., a Delaware corporation. Thereafter,

pursuant to a stock purchase agreement, we transferred all of the outstanding capital stock of Plesk Holdings, Inc. to certain

of our former shareholders in exchange for cancellation of an aggregate of 112,500,000 shares of our common stock held by such

persons.

Our principal executive

offices are located at 1001 Avenue of the Americas, 11th Floor, New York, NY 10018 and our telephone number is (888) 859-4441.

Our website is http://www. yappn.com (which website is expressly not incorporated into this filing).

Our Business

Yappn Corp. is a

real-time multilingual company that amplifies brand and social messaging, expands online commerce and provides customer support

by globalizing these experiences with its proprietary technologies, solutions and linguistic computational approach to language

service and engagement in a cost effective way. Through its real-time multilingual amplification platform, Yappn eliminates the

language barrier, allowing the free flow of communications in 67 languages to support brand and individuals’ marketing objectives,

commerce revenue goals and customer support objectives by making language universal for all fans and consumers.

Focused on delivering global

reach and efficiencies without the primary need of human intervention, these services are increasingly becoming essential for

companies to conduct business online, as English is no longer the language of the Internet. According to InternetWorldStats.com,

as of December 2014, there were over 3 billion Internet users and over 73% engage online in a language other than English. The

US Census released by the Center of Immigration Studies last October, 2014 cites that in 2013, a record 61.8 million U.S. residents

spoke a language other than English at home, which means that approximately one in five U.S. residents speaks a language other

than English, representing a 32% increase from 2010 and almost a 94% increase since 1990.

Yappn’s offerings

engage through all phases of Ecommerce, online events, and content programming. Through its recently launched Windrose Global

Ecommerce framework (“WGE”), Yappn provides an end-to-end multilingual Ecommerce solution for companies of all sizes.

Covering everything from pre to post sale, WGE’s proprietary suite includes all the tools for multilingual marketing (advertising),

shopping (store, catalog, shopping cart and check-out) and customer support.

Yappn’s cloud-based

platform is built from the ground up upon Yappn’s first-in-class technology that automatically detects an online or mobile

user’s language. WGE completes the process through advanced technology to understand the meaning and interpretation of a

message to seamlessly return a translation that is reflective of the meaning and spirit of the message.

Yappn’s WGE

technology is, in managements’ opinion, a game changing solution that can help a retailer revolutionize their business quickly

and cost effectively. By interfacing with a retailer’s existing Ecommerce solution, Yappn can assist the E-tailer to greatly

expand their global reach by presenting and promoting their store as well as supporting sales in multiple languages. An E-tailer

no longer has to be constrained to whom they can sell to because of language.

Yappn

derives revenue from a percentage of each sale and/or through professional services fees, when applicable, depending on the application

and installation of its offerings. Yappn redefines global social marketing by providing a set of stand-alone commercial tools

for brands to easily implement cost effective globalization solutions as they are complementary, not competitive, to today’s

top social media networks such as Twitter, Facebook, Pinterest, Instagram, Flickr and YouTube, web, mobile, video players, blogs,

online broadcasting, private networks, event virtualization and Ecommerce platforms.

Continued expansion

of Yappn’s business rollout will likely require additional debt or equity financing and there can be no assurance that additional

financing can be obtained on acceptable terms. Yappn is in the early stage of commercialization, and has insufficient revenues

to cover its operating costs. As such, Yappn has incurred an operating loss since inception. This and other factors raise substantial

doubt about our ability to continue as a going concern. Yappn’s continuation as a going concern is dependent on our ability

to meet our obligations, to obtain additional financing as may be required, and ultimately to attain profitability. Yappn’s

independent auditors have included an explanatory paragraph, in their audit report on our financial statements for the fiscal year

ended May 31, 2015 regarding concerns about our ability to continue as a going concern. Footnote 2 to the Notes to this Annual

Report also discusses concerns about our ability to continue as a going concern. Yappn’s financial statements do not include

any adjustments that might result from the outcome of this uncertainty.

Our Strategy

The

Yappn Ecommerce business model includes a business plan that we believe allows companies to extend their reach online and become

truly “international” by servicing customers in 67 languages. This advantage can improve their relationship with their

consumers through the elimination of the language barrier and by offering the shopping cart and catalog in multiple languages.

Out of 3 billion Internet users, only 800.6 million engage online in English, according to Internet World Stats.com.

Management believes that prime markets for Ecommerce growth are in China, Eastern Europe and Latin America.

The

Yappn tool set is comprised of three segments: Online Marketing, Ecommerce Sales, and Customer Care, to provide brands with a

series of technology add-ons to complement their current social media activities and allows them to reach a global audience by

instantly providing key messaging in 67 languages.

Online

Marketing: Advertisement, Social Wall and FotoYapp, Live and Global Events, Video Capturing

| ● | Digital

Advertisement will be presented in the viewer’s choice of language, regardless

of their location. The WGE technology will automatically detect the language of the customers’

browser and present the ad in that language, inclusive of local promotions. |

| ● | The

Social Wall is an aggregation of major social media accounts for fans and consumers

to interact with in 67 languages on up to 54 social media platforms. |

| | | |

| ● | FotoYapp

is a mobile app that provides brands with the ability to share media content instantly

across the global social sphere, engaging customers via pictures and short burst video,

deploying coupons presented as images. Customers can also use FotoYapp to draw users

into their Estore from their social network pages with a unique embeddable FotoWall that

resides in their web-store, thereby dramatically increasing traffic to their store. FotoYapp

can currently connect to 54 different networks. |

|

|

● |

A

live Q&A is an interactive live stream with fans worldwide that allows them to participate and ask moderated questions

in 67 languages. |

| |

|

|

|

|

● |

Engagement

events such as a custom branded Twitter Q&A session which allows for real-time multilingual events to activate on a global

scale for brands and individuals. |

| |

|

|

|

|

● |

Live

video captioning is to broadcast a live event with real-time video closed captioning

in 67 languages. |

| |

|

|

|

● |

Post-production

video provides closed captioning in 67 languages for archive videos and feature films. |

Ecommerce

Sales: Store, Catalog, Shopping Cart & Check-Out

| ● | By

interfacing with a retailer’s existing Ecommerce solution, the WGE technology helps

a retailer greatly expand their global reach by presenting its store, catalog, shopping

cart and check-out in up to 67 different languages instantaneously using enhanced machine-based

translation. |

Customer

Care: Multilingual Chat

| |

● |

Multilingual Chat provides companies,

brands, organizations and consumers with the ability to have topical discussions in almost any language in real-time. Instant

globalization allows a company to converse in a customer’s language of choice without incurring the heavy cost of a

Customer Service Representative having fluency in every language that the business chooses to service in. |

The

tools are a "build once and deploy everywhere" arrangement allowing brands to embed key social media like Twitter, Facebook,

YouTube, Instagram, Pinterest, Flickr and Tumblr and mobile into a total of 54 existing platforms. Yappn tools have been effectively

tested and commercially deployed through a number of entertainment, sports and commercial brands and they are now available to

agencies to enhance their client's domestic and global outreach plans. The programs are available on a servicing contractual basis

and we have begun to receive commitments from various brands for the use of its tool sets.

According

to eMarketer.com, China and USA are the world’s leading Ecommerce markets, combining for more than 55% of the world’s

Internet retail in 2014. In 2015, worldwide web sales are expected to increase nearly 21% to $1.59 Trillion. With this view in

mind, Yappn’s newly launched WGE platform is focused on the Ecommerce market to enable retailers to break the language barrier

that prevents them from accessing global markets. Yappn has altered this paradigm with an API (application program interface)

that renders any Ecommerce site into a global site in real-time and in up to 67 languages inclusive of the shopping cart checkout.

With very high fidelity experience and without any human translation or intervention, the Software as a Service (SaaS) application

is focused on three distinct sales models: Partner, Direct and Channel.

The

Partner Model is a “One to Many” sales model based on the Yappn Sales Team building relationships directly with partners

with the intent of establishing contacts into the partner’s own community in addition to working with the partner themselves.

This includes agencies, developer networks and software partnership communities.

The

Direct Sales model is a “One-to-One” Model based on the Yappn Sales Team directly selling to a particular customer.

This model is generally reserved for strategic and high brand value sales opportunities.

The

Channel Sales Model is “One-to-One-to-Many” sales model based on the Yappn Sales Team building relationships directly with

software and platform developers, like Shopify and other Ecommerce systems.

Yappn

will continue to develop additional revenue-centric features and tools and refine our current business plan. Each new feature

set is built on a prime revenue driver for our business as it continues to work with clients and their agencies to develop new

deployment tools and programs to reach an expanding global audience.

Digital Widget

Factory

Yappn

has executed a three-year Master Services Agreement (MSA) and Statement of Work (SOW) with Digital Widget Factory to develop and

manage a minimum of 200 multilingual Ecommerce sites which will include multilingual online marketing through traditional online

services and social engagement. Expected first year revenues for the program are estimated to be up to $3,000,000 (although no

assurances can be provided that such amounts will be achieved or profitability realized) with rapid expansion of sites planned

for 2016 and 2017. Contract terms allowed for pre-paid fees in association with the project of a minimum of $700,000 plus ongoing

professional fees and 20% net profit on the program for the term duration.

The

Global Content Market is an ever growing market, with Ipsos Market Research stating that 7 out of 10 online consumers in 24 countries

indicate that in a month they share some type of content on social media sites, including pictures as well as articles and something

recommended, such as a product, service, movie or book. Emarketer.com also points out that global ad spending will be nearly $600

billion worldwide in 2015 with the increase in digital and mobile platforms being the key growth in ad spending.

Yappn

will provide multilingual online marketing through traditional online services and social engagement with its proprietary patented

technology to DWF by scheduling and supporting DWF’s revenue programs related to direct and network online advertising, schedule

and support DWF’s affiliate and Ecommerce partnerships and also support DWF users to customize their content experience,

submit original content and provides tools to incent sharing of content and encourage users to build the membership base.

Revenues recognized to May 31, 2015 from this program totals $1,374,384, which are from ongoing development,

programs. Future higher revenues are expected, but not guaranteed, based on an advertising model and an affiliate/membership model

which has been effective after the fiscal year end. With over 73% of the Internet surfing languages other than English, this program

is designed to capture the foreign advertising market for content that is dominated in English speaking ad partners.

The

Services Agreement

We acquired the

rights to use technology and management and development support services under the Services Agreement, dated March 21, 2013, between

IMI and IMI’s wholly owned Ortsbo subsidiaries. Pursuant to the terms of the Services Agreement, Ortsbo made available

to us its representational state transfer application programming interface (the “Ortsbo API”), which provides multi-language

real-time translation as a cloud service. The Services Agreement also provides that Ortsbo makes its “Live and Global”

product offering, which enables a cross language experience for a live, video streaming production, available to us as a service

for marketing and promoting the Yappn product in the marketplace (the “Services”). The Services do not include

the “chat” technology itself and we shall be solely responsible for creating, securing or otherwise building out our

website and any mobile applications to include chat functionality, user forums, user feedback, and related functionality within

which the Ortsbo API can be utilized to enable multi-language use. Under the initial agreement, no intellectual property

owned by Ortsbo would be transferred to us except to the extent set forth in the Services Agreement as described in “Intellectual

Property” set forth below.

For all ongoing

services provided under the Services Agreement, we shall pay Ortsbo an amount equal to the actual cost incurred by Ortsbo in providing

the Services, plus thirty percent (30%). In addition, we shall pay to Ortsbo an ongoing revenue share which shall equal

seven percent (7%) of the gross revenue generated by our activities utilizing the Services. If we are earning revenue

without the use of the Services because, for example, all communications are taking place in English, then no revenue share shall

be owing to Ortsbo with respect thereto. If there is a blend of multi-language and English-English communications, then

the parties shall do their best to pro rate or apportion the revenues appropriately in order to compensate Ortsbo for the portion

of our revenues enabled by use of the Services from Ortsbo. The Services Agreement may be terminated by either party

with 60 days written notice and both parties may not, for the term of the Agreement and a period of two years thereafter, (i) directly

or indirectly assist any business that is competitive with the other party’s business, (ii) solicit any person to leave employment

with the other and (iii) solicit or encourage any customer to terminate or otherwise modify adversely its business relationship

with the other.

In

October 2013, we amended the Services Agreement. Under the terms of the amendment to the Services Agreement, we would

have the first right of refusal to purchase the Ortsbo platform and all its assets and operations for a period of two years; increasing

its use of Ortsbo's technology for business to consumer social programs at a purchase price to be negotiated at the time we exercise

our right. We would also have a right to purchase a copy of the source code only applicable to Yappn programs for $2,000,000 which

may be paid in cash or restricted shares of our common stock at a per share price of $.15 per share. As part of the enhancement

agreement, we issued Ortsbo 1,666,667 shares of our restricted common stock. On April 28, 2014, we exercised our right to purchase

a copy of the source code for the Ortsbo property in exchange for 13,333,333 shares of restricted common stock for a value of

$2,000,000.

On

July 6, 2015, Yappn entered into a definitive agreement to acquire all of the intellectual property assets of Ortsbo. The purchased

assets include US Patent No. 8,983,850 B2, US Patent No. 8,917,631 B2, US Patent No. 9,053,097 B2, and other intellectual property

including Ecommerce and Customer Care know-how for a total purchase price of US $17 Million, which will be paid by the assumption

of US $1 Million in debt and the issuance of US $16 Million worth of Yappn restricted common shares (320 Million shares at US

$0.05 per share). The transaction is subject to closing conditions including each party obtaining all necessary approvals, including

stock exchange approval and shareholder approval, if required. Upon the completion of the transaction the amended Services Agreement

will be terminated.

Competition

Our business relating to

and arising from the development of the Yappn assets is characterized by innovation, rapid change, patented, proprietary and disruptive

technologies. We may face significant competition, including from companies that provide translation, tools to facilitate

the sharing of information, that enable marketers to display advertising and that provide users with multilingual real-time translation

of Ecommerce, events and proprietary social media and chat platforms. These may include:

| |

● |

Companies that offer full-featured

products that provide a similar range of communications and related capabilities that we provide. |

| |

|

|

| |

● |

Companies that provide web- and mobile-based

information and entertainment products and services that are designed to engage users. |

| |

|

|

| |

● |

Companies that offer Ecommerce solutions

with built in language support. |

| |

|

|

| |

● |

Traditional and online businesses that

offer corporate sponsorship opportunities and provide media for marketers to reach their audiences and/or develop tools and

systems for managing and optimizing advertising campaigns. |

Competitors, in some cases,

may have access to significantly more resources than Yappn.

We anticipate that we will

compete to attract, engage, and retain clients and users, to attract and retain marketers, to attract and retain corporate sponsorship

opportunities, and to attract and retain highly talented individuals, especially software engineers, designers, and product managers.

As we introduce new features to the Yappn platform, as the platform evolves, or as other companies introduce new

platforms and new features to their existing platforms, we may become subject to additional competition. We believe that

our ability to quickly adapt to a changing marketplace, and our experienced management team, will enable us to compete effectively

in the market. Further, we believe that our focus on encouraging user engagement based on topics and interests, rather

than on “friends” or connections, will differentiate us from much of the competition.

Intellectual Property

We own (i) the yappn.com

domain name (which website is expressly not incorporated into this filing) and (ii) the Yappn name and all trademarks, service

marks, trade dress and copyrights associated with the Yappn name, logo and graphic art. We may prepare several patent

filings in the future. Upon payment of the applicable fees pursuant to the Services Agreement, Yappn became the exclusive owner

of copyright in the literary works or other works of authorship delivered by Ortsbo to us as part of the Services provided under

the Services Agreement (the “Deliverables”). All such rights shall not be subject to rescission upon termination

of the Services Agreement. Also as set forth in the Services Agreement, we shall grant to Ortsbo (i) a non-exclusive

(subject to certain limitations) license to use the Deliverables for the sole purpose of developing its technology, (ii) a non-exclusive

license to use, solely in connection with the provision of the Services, any intellectual property owned or developed by us or

on our behalf and necessary to enable Ortsbo to provide the Services and (iii) a license to use intellectual property obtained

by us from third parties and necessary to enable Ortsbo to provide the Services. All such licenses shall expire upon

termination of the Services Agreement.

On April 28, 2014, we purchased

a copy of the source code for the Ortsbo property and all the rights associated with it.

On July 16, 2015, Yappn

entered into a definitive agreement to acquire all of the intellectual property assets of Ortsbo. The purchased assets include

US Patent No. 8,983,850 B2, US Patent No. 8,917,631 B2, US Patent No. 9,053,097 B2, and other intellectual property including

Ecommerce and Customer Care know-how (Proprietary lexicons and linguistic databases that integrate into Yappn’s language

services platform).

Yappn continues to engage

in activities to maintain and further build differentiated technologies that increase its intellectual properties.

Government Regulation

We are subject to a number

of U.S. federal and state, and foreign laws and regulations that affect companies conducting business on the Internet, many of

which are still evolving and being tested in courts, and could be interpreted in ways that could harm our business. These may

involve user privacy, rights of publicity, data protection, content, intellectual property, distribution, electronic contracts

and other communications, competition, protection of minors, consumer protection, taxation and online payment services. In particular,

we are subject to federal, state, and foreign laws regarding privacy and protection of user data. Foreign data protection, privacy,

and other laws and regulations are often more restrictive than those in the United States. U.S. federal and state and foreign

laws and regulations are constantly evolving and can be subject to significant change. In addition, the application and interpretation

of these laws and regulations are often uncertain, particularly in the new and rapidly-evolving industry in which we operate.

There are also a number of legislative proposals pending before the U.S. Congress, various state legislative bodies, and foreign

governments concerning data protection which could affect us. For example, a revision to the 1995 European Union Data

Protection Directive is currently being considered by legislative bodies that may include more stringent operational requirements

for data processors and significant penalties for non-compliance.

Legal Proceedings

None.

Registration Statement

We filed a Registration

Statement on Form S-1 (File No. 333-199569) (the “Registration Statement”) with the Securities and Exchange

Commission (the “SEC”) on October 24, 2014 (amended November 7, 2014) for up to 75,926,665 shares of

our $0.0001 par value per share common stock (the "Common Stock") issuable to certain selling stockholders upon conversion

of promissory notes and/or warrants currently held by those selling stockholders, specifically (i) 18,440,000 shares of Common

Stock issuable to them upon exercise of promissory notes and (ii) 45,880,000 shares of Common Stock issuable to them upon exercise

of warrants. The warrants have an exercise prices varying from $0.10 to $0.22 per share (subject to adjustment). The Registration

Statement covering the above noted securities was declared effective under the Securities Act of 1933 on November 17, 2014.

Investing in our common

stock involves a high degree of risk. Before investing in our common stock you should carefully consider the following risks,

together with the financial and other information contained in this report. If any of the following risks actually occurs, our

business, prospects, financial condition and results of operations could be adversely affected. In that case, the trading price

of our common stock would likely decline and you may lose all or a part of your investment.

Risks Relating to Our Business

Our limited operating history makes

it difficult to evaluate our current business and future prospects.

We are transitioning from

a development stage company to a growth company and have generated relatively limited revenue to date. We have, prior to the purchase

of the Yappn assets, as further described herein, been involved in unrelated businesses. We have limited history in executing

our business model which includes, among other things, implementing and completing alpha and beta testing programs, attracting

and engaging clients, customers and users, developing methods for engaging users, and providing clients, customers and users with

access to our services platform. Our limited operating history makes it difficult to evaluate our current business

model and future prospects.

In light of the costs,

uncertainties, delays and difficulties frequently encountered by companies in the early stages of development with limited operating

history, there is a significant risk that we will not be able to implement or execute our current business plan, or demonstrate

that our business plan is sound; and/or raise sufficient funds in the capital markets to effectuate our business plan. If

we cannot execute any one of the foregoing or similar matters relating to our operations, our business may fail.

Competition presents an ongoing threat

to the success of our business.

We may face significant

competition in our business, including from companies that provide translation, tools to facilitate the sharing of information,

companies that enable marketers to display advertising and companies that provide development platforms for applications developers.

We may compete with companies that attempt to or offer products that replicate services we provide.

Many of our potential competitors

may have significantly greater resources or better competitive positions in certain product segments, geographic regions or user

demographics than we do. These factors may allow our competitors to respond more effectively than us to new or emerging technologies

and changes in market conditions. We believe that some of our potential users are aware of and actively engaging with other products

and services similar to, or as a substitute for, Yappn. In the event that our users increasingly engage with other products and

services, we may experience a decline in user engagement and our business could be harmed.

Our competitors may develop

products, features, or services that are similar to ours or that achieve greater acceptance, may undertake more far-reaching and

successful product development efforts or marketing campaigns, or may adopt more aggressive pricing policies. Certain competitors,

could use strong or dominant positions in one or more market areas not serviced by Yappn to gain competitive advantage against

us in areas where we operate. As a result, our competitors may acquire and engage clients at the expense of the growth or engagement,

which may negatively affect our business and financial results. We believe that our ability to compete effectively will depend

upon many factors both within and beyond our control, including:

| |

● |

the popularity, usefulness, ease of

use, performance, and reliability of our products compared to our competitors; |

| |

● |

the engagement of our clients and their

users with our products; |

| |

|

|

| |

● |

the timing and market acceptance of

products, including developments and enhancements to our or our competitors' products; |

| |

|

|

| |

● |

our ability to monetize our products,

including our ability to successfully monetize mobile usage; |

| |

|

|

| |

● |

the frequency, size, and relative prominence

of the ads displayed by us or our competitors; |

| |

|

|

| |

● |

customer service and support efforts; |

| |

|

|

| |

● |

marketing and selling efforts; |

| |

|

|

| |

● |

changes mandated by legislation, regulatory

authorities, or litigation, including settlements and consent decrees, some of which may have a disproportionate effect on

us; |

| |

|

|

| |

● |

acquisitions or consolidation within

our industry, which may result in more formidable competitors; |

| |

|

|

| |

● |

our ability to attract, retain, and

motivate talented employees, particularly software engineers; |

| |

|

|

| |

● |

our ability to cost-effectively manage

and grow our operations; and |

| |

|

|

| |

● |

our reputation and brand strength relative

to our competitors. |

If we are not able to compete

effectively, our customer base and level of user engagement may decrease, which could make us less attractive to marketers and

materially and adversely affect our revenue and results of operations.

As previously explained,

implementation of our business plan will require debt or equity financing until we are out of the developmental stage and can

generate sufficient cash flows to operate. Competition may require increased needs for operating cash to meet such

challenges.

Our new products and changes to existing

products could fail to generate revenue.

Our ability to retain,

increase, and engage our customer base and to escalate our revenue will depend heavily on our ability to enhance our current products

and create successful new products. We may introduce significant changes to our existing products or develop and introduce new

and unproven products, including using technologies with which we have little or no prior development or operating experience.

If new or enhanced products fail to engage clients, we may fail to attract or retain clients or to generate sufficient revenue,

operating margin, or other value to justify our investments, and our business may be adversely affected. In the future, we may

invest in new products and initiatives to generate revenue, but there is no guarantee these approaches will be successful. If

we are not successful with new approaches to monetization, we may not be able to maintain or grow our revenue as anticipated or

recover any associated development costs, and our financial results could be adversely affected.

One customer accounts

for a significant portion of our business.

We have derived,

and over the near term we expect to continue to derive, a significant portion of our revenues from one customer. For example, this

customer accounted for a total of 90% of our revenues for the year ended May 31, 2015. The loss of this customer or non-payment

of outstanding amounts due to our company from this customer could materially and adversely affect our results of operations, financial

position and liquidity.

Our costs are continuing to grow, which

could harm our business model and profitability.

Developing the Yappn

platform has been a costly undertaking and we expect our expenses to continue to increase in the future as we implement and complete

continued rollout of our services and platform, build up our client base and develop and implement new product features. We expect

that we will incur increasing costs to support our anticipated future growth. In addition, our costs may increase as we hire additional

employees, particularly as a result of the significant competition that we face to attract and retain technical talent. Our expenses

may continue to grow faster than our revenue over time. Our expenses may be greater than we anticipate, and our investments may

not be successful. In addition, we may increase marketing, sales, and other operating expenses in order to grow and expand our

operations and to remain competitive. Increases in our costs may adversely affect our business and profitability.

Our business is subject to complex and

evolving U.S. and foreign laws and regulations regarding privacy, data protection, and other matters. Many of these laws and regulations

are subject to change and uncertain interpretation, and could result in claims, monetary penalties, increased cost of operations,

or declines in user growth or engagement, or otherwise harm our new business model.

We are subject to a variety

of laws and regulations in the United States and abroad that involve matters central to our business, including user privacy,

rights of publicity, data protection, content, intellectual property, distribution, electronic contracts and other communications,

competition, protection of minors, consumer protection, taxation, securities law compliance, and online payment services. The

introduction of new products may subject us to additional laws and regulations. In addition, foreign data protection, privacy,

and other laws and regulations are often more restrictive than those in the United States. These U.S. federal and state and foreign

laws and regulations, which can be enforced by private parties or government entities, are constantly evolving and can be subject

to significant change. In addition, the application and interpretation of these laws and regulations are often uncertain, particularly

in the new and rapidly evolving industry in which we operate. For example, the interpretation of some laws and regulations that

govern the use of names and likenesses in connection with advertising and marketing activities is unsettled and developments in

this area could affect the manner in which we design our products, as well as our terms of use. A number of proposals are pending

before federal, state, and foreign legislative and regulatory bodies that could significantly affect our business. For example,

a revision to the 1995 European Union Data Protection Directive is currently being considered by European legislative bodies that

may include more stringent operational requirements for data processors and significant penalties for non-compliance. Similarly,

there have been a number of recent legislative proposals in the United States, at both the federal and state level, that would

impose new obligations in areas such as privacy and liability for copyright infringement by third parties. These existing and

proposed laws and regulations can be costly to comply with and can delay or impede the development of new products, result in

negative publicity, increase our operating costs, require significant management time and attention, and subject us to inquiries

or investigations, claims or other remedies, including fines or demands that we modify or cease existing business practices.

If we are unable to protect our intellectual

property, the value of our brand and other intangible assets may be diminished, and our business may be adversely affected.

We rely and expect to continue

to rely on a combination of confidentiality and license agreements with our employees, consultants, and third parties with whom

we have relationships, as well as trademark, copyright, patent, trade secret, and domain name protection laws, to protect our

proprietary rights. In the future we may acquire additional patents or patent portfolios, which could require significant

cash expenditures. Third parties may knowingly or unknowingly infringe our proprietary rights, third parties may challenge proprietary

rights held by us, and pending and future trademark and patent applications may not be approved. In addition, effective intellectual

property protection may not be available in every country in which we operate or intend to operate our business. In any or all

of these cases, we may be required to expend significant time and expense in order to prevent infringement or to enforce our rights.

Although we have taken measures to protect our proprietary rights, there can be no assurance that others will not offer products

or concepts that are substantially similar to ours and compete with our business.

In addition, from time

to time, we may contribute software source code under open source licenses and make other technology we develop available under

other open licenses, and include open source software in our products. As a result of any open source contributions and the use

of open source in our products, we may license or be required to license innovations that turn out to be material to our business

and may also be exposed to increased litigation risk. If the protection of our proprietary rights is inadequate to prevent unauthorized

use or appropriation by third parties, the value of our brand and other intangible assets may be diminished and competitors may

be able to more effectively mimic our service and methods of operations. Any of these events could have an adverse effect on our

business and financial results.

Our business will be dependent on

our ability to maintain and scale our technical infrastructure, and any significant disruption in our service could damage our

reputation, result in a potential loss of users and engagement, and adversely affect our financial results.

Our reputation and ability

to attract, retain, and serve our users may be dependent upon the reliable performance of the Yappn platform and our underlying

technical infrastructure. Performance delays or outages could be harmful to our business. If Yappn is unavailable when users attempt

to access it, or if it does not load as quickly as they expect, users may not return to our service in the future, or at all.

As Yappn continues to grow, we will need an increasing amount of technical infrastructure, including network capacity, and computing

power, to continue to satisfy the needs of our users. It is possible that we may fail to effectively scale and grow our technical

infrastructure to accommodate these increased demands. In addition, our business is subject to interruptions, delays, or failures

resulting from our cloud services provider and / or factors beyond the normal control of Yappn.

We believe that a substantial

portion of our network infrastructure will be provided by third parties. Any disruption or failure in the services we receive

from these providers could harm our ability to handle existing or increased traffic and could significantly harm our business.

Any financial or other difficulties these providers face may adversely affect our business, and we exercise little control over

these providers, which increases our vulnerability to problems with the services they provide.

We are exposed to general economic

conditions, which could have a material adverse impact on our business, operating results and financial condition.

Recently there have been

adverse conditions and uncertainty in the global economy as the result of unstable global financial and credit markets, inflation,

and recession. These unfavorable economic conditions and the weakness of the credit market may continue to have, an impact on

our Company’s business and our Company’s financial condition. The current global macroeconomic environment may affect

our Company’s ability to access the capital markets may be severely restricted at a time when our Company wishes or needs

to access such markets, which could have a materially adverse impact on our Company’s flexibility to react to changing economic

and business conditions or carry on our operations.

We could experience unforeseen difficulties

in building and operating key portions of our technical infrastructure.

We intend to design and

build software that will rely upon cloud computing infrastructure and we may also develop our own data centers and technical infrastructure

through which we intend to service our products. These undertakings are complex, and unanticipated delays in the completion

of these projects or availability of components may lead to increased project costs, operational inefficiencies, or interruptions

in the delivery or degradation of the quality of our products. In addition, there may be issues related to this infrastructure

that are not identified during the testing phases of design and implementation, which may only become evident after we have started

to fully utilize the underlying equipment, that could further degrade the user experience or increase our costs.

Our software is highly technical,

and if it contains undetected errors, our business could be adversely affected.

Our products incorporate

software that is highly technical and complex. Our software has contained, and may now or in the future contain, undetected errors,

bugs, or vulnerabilities. Some errors in our software code may only be discovered after the code has been released. Any errors,

bugs, or vulnerabilities discovered in our code after release could result in damage to our reputation, loss of users, loss of

revenue, or liability for damages, any of which could adversely affect our business and financial results.

The loss of one or more of our key

personnel, or our failure to attract and retain other highly qualified personnel in the future, could harm our business.

We currently depend

on the continued services and performance of David Lucatch, Craig McCannell, and David Bercovitch, our Chief Executive Officer

and a director, Chief Financial Officer, and Chief Operating Officer, respectively. In June 2014, we entered into an employment

agreement with Mr. Lucatch. Under the terms of this agreement, Mr. Lucatch will continue

to serve as our Chief Executive Officer. Mr. Lucatch will receive a base salary of $190,000 per year in the first year of the

agreement, subject to future increases in base salary as well as options that vest over time. Mr. Lucatch will be entitled to

certain bonus payments based on the revenue of the Company and standard expense reimbursements and benefits.

On October 31,

2014, we entered into a consulting agreement with Maranden Holdings, Inc., an entity controlled by David Bercovitch, memorializing

the agreement by which David Bercovitch would act as our Chief Operating Officer. Under the terms of this agreement, Mr. Bercovitch

will continue to serve as our Chief Operating Officer. Maranden Holdings, Inc will received one million, five hundred thousand

(1,500,000) common stock purchase warrants as compensation in lieu of cash salary, such common stock purchase warrants vesting

over two years. Maranden Holdings, Inc., is entitled to certain bonus payments and payment of expenses.

On September 1, 2014

we entered into an employment agreement with Craig McCannell, our CFO, which has an indefinite term. Under the terms of this agreement,

Mr. McCannell will continue to serve as our Chief Financial Officer. Mr. McCannell will receive a base salary of $160,000 per

year in the first year of the agreement, subject to future increases in base salary as well as options that vest over time. Mr.

McCannell will be entitled to certain bonus payments based on the revenue of the Company and standard expense reimbursements and

benefits.

Aside from Mr. Lucatch

and Mr. McCannell (and the consulting agreement with Maranden Holdings, Inc.), we have no employment agreements with any of our

other directors as of the date of this Annual Report.

As we continue to grow,

we cannot guarantee we will be able to attract the personnel we need to achieve a competitive position. In particular, we

intend to hire technical and sales personnel in fiscal 2016, and we expect to face significant competition from other companies

in hiring such personnel. As we mature, the incentives to attract, retain, and motivate employees provided by our equity

awards or by future arrangements may not be as effective as in the past, and if we issue significant equity to attract additional

employees, the ownership of our existing stockholders may be further diluted. If we do not succeed in attracting, hiring, and

integrating excellent personnel, or retaining and motivating existing personnel, we may be unable to grow effectively.

Risks Relating to our Organization and

our Common Stock

Difficulties we may encounter managing

our growth could adversely affect our results of operations.

If we experience a period

of rapid and substantial growth, and if such growth continues, we will continue to place a strain on our limited administrative

infrastructure. As our needs expand, we may need to hire a significant number of employees. This expansion could place a significant

strain on our managerial and financial resources. To manage the possible growth of our operations and personnel, we will be required

to:

| |

● |

improve existing, and implement new,

operational, financial and management controls, reporting systems and procedures; |

| |

|

|

|

● |

install enhanced management information

systems; and |

| |

|

|

| |

● |

train, motivate and manage our employees. |

We may not be able to install

adequate management information and control systems in an efficient and timely manner, and our current or planned personnel, systems,

procedures and controls may not be adequate to support our future operations. If we are unable to manage growth effectively, our

business would be seriously harmed.

Failure to achieve and maintain effective

internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our

business and operating results.

It may be time consuming,

difficult and costly for us to develop and implement the additional internal controls, processes and reporting procedures required

by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal auditing and other finance staff in order

to develop and implement appropriate additional internal controls, processes and reporting procedures.

If we fail to comply in

a timely manner with the requirements of Section 404 of the Sarbanes-Oxley Act regarding internal control over financial

reporting or to remedy any material weaknesses in our internal controls that we may identify, such failure could result in material

misstatements in our financial statements, cause investors to lose confidence in our reported financial information and have a

negative effect on the trading price of our common stock.

Pursuant to Section 404

of the Sarbanes-Oxley Act and current SEC regulations, we are required to prepare assessments regarding internal controls over

financial reporting and, furnish a report by our management on our internal control over financial reporting. We have begun the

process of documenting and testing our internal control procedures in order to satisfy these requirements, which is likely to

result in increased general and administrative expenses and may shift management time and attention from revenue-generating activities

to compliance activities. While our management is expending significant resources in an effort to complete this important project,

there can be no assurance that we will be able to achieve our objective on a timely basis. Failure to achieve and maintain an

effective internal control environment or complete our Section 404 certifications could have a material adverse effect on

our stock price.

In addition, in connection

with our on-going assessment of the effectiveness of our internal control over financial reporting, we may discover “material

weaknesses” in our internal controls as defined in standards established by the Public Company Accounting Oversight Board,

or the PCAOB. A material weakness is a significant deficiency, or combination of significant deficiencies, that results in more

than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected.

The PCAOB defines “significant deficiency” as a deficiency that results in more than a remote likelihood that

a misstatement of the financial statements that is more than inconsequential will not be prevented or detected.

In the event that a material

weakness is identified, we will employ qualified personnel and adopt and implement policies and procedures to address any material

weaknesses that we identify. However, the process of designing and implementing effective internal controls is a continuous effort

that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend

significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public

company. We cannot assure you that the measures we will take will remediate any material weaknesses that we may identify or that

we will implement and maintain adequate controls over our financial process and reporting in the future.

Any failure to complete

our assessment of our internal control over financial reporting, to remediate any material weaknesses that we may identify or

to implement new or improved controls, or difficulties encountered in their implementation, could harm our operating results,

cause us to fail to meet our reporting obligations or result in material misstatements in our financial statements. Any such failure

could also adversely affect the results of the periodic management evaluations of our internal controls and, in the case of a

failure to remediate any material weaknesses that we may identify, would adversely affect the annual auditor attestation reports

regarding the effectiveness of our internal control over financial reporting that are required under Section 404 of the Sarbanes-Oxley

Act. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could

have a negative effect on the trading price of our common stock.

Our stock price may be volatile.

The stock market in general

has experienced volatility that often has been unrelated to the operating performance of any specific public company. The

market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors,

many of which are beyond our control, including the following:

| |

● |

changes in our industry; |

| |

|

|

| |

● |

competitive pricing pressures; |

| |

|

|

| |

● |

our ability to obtain working capital

financing; |

| |

|

|

| |

● |

additions or departures of key personnel; |

| |

● |

limited "public float" in

the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure

on the market price for our common stock; |

| |

|

|

| |

● |

sales of our common stock (particularly

following effectiveness of any resale registration statements or expiration of lockup agreements); |

| |

|

|

| |

● |

our ability to execute our business

plan; |

| |

|

|

| |

● |

operating results that fall below expectations; |

| |

|

|

| |

● |

loss of any strategic relationship; |

| |

|

|

| |

● |

regulatory developments; |

| |

|

|

| |

● |

economic and other external factors; |

| |

|

|

| |

● |

period-to-period fluctuations in our

financial results; and |

| |

|

|

| |

● |

inability to develop or acquire new

or needed technology. |

In addition, the securities

markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance

of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

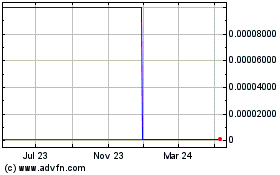

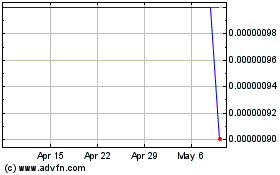

The market for our common

shares is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price

will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable

to a number of factors. First, as noted above, our common shares are sporadically and thinly traded. As a consequence of this

lack of liquidity, the trading of relatively small quantities of shares by our shareholders may disproportionately influence the

price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that

a large number of our common shares are sold on the market without commensurate demand, as compared to a seasoned issuer which

could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative or “risky”

investment due to our limited operating history and lack of profits to date, and uncertainty of future market acceptance for our

potential products. As a consequence of this enhanced risk, more risk-adverse investors may, under the fear of losing all or most

of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more

quickly and at greater discounts than would be the case with the stock of a seasoned issuer. Many of these factors are beyond

our control and may decrease the market price of our common shares, regardless of our operating performance. We cannot make any

predictions or projections as to what the prevailing market price for our common shares will be at any time, including as to whether

our common shares will sustain their current market prices, or as to what effect that the sale of shares or the availability of

common shares for sale at any time will have on the prevailing market price.

Shareholders should be

aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns

of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that

are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales

and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic

price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling

broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been

manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses.

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to

be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive

within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

The occurrence of these patterns or practices could increase the volatility of our share price.

Volatility in our common share price

may subject us to securities litigation, thereby diverting our resources that may have a material effect on our profitability

and results of operations.

As discussed in the preceding

risk factors, the market for our common shares is characterized by significant price volatility when compared to seasoned issuers,

and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the

past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in

the market price of its securities. We may in the future be the target of similar litigation. Securities litigation could result

in substantial costs and liabilities and could divert management’s attention and resources.

We have not paid dividends in the past

and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common

stock.

We have never paid cash

dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on

our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time

as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable

because a return on investment will only occur if our stock price appreciates.

Our common stock may be considered a

“penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to

sell.

Our common stock is considered

to be a “penny stock.” It does not qualify for one of the exemptions from the definition of “penny stock”

under Section 3a51-1 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Our common stock is a “penny

stock” because it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share;

(ii) it is not traded on a “recognized” national exchange or (iii) it is not quoted on the NASDAQ Global Market, or

has a price less than $5.00 per share. The principal result or effect of being designated a “penny stock” is that

securities broker-dealers participating in sales of our common stock are subject to the “penny stock” regulations

set forth in Rules 15-2 through 15g-9 promulgated under the Securities Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually

signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock

for the investor's account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor

for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to

(i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives;

(ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that

the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions;

(iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination

in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects

the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make

it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose

of them in the market or otherwise.

FINRA sales practice requirements may

also limit a stockholder's ability to buy and sell our stock.

In addition to the “penny

stock” rules described above, the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in

recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable

for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers

must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and

other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low

priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers

to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse

effect on the market for our shares.

Offers or availability for sale of a

substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell

substantial amounts of our common stock in the public market upon the expiration of any statutory holding period, under Rule 144,

expiration of any lock-up agreements, or issued upon the exercise of outstanding options or warrants, it could create a circumstance

commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The

existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise