Current Report Filing (8-k)

February 11 2022 - 4:26PM

Edgar (US Regulatory)

0001082733false00010827332022-02-072022-02-07iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2022

|

VISIUM TECHNOLOGIES, INC.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Florida

|

|

000-25753

|

|

87-0449667

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4094 Majestic Lane, Suite 360

Fairfax, Virginia 22033

(Address of principal executive offices, including zip code)

(703) 273-0383

(Registrant’s telephone number, including area code)

Check the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

Securities Purchase Agreements and Promissory Notes

On February 7, 2022, Visium Technologies, Inc., a Florida corporation (the “Company”), entered into two Securities Purchase Agreements (the “Purchase Agreements”) with each of Talos Victory Fund, LLC, a Delaware limited liability company, and Mast Hill Fund, L.P., a Delaware limited partnership (the “Investors”), respectively, pursuant to which each Investor purchased a promissory note, each with a face value of $270,000, made by the Company in favor of the Investors (the “Notes”) in the total combined principal amount of $540,000 (the “Total Principal Amount”) for a combined purchase price of $496,800 (the “Total Purchase Price”). The closing of the Purchase Agreements occurred on February 7, 2022. The Notes, bear an aggregate original issue discount of $43,200, each bear interest of 8% per year and mature on February 7, 2023 (the “Maturity Date”). The Notes are convertible into shares of the Company’s common stock at conversion price of $0.0018 per share, subject to adjustment as provided therein. The Company has the right to prepay each Note in full, including accrued but unpaid interest, without prepayment penalty provided an event of default, as defined therein, has not occurred. In the seven (7) trading days prior to any prepayment the Investors shall have the right to convert their Notes into Common Stock of the Company in accordance with the terms of such Note. The Notes contain events of defaults and certain negatives covenants that are typical in the types of transactions contemplated by the Purchase Agreements.

Pursuant to the Purchase Agreements, the Company issued to the Investors an aggregate 54,000,000 commitment shares of the Company’s common stock (the “Commitment Shares”) as a condition to closing.

In connection with the Purchase Agreements, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with each of the Investors, pursuant to which the Company is obligated to file a registration statement within 30 days of the date of the Registration Rights Agreement covering the sale of the Commitment Shares and the shares of the Company’s common stock that may be issued to the Investors pursuant to the conversion of the Notes.

The foregoing descriptions of the Purchase Agreements, the Notes and the Registration Rights Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Purchase Agreements, the Notes, and the Registration Rights Agreements, copies of the forms of which are filed as Exhibits 10.1, 4.1 and 10,2, respectively, to this Current Report on Form 8-K and incorporated by reference herein.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided above in Item 1.01 herein is incorporated by reference into this Item 2.03.

Item 3.02. Unregistered Sales of Equity Securities

The applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02. The issuance of the securities set forth herein was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act for the offer and sale of securities not involving a public offering. The Company’s reliance upon Section 4(a)(2) of the Securities Act in issuing the securities was based upon the following factors: (a) the issuance of the Shares was an isolated private transaction by us which did not involve a public offering; (b) there was only one recipient; (c) there were no subsequent or contemporaneous public offerings of the Shares by the Company; (d) the Shares were not broken down into smaller denominations; (e) the negotiations for the issuance of the Shares took place directly between the individual and the Company; and (f) the recipient of the Shares is an accredited Investors.

Item. 9.01. Financial Statements and Exhibits.

_______________

* filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

VISIUM TECHNOLOGIES, INC.

|

|

|

|

|

|

|

Date: February 11, 2022

|

By:

|

/s/ Mark Lucky

|

|

|

|

|

Mark Lucky

|

|

|

|

|

Chief Executive Officer

|

|

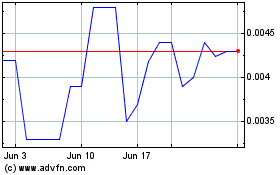

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Dec 2023 to Dec 2024