Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

February 24 2014 - 3:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number:

811-22178

Davlin Philanthropic Funds

(Exact Name of Registrant as Specified in Charter)

44 River Road, Suite A

Wayland, MA 01778

(Address of Principal Executive Offices) (Zip Code)

William E.B. Davlin

Davlin Philanthropic Funds

44 River Road, Suite A

Wayland, MA 01778

(Name and Address of Agent for Service)

With copy to:

JoAnn M. Strasser

Thompson Hine LLP

312 Walnut Street, 14th Floor

Cincinnati, Ohio 45202

Registrant’s Telephone Number, including Area Code:

508-276-1705

Date of fiscal year end:

March 31

Date of reporting period:

December 31, 2013

Form N-Q is to be used by management investment companies, other than small business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of this chapter), to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use the information provided on Form N-Q in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-Q unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, and 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. SCHEDULE OF INVESTMENTS.

|

|

|

|

|

|

|

|

|

|

|

The Davlin Philanthropic Fund

|

|

|

|

|

|

|

|

Schedule of Investments

|

|

|

|

|

|

|

|

December 31, 2013 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCKS - 82.73%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agricultural Chemicals - 2.05%

|

|

|

|

|

|

850

|

|

CF Industries Holdings, Inc.

|

$ 198,084

|

|

|

|

|

|

|

|

|

|

|

|

|

Bottled & Canned Soft Drinks - 1.29%

|

|

|

|

|

|

1,400

|

|

Monster Beverage Corp. *

|

94,878

|

|

|

|

|

1,500

|

|

National Beverage Corp. *

|

30,240

|

|

|

|

|

|

|

|

125,118

|

|

|

|

|

Communication Services, NEC - 1.61%

|

|

|

|

|

|

18,500

|

|

RRSat Global Communications Network Ltd. (Israel)

|

155,400

|

|

|

|

|

|

|

|

|

|

|

|

|

Computer & Office Equipment - 1.97%

|

|

|

|

|

|

6,800

|

|

Hewlett-Packard Co.

|

190,264

|

|

|

|

|

|

|

|

|

|

|

|

|

Concrete, Gypsum & Plaster Products - 0.50%

|

|

|

|

|

|

2,000

|

|

Monarch Cement Co.

|

48,200

|

|

|

|

|

|

|

|

|

|

|

|

|

Cookies & Crackers - 0.73%

|

|

|

|

|

|

800

|

|

J&J Snack Food Corp.

|

70,872

|

|

|

|

|

|

|

|

|

|

|

|

|

Drilling Oil & Gas Wells - 1.51%

|

|

|

|

|

|

3,900

|

|

Noble Corp.

|

146,133

|

|

|

|

|

|

|

|

|

|

|

|

|

Engines & Turbines - 2.04%

|

|

|

|

|

|

1,400

|

|

Cummins, Inc.

|

197,358

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance Lessors - 0.32%

|

|

|

|

|

|

600

|

|

CIT Group, Inc. *

|

31,278

|

|

|

|

|

|

|

|

|

|

|

|

|

Fire, Marine & Casualty Insurance - 7.01%

|

|

|

|

|

|

1,800

|

|

ACE Ltd. (Switzerland)

|

186,354

|

|

|

|

|

325

|

|

Fairfax Financial Holdings Ltd. (Canada) *

|

130,019

|

|

|

|

|

3,200

|

|

Montpelier RE Holdings Ltd. (Bermuda)

|

93,120

|

|

|

|

|

2,200

|

|

Safety Insurance Group, Inc.

|

123,860

|

|

|

|

|

1,600

|

|

Travelers Co., Inc.

|

144,864

|

|

|

|

|

|

|

|

678,217

|

|

|

|

|

Footwear - 0.44%

|

|

|

|

|

|

1,300

|

|

Sketchers USA, Inc. Class-A *

|

43,069

|

|

|

|

|

|

|

|

|

|

|

|

|

Hospital & Medical Service Plans - 1.60%

|

|

|

|

|

|

2,200

|

|

Wellcare Health Plans, Inc. *

|

154,924

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Audio & Video Equipment - 1.41%

|

|

|

|

|

|

18,900

|

|

Skullcandy, Inc. *

|

136,269

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Inorganic Chemicals - 0.95%

|

|

|

|

|

|

4,000

|

|

Tronox, Ltd. Class A F

|

92,280

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Instruments For Measurement - 1.58%

|

|

|

|

|

|

4,000

|

|

Cognex Corp.

|

152,720

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Advise - 2.83%

|

|

|

|

|

|

1,800

|

|

Franklin Resources, Inc.

|

103,914

|

|

|

|

|

3,500

|

|

Legg Mason, Inc.

|

152,180

|

|

|

|

|

1,000

|

|

Manning & Napier, Inc. Class A

|

17,650

|

|

|

|

|

|

|

|

273,744

|

|

|

|

|

Leather & Leather Products - 1.74%

|

|

|

|

|

|

7,000

|

|

Vera Bradley, Inc. *

|

168,280

|

|

|

|

|

|

|

|

|

|

|

|

|

Meat Packing Plants - 1.59%

|

|

|

|

|

|

55

|

|

Seaboard Corp. *

|

153,723

|

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous Manufacturing Industries - 1.34%

|

|

|

|

|

|

3,000

|

|

Hillenbrand, Inc.

|

88,260

|

|

|

|

|

1,100

|

|

Oil-Dri Corp. of America

|

41,624

|

|

|

|

|

|

|

|

129,884

|

|

|

|

|

Motor Vehicle Parts & Accessories - 2.62%

|

|

|

|

|

|

800

|

|

Delphi Automotive PLC

|

48,104

|

|

|

|

|

4,800

|

|

Fuel Systems Solutions, Inc. *

|

66,576

|

|

|

|

|

3,100

|

|

Strattec Security Corp.

|

138,477

|

|

|

|

|

|

|

|

253,157

|

|

|

|

|

Motor Vehicles & Passenger Car Bodies - 2.49%

|

|

|

|

|

|

1,980

|

|

Toyota Motor Corp. ADR (Japan) *

|

241,402

|

|

|

|

|

|

|

|

|

|

|

|

|

National Commercial Banks - 2.81%

|

|

|

|

|

|

3,800

|

|

JPMorgan Chase & Co.

|

222,224

|

|

|

|

|

1,100

|

|

Wells Fargo & Co.

|

49,940

|

|

|

|

|

|

|

|

272,164

|

|

|

|

|

Newspapers: Publishing or Publishing & Printing - 0.64%

|

|

|

|

|

|

800

|

|

Tribune Co., Class A *

|

61,920

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Natural Gas - 4.68%

|

|

|

|

|

|

1,400

|

|

Marathon Petroleum Corp.

|

128,422

|

|

|

|

|

2,050

|

|

Phillips 66

|

158,116

|

|

|

|

|

3,300

|

|

Valero Energy Corp.

|

166,320

|

|

|

|

|

|

|

|

452,858

|

|

|

|

|

Primary Production of Aluminum - 0.87%

|

|

|

|

|

|

1,200

|

|

Kaiser Aluminum Corp.

|

84,288

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Equity Firm - 0.60%

|

|

|

|

|

|

4,300

|

|

MVC Capital, Inc.

|

58,050

|

|

|

|

|

|

|

|

|

|

|

|

|

Railroad Equipment - 0.57%

|

|

|

|

|

|

1,200

|

|

American Railcar Industries, Inc.

|

54,900

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail-Auto Dealers & Gasoline Stations - 3.32%

|

|

|

|

|

|

2,966

|

|

CST Brands, Inc. *

|

108,911

|

|

|

|

|

14,900

|

|

West Marine, Inc. *

|

212,027

|

|

|

|

|

|

|

|

320,938

|

|

|

|

|

Retail-Eating Places - 3.52%

|

|

|

|

|

|

4,100

|

|

Nathans Famous, Inc. *

|

206,681

|

|

|

|

|

19,400

|

|

Ruby Tuesday, Inc. *

|

134,442

|

|

|

|

|

|

|

|

341,123

|

|

|

|

|

Retail-Grocery Stores - 2.16%

|

|

|

|

|

|

5,400

|

|

Village Super Market, Inc. Class-A

|

167,454

|

|

|

|

|

800

|

|

Weis Markets, Inc.

|

42,048

|

|

|

|

|

|

|

|

209,502

|

|

|

|

|

Retail-Miscellaneous Shopping - 2.56%

|

|

|

|

|

|

12,000

|

|

Office Depot, Inc. *

|

63,480

|

|

|

|

|

11,600

|

|

Staples, Inc.

|

184,324

|

|

|

|

|

|

|

|

247,804

|

|

|

|

|

Retail-Radio, TV & Consumer Electronic Stores - 0.19%

|

|

|

|

|

|

7,200

|

|

Radioshack Corp. *

|

18,720

|

|

|

|

|

|

|

|

|

|

|

|

|

Rolling Drawing & Extruding of Nonferrous Metals - 0.71%

|

|

|

|

|

|

2,000

|

|

RTI International Metals, Inc. *

|

68,420

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings Institution, Federally Chartered - 2.26%

|

|

|

|

|

|

3,900

|

|

People's United Financial, Inc.

|

58,968

|

|

|

|

|

6,900

|

|

Territorial Bancorp, Inc.

|

160,080

|

|

|

|

|

|

|

|

219,048

|

|

|

|

|

Search, Detection, Navigation, Guidance, Aeronautical Systems - 0.29%

|

|

|

|

|

|

600

|

|

Garmin Ltd. (Switzerland)

|

27,714

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Brokers, Dealers & Flotation Companies - 5.82%

|

|

|

|

|

|

2,200

|

|

Gamco Investors, Inc.

|

191,334

|

|

|

|

|

11,315

|

|

Gleacher & Co., Inc. *

|

117,563

|

|

|

|

|

11,100

|

|

JMP Group, Inc.

|

82,140

|

|

|

|

|

5,500

|

|

Morgan Stanley

|

172,480

|

|

|

|

|

|

|

|

563,517

|

|

|

|

|

Semiconductors & Related Devices - 0.41%

|

|

|

|

|

|

900

|

|

Texas Instruments, Inc.

|

39,519

|

|

|

|

|

|

|

|

|

|

|

|

|

Services-Advertising Agencies - 1.93%

|

|

|

|

|

|

8,000

|

|

ValueClick, Inc. *

|

186,960

|

|

|

|

|

|

|

|

|

|

|

|

|

Services-Amusement & Recreation Services - 0.64%

|

|

|

|

|

|

41,900

|

|

Dover Downs Gaming & Entertainment, Inc. *

|

62,012

|

|

|

|

|

|

|

|

|

|

|

|

|

Services-Equipment Rental & Leasing - 4.75%

|

|

|

|

|

|

12,000

|

|

AerCap Holdings N.V. (Netherlands) *

|

460,200

|

|

|

|

|

|

|

|

|

|

|

|

|

Sporting & Athletic Goods, NEC - 0.63%

|

|

|

|

|

|

7,200

|

|

Callaway Golf Co.

|

60,696

|

|

|

|

|

|

|

|

|

|

|

|

|

State Commercial Banks - 3.94%

|

|

|

|

|

|

4,100

|

|

Bank of NY Mellon Corp.

|

143,254

|

|

|

|

|

8,000

|

|

Glacier Bancorp, Inc.

|

238,320

|

|

|

|

|

|

|

|

381,574

|

|

|

|

|

Sugar & Confectionery Products - 0.71%

|

|

|

|

|

|

2,800

|

|

John B Sanfilipo & Sons, Inc.

|

69,104

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgical & Medical Instruments - 0.21%

|

|

|

|

|

|

1,000

|

|

Globus Medical, Inc. *

|

20,180

|

|

|

|

|

|

|

|

|

|

|

|

|

Water Transportation - 0.89%

|

|

|

|

|

|

1,450

|

|

Tidewater, Inc.

|

85,942

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL FOR COMMON STOCKS (Cost $4,414,386) - 82.73%

|

$ 8,007,529

|

|

|

|

|

|

|

|

|

|

|

|

EXCHANGE TRADED FUNDS - 4.91%

|

|

|

|

|

|

1,300

|

|

ETFS Palladium Trust *

|

90,506

|

|

|

|

|

720

|

|

ETFS Platinum Trust *

|

96,401

|

|

|

|

|

9,433

|

|

Global X Uranium ETF

|

144,042

|

|

|

|

|

1,700

|

|

iShares MSCI Turkey Index Fund

|

81,022

|

|

|

|

|

800

|

|

ProShares Ultrashort 20+ Year Treasury *

|

63,360

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL FOR EXCHANGE TRADED FUNDS (Cost $538,025) - 4.91%

|

$ 475,331

|

|

|

|

|

|

|

|

|

|

|

|

PREFERRED STOCK - 2.25%

|

|

|

|

|

|

3,900

|

|

Bank of New York Mellon Corp. PFD-C 5.20%

|

80,925

|

|

|

|

|

5,200

|

|

The Goldman Sachs Group, Inc. 2010 PFD-C 5.44% **

|

98,488

|

|

|

|

|

375

|

|

Southern California Edison Co. PFD 5.349% **

|

38,040

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL PREFERRED STOCK (Cost $227,273) - 2.25%

|

$ 217,453

|

|

|

|

|

|

|

|

|

|

|

|

REAL ESTATE INVESTMENT TRUST - 3.31%

|

|

|

|

|

|

9,200

|

|

Chatham Lodging Trust

|

188,140

|

|

|

|

|

11,100

|

|

Franklin Street Properties Corp.

|

132,645

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REAL ESTATE INVESTMENT TRUST (Cost $245,905) - 3.31%

|

$ 320,785

|

|

|

|

|

|

|

|

|

|

|

|

SHORT TERM INVESTMENTS - 6.57%

|

|

|

|

|

|

636,215

|

|

Fidelity Institutional Money Market Portfolio 0.06% ** (Cost $636,215)

|

636,215

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS (Cost $6,687,378) - 99.78%

|

$ 9,657,313

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS LESS LIABILITIES - 0.22%

|

21,479

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS - 100.00%

|

$ 9,678,792

|

|

|

|

|

|

|

|

|

|

|

|

|

ADR - American Depository Receipt.

|

|

|

|

|

|

* Non-income producing security during the period

|

|

|

|

|

|

** Variable rate security: the coupon rate shown represents the yield at December 31, 2013.

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO FINANCIAL STATEMENTS

|

|

|

|

|

THE DAVLIN PHILANTHROPIC FUND

|

|

|

|

|

1. SECURITY TRANSACTIONS

|

|

|

|

|

|

At December 31, 2013, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $6,687,378 amounted to $2,969,935, which consisted of aggregate gross unrealized appreciation of $3,269,747 and aggregate gross unrealized depreciation of $299,812.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. SECURITY VALUATIONS

|

|

|

|

|

|

Portfolio securities that are listed on national securities exchanges or the NASDAQ National Market System are valued at the last sale price as of 4:00 p.m. Eastern time, or in the absence of recorded sales, at the readily available closing bid price on such exchanges or such System. Unlisted securities that are not included in such System are valued at the quoted bid price in the over-the-counter-market. Securities and other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Advisor under procedures established by and under the general supervision and responsibility of the Fund's Board of Directors. Short-term investments are valued at amortized cost, if their original maturity was 60 days or less, or by amortizing the values as of the 61st day prior to maturity, if their original term to maturity exceeded 60 days.

|

|

|

As required by the fair value topic of the FASB Accounting Standards Codification, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The topic also establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. The three-tier hierarchy of inputs is summarized below:

|

|

|

Level 1 - quoted prices in active markets for identical investments

|

|

|

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

|

|

Level 3 - significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

|

|

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

|

|

|

|

|

|

|

|

|

|

|

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of December 31, 2013:

|

|

|

|

|

|

|

|

Valuation Inputs of Assets

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Common Stock

|

|

$8,007,529

|

$0

|

$0

|

$8,007,529

|

|

Real Estate Investment Trust

|

|

$320,785

|

|

|

$320,785

|

|

Exchange Traded Funds

|

|

$475,331

|

$0

|

$0

|

$475,331

|

|

Preferred Stocks

|

|

$217,453

|

|

|

$217,453

|

|

Cash Equivalents

|

|

$636,215

|

$0

|

$0

|

$636,215

|

|

Total

|

|

$9,657,313

|

$0

|

$0

|

$9,657,313

|

ITEM 2. CONTROLS AND PROCEDURES.

(a)

EVALUATION OF DISCLOSURE CONTROLS AND PROCEDURES. The Registrant maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in the Registrant's filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 is recorded, processed, summarized and reported within the periods specified in the rules and forms of the Securities and Exchange Commission. Such information is accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. The Registrant's management, including the principal executive officer and the principal financial officer, recognizes that any set of controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

Within 90 days prior to the filing date of this Quarterly Schedule of Portfolio Holdings on Form N-Q, the Registrant had carried out an evaluation, under the supervision and with the participation of the Registrant's management, including the Registrant's principal executive officer and the Registrant's principal financial officer, of the effectiveness of the design and operation of the Registrant's disclosure controls and procedures. Based on such evaluation, the Registrant's principal executive officer and principal financial officer concluded that the Registrant's disclosure controls and procedures are effective.

(b)

CHANGES IN INTERNAL CONTROLS. There have been no significant changes in the Registrant's internal controls or in other factors that could significantly affect the internal controls subsequent to the date of their evaluation in connection with the preparation of this Quarterly Schedule of Portfolio Holdings on Form N-Q.

ITEM 3. EXHIBITS.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Davlin Philanthropic Funds

By

/s/William E.B. Davlin

William E.B. Davlin

Trustee, President and Principal Executive Officer

Date:

February 24, 2014

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By

/s/William E.B. Davlin

William E.B. Davlin

Trustee, President and Principal Executive Officer

Date

February 24, 2014

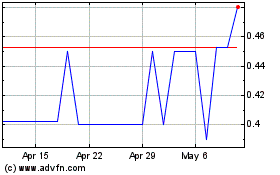

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jun 2024 to Jul 2024

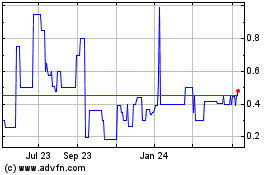

Summer Energy (QB) (USOTC:SUME)

Historical Stock Chart

From Jul 2023 to Jul 2024